American Capital Agency and Chimera -- Impressive Dividends but Still Highly Scrutinized

23 Novembre 2011 - 2:16PM

Marketwired

Shares of high yielding Real Estate Investment Trusts (REITs) have

been volatile in recent months. While the favorable interest rate

spreads have benefitted the sector, mortgage REITs -- like the rest

of Wall Street -- have been challenged by investor anxiety over the

European debt crisis. Moreover, potential measures being proposed

by Congress and the Obama Administration could potentially weigh on

the industry's profits -- and dividends. The Paragon Report

examines the outlook for diversified REITs and provides equity

research on American Capital Agency Corporation (NASDAQ: AGNC) and

Chimera Investment Corporation (NYSE: CIM). Access to the full

company reports can be found at:

www.paragonreport.com/AGNC

www.paragonreport.com/CIM

The Obama administration's latest plan to help underwater

homeowners refinance turned some investors away from mortgage

REITs. Mortgage prepayments are known to crimp mortgage REIT

earnings. Mortgage REITs make money on the spread between interest

rates on short-term debt that they use to buy higher-yielding,

long-term mortgage securities. By purchasing bonds guaranteed by

the government, analysts argue these companies take on no risk of

default, with the principle concern being an interest rate

risk.

The Paragon Report provide investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on diversified REITs register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

According to a recent article from Forbes, Agency mREITs as a

group outperformed the S&P 500 in the third quarter. A set of

the 7 most actively traded Agency REITs lost just over 6 percent

(including dividends) compared to a 14 percent loss for the S&P

500. Net Interest Margins for the sector were under pressure in the

most recent quarter as longer-term investment rates fell following

implementation of Operation Twist, which led to a modest downturn

for some dividends in the sector. Operation Twist was aimed at

reducing the cost of borrowing for businesses and consumers,

including the cost of mortgage loans, by lowering long term

interest rates.

For nine consecutive quarters American Capital Agency has paid a

dividend of $1.40 per share. American Capital Agency reported

earnings of $1.39 per share during third quarter 2011, compared to

$1.69 in the year-earlier quarter.

Chimera Investment Corporation is considered a "Hybrid mREIT."

Hybrid mREITs are moderately riskier as they own mortgage backed

securities (MBS) or any debt obligations which do not have an

implicit guarantee of the US Federal Government. Last week the

company said profit slid 43 percent in the third quarter as the

company's income from investments declined, offsetting gains in net

interest income. Chimera pays an annual dividend of 52 cents for a

yield of around 19.4 percent.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

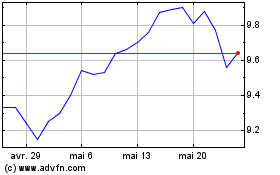

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024