High Yielding American Capital Agency and Annaly Capital Remain Buoyed by Bernanke

30 Novembre 2011 - 2:16PM

Marketwired

High yielding Real Estate Investment Trusts (REITs) have been a

popular investment since the low interest rate environment set in

two years ago. Several REITs earn their money on the spread between

low-interest short-term borrowing and purchasing high-interest

long-term securities, making the present economic climate highly

lucrative for REITs. The Bedford Report examines the outlook for

diversified REITs and provides equity research on American Capital

Agency Corporation (NASDAQ: AGNC) and Annaly Capital Management,

Inc. (NYSE: NLY). Access to the full company reports can be found

at:

www.bedfordreport.com/AGNC

www.bedfordreport.com/NLY

Federal Reserve Officials kept policy unchanged earlier this

month, saying they would lengthen the maturity of the Fed's bond

portfolio and hold the benchmark interest rate near zero through at

least mid-2013 if unemployment remains high and the inflation

outlook is "subdued." High yielding REITs must pay out 90 percent

of their taxable income in dividends. With the risk of higher

interest rates of the table for the foreseeable future, profits --

and therefore dividends -- should remain stable.

The Bedford Report releases regular market updates on REITs so

investors can stay ahead of the crowd and make the best investment

decisions to maximize their returns. Take a few minutes to register

with us free at www.bedfordreport.com and get exclusive access to

our numerous analyst reports and industry newsletters.

Annaly Capital Management, Inc., invests primarily in mortgage

pass-through certificates, collateralized mortgage obligations,

agency callable debentures, and other mortgage-backed securities

representing interests in or obligations backed by pools of

mortgage loans. Annaly Capital also invests in Federal Home Loan

Bank, Federal Home Loan Mortgage Corporation, and Federal National

Mortgage Association debentures. Presently the company pays an

annual dividend of $2.40 for a yield of around 15.1 percent. Annaly

was in the headlines earlier this month after a (former) Cantor

Fitzgerald equity analyst, Michael Diana, released a highly

critical report that openly mocked Annaly's disclosures on

conference calls with analysts and investors.

American Capital Agency Corp. is a real estate investment trust

(REIT), which invests in residential mortgage pass-through

securities and collateralized mortgage obligations on a leveraged

basis. The company currently pays an annual dividend of $5.50 per

share for a massive yield of around 19.9 percent.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

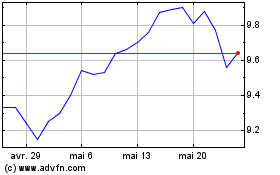

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024