Large Dividends From American Capital Agency and CYS Investments Benefit From Record Low Interest Rates

20 Mars 2012 - 1:20PM

Marketwired

High yielding mortgage REITs have performed well this year.

Continuously low interest rates are boosting earnings throughout

the sector and therefore are helping to boost dividends. REITs

trade like stocks, but by law, they must pay out 90 percent of

their taxable income to shareholders as dividends. The Paragon

Report examines the outlook for diversified REITs and provides

equity research on American Capital Agency Corporation (NASDAQ:

AGNC) and CYS Investments, Inc. (NYSE: CYS). Access to the full

company reports can be found at:

www.paragonreport.com/AGNC

www.paragonreport.com/CYS

Dividend returns for Mortgage REITs are partially dependent on

interest rate spreads. Higher interest rates make borrowing more

expensive for REITs. In late February Fed Chairman Ben Bernanke

said the Federal Reserve is sticking with its plan to hold interest

rates at record-low levels until at least late 2014, despite a

pickup in hiring that's steadily lowered the unemployment rate.

The Federal Reserve has kept its benchmark rate near zero since

December 2008, and in January extended a previous pledge to keep

rates low through mid-2013. It has also bought $2.3 trillion of

bonds in two rounds of so-called quantitative easing.

The Paragon Report provide investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on diversified REITs register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

American Capital Agency Corp. operates as a real estate

investment trust (REIT). It invests in residential mortgage

pass-through securities and collateralized mortgage obligations for

which the principal and interest payments are guaranteed by

government-sponsored entities or by the United States government

agency. Presently the company pays an annual dividend of five

dollars per share for a yield of around 17 percent. Earlier this

month the company priced a public offering of 62,000,000 shares of

common stock for total estimated gross proceeds of approximately

$1.8 billion.

Earlier this month the board of directors of CYS Investments

declared a quarterly dividend of $0.50 per share of common stock

for the first quarter of 2012. The dividend will be paid on April

18, 2012 to stockholders of record on March 23, 2012.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

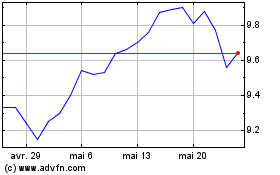

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024