High Yielding REITs Begin to Slump as Stimulus Measures Pressure Bond Yields Lower

23 Octobre 2012 - 2:20PM

Marketwired

Shares of high yielding REITs have experienced a little pull back

this month. During the five days through October 15 mortgage

real-estate investment trusts have fallen 5.9 percent, which was

the largest decline since October of last year. The Paragon Report

examines investing opportunities in diversified REITs and provides

equity research on American Capital Agency Corp. (NASDAQ: AGNC) and

Invesco Mortgage Capital Inc. (NYSE: IVR).

Access to the full company reports can be found at:

www.ParagonReport.com/AGNC www.ParagonReport.com/IVR

Mortgage REITs have been successful in the past as the cost to

borrow money to buy bonds and securities have been far less than

the yields they receive. But there have been some concerns

regarding the current spread REITs earn on their purchases. As the

Federal Reserve has pledged to keep interest rates near-zero till

at least mid-2015, yields of bonds and mortgage backed securities

have been pressured lower. The yield on the Barclays U.S. MBS

Conventional 30 Year Index has fallen from 2.9 percent, in January,

to 2.4 percent. "The spread between yields and funding is

abnormally low," says Sean Kelleher, president of Shay Asset

Management.

Paragon Report releases regular market updates on diversified

REITs so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.ParagonReport.com and get exclusive

access to our numerous stock reports and industry newsletters.

American Capital has $101 billion in assets under management and

seven offices in the U.S. and Europe. The company has declared a

cash dividend of $1.25 per share for the third quarter 2012, for a

yield of roughly 14.6 percent. American Capital Agency is scheduled

to release their third quarter 2012 financial results on October

29, 2012.

Invesco Mortgage Capital is a real estate investment trust that

focuses on financing and managing residential and commercial

mortgage-backed securities and mortgage loans. The company offers

an annual dividend of $2.60 per share for a yield of around 12.5

percent. Shares of Invesco are up nearly 50 percent for the

year.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at: http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

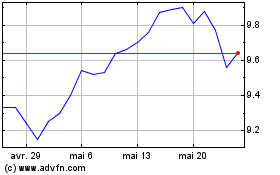

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024