Company Announces 2017 Guidance

Alliance HealthCare Services, Inc. (NASDAQ: AIQ) (the “Company,”

“Alliance,” “we” or “our”), a leading national provider of

outsourced radiology, oncology and interventional services,

announced today the results for the fourth quarter and full year

ended December 31, 2016, and provided 2017 guidance.

Full Year 2016 Highlights

- The Company reported revenue totaling

$505.5 million, a $32.5 million or 6.9% increase

year-over-year.

- The Company generated $131.5 million of

Adjusted EBITDA (as defined below), a $0.2 million or 0.2% increase

year-over-year.

- The Company continued to generate

strong cash flow with $108.8 million in operating cash flows for

full year 2016, compared to $92.5 million in the prior year.

- Net Income Per Share before the impact

of shareholder transaction expenses and one time step up gains from

2015 was $0.56 for full year 2016, compared to $0.15 in 2015. GAAP

Net Income per share was $0.04 for the full year 2016, compared to

$0.62 in 2015.

- Alliance Radiology revenue increased by

3.3% to $350.8 million with strong same-store volume growth of

+1.6% for MRI and +6.7% for PET/CT for full year 2016.

- Alliance Oncology revenue increased

7.3% to $107.2 million for full year 2016 with same-store volume

growth of +2.9% for LINAC and +0.4% for SRS.

- Alliance Interventional revenue

increased 37.3% to $45.6 million for full year 2016.

- Our results for this year were in line

with full-year 2016 guidance for revenue, which ranged from $505

million to $535 million, and Adjusted EBITDA, which ranged from

$130 million to $150 million.

Fourth Quarter 2016 Highlights

- The Company reported revenue totaling

$129.4 million for the fourth quarter, a $5.1 million or 4.1%

increase over the fourth quarter of last year.

- The Company generated $31.5 million of

Adjusted EBITDA (as defined below) for the quarter, a $1.7 million

or 5.2% decrease from the fourth quarter of last year.

- Adjusted Net Income Per Share (as

defined below) was $0.11, and GAAP net loss per share was $0.20 for

the quarter.

- The Company continued to generate

strong cash flow with $26.7 million of quarterly operating cash

flow.

2016 Financial Results

“During 2016 we successfully executed a number of initiatives to

position the Company for future accelerated growth.

We continued to see positive same-store volume growth in our

business segments in full year 2016. The heavy year-over-year

price impact in our Radiology segment is largely behind us, having

successfully renewed the majority of our contracts with customers

over the last few years,” stated Tom Tomlinson, Chief Executive

Officer and President of Alliance HealthCare

Services. “Results for the fourth quarter trailed our

internal expectations somewhat, driven primarily by continued

physician capacity challenges in our Interventional business and

some same-store volume softness across MRI and Stereotactic

Radiosurgery. In addition, we began to absorb some impact from

staff and resources we have added as we explore opportunities in

China. Looking ahead, we expect our growth investments and

improving execution to deliver strong growth in both revenue and

earnings in 2017,” continued Mr. Tomlinson.

For full year 2016, revenue increased to $505.5 million,

compared to $473.1 million in 2015. This increase was primarily due

to an increase in Interventional, Radiology and Oncology revenue of

$12.4 million, $11.2 million, and $7.3 million, respectively, when

compared to 2015. Revenue for the fourth quarter of 2016 increased

to $129.4 million, compared to $124.3 million in the fourth quarter

of 2015. This increase was primarily due to increases in Radiology

and Oncology revenue of $1.9 million and $3.8 million,

respectively, partially offset by a decrease of $1.2 million in

Interventional revenue.

For full year 2016, Adjusted EBITDA increased to $131.5 million,

compared to $131.3 million in 2015. The year-over-year increase was

primarily due to increases in earnings from Radiology and Oncology,

partially offset by Corporate investments as well as a decline in

the Interventional segment. Adjusted EBITDA growth in both

Radiology and Oncology was driven by year-over-year same-store

volume growth as well as the addition of new partnerships such as

Pacific Cancer Institute and the Northern Alabama Cancer Care

Network. Alliance’s Adjusted EBITDA for the fourth quarter of 2016

decreased 5.2% to $31.5 million from $33.3 million in the fourth

quarter of 2015. The Radiology and Oncology segments continued to

provide quarter-over-quarter growth in Adjusted EBITDA, offset,

however, by Corporate investments as well as a decrease in

Interventional earnings. Increases in Radiology and Oncology were

attributable to strong continued same-store volume growth across

both divisions and net new sales and partnerships. The declines in

the Interventional business were driven by challenges in physician

capacity as well as additional platform investments made to

strengthen management and development capabilities. Corporate /

Other Adjusted EBITDA decreased due to additional investments in

organization, systems and infrastructure to support expanded

workforce, entities and partnerships, and gains on asset sales that

occurred in the fourth quarter of 2015 that did not recur in the

fourth quarter of 2016.

For full year 2016, net income totaled $0.5 million, compared to

$6.7 million in 2015. The $6.2 million decrease is largely due to

the net impact of a $10.7 million non-cash gain in the second half

of 2015 which did not recur in 2016, as well as a $6.6 million

increase in certain expenses related to Tahoe Investment Group Co.,

Ltd.’s (“Tahoe’s”) majority ownership purchase of common stock from

the Company’s former shareholders on March 29, 2016 (“Tahoe

Transaction”). These expenses were borne by both the buyer and

sellers involved in the Tahoe transaction and not by the Company.

Excluding the one-time cash gain and the expenses related to the

Tahoe transaction on a tax-effected basis, the net income

attributable to Alliance would have been $1.7 million in 2015,

compared to $6.1 million in the current year.

For full year 2016, GAAP net income per share on a diluted basis

was $0.04 per share, compared to $0.62 in 2015. Excluding the

impact of the one-time non-cash gain and the expenses related to

the Tahoe Transaction, GAAP net income per share on a diluted basis

would have been $0.56 for full year 2016, compared to $0.15 in

2015. Adjusted Net Income Per Share was $0.85 and $1.28 for full

years 2016 and 2015, respectively. GAAP net income per share on a

diluted basis was impacted by net charges of $0.81, compared to

$0.66 in 2015, which were comprised of: severance and related

costs; restructuring charges; transaction costs; shareholder

transaction costs; deferred financing costs in connection with the

Tahoe Transaction; impairment charges; legal matters expense, net;

changes in fair value of contingent consideration related to

acquisitions; non-cash gain on step acquisition; other non-cash

(benefits) charges; and differences in the GAAP income tax rate

from our historical income tax rate of 42.5%.

Cash flows provided by operating activities totaled $108.8

million for full year 2016, compared to $92.5 million in 2015. For

the full year 2016, total capital expenditures, including cash paid

for equipment purchases and deposits on equipment and including

capital leases, totaled $74.7 million compared to $82.9 million in

2015. Growth capital expenditures totaled $33.2 million and

maintenance capital expenditures totaled $41.5 million.

Alliance’s gross debt, defined as total long-term debt

(including current maturities but excluding the impact of deferred

financing costs), decreased $4.5 million to $573.2 million at

December 31, 2016 from $577.7 million at December 31, 2015.

Alliance’s net debt, defined as total long-term debt (including

current maturities but excluding the impact of deferred financing

costs) less cash and cash equivalents, increased $11.4 million to

$551.0 million at December 31, 2016 from $539.6 million at December

31, 2015. Cash and cash equivalents were $22.2 million at December

31, 2016 and $38.1 million at December 31, 2015.

Alliance’s total debt, as defined above, divided by the last

twelve months Consolidated Adjusted EBITDA was 4.03x for the twelve

month period ended December 31, 2016, compared to 4.13x for the

quarter ended September 30, 2016 and 4.10x for the year ended

December 31, 2015. Alliance’s net debt, as defined above, divided

by the last twelve months Consolidated Adjusted EBITDA was 3.87x

for the twelve month period ended December 31, 2016, compared to

3.83x for the year ended December 31, 2015.

Full Year 2017 Guidance

“With respect to our guidance for 2017, we are looking for

balanced growth in Revenue and Adjusted EBITDA. The revenue

momentum that has been evident throughout the previous year will

enable us to drive earnings growth as we leverage existing

investments that have been made in new clinical sites and

strengthening our team. We will also make meaningful progress

towards our long-term goal of reducing leverage to the 3.5x

Adjusted EBITDA range,” stated Mr. Tomlinson.

Alliance’s full year 2017 guidance ranges are as follows:

(in millions) Ranges Revenue $529 - $540

Adjusted EBITDA $135 - $140 Capital expenditures $54 - $70

Maintenance $30 - $35 Growth $24 - $35

Decrease in long-term debt, net of the

change in

cash and cash equivalents (before

investments in

acquisitions), before growth capital

expenditures

or “free cash flow before growth capital

expenditures”

$50 - $55 Decrease in long-term debt, net of the change

in cash and cash equivalents (before

investments in

acquisitions), after growth capital

expenditures

or “free cash flow after growth capital

expenditures”

$19 - $26

Full Year 2016 Earnings and 2017 Guidance Conference

Call

Investors and all others are invited to listen to a conference

call discussing fourth quarter 2016 and full year 2016 results as

well as 2017 guidance. The conference call is scheduled for

Thursday, March 9, 2017 at 5 p.m. Eastern Time. Additionally, a

live webcast of the call will be available on the Company’s website

at www.alliancehealthcareservices-us.com. Click on “About Us,”

then, “Investor Relations.” You will find the Audio Presentation in

the “News & Events” section. A replay of the webcast will be

available on the Company’s website until May 9, 2017.

The conference call can be accessed at 877.638.4550

(International callers can dial 443.961.0596). Interested parties

should call at least five minutes prior to the call to register. A

telephone replay will be available until May 3, 2017. The telephone

replay can be accessed by calling 800.585.8367. The conference call

identification number is 10068564.

Definition of Non-GAAP Measures

Total Adjusted EBITDA and Adjusted Net Income Per Share are not

measures of financial performance under generally accepted

accounting principles in the United States (“GAAP”).

For a more detailed discussion of these non-GAAP financial

measures and a reconciliation to the most directly comparable GAAP

financial measure, see the section entitled “Non-GAAP Measures”

included in the tables following this release.

About Alliance HealthCare Services

Alliance HealthCare Services (NASDAQ: AIQ) is a leading national

provider of outsourced medical services including radiology,

oncology and interventional. We partner with healthcare providers

and hospitals to provide a full continuum of services from mobile

to fixed-site to comprehensive service line management and joint

venture partnerships. We also operate freestanding clinics and

Ambulatory Surgical Centers (“ASCs”) that are not owned by

hospitals or providers.

As of December 31, 2016, Alliance operated 625 diagnostic

radiology and radiation therapy systems, including 113 fixed-site

radiology centers across the country, and 33 radiation therapy

centers and SRS facilities. With a strategy of partnering with

hospitals, health systems and physician practices, Alliance

provides quality clinical services for over 1,100 hospitals and

other healthcare partners in 46 states, where approximately 2,450

Alliance Team Members are committed to providing exceptional

patient care and exceeding customer expectations. For more

information, visit www.alliancehealthcareservices-us.com.

Forward-Looking Statements

This press release contains forward-looking statements relating

to future events, including statements related to the Company’s

long-term growth strategy and efforts to diversify its business

model, the Company’s plans to expand its Interventional Division,

both organically and through one or more acquisitions, the

Company’s expectations regarding growth across the Company’s

divisions, the expansion of its service footprint and revenue

growth, maximizing shareholder value, and the Company’s Full Year

2017 Guidance, including its forecasts of revenue, Adjusted EBITDA,

capital expenditures, and decrease (increase) in long-term debt. In

this context, forward-looking statements often address the

Company’s expected future business and financial results and often

contain words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks” or “will.” Forward-looking statements by their

nature address matters that are uncertain and subject to risks.

Such uncertainties and risks include: changes in the preliminary

financial results and estimates due to the restatement or review of

the Company’s financial statements; the nature, timing and amount

of any restatement or other adjustments; the Company’s ability to

make timely filings of its required periodic reports under the

Securities Exchange Act of 1934; issues relating to the Company’s

ability to maintain effective internal control over financial

reporting and disclosure controls and procedures; the Company’s

high degree of leverage and its ability to service its debt;

factors affecting the Company’s leverage, including interest rates;

the risk that the counterparties to the Company’s interest rate

swap agreements fail to satisfy their obligations under these

agreements; the Company’s ability to obtain financing; the effect

of operating and financial restrictions in the Company’s debt

instruments; the Company’s ability to comply with reporting

obligations and other covenants under the Company’s debt

instruments, the failure of which could cause the debt to become

due; the accuracy of the Company’s estimates regarding its capital

requirements; the effect of intense levels of competition and

overcapacity in the Company’s industry; changes in the methods of

third party reimbursements for medical imaging, oncology and

interventional services; fluctuations or unpredictability of the

Company’s revenues, including as a result of seasonality; changes

in the healthcare regulatory environment; the Company’s ability to

keep pace with technological developments within its industry; the

growth or lack thereof in the market for radiology, oncology,

interventional and other services; the disruptive effect of

hurricanes and other natural disasters; adverse changes in general

domestic and worldwide economic conditions and instability and

disruption of credit and equity markets; difficulties the Company

may face in connection with recent, pending or future acquisitions,

including unexpected costs or liabilities resulting from the

acquisitions, diversion of management’s attention from the

operation of the Company’s business, costs, delays and impediments

to completing the acquisitions, and risks associated with

integration of the acquisitions; and other risks and uncertainties

identified in the Risk Factors section of the Company’s Form 10-K

for the year ended December 31, 2016, filed with the Securities and

Exchange Commission (the “SEC”), as may be modified or supplemented

by our subsequent filings with the SEC. These uncertainties may

cause actual future results or outcomes to differ materially from

those expressed in the Company’s forward-looking statements.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

The Company does not undertake to update its forward-looking

statements except as required under the federal securities

laws.

ALLIANCE HEALTHCARE SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND

COMPREHENSIVE INCOME (in thousands, except per share

amounts) Quarter Ended December 31,

(unaudited)

Year Ended December 31,

(audited)

2016 2015 2016 2015

Revenues $ 129,387 $ 124,337 $ 505,549 $ 473,054 Costs and

expenses: Cost of revenues, excluding depreciation and amortization

73,761 72,676 285,746 269,104 Selling, general and administrative

expenses 25,162 22,173 96,663 88,471 Transaction costs 900 1,332

1,886 3,296 Shareholder transaction costs 703 1,853 4,219 1,853

Severance and related costs 724 616 3,910 1,347 Impairment charges

632 — 632 6,817 Depreciation expense 14,295 12,643 54,972 48,595

Amortization expense 3,068 2,418 10,561 9,325 Interest expense, net

9,067 6,659 34,506 26,241 Other income, net (337 )

(1,931 ) (6,586 ) (12,255 ) Total costs and expenses

127,975 118,439 486,509 442,794 Income

before income taxes, earnings from unconsolidated

investees, and noncontrolling interest

1,412 5,898 19,040 30,260 Income tax (benefit) expense (285 ) 1,232

2,852 6,536 Earnings from unconsolidated investees (363 )

(344 ) (1,290 ) (3,391 ) Net income 2,060

5,010 17,478 27,115 Less: Net income attributable to noncontrolling

interest (4,194 ) (5,262 ) (16,985 )

(20,373 ) Net (loss) income attributable to Alliance HealthCare

Services, Inc. $ (2,134 ) $ (252 ) $ 493 $ 6,742

Comprehensive income (loss), net of taxes: Net income 2,060 5,010

17,478 27,115 Unrealized gain (loss) on hedging transactions, net

of taxes 122 (29 ) 104 (178 )

Reclassification adjustment for losses

included in net income, net

of taxes

181 18 417 18 Comprehensive income, net

of taxes 2,363 4,999 17,999 26,955 Less: Comprehensive income

attributable to noncontrolling interest (4,194 )

(5,262 ) (16,985 ) (20,373 ) Comprehensive (loss)

income attributable to Alliance HealthCare

Services, Inc.

$ (1,831 ) $ (263 ) $ 1,014 $ 6,582

(Loss) income per common share attributable to Alliance HealthCare

Services, Inc.: Basic $ (0.20 ) $ (0.02 ) $ 0.05 $ 0.63 Diluted $

(0.20 ) $ (0.02 ) $ 0.04 $ 0.62 Weighted average number of shares

of common stock and

common stock equivalents:

Basic 10,897 10,742 10,866 10,741 Diluted 10,897 10,802 10,959

10,849

ALLIANCE HEALTHCARE SERVICES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (Audited)

(in thousands) December 31, 2016

2015 ASSETS Current assets: Cash and cash equivalents

$ 22,241 $ 38,070 Accounts receivable, net of allowance for

doubtful accounts 77,496 73,208 Prepaid expenses 9,568 13,463 Other

current assets 3,853 3,206 Total current assets

113,158 127,947 Plant, property and equipment, net 204,814 177,188

Goodwill 119,130 102,782 Other intangible assets, net 198,977

162,923 Other assets 23,785 32,820 Total assets $

659,864 $ 603,660

LIABILITIES AND STOCKHOLDERS’ DEFICIT

Current liabilities: Accounts payable $ 28,185 $ 20,796 Accrued

compensation and related expenses 24,895 19,933 Accrued interest

payable 3,308 3,323 Current portion of long-term debt 17,298 17,732

Current portion of obligations under capital leases 3,354 2,674

Other accrued liabilities 29,323 36,453 Total current

liabilities 106,363 100,911 Long-term debt, net of current portion

515,407 540,353 Obligations under capital leases, net of current

portion 12,686 10,332 Deferred income taxes 25,818 23,020 Other

liabilities 9,093 6,664 Total liabilities 669,367

681,280 Stockholders’ deficit: Common stock 110 108 Treasury

stock (3,138 ) (3,138 ) Additional paid-in capital 61,353 29,297

Accumulated comprehensive income (loss) 10 (511 ) Accumulated

deficit (197,900 ) (198,393 ) Total stockholders’

deficit attributable to Alliance HealthCare Services, Inc. (139,565

) (172,637 ) Noncontrolling interest 130,062 95,017

Total stockholders’ deficit (9,503 ) (77,620 ) Total

liabilities and stockholders’ deficit $ 659,864 $ 603,660

ALLIANCE HEALTHCARE SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Audited) (in thousands) Year Ended

December 31, 2016 2015 Operating

activities: Net income $ 17,478 $ 27,115 Adjustments to

reconcile net income to net cash provided by operating activities:

Provision for doubtful accounts 2,255 2,911 Share-based payment

2,713 1,701 Depreciation and amortization 65,533 57,920

Amortization of deferred financing costs 8,126 2,554 Accretion of

discount on long-term debt 513 481 Adjustment of derivatives to

fair value 727 29 Distributions from unconsolidated investees 1,335

3,880 Earnings from unconsolidated investees (1,290 ) (3,391 )

Deferred income taxes 1,780 6,350 Gain on sale of assets, net

(1,133 ) (1,883 ) Changes in fair value of contingent consideration

related to acquisitions (4,790 ) — Non-cash gain on step

acquisition — (10,672 ) Other non-cash gain (423 ) (209 )

Impairment charges 632 6,817 Excess tax benefit from share-based

payment arrangements (100 ) 5 Changes in operating assets and

liabilities, net of the effects of acquisitions: Accounts

receivable (6,270 ) (7,112 ) Prepaid expenses 3,567 (877 ) Other

current assets 1,267 1,494 Other assets (881 ) 2,607 Accounts

payable 8,040 3,442 Accrued compensation and related expenses 4,962

(1,363 ) Accrued interest payable (15 ) 168 Income taxes payable

868 40 Other accrued liabilities 3,888 454 Net cash

provided by operating activities 108,782 92,461

Investing activities: Equipment purchases (56,401 ) (55,511

) Increase in deposits on equipment (11,768 ) (15,751 )

Acquisitions, net of cash received (25,912 ) (49,140 ) Proceeds

from sale of assets 1,830 1,941 Net cash used in

investing activities (92,251 ) (118,461 )

ALLIANCE HEALTHCARE SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(Audited) (in thousands) Year Ended

December 31, 2016 2015 Financing

activities: Principal payments on equipment debt and capital

lease obligations $ (16,925 ) $ (12,697 ) Proceeds from equipment

debt 7,101 27,049 Principal payments on term loan facility (5,200 )

(9,951 ) Proceeds from term loan facility — 29,850 Principal

payments on revolving loan facility (61,000 ) (33,000 ) Proceeds

from revolving loan facility 63,000 50,500 Payments of debt

issuance costs and deferred financing costs (25,741 ) (808 )

Distributions to noncontrolling interest in subsidiaries (23,526 )

(21,659 ) Contributions from noncontrolling interest in

subsidiaries 1,411 1,732 Issuance of common stock 1 1 Excess tax

benefit from share-based payment arrangements 100 (5 ) Proceeds

from exercise of stock options 614 25 Settlement of contingent

consideration related to acquisitions (825 ) — Proceeds from

shareholder transaction 28,630 — Net cash (used in)

provided by financing activities (32,360 )

31,037 Net (decrease) increase in cash and cash equivalents (15,829

) 5,037 Cash and cash equivalents, beginning of period

38,070 33,033 Cash and cash equivalents, end of period $

22,241 $ 38,070

Supplemental disclosure of cash flow

information: Interest paid $ 25,368 $ 23,373 Income taxes

refunded, net (3,852 ) (664 )

Supplemental disclosure of

non-cash investing and financing activities: Net book value of

assets exchanged 170 199 Capital lease obligations related to the

purchase of equipment 6,558 11,273 Changes in equipment purchases

in accounts payable and accrued equipment (4,591 ) 3,700

Extinguishment of note receivable — 3,071 Transfer of equity

investment as consideration in step acquisition — 721 Transfer of

assets as consideration in acquisitions 9,900 477 Transfer of fair

value of equity investment in step acquisition — 13,645

Noncontrolling interest assumed in connection with acquisitions

39,141 36,231 Mandatorily redeemable noncontrolling interest in

connection with acquisition — 2,386 Fair value of contingent

consideration related to acquisitions 420 5,750

ALLIANCE HEALTHCARE SERVICES,

INC.NON-GAAP MEASURES

Total Adjusted EBITDA and Adjusted Net Income Per Share (the

“Non-GAAP Measures”) are not measures of financial performance

under generally accepted accounting principles in the U.S.

(“GAAP”).

Total Adjusted EBITDA, as defined by the Company’s management,

is consistent with the definition in the Company’s Credit Agreement

and represents net (loss) income before: income tax (benefit)

expense; interest expense, net; depreciation expense; amortization

expense; share-based payment; severance and related costs; net

income attributable to noncontrolling interest; restructuring

charges; transaction costs; shareholder transaction costs;

impairment charges; legal matters expense, net; changes in fair

value of contingent consideration related to acquisitions; non-cash

gain on step acquisition; and other non-cash (benefits) charges,

which include non-cash (gains) losses on sales of assets. The

components used to reconcile net (loss) income to Total Adjusted

EBITDA are consistent with our historical presentation of Total

Adjusted EBITDA.

Adjusted Net Income Per Share, as defined by the Company’s

management, represents net (loss) income before: severance and

related costs; restructuring charges; transaction costs;

shareholder transaction costs; deferred financing costs in

connection with shareholder transaction; impairment charges; legal

matters expenses, net; changes in fair value of contingent

consideration related to acquisitions; non-cash gain on step

acquisition; other non-cash (benefits) charges; and differences in

the GAAP income tax rate compared to our historical income tax

rate. The components used to reconcile net (loss) income per share

to Adjusted Net Income Per Share are consistent with our historical

presentation of Adjusted Net Income Per Share.

Management uses the Non-GAAP Measures, and believes they are

useful measures for investors, for a variety of reasons. Management

regularly communicates the results of its Non-GAAP Measures and

management’s interpretation of such results to its board of

directors. Management also compares the Company’s results of its

Non-GAAP Measures against internal targets as a key factor in

determining cash incentive compensation for executives and other

employees, largely because management feels that these measures are

indicative of how our radiology, oncology and interventional

businesses are performing and are being managed. The diagnostic

imaging and radiation oncology industry continues to experience

significant consolidation. These activities have led to significant

charges to earnings, such as those resulting from acquisition

costs, and to significant variations among companies with respect

to capital structures and cost of capital (which affect interest

expense) and differences in taxation and book depreciation of

facilities and equipment (which affect relative depreciation

expense), including significant differences in the depreciable

lives of similar assets among various companies. In addition,

management believes that because of the variety of equity awards

used by companies, the varying methodologies for determining

non-cash share-based compensation expense among companies and from

period to period, and the subjective assumptions involved in that

determination, excluding non-cash share-based compensation from

Adjusted EBITDA enhances company-to-company comparisons over

multiple fiscal periods and enhances the Company’s ability to

analyze the performance of its radiology, oncology and

interventional businesses.

In the future, the Company expects that it may incur expenses

similar to the excluded items discussed above. Accordingly, the

exclusion of these and other similar items in the Company’s

non-GAAP presentation should not be interpreted as implying that

these items are non-recurring, infrequent or unusual. The Non-GAAP

Measures have certain limitations as analytical financial measures,

which management compensates for by relying on the Company’s GAAP

results to evaluate its operating performance and by considering

independently the economic effects of the items that are or are not

reflected in the Non-GAAP Measures. Management also compensates for

these limitations by providing GAAP-based disclosures concerning

the excluded items in the Company’s financial disclosures. As a

result of these limitations and because the Non-GAAP Measures may

not be directly comparable to similarly titled measures reported by

other companies, however, the Non-GAAP Measures should not be

considered as an alternative to the most directly comparable GAAP

measure, or as an alternative to any other GAAP measure of

operating performance.

The calculation of Adjusted EBITDA is shown below:

Quarter Ended December 31, Year Ended December

31, (in thousands) 2016 2015

2016 2015 Net (loss) income attributable to

Alliance HealthCare Services, Inc. $ (2,134 ) $ (252 ) $ 493 $

6,742 Income tax (benefit) expense (285 ) 1,232 2,852 6,536

Interest expense, net 9,067 6,659 34,506 26,241 Depreciation

expense 14,295 12,643 54,972 48,595 Amortization expense 3,068

2,418 10,561 9,325 Share-based payment (included in “Selling,

general and

administrative expenses”)

526 459 3,176 1,701 Severance and related costs 724 616 3,910 1,347

Net income attributable to noncontrolling interest 4,194 5,262

16,985 20,373 Restructuring charges — 620 1,635 1,327 Transaction

costs 900 1,332 1,886 3,296 Shareholder transaction costs 703 1,853

4,219 1,853 Impairment charges 632 — 632 6,817 Legal matters

expense, net (included in “Selling, general and

administrative expenses”)

— 1,088 106 6,915 Changes in fair value of contingent consideration

related to

acquisitions (included in “Other income,

net”)

(150 ) — (4,790 ) — Non-cash gain on step acquisition (included in

“Other income,

net”)

— (722 ) — (10,672 ) Other non-cash charges (included in “Other

income, net”) 1 59 325 864 Adjusted

EBITDA $ 31,541 $ 33,267 $ 131,468 $ 131,260

Adjusted EBITDA by segment is shown below:

Year Ended December 31, (in thousands)

2016 2015 Adjusted EBITDA: Radiology $ 96,828

$ 94,475 Oncology 46,609 43,112 Interventional 3,935 5,175

Corporate / Other (15,904 ) (11,502 ) Total $ 131,468

$ 131,260

The leverage ratio calculations as of December 31, 2016 are

shown below:

(dollars in thousands) Consolidated Total debt

$ 573,247 Less: Cash and cash equivalents (22,241 ) Net debt

$ 551,006 Last 12 months’ Adjusted EBITDA 131,468 Pro-forma

acquisitions in the last 12 month period(1) 10,784 Last 12

months’ Consolidated Adjusted EBITDA $ 142,252 Total leverage ratio

4.03 x Net leverage ratio 3.87 x (1) Gives pro-forma effect

to acquisitions occurring during the last twelve months, pursuant

to the terms of the Credit Agreement.

The reconciliation of (loss) income per diluted share

attributable to Alliance HealthCare Services, Inc. – GAAP to

Adjusted Net income Per Share is shown below:

Quarter Ended December 31, Year

Ended December 31, 2016 2015 2016

2015 (Loss) income per diluted share – GAAP $ (0.20 )

$ (0.02 ) $ 0.04 $ 0.62 Reconciling charges (benefits) to arrive at

Adjusted Net Income

Per Share – non-GAAP:

Severance and related costs, net of taxes 0.04 0.03 0.21 0.07

Restructuring charges, net of taxes — 0.03 0.09 0.07 Transaction

costs, net of taxes 0.05 0.07 0.10 0.17 Shareholder transaction

costs, net of taxes 0.04 0.10 0.22 0.10 Deferred financing costs in

connection with shareholder

transaction, net of taxes

0.10 — 0.29 — Impairment charges, net of taxes 0.03 — 0.03 0.36

Legal matters expense, net, net of taxes — 0.06 0.01 0.37 Changes

in fair value of contingent consideration related to

acquisitions, net of taxes

(0.01 ) — (0.25 ) — Non-cash gain on step acquisition, net of taxes

— (0.04 ) — (0.57 ) Other non-cash charges, net of taxes — — 0.02 —

GAAP income tax rate compared to our historical income

tax rate

0.06 0.08 0.09 0.09 Total reconciling

charges 0.31 0.33 0.81 0.66 Adjusted

Net Income Per Share – non-GAAP $ 0.11 $ 0.31 $ 0.85 $ 1.28

The reconciliation from net income to Adjusted EBITDA for the

2017 guidance range is shown below (in millions):

2017 Full Year Guidance Range Net income $ 1

$ 2 Income tax benefit — (2 ) Interest expense and

other, net; depreciation expense;

amortization expense; share-based payment

and

other expenses; noncontrolling interest in

subsidiaries

134 140 Adjusted EBITDA $ 135 $ 140

ALLIANCE HEALTHCARE SERVICES, INC. SELECTED

STATISTICAL INFORMATION Quarter Ended December

31, 2016 2015 MRI:

Average number of total systems 287.1 268.0 Average number of

scan-based systems 220.8 218.5 Scans per system per day (scan-based

systems) 9.25 9.33 Total number of scan-based MRI scans 137,068

138,395 Revenue per scan $ 313.22 $ 304.71 Scan-based MRI revenue

(in thousands) $ 42,933 $ 42,171 Non-scan based MRI revenue (in

thousands) 8,171 5,983 Total MRI revenue (in

thousands) $ 51,104 $ 48,154

PET/CT: Average number

of total systems 117.5 116.5 Average number of scan-based systems

111.5 108.3 Scans per system per day 5.55 5.44 Total number of

PET/CT scans 34,637 35,315 Revenue per scan $ 873.85 $ 876.40

Scan-based PET/CT revenue (in thousands) $ 30,268 $ 30,950

Non-scan-based PET/CT revenue (in thousands) 958

1,014 Total PET/CT revenue (in thousands) $ 31,226 $ 31,964

Oncology: Linac treatments 28,096 20,134 Stereotactic

radiosurgery patients 872 887 Total Oncology revenue (in thousands)

$ 29,058 $ 25,217

Interventional: Visits 56,324 54,576 Total

interventional revenue (in thousands) $ 10,990 $ 12,213

Revenue

breakdown (in thousands): MRI revenue $ 51,104 $ 48,154 PET/CT

revenue 31,226 31,964 Other radiology revenue 6,557

6,844 Radiology revenue 88,887 86,962 Oncology revenue 29,058

25,217 Interventional revenue 10,990 12,213 Corporate / Other

452 (55 ) Total revenues $ 129,387 $

124,337

ALLIANCE HEALTHCARE SERVICES,

INC.SELECTED STATISTICAL INFORMATIONRADIOLOGY AND

ONCOLOGY DIVISION SAME-STORE VOLUME

The Company utilizes same-store volume growth as a historical

statistical measure of the MRI and PET/CT imaging procedure, linear

accelerator (“Linac”) treatment and stereotactic radiosurgery

(“SRS”) case growth at its customers in a specified period on a

year-over-year basis. Same-store volume growth is calculated by

comparing the cumulative scan, treatment or case volume at all

locations in the current year quarter to the same quarter in the

prior year. The group of customers whose volume is included in the

scan, treatment or case volume totals is only those that received

service from Alliance for the full quarter in each of the

comparison periods. A positive percentage represents growth over

the prior year quarter and a negative percentage represents a

decline over the prior year quarter. Alliance measures each of its

major radiology and oncology modalities (MRI, PET/CT, Linac and

SRS) separately.

The Radiology Division same-store volume (decline) growth for

the last four calendar quarters ended December 31, 2016 is as

follows:

Same-Store Volume MRI PET/CT

2016

Fourth Quarter (1.2 )% 5.8 % Third Quarter 1.1 % 5.3

% Second Quarter 2.0 % 5.8 % First Quarter 6.6 % 9.3 %

The Oncology Division same-store volume growth (decline) for the

last four calendar quarters ended December 31, 2016 is as

follows:

Same-Store Volume Linac SRS

2016

Fourth Quarter 1.5 % (2.5 )% Third Quarter 5.7 % (4.6

)% Second Quarter (1.1 )% (0.2 )% First Quarter 5.6 % 9.0 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170309006372/en/

Alliance HealthCare Services, Inc.Rhonda Longmore-GrundExecutive

Vice PresidentChief Financial Officer949.242.5300

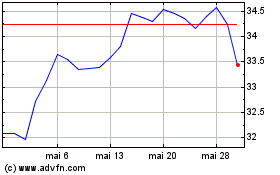

Global X Funds Global X ... (NASDAQ:AIQ)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Global X Funds Global X ... (NASDAQ:AIQ)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025