0000713425FALSE00007134252024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024 (February 21, 2024)

AMERICAN SOFTWARE, INC.

(Exact Name of Registrant as Specified in Charter)

Commission File Number 001-12456

| | | | | |

| Georgia | 58-1098795 |

| (State or Other Jurisdiction | (I.R.S. Employer |

| of Incorporation) | Identification No.) |

470 East Paces Ferry Road, NE, Atlanta, Georgia 30305

(Address of principal executive offices)

(404) 261-4381

Registrant's telephone number, including area code

Not Applicable

(Former Name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbols | | Name of Exchange on which Registered |

| Common Stock | | AMSWA | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financing accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

(b) Executive Chairman and Treasurer Transition

On February 21, 2024, Mr. James C. Edenfield informed the Board of Directors (the “Board”) of American Software, Inc. (the “Company”) that he has decided to retire from service as Executive Chairman and Director of the Board and Treasurer of the Company, effective immediately. Mr. Edenfield’s decision to retire from the Board and the Company is not the result of any dispute or disagreement with the Board and the Company. The Company is grateful to Mr. Edenfield for his many decades of service and contributions to the Board and the Company.

On February 21, 2024, in light of Mr. Edenfield’s retirement, the Board formally resolved to decrease the size of the Board to eight members. The Board appointed Mr. James B. Miller, Jr., a current director of the Company, to serve as Chairman of the Board effective February 21, 2024. The Board will compensate Mr. Miller for his additional responsibilities as Chairman through payment of fifty thousand dollars ($50,000) on an annualized basis, in addition to his other Board compensation, and will revisit this amount in the August Board meeting.

Additionally, the Board appointed Mr. Vince Klinges, the Chief Financial Officer of the Company, to serve as Treasurer of the Company effective February 21, 2024. Other than his employment by the Company as Chief Financial Officer, Mr. Klinges has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), nor are any such transactions currently proposed. There is no arrangement or understanding between Mr. Klinges and any other persons pursuant to which Mr. Klinges was appointed as Treasurer. There are no family relationships between Mr. Klinges and any of the Company’s directors or executive officers.

(e) Advisor Agreement with James C. Edenfield

On February 21, 2024, the Company entered into an Advisor Agreement with Mr. Edenfield (the “Advisor Agreement”), pursuant to which Mr. Edenfield will remain with the Company as a strategic consultant to the Board pursuant to the terms of the Advisor Agreement. Mr. Edenfield’s role as a consultant is designed to assist with a seamless transition of his former duties and to provide advice to the Board.

The foregoing description of the Advisor Agreement does not purport to be complete and it is qualified in its entirety by reference to the Advisor Agreement that is attached hereto as Exhibit 10.1 of this Current Report on Form 8-K, and is incorporated by reference into this Item 5.02.

ITEM 7.01 REGULATION FD DISCLOSURE

On February 21, 2024, the Company issued a press release announcing Mr. Edenfield’s retirement and Mr. Miller’s and Mr. Klinges’ appointments. Attached as Exhibit 99.1 and incorporated herein by reference is a copy of the press release.

Pursuant to the rules and regulations of the Securities Exchange Commission, the information furnished pursuant to Item 7.01 of this report is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: February 21, 2024

| | AMERICAN SOFTWARE, INC. |

| | |

| | (Registrant) |

| | |

| | |

| | By: | /s/ Vincent C. Klinges |

| Name: | Vincent C. Klinges |

| Title: | Chief Financial Officer |

ADVISOR AGREEMENT

This Advisor Agreement (“Agreement”), dated as of February 21, 2024 (“Effective Date”), is by and between Logility, Inc. (“Company”), and James C. Edenfield (“Consultant”).

WHEREAS, Consultant, as a founder, former member of the Board of Directors (“Board”) of American Software, Inc., the Company’s parent corporation (“Parent”), and former executive employee of Parent, has unique, special knowledge of the business and operations of the Company and its Affiliates (defined below);

WHEREAS, in light of Consultant’s unique knowledge and expertise, the Company desires for Consultant to perform certain Services (as defined below) for the Company; and

WHEREAS, Consultant has agreed to provide such Services pursuant to this Agreement.

NOW, THEREFORE, in consideration of the mutual promises and obligations in this Agreement and other good and valuable consideration, the receipt, adequacy and sufficiency of which are hereby acknowledged, the Company and Consultant agree as follows:

1.Services. Upon request from time to time of the Board, Consultant will observe Board meetings and provide advice to the Board (“Services”).

2.Compensation.

(a)As compensation for providing the Services, Company will pay Consultant fifty thousand dollars ($50,000) per year, payable in twenty-five thousand dollar ($25,000) increments every six months, beginning on the Effective Date. Company will pay such incremental amount on or before 30 days after the applicable six month anniversary of the Effective Date. Upon termination of the Agreement, Consultant will have the right to retain the preceding twenty-five thousand dollar ($25,000) payment, without providing a refund back to Company.

(b)As additional compensation for providing the Services, the Company will continue to enroll Consultant and his dependents in Company’s health insurance plan and will pay Consultant’s monthly premium that is required to maintain such health insurance. In the event that Consultant dies, the Company will continue to enroll the Consultant’s spouse in the Company’s health insurance plan for up to and no more than eighteen (18) months after his death and will pay the monthly premiums required to maintain such health insurance during such eighteen (18) month period. Consultant will otherwise remain responsible for Consultant and his dependents’ medical expenses, including without limitation any co-payments, deductibles or medical expenses that are not covered by such health insurance.

(c)As additional compensation for providing the Services, Consultant’s unvested stock options and Restricted Stock Units issued under written agreements by and between Consultant and Parent will continue to vest, even though Consultant is no longer an employee or Board member of Parent.

3.Term. This Agreement shall be effective as of the Effective Date and shall continue from year to year until terminated by either party upon thirty (30) days’ written notice to the other party for any or no reason or until the death of Consultant. The effective date of termination of this Agreement is the “Termination Date.” Notwithstanding the termination of this Agreement in the event of Consultant’s death, the obligations in Section 2(a) will survive such termination, as set forth above in Section 2(a).

4.Confidentiality.

(a)As used herein, “Confidential Information” means all information disclosed by the Company or any of its Affiliates to the Consultant, whether orally or in writing, that is designated as confidential or that reasonably should be understood to be proprietary or confidential given the nature of the information and the circumstances of disclosure. Confidential Information shall include, but not be limited to, business and marketing plans, technology and technical information, customer and supplier lists, pricing, product plans and designs, and business processes. However, Confidential Information shall not include any information that: (i) is or becomes generally known to the public without breach of any obligation owed to the Company; (ii) was known to the Consultant prior to its disclosure by the Company without breach of any obligation owed to the Company; (iii) is received from a third party without breach of any obligation owed to the Company; or (iv) was independently developed by the Consultant without violation of any obligation under this Agreement.

(b)During the Consultant’s engagement by the Company and for five (5) years after the Termination Date, or such longer period as may be authorized for Confidential Information that is a trade secret under applicable law, the Consultant will not at any time, directly or indirectly: (i) use any Confidential Information for any purpose; or (ii) except as otherwise authorized by the Company, disclose any Confidential Information to any other person or entity, in each case except as required in connection with the performance of the Consultant’s duties for the Company, and except to the extent required by law (but only after the Consultant has provided the Company with reasonable notice and opportunity to take action against any legally required disclosure).

(c)Upon the termination of the Consultant’s engagement by the Company, or upon the Company’s request for any reason, the Consultant shall promptly return to the Company or destroy, as the Company directs, all materials (including all electronic and hard copies) in the Consultant’s possession that contain, summarize, or in any way relate to Confidential Information.

(d)The Consultant will not be held criminally or civilly liable under this Agreement for a disclosure of Confidential Information, including trade secrets, that: (i) is made in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney, solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Further, if the Consultant files a lawsuit for retaliation by the Company for reporting a suspected violation of law, the Consultant may disclose the Confidential Information, including trade secrets, to his or her attorney and may use that information in the court proceeding, if the Consultant: (A) files any document containing such information under seal, and (B) does not disclose it, except pursuant to court order.

5.Intellectual Property; Assignment.

(a)Except and solely to the extent prohibited by applicable law, all inventions, modifications, discoveries, designs, developments, improvements, processes, software programs, works of authorship, documentation, formulae, data, techniques, know-how, secrets or other intellectual property rights or any interest therein (each, a “Development”, and collectively, “Developments”) made by the Consultant, either alone or in conjunction with others, at any time or at any place during the Consultant’s engagement by the Company, whether or not reduced to writing or practice during such period of engagement, that (i) relate to an existing or prospective Company product or service at the time the Consultant develops, invents, or creates them, (ii) are developed for use by the Company, or (iii) are developed or promoted with existing Company intellectual property or with the Company’s endorsement, shall be and hereby are the exclusive property of the Company without any further compensation to the Consultant. In addition, without limiting the generality of the prior sentence, all Developments that are copyrightable by the Consultant are intended to be “work made for hire” as defined in Section 101 of the Copyright Act of 1976, as amended, and shall be and hereby are the property of the Company.

(b)The Consultant shall promptly disclose any Developments to the Company. If any Development is not the property of the Company by operation of law, this Agreement or otherwise, the Consultant will, and hereby does, assign to the Company all right, title and interest in and to such Development, without further consideration, and will assist the Company and its nominees in every way, at the Company’s expense, to secure, maintain and defend the Company’s rights in such Development. The Consultant shall sign all instruments necessary for the filing and prosecution of any applications for, or extensions or renewals of, patent and other intellectual property registrations or filings of the United States or any foreign country that the Company desires to file in connection with any Development. The Consultant hereby irrevocably designates and appoints the Company and its duly authorized officers and agents as the Consultant’s agent and attorney-in-fact (which designation and appointment shall be deemed coupled with an interest and shall survive the Consultant’s death or incapacity), to act for and in the Consultant’s behalf to execute and file any such applications, extensions or renewals and to do all other lawfully permitted acts to further the prosecution and issuance of such intellectual property registrations or filings, or other similar documents with the same legal force and effect as if executed by the Consultant.

(c)For the avoidance of doubt, the foregoing subsections are not intended to apply to any Development that does not meet the stated criteria, including without limitation contributions to open source software and Developments created prior to engagement by the Company (“Other Developments”); provided, that if the Consultant includes any Other Development in a Company product or service, the Consultant hereby grants to the Company a non-exclusive, irrevocable, fully paid-up, royalty-free, perpetual, sublicensable, transferable, worldwide license to use such Other Development without restriction in any way or implementation, in modified form, or as is, by itself, or incorporated into another product or service.

6.Consultant Acknowledgment. The Consultant acknowledges and agrees that: (a) the restrictions contained in this Agreement are necessary and reasonable to protect the Company’s legitimate business interests in its trade secrets and other valuable Confidential Information and its relationships and goodwill with its employees and existing and prospective customers and vendors; and (b) the restrictions in this Agreement have been drafted as narrowly as reasonably possible to protect such legitimate business interests.

7.Remedies. Without limiting the remedies available to the Company, the Consultant acknowledges that a breach of any of the covenants contained herein could result in irreparable injury to the Company for which there might be no adequate remedy at law, and that, in the event of such a breach or threat thereof, the Company shall be entitled to seek, without having to post bond, an injunction or such other equitable relief as may be required to enforce specifically any of the covenants hereof. Any such relief shall be in addition to, and not in lieu of, any other remedies to which the Company may be entitled.

8.Independent Contractors. The relationship between the parties hereto is that of independent contractors. The Consultant shall be free to arrange the time, manner of performance and other details of the Services. The parties acknowledge and agree that neither this Agreement nor any related document shall in any respect be interpreted, deemed or construed as creating a partnership or joint venture between the parties, or making either party an agent or representative of the other party, and each party agrees not to make any contrary assertion, contention, claim or counterclaim in any action, suit or other legal proceeding involving any of the parties. In no event shall either of the parties be liable for debts or claims accruing or arising against the other party. The Consultant represents and warrants to Company that: (a) the Consultant is an independent contractor; (b) the Company shall not be required to withhold taxes from any payments due to the Consultant, and, if applicable, the Consultant shall pay all applicable sales and use taxes relating to the Services; and (c) Consultant is not entitled to participate in any of Company’s benefits programs other than health insurance. Consultant will not subcontract or otherwise assign or delegate performance of the Services to a third party without Company’s prior, written approval in each case.

9.Tax Matters. The Consultant shall be solely responsible for withholding and paying all taxes relating to the Services and the fees paid hereunder, including without limitation any federal, state or local income, business, franchise, withholding, social security or other similar taxes or estimated taxes and any and all unemployment or other similar insurance premiums or fees. The Company shall be solely responsible for taxes based on the Company’s income or property.

10.Notice. Except as otherwise specified in this Agreement, any notice required or permitted to be given under this Agreement will be sufficient if given in writing and: (i) personally delivered; (ii) deposited for next day delivery with a reputable overnight courier service; (iii) deposited in the mail, prepaid and certified or registered with return receipt requested; or (iv) sent by e-mail with confirmation of receipt by response email, provided that an automatic “read receipt,” out of office message or similar automated message will not constitute confirmation of receipt, in each case addressed as follows (or to such other address as a party may specify by notice in accordance with the terms of this Section):

| | | | | |

| If to the Company: | If to the Consultant: |

Logility, Inc. 470 East Paces Ferry Rd. NE Atlanta, GA 30305 Attn: Legal Department E-mail: notice@logility.com | James C. Edenfield [On file with the Company] |

11.Survival. This Agreement shall survive the termination of the Consultant’s engagement by the Company, and shall continue thereafter in full force and effect in accordance with its terms. The rights and protections of the Company hereunder shall extend to any successors or assigns of the Company, and to any of the Company’s parents, subsidiaries, and affiliates not included hereunder. As used herein, “successor” means any person, firm, corporation, or business entity which at any time, whether by merger, purchase, or otherwise, acquires or gains control of all or substantially all of the assets or the business of the Company.

12.Severability. If any provision of this Agreement is held by a court having jurisdiction over the parties to be wholly or partially unenforceable for any reason, such unenforceability shall not affect the remainder of this Agreement, which shall remain in full force and effect. Without limiting the generality of the foregoing, if any of the provisions contained in this Agreement for any reason is held to be excessively broad as to duration, geographical scope, activity or subject, such provision shall be construed by limiting and reducing it so as to be enforceable to the maximum extent permitted by applicable law.

13.Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia, without regard to its conflict of laws principles.

14.Amendments. No modification, amendment, or waiver of any provision of this Agreement shall be effective unless in writing and signed by the party against whom the modification, amendment or waiver is to be asserted.

15.Waivers. The waiver of a breach of any provision of this Agreement shall not be construed as a waiver or a continuing waiver of the same or any subsequent breach of any provision of this Agreement. No delay or omission in exercising any right under this Agreement shall operate as a waiver of that or any other right.

16.Headings; Gender; Number. The headings and captions in this Agreement are for convenience and identification purposes only, are not an integral part of this Agreement, and are not to be considered in the interpretation of any part of this Agreement. When the context so

requires, the masculine, feminine and neuter genders may be used interchangeably and the singular may include the plural and vice versa.

17.Entire Agreement. This Agreement constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all prior and contemporaneous agreements, proposals or representations, written or oral, concerning such subject matter.

18.Affiliates. This Agreement will also benefit Company’s Affiliates (defined below) that Company elects to utilize the Services under this Agreement and who are obligated to be bound by this Agreement. Each reference to Company in this Agreement will be deemed to also include such Affiliates. Company is responsible for any breach of this Agreement by Company’s Affiliates; any claim, action or proceeding by Consultant against such Affiliates arising out of or relating to this Agreement will be brought against Company in lieu of such Affiliates. “Affiliates” means those legal entities that are any one or more of the following: controlled by a party to this Agreement, are under common control with such party, or that control such party. For purposes of the preceding sentence, “control” means direct and indirect ownership of fifty percent (50%) or more of the voting securities, other equity, assets or other financial interests of the applicable entity, but such corporation, company or other entity shall be deemed to be an Affiliate only as long as the criteria set forth in this definition are met.

19.Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original and which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

Consultant: Company:

James C. Edenfield Logility, Inc.

By: By:

Date: Name:

Date:

Title:

American Software, Inc. Announces Resignation of Executive Chair Jim Edenfield

ATLANTA – February 21, 2024 –The Board of Directors of American Software, Inc. (NASDAQ: AMSWA), a leading provider of innovative AI-powered supply chain management and advanced retail planning platforms, announced today that the company’s co-founder, Executive Chairman and Treasurer, James C. Edenfield, has elected to step down from the Board and as the company’s Treasurer, after over 50 years of leadership for the company. Mr. Edenfield submitted a letter of resignation, which the Board accepted today. Mr. Edenfield will continue as an advisor to the company and its Board.

Mr. Edenfield is an original co-founder of the company, dating back to 1970, when Mr. Edenfield and Dr. Thomas L. Newberry, IV, formed the predecessor to the company and served on its Board, with Mrs. Norma Edenfield and Mrs. Evelyn Newberry. Mr. Edenfield, together with Dr. Newberry, pioneered the development and use of manufacturing and distribution planning and execution software applications; which were foundational for the supply chain management software industry as a whole, above and beyond being foundational for the company.

For decades, Mr. Edenfield served as the company’s Co-Chief Executive Officer, President and Treasurer. He oversaw the company’s growth, its initial public offering in 1983, global expansion and successfully led the company through rapid and enormous changes in the business and industry.

The Board announced that James B. Miller, Jr., a member of the Board since 2002, has agreed to serve as the Chair of the Board, effective today.

"Jim Edenfield has been a leader, mentor and friend through the decades I have known him,” said Allan Dow, CEO of American Software. “We are glad that Jim will continue to advise our Board and me and are grateful for his half a century of service to the company. We’re also thankful for Jim Miller’s willingness to step up as our Board Chair and look forward to his leadership in this transitionary period.”

This announcement does not affect the company’s previously announced Nomination and Corporate Governance Committee review of the Company’s corporate structure and dual class structure. The Committee expects that the completion of that work can be announced prior to the annual shareholder meeting.

About American Software

Atlanta-based American Software, Inc. (NASDAQ: AMSWA), through its operating entity Logility, delivers prescriptive demand, inventory, manufacturing, and supply planning tools – helping to provide executives the confidence and control to increase margins and service levels, while delivering sustainable supply chains.

Serving clients such as Big Lots, Carter’s, Destination XL, Hostess, Husqvarna Group, Jockey International, Johnson Controls, Parker Hannifin, Red Wing Shoe Company, Spanx, Dole Fresh Vegetables, Inc., and Fender Musical Instrument Co, our solutions are marketed and sold through a direct sales team as well as an independent global value-added reseller distribution network.

Logility’s supply chain planning platform leverages Generative AI, advanced AI-driven algorithms, and machine learning. Our engineered approach drives team alignment for over 800 customers in 80 countries with prioritized, value-focused outcomes. For more information about Logility, please visit www.logility.com. You can learn more about American Software at www.amsoftware.com or by calling (404) 364-7615 or email kliu@amsoftware.ocom.

Forward-Looking Statements

This press release contains forward-looking statements that are subject to substantial risks and uncertainties. There are a number of factors that could cause actual results or performance to differ materially from what is anticipated by statements made herein. These factors include, but are not limited to, continuing U.S. and global economic uncertainty and the timing and degree of business recovery; the irregular pattern of American Software’s revenues; dependence on particular market segments or clients; competitive pressures; market acceptance of American Software’s products and services; technological complexity; undetected software errors; potential product liability or warranty claims; risks associated with new product development; the challenges and risks associated with integration of acquired product lines, companies and services; uncertainty about the viability and effectiveness of strategic alliances; American Software, Inc.’s ability to satisfy in a timely manner all Securities and Exchange Commission (SEC) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and

Worldwide Headquarters ● 470 East Paces Ferry Road, N.E. ● Atlanta, Georgia 30305 ● 800.762.5207 ● www.amsoftware.com

regulations adopted under that Section; as well as a number of other risk factors that could affect American Software’s future performance. For further information about risks American Software could experience as well as other information, please refer to American Software, Inc.’s current Form 10-K and other reports and documents subsequently filed with the SEC. For more information, contact: Kevin Liu, American Software, Inc., (626) 657-0013 or email kliu@amsoftware.com.

Investor Contact:

Kevin Liu

kliu@amsoftware.com

(626) 424-1535

Worldwide Headquarters ● 470 East Paces Ferry Road, N.E. ● Atlanta, Georgia 30305 ● 800.762.5207 ● www.amsoftware.com

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

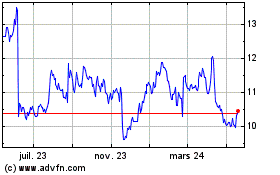

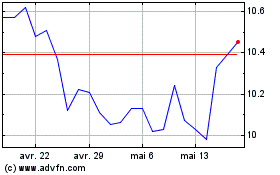

American Software (NASDAQ:AMSWA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

American Software (NASDAQ:AMSWA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024