false

0001705110

0001705110

2025-01-10

2025-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 10, 2025

Angi Inc.

(Exact name of registrant as specified in

charter)

| Delaware |

|

001-38220 |

|

82-1204801 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

3601 Walnut Street, Suite 700

Denver, CO |

|

80205 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 963-7200

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 |

ANGI |

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.02 | Unregistered Sales of Equity Securities |

The information set forth under Item 5.02

below with respect to the transfer of shares to Joseph Levin is incorporated herein by reference. On January 13, 2025, Angi Inc.

(the “Company” or “Angi”) issued a number of shares of Class A Common Stock (as defined below) equal to the

number of converted shares of Class B Common Stock (as defined below) to Mr. Levin, in accordance with the terms of the Class B

Common Stock. The issuance of such shares of Class A Common Stock was made in reliance upon the exemption from registration

contained in Section 4(2) of the Securities Act of 1933, as amended.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Mr. Levin, the current Chairman of the board

of directors (the “Board”) of Angi has been elected by the Board to serve as Executive Chairman of the Board, effective as

of the earlier of: (i) the date on which the Company’s controlling stockholder, IAC Inc. (“IAC”), completes the separation

of the Company from IAC described under Item 8.01 below and (ii) May 31, 2025 (the “Effective Date”). In the role of Executive

Chairman, Mr. Levin will receive a base salary of $350,000 and will be eligible to receive discretionary annual cash bonuses. He will

also be provided with an executive assistant and will participate in the Company’s health and welfare benefits plan.

Mr. Levin will also enter into a non-competition agreement whereby he will agree not to compete with the Company until the later of (i)

two years from the Effective Date and (ii) the date he no longer serves as Executive Chairman.

Mr. Levin, age 45, has served as Chief Executive

Officer and a member of the board of directors of IAC since June 2015, where he has overseen the constant evolution of the company and

its businesses, including the initial public offering and subsequent spin-off of Match Group, Inc. the spin-off of Vimeo, Inc. and the

acquisitions of Angie’s List, Inc. and Care.com, Inc. Mr. Levin also served as Chief Executive Officer of Angi from October 2022

to April 2024. Mr. Levin joined IAC in 2003 as an associate director in the Mergers & Acquisitions group, working his way up to Senior

Vice President of Mergers & Acquisitions and Finance before moving to operations and business management, where he oversaw the strategy

and growth of IAC’s search and applications businesses. He graduated from the Jerome Fisher Program in Management & Technology

from the University of Pennsylvania, with a BS in Economics from the Wharton School and a BAS in Engineering from the School of Engineering

and Applied Sciences.

On January 13, 2025, IAC announced that Mr.

Levin would cease to serve as Chief Executive Officer and as a member of the board of directors of IAC as of the Effective Date. In

connection with this announcement, Mr. Levin and IAC entered into an employment transition agreement, dated January 13, 2025 (the

“ETA”). Pursuant to the ETA, among its other terms and conditions, on January 13, 2025, IAC transferred 5,008,600 fully

vested shares of Angi Class B common stock, par value $0.001 per share (“Class B Common Stock”), to Mr. Levin. Also

pursuant to the ETA, Mr. Levin has converted all shares of Class B Common Stock into shares of Class A common stock, par value $0.001

per share, of the Company (“Class A Common Stock”), and committed not to transfer or otherwise dispose of such shares

for a period of six years following the Effective Date, subject to certain limited exceptions.

In addition to serving as Chairman of the Board

of Angi, Mr. Levin serves on the board of directors of MGM Resorts International. In addition to his for-profit affiliations,

Mr. Levin also currently serves on the Board of Advisors of The Wharton School.

On January 13, 2025, IAC announced that its board

of directors approved a plan to spin off IAC’s ownership stake in the Company to IAC stockholders.

IAC intends to effect the spin-off through a dividend

of all of the capital stock of the Company owned by IAC at the effective time of such dividend to the holders of its common stock and

Class B common stock. Prior to the effective time of such dividend, IAC intends to voluntarily convert all of the shares of Class B Common

Stock that it owns to shares of Class A Common Stock. The completion of the spin-off and dividend remain subject to conditions and to

the final approval of the board of directors of IAC in its sole discretion, and may not be completed, on the anticipated terms or at all.

The decision whether the spin-off will be completed is in the sole discretion of IAC.

The joint press release issued by the Company

and IAC on January 13, 2025 relating to the above matters is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated

herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

ANGI INC. |

| |

|

|

| |

|

|

| |

|

By: |

/s/ Shannon M. Shaw |

| |

|

Name: |

Shannon M. Shaw |

| |

|

Title: |

Chief Legal Officer |

Date: January 13, 2025

Exhibit 99.1

IAC Announces Plan

to Spin Off Angi; Reorganizes Leadership

Angi Announces Joey

Levin will guide Angi’s next chapter as Executive Chairman

NEW YORK and DENVER, January 13, 2025—IAC

(NASDAQ: IAC) announced today its Board of Directors has approved a plan to spin off IAC’s full stake in Angi (NASDAQ: ANGI), a

leading platform for home services, to IAC shareholders. IAC will also reorganize its leadership: Joey Levin will leave his role as IAC

CEO and become an advisor to the company, with the transition expected to occur upon the completion of the spin-off. Angi concurrently

announced its appointment of Mr. Levin as Executive Chairman of Angi. In this role, Mr. Levin will serve as Angi’s senior executive

in partnership with Angi CEO Jeff Kip, who will continue to report to Mr. Levin and the Angi Board of Directors, to shape Angi’s

next chapter as IAC’s 10th fully independent company.

Following Mr. Levin’s transition, IAC

does not intend to appoint a new CEO. IAC Chief Financial Officer & Chief Operating Officer Christopher Halpin and Chief Legal

Officer Kendall Handler will report directly to Barry Diller, Senior Executive and Chairman of IAC.

“Joey Levin has wanted a store of his

own for some time and the spin-off of Angi affords him this opportunity. Although IAC will relinquish his services as CEO, we expect that

he will continue to advise us for many years. As we approach yet another milestone, IAC does what it does best: evolves. Joey Levin has

been an exemplary leader of IAC, creating significant value during his nearly decade-long tenure as IAC CEO,” said Mr. Diller. “Over

the last few years Joey has been deeply and personally invested in the transformation of Angi, and with its full independence can drive

the company to expand any which way he, Jeff Kip and Angi’s Board desire.”

“I consider myself among the luckiest

in the world to have spent the past two decades working with and learning from Barry Diller and the many brilliant minds he has always

attracted to his orbit,” said Mr. Levin. “Together we’ve accomplished remarkable things, and we start 2025 with each

of our businesses executing winning growth plans, led by exceptionally talented teams. Each of IAC and Angi has a vigorous

future, and I expect to remain an active participant in both. I am energized to partner with Jeff Kip and the leadership team he

has organized at Angi to win a large, captivating category that has yet to be tamed.”

The

spin-off transaction, which is expected to be tax free, will give IAC shareholders direct ownership of Angi, resulting in IAC and Angi

becoming wholly separate entities. IAC expects that the spin-off will be in the form of one share/one vote common stock of Angi, eliminating

Angi’s dual-class structure. Today, all of Angi’s high vote shares are owned by IAC. The spin-off will allow IAC management

to focus on its broader portfolio as well as new growth opportunities. A simplified IAC is also expected to benefit from an enhanced ability

to use its stock to make acquisitions and incentivize employees. As a fully independent company, Angi will benefit from a more attractive

equity currency to accelerate growth, whether through M&A, capital formation or talent acquisition, undiluted focus on its specific

operating and strategic priorities, and streamlined decision-making. As a result of the spin-off, each of IAC and Angi is expected

to benefit from the ability to allocate its resources to meet the unique needs of its respective business and to implement its optimal

capital structure tailored to its strategy and business needs.

The completion of the proposed spin-off transaction

is subject to a number of conditions including final approval by the IAC Board of Directors and receipt of a tax opinion. The transaction

is expected to close in the first half of 2025 but no sooner than March 31, 2025.

IAC and Angi also announced that, after the close of market trading

on Tuesday, February 11, 2025, they will post their respective fourth quarter results at https://ir.iac.com/quarterly-results (IAC) and

ir.angi.com/quarterly-earnings (Angi). On Wednesday, February 12 2025, at 8:30 a.m. ET, IAC and Angi Inc. will host a conference call

to answer questions regarding the companies’ respective fourth quarter results. The live audiocast and replay will be open to the

public through the investor relations section of the IAC site at https://ir.iac.com/quarterly-results and the Angi site at ir.angi.com/quarterly-earnings.

IAC and Angi also affirmed prior financial

expectations for the fourth quarter of 2024.

###

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995

This press release may contain "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as "anticipates,"

"estimates," "expects," "plans" and "believes," among others, generally identify forward-looking

statements. These forward-looking statements include, among others, statements relating to: the reorganization of IAC’s leadership,

our ability to successfully manage our planned leadership transitions, the proposed spin-off of IAC’s ownership in Angi Inc. and

anticipated benefits, business prospects and strategy, the future financial performance of IAC and its businesses, the future financial

performance of Angi Inc. as an independent organization, anticipated trends and prospects in the industries in which IAC’s or Angi’s

businesses operate and other similar matters. Actual results could differ materially from those contained in these forward-looking statements

for a variety of reasons, including, among others: (i) our ability to market our products and services in a successful and cost-effective

manner, (ii) the display prominence of links to websites offering our products and services in search results, (iii) changes in our relationship

with (or policies implemented by) Google, (iv) our ability to compete with generative artificial intelligence technology and the related

disruption to marketing technologies, (v) the failure or delay of the markets and industries in which our businesses operate to migrate

online and the continued growth and acceptance of online products and services as effective alternatives to traditional products and services,

(vi) our continued ability to develop and monetize versions of our products and services for mobile and other digital devices, (vii) unstable

market and economic conditions (particularly those that adversely impact advertising spending levels and consumer confidence and spending

behavior), either generally and/or in any of the markets in which our businesses operate, as well as geopolitical conflicts, (viii) the

ability of IAC’s Digital business to successfully expand the digital reach of its portfolio of publishing brands, (ix) our continued

ability to market, distribute and monetize our products and services through search engines, digital app stores, advertising networks

and social media platforms, (x) risks related to IAC’s Print business (declining revenue, increased paper and postage costs, reliance

on a single supplier to print its magazines and potential increases in pension plan obligations), (xi) our ability to establish and maintain

relationships with quality and trustworthy professionals and caregivers, (xii) the ability of Angi Inc. to expand its pre-priced offerings,

while balancing the overall mix of service requests and directory services on Angi platforms, (xiii) the ability of Angi Inc. to continue

to generate leads for professionals given changing requirements applicable to certain communications with consumers, (xiv) our ability

to access, collect, use and protect the personal data of our users and subscribers, (xv) our ability to engage directly with users, subscribers,

consumers, professionals and caregivers on a timely basis, (xvi) the ability of IAC’s Chairman and Senior Executive and certain

members of his family to exercise significant influence over the composition of the IAC board of directors, matters subject to stockholder

approval and IAC’s operations, (xvii) risks related to our liquidity and indebtedness (the impact of our indebtedness on our ability

to operate our business, our ability to generate sufficient cash to service our indebtedness and interest rate risk), (xviii) IAC’s

inability to freely access the cash of Dotdash Meredith and its subsidiaries, (xix) dilution with respect to investments in either IAC

and Angi Inc., (xx) our ability to compete, (xxi) our ability to build, maintain and/or enhance our various brands, (xxii) our ability

to protect our systems, technology and infrastructure from cyberattacks (including cyberattacks experienced by third parties with whom

we do business), (xxiii) the occurrence of data security breaches and/or fraud, (xxiv) increased liabilities and costs related to the

processing, storage, use and disclosure of personal and confidential user information, (xxv) the integrity, quality, efficiency and scalability

of our systems, technology and infrastructure (and those of third parties with whom we do business), (xxvi) changes in key personnel and

risks related to leadership transitions and (xxvii) risks related to the proposed spin-off of IAC’s ownership in Angi Inc. Certain

of these and other risks and uncertainties are described in IAC’s and Angi’s respective filings with the Securities and Exchange

Commission (the “SEC”), including the most recent Annual Reports on Form 10-K filed by IAC and Angi with the SEC on February

29, 2024, and subsequent reports that IAC or Angi files with the SEC. Other unknown or unpredictable factors that could also adversely

affect IAC or Angi's business, financial condition and results of operations may arise from time to time. It is not possible for our management

to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those expressed in any forward-looking statements we may make. Except as required

by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such

statements. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to

the date of this press release.

About IAC

IAC (NASDAQ: IAC) builds companies. We are guided by curiosity, a questioning

of the status quo, and a desire to invent or acquire new products and brands. From the single seed that started as IAC over two decades

ago have emerged 11 public companies and generations of exceptional leaders. We will always evolve, but our basic principles of financially-disciplined

opportunism will never change. IAC is today comprised of category-leading businesses including Angi Inc. (NASDAQ: ANGI), Dotdash Meredith

and Care.com, among many others ranging from early stage to established businesses. IAC is headquartered in New York City with business

locations worldwide.

About Angi Inc.

Angi (NASDAQ: ANGI) helps homeowners get home projects done well and

helps home professionals grow their business. We started in 1995 with a simple goal to help people find skilled home pros in their area.

Now more than 25 years later, we've evolved to help people with everything from finding, booking and hiring a skilled pro, to researching

costs, finding inspiration and discovering project possibilities. With an extensive nationwide network of skilled home pros, Angi has

helped more than 150 million people maintain, repair, renovate and improve their homes and has helped hundreds of thousands of small local

businesses grow.

Contact Us

IAC/Angi Inc. Investor Relations

Mark Schneider

(212) 314-7400

IAC Corporate Communications

Valerie Combs

(212) 314-7251

Angi Inc. Corporate Communications

Emily Do

(303) 963-8352

IAC

555 West 18th Street, New York, NY

10011 (212) 314-7300 http://iac.com

Angi Inc.

3601 Walnut Street, Denver, CO 80205 (303) 963-7200 http://www.angi.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

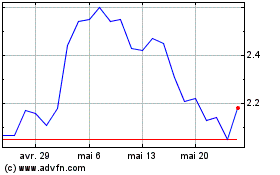

Angi (NASDAQ:ANGI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Angi (NASDAQ:ANGI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025