0001437958FALSE00014379582024-09-302024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024

COASTAL FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Washington | | 001-38589 | | 56-2392007 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

5415 Evergreen Way, Everett, Washington 98203

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (425) 257-9000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, no par value per share | CCB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ⃞

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ⃞

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Appointment of Brian Hamilton as President of CCBX

On September 30, 2024, Coastal Community Bank (the “Bank”), a subsidiary of Coastal Financial Corporation (the “Company”), appointed Brian Hamilton, a current member of the Company’s Board of Directors, as President of CCBX, the FinTech and banking-as-a-service division of the Bank.

Mr. Hamilton, 47, is a seasoned financial technology executive and business leader, with more than 25 years of experience in banking, lending, payments and digital product development. Mr. Hamilton has held senior leadership roles at Capital One, serving as President of their Merchant Services division from January 2013 until February 2015, Wells Fargo from July 1998 until March 2006 and Verifone from January 2012 until January 2013, in addition to founding and operating multiple companies in the fintech space. Most recently Mr. Hamilton was co-founder and CEO of ONE (One Finance Inc.) from January 2019 until August 2023, which was acquired by a Walmart led joint venture in 2022. Prior to co-founding ONE, he was the founder of Azlo, a digital bank for small businesses, and helped to build out the BBVA Open Platform for sponsor banking services. Mr. Hamilton is an honors graduate of Oregon State University, with technical certifications from Wells Fargo’s commercial banking school and various industry groups.

On September 30, 2024, the Bank entered into an employment agreement (the “Employment Agreement”), an offer letter agreement (the “Offer Letter”), a time-based restricted stock unit award agreement (the “RSU Award Agreement”), and a performance-based restricted stock unit award agreement (the “PSU Award Agreement”) with Mr. Hamilton. The Employment Agreement governs the terms of Mr. Hamilton’s employment and contains standard non-competition and non-solicitation provisions, as well as standard confidentiality, and non-disparagement provisions. The initial term of the Employment Agreement is four years, with automatic annual renewal absent prior notice of non-renewal.

Pursuant to the terms of the Employment Agreement, Offer Letter, RSU Award Agreement, and PSU Award Agreement, Mr. Hamilton will be entitled to an initial annual base salary of $470,000. He will also receive a one-time award of 25,000 restricted stock units and 75,000 performance-based restricted stock units. The restricted stock units vest over a 43-month period, with 16.28% vesting on April 30, 2025, and 2.3256% vesting each month thereafter. With respect to the performance-based restricted stock units, (1) 60,000 performance-based restricted stock units are eligible to vest on the first day of each month beginning on October 1, 2024 until April 30, 2028, subject to continuous employment with the Company and the achievement of certain stock price conditions, with RSUs earned in pro-rata tranches at 60-day sustained stock prices of $75.00, $90.00, and $105.00 and (2) 15,000 performance-based restricted stock units are eligible to vest on April 30, 2028, subject to continuous employment with the Company and provided that the Company’s return on equity for the period of January 1, 2024 to December 31, 2027 is at least in the 80th percentile of the Company’s peer group. Mr. Hamilton will be eligible to participate in the Company’s annual cash incentive plan in a manner similar to other senior Company executives, with opportunities based upon the achievement of performance goals. He will also be eligible to receive equity incentive awards under the Company’s 2018 Omnibus Incentive Plan, with award opportunities based upon continued service and the achievement of certain performance conditions.

There is no arrangement or understanding between Mr. Hamilton and any other person pursuant to which he was selected as President of CCBX. The Bank is also excited to announce that Michael Barreiro, who has extensive experience as a software engineer and technology executive and

has worked alongside Mr. Hamilton at Azlo and ONE, was appointed as the Bank’s Chief Technology Officer on September 30, 2024. Mr. Hamilton and Mr. Barreiro are first cousins. In addition, Mr. Hamilton has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with Mr. Hamilton’s appointment, the current role of President of the Bank will be bifurcated into two roles: President of the CCBX division and President of the community bank division. Curt Queyrouze will serve as President of the community bank division and will be responsible for leading the community bank and corporate credit.

Item 7.01 Regulation FD

A copy of the press release announcing the appointment of Brian Hamilton as the President of CCBX issued by the Company on October 3, 2024, is attached hereto as Exhibit 99.1 to this current report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Number | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (Embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| COASTAL FINANCIAL CORPORATION |

| | |

Date: October 3, 2024 | By: | /s/ Joel G. Edwards |

| | Joel G. Edwards |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Coastal Community Bank Appoints President to CCBX Division

EVERETT, Wash., October 3, 2024 (GLOBE NEWSWIRE) -- Coastal Financial Corporation (Nasdaq: CCB) (the “Company”), and its subsidiary, Coastal Community Bank (the “Bank”), announced that its role of President of the Bank is to be bifurcated to accommodate the Bank’s growth and plans for the future. The Bank announced the appointment of Brian Hamilton as President of CCBX, the FinTech and banking-as-a-service division of the Bank. Mr. Hamilton is a current member of the Company’s Board of Directors. In connection with the reorganization of the role of the President, the Bank also announced that Curt Queyrouze, the President of the Company and the Bank, will serve as President of the community bank division and will be responsible for leading the community bank and corporate credit.

“As Coastal focuses on growing CCBX, we continuously seek out individuals with the skillsets and experience that we believe will bolster our banking-as-a-service division and who complement the leadership team already in place,” said Eric Sprink, the Company’s Chief Executive Officer. “We were fortunate to add Brian to our Board of Directors earlier this year and since then, he has been an invaluable contributor to the Company and the Bank. Brian’s appointment to this new role will allow the Company to benefit more deeply from his background and extensive expertise in banking, lending, payments and digital products development,” Mr. Sprink added.

“Outside of CCBX, Coastal has been a fixture of community banking in the Puget Sound region for decades. We are excited to be able to bring that local, customer-first, community banking perspective and experience to new customers by evolving the community banking division to incorporate additional digital access for customers,” said Mr. Sprink. “Curt’s leadership, experience, and foresight have been key to Coastal’s success since he was appointed as President, and we are excited for him to build Coastal’s community bank division.”

Mr. Hamilton is a seasoned financial technology executive and business leader, with more than 25 years of experience in banking, lending, payments and digital product development. Mr. Hamilton has held senior leadership roles at Capital One, serving as President of their Merchant Services division, Wells Fargo and Verifone, in addition to founding and operating multiple companies in the fintech space. Most recently Mr. Hamilton was co-founder and CEO of ONE (One Finance Inc.), which was acquired by a Walmart led joint venture in 2022. Prior to co-founding ONE, he was the founder of Azlo, a digital bank for small businesses, and helped to build out the BBVA Open Platform for sponsor banking services.

“I am thrilled to deepen my relationship with the Coastal team in my new role leading the CCBX business. I have been lucky enough to work with many in management and across the Company and the Bank since joining the Board of Directors. I am excited to be able to take the experiences I gained and serve the Company and the Bank both as a member of management and as a director,” said Mr. Hamilton.

About Coastal Financial

Coastal Financial Corporation (NASDAQ: CCB), is an Everett, Washington-based Bank holding company with Coastal Community Bank (the “Bank”) a full-service commercial bank, as its sole wholly-owned banking subsidiary. The Bank operates 14 branches in Snohomish, Island, and King Counties, online and through mobile banking. The Bank’s CCBX division provides banking as a service (“BaaS”) that allows our broker-dealer and digital financial service partners to offer their customers banking services. As of June 30, 2024, we had total assets of $3.96 billion, loans receivable of $3.3 billion, total deposits of $3.5 billion, and total shareholders’ equity of $316.7 million. To learn more about Coastal Community Bank visit www.coastalbank.com. Member FDIC.

Contact

Eric Sprink, Chief Executive Officer, (425) 357-3659

Joel Edwards, Executive Vice President & Chief Financial Officer, (425) 357-3687

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. Any statements about our management’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Any or all of the forward-looking statements in this earnings release may turn out to be inaccurate. The inclusion of or reference to forward-looking information in this earnings release should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of risks, uncertainties and assumptions that are difficult to predict. Factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the most recent period filed and in any of our subsequent filings with the Securities and Exchange Commission.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as required by law.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

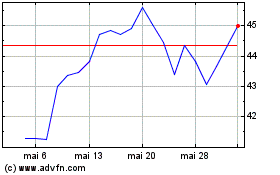

Coastal Financial (NASDAQ:CCB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

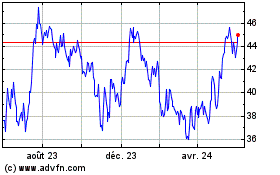

Coastal Financial (NASDAQ:CCB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024