false000152493100015249312024-09-302024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024

CHUY’S HOLDINGS, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| | | | | | | | |

| Delaware | 001-35603 | 20-5717694 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1623 Toomey Rd.

Austin, Texas 78704

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (512) 473-2783

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CHUY | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

Demand Letters and Actions Relating to the Merger

As previously disclosed, on July 17, 2024, Chuy’s Holdings, Inc. (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Darden Restaurants, Inc., a Florida corporation (“Parent”), and Cheetah Merger Sub Inc., a Delaware corporation and an indirect, wholly-owned subsidiary of Parent (“Merger Sub”), providing for the merger of Merger Sub with and into the Company (the “Merger”), with the Company surviving the Merger as an indirect, wholly-owned subsidiary of Parent (the “Surviving Corporation”) in accordance with the Delaware General Corporation Law (as amended, the “DGCL”).

On August 20, 2024, the Company filed a preliminary proxy statement (the “Preliminary Proxy Statement”) with the Securities and Exchange Commission (the “SEC”). On September 5, 2024, the Company filed a definitive proxy statement (the “Definitive Proxy Statement”) with the SEC in connection with the special meeting of the Company’s stockholders to be held at 9:00 a.m. Central Time on Thursday, October 10, 2024 at the Company’s headquarters located at 1623 Toomey Rd., Austin, TX 78704 (the “Special Meeting”).

Following announcement of the Merger, as of the date of this Current Report on Form 8-K, the Company has received thirteen demand letters from purported stockholders (collectively, the “Demand Letters”) and two complaints were filed in the New York State Supreme Court, New York County, by purported stockholders (collectively, the “Actions”). The Demand Letters and Actions allege that the disclosures contained in the Preliminary Proxy Statement and/or the Definitive Proxy Statement are deficient and demanding that the Company issue certain additional disclosures.

The Company and the members of the Company’s Board of Directors (the “Board”) believe that the Demand Letters and the Actions are without merit, that each of the Preliminary Proxy Statement and the Definitive Proxy Statement fully complies with the Securities Exchange Act of 1934, as amended, and all other applicable law, and that no further disclosure is required. However, solely in order to mitigate any risk of the Demand Letters or the Actions delaying or otherwise adversely affecting the consummation of the Merger and to minimize any costs, risks, and uncertainties inherent in any potential litigation related thereto, and without admitting any liability or wrongdoing, the Company has determined to voluntarily supplement the Definitive Proxy Statement, as described in this Current Report on Form 8-K, in order to moot the allegations in the Demands and Actions. Nothing in this Current Report on Form 8-K shall be deemed an admission of the legal necessity or materiality of any such disclosures under applicable laws.

These supplemental disclosures will not change the consideration to be paid to the Company’s stockholders in connection with the Merger or the timing of the Special Meeting. The Board continues to recommend that you vote “FOR” each of the proposals to be voted on at the Special Meeting described in the Definitive Proxy Statement, including the proposal to adopt the Merger Agreement.

The information contained in this Current Report on Form 8-K is incorporated by reference into the Definitive Proxy Statement. To the extent that information in this Current Report on Form 8-K differs from or updates information contained in the Definitive Proxy Statement, the information in this Current Report on Form 8-K shall supersede or supplement such information in the Definitive Proxy Statement.

Supplement to Definitive Proxy Statement

The Company has determined to voluntarily make these supplemental disclosures to the Definitive Proxy Statement. This supplemental information should be read in conjunction with the disclosures contained in the Definitive Proxy Statement, which in turn should be read in its entirety. All page references are to the Definitive Proxy Statement and terms used below, unless otherwise defined, shall have the meanings ascribed to such terms in the Definitive Proxy Statement. New text within restated language from the Definitive Proxy Statement is indicated in bold, underlined text (e.g., bold, underlined text) and removed language within the restated language from the Definitive Proxy Statement is indicated in strikethrough text (e.g., strikethrough text), as applicable. The information contained herein speaks only as of September 30, 2024 unless the information indicates another date applies.

1. The following disclosure replaces in its entirety the disclosure beginning on page 38 of the Definitive Proxy Statement under the heading “The Merger—Opinion of Our Financial Advisor—Financial Analysis—Selected Public Company Analysis”:

Selected Public Companies Analysis. Piper reviewed certain publicly available financial, operating, and stock market information of the company and the following selected U.S. publicly traded companies in the restaurant industry that Piper deemed relevant. Piper selected companies based on information obtained by searching SEC filings, publicly available disclosures, and company presentations, press releases, and other sources and by applying the following criteria:

| | | | | | | | | | | |

| | • | | companies that operate in the full service restaurant industry, defined as establishments offerings table service with a waitstaff; |

| | | | | | | | | | | |

| | • | | companies that have a market capitalization greater than or equal to $100.0 million, and separated between small cap (defined as sub-$1 billion market capitalization) and mid/large cap (defined as $1 billion+ market capitalization); and |

| | | | | | | | | | | |

| | • | | companies that operate a significant number of company-owned restaurants, defined as greater than or equal to 70.0% of the units being company-owned. |

Based on these criteria, Piper identified and analyzed the following eleven selected companies and corresponding financial data:

Sub $1 billion Market Cap Public Companies:

| | | | | | | | | | | |

| | • | | Cracker Barrel Old Country Store, Inc. |

| | | | | | | | | | | |

| | • | | The ONE Group Hospitality, Inc. |

| | | | | | | | | | | |

| | • | | Red Robin Gourmet Burgers, Inc. |

$1 billion+ Market Cap Public Companies:

| | | | | | | | | | | |

| | • | | Brinker International, Inc. |

| | | | | | | | | | | |

| | • | | The Cheesecake Factory Incorporated |

| | | | | | | | | | | |

| | • | | Darden Restaurants, Inc. |

| | | | | | | | | | | |

| | • | | Dave & Buster’s Entertainment, Inc. |

| | | | | | | | | | | |

| | • | | First Watch Restaurant Group, Inc. |

| | | | | | | | | | | |

| | EV / CY 2024E EBITDA (1)(2) | | EV / CY 2025E EBITDA (1)(2) |

| Sub $1 billion Market Cap Public Companies |

BJ’s Restaurants, Inc. | 7.9x | | 7.4x |

Cracker Barrel Old Country Store, Inc. | 6.9x | | 6.6x |

The ONE Group Hospitality, Inc. | 6.3x | | 4.8x |

Red Robin Gourmet Burgers, Inc. | 4.2x | | 3.5x |

Maximum | 7.9x | | 7.4x |

Minimum | 4.2x | | 3.5x |

| | | | | | | | | | | |

Median | 6.6x | | 5.7x |

| | | |

| $1 billion+ Market Cap Public Companies | | |

Bloomin’ Brands, Inc. | 4.8x | | 4.6x |

Brinker International, Inc. | 8.4x | | 8.4x |

The Cheesecake Factory Incorporated | 9.3x | | 8.6x |

Darden Restaurants, Inc. | 10.7x | | 10.1x |

Dave & Buster’s Entertainment, Inc. | 5.4x | | 4.9x |

First Watch Restaurant Group, Inc. | 10.3x | | 8.7x |

Texas Roadhouse, Inc. | 17.8x | | 16.2x |

Maximum | 17.8x | | 16.2x |

Minimum | 4.8x | | 4.6x |

Median | 9.3x | | 8.6x |

(1) Represents EBITDA adjusted for disclosed non-recurring items and burdened for pre-opening costs and stock based compensation

(2) Per Wall Street Consensus estimates

For the selected public companies analysis, Piper calculated the following valuation multiples for the company, including as implied by the merger consideration, and the selected companies:

| | | | | | | | | | | |

| | • | | Enterprise value (which is defined as fully diluted equity value, based on closing prices per share on July 16, 2024, plus total debt, finance lease obligations, preferred equity, and noncontrolling interests (as applicable) less total cash and cash equivalents) as a multiple of EBITDA for estimated calendar year 2024; and |

| | | | | | | | | | | |

| | • | | Enterprise value as a multiple of EBITDA for estimated calendar year 2025. |

Financial data of the selected companies were based on publicly available research analysts’ estimates, public filings, and other publicly available information. Financial data of the company was based on publicly available information and the Company Projections furnished to Piper by company management.

The results of this analysis are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Merger Consideration Implied Multiple: | | Implied Multiple Reference Ranges: |

EV / CY 2024E

Updated EBITDA | | EV / CY 2025E

EBITDA | | $1B+ Market Cap: | | Sub $1B Market Cap: |

| | EV / CY 2024E

Updated EBITDA | | EV / CY 2025E

EBITDA | | EV / CY 2024E

Updated EBITDA | | EV / CY 2025E

EBITDA |

| 10.9x | | 9.4x | | 4.8x – 17.8x | | 4.6x – 16.2x | | 4.2x – 7.9x | | 3.5x – 7.4x |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Merger Consideration: | | Implied Equity Value per Share Reference Ranges: |

| $37.50 | | $1B+ Market Cap: | | Sub $1B Market Cap: |

| | EV / CY 2024E

EBITDA | | EV / CY 2025E

EBITDA | | EV / CY 2024E

EBITDA | | EV / CY 2025E

EBITDA |

| | $18.31– $59.16 | | $19.78 – $62.04 | | $16.41 – $27.91 | | $15.67 – $29.96 |

No company utilized in the selected public companies analysis is identical to the company. In evaluating the selected companies, Piper made judgments and assumptions with regard to industry performance, general business, macroeconomic, market and financial conditions, and other matters.

2. The following disclosure replaces in its entirety the table on page 40 of the Definitive Proxy Statement under the heading “The Merger—Opinion of Our Financial Advisor—Financial Analysis—Selected Precedent Transactions Analysis”:

| | | | | | | | | | | | | | |

| Date Announced | Date Closed | Target | Acquiror | EV / LTM EBITDA (1)(2) |

| Apr 2024 | Pending | TGI Fridays | Hostmore | 5.4x |

| Mar 2024 | May 2024 | Safflower Holdings | The ONE Hospitality Group | 5.8x |

| May 2023 | June 2023 | Ruth’s Hospitality Group | Darden Restaurants | 9.4x |

| Aug 2022 | Sep 2022 | BBQ Holdings | MTY Food Group | 10.5x |

| Apr 2022 | June 2022 | Main Event | Dave & Buster’s Entertainment | 9.3x |

| Sep 2021 | Oct 2021 | Twin Peaks | FAT Brands | 10.0x |

| July 2021 | Sep 2021 | J. Alexander’s Holdings | SPB Hospitality | 8.7x |

| Sep 2019 | Nov 2019 | Del Frisco’s Double Eagle & Del Frisco’s Grille | Landry’s | * |

| June 2019 | Sep 2019 | Del Frisco’s Restaurant Group | L Catterton | 18.8x |

| May 2018 | June 2018 | Barteca Restaurant Group | Del Frisco’s Restaurant Group | 18.0x |

| Mar 2018 | May 2018 | Bravo Brio Restaurant Group | Spice Private Equity | 6.6x |

| Feb 2018 | Apr 2018 | Fogo de Chão | Rhône Capital | 10.2x |

| Nov 2017 | Feb 2018 | Buffalo Wild Wings | Arby’s Restaurant Group | 10.8x |

| Oct 2017 | Dec 2017 | Ruby Tuesday | NRD Capital Management | 5.0x |

| Mar 2017 | Apr 2017 | Cheddar’s Casual Café | Darden Restaurants | 10.4x |

| Jan 2017 | Apr 2017 | Bob Evans Restaurants | Golden Gate Capital | 6.5x |

| May 2015 | Aug 2015 | Frisch’s Restaurants | NRD Capital Management | 6.3x |

| May 2014 | July 2014 | TGI Fridays | Sentinel Capital Partners, Tri-Artisan Capital Partners | 8.0x |

| May 2014 | July 2014 | Red Lobster Seafood Co. | Golden Gate Capital | 5.6x |

| Jan 2014 | Feb 2014 | CEC Entertainment | Apollo Global Management | 7.8x |

(1) For transactions with significant real estate value where there was an associated sale-leaseback, enterprise value is adjusted to exclude sale-leaseback proceeds and EBITDA is burdened for pro forma rent where applicable

(2) Represents EBITDA adjusted for disclosed non-recurring items and burdened for pre-opening costs and stock based compensation

* Represents proprietary multiple

3. The following disclosure replaces in its entirety the disclosure beginning on page 40 of the Definitive Proxy Statement under the heading “The Merger—Opinion of Our Financial Advisor—Financial Analysis—Discounted Cash Flow Analysis”:

Discounted Cash Flow Analysis. Using a discounted cash flows analysis, Piper calculated an estimated range of theoretical values for the company based on the net present value of (i) projected unlevered free cash flows from second half of fiscal 2024 (consisting of the third and fourth fiscal quarters) to fiscal year 2028, discounted back to June 30, 2024 (the end of the company’s second fiscal quarter 2024), based on the Company Projections furnished to Piper by company management, and (ii) a terminal value at fiscal year 2028 based upon EBITDA exit multiples, discounted back to June 30, 2024. The unlevered free cash flows for each year were calculated from the Company Projections as adjusted EBITDA less depreciation and amortization, less closed restaurant costs, less income taxes (utilizing a 14.9% tax rate), plus depreciation and amortization, plus non-cash rent expense, less net capital

expenditures, and less the change in net working capital. The table below sets forth the unlevered free cash flow Piper used in its analysis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period Ending December 31, |

| ($ in millions) | | 2H 2024E | | 2025E | | 2026E | | 2027E | | 2028E |

| Unlevered Free Cash Flow | | ($2.1) | | $6.6 | | $9.1 | | $9.8 | | $24.3 |

In addition, stock-based compensation was treated as a cash expense for purpose of determining unlevered free cash flow. The terminal values of the company were calculated by applying the company’s fiscal year 2028 adjusted EBITDA, which was $95.6 million, to a selected range of EBITDA exit multiples of 8.0x to 10.0x, with a mid-point of 9.0x, based on the median of the selected precedent transactions’ LTM EBITDA multiples.

Piper performed discounted cash flow analyses by calculating the range of net present values for each period from second half of fiscal 2024, consisting of the third and fourth fiscal quarters 2024, to fiscal year 2028, based on a discount rate ranging from 11.5% to 16.5%, with a mid-point of 14.0%. The discount rate reflects Piper’s estimates of the company’s weighted average cost of capital, based on Piper’s experience and professional judgement. Piper derived these discount rates by application of the capital asset pricing model, which requires certain company-specific inputs, including a market capitalization size risk premium, as well as certain financial metrics for the U.S. financial markets generally.

This analysis indicated the following approximate implied equity value per share reference ranges for the company, as compared to the merger consideration:

| | | | | | | | |

| Merger Consideration | | Implied Equity Value per Share Reference Range: |

| $37.50 | | $26.55 – $38.20 |

4. The following disclosure replaces the first full paragraph on page 44 of the Definitive Proxy Statement under the heading “The Merger—Opinion of Our Financial Advisor—Information About Piper”:

Piper acted as the board of directors’ financial advisor in connection with the merger and will receive a fee, currently estimated to be approximately $8.2 million, from the company. A significant portion of Piper’s fee is contingent upon completion of the merger, and $1.0 million of such fee has been earned by Piper for rendering its fairness opinion and is creditable against the total fee. The opinion fee was not contingent upon the completion of the merger or the conclusions reached in Piper’s opinion. The remainder of the fee is payable to Piper contingent upon the closing of the merger. The company has also agreed to indemnify Piper against certain liabilities and reimburse Piper for certain expenses in connection with its services. In addition, in the ordinary course of its business, Piper and its affiliates may actively trade securities of the company or Darden for Piper’s own account or the account of its customers and, accordingly, may at any time hold a long or short position in such securities. In the ordinary course of its business, Piper also publishes research on the shares of company and Darden common stock. Piper may also, in the future, provide investment banking and financial advisory services to the company or the Darden or entities that are affiliated with the company or the Darden, for which Piper would expect to receive compensation.

6. The following disclosure replaces the disclosure beginning on page 45 of the Definitive Proxy Statement under the heading “The Merger—Interests of Our Directors and Executive Officers in the Merger—Employment or Other Agreements with Darden”:

As of the date of this proxy statement, no executive officer of the company has (i) entered into an agreement with Darden or Merger Sub or any of their respective affiliates regarding employment with, or the right to purchase or participate in the equity of, the surviving corporation or any of its affiliates or (ii) discussed, communicated or negotiated with Darden or Merger Sub regarding post-closing compensation, other than as described in “—Background of the Merger”. Under the merger agreement, Darden has agreed to honor, or cause one of its affiliates to honor, the terms of the employment agreements with certain executives, including each named executive officer, following the closing date. Prior to or following the closing of the merger, however, these executive officers may

discuss or enter into new employment or equity agreements with Darden, Merger Sub, and/or any of their respective affiliates.

In addition, the Company is making the following supplemental disclosures to the Definitive Proxy Statement in connection with certain events that occurred after the date of the Definitive Proxy Statement.

1. The following disclosure replaces the second sentence of the fourth full paragraph on page 27 of the Definitive Proxy Statement under the heading “The Merger—Background of the Merger”:

Messrs. Hislop and Cardenas did not engage in any specific discussion, or any subsequent specific discussions, regarding potential post-closing compensation or other remuneration with respect to Messrs. Hislop or Howie until September 19, 2024.

2. The following disclosure is inserted as a new final paragraph on page 29 of the Definitive Proxy Statement under the heading “The Merger—Background of the Merger”:

On September 16, 2024, the Board unanimously approved Messrs. Hislop and Howie having specific discussions regarding post-closing compensation in connection with their potential retention by Darden following the transaction. Subsequently, Mr. Hislop engaged in discussions with Mr. Cardenas regarding his and other executives’ post-closing compensation arrangements in connection with their potential retention by Darden following the transaction, which discussions remain ongoing.

Additional Information and Where to Find It

This communication is being made in connection with the Merger. In connection with the Merger, the Company has filed with the SEC and mailed to its stockholders a definitive proxy statement and will file certain other documents regarding the Merger with the SEC. This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT THAT HAS BEEN FILED WITH THE SEC (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. Stockholders of the Company will be able to obtain free copies of these documents (when available) and other documents filed with the SEC by the Company through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by the Company will also be available to stockholders of the Company free of charge on the Company’s website at https://www.chuys.com or by written request to our Corporate Secretary at 1623 Toomey Road, Austin, TX 78704, Attn: Corporate Secretary.

Participants in the Solicitation

The Company, its directors and certain of its executive officers may be considered participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 29, 2024, its Amendment No. 1 to Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on April 25, 2024, its Proxy Statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on June 13, 2024, and in other documents filed with the SEC by the Company and its officers and directors.

These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials in connection with the transaction to be filed with the SEC when they become available.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this communication that are not historical facts, including, without limitation, statements relating to the Merger, including the ability to complete, and the timing of completion of, the transactions contemplated by the Merger Agreement, including stockholder approval, the merits of the Demand Letters received by the Company and the Actions filed against the Company and its directors and the ability of the Company to

eliminate or limit the costs, risks, and uncertainties of litigation and to avoid potential delays or adverse effects to the Merger and financial estimates and statements as to the effects of the Merger and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “believes,” “plans,” “anticipates,” “projects,” “estimates,” “expects,” “intends,” “strategy,” “future,” “opportunity,” “may,” “will,” “should,” “could,” “potential,” “continues,” or similar expressions. Such statements are based upon the current beliefs and expectations of management of the Company. These statements are subject to risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are outside management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Actual results may differ materially from current expectations because of numerous risks and uncertainties including, among others: (1) the risk that the proposed transaction may not be completed in a timely manner or at all; (2) the risk of legal proceedings that may be instituted against the Company related to the Merger Agreement, which may result in significant costs of defense, indemnification and liability; (3) the possibility that competing acquisition proposals for the Company will be made; (4) the possibility that any or all of the various conditions to the consummation of the Merger may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Merger; (5) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, including in circumstances requiring the Company to pay a termination fee; (6) the effects of disruption from the transactions on the Company’s business and the fact that the announcement and pendency of the transactions may make it more difficult to establish or maintain relationships with employees and business partners; (7) actual number of restaurant openings; (8) the sales at the Company’s restaurants; (9) changes in restaurant development or operating costs, such as food and labor; (10) the Company’s ability to leverage its existing management and infrastructure; (11) changes in restaurant pre-opening expense, general and administrative expenses, capital expenditures, effective tax rate, impairment, closed restaurant and other costs; (12) strength of consumer spending and (13) conditions beyond the Company’s control such as timing of holidays, weather, natural disasters, acts of war or terrorism. The foregoing factors should be read in conjunction with the risks and cautionary statements discussed or identified in the Company’s public filings with the SEC from time to time, including the Company’s most recent Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company’s stockholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update any forward-looking statements, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | CHUY’S HOLDINGS, INC. |

| | |

| By: | /s/ Jon W. Howie |

| | Jon W. Howie

Vice President and Chief Financial Officer |

Date: September 30, 2024

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

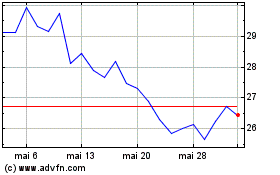

Chuy s (NASDAQ:CHUY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Chuy s (NASDAQ:CHUY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024