As filed with the Securities and Exchange Commission on September 20, 2024.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CPS TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

04-2832509

(I.R.S. Employer Identification No.)

111 South Worcester Street Norton, MA 02766 (508) 222-0614

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian T. Mackey

President and Chief Executive Officer

c/o CPS Technologies Corp.

111 South Worcester Street

Norton, MA 02766

(508) 222-0614

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Thomas B. Rosedale, Esq.

Nutter, McClennen & Fish, LLP

155 Seaport Blvd

Boston, MA 02210

(617) 439-2000 (telephone number)

(617) 310-9000 (facsimile number)

From time to time after this Registration Statement becomes effective.

(Approximate date of commencement of proposed sale to public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), shall determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 20, 2024

PROSPECTUS

CPS TECHNOLOGIES CORP.

$25,000,000

Common Stock

Preferred Stock

Warrants

Rights

Units

We may offer and sell, from time to time in one or more offerings, up to $25,000,000 in the aggregate of common stock, preferred stock, warrants, rights and units, in any combination. We intend to use the proceeds, if any, for general corporate purposes unless otherwise indicated in the applicable prospectus supplement.

This prospectus provides you with a general description of the securities offered. Each time we offer and sell securities, we will file a prospectus supplement to this prospectus that contains specific information about the offering and, if applicable, the amounts, prices and terms of the securities. Such supplements may also add, update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities. This prospectus may not be used to consummate sales of securities unless accompanied by a prospectus supplement.

We may offer and sell the securities described in this prospectus and any prospectus supplement directly to our stockholders or to other purchasers or through agents on our behalf or through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commission or discounts.

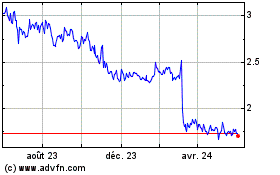

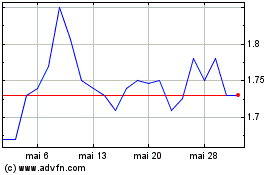

Our common stock is traded on the Nasdaq Capital Market under the symbol “CPSH.” On September 12, 2024, the last reported sales price of our common stock was $1.37 per share.

As of the date of this prospectus, the aggregate market value of our outstanding common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 is $17,445,048, which was calculated based on 12,733,612 shares of our outstanding common stock held by non-affiliates as of September 12, 2024 and a price of $1.37 per share, the closing price of our common stock on September 12, 2024, which is within 60 days of the date of this prospectus. As of the date of this prospectus, we have sold approximately $0 of our securities pursuant to General Instruction I.B.6 of Form S-3 during the period of 12 calendar months immediately prior to, and including, the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in public primary offerings on Form S-3 with a value exceeding more than one-third of our public float (as defined by General Instruction I.B.6) in any 12 calendar month period so long as our public float remains below $25.0 million.

Our principal executive office is located at 111 South Worcester Street, Norton, Massachusetts 02766 and our telephone number is (508) 222-0614.

Investing in our securities involves risks. You should carefully read and consider the “Risk Factors” commencing on page 4 of this prospectus, in any applicable prospectus supplement relating to a specific offering of securities and in any other documents we file with the U.S. Securities and Exchange Commission (“SEC”).

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 20, 2024.

TABLE OF CONTENTS

|

Base Prospectus

|

|

Page

|

|

|

About This Prospectus

|

|

1

|

|

|

Where You Can Find More Information

|

|

2

|

|

|

Incorporation of Certain Documents by Reference

|

|

2

|

|

|

Prospectus Summary

|

|

3

|

|

|

The Company

|

|

3

|

|

|

Risk Factors

|

|

4

|

|

|

Cautionary Statement Regarding Forward-Looking Statements

|

|

9

|

|

|

Use of Proceeds

|

|

10

|

|

|

Description of Capital Stock

|

|

10

|

|

|

Description of Warrants

|

|

14

|

|

|

Description of Rights

|

|

15

|

|

|

Plan of Distribution

|

|

15

|

|

|

Legal Matters

|

|

17

|

|

|

Experts

|

|

17

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $25,000,000.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the securities being offered and the terms of that offering. The prospectus supplement may also add to, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” carefully before making an investment decision. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the later-dated document modifies or supersedes the earlier statement.

This prospectus and any accompanying prospectus supplement or other offering materials do not contain all of the information included in the registration statement as permitted by the rules and regulations of the SEC. For further information, we refer you to the registration statement on Form S-3, including its exhibits. We are subject to the informational requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), and, therefore, file reports and other information with the SEC. Statements contained in this prospectus and any accompanying prospectus supplement or other offering materials about the provisions or contents of any agreement or other document are only summaries. If SEC rules require that any agreement or document be filed as an exhibit to the registration statement, you should refer to that agreement or document for its complete contents.

This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, certain market and industry data obtained from independent market research, industry publications and surveys, governmental agencies and publicly available information. Industry surveys, publications and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe the data from such third-party sources to be reliable. However, we have not independently verified any of such data and cannot guarantee its accuracy or completeness. Similarly, internal market research and industry forecasts, which we believe to be reliable based upon our management’s knowledge of the market and the industry, have not been verified by any independent sources. While we are not aware of any misstatements regarding the market or industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors.

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement, including the information incorporated by reference herein as described under “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference”, and any free writing prospectus that we prepare and distribute. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information in this prospectus, any accompanying prospectus supplement or any other offering materials is only accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless otherwise indicated. Our business, financial condition, results of operations and prospects may have changed since such date.

Unless the context otherwise requires, the terms “CPS,” “the Company,” “our company,” “we,” “us,” “our” and similar names refer to CPS Technologies Corp.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that contains our reports, proxy and other information regarding us and other issuers that file electronically with the SEC, at http://www.sec.gov. Our SEC filings are also available at our website (www.cpstechnologysolutions.com). However, except for our filings with the SEC that are incorporated by reference into this prospectus, the information on our website is not, and should not be deemed to be, a part of, or incorporated by reference into this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows “incorporation by reference” into this prospectus of information that we file with the SEC. This permits us to disclose important information to you by referencing these filed documents. Any information referenced this way is considered to be a part of this prospectus and any information filed by us with the SEC subsequent to the date of this prospectus automatically will be deemed to update and supersede this information. We incorporate by reference the following documents which we have filed with the SEC (excluding any documents or portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

(1) The Company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023, which incorporates by reference certain portions of the Registrant’s definitive proxy statement for the Registrant’s 2024 Annual Meeting of Stockholders filed on April 25, 2024; and

(2) The description of our common stock contained in our Registration Statement on Form 8-A filed on January 13, 2015, including any amendments or reports filed for the purpose of updating such description;

(3) The Company’s Current Reports on Form 8-K filed with the SEC on April 29, 2024, and June 6, 2024; and

(4) The Company’s Periodic Reports on Form 10-Q for the quarters ended March 30, 2024 and June 29, 2024.

We incorporate by reference any filings made by us with the SEC in accordance with Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and the date all of the securities offered hereby are sold or the offering is otherwise terminated, with the exception of any information furnished under Item 2.02 and Item 7.01 (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01) of Form 8-K, which is not deemed filed and which is not incorporated by reference herein. Any such filings shall be deemed to be incorporated by reference and to be a part of this prospectus from the respective dates of filing of those documents.

This prospectus and any accompanying prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus or any accompanying prospectus supplement or free writing prospectus about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s website, as provided above.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with this prospectus, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this prospectus. You should direct requests for documents to:

CPS Technologies Corp.

Attn: Chief Financial Officer

111 South Worcester Street

Norton, MA 02766

(508) 222-0614

PROSPECTUS SUMMARY

This summary highlights certain information about us and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding to invest in our common stock. For a more complete understanding of our company, we encourage you to read and consider carefully the more detailed information in this prospectus, including the information incorporated by reference in this prospectus, and the information under the heading “Risk Factors” in this prospectus, beginning on page 4, before making an investment decision.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus, the documents that are incorporated by reference in this prospectus and other written or oral statements made by or on behalf of our Company may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Exchange Act. Forward-looking statements may be identified by the use of words such as “may,” “will,” “forecast,” “estimate,” “project,” “intend,” “plan,” “expect,” “should,” “believe” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements relate to our future plans, objectives, expectations, intentions and financial performance and the assumptions that underlie these statements, and are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions and speak only as of the date on which it is made. These forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors, including those discussed in “Risk Factors”, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

These risks and uncertainties include, but are not limited to, the following:

• If we fail to comply with any of the covenants in our existing financing arrangement, we may not be able to access our existing revolving credit facility, and we may face an accelerated obligation to repay any indebtedness;

• Cybersecurity incidents could result in the compromise of potentially sensitive information about our employees, vendors or company and expose us to business disruption, negative publicity, costly government enforcement actions or private litigation and our reputation could suffer;

• Changes in regulatory and statutory laws, such as increases in the minimum wage, and the costs of compliance and non-compliance with such laws, may result in increased costs to our business;

• We rely heavily on our information technology systems for our key business processes. If we experience an interruption in their operation, our results of operations may be affected;

• A worldwide pandemic and the measures implemented to contain its spread, may have a material adverse impact on our business and results of operations, and may impact the operations of the Company’s key suppliers, including its raw materials, components and personal protective equipment (PPE) suppliers;[KH1] [GC2]

• If we fail to maintain an effective system of internal controls over financial reporting, we may not be able to accurately report our financial results and prevent or detect material misstatement due to fraud, which could reduce investor confidence and adversely affect the value of our common stock;

• We could be subject to changes in tax rates, the adoption of new U.S. or international tax legislation or exposure to additional tax liabilities;

• Failure to control costs may adversely affect our operating results;

• Changes in the general economic environment may impact our business and results of operations; and

• We rely on our management team and other key personnel.

This list of factors that may affect future performance and the accuracy of forward-looking statements is illustrative but not exhaustive. In addition, new risks and uncertainties may arise from time to time. Accordingly, all forward-looking statements should be evaluated with an understanding of their inherent uncertainty and we caution accordingly against relying on forward-looking statements.

Consider these factors carefully in evaluating the forward-looking statements. Additional factors that may cause results to differ materially from those described in the forward-looking statements are set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the 2023 Annual Report on Form 10-K and in subsequent reports filed by us with the SEC, including on Forms 10-K, 10-Q and 8-K. Because of the foregoing, you are cautioned against relying on forward-looking statements, which speak only as of the date hereof. We do not undertake to update any of these statements in light of new information or future events, except as required by applicable law.

THE COMPANY

Overview

CPS Technologies Corp. (the “Company” or “CPS”) provides advanced material solutions for the transportation, automotive, energy, computing/internet, telecommunications, aerospace and defense markets. CPS products are important elements in electrifying the green economy and in the protection of military personnel around the world.

Our primary material solution is metal matrix composites (“MMCs”). We design, manufacture and sell custom MMC components that improve the performance and reliability of systems in the end markets described above.

The Company is an important participant in the growing movement towards alternative energy. The Company’s products are used in high-speed trains, mass transit, hybrid and electric cars, wind-turbines for electricity generation, routers, switches and fiber optic components for internet infrastructure. The Company’s products are used in high reliability communications and power modules for avionics and satellite applications such as the current generation of GPS satellites. The Company also produces housings and heat spreaders for high-performance microprocessors, graphics processing chips, and application-specific integrated circuits. All of these applications involve electrical energy use or energy generation; the Company’s products allow higher performance and improved energy efficiency.

Using its proprietary MMC technology, the Company also produces light-weight armor. Due to its ability to withstand extreme environments and high threat levels, CPS armor has been selected as the solution for the U.S. Navy’s crew served weapons station program. Its light weight also makes it an ideal solution for aircraft and other vehicles requiring a high strength to weight ratio.

MMCs are a class of materials consisting of a combination of metals and ceramics. Compared to conventional materials, MMCs provide superior thermal conductivity, improved thermal expansion matching, greater stiffness and lighter weight. These factors, in particular the lighter weight, are among the reasons CPS parts are on the last two Mars Rovers as well as many satellites.

CPS is a fully qualified manufacturer for many of the world’s largest electronics OEMs.

In 2022 CPS resumed its participation in the Small Business Innovation Research (“SBIR”) and Small Business Technology Transfer (“STTR”) programs, sponsored by the US Small Business Administration. These programs provide funding for innovative research and development to domestic small businesses, who maintain certain intellectual property rights. The technologies developed by the Company during these programs will further enhance CPS’ intellectual property portfolio.

CPS management believes our business model of providing advanced material solutions to a portfolio of high growth end markets in various stages of the technology adoption lifecycle provides CPS with the opportunity for sustained growth and a diversified customer base. We believe we have validated this model as we are now supplying customers at all stages of the technology adoption lifecycle.

Our products are manufactured by proprietary processes we have developed including the QuicksetTM Injection Molding Process (“Quickset Process”) and the QuickCastTM Pressure Infiltration Process (“QuickCast Process”).

CPS was incorporated in Massachusetts in 1984 as Ceramics Process Systems Corporation and reincorporated in Delaware in April 1987 through a merger into a wholly-owned Delaware subsidiary organized for purposes of the reincorporation. In July 1987, CPS completed our initial public offering of 1.5 million shares of our Common Stock. In March 2007, the Company changed its name from Ceramics Process Systems Corporation to CPS Technologies Corp.

CPS’ website is http://www.cpstechnologysolutions.com.

Our Corporate Information

We maintain our principal executive offices at 111 South Worcester Street, Norton, MA 02766 and our telephone number is (508) 222-0614. Our corporate website address is www.cpstechnologysolutions.com. Our website and the information contained on, or that can be accessed through, the website is not incorporated by reference in, and is not part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our securities.

RISK FACTORS

Investing in our securities involves risks. You should carefully consider the risk factors included in this prospectus, and any updates to those risk factors or new risk factors contained in our subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, all of which are incorporated by reference into this prospectus, as the same may be amended, supplemented or superseded from time to time by our filings under the Exchange Act, as well as any prospectus supplement relating to a specific offering or resale. Before making any investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus or in any applicable prospectus supplement or free writing prospectus. For more information, see the section entitled “Where You Can Find More Information” and “Incorporation of Documents by Reference” elsewhere in this prospectus. These risks could materially affect our business, results of operations or financial condition and affect the value of our securities. You could lose all or part of your investment. Additionally, the risks and uncertainties discussed in this prospectus or in any document incorporated by reference into this prospectus are not the only risks and uncertainties that we face, and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, results of operations or financial condition.

Risk Factors

In addition to the other information set forth in this Registration Statement on Form S-3, please carefully consider the risk factors described below. The risks set forth below may not be the only risk factors relating to the Company. Any of these factors, many of which are beyond our control, could materially adversely affect our business, financial condition, operating results, cash flow and stock price.

We have a highly concentrated customer base so that changes in ordering patterns, delays or order cancellations could have a material adverse effect on our business and results of operations.

Three customers accounted for 60% of revenue in 2023 and 53% of revenue in 2022. We believe that our relationships with these customers are positive and may provide us with ongoing continuous sustainability for years to come, however a large customer, if lost, would be difficult to be replace, and our inability to do so may have a material adverse effect on our business and financial condition. We expect that orders from a relatively limited number of customers will continue to account for a substantial portion of our business. The mix and type of customers, and sales to any single customer, may vary significantly from quarter to quarter and from year to year. If any of our significant customers do not place orders, or they substantially reduce, delay or cancel orders, we may not be able to replace the business in a timely manner or at all, which can and has had a material adverse effect on our results of operations and financial condition. Major customers may also seek, and on occasion receive, pricing, payment or other commercial terms that are less favorable to us and can hurt our competitive position.

Our lengthy and variable sales cycle makes it difficult to predict our financial results.

The sales cycle for our products is often lengthy, ranging from several months to several years. In many cases potential customers must evaluate the properties of our product against their current solution, which may not be as robust as the CPS solution, but is often less expensive. In many cases potential customers must redesign other components of the end product they are making to realize the full benefits of using our products. The lengthy sales cycle makes forecasting the volume and timing of sales difficult and raises additional risks that customers may cancel or delay introduction of their end-products into the marketplace, thus affecting our demand. The length of the sales cycle depends on the size and complexity of the project, and the depth of the evaluation of our products conducted by the customers.

Because a significant portion of our operating expenses is fixed, we have and may continue to incur substantial expense before we earn associated revenue. If customer cancellations occur, they could result in the loss of anticipated sales without allowing us sufficient time to reduce our operating expenses.

Fluctuations in foreign exchange rates can negatively impact our ability to compete against foreign based competitors.

Several of our major competitors are located outside of the United States. The relative strength of the U.S. dollar compared to such competitors’ respective local currencies makes our products more expensive to our customers relative to our competitors’ prices. Such circumstances could result in a reduction in product pricing (and profitability) in order to maintain or grow our current levels of business. If we are unable or unwilling to reduce pricing of our products to the level necessary to maintain current business levels, we could see an overall reduction in revenue.

Our success is highly dependent on managerial contributions of key individuals and we may be unable to retain these individuals or recruit others.

We depend on our senior executives and certain key managers as well as engineering, research and development, sales, marketing and manufacturing personnel, who are critical to our business. While we have employment agreements with certain executives, none of these agreements would prevent any such person from leaving the Company. Furthermore, larger competitors may be able to offer more generous compensation packages to our executives and key employees, and therefore we risk losing key personnel to those competitors. If we were to lose the services of any of our key personnel, or if we fail to attract and train qualified personnel, our engineering, product development, manufacturing and sales efforts could be slowed. In particular, we have, from time to time, experienced difficulty in hiring and retaining skilled engineers with appropriate qualifications to support our growth strategy. Our success depends on our ability to identify, hire, train and retain qualified engineering personnel. Specifically, we need to continue to attract and retain product development, materials and manufacturing engineers to work with our direct sales force to technically qualify and perform on new sales opportunities and orders, and to demonstrate our products.

We may also incur increased operating expenses and be required to divert the attention of our senior executives to search for replacements. The integration of any new personnel could disrupt our ongoing operations.

Business or economic disruptions or global health concerns could seriously harm our business.

Broad-based business, economic disruptions or global health concerns could adversely affect our business and the sale of our products. For example, in December 2019 an outbreak of a novel strain of the coronavirus disease (COVID-19) originated in Wuhan, China, and has since spread to a number of other countries, including the United States. Initially, this outbreak resulted in extended shutdowns of certain businesses in the Wuhan region and had ripple effects to businesses around the world. While the impact of this pandemic has largely subsided, a resurgence of this virus or another could have an impact on our business. Although the Company has remained open throughout the COVID-19 pandemic, complete or partial government shutdowns of many businesses, schools, bars and restaurants have occurred. The Russian invasion of Ukraine and the conflict in Israel and Gaza could also adversely affect our business in spite of the immaterial amount of direct business we have done in this region in the past. We cannot presently predict the scope and severity of any future business shutdowns or disruptions to us, but if we or any of the third parties with whom we engage, including our customers, suppliers and other third parties, were to experience extended shutdowns or other business disruptions, our ability to conduct our business could be materially and negatively impacted, and could have a material adverse effect on our business and our results of operation and financial condition.

Acquisitions can result in an increase in our operating costs, divert management’s attention away from other operational matters and expose us to other associated risks.

From time to time, we evaluate potential acquisitions of businesses and technologies, and we consider targeted acquisitions that expand our core competencies to be an important part of our future growth strategy. We expect that any acquisitions of other businesses will have synergistic products, services and technologies.

Acquisitions involve numerous risks, which include but are not limited to:

| |

●

|

difficulties and increased costs in connection with the integration of the personnel, operations, technologies, services and products of the acquired companies into our existing facilities and operations;

|

| |

●

|

diversion of management’s attention from other operational matters;

|

| |

●

|

failure to commercialize the acquired technology;

|

| |

●

|

the potential loss of key employees of the acquired companies;

|

| |

●

|

lack of synergy, or inability to realize expected synergies, resulting from the acquisitions;

|

| |

●

|

the risk that the issuance of our common stock, if any, in an acquisition or merger could be dilutive to our shareholders;

|

| |

●

|

the inability to obtain and protect intellectual property rights in key technologies; and

|

| |

●

|

the acquired assets becoming impaired as a result of technological advancements or worse-than-expected performance of the acquired assets.

|

The conditions of the markets in which we operate are volatile. The demand for our products and the profitability of our products can change significantly from period to period as a result of numerous factors.

The industries in which we operate are characterized by ongoing changes, including:

| |

●

|

the availability of funds for research and development;

|

| |

●

|

global and regional economic conditions;

|

| |

●

|

governmental budgetary and political constraints; and

|

| |

●

|

changes in technology.

|

For these and other reasons, our results of operations for past periods may not necessarily be indicative of future operating results.

Volatile and cyclical demand for our products may make it difficult for us to accurately budget our expense levels, which are based in part on our projections of future revenues.

When cyclical fluctuations result in lower-than-expected revenue levels, operating results may be materially adversely affected and cost reduction measures may be necessary for us to remain competitive and financially sound. During a down cycle, we must be able to make timely adjustments to our cost and expense structure to correspond to the prevailing market conditions. In addition, during periods of rapid growth, we must be able to increase manufacturing capacity and the number of our personnel to meet customer demand, which may require additional liquidity. We can provide no assurance that these objectives can be met in a timely manner in response to changes within the industry cycles in which we operate. If we fail to respond to these cyclical changes, our business could be seriously harmed.

We do not have long-term volume production contracts with our customers, and we do not control the timing or volume of orders placed by our customers. Whether and to what extent our customers place orders for any specific products, and the mix and quantities of products included in those orders are factors beyond our control. Insufficient orders would result in under-utilization of our manufacturing facilities and infrastructure, and will negatively affect our financial position and results of operations.

We face significant competition, are relatively small in size and have fewer resources in comparison with some of our competitors.

We face significant competition throughout the world, which may increase as certain markets in which we operate continue to evolve. Our future performance depends, in part, upon our ability to continue to compete successfully worldwide. Some of our competitors are diversified companies that have substantially greater financial resources and more extensive research, engineering, manufacturing, marketing and customer service and support capabilities than we can provide. Our failure to compete successfully with these other companies would seriously harm our business. There is a risk that larger, better financed competitors will develop and market more advanced products than those we currently offer, or that competitors with greater financial resources may decrease prices, thereby putting us under financial pressure.

We may experience increasing price pressure.

Our historical business strategy for many of our products has focused on product performance and customer service rather than on price. As a result of budgetary constraints, many of our customers are extremely price sensitive when purchasing our products. Recent inflationary trends could further exacerbate this issue. If we are unable to obtain prices that allow us to continue to compete on the basis of product performance and customer service, our profit margins will be reduced.

Manufacturing interruptions or delays could affect our ability to meet customer demand and lead to higher costs.

We may experience significant interruptions of our manufacturing operations, delays in our ability to deliver products or services, increased costs or customer order cancellations as a result of:

| |

●

|

the failure or inability of suppliers to timely deliver sufficient quantities of materials and components on a cost-effective basis;

|

| |

●

|

volatility in the availability and cost of materials;

|

| |

●

|

unforeseen equipment failures resulting in the need to delay or outsource certain production processes;

|

| |

●

|

difficulties or delays in obtaining required import or export approvals;

|

| |

●

|

information technology or infrastructure failures;

|

| |

●

|

natural disasters or other events beyond our control (such as earthquakes, floods or storms, regional economic downturns, pandemics, social unrest, political instability, terrorism, or acts of war); and

|

| |

●

|

the effects of a global pandemic on our employees, suppliers and other third-parties upon which we rely.

|

Continued growth could result in the need to move or expand our facilities. The costs of such a move or expansion could be significant to our profitability.

Our ability to meet our customer’s needs including the on-time shipment of products, is paramount to our success. Our current facility may not be able to adequately handle future growth and our ability to meet the needs of our customers. This could result in our having to relocate to a new facility which could have a material impact on our profitability.

We have made investments in our proprietary technologies. If third parties violate our proprietary rights, or accuse us of infringing upon their proprietary rights, such events could result in a loss of value of some of our intellectual property or costly litigation.

Our success is dependent in part on our technologies and our other proprietary rights. We believe that while patents can be useful and may be utilized by us in the future, they are not always necessary or feasible to protect our intellectual property. The process of seeking patent protection is lengthy and expensive, and we cannot be certain that applications will actually result in issued patents or that issued patents will be of sufficient scope or strength to provide meaningful protection or commercial advantage to us. In addition to patent protection, we have also historically protected our proprietary information and intellectual property such as design specifications, blueprints, technical processes and employee know-how, by limiting access to this confidential information and trade secrets and through the use of non-disclosure agreements. Other companies and individuals, including our competitors, may develop technologies that are similar or superior to our technology, or design around the intellectual property that we own or license. Our failure to adequately protect our intellectual property, could result in the reduction or extinguishment of our rights to such intellectual property. We also assert rights to certain trademarks relating to certain of our products and product lines.

While patent, copyright and trademark protection for our intellectual property may be important, we believe our future success in highly dynamic markets is most dependent upon the technical competence and creative skills of our personnel. We attempt to protect our trade secrets and other proprietary information through confidentiality agreements with our customers, suppliers, employees and consultants, and through other internal security measures. However, these employees, consultants and third parties may breach these agreements, and we may not have adequate remedies for wrongdoing. In addition, the laws of certain territories in which we sell our products may not protect our intellectual property rights to the same extent as do the laws of the United States.

We may receive communications from other parties asserting the existence of patent rights or other intellectual property rights that they believe cover certain of our products, processes, technologies or information. If such cases arise, we will evaluate our position and consider the available alternatives, which may include seeking licenses to use the technology in question on commercially reasonable terms, or defending our position. Nevertheless, we cannot ensure that we will be able to obtain licenses, or, if we are able to obtain licenses, that related terms will be acceptable, or that litigation or other administrative proceedings will not occur. Defending our intellectual property rights through litigation could be very costly. If we are not able to negotiate the necessary licenses on commercially reasonable terms or successfully defend our position, our financial position and results of operations could be materially and adversely affected.

The price of our common shares is volatile and could decline significantly.

The stock market has at times over the last 15 years experienced periods of high and extreme volatility. If these market fluctuations continue, the trading price of our common shares could decline significantly independent of the overall market, and stockholders could lose all or a substantial part of their investment. The market price of our common shares could fluctuate significantly in response to several factors, including, among others:

| |

●

|

difficult macroeconomic conditions, including inflation, unfavorable geopolitical events, and general stock market uncertainties, such as those occasioned by a global liquidity crisis and a failure of large financial institutions;

|

| |

●

|

receipt of large orders or cancellations of orders for our products;

|

| |

●

|

issues associated with the performance and reliability of our products;

|

| |

●

|

actual or anticipated variations in our results of operations;

|

| |

●

|

announcements of financial developments or technological innovations;

|

| |

●

|

changes in recommendations and/or financial estimates by investment research analysis;

|

| |

●

|

strategic transactions, such as acquisitions, divestitures, or spin-offs; and

|

| |

●

|

the occurrence of major catastrophic events, including the effects of a possible resurgence of the novel coronavirus (COVID-19).

|

Significant price and value fluctuations have occurred with respect to our publicly traded securities. The price of our common shares is likely to be volatile in the future. In the past, securities class action litigation often has been brought against a company following periods of volatility in the market price of its securities. If similar litigation were pursued against us, it could result in substantial costs and a diversion of management’s attention and resources, which could materially and adversely affect our financial condition, results of operations, and liquidity.

If we are subject to cyber-attacks, we could incur substantial costs and, if such attacks are successful, we could incur significant liabilities, reputational harm, and disruption to our operations.

We manage, store and transmit proprietary information and sensitive data relating to our operations. We may be subject to breaches of the information technology systems we use for these purposes. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate and/or compromise our confidential information (and or third-party confidential information), create system disruptions, or cause shutdowns. Computer programmers and hackers also may be able to develop and deploy viruses, worms, and other malicious software programs that attack our systems or our products, or that otherwise exploit any security vulnerabilities.

The costs to address the foregoing security problems and security vulnerabilities before or after a cyber-incident could be significant. Our remediation efforts may not be successful and could result in interruptions, delays, or cessation of service, and loss of existing or potential customers, impeding our sales, manufacturing, distribution, or other critical functions. In addition, breaches of our security measures and the unapproved dissemination of proprietary information or sensitive data about us, our customer, or other third parties, could expose us, our customers, or other third parties to a risk of loss or misuse of this information, result in litigation and potential liability for us, damage our reputation, or otherwise harm our business.

USE OF PROCEEDS

Except as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities offered by this prospectus for general corporate purposes, which may include working capital, capital expenditures, the repayment or refinancing of existing indebtedness and other investments. Additional information on the use of net proceeds from the sale of securities offered by this prospectus may be set forth in the prospectus supplement relating to that offering.

DILUTION

If there is a material dilution of the purchasers’ equity interest from the sale of common equity securities offered under this prospectus, we will set forth in any prospectus supplement the following information regarding any such material dilution of the equity interests of purchasers purchasing securities in an offering under this prospectus:

• the net tangible book value per share of our equity securities before and after the offering;

• the amount of the increase in such net tangible book value per share attributable to the cash payments made by the purchasers in the offering; and

• the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

DESCRIPTION OF CAPITAL STOCK

The following descriptions of our common stock and preferred stock do not purport to be complete and are subject to and qualified in their entirety by our Certificate of Incorporation and By-laws (each as amended and restated to date), and by the applicable provisions of the Delaware General Corporate Law. For information on how to obtain copies of our organizational documents, see “Where You Can Find More Information” contained elsewhere.

General

Our current authorized capital stock consists of 20,000,000 shares of common stock, par value $0.01 per share, of which 14,661,487 shares were issued and 14,525,960 shares were outstanding as of September 12, 2024, and 5,000,000 shares of preferred stock, par value $0.01 per share, none of which was issued and outstanding as of September 12, 2024.

Common Stock

Each share of common stock entitles the holder to one vote on all matters submitted to a vote of the Company’s stockholders. At meetings at which action is to be taken, the presence in person or by proxy of the holders of a majority of the shares of common stock of the Company issued and outstanding and entitled to vote at the meeting shall constitute a quorum for the transaction of business. Except as otherwise provided by law, the Certificate of Incorporation or the By-laws of the Company, all action taken by the holders of a majority of the stock voting, present or represented by proxy and voting on such matter at any meeting at which a quorum is present shall be valid and binding upon the Company, although directors are elected by a plurality of the votes cast by those entitled to vote in the election.

Holders of our common stock are entitled to receive such dividends, if any, as and when declared by the Board of Directors out of funds legally available therefor, subject to any preferential dividend rights of any then outstanding preferred stock. Upon the voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of our common stock are entitled to receive ratably the net assets of the Company available after the payment of all debts and liabilities and subject to the prior rights of any outstanding preferred stock.

Holders of our common stock do not have cumulative voting rights, are not entitled to pre-emptive or subscription rights or any rights of conversion or redemption, and such shares are not subject to any sinking fund provisions. Shares of our common stock are, and any shares sold pursuant to the registration statement of which this prospectus is a part will be, when issued, fully paid and non-assessable.

The rights, preferences and privileges of holders of our common stock may be subject, and may be adversely affected by, the rights of holders of shares of any series or class of preferred stock that we may designate and issue in the future, if any.

Our common stock is traded on the Nasdaq Capital Market under the symbol CPSH. On September 12, 2024, the closing price of our common stock as reported on the Nasdaq Capital Market was $1.37 per share.

Preferred Stock

Our Certificate of Incorporation permits us to issue up to 5,000,000 shares of preferred stock in one or more series and with such rights and preferences as may be determined by our Board of Directors without the need for further stockholder approval, subject to any limitation imposed by law and voting provisions set forth in our charter. We currently have no shares of preferred stock issued or outstanding. Any shares of preferred stock that may be redeemed, purchased or acquired by the Company may be reissued except as otherwise provided by law. Different series of preferred stock shall not be construed to constitute different classes of shares for the purposes of voting by classes unless expressly provided.

Examples of rights and preferences the Board of Directors may fix include voting rights, dividend rights and rates, conversion rights, redemption privileges and terms, and liquidation preferences. The issuance of preferred stock, while providing desirable flexibility in connection with possible financings, could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from acquiring, a majority of the outstanding voting stock of the company. The rights of holders of our common stock, described above, will be subject to, and may be adversely affected by, the rights of any preferred stock that we may designate and issue in the future, including with respect to voting and dividend and liquidation payments.

Options and Incentive Awards

As of September 12, 2024, we had outstanding stock awards to purchase an aggregate of 263,400 shares of our common stock at exercise prices ranging from $1.40 to $2.90 per share under our 2009 Stock Incentive Plan and 774,500 shares of our common stock at exercise prices ranging from $1.49 to $11.87 per share under our 2020 Equity Incentive Plan. While the Board of Directors continues to administer the 2009 Stock Incentive Plan, such plan expired in December 2019 and no further awards can be made thereunder. Vesting periods for awards under the plans are at the discretion of the Board of Directors and typically range between one and five years. Options under these plans are granted with an exercise price determined by the Board on the date of grant (typically not less than the fair market value of the common stock on the date of grant, except when incentive stock options under Section 422 of the Internal Revenue Code are granted to certain employees, in which case the exercise price will not be less than 110% of the fair market value of the common stock on the date of grant), and have terms of 10 years, or, in some cases of incentive stock options, terms of five years. As of September 12, 2024, there were no shares available for new option grants under the 2009 Stock Incentive Plan and there were 1,362,800 shares authorized and available for grant under the 2020 Equity Incentive Plan.

The 2020 Plan provides for the issuance of awards to officers, directors, consultants and advisors to the Company pursuant to the award of stock options, stock appreciation rights, restricted stock, restricted stock units and other stock-based awards.

Effects of Certain Provisions of Our Certificate of Incorporation and By-Laws and Delaware Law

Certain provisions of our Certificate of Incorporation and By-laws, as well as applicable Delaware law, may be deemed to have an anti-takeover effect and may delay, defer or prevent a change in control or takeover attempt that a stockholder may deem in his, her or its best interest. The existence of these provisions also could limit the price that investors might be willing to pay for our securities. They include:

Authorized but Unissued Shares

The authorized but unissued shares of our common stock and preferred stock are available for future issuance without stockholder approval, subject to any limitations imposed by The Nasdaq Stock Market and the provisions relating to interested stockholder transactions described below. These additional shares may be utilized for a variety of corporate purposes. In particular, although our Board of Directors has no present intention to do so, it could issue shares of stock that could, depending on the terms, impede the completion of a merger, tender offer, proxy contest or other takeover attempt. Our Board may determine that the issuance of such shares of stock is in the best interest of the Company and our stockholders. Such issuance could discourage a potential acquiror from making an unsolicited acquisition attempt through which such acquiror may be able to change the composition of the board, including a tender offer or other transaction that some, or a majority, of our stockholders might believe to be in their best interest or in which stockholders might receive a premium for their stock over the then-current market price.

No Cumulative Voting

Our Certificate of Incorporation does not provide for cumulative voting in the election of directors, which would allow the holders of less than a majority of the stock to elect some directors.

No Action by Stockholders Without a Meeting

Our Certificate of Incorporation expressly provides that stockholders of the Company may not take any action by written consent in lieu of a meeting. Moreover, Article FIFTH of our Certificate of Incorporation provides that notwithstanding any other provision of law, the charter or our By-laws, and notwithstanding the fact that a lesser percentage may be specified by law, the affirmative vote of the holders of at least 80% of the votes which all stockholders would be entitled to cast at any annual election of directors is required to amend, repeal or adopt any provision inconsistent with such Article. Eliminating the ability of stockholders to act by written consent and imposing a super-majority threshold to permit such right may delay or prevent a stockholder vote on an extraordinary transaction such as a merger or business combination.

Special Meetings of Shareholders

Our By-laws provide that special meetings of stockholders may be called by the President or Board of Directors but is silent as to the ability of stockholders to request a meeting. The inability of stockholders to call a special meeting may delay or prevent a stockholder vote on an extraordinary transaction such as a merger or business combination.

Director Vacancies; Size of Board

Unless and until filled by stockholders, our By-laws permit incumbent directors to fill any vacancies on the Board, however occurring, including a vacancy resulting from an enlargement of the Board, by a vote of a majority of the directors then in office, although less than a quorum, or by a sole remaining director.

The number of directors that shall constitute the whole Board is determined by resolution of the stockholders or the Board. The number of directors may be decreased at any time by stockholders or by a majority of the directors then in office but only to eliminate vacancies existing by reason of the death, resignation, removal or expiration of the term of one or more directors. The number of directors may be increased at any time by stockholders or by a majority of the directors then in office.

Advance Notice Requirements for Director Nominations and Stockholder Proposals

Our By-laws provide that except as otherwise provided by law, at any annual or special meeting of stockholders, only such business shall be conducted as shall have been properly brought before the meeting. In order to be properly brought before the meeting, such business must have been either:

| |

●

|

specified in the written notice of the meeting given to stockholders of record on the record date for such meeting by or at the direction of the Board;

|

| |

●

|

brought before the meeting at the direction of the Board or the Chairman of the meeting; or

|

| |

●

|

specified in a written notice given by or on behalf of a stockholder of record on the record date for the meeting entitled to vote thereat or a duly authorized proxy in accordance with specified requirements.

|

A stockholder wishing to raise a matter must provide notice thereof. Notice must be delivered personally to, or mailed to and received at, the principal executive office of the Company, addressed to the Secretary, (1) not more than 10 days after the date of the notice of the meeting provided by the Board, in the case of business to be brought before a special meeting of stockholders, and (2) not less than 30 days prior to the first anniversary of the notice provided for the prior year’s annual meeting, in the case of business to be brought before an annual meeting of stockholders. However, notice shall not be required to be given more than 50 days prior to an annual meeting of stockholders.

Such notice shall set forth a full description of each item of business proposed to be brought before the meeting, the name and address of the person proposing to bring such business before the meeting, and the class and number of shares held of record, held beneficially, and represented by proxy by such person as of the record date for the meeting (if such date has been made available) and as of the date of such notice.

Notwithstanding the foregoing, our By-Laws give the Board the authority to decline to include information as to any nominee for director in any proxy statement or other communication sent to stockholders, subject to applicable federal securities law requirements.

Higher Vote for Business Combinations and Other Transactions

Article TENTH of our Certificate of Incorporation provides that in addition to any affirmative vote required by law, the Company’s By-laws or the charter itself, and except as expressly provided in such Article TENTH, any

| |

●

|

merger or consolidation of the Company or any subsidiary with (1) an “interested stockholder” or (2) any other corporation, whether or not itself an interested stockholder which is, or after such merger or consolidation would be an “affiliate” or “associate” of an interested stockholder, or

|

| |

●

|

sale, lease, exchange, mortgage, pledge, transfer or other disposition to or with an interested stockholder or any affiliate or associate thereof of all or a “substantial part” of the assets of the Company or any subsidiary, or

|

| |

●

|

the issuance, exchange or transfer by the company or any subsidiary to an interested stockholder or any affiliate or associate thereof for consideration equal to or in excess of the fair market value of a substantial part of the assets of the Company, or

|

| |

●

|

the adoption of any plan or proposal for the liquidation or dissolution of the company proposed by or on behalf of an interested stockholder or any affiliate or associate thereof, or

|

| |

●

|

reclassification of securities, or recapitalization of the Company, or any merger or consolidation of the Company with a subsidiary, which has the effect of increasing the proportionate share of the outstanding shares of any class of equity or convertible securities of the Company or any subsidiary which is owned by an interested stockholder or any affiliate or associate thereof, or

|

| |

●

|

agreement, contract or arrangement with an interested stockholder providing for any of the foregoing

|

requires the affirmative vote of the holders of at least 80% of the votes which all stockholders would be entitled to cast at any annual election of directors. Such affirmative vote is required notwithstanding the fact that no vote may be required or that a lesser percentage may be specified by law or in any agreement with any national securities exchange or otherwise.

Nevertheless, such higher vote would not be required for any of the above in the event (a) such transaction is approved by a majority of “disinterested directors” and (b) eight specified transaction requirements are met, including that holders of the common stock receive per share consideration at least equal to the highest of (i) the per share price (including brokerage commissions, transfer taxes and soliciting dealers’ fees) paid by or on behalf of the interested stockholder for any share of stock in connection with the acquisition by such stockholder of shares of common stock within the prior two year period or the transaction in which such stockholder became an interested stockholder, whichever is higher, and (ii) the fair market value per share of common stock on the date of the announcement of the transaction at issue or the date on which the interested stockholder became interested, whichever is higher.

“Interested stockholder” is defined to mean any person who or which (a) is the beneficial owner, directly or indirectly, of shares of the Company having more than 10% of the voting power of the then-outstanding voting stock, (b) at any time within the prior two-year period was the beneficial owner, directly or indirectly, of shares of the Company having more than 10% of the voting power of the then-outstanding voting stock, or (c) is at any time an assignee or has otherwise succeeded to the beneficial ownership of any shares of voting stock which were at any time within the prior two-year period beneficially owned by any interested stockholder. “Substantial part” of the Company is defined to mean more than 10% of the fair market value of the total assets of the Company as of the end of its most recent fiscal quarter ending prior to the time the determination is made.

The super-majority approval requirement and the broad definition of “business combination” may delay or prevent any extraordinary transaction with an interested stockholder. Moreover, the provisions of Article TENTH imposing such voting requirement and including such broad definitions cannot be amended without the affirmative vote of at least 80% of the votes which all stockholders would be entitled to cast at any annual election of directors, further reducing the likelihood of a transaction with an interested party.

Section 203 of the Delaware General Corporation Law

Section 203 of the Delaware General Corporation Law prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

| |

●

|

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

| |

●

|

upon closing of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned by (1) persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

| |

●

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

In general, Section 203 defines business combination to include the following:

| |

●

|

any merger or consolidation involving the corporation and the interested stockholder;

|

| |

●

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

| |

●

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

| |

●

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

| |

●

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation.

Amendments to Organizational Documents

Article ELEVENTH of our Certificate of Incorporation provides that the notwithstanding any other provision of law, our charter or our by-laws, the affirmative vote of the holders of at least 80% of the votes which all stockholders would be entitled to cast at any annual election of directors is required to amend or repeal, or adopt any provision inconsistent with, the sections of our charter relating to the personal liability of directors, indemnification and the Article itself.

Listing

Our common stock is traded on the Nasdaq Capital Market under the symbol “CPSH.” Neither shares of our preferred stock nor warrants to purchase shares of our common stock are listed on any exchange, and neither security is publicly traded.

Transfer Agent and Registrar

Our stock transfer agent is Computershare, 250 Royall Street, Canton, MA 02021, United States and its telephone number is (781) 575-4223.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of shares of our common stock or preferred stock. We may issue warrants independently or together with other securities, and the warrants may be attached to or separate from any offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and the investors or a warrant agent. The following summary of material provisions of the warrants and warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and warrant certificate applicable to a particular series of warrants. The terms of any warrants offered under a prospectus supplement may differ from the terms described below. We urge you to read the applicable prospectus supplement and any related free writing prospectus, as well as the complete warrant agreements and warrant certificates that contain the terms of the warrants.

The particular terms of any issue of warrants will be described in the prospectus supplement relating to the issue. Those terms may include:

|

•

|

The number of shares of common stock or preferred stock purchasable upon the exercise of warrants to purchase such shares and the price at which such number of shares may be purchased upon such exercise;

|

|

•

|

The designation, stated value and terms (including, without limitation, liquidation, dividend, conversion and voting rights) of the series of preferred stock purchasable upon exercise of warrants to purchase preferred stock;

|

|

•

|

The date, if any, on and after which the warrants and the related preferred stock or common stock will be separately transferable;

|

|

•

|

The terms of any rights to redeem or call the warrants;

|

|

•

|

The date on which the right to exercise the warrants will commence and the date on which the right will expire;

|

|

•

|

A discussion of certain United States federal income tax consequences applicable to the warrants; and

|

|

•

|

Any additional terms of the warrants, including terms, procedures, and limitations relating to the exchange, exercise and settlement of the warrants.

|

Holders of equity warrants will not be entitled to:

|

•

|

Vote, consent or receive dividends;

|

|

•

|

Receive notice as stockholders with respect to any meeting of stockholders for the election of our directors or any other matter; or

|

|

•

|

Exercise any rights as stockholders of the Company.

|

Each warrant will entitle its holder to purchase the principal amount of the number of shares of preferred stock or common stock at the exercise price set forth in, or calculable as set forth in, the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders of the warrants may exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

A holder of warrant certificates may exchange them for new warrant certificates of different denominations, present them for registration of transfer and exercise them at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement. Until any warrants to purchase common stock or preferred stock are exercised, the holders of the warrants will not have any rights of holders of the underlying common stock or preferred stock, including any rights to receive dividends or payments upon any liquidation, dissolution or winding up on the common stock or preferred stock, if any.

DESCRIPTION OF RIGHTS

We may issue rights to purchase our common stock. The rights may or may not be transferable by the persons purchasing or receiving the rights. In connection with any rights offering, we may enter into a standby underwriting or other arrangement with one or more underwriters or other persons pursuant to which such underwriters or other persons would purchase any offered securities remaining unsubscribed for after such rights offering. Each series of rights will be issued under a separate rights agent agreement to be entered into between us and one or more banks, trust companies or other financial institutions, as rights agent, that we will name in the applicable prospectus supplement. The rights agent will act solely as our agent in connection with the rights and will not assume any obligation or relationship of agency or trust for or with any holders of rights certificates or beneficial owners of rights.

The prospectus supplement and any incorporated documents relating to any rights that we offer will include specific terms relating to the offering, including, among other matters:

|

•

|

The date of determining the security holders entitled to the rights distribution;

|

|

•

|

The aggregate number of rights issued and the aggregate number of shares of common stock purchasable upon exercise of the rights;

|

|

•

|

The conditions to completion of the rights offering;

|

|

•

|