0001595097falseNONE00015950972023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 08, 2023 |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37348 |

46-4348039 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 River Ridge Drive |

|

Norwood, Massachusetts |

|

02062 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 963-0100 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

CRBP |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Corbus Pharmaceuticals Holdings, Inc. (the “Company”) issued a press release on August 8, 2023, disclosing financial information and operating metrics for its fiscal quarter ended June 30, 2023 and discussing its business outlook. A copy of the Company’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

See “Item 2.02 Results of Operations and Financial Condition” above.

The information in this Current Report on Form 8-K under Items 2.02 and 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by a specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

August 8, 2023 |

By: |

/s/ Yuval Cohen |

|

|

|

Name: Yuval Cohen

Title: Chief Executive Officer |

Corbus Pharmaceuticals Reports Second Quarter 2023 Financial Results and

Provides Corporate Update

•CRB-701 Phase 1 trial in China is ahead of schedule with dose escalation completion expected Q4 2023 and U.S. clinical trial start planned for Q1 2024

•Preliminary clinical PK data indicates CRB-701 has a longer half-life and reduced levels of circulating free MMAE relative to published data for PADCEV®

•CRB-601 IND submission is on track for Q4 2023

Norwood, MA, August 8, 2023 (GLOBE NEWSWIRE) -- Corbus Pharmaceuticals Holdings, Inc. (NASDAQ: CRBP) (“Corbus” or the “Company”), a precision oncology company, today provided a corporate update and reported financial results for the second quarter of 2023.

“During the second quarter, substantial progress was made advancing CRB-701, our next generation Nectin-4 antibody drug conjugate (ADC), in-licensed earlier this year from CSPC Pharmaceutical Group (CSPC)” said Yuval Cohen, Ph.D., Chief Executive Officer of Corbus. “Following a recent visit to CSPC in China, we’re pleased to share that the Phase 1 dose escalation in patients with Nectin-4 enriched solid tumors is proceeding well and is currently ahead of the planned schedule. We now anticipate that the dose escalation portion of this trial in China will be completed in Q4 2023. Accordingly, we are accelerating our own development plans for CRB-701, and now anticipate initiating our U.S. clinical trial in Q1 2024 under the currently active US IND. Preliminary clinical data generated to date demonstrates a differentiated pharmacokinetic profile relative to other Nectin-4 targeting agents.”

“Development of our anti-aVb8 mAb CRB-601, is also ongoing and we were pleased to present the latest pre-clinical data for this asset at the AACR 2023 annual meeting in April,” continued Dr. Cohen. “The data that was presented builds upon the robust target engagement previously presented alone and in combination with anti-PD-1. We believe this data reinforces the potential of this new approach in blocking activation of TGFβ locally in the TME. We plan to submit our Investigational New Drug (IND) application for CRB-601 in Q4 2023 and anticipate initiating our Phase 1 clinical trial in the first half of 2024. We note that key competitive programs from Pfizer and AbbVie have progressed to Phase 2 clinical trials, and we see this as supportive evidence that this class of drugs warrant further clinical exploration. It will be a busy 12 months for us, as we continue our evolution into a precision oncology company, and advance both of our programs into the clinic in the US.”

Key Corporate and Program Updates:

•CRB-701 next generation Nectin-4 ADC:

oThe dose exploration of CRB-701 in Nectin-4 positive solid tumors is ahead of schedule. CSPC, our development partner, is enrolling its Phase 1 dose escalation study in China and Corbus now estimates this escalation will be completed by the end of 2023 and plans to initiate an abbreviated Phase 1 in the US in the first quarter of 2024 leveraging the clinical experience from China.

oPreliminary clinical pharmacology data indicates CRB-701 is differentiated from PADCEV® with an increased half-life and reduced levels of circulating free monomethyl auristatin E (MMAE).

oCorbus licensed CRB-701 from CSPC in February 2023 and has exclusive development and commercialization rights in the United States, Canada, the European Union (including the European Free Trade Area), the United Kingdom, and Australia.

oNectin-4 is a clinically validated tumor associated antigen in urothelial cancer. The Nectin-4 ADC PADCEV® (SeaGen/Astellas) is approved for use in late metastatic urothelial cancer and recently received an expanded label from the Food and Drug Administration based on accelerated approval for use in combination with KEYTRUDA® for patients with locally advanced or metastatic urothelial carcinoma who are ineligible for cisplatin-containing chemotherapy.

oCRB-701 is designed to achieve an improved therapeutic index and will be explored in urothelial cancer, as well as a range of other Nectin-4 expressing solid tumors.

oCRB-701 has key features that support a differentiated profile including a novel Nectin-4 antibody and a site-specific conjugation linker that results in faster ADC internalization, longer half-life, and reduced payload release in plasma. Pre-clinical and dose escalation data demonstrates the potential to achieve higher exposures with CRB-701 resulting in an opportunity to improve the therapeutic index.

•CRB-601 blocking the activation of TGFβ

oCRB-601 is a potent and selective anti-αvβ8 integrin monoclonal antibody (mAb) designed to block the activation of latent TGFβ within the tumor micro-environment (TME). CRB-601 significantly inhibits tumor growth as a monotherapy in murine models and enhances the efficacy of anti-PD-1 immunotherapy as a combination in checkpoint inhibitor (CPI) sensitive and CPI-resistant tumor models.

oCorbus presented pre-clinical data at the American Association of Cancer Research (AACR) 2023 annual meeting indicating that CRB-601 exhibited dose dependent tumor growth inhibition (TGI) in the EMT6 tumor model which was significantly augmented in combination with anti-PD-1 therapy. These effects were associated with changes in TME immune cell populations with marked increases in infiltrating T cells, NK cells and M1 polarized macrophages. Efficacy correlated with cell surface αvβ8 occupancy by CRB-601. CRB-601 treatment downregulated phosphorylation of SMAD proteins, pSMAD2 and pSMAD3, consistent with blockade of the TGFβ signaling pathway.

oThe IND submission for CRB-601 is anticipated in Q4 2023, and the Company expects to enroll the first patient in its Phase 1 study in the first half of 2024.

oWe note that recent events from other development programs of mAb with a similar mechanism of action including those of Pfizer and AbbVie indicate their advancement into Phase 2 clinical trials.

Financial Results for Quarter Ended June 30, 2023:

The Company reported a net loss of approximately $8.8 million, or a net loss per diluted share of $2.05, for the three months ended June 30, 2023, compared to a net loss of approximately $13.2 million, or a net loss per diluted share of $3.18, for the same period in 2022.

Operating expenses decreased by $4.1 million to approximately $8.2 million for the three months ended June 30, 2023, compared to $12.3 million in the comparable period in the prior year. The decrease was primarily attributable to a litigation settlement payment of $5.0 million in 2022 and reduction in general and administrative expenses in the current period offset by increases in product development expenses for CRB-701 and CRB-601.

As of June 30, 2023, the company has $36.6 million of cash, cash equivalents and investments on hand which is expected to fund operations through the second quarter of 2024, based on the current planned expenditures.

About Corbus

Corbus Pharmaceuticals Holdings, Inc. (the “Company” or “Corbus”) is a precision oncology company committed to helping people defeat serious illness by bringing innovative scientific approaches to well understood biological pathways. Corbus’ internal development pipeline includes CRB-701, a next generation antibody drug conjugate (ADC) that targets the expression of Nectin-4 on cancer cells to release a cytotoxic payload and CRB-601, an anti-integrin monoclonal antibody which blocks the activation of TGFβ expressed on cancer cells. Corbus is headquartered in Norwood, Massachusetts. For more information on Corbus, visit corbuspharma.com. Connect with us on Twitter, LinkedIn and Facebook.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the Company's restructuring, trial results, product development, clinical and regulatory timelines, market opportunity, competitive position, possible or assumed future results of operations, business strategies, potential growth opportunities and other statement that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management's current beliefs and assumptions.

These statements may be identified by the use of forward-looking expressions, including, but not limited to, "expect," "anticipate," "intend," "plan," "believe," "estimate," "potential,” "predict," "project," "should," "would" and similar expressions and the negatives of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors on our operations, clinical development plans and timelines, which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company's filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

INVESTOR CONTACT:

Sean Moran

Chief Financial Officer

Corbus Pharmaceuticals

smoran@corbuspharma.com

Bruce Mackle

Managing Director

LifeSci Advisors, LLC

bmackle@lifesciadvisors.com

---tables to follow---

Corbus Pharmaceuticals Holdings, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

8,349,346 |

|

|

$ |

17,002,715 |

|

Investments |

|

|

28,216,560 |

|

|

|

42,194,296 |

|

Restricted cash |

|

|

192,475 |

|

|

|

192,475 |

|

Prepaid expenses and other current assets |

|

|

1,515,616 |

|

|

|

791,616 |

|

Total current assets |

|

|

38,273,997 |

|

|

|

60,181,102 |

|

Restricted cash |

|

|

477,425 |

|

|

|

477,425 |

|

Property and equipment, net |

|

|

1,273,602 |

|

|

|

1,613,815 |

|

Operating lease right of use assets |

|

|

3,486,416 |

|

|

|

3,884,252 |

|

Other assets |

|

|

211,943 |

|

|

|

155,346 |

|

Total assets |

|

$ |

43,723,383 |

|

|

$ |

66,311,940 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Notes payable |

|

$ |

51,157 |

|

|

$ |

353,323 |

|

Accounts payable |

|

|

1,505,734 |

|

|

|

2,173,963 |

|

Accrued expenses |

|

|

6,418,803 |

|

|

|

5,999,252 |

|

Derivative liability |

|

|

36,868 |

|

|

|

36,868 |

|

Operating lease liabilities, current |

|

|

1,357,240 |

|

|

|

1,280,863 |

|

Current portion of long-term debt |

|

|

7,016,096 |

|

|

|

2,795,669 |

|

Total current liabilities |

|

|

16,385,898 |

|

|

|

12,639,938 |

|

Long-term debt, net of debt discount |

|

|

11,319,365 |

|

|

|

15,984,426 |

|

License agreement payable, noncurrent |

|

|

2,500,000 |

|

|

|

— |

|

Other long-term liabilities |

|

|

22,205 |

|

|

|

22,205 |

|

Operating lease liabilities, noncurrent |

|

|

3,975,329 |

|

|

|

4,675,354 |

|

Total liabilities |

|

|

34,202,797 |

|

|

|

33,321,923 |

|

Stockholders’ equity |

|

|

|

|

|

|

Preferred stock, $0.0001 par value; 10,000,000 shares authorized, no shares issued and outstanding at June 30, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value; 300,000,000 shares authorized,

4,422,741 and 4,171,297 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively |

|

|

442 |

|

|

|

417 |

|

Additional paid-in capital |

|

|

428,153,252 |

|

|

|

425,196,359 |

|

Accumulated deficit |

|

|

(418,609,320 |

) |

|

|

(392,080,667 |

) |

Accumulated other comprehensive loss |

|

|

(23,788 |

) |

|

|

(126,092 |

) |

Total stockholders’ equity |

|

|

9,520,586 |

|

|

|

32,990,017 |

|

Total liabilities and stockholders’ equity |

|

$ |

43,723,383 |

|

|

$ |

66,311,940 |

|

Corbus Pharmaceuticals Holdings, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months

Ended June 30, |

|

|

For the Six Months

Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

4,248,705 |

|

|

$ |

2,499,642 |

|

|

$ |

17,637,048 |

|

|

$ |

5,785,878 |

|

General and administrative |

|

|

3,940,286 |

|

|

|

4,840,368 |

|

|

|

7,848,968 |

|

|

|

10,071,291 |

|

Litigation Settlement |

|

|

— |

|

|

|

5,000,000 |

|

|

|

— |

|

|

|

5,000,000 |

|

Total operating expenses |

|

|

8,188,991 |

|

|

|

12,340,010 |

|

|

|

25,486,016 |

|

|

|

20,857,169 |

|

Operating loss |

|

|

(8,188,991 |

) |

|

|

(12,340,010 |

) |

|

|

(25,486,016 |

) |

|

|

(20,857,169 |

) |

Other expense, net: |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

182,657 |

|

|

|

(208,683 |

) |

|

|

412,164 |

|

|

|

(402,034 |

) |

Interest expense, net |

|

|

(775,586 |

) |

|

|

(490,339 |

) |

|

|

(1,453,608 |

) |

|

|

(949,248 |

) |

Foreign currency exchange loss, net |

|

|

(1,921 |

) |

|

|

(209,856 |

) |

|

|

(1,193 |

) |

|

|

(477,679 |

) |

Other expense, net |

|

|

(594,850 |

) |

|

|

(908,878 |

) |

|

|

(1,042,637 |

) |

|

|

(1,828,961 |

) |

Net loss |

|

$ |

(8,783,841 |

) |

|

$ |

(13,248,888 |

) |

|

$ |

(26,528,653 |

) |

|

$ |

(22,686,130 |

) |

Net loss per share, basic and diluted |

|

$ |

(2.05 |

) |

|

$ |

(3.18 |

) |

|

$ |

(6.27 |

) |

|

$ |

(5.44 |

) |

Weighted average number of common shares outstanding, basic and diluted |

|

|

4,277,701 |

|

|

|

4,170,464 |

|

|

|

4,229,894 |

|

|

|

4,170,255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,783,841 |

) |

|

$ |

(13,248,888 |

) |

|

$ |

(26,528,653 |

) |

|

$ |

(22,686,130 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Change in unrealized gain (loss) on marketable debt securities |

|

|

44,681 |

|

|

|

50,373 |

|

|

|

102,304 |

|

|

|

(56,875 |

) |

Total other comprehensive income (loss) |

|

|

44,681 |

|

|

|

50,373 |

|

|

|

102,304 |

|

|

|

(56,875 |

) |

Total comprehensive loss |

|

$ |

(8,739,160 |

) |

|

$ |

(13,198,515 |

) |

|

$ |

(26,426,349 |

) |

|

$ |

(22,743,005 |

) |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

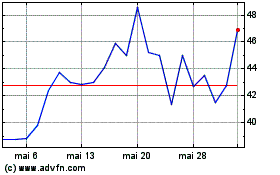

Corbus Pharmaceuticals (NASDAQ:CRBP)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

Corbus Pharmaceuticals (NASDAQ:CRBP)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025