false

0001213809

0001213809

2024-10-04

2024-10-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October 4, 2024

Dyadic International, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

000-55264 |

45-0486747 |

|

(State or other jurisdiction of incorporation or

organization)

|

(Commission File Number) |

(I.R.S. Employer Identification Number) |

1044 North U.S. Highway One, Suite 201 Jupiter, FL 33477

(Address of principal executive offices and zip code)

(561) 743-8333

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

DYAI

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On October 4, 2024, Dyadic International, Inc. (the “Company”) entered into an amendment (the “Amendment”) to the Form of Senior Secured Convertible Promissory Note due March 8, 2027 (the “Convertible Notes”). Pursuant to the Amendment, (i) the conversion price upon which the Convertible Notes will be convertible into shares of the Company’s common stock now is $1.40 per share of common stock, and (ii) the Redemption Date (as defined in the Amendment) will fall on any of the 26, 29 and 32‑month anniversaries of the original issue date of the Convertible Notes.

The foregoing description of the Amendment is only a summary of the material terms thereof, does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 8, 2024

| |

Dyadic International, Inc. |

| |

|

|

| |

By: |

/s/ Mark A. Emalfarb |

| |

Name: |

Mark A. Emalfarb |

| |

Title: |

Chief Executive Officer |

Exhibit 4.1

AMENDMENT TO FORM OF SENIOR SECURED CONVERTIBLE PROMISSORY NOTE

DUE MARCH 8, 2027

This Amendment (this “Amendment”), dated as of October 4, 2024, to that certain Senior Secured Convertible Promissory Note Due March 8, 2027 issued to the holder set forth on the signature page hereto (the “Holder”) on March 8, 2024 (the “Note”), is entered into by and among Dyadic International, Inc. (the “Company”) and the Holder. Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Note.

WHEREAS, any provision of the Note and any other Notes issued pursuant to the Purchase Agreement may be amended by a written instrument executed by the Company and Holders holding a majority of the then outstanding principal under all Notes issued pursuant to the Purchase Agreement, which amendment shall be binding on all successors and assigns.

NOW, THEREFORE, in consideration of the covenants and mutual promises contained herein and other good and valuable consideration, the receipt and legal sufficiency of which are hereby acknowledged and intending to be legally bound hereby, the parties agree as follows:

1. Section 4(b) of the Note shall be deleted in its entirety and replaced with:

“Conversion Price. The conversion price in effect on any Conversion Date shall be equal to $1.40, subject to adjustment as set forth herein (the “Conversion Price”). All such foregoing determinations will be appropriately adjusted for any stock dividend, stock split, stock combination, reclassification or similar transaction that proportionately decreases or increases the Common Stock during such measuring period.”

2. Section 7(a) of the Note shall be deleted in its entirety and replaced with:

“Redemption by Holder. The Holder shall have the right to elect to have the Company redeem all, or any part, of the principal amount then remaining under this Note (each, a “Redemption Amount”) on the Redemption Date (each as defined below) (each, a “Holder Redemption”). The portion of this Note subject to redemption pursuant to this Section 7 shall be redeemed by the Company in cash at a price (each, a “Redemption Price”) equal to all outstanding principal being redeemed, together with all accrued and unpaid interest, liquidated damages and other amounts due Holder pursuant to the Transaction Documents. The Holder may exercise its right to require redemption under this Section 7 by delivering a written notice thereof by electronic mail to the Company (the “Holder Redemption Notice”). The Holder Redemption Notice shall (x) state the date on which the Holder Redemption shall occur, which may only be any of the 26, 29 and 32-month anniversaries of the Original Issue Date (the “Redemption Date”) which date such Holder Redemption Notice is delivered shall not be less than sixty (60) calendar days prior to the applicable Redemption Date, and (y) state the aggregate principal amount of the Note which is being redeemed in such Holder Redemption. The Company shall honor any Notice of Conversion received until the Redemption Date, and all principal amounts converted by the Holder after the date the Holder Redemption Notice is delivered shall reduce the Redemption Amount of this Note required to be redeemed on the Redemption Date. For the avoidance of doubt, any existing Event of Default shall have no effect upon the Holder’s right to elect a redemption pursuant to this Section 7.”

3. Except as modified herein, the terms of the Note shall remain in full force and effect.

4. This Amendment may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and shall be binding upon all parties, their successors and assigns, and all of which taken together shall constitute one and the same Amendment. A signature delivered by facsimile shall constitute an original.

5. This Amendment shall be governed pursuant to New York law.

[Remainder of page intentionally blank; signature page to follow.]

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date set forth above.

| Dyadic International, Inc. |

|

| |

|

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| |

|

|

| HOLDER: |

|

| |

|

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Current Principal Amount of Note: |

|

|

v3.24.3

Document And Entity Information

|

Oct. 04, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Dyadic International, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 04, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-55264

|

| Entity, Tax Identification Number |

45-0486747

|

| Entity, Address, Address Line One |

1044 North U.S. Highway One, Suite 201

|

| Entity, Address, City or Town |

Jupiter

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33477

|

| City Area Code |

561

|

| Local Phone Number |

743-8333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DYAI

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001213809

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

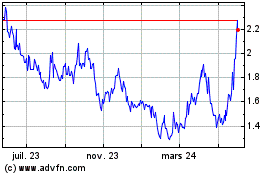

Dyadic (NASDAQ:DYAI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Dyadic (NASDAQ:DYAI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025