0000866374falseSG00008663742024-11-182024-11-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 18, 2024

FLEX LTD.

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | | | | |

| Singapore | 0-23354 | 98-1773351 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

2 Changi South Lane, Singapore | 486123 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (65) 6876-9899

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Ordinary Shares, No Par Value | FLEX | The Nasdaq Stock Market LLC |

| | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | |

| Emerging growth company | ☐ |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 22, 2024, Flex Ltd. (the “Company”) announced that, effective January 6, 2025 (the “Effective Date”), Kevin S. Krumm has been appointed Chief Financial Officer of the Company. In connection with Mr. Krumm’s appointment, Jaime Martinez will cease to serve as the Company’s Interim Chief Financial Officer as of the Effective Date.

Mr. Krumm, age 50, has served as Executive Vice President and Chief Financial Officer of APi Group Corporation, a global life safety services provider specializing in fire safety and security, a position he has held since September 2021. Prior to that, since December 2019, Mr. Krumm served as Corporate Treasurer and Senior Vice President of Global Financial Shared Services for Ecolab Inc., a global manufacturer of water, hygiene and infection prevention solutions. During his 15-year tenure at Ecolab, Mr. Krumm also held roles leading the Industrial segment finance team, regional finance teams in Europe, the Middle East and Africa, Asia and Latin America, and leading international integration efforts for a major acquisition. He began his career in public accounting working for consulting firms PwC, Arthur Andersen and Deloitte, with a heavy emphasis on M&A and corporate finance. Mr. Krumm holds a bachelor’s degree in Accounting from the University of Northern Iowa and an MBA from the University of Chicago Booth School of Business. There is no arrangement or understanding between Mr. Krumm and any other person pursuant to which he was appointed Chief Financial Officer.

In connection with his appointment as Chief Financial Officer, the Company entered into an offer letter (the “Offer Letter”) with Mr. Krumm on November 18, 2024. Under the terms of the Offer Letter, Mr. Krumm’s annual base salary will be $832,000. Mr. Krumm will be eligible to participate in the Company’s annual incentive bonus plan, with a target annual bonus of 115% of base salary, and a maximum opportunity of 200% of target. Actual payout levels will be prorated and dependent upon Company performance and in accordance with the terms of the annual incentive bonus plan. Under the Company’s long-term share-based incentive compensation program for fiscal year 2026, Mr. Krumm will be granted an award comprised of 50% performance-based restricted share units (“PSUs”) and 50% service-based restricted share units (“RSUs”) having a target value in the aggregate as of the date of grant of $2,900,000. The RSUs will vest in three substantially equal annual installments on the first three anniversaries of the grant date, subject to continued employment through each vesting date. The PSUs will vest, subject to continued employment through the vesting date, based on the attainment of performance conditions over the next three fiscal years (with the number of shares that vest dependent on the level of achievement), consistent with the Company’s other executive officers. Mr. Krumm will also be eligible to participate in the Company’s Deferred Compensation Plan under which he may receive an annual Company contribution, based on Company performance, with a target amount of 30% of base salary. The fiscal year 2025 contribution will be based on Company performance and prorated based on service during fiscal year 2025. Additionally, Mr. Krumm will be credited with a one-time funding payment of $416,000 (50% of base salary) under the Deferred Compensation Plan, which will cliff vest on the fourth anniversary of the funding date, provided that Mr. Krumm remains employed by the Company through that date.

To compensate Mr. Krumm for certain forfeitures of incentive compensation upon leaving his current employer, Mr. Krumm will receive: (1) a one-time make-whole grant of RSUs having a grant date fair value of $5,800,000 which will vest in three substantially equal annual installments on the first three anniversaries of the grant date, subject to continued employment through each vesting date; and (2) a one-time sign-on cash bonus of $3,500,000, which he is required to repay if, within 24 months of the employment commencement date, he either voluntarily terminates his employment with the Company (other than for “Good Reason” (as defined in the Company’s Executive Severance Plan)) or the Company terminates his employment for “Cause” (as defined in the Company’s Executive Severance Plan). In connection with his relocation to the Austin, Texas area, the Company will provide Mr. Krumm with relocation benefits under the Company’s standard executive relocation policy.

Mr. Krumm’s employment may be terminated by Mr. Krumm or the Company at any time, with or without cause. Mr. Krumm will be eligible to participate in the Company’s Executive Severance Plan. Under the Executive Severance Plan, in the event that Mr. Krumm terminates his employment for Good Reason or the Company terminates his employment without Cause, Mr. Krumm would be entitled to receive the following benefits, subject to entering into and complying with a transition and release agreement in a form provided by the Company (the “Plan Transition Agreement”): (a) salary and benefits coverage continuation for the duration of the transition period in the Plan Transition Agreement; (b) pro-rated portion of annual bonus prior to the transition period, based on actual performance through the end of the performance period; and (c) service-based vesting RSUs, performance-based vesting PSUs and deferred compensation awards continued vesting during the transition period. Following the transition period, the Executive Severance Plan provides for accelerated vesting of RSUs and deferred compensation awards that would have vested during the one-year period following the transition period. Such accelerated vesting would be subject to Mr. Krumm’s signing a release of claims and compliance with post-termination covenants. All other unvested awards would be forfeited. During the transition period, Mr. Krumm would be required to discharge his transition duties and comply with other terms and conditions set forth in the Plan Transition Agreement, including customary non-competition, non-solicitation, non-disclosure, non-disparagement, and cooperation provisions. Any violation of such obligations may result in cessation of benefits and trigger clawback rights of the Company.

The foregoing description of the Offer Letter is qualified in its entirety by reference to the full text of the Offer Letter which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ending December 31, 2024.

Item 7.01 Regulation FD Disclosure.

On November 22, 2024, the Company issued a press release announcing the appointment of Mr. Krumm as Chief Financial Officer. A copy of the press release is furnished with this report as Exhibit 99.1.

The information in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | FLEX LTD. |

| | | |

| | | |

| Date: November 22, 2024 | | | |

| | | |

| By: | /s/ Jaime Martinez |

| | Name: | Jaime Martinez |

| | Title: | Interim Chief Financial Officer |

EXHIBIT 99.1

PRESS RELEASE

Flex Announces Kevin Krumm as Chief Financial Officer

CFO to focus on continuing Flex’s momentum in creating shareholder value and achieving

long-term financial success in line with the company’s transformational goals

AUSTIN, Texas, Nov. 22, 2024 – Flex (NASDAQ: FLEX) today announced that Kevin S. Krumm will join the company as Chief Financial Officer (CFO), effective January 6, 2025. He will succeed Jaime Martinez, interim CFO, who will remain with Flex and support a smooth transition. Reporting to Flex CEO Revathi Advaithi, Mr. Krumm will focus on driving the company’s long-term financial strategy and creating shareholder value.

Mr. Krumm joins Flex with more than 20 years of experience across industrial, chemical, and healthcare industries. Previously, he served as Executive Vice President and Chief Financial Officer of APi Group Corporation, a global market-leading business services provider of safety and specialty services. Prior to APi Group, Mr. Krumm had a 15-year tenure at Ecolab Inc. in various roles of increasing responsibility, most recently as Corporate Treasurer and Senior Vice President of Global Financial Shared Services.

“Kevin’s demonstrated leadership and success across several industries is well aligned with Flex’s strategy,” said Revathi Advaithi, CEO, Flex. “I look forward to partnering with Kevin to continue to create shareholder value and drive Flex’s long-term financial success.”

“I am delighted to be joining the Flex team. Flex is uniquely positioned at the intersection of innovation and operational excellence, with a strong legacy of collaboration and execution,” said Mr. Krumm. “I look forward to working with the Flex team to build on its track record of financial performance and continue to deliver shareholder value."

Mr. Krumm holds a bachelor’s degree in accounting from the University of Northern Iowa and a master’s in business administration from the University of Chicago Booth School of Business.

About Flex

Flex (Reg. No. 199002645H) is the manufacturing partner of choice that helps a diverse customer base design and build products that improve the world. Through the collective strength of a global workforce across 30 countries and responsible, sustainable operations, Flex delivers technology innovation, supply chain, and manufacturing solutions to diverse industries and end markets.

Contacts

Investors & Analysts

David Rubin

Vice President, Investor Relations

(408) 577-4632

David.Rubin@flex.com

Media & Press

Yvette Lorenz

Director, Executive Communications

(415) 225-7315

Yvette.Lorenz@flex.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. securities laws, including statements related to our future financial results and changes to Flex’s leadership and the expected timing and benefits thereof. These forward-looking statements are based on current expectations, forecasts and assumptions involving risks and uncertainties that could cause the actual outcomes and results to differ materially from those anticipated by these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Additional information concerning these and other risks is described under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent Annual Report on Form 10-K and in our subsequent filings with the U.S. Securities and Exchange Commission. Flex assumes no obligation to update any forward-looking statements, which speak only as of the date they are made.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

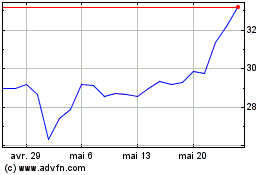

Flex (NASDAQ:FLEX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Flex (NASDAQ:FLEX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024