Current Report Filing (8-k)

22 Juin 2023 - 10:32PM

Edgar (US Regulatory)

0001385613false00013856132023-06-162023-06-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

June 16, 2023

Date of report (Date of earliest event reported)

GREENLIGHT CAPITAL RE, LTD.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Cayman Islands | 001-33493 | N/A |

(State or other jurisdiction of incorporation) |

(Commission file number) |

(IRS employer identification no.) |

| 65 Market Street | | |

| Suite 1207, Jasmine Court | | |

| P.O. Box 31110 | | |

| Camana Bay | | |

| Grand Cayman | | |

| Cayman Islands | | KY1-1205 |

| (Address of principal executive offices) | | (Zip code) |

(205) 291-3440

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Ordinary Shares | GLRE | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

On June 16, 2023, Greenlight Capital Re, Ltd. (the “Company”) entered into a Credit Agreement (the “Credit Agreement”) with a group of banks (the “Banks”), for which CIBC Bank USA is acting as administrative agent (the “Administrative Agent”).

The Credit Agreement provides, subject to certain customary conditions, for a delayed draw term loan facility (the “Facility”), in an aggregate amount of $75.0 million.

The Facility matures on August 1, 2026.

Outstanding loans under the Facility will (i) amortize in equal quarterly installments in an aggregate annual amount equal to 5.0% of the outstanding loans and (ii) accrue interest at a rate equal to an adjusted Term SOFR rate plus 3.50% per annum.

The obligations of the Company under the Credit Agreement are guaranteed by substantially all of the Company’s subsidiaries, other than the Company’s regulated insurance subsidiaries and Greenlight Re Corporate Member Ltd. The obligations of the Company under the Credit Agreement are secured by a first-priority lien on a collateral account with a minimum cash balance of $10.0 million which is held with CIBC Bank USA.

Proceeds under the Credit Agreement will be used to repay, in full, the Company’s outstanding convertible notes due on August 1, 2023 and the balance of the proceeds may be used for general corporate purposes of the Company.

The Credit Agreement contains customary conditions, representations and warranties, affirmative and negative covenants and events of default. The covenants include certain financial covenants requiring the Company to maintain compliance with (i) a quarterly maximum net debt to capital and surplus ratio covenant set at 17.5% and (ii) an annual minimum capital and surplus to prescribed capital requirement ratio covenant set at (a) with respect to Greenlight Reinsurance, Ltd., 137% and (b) with respect to Greenlight Reinsurance Ireland, dac, 105%.

There is no material relationship between the Company or any of its subsidiaries or affiliates and CIBC Bank USA, other than in respect of the Credit Agreement and certain commercial banking relationships, all of which have been entered into in the ordinary course of business.

The foregoing description of the Credit Agreement does not purport to be complete and is qualified, in its entirety, by reference to the Credit Agreement, a copy of which is attached as Exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description of Exhibit |

| 10.1 | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GREENLIGHT CAPITAL RE, LTD. |

| | (Registrant) |

| | | |

| | By: | /s/ Faramarz Romer |

| | Name: | Faramarz Romer |

| | Title: | Chief Financial Officer |

| | Date: | June 22, 2023 |

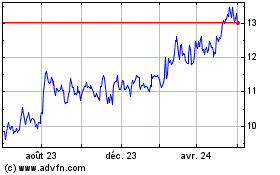

Greenlight Capital Re (NASDAQ:GLRE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

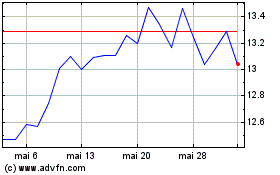

Greenlight Capital Re (NASDAQ:GLRE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024