Form 8-K - Current report

19 Novembre 2024 - 10:59PM

Edgar (US Regulatory)

0001606757false00016067572024-11-152024-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 15, 2024

KIMBALL ELECTRONICS, INC.

________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Indiana | | 001-36454 | | 35-2047713 |

| (State or other jurisdiction of | | (Commission File | | (IRS Employer Identification No.) |

| incorporation) | | Number) | | |

| | | | | | | | |

| | | |

1205 Kimball Boulevard, Jasper, Indiana | | 47546 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (812) 634-4000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, no par value | KE | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.07 Submission of Matters to a Vote of Security Holders

At the Annual Meeting of Share Owners of the Company held on November 15, 2024, the Share Owners voted on the following items:

1. The Board of Directors (the “Board”) is divided into three classes with approximately one-third of the directors up for election each year, with Class I standing for election at this meeting. Director nominees are elected by a majority of the votes cast by the shares entitled to vote in the election at the meeting. The Share Owners voted to reelect each of the Class I nominees for director as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I Nominees for Directors to serve a three-year term | | Votes For | | Votes

Withheld | | Broker

Non-Votes | | Percentage of Votes Cast in Favor |

| Gregory J. Lampert | | 18,395,892 | | | 560,024 | | | 3,171,788 | | | 97 | % |

| Colleen C. Repplier | | 18,240,361 | | | 715,555 | | | 3,171,788 | | | 96 | % |

| | | | | | | | |

2. The Share Owners voted to ratify the selection of Deloitte & Touche, LLP as the Company’s independent registered public accounting firm for fiscal year 2025 as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Votes For | | Votes Against | | Votes Abstaining | | Percentage of Votes Cast in Favor | | |

| | 21,300,019 | | | 796,412 | | | 31,273 | | | 96 | % | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

3. The Share Owners approved, on a non-binding, advisory basis, the compensation paid to the Company’s Named Executive Officers as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Votes For | | Votes Against | | Votes Abstaining | | Broker

Non-Votes | | Percentage of Votes Cast in Favor |

| | 18,195,117 | | | 512,190 | | | 248,609 | | | 3,171,788 | | | 97 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

4. The Share Owners approved, on a non-binding, advisory basis, the preferred frequency of every one year for future advisory votes on the compensation paid to the Company’s Named Executive Officers as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 1 Year | | 2 Years | | 3 Years | | Votes Abstaining | | |

| | 16,602,601 | | | 14,164 | | | 2,072,719 | | | 266,432 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Item 8.01 Other Events

Stock Repurchase Plan

On November 15, 2024, the Board approved a resolution to authorize an extension to the Company’s current stock repurchase program (the “Plan”) by allowing a repurchase of up to an additional $20 million of common stock of the Company. This extension brings the total authorized stock repurchases under the Plan to $120 million, with no expiration date. The Plan was initially authorized on October 21, 2015 as an 18-month repurchase plan to repurchase up to $20 million of our common stock. Then, separately on each of September 29, 2016, August 23, 2017, November 8, 2018, and November 10, 2020, the Board extended and increased the Plan to allow the repurchase of up to an additional $20 million worth of common stock with no expiration date. The Plan may be suspended or discontinued at any time.

Board Chair, Committee Appointments

On November 15, 2024, the Board, at its regular meeting held after the annual Share Owners’ meeting, maintained its Committee and Chairperson appointments from the prior year. Robert J. Phillippy will continue as Chairperson of the Board. The current compositions of the Board’s Committees are listed in the table below:

| | | | | | | | | | | | | | | | | | | | |

| Director | | Audit Committee | | Nominating and ESG Committee | | Talent, Culture, Compensation Committee |

| Michele A. M. Holcomb | | | | Chair | | |

| Gregory J. Lampert | | X | | X | | |

| | | | | | |

| Colleen C. Repplier | | | | X | | X |

| Gregory A. Thaxton | | X | | | | X |

| Tom G. Vadaketh | | Chair | | | | |

| Holly A. Van Deursen | | | | | | Chair |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Each of the three Committees reports directly to the Board and is comprised entirely of independent Directors.

Updated Stock Ownership Guidelines

Also on November 15, 2024, the Company’s Board of Directors revised its existing Share Ownership Guidelines for directors, the Company’s Chief Executive Officer, and executives reporting directly to the CEO to (1) explicitly include restricted shares and earned performance shares from the calculation of shares held by the covered person; (2) explicitly exclude unexercised stock options from the same calculation (although the Company has not granted stock options since becoming a public company in 2014); and (3) shorten the target for executives reporting directly to the CEO to attain their share ownership requirements from seven years to five years. Each covered director or executive continues to have the requirement to maintain Common Stock ownership equal to either three times their annual cash retainer or base salary (for directors and for executives reporting directly to the CEO) or six times their base salary (for the CEO) and to have a reasonable time from their appointment to attain those share ownership requirements.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are filed as part of this report:

| | | | | | | | |

| Exhibit | | |

| Number | | Description |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | |

| | KIMBALL ELECTRONICS, INC. |

| | |

| By: | /s/ Douglas A. Hass |

| | DOUGLAS A. HASS

Chief Legal & Compliance Officer, Secretary |

Date: November 19, 2024

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

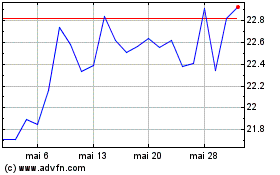

Kimball Electronics (NASDAQ:KE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Kimball Electronics (NASDAQ:KE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025