false

0001819576

0001819576

2024-08-07

2024-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

| LIQUIDIA CORPORATION |

| (Exact name of registrant as specified in its charter) |

| |

|

|

| Delaware |

001-39724 |

85-1710962 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

|

|

| 419 Davis Drive, Suite 100, Morrisville, North Carolina |

27560 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (919) 328-4400

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock |

LQDA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 7, 2024, Liquidia Corporation, a

Delaware corporation, issued a press release announcing its financial results for the quarter ended June 30, 2024, and also provided

a corporate update. A copy of the press release is furnished herewith as Exhibit 99.1.*

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

* The information in Item 2.02 of this Form 8-K shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| August 7, 2024 |

Liquidia Corporation |

| |

|

| |

By: |

/s/ Michael Kaseta |

| |

|

Name: |

Michael Kaseta |

| |

|

Title: |

Chief Financial Officer and Chief Operating Officer |

Exhibit 99.1

Liquidia

Corporation Reports Second Quarter 2024 Financial Results and

Provides Corporate Update

MORRISVILLE,

N.C., August 7, 2024 -- Liquidia Corporation (NASDAQ: LQDA), a biopharmaceutical company developing innovative

therapies for patients with rare cardiopulmonary disease, today reported financial results for the second quarter ended June 30,

2024. The company will host a webcast at 8:30 a.m. ET on August 7, 2024 to discuss the financial results

and provide a corporate update.

Dr. Roger Jeffs, Liquidia’s Chief Executive

Officer, said: “We continue to face no legal impediments for the FDA approval of YUTREPIA for the treatment of pulmonary arterial

hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD), and our commercial team stands ready

to launch YUTREPIA contingent on the FDA’s final approval. If approved, we firmly believe that the ease of administration and broad

dosage spectrum of YUTREPIA will drive the treatment to become the preferred prostacyclin therapy of choice.”

Corporate Updates

Progressed litigation, maintaining a clear legal path to full approval

of YUTREPIA

On May 31, Judge

Andrews of the U.S. District Court for the District of Delaware denied the motion for preliminary injunction filed by United

Therapeutics (UTHR) in its lawsuit alleging that YUTREPIA infringes U.S. Patent No. 11,826,327 (‘327 patent).

In addition,

on March 29, the U.S. District Court for the District of Columbia has denied motions for a temporary restraining order and preliminary

injunction requested by UTHR in its suit against the U.S. Food and Drug Administration (FDA). On May 7, both Liquidia and FDA filed

motions to dismiss UTHR’s complaint.

While both lawsuits are continuing forward, these rulings reinforce

the clear legal path for FDA to issue a final decision on the amended New Drug Application (NDA) for YUTREPIA for the treatment of both

PAH and PH-ILD.

Progressed clinical studies in YUTREPIA and presented new posters

at the World Symposia on Pulmonary Hypertension

During

the World Symposia on Pulmonary Hypertension in Barcelona this summer, Liquidia presented two

live thematic poster sessions and five encore presentations covering the company’s investigational products, YUTREPIA™ (treprostinil)

inhalation powder and L606 (liposomal treprostinil) inhalation suspension. The two new posters entitled: “Exploratory

Efficacy Analysis of INSPIRE Open Label Extension Study with Inhaled Treprostinil (YUTREPIA™)” and “High Resolution

Computed Tomography (HRCT) Chest Scans to Examine the Association Between Regional Drug Deposition of LIQ861 (YUTREPIA™) and Vasodilation

in PH-ILD Population,” along with the five encore presentations, can be found on the Publications section

of Liquidia’s website.

Progressed L606 in clinic and presented summary of safety and dosing

poster at the American Thoracic Society 2024 International Conference (ATS)

In May at the ATS Conference in San Diego, Liquidia presented

data related to the investigational use of L606 (liposomal treprostinil) inhalation suspension in patients with pulmonary arterial hypertension

(PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD).

The Phase 3,

2-part, open-label, multicenter study aims to demonstrate the safety and tolerability of L606 in patients with PAH or PH-ILD in the short-term

and long-term. The trial is enrolling patients in two groups, a transition group and a naïve group. The transition group is comprised

of participants with PAH or PH-ILD who transitioned from nebulized Tyvaso or Tyvaso DPI to L606. The naïve group is comprised of

participants with PAH who have not previously received treprostinil therapy and added L606 to no more than two non-prostacyclin oral

therapies.

Second Quarter 2024 Financial

Results

Cash and cash equivalents

totaled $133.1 million as of June 30, 2024, compared to $83.7 million as of December 31, 2023.

Revenue

was $3.7 million for the three months ended June 30, 2024, compared to $4.8 million for the three months ended June 30,

2023. Revenue related primarily to our promotion agreement with Sandoz pursuant to which we share profits from the sale of

Treprostinil Injection in the United States (the Promotion Agreement). The decrease of $1.1 million was primarily due to the

impact of lower sales quantities in the current year as compared to the same period in the prior year.

Cost

of revenue was $1.5 million for the three months ended June 30, 2024, compared to $0.7 million for the three

months ended June 30, 2023. Cost of revenue related to the Promotion Agreement as noted above. The increase from the

prior year was primarily due to our sales force expansion during the fourth quarter of 2023.

Research

and development expenses were $9.4 million for the three months ended June 30, 2024, compared to $17.7 million for

the three months ended June 30, 2023. The decrease of $8.3 million or 47% was primarily due to a $10 million upfront

license fee due to Pharmosa for the exclusive license in North America to develop and commercialize L606 recorded during the three months

ended June 30, 2023. Additionally, there was a $1.4 million decrease in expenses related to our YUTREPIA program driven by expensing

prelaunch inventory costs in the prior year. These decreases were offset by a $1.7 million increase in clinical expenses related to our

L606 program and a $1.5 million increase in personnel expenses (including stock-based compensation) related to increased headcount.

General

and administrative expenses were $20.0 million for the three months ended June 30, 2024, compared to $9.2 million for

the three months ended June 30, 2023. The increase of $10.8 million or 116% was primarily due to a

$6.3 million increase in personnel expenses (including stock-based compensation) driven by higher headcount and expansion of our sales

force in the fourth quarter of 2023, a $2.2 million increase in commercial and consulting expenses in preparation for the potential commercialization

of YUTREPIA, and a $0.9 million increase in legal fees related to our ongoing YUTREPIA-related

litigation.

Total

other expenses, net was $0.7 million for both the three months ended June 30, 2024 and 2023. There was a $1.2 million

increase in interest expenses attributable to the higher borrowings under the company’s Revenue Interest Financing Agreement (RIFA)

with HealthCare Royalty Partners (HCRx) as compared to the prior year, and a $1.1 million increase in interest income attributable to

higher money market balances.

Net loss for the three months

ended June 30, 2024, was $27.9 million or $0.37 per basic and diluted share, compared to a net loss of $23.5

million, or $0.36 per basic and diluted share, for the three-month ended June 30, 2023.

About

YUTREPIA™ (treprostinil) Inhalation Powder

YUTREPIA is an investigational, inhaled dry-powder formulation of treprostinil

delivered through a convenient, low-effort, palm-sized device. The FDA previously issued tentative approval of YUTREPIA for the PAH indication

in November 2021. In July 2023, Liquidia filed an amendment to its New Drug Application for YUTREPIA, seeking

to add PH-ILD to the label. YUTREPIA was designed using Liquidia’s PRINT® technology, which enables the development of drug

particles that are precise and uniform in size, shape and composition, and that are engineered for enhanced deposition in the lung following

oral inhalation. Liquidia has completed INSPIRE, or Investigation of the Safety and Pharmacology of Dry Powder Inhalation of

Treprostinil, an open-label, multi-center phase 3 clinical study of YUTREPIA in patients diagnosed with PAH who are naïve to inhaled

treprostinil or who are transitioning from Tyvaso® (nebulized treprostinil). YUTREPIA is currently being studied in the ASCENT trial,

an Open-Label Prospective Multicenter Study to Evaluate Safety and Tolerability of Dry Powder Inhaled Treprostinil in Pulmonary Hypertension,

with the objective of informing YUTREPIA’s dosing and tolerability profile in patients with PH-ILD. YUTREPIA was previously referred

to as LIQ861 in investigational studies.

About

L606 (liposomal treprostinil) Inhalation Suspension

L606 is an investigational, sustained-release formulation of treprostinil

administered twice-daily with a next-generation nebulizer. The L606 suspension uses Pharmosa Biopharm’s proprietary liposomal formulation

to encapsulate treprostinil which can be released slowly at a controlled rate into the lung, enhancing drug exposure over an extended

period of time and potentially mitigating local and systemic side effects. L606 is currently being evaluated in an open-label study in the

United States for treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung

disease (PH-ILD) with a planned global pivotal placebo-controlled efficacy study for the treatment of PH-ILD.

About

Treprostinil Injection

Treprostinil Injection is the first-to-file, fully substitutable generic treprostinil for parenteral

administration. Treprostinil Injection contains the same active ingredient, same strengths, same dosage form and same inactive ingredients

as Remodulin® (treprostinil) and is offered to patients and physicians with the same level of service and support,

but at a lower price than the branded drug. Liquidia PAH promotes the appropriate use of Treprostinil Injection for the treatment of

PAH in the United States in partnership with its commercial partner, Sandoz, Inc. (Sandoz), who holds the Abbreviated

New Drug Application (ANDA) with the FDA.

About

Pulmonary Arterial Hypertension (PAH)

Pulmonary arterial hypertension (PAH) is a rare, chronic, progressive disease caused

by hardening and narrowing of the pulmonary arteries that can lead to right heart failure and eventually death. Currently, an estimated

45,000 patients are diagnosed and treated in the United States. There is currently no cure for PAH, so the goals of existing

treatments are to alleviate symptoms, maintain or improve functional class, delay disease progression, and improve quality of life.

About

Pulmonary Hypertension Associated with Interstitial Lung Disease (PH-ILD)

Pulmonary hypertension (PH) associated with interstitial

lung disease (ILD) includes a diverse collection of up to 150 different pulmonary diseases, including interstitial pulmonary fibrosis,

chronic hypersensitivity pneumonitis, connective tissue disease related ILD, and chronic pulmonary fibrosis with emphysema (CPFE) among

others. Any level of PH in ILD patients is associated with poor 3-year survival. A current estimate of PH-ILD prevalence in the

United States is greater than 60,000 patients, though population growth in many of these underlying ILD diseases is not yet known

due to factors including underdiagnosis and lack of approved treatments until March 2021, when inhaled treprostinil was first

approved for this indication.

About Liquidia

Corporation

Liquidia Corporation is a biopharmaceutical

company developing innovative therapies for patients with rare cardiopulmonary disease. The company’s current focus spans the development

and commercialization of products in pulmonary hypertension and other applications of its proprietary PRINT® Technology.

PRINT enabled the creation of Liquidia’s lead candidate, YUTREPIA™ (treprostinil) inhalation powder, an investigational drug

for the treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease

(PH-ILD). The company is also developing L606, an investigational sustained-release formulation of treprostinil administered twice-daily

with a next-generation nebulizer, and currently markets generic Treprostinil Injection for the treatment of PAH. To learn more about

Liquidia, please visit www.liquidia.com.

Remodulin® and

Tyvaso® are registered trademarks of United Therapeutics Corporation.

Cautionary

Statements Regarding Forward-Looking Statements

This press release may include forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical

facts, including statements regarding our future results of operations and financial position, our strategic and financial initiatives,

our business strategy and plans and our objectives for future operations, are forward-looking statements. Such forward-looking statements,

including statements regarding clinical trials, clinical studies and other clinical work (including the funding therefor, anticipated

patient enrollment, safety data, study data, trial outcomes, timing or associated costs), regulatory applications and related submission

contents and timelines, including the potential for final FDA approval of the NDA for YUTREPIA, the timeline or outcome related to patent

litigation in the U.S. District Court for the District of Delaware or inter partes review proceedings conducted

at the PTAB or other litigation instituted by United Therapeutics or others, including rehearings or appeals of decisions in any such

proceedings, the issuance of patents by the USPTO and our ability to execute on our strategic or financial initiatives, involve significant

risks and uncertainties and actual results could differ materially from those expressed or implied herein. The favorable decisions of

courts or other tribunals are not determinative of the outcome of the appeals or rehearings of the decisions. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” “should,” “target,”

“would,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking

statements largely on our current expectations and projections about future events and financial trends that we believe may affect our

financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial

needs. These forward-looking statements are subject to a number of risks discussed in our filings with the SEC, as well as a number

of uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment and our industry has inherent

risks. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of

all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future

events discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated

or implied in the forward-looking statements. Nothing in this press release should be regarded as a representation by any person that

these goals will be achieved, and we undertake no duty to update our goals or to update or alter any forward-looking statements, whether

as a result of new information, future events or otherwise.

Contact Information

Investors:

Jason Adair

Chief Business Officer

919.328.4350

Jason.adair@liquidia.com

Media:

Patrick Wallace

Director, Corporate Communications

919.328.4383

patrick.wallace@liquidia.com

Liquidia Corporation

Select Condensed Consolidated Balance Sheet Data (unaudited)

(in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Cash and cash equivalents | |

$ | 133,093 | | |

$ | 83,679 | |

| Total assets | |

$ | 177,361 | | |

$ | 118,332 | |

| Total liabilities | |

$ | 114,639 | | |

$ | 71,039 | |

| Accumulated deficit | |

$ | (497,968 | ) | |

$ | (429,098 | ) |

| Total stockholders’ equity | |

$ | 62,722 | | |

$ | 47,293 | |

Liquidia Corporation

Condensed Consolidated Statements of Operations and Comprehensive Loss

(unaudited)

(in thousands, except share and per share amounts)

| | |

Three Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Revenue | |

$ | 3,659 | | |

$ | 4,786 | |

| Costs and expenses: | |

| | | |

| | |

| Cost of revenue | |

| 1,493 | | |

| 671 | |

| Research and development | |

| 9,420 | | |

| 17,695 | |

| General and administrative | |

| 19,943 | | |

| 9,245 | |

| Total costs and expenses | |

| 30,856 | | |

| 27,611 | |

| Loss from operations | |

| (27,197 | ) | |

| (22,825 | ) |

| Other income (expense): | |

| | | |

| | |

| Interest income | |

| 1,855 | | |

| 734 | |

| Interest expense | |

| (2,600 | ) | |

| (1,426 | ) |

| Total other expense, net | |

| (745 | ) | |

| (692 | ) |

| Net loss and comprehensive loss | |

$ | (27,942 | ) | |

$ | (23,517 | ) |

| Net loss per common share, basic and diluted | |

$ | (0.37 | ) | |

$ | (0.36 | ) |

| Weighted average common shares outstanding, basic and diluted | |

| 76,435,831 | | |

| 64,788,482 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

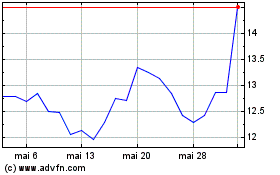

Liquidia (NASDAQ:LQDA)

Graphique Historique de l'Action

De Oct 2024 à Oct 2024

Liquidia (NASDAQ:LQDA)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024