UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934 (Amendment No. 1)

MERCADOLIBRE, INC.

(Name of Issuer)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

587733R102

(CUSIP Number)

Meliga No. 1 Corp.

Meliga No. 1 LP

Corpag Trust South Dakota Inc.

MercadoLibre, Inc.

WTC Free Zone

Dr. Luis Bonavita 1294, Of. 1733, Tower II

Montevideo, Uruguay, 11300

(+598) 2-927-2770

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October 31, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| |

1

|

Names of Reporting Person

Meliga No. 1 Corp.

|

| |

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

| |

|

(a)

|

☒

|

| |

|

(b)

|

☐

|

| |

3

|

SEC Use Only

|

| |

4

|

Source of Funds (See Instructions)

OO

|

| |

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

| |

6

|

Citizenship or Place of Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0

|

|

8

|

Shared Voting Power

3,550,136

|

|

9

|

Sole Dispositive Power

0

|

|

10

|

Shared Dispositive Power

3,550,136

|

| |

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,550,136*

|

| |

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| |

13

|

Percent of Class Represented by Amount in Row (11)

7.00%

|

| |

14

|

Type of Reporting Person (See Instructions)

CO

|

*The Reporting Person reported on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns 3,550,136 shares of Common Stock in the aggregate, representing approximately 7.00% of the outstanding shares of Common Stock. See Item 5.

| |

1

|

Names of Reporting Person

Meliga No. 1 LP

|

| |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

| |

2

|

(a)

|

☒

|

| |

|

(b)

|

☐

|

| |

3

|

SEC Use Only

|

| |

4

|

Source of Funds (See Instructions)

OO

|

| |

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

| |

6

|

Citizenship or Place of Organization

New Zealand

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0

|

|

8

|

Shared Voting Power

3,550,136

|

|

9

|

Sole Dispositive Power

0

|

|

10

|

Shared Dispositive Power

3,550,136

|

| |

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,550,136*

|

| |

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| |

13

|

Percent of Class Represented by Amount in Row (11)

7.00%

|

| |

14

|

Type of Reporting Person (See Instructions)

OO

|

*The Reporting Person reported on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns 3,550,136 shares of Common Stock in the aggregate, representing approximately 7.00% of the outstanding shares of Common Stock. See Item 5.

| |

1

|

Names of Reporting Person

Galperin Trust /SD

|

| |

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

| |

|

(a)

|

☒

|

| |

|

(b)

|

☐

|

| |

3

|

SEC Use Only

|

| |

4

|

Source of Funds (See Instructions)

OO

|

| |

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

| |

6

|

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0

|

|

8

|

Shared Voting Power

3,550,136

|

|

9

|

Sole Dispositive Power

0

|

|

10

|

Shared Dispositive Power

3,550,136

|

| |

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,550,136*

|

| |

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| |

13

|

Percent of Class Represented by Amount in Row (11)

7.00%

|

| |

14

|

Type of Reporting Person (See Instructions)

OO

|

*The Reporting Person reported on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns 3,550,136 shares of Common Stock in the aggregate, representing approximately 7.00% of the outstanding shares of Common Stock. See Item 5.

| |

1

|

Names of Reporting Person

Corpag Trust South Dakota Inc.

|

| |

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

| |

|

(a)

|

☒

|

| |

|

(b)

|

☐

|

| |

3

|

SEC Use Only

|

| |

4

|

Source of Funds (See Instructions)

OO

|

| |

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

| |

6

|

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0

|

|

8

|

Shared Voting Power

3,550,136

|

|

9

|

Sole Dispositive Power

0

|

|

10

|

Shared Dispositive Power

3,550,136

|

| |

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,550,136*

|

| |

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| |

13

|

Percent of Class Represented by Amount in Row (11)

7.00%

|

| |

14

|

Type of Reporting Person (See Instructions)

CO

|

*The Reporting Person reported on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns 3,550,136 shares of Common Stock in the aggregate, representing approximately 7.00% of the outstanding shares of Common Stock. See Item 5.

| |

1

|

Names of Reporting Person

Volorama Stichting

|

| |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

| |

2

|

(a)

|

☒

|

| |

|

(b)

|

☐

|

| |

3

|

SEC Use Only

|

| |

4

|

Source of Funds (See Instructions)

OO

|

| |

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

| |

6

|

Citizenship or Place of Organization

The Netherlands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0

|

|

8

|

Shared Voting Power

3,550,136

|

|

9

|

Sole Dispositive Power

0

|

|

10

|

Shared Dispositive Power

3,550,136

|

| |

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,550,136*

|

| |

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| |

13

|

Percent of Class Represented by Amount in Row (11)

7.00%

|

| |

14

|

Type of Reporting Person (See Instructions)

OO

|

*The Reporting Person reported on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns 3,550,136 shares of Common Stock in the aggregate, representing approximately 7.00% of the outstanding shares of Common Stock. See Item 5.

Explanatory Note

This Amendment No. 1 amends and updates the statement on Schedule 13D filed with the Securities and Exchange Commission on May 24, 2024. By means of a deed of accession with an effective date of October 31, 2024, and within the scope of a trust restructuring in the context of estate planning transactions, Galperin Trust /SD transferred its limited partnership interests in Meliga No. 1 LP to Meliga No.1 Corp., a British Virgin Islands corporation (the “Transfer”). As a result of the Transfer, Meliga No.1 Corp., as a limited partner in Meliga No. 1 LP, acquired shared beneficial ownership of 3,550,136 shares of Common Stock.

|

Item 1.

|

Security and Issuer.

|

This statement on Schedule 13D (this “Schedule 13D”) relates to the Common Stock, $0.001 par value per share (the “Common Stock”), of MercadoLibre, Inc., a Delaware corporation (the “Issuer”). The address of the Issuer’s principal executive office is WTC Free Zone, Dr. Luis Bonavita 1294, Of. 1733, Tower II, Montevideo, Uruguay, 11300.

|

Item 2.

|

Identity and Background.

|

(a) This Schedule 13D is being filed by Meliga No. 1 LP, Meliga No.1 Corp., Galperin Trust /SD, Corpag Trust South Dakota Inc., and Volorama Stichting (each, a “Reporting Person” and collectively, the “Reporting Persons”).

(b) The principal business address of Galperin Trust /SD and Corpag Trust South Dakota Inc. is 3500 S 1st Ave Circle Suite 255, Sioux Falls, SD 57105. The principal business address of Meliga No. 1 LP and Volorama Stichting is Zuidplein 116, Tower H, 14th floor, 1077 XV Amsterdam, The Netherlands. The principal business address of Meliga No. 1 Corp. is Palm Grove House, 3rd Floor, Road Town, Tortola, British Virgin Islands.

(c) (i) Galperin Trust /SD is an irrevocable trust formed under the laws of South Dakota and was established for the benefit of certain individuals and certain charitable organizations. Galperin Trust /SD owns 100% of the shares of Meliga No.1 Corp. Pursuant to the articles of association of Meliga No.1 Corp., the shares of Common Stock may not be voted or disposed of without the approval of Galperin Trust /SD.

(ii) Corpag Trust South Dakota Inc. is a corporation established under the laws of South Dakota and has acted as trustee of Galperin Trust /SD since December 1, 2023.

(iii) Meliga No. 1 LP is a New Zealand limited partnership and holds directly 3,550,136 shares of Common Stock, representing approximately 7.00% of the outstanding Common Stock of the Issuer. Meliga No.1 Corp owns approximately 99.999% of the limited partnership interests of Meliga No. 1 LP and Volorama Stichting owns the remaining 0.001% of the limited partnership interests of Meliga No. 1 LP.

(iv) Meliga No.1 Corp. is a British Virgin Islands corporation and owns approximately 99.999% of the limited partnership interests of Meliga No. 1 LP.

(v) Volorama Stichting is a Dutch foundation based in Amsterdam, the Netherlands and serves as the general partner of Meliga No. 1 LP. Pursuant to the limited partnership agreement of Meliga No. 1 LP, the shares of Common Stock may not be voted or disposed of without the approval of Meliga No.1 Corp and Volorama Stichting.

(d) During the last five years, neither Reporting Person has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, neither Reporting Person has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Galperin Trust /SD is an irrevocable trust formed under the laws of South Dakota, Corpag Trust South Dakota Inc. is a corporation formed under the laws of South Dakota, Meliga No. 1 LP is a New Zealand limited partnership, Meliga No.1 Corp. is a corporation formed under the laws of the British Virgin Islands and Volorama Stichting is a Dutch foundation.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

As a result of the Transfer, Meliga No.1 Corp., as a limited partner in Meliga No. 1 LP, acquired shared beneficial ownership of 3,550,136 shares of Common Stock. As a consequence of the contribution of the 99.999% of the limited partnership interests of Meliga No. 1 LP held by Galperin Trust/ SD into Meliga No. 1 Corp, Galperin Trust/ SD received 10,000 additional shares in Meliga No. 1 Corp.

|

Item 4.

|

Purpose of Transaction.

|

The purpose of the Transfer was to transfer voting and dispositive power in respect of those shares of Common Stock to Meliga No.1 Corp. as part of a series of estate planning transactions. Following the Transfer, Volorama Stichting, as the general partner of Meliga No. 1 LP, intends to dissolve Meliga No. 1 LP and its assets will be transferred to Meliga No. 1 Corp. in addition to Volorama Stichting’s .001% interest in Meliga No. 1 LP. The series of estate planning transactions are expected to be made for no consideration and completed by December 31, 2024.

Except as set forth herein, the Reporting Persons have no current intention, plan or proposal with respect to items 4(a) through (j) of Schedule 13D.

|

Item 5.

|

Interest in Securities of the Issuer.

|

(a) As of October 31, 2024, the Reporting Persons, on a combined basis, are the beneficial owners of an aggregate of 3,550,136 shares of Common Stock of the Issuer, representing approximately 7.00% of the outstanding shares of Common Stock of the Issuer. In addition, the disposition of shares and the reinvestment of funds received from dividends or proceeds from disposition of shares is subject to the direction of a trust investment advisor with the prior unanimous consent of two individual trust protectors; and the distribution of dividends or proceeds from disposition of shares to the beneficiaries of each Meliga No. 1 Corp. and Galperin Trust /SD is subject to the direction of a trust distribution advisor with the prior unanimous consent of two individual trust protectors.

(b) The aggregate beneficial ownership of Common Shares by each of the Reporting Persons is as follows:

|

Sole Voting Power

|

0

|

|

Shared Voting Power

|

3,550,136

|

|

Sole Dispositive Power

|

0

|

|

Shared Dispositive Power

|

3,550,136

|

The Reporting Persons aggregate percentage beneficial ownership of the total amount of Common Shares outstanding is 7.00%, based on 50,697,442 shares of Common Stock outstanding on August 1, 2024.

(c) Except as described in the Explanatory Note and Item 3 above, no other transactions have occurred in the past sixty days.

(d) Except as set forth herein, to the knowledge of the Reporting Persons, no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, any shares of Common Stock reported herein as beneficially owned (considering the statements made in Item 5(a) above with regards to the powers to direct vested in the investment advisor, the distribution advisor, and individual protectors as applicable).

(e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to the Securities of the Issuer

|

Except as described herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Persons named in Item 2 hereof and any person with respect to any securities of the Issuer, including but not limited to transfer or voting of any other securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, divisions of profits or loss, or the giving or withholding of proxies.

|

Item 7.

|

Material to be Filed as Exhibits.

|

Exhibit Index

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Meliga No. 1 Corp.

/s/ Eduardo Sanguinetti

|

| |

Name: Eduardo Sanguinetti

Title: Director

|

| |

/s/ Agustín Mayer West

|

| |

Name: Agustín Mayer West

Title: Director

|

| |

|

| |

Meliga No. 1 LP

By: Volorama Stichting, its general partner

/s/ Eduardo M. Sanguinetti

|

| |

Name: Eduardo M. Sanguinetti

Title: Managing Director A

|

| |

By: Corpag Services (Netherlands) B.V., its Managing Director B

/s/ Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

|

| |

Name: Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

Title: Managing Director B

|

| |

By: Galperin Trust /SD, its limited partner

/s/ James Petree

|

| |

Names: James Petree

Title: Trust Officer, Corpag Trust South Dakota Inc., Trustee

|

| |

Galperin Trust /SD

/s/ James Petree

|

| |

Name: James Petree

Title: Trust Officer, Corpag Trust South Dakota Inc., Trustee

|

| |

|

| |

Corpag Trust South Dakota Inc.

|

| |

/s/ James Petree

|

| |

Name: James Petree

Title: Trust Officer, Corpag Trust South Dakota Inc., Trustee

|

| |

Volorama Stichting

/s/ Eduardo M. Sanguinetti

|

| |

Name: Eduardo M. Sanguinetti

Title: Managing Director A

|

|

|

|

| |

By: Corpag Services (Netherlands) B.V., its Managing Director B

/s/ Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

|

| |

Name: Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

Title: Managing Director B

|

Exhibit 99.1

Joint Filing Agreement

October 31, 2024

In accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended Meliga No. 1 LP, Meliga No.1 Corp., Galperin Trust /SD, Corpag Trust South Dakota Inc., and Volorama Stichting each hereby agree to the joint filing of this Statement on Schedule 13D (including any and all amendments hereto). In addition, each party to this Agreement expressly authorizes each other party to this Agreement to file on its behalf any and all amendments to such Statement on Schedule 13D. A copy of this Agreement shall be attached as an exhibit to the Statement on Schedule 13D filed on behalf of each of the persons hereto, to which this Agreement relates.

This Agreement may be executed in multiple counterparts, each of which shall constitute an original, one and the same instrument.

Meliga No. 1 Corp.

|

/s/ Eduardo Sanguinetti

|

|

Name: Eduardo Sanguinetti

Title: Director

|

|

/s/ Agustín Mayer West

|

|

Name: Agustín Mayer West

Title: Director

Meliga No. 1 LP

By: Volorama Stichting, its general partner

|

| /s/ Eduardo Sanguinetti |

|

Name: Eduardo M. Sanguinetti

Title: Managing Director A

|

| |

| By: Corpag Services (Netherlands) B.V., its Managing Director B |

|

|

| /s/ Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V. |

|

Name: Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

Title: Managing Director B

|

| |

| By: Galperin Trust /SD, its limited partner |

|

|

|

/s/ James Petree

|

|

Names: James Petree

Title: Trust Officer, Corpag Trust South Dakota Inc., Trustee

|

|

Galperin Trust /SD

|

|

/s/ James Petree

|

|

Name: James Petree

Title: Trust Officer, Corpag Trust South Dakota Inc., Trustee

|

|

|

|

Corpag Trust South Dakota Inc.

|

|

/s/ James Petree

|

|

Name: James Petree

Title: Trust Officer, Corpag Trust South Dakota Inc., Trustee

|

|

Volorama Stichting

/s/ Eduardo Sanguinetti

|

|

Name: Eduardo M. Sanguinetti

Title: Managing Director A

|

By: Corpag Services (Netherlands) B.V., its Managing Director B

|

/s/ Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

|

|

Name: Annemarie van Munster on behalf of Corpag Services (Netherlands) B.V.

Title: Managing Director B

|

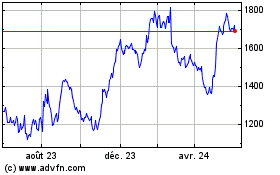

MercadoLibre (NASDAQ:MELI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

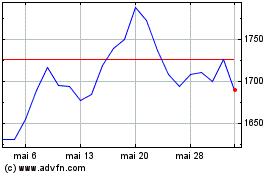

MercadoLibre (NASDAQ:MELI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025