Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-272616

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated March 1, 2024)

MicroVision,

Inc.

5,750,225

Shares of Common Stock

Warrants

to Purchase up to 5,750,225 Shares of Common Stock

We

are offering directly to High Trail Special Situations LLC (the “investor”) up to 5,750,225 shares of our common stock,

par value $0.001 per share, and warrants to purchase up to 5,750,225 shares of our common stock. This prospectus supplement also

relates to the offering of the shares of common stock issuable upon exercise of the warrants. The warrants will have an exercise price

of $1.57 per share of our common stock. The warrants will be exercisable at any time on or after the earlier of (i) the date that

is six months after the date of issuance and (ii) the date that the Requisite Stockholder Approval (as defined in that certain Senior

Secured Convertible Note due 2026, Certificate No. A-1, issued to the investor by the Company on October 23, 2024) is obtained and will

terminate on the fifth anniversary of the initial exercise date. For a more detailed description of the warrants, see the section

entitled “Description of Securities We Are Offering—Warrants” beginning on page S-7 of this prospectus supplement.

Our

common stock is traded on The Nasdaq Global Market under the symbol “MVIS.” On January 31, 2025, the closing price

of our common stock on The Nasdaq Global Market was $1.59 per share.

We

have engaged WestPark Capital, Inc. and D. Boral Capital LLC as placement agents in connection with this offering. The placement agents

are not purchasing or selling any shares of common stock or warrants in this offering.

The

securities offered by this prospectus involve a high degree of risk. You should carefully consider the information under the heading

“Risk Factors” set forth on page S-4 of this prospectus supplement, on page 2 of the accompanying prospectus, as well as

in our periodic reports filed with the Securities and Exchange Commission and incorporated by reference herein, in determining whether

to purchase our securities.

Our

executive offices are located at 18390 NE 68th Street, Redmond, Washington 98052, and our telephone number is (425) 936-6847.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

| WestPark

Capital, Inc. |

D.

Boral Capital |

The

date of this prospectus supplement is February 3, 2025.

TABLE

OF CONTENTS

Prospectus

Supplement

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement is not complete without, and may not be utilized except in connection with, the accompanying prospectus dated March

1, 2024, and any amendments to such prospectus. This prospectus supplement provides supplemental information regarding the Company, updates

and changes information contained in the accompanying prospectus and describes the specific terms of this offering. The accompanying

prospectus gives more general information, some of which may not apply to this offering. We incorporate by reference important information

into this prospectus supplement and the accompanying prospectus. You may obtain the information incorporated by reference into this prospectus

supplement and the accompanying prospectus without charge by following the instructions under “Incorporation of Certain Information

by Reference” in this prospectus supplement and “Where You Can Find More Information” in the accompanying prospectus.

You should carefully read both this prospectus supplement and the accompanying prospectus, as well as additional information described

under “Incorporation of Certain Information by Reference,” before deciding to invest in our securities. If the information

in, or incorporated by reference in, this prospectus supplement conflicts with information in the accompanying prospectus or a document

incorporated by reference herein or therein, the information in, or incorporated by reference in, this prospectus supplement shall control.

All

references in this prospectus supplement to “MicroVision,” “the Company,” “we,” “us”

or “our” mean MicroVision, Inc., unless we state otherwise or the context otherwise requires.

In

making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus supplement,

the accompanying prospectus and any free writing prospectus that we authorize for use in connection with this offering and to which we

have referred you. We have not authorized anyone to provide you with different or additional information. If anyone provides you with

different or additional information, you should not rely on it. We are not making an offer to sell these securities under any circumstance

or in any jurisdiction where the offer is not permitted or unlawful. You should assume that the information contained in this prospectus

supplement and the accompanying prospectus is accurate only as of their respective dates, and that any information in documents that

we have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, financial

condition, results of operations, cash flows and prospects may have changed since those dates.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking

statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the

Securities Exchange Act of 1934, as amended, or the Exchange Act, and is subject to the safe harbor created by those sections. Such statements

may include, but are not limited to, projections of revenues, income or loss, capital expenditures, plans for product development and

cooperative arrangements, future operations, financing needs or plans of MicroVision, as well as assumptions relating to the foregoing.

The words “anticipate,” “believe,” “estimate,” “expect,” “goal,” “may,”

“plan,” “project,” “will,” and similar expressions identify forward-looking statements, which speak

only as of the date the statement was made.

These

forward-looking statements are not guarantees of future performance. Factors that could cause actual results to differ materially from

those projected in our forward-looking statements include the following: our ability to operate with limited cash or to raise additional

capital when needed; market acceptance of our technologies and products or for products incorporating our technologies; the failure of

our commercial partners to perform as expected under our agreements; our financial and technical resources relative to those of our competitors;

our ability to keep up with rapid technological change; government regulation of our technologies; our ability to enforce our intellectual

property rights and protect our proprietary technologies; the ability to obtain additional contract awards and develop partnership opportunities;

the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products;

dependence on third parties to develop, manufacture, sell and market our products; potential product liability claims; our ability to

maintain our listing on The Nasdaq Stock Market; and other risk factors identified from time to time in this prospectus (including any

prospectus supplement) and our Securities and Exchanges Commission, or SEC, reports, including the our Annual Report on Form 10-K filed

with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect us. It should

be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future,

and the factors set forth in or incorporated into this prospectus supplement and the accompanying prospectus may affect us to a greater

extent than indicated. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their

entirety by the cautionary statements set forth in or incorporated into this prospectus supplement and the accompanying prospectus. Except

as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future

events, changes in circumstances or any other reason.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary is qualified in its entirety by, and should be read together with, the more detailed information and our consolidated

financial statements and related notes thereto appearing elsewhere or incorporated by reference in this prospectus supplement and the

accompanying prospectus. Before you decide to invest in our securities, you should read the entire prospectus supplement and the accompanying

prospectus carefully, including the risk factors and the financial statements and related notes included or incorporated by reference

in this prospectus supplement and the accompanying prospectus.

Our

Company

Overview

MicroVision

is a global developer and supplier of lidar hardware and software solutions focused primarily on automotive lidar and advanced driver-assistance

systems, or ADAS, markets where we can deliver safe mobility at the speed of life. We offer a suite of light detection and ranging, or

lidar, sensors and perception and validation software to automotive original equipment manufacturers, or OEMs, for ADAS and autonomous

vehicle, or AV, applications, as well as to complementary markets for non-automotive applications including industrial, robotics and

smart infrastructure. Our long history of developing and commercializing the core components of our lidar hardware and related software,

combined with the experience of the team we acquired from Ibeo Automotive Systems, or Ibeo, with automotive-grade qualification, gives

us a compelling advantage as a development and commercial partner.

Founded

in 1993, MicroVision, Inc. is a pioneer in laser beam scanning, or LBS, technology, which is based on our patented expertise in micro-electromechanical

systems, or MEMS, laser diodes, opto-mechanics, electronics, algorithms and software and how those elements are packaged into a small

form factor. Throughout our history, we have combined our proprietary technology with our development expertise to create innovative

solutions to address existing and emerging market needs, such as augmented reality microdisplay engines; interactive display modules;

consumer lidar components; and, most recently, automotive lidar sensors and software solutions for the automotive market.

In

January 2023, we acquired certain strategic assets of Germany-based Ibeo, which was founded in 1998 as a lidar hardware and software

provider. Ibeo developed and launched the first lidar sensor to be automotive qualified for serial production with a Tier 1 automotive

supplier and that is currently available in passenger cars by premium OEMs. Ibeo developed software solutions, including perception and

validation software, which are also used by premium OEMs. In addition, Ibeo sold its products for non-automotive uses such as industrial,

smart infrastructure and robotics applications.

For

the automotive market, our integrated solution combines our MEMS-based dynamic-range lidar sensor and perception software, to be integrated

on our custom application specific integrated circuit, or ASIC, targeted for sale to premium automotive OEMs and Tier 1 automotive suppliers.

Our ADAS solution is intended to leverage edge computing and custom ASICs to enable our hardware and perception software to be integrated

into an OEM’s ADAS stack.

In

addition to our dynamic-range and long-range MAVIN sensor and perception software solution for the automotive market, our product suite

includes our short-range flash-based MOVIA lidar sensor, for automotive and industrial applications, including smart infrastructure,

robotics, and other commercial segments. Also, our validation software tool, the MOSAIK suite, is used by OEMs and other customers including

Tier 1s for validating vehicle sensors for ADAS and AV applications. The tool includes software that automates the manual data classification

or annotation process, significantly reducing the time and resources required by OEMs to validate their ADAS and AV systems.

In

the recent past, we developed micro-display concepts and designs for use in head-mounted augmented reality, or AR, headsets and developed

a 1440i MEMS module supporting AR headsets. We also developed an interactive display solution targeted at the smart speakers market and

a small consumer lidar sensor for use indoors with smart home systems.

To

date, we have been unable to secure the customers at the scale needed to successfully launch our products. We have incurred substantial

losses since inception, incurred a significant loss during the fiscal year ended December 31, 2024 and expect to incur a significant

loss during the fiscal year ended December 31, 2025.

Corporate

Information

We

were founded in 1993 as a Washington corporation and reincorporated in 2003 under the laws of the State of Delaware. Our principal office

is located at 18390 NE 68th Street, Redmond, WA 98052 and our telephone number is 425-936-6847. We maintain a website at www.microvision.com,

where general information about us is available. We do not incorporate the information on our website into this prospectus supplement

or the accompanying prospectus and you should not consider it part of this prospectus supplement or the accompanying prospectus.

The

Offering

| Common

stock offered by us |

|

5,750,225

shares. |

| Common

stock to be outstanding immediately after this offering(1) |

|

230,731,480

shares. |

| |

|

|

| Warrants

we are offering |

|

We

are offering warrants to purchase up to 5,750,225 shares of common stock, which will be exercisable at any time on or after

the earlier of (i) the date that is six months after the date of issuance and (ii) the date that the Requisite Stockholder Approval

(as defined in that certain Senior Secured Convertible Note due 2026, Certificate No. A-1, issued to the investor by the Company

on October 23, 2024) is obtained at an exercise price per share equal to $1.57. This prospectus supplement also relates to

the offering of the shares of common stock issuable upon exercise of the warrants. For additional information regarding the warrants,

see “Description of Securities We are Offering—Warrants.” |

| Listing |

|

Our

common stock is listed on the Nasdaq Global Market under the symbol “MVIS.” There is no established public trading market

for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for listing of the warrants on

any national securities exchange or other nationally recognized trading system. |

| Use

of proceeds |

|

We

intend to use the net proceeds from the sale of common stock and warrants offered by this prospectus supplement for general corporate

purposes, which may include, but are not limited to, working capital and capital expenditures. See “Use of Proceeds.”

|

| Risk

factors |

|

Investing

in our securities involves a high degree of risk. See “Risk Factors.” |

(1) The

number of shares of common stock to be outstanding after this offering is based on 224,981,255 shares of our common stock outstanding

as of January 30, 2025 and excludes, as of that date, the following:

| |

● |

666,058

shares of our common stock issuable upon exercise of outstanding options, all of which were exercisable at a weighted average

exercise price of $1.43 per share, under our 2022 Incentive Plan, as amended, or the Incentive Plan; |

| |

● |

12,023,477

shares of our common stock underlying unvested and/or deferred stock awards; |

| |

● |

2,184,223

shares of our common stock reserved for issuance pursuant to the Incentive Plan; and |

| |

● |

5,750,225

shares of our common stock issuable upon exercise

of the warrants to be offered in this offering. |

The

number of shares outstanding shown above does not reflect any issuances of shares following September 30, 2024, including shares of our

common stock issuable to High Trail Special Situations LLC upon exercise of that certain senior secured convertible note in the aggregate

principal amount of $45,000,000 sold by us pursuant to the Securities Purchase Agreement dated October 14, 2024, in a private placement

that we consummated on October 23, 2024.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider all of the information in this prospectus

supplement and the accompanying prospectus, including the risks and uncertainties described below, and all other information included

or incorporated by reference in this prospectus supplement and the accompanying prospectus, before you decide whether to purchase our

securities. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that

we currently deem immaterial may also impair our business operations. If any of these risks were to occur, our business, financial condition

or results of operations would likely suffer. In that event, the trading price of our common stock could decline and you could lose all

or part of your investment.

Risks

Related to Our Common Stock, Warrants and this Offering

We

have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways

that do not necessarily improve our results of operations or enhance the value of our common stock. Our failure to apply these funds

effectively could have a material adverse effect on our business, financial condition, operating results and cash flow, and could cause

the price of our common stock to decline.

If

you purchase the common stock sold in this offering, you will experience immediate and substantial dilution in your investment. You will

experience further dilution if we issue additional equity securities in future fundraising transactions.

Since

the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common

stock, you will suffer substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering.

Based on a public offering price of $1.39125 per share and our net tangible book value as of September 30, 2024, if you purchase

shares of common stock in this offering, you will suffer immediate and substantial dilution of $1.11 per share with respect to

the net tangible book value of the common stock (excluding any shares issuable upon exercise of the warrants). See the section entitled

“Dilution” elsewhere in this prospectus supplement for a more detailed discussion of the dilution you will incur if you purchase

common stock in this offering.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. If we issue additional common stock, or securities convertible into or exchangeable

or exercisable for common stock, our stockholders, including investors who purchase shares of common stock in this offering, could experience

additional dilution, and any such issuances may result in downward pressure on the price of our common stock.

Our

stock price has fluctuated in the past, has recently been volatile and may be volatile in the future, and as a result, investors in our

common stock could incur substantial losses.

Our

stock price has fluctuated in the past, has recently been volatile and may be volatile in the future. During the 12 months prior to the

date of this prospectus, our common stock has traded at a low of $0.80 and a high of $2.70. We may continue to experience sustained depression

or substantial volatility in our stock price in the foreseeable future unrelated to our operating performance or prospects. For the year

ended December 31, 2023, we incurred a loss per share of $0.45.

As

a result of this volatility, investors may experience losses on their investment in our common stock. The market price for our common

stock may be influenced by many factors, including the following:

| |

● |

investor

reaction to our business strategy; |

| |

● |

the

success of competitive products or technologies; |

| |

● |

strategic

alternatives; |

| |

● |

the

timing and results of our development efforts with respect to our lidar sensors and ADAS solutions; |

| |

● |

changes

in regulatory or industry standards applicable to our technologies; |

| |

● |

variations

in our or our competitors’ financial and operating results; |

| |

● |

developments

concerning our collaborations or partners; |

| |

● |

developments

or disputes with any third parties that supply, manufacture, sell or market any of our products; |

| |

● |

developments

or disputes concerning patents or other proprietary rights, including patents, litigation matters and our ability to obtain patent

protection for our products; |

| |

● |

actual

or perceived defects in any of our products, if commercialized, and any related product liability claims; |

| |

● |

our

ability or inability to raise additional capital and the terms on which we raise it; |

| |

● |

declines

in the market prices of stocks generally; |

| |

● |

trading

volume of our common stock; |

| |

● |

sales

of our common stock by us or our stockholders; |

| |

● |

general

economic, industry and market conditions; and |

| |

● |

other

events or factors, including war, terrorism and other international conflicts, public health issues including health epidemics or

pandemics, such as the COVID-19 outbreak, and natural disasters such as fire, hurricanes, earthquakes, tornados or other adverse

weather and climate conditions, whether occurring in the United States or elsewhere. |

Since

the stock price of our common stock has fluctuated in the past, has been recently volatile and may be volatile in the future, investors

in our common stock could incur substantial losses. In the past, following periods of volatility in the market, securities class-action

litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs

and diversion of management’s attention and resources, which could materially and adversely affect our business, financial condition,

results of operations and growth prospects. There can be no guarantee that our stock price will remain at current levels or that future

sales of our common stock will not be at prices lower than those sold to investors.

Additionally,

securities of certain companies have recently experienced significant and extreme volatility in stock price due to short sellers of shares

of common stock, known as a “short squeeze.” These short squeezes have caused extreme volatility in both the stock prices

of those companies and in the market, and have led to the price per share of those companies to trade at a significantly inflated rate

that is disconnected from the underlying value of the company. Many investors who have purchased shares in those companies at an inflated

rate face the risk of losing a significant portion of their original investment, as in many cases the price per share has declined steadily

as interest in those stocks have abated. While we have no reason to believe our shares would be the target of a short squeeze, there

can be no assurance that we will not be in the future, and you may lose a significant portion or all of your investment if you purchase

our shares at a rate that is significantly disconnected from our underlying value.

Sales

of shares of our common stock by the investor may cause our stock price to decline.

As

of January 24, 2025, we had 70,144,987 shares of common stock outstanding. Sales of substantial amounts of our shares of common stock

in the public market by the investor, or the perception that those sales may occur, could cause the market price of shares of our common

stock to decline and impair our ability to raise capital through the sale of additional shares of our common stock.

There

is no public market for the warrants in this offering.

There

is no established public trading market for the warrants being offered in this offering, and we do not expect a market to develop. In

addition, we do not intend to apply for listing of the warrants on any national securities exchange or other nationally recognized trading

system. Without an active market, the liquidity of the warrants will be limited.

We

do not currently intend to pay dividends on our common stock, and any return to investors is expected to come, if at all, only from potential

increases in the price of our common stock.

At

the present time, we intend to use available funds to finance our operations. Accordingly, while payment of dividends rests within the

discretion of our board of directors, no cash dividends on our common shares have been declared or paid by us and we have no intention

of paying any such dividends in the foreseeable future. Any return to investors is expected to come, if at all, only from potential increases

in the price of our common stock.

USE

OF PROCEEDS

We

anticipate that the net proceeds from the sale of the securities offered under this prospectus supplement will be approximately $7,660,000,

after deducting estimated offering expenses that are payable by us. We anticipate that the net proceeds from the sale of the securities

offered under this prospectus supplement will be used for general corporate purposes, which may include, but are not limited to, working

capital and capital expenditures. Pending the application of the net proceeds, we expect to invest the proceeds in investment-grade,

interest-bearing instruments or other securities.

DESCRIPTION

OF SECURITIES WE ARE OFFERING

We

are offering (i) up to 5,750,225 shares of our common stock and (ii) warrants to purchase up to 5,750,225 shares of our

common stock.

Common

Stock

The

material terms and provisions of our common stock are described under the caption “Description of Capital Stock” starting

on page 4 of the accompanying prospectus.

Warrants

The

following is a summary of the material attributes and characteristics of the warrants. The form of warrant will be provided to the investor

in this offering and will be filed as an exhibit to a Current Report on Form 8-K with the SEC in connection with this offering.

Each

warrant entitles the holder thereof to purchase shares of our common stock at an exercise price equal to $1.57 per share. The

warrants will be exercisable at any time on or after the earlier of (i) the date that is six months after the date of issuance and (ii)

the date that the Requisite Stockholder Approval (as defined in that certain Senior Secured Convertible Note due 2026, Certificate No.

A-1, issued to the investor by the Company on October 23, 2024) is obtained. The exercise price and the number and type of securities

purchasable upon exercise of warrants are subject to adjustment upon certain corporate events, including certain combinations, consolidations,

liquidations, mergers, recapitalizations, reclassifications, reorganizations, stock dividends and stock splits, a sale of all or substantially

all of our assets and certain other events. We may, in connection with certain fundamental transactions, be required to pay an

amount in cash equal to the value of the warrant as determined in accordance with the Black Scholes option pricing model.

Holders

of the warrants may exercise their warrants to purchase shares of our common stock on or before the termination date by delivering an

exercise notice, appropriately completed and duly signed, and payment of the exercise price for the number of shares for which the warrant

is being exercised in cash. If, and only if, a registration statement relating to the issuance of the shares underlying the warrants

is not then effective or available or such shares would not be freely tradable, a holder of warrants would be entitled to exercise the

warrants on a cashless basis, where the holder receives the net value of the warrant in shares of common stock.

The

warrants do not confer upon holders any voting or other rights as stockholders of the Company.

DILUTION

If

you invest in our securities, your interest will be diluted by an amount equal to the difference between the public offering price and

the net tangible book value per share of our common stock after this offering. We calculate net tangible book value per share by dividing

our net tangible book value (total assets less intangible assets and total liabilities) by the number of outstanding shares of common

stock.

Our

net tangible book value at September 30, 2024 was approximately $53.3 million, or $0.25 per share of common stock. After giving effect

to the sale of shares of common stock in the aggregate principal amount of $8,000,000, and our receipt of the expected proceeds

from the sale of those shares, our adjusted net tangible book value at September 30, 2024 would be approximately $60.9 million, or $0.28

per share. This represents an immediate increase in as-adjusted net tangible book value of $0.03 per share to existing shareholders and

an immediate and substantial dilution of $1.11 per share to the investor in this offering. The following table illustrates this

per share dilution:

| Public offering price per share | |

| | | |

$ | 1.39125 | |

| Net tangible book value per share at September

30, 2024 | |

$ | 0.25 | | |

| | |

| Increase in net tangible

book value per share attributable to this offering | |

$ | 0.03 | | |

| | |

| As-adjusted net tangible book value per share

as of September 30, 2024, after giving effect to this offering | |

| | | |

$ | 0.28 | |

| Dilution per share to the investor in this

offering | |

| | | |

$ | 1.11 | |

The

table and discussion above are based on 213,373,426 shares of our common stock outstanding as of September 30, 2024 and excludes, as

of that date, the following:

| |

● |

666,058

shares of our common stock issuable upon exercise of outstanding options, all of which were exercisable

at a weighted average exercise price of $1.43 per share, under our Incentive Plan; |

| |

● |

12,845,744

shares of our common stock underlying unvested and/or deferred stock awards; |

| |

● |

2,784,660

shares of our common stock reserved for issuance pursuant to the Incentive Plan; and |

| |

|

|

| |

● |

5,750,225

shares of our common stock issuable upon exercise

of the warrants to be offered in this offering. |

The

number of shares outstanding shown above does not reflect any issuances of shares following September 30, 2024, including shares of our

common stock issuable to High Trail Special Situations LLC upon exercise of that certain senior secured convertible note in the aggregate

principal amount of $45,000,000 sold by us pursuant to the Securities Purchase Agreement dated October 14, 2024, in a private placement

that we consummated on October 23, 2024.

PLAN

OF DISTRIBUTION

We

have agreed to sell directly to the investor all of the shares of common stock and warrants offered by this prospectus supplement. Other

than WestPark Capital, Inc. and D. Boral Capital LLC, which are described below, no underwriters or agents were engaged by us for this

transaction. We have entered into a securities purchase agreement directly with the investor in connection with this offering. The securities

purchase agreement contains customary representations, warranties and covenants for transactions of this type. These representations,

warranties and covenants were made solely for purposes of the securities purchase agreement and should not be relied upon by any of our

investors who are not parties to the agreement, nor should any such investor rely upon any descriptions thereof as characterizations

of the actual state of facts or condition. Such investors are not third party beneficiaries under the securities purchase agreement.

The

purchase and sales under the securities purchase agreement (and the shares issuable upon exercise of the warrants) is registered pursuant

to our shelf registration statement on Form S-3 File Number 333-272616 and as to which this prospectus supplement relates.

The

foregoing description of the securities purchase agreement is only a summary, does not purport to be complete and is qualified in its

entirety by reference to the securities purchase agreement, a copy of which is attached as Exhibit 10.2 to our Current Report on Form

8-K, filed with the SEC on February 3, 2025 and is incorporated herein by reference.

We

engaged WestPark Capital, Inc. and D. Boral Capital LLC to act as placement agents in connection with this offering. The placement agents

are not purchasing or selling any shares of common stock or warrants in this offering. We have agreed to pay the placement agents an

aggregate cash fee of $160,000 in connection with this offering.

LEGAL

MATTERS

The

validity of the common stock and warrants being offered hereby will be passed upon by Ropes & Gray LLP, Boston, Massachusetts.

EXPERTS

The

consolidated financial statements and financial statement schedule of the Company as of December 31, 2023 and 2022 and for each of the

three-years in the period ended December 31, 2023 incorporated in this prospectus supplement by reference from the Annual Report on Form

10-K of the Company for the year ended December 31, 2023 and the effectiveness of our internal control over financial reporting, have

been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their report. Such consolidated financial

statements and financial statement schedule are incorporated by reference in reliance upon the report of such firm given their authority

as experts in accounting and auditing.

The

financial statements of Ibeo Automotive Systems GmbH appearing in our Current Report on Form 8-K/A Amendment No. 1 and filed with the

Securities and Exchanges Commission on April 18, 2023, have been audited by EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft

(formerly Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft), an independent auditor, as set forth in their report thereon,

included therein and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon

such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, proxy statements and other information with the SEC. These documents are on file with the

SEC. Our SEC filings are also available to the public from the SEC’s website at www.sec.gov.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information contained in documents that we file with them, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered

to be part of this prospectus supplement and the accompanying prospectus. Information in the accompanying prospectus supersedes information

incorporated by reference that we filed with the SEC before the date of the prospectus, and information in this prospectus supplement

supersedes information incorporated by reference that we filed with the SEC before the date of this prospectus supplement, while information

that we file later with the SEC will automatically update and supersede the information in this prospectus supplement and the accompanying

prospectus or incorporated by reference. We incorporate by reference the documents listed below and any future filings we will make with

the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the time that all securities covered by this prospectus

supplement have been sold; provided, however, that we are not incorporating any information furnished under any of Item 2.02 or Item

7.01 of any current report on Form 8-K:

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on February 29, 2024; |

| |

● |

Our

Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2024 (to the extent incorporated by reference into Part

III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023); |

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on February

3, 2023, as amended on April

18, 2023, on March

5, 2024, April

8, 2024, June

10, 2024, July

25, 2024, September

27, 2024, October

15, 2024; October

15, 2024; February 3, 2025; and |

| |

● |

The

description of our Common Stock contained in Exhibit 4.2 to our Form 10-K for the fiscal year ended December 31, 2020, filed with

the SEC on March 15, 2021, including any amendments or reports filed for the purpose of updating this description. |

You

may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

MicroVision,

Inc.

18390

NE 68th Street

Redmond,

Washington 98052

Attention:

Investor Relations

(425)

936-6847

You

can also find these filings on our website at www.microvision.com. We are not incorporating the information on our website other than

these filings into this prospectus supplement.

PROSPECTUS

MicroVision,

Inc.

$250,000,000

Common

Stock

Preferred

Stock

Warrants

We

may sell from time to time up to $250,000,000 in the aggregate of our common stock, preferred stock, or warrants in one or more transactions.

We

will provide specific terms of these securities and offerings in supplements to this prospectus. You should read this prospectus and

any supplement carefully before you invest.

Our

common stock is traded on The Nasdaq Global Market under the symbol “MVIS.” On February 26, 2024, the closing price of our

common stock on The Nasdaq Global Market was $2.09 per share.

The

securities offered in this prospectus involve a high degree of risk. You should carefully consider the information under the heading

“Risk Factors” set forth herein on page 2 and in our filings made with the Securities and Exchange

Commission, which are incorporated by reference in this prospectus, in determining whether to purchase our securities.

Our

executive offices are located at 18390 NE 68th Street, Redmond, Washington 98052, and our telephone number is (425) 936-6847.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is March 1, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission, or the SEC. By using

a shelf registration statement, we may, from time to time, sell any combination of the securities described in this prospectus in one

or more offerings for an aggregate offering amount of up to $250,000,000. This prospectus provides you with a general description of

the securities we may offer. Each time we sell securities, we will provide a prospectus supplement and, if necessary, a free writing

prospectus, that will contain specific information about the terms of that offering. The prospectus supplement and, if necessary, a free

writing prospectus, may also add to, update or change information contained in this prospectus. Accordingly, to the extent inconsistent,

the information in this prospectus will be deemed to be modified or superseded by any inconsistent information contained in a prospectus

supplement or a free writing prospectus. You should read carefully this prospectus, the applicable prospectus supplement and any free

writing prospectus, together with the additional information incorporated by reference in this prospectus described below under “Where

You Can Find More Information” before making an investment in our securities.

We

have not authorized anyone to give you any additional information different from that contained in this prospectus, any accompanying

prospectus supplement or any free writing prospectus provided in connection with an offering. We take no responsibility for, and can

provide no assurance as to the reliability of, any other information that others may give you.

You

should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and

any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations

and prospects may have changed since that date.

This

prospectus is not an offer to sell or solicitation of an offer to buy our securities in any circumstances under which or jurisdiction

in which the offer or solicitation is unlawful. Unless the context otherwise indicates, the terms “MicroVision,” “Company,”

“we,” “us,” and “our” as used in this prospectus refer to MicroVision, Inc. and its consolidated

subsidiaries. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the

context otherwise requires.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements, within the meaning of Section

27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act, and is subject to the safe harbor created by those sections. Such statements may include, but are not limited to,

projections of revenues, income or loss, capital expenditures, plans for product development and cooperative arrangements, future operations,

financing needs or plans of MicroVision, as well as assumptions relating to the foregoing. The words “anticipate,” “believe,”

“estimate,” “expect,” “goal,” “may,” “plan,” “project,” “will,”

and similar expressions identify forward-looking statements, which speak only as of the date the statement was made.

These

forward-looking statements are not guarantees of future performance. Factors that could cause actual results to differ materially from

those projected in such forward-looking statements include our ability to operate with limited cash or to raise additional capital when

needed; market acceptance of our technologies and products or for products incorporating our technologies; the failure of our commercial

partners to perform as expected under our agreements; our ability to identify parties interested in paying any amounts or amounts we

deem desirable for the purchase or license of intellectual property assets; our or our customers’ failure to perform under open

purchase orders; our financial and technical resources relative to those of our competitors; our ability to keep up with rapid technological

change; government regulation of our technologies; our ability to enforce our intellectual property rights and protect our proprietary

technologies; the ability to obtain additional contract awards and develop partnership opportunities; the timing of commercial product

launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties

to develop, manufacture, sell and market our products; potential product liability claims; our ability to maintain our listing on The

Nasdaq Stock Market; and other risk factors identified from time to time in the Company’s SEC reports, including the Company’s

Annual Report on Form 10-K filed with the SEC. These factors are not intended to represent a complete list of the general or specific

factors that may affect us. It should be recognized that other factors, including general economic factors and business strategies, may

be significant, now or in the future, and the factors set forth in this prospectus may affect us to a greater extent than indicated.

Except as expressly required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, changes in circumstances or any other reason.

RISK

FACTORS

You

should carefully consider the specific risks set forth under the caption “Risk Factors” in our most recent annual report

on Form 10-K and quarterly report on Form 10-Q, each as amended or supplemented, which are incorporated by reference in this prospectus,

as the same may be amended, supplemented or superseded by our subsequent quarterly or annual reports or other filings, including filings

after the date hereof, with the SEC under the Exchange Act. The risks and uncertainties we describe are not the only ones facing us.

Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these

risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the trading price

of our common stock could decline, and you could lose all or part of your investment.

THE

COMPANY

MicroVision

is a global developer and supplier of lidar hardware and software solutions focused primarily on automotive lidar and advanced driver-assistance

systems, or ADAS, markets where we can deliver safe mobility at the speed of life. We offer a suite of light detection and ranging, or

lidar, sensors and perception and validation software to automotive original equipment manufacturers for ADAS and autonomous vehicle,

or AV, applications, as well as to complementary markets for non-automotive applications including industrial, robotics and smart infrastructure.

Our long history of developing and commercializing the core components of our lidar hardware and related software, combined with the

experience of the team we acquired from Ibeo Automotive Systems, or Ibeo, with automotive-grade qualification, gives us a compelling

advantage as a development and commercial partner.

To

date, we have been unable to secure customers at scale needed to successfully launch our products. We have incurred substantial losses

since inception, have incurred a significant loss during the fiscal year ended December 31, 2023 and expect to incur a significant loss

during the fiscal year ended December 31, 2024.

USE

OF PROCEEDS

Unless

otherwise indicated in the applicable prospectus supplement, we anticipate that the net proceeds from the sale of the securities offered

under this prospectus will be used for general corporate purposes, which may include, but are not limited to, working capital and capital

expenditures. The prospectus supplement relating to specific sales of our securities hereunder will set forth our intended use for the

net proceeds we receive from the sales. Pending the application of the net proceeds, we expect to invest the proceeds in investment-grade,

interest-bearing instruments or other securities.

DESCRIPTION

OF CAPITAL STOCK

Our

Amended and Restated Certificate of Incorporation, as amended, authorizes us to issue 310,000,000 shares of common stock, $0.001 par

value per share, and 25,000,000 shares of preferred stock, $0.001 par value per share. As of December 31, 2023, there were 194,712,732

shares of common stock, and no shares of preferred stock, outstanding.

Common

Stock. All outstanding common stock is, and any stock issued under this prospectus will be, duly authorized, fully paid and nonassessable.

Subject to the rights of the holders of our outstanding preferred stock, holders of common stock:

| ● |

are

entitled to any dividends validly declared; |

| |

|

| ● |

will

share ratably in our net assets in the event of a liquidation; and |

| |

|

| ● |

are

entitled to one vote per share. |

The

common stock has no conversion rights. Holders of common stock have no preemption, subscription, redemption, or call rights related to

those shares.

Equiniti

Trust Company, LLC is the transfer agent and registrar for our common stock.

Preferred

Stock. The Board of Directors has the authority, without further action by the shareholders, to issue shares of preferred stock in

one or more series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, conversion rights,

voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the

designation of such series. The issuance of preferred stock could adversely affect the voting power of holders of our common stock and

the likelihood that such holders will receive dividend payments and payments upon liquidation may have the effect of delaying, deferring

or preventing a change in control of MicroVision, which could depress the market price of our common stock. If we offer preferred stock,

the terms of that series of preferred stock will be set forth in the prospectus supplement relating to that series.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of common stock, preferred stock, warrants or units of any combination of the foregoing securities.

Each series of warrants will be issued under a warrant agreement all as set forth in the prospectus supplement or term sheet relating

to the warrants offered hereby. A copy of the form of warrant agreement, including any form of warrant certificates representing the

warrants, reflecting the provisions to be included in the warrant agreements and/or warrant certificates that will be entered into with

respect to particular offerings of warrants, will be filed as an exhibit to a Form 8-K to be incorporated into the registration statement

of which this prospectus forms a part prior to the issuance of any warrants.

The

applicable prospectus supplement or term sheet will describe the terms of the warrants offered thereby, any warrant agreement relating

to such warrants and the warrant certificates, including but not limited to the following:

●

the offering price or prices;

●

the aggregate amount of securities that may be purchased upon exercise of such warrants and minimum number of warrants that are exercisable;

●

the number of securities, if any, with which such warrants are being offered and the number of such warrants being offered with each

security;

●

the date on and after which such warrants and the related securities, if any, will be transferable separately;

●

the amount of securities purchasable upon exercise of each warrant and the price at which the securities may be purchased upon such exercise,

and events or conditions under which the amount of securities may be subject to adjustment;

●

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

●

the circumstances, if any, which will cause the warrants to be deemed to be automatically exercised;

●

any material risk factors, if any, relating to such warrants;

●

the identity of any warrant agent; and

●

any other terms of such warrants.

Prior

to the exercise of any warrants, holders of such warrants will not have any rights of holders of the securities purchasable upon such

exercise, including the right to receive payments of dividends, if any, on the securities purchasable upon such exercise, statutory appraisal

rights or the right to vote such underlying securities.

Prospective

purchasers of warrants should be aware that material U.S. federal income tax, accounting and other considerations may be applicable to

instruments such as warrants.

PLAN

OF DISTRIBUTION

General.

We may sell the securities offered hereby directly to one or more purchasers, through agents, or through underwriters or dealers

designated from time to time. The distribution of securities may be effected from time to time in one or more transactions at a fixed

price or prices (which may be changed from time to time), at market prices prevailing at the times of sale, at prices related to these

prevailing market prices or at negotiated prices. The applicable prospectus supplement will describe the terms of the offering of the

securities, including:

●

the terms of the securities to which such prospectus supplement relates;

●

the name or names of any underwriters, if any;

●

the purchase price of the securities and the proceeds we will receive from the sale;

●

any underwriting discounts and other items constituting underwriters’ compensation; and

●

any discounts or concessions allowed or reallowed or paid to dealers.

Underwriters

named in the prospectus supplement, if any, are only underwriters of the securities offered with the prospectus supplement.

Sales

Directly to Purchasers. We may enter into agreements directly with one or more purchasers. Such agreements may provide for the sale

of securities at a fixed price, based on the market price of the securities or otherwise.

Use

of Underwriters and Agents. If underwriters are used in the sale of securities, they will acquire the securities for their own accounts

and may resell them from time to time in one or more transactions at a fixed public offering price or at varying prices determined at

the time of sale. The securities may be offered to the public through underwriting syndicates represented by managing underwriters or

by underwriters without a syndicate. Subject to certain conditions, the underwriters will be obligated to purchase all the securities

offered by the prospectus supplement. Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers

may change from time to time.

Securities

may be sold directly to or through agents from time to time. Any agent involved in the offering and sale of securities will be named

and any commissions paid to the agent will be described in the prospectus supplement. Unless the prospectus supplement states otherwise,

any agent will act on a best-efforts basis for the period of its appointment. Agents or underwriters may be authorized to solicit offers

by certain types of institutional investors to purchase securities at the public offering price set forth in the prospectus supplement

pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The conditions to these

contracts and the commissions paid for solicitation of these contracts will be described in the prospectus supplement. We may engage

in “at the market” offerings only of our common stock. An “at the market” offering is defined in Rule 415(a)(4)

under the Securities Act as an offering of equity securities into an existing trading market for outstanding shares of the same class

at other than a fixed price.

Deemed

Underwriters. In connection with the sale of the securities offered with this prospectus, underwriters, dealers or agents may receive

compensation from us or from purchasers of the securities for whom they may act as agents, in the form of discounts, concessions or commissions.

The underwriters, dealers or agents which participate in the distribution of the securities may be deemed to be underwriters under the

Securities Act and any discounts or commissions received by them and any profit on the resale of the securities received by them may

be deemed to be underwriting discounts and commissions under the Securities Act. Anyone deemed to be an underwriter under the Securities

Act may be subject to statutory liabilities, including Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange

Act.

Indemnification

and Other Relationships. We may provide agents and underwriters with indemnification against certain civil liabilities, including

liabilities under the Securities Act, or contribution with respect to payments that the agents or underwriters may make with respect

to such liabilities. Agents and underwriters may engage in transactions with, or perform services for, us in the ordinary course of business.

Listing

of Securities. Except as indicated in the applicable prospectus supplement, the securities offered hereby are not expected to be

listed on a securities exchange or market, except for the common stock, which is currently listed on The Nasdaq Global Market, and any

underwriters or dealers will not be obligated to make a market in securities. We cannot predict the activity or liquidity or any trading

in the securities.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, proxy statements and other information with the SEC. These documents are on file with the

SEC. Our SEC filings are also available to the public from the SEC’s website at www.sec.gov.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with them, which means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus,

and the information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future filings we will make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act prior to the time that all securities covered by this prospectus have been sold; provided, however, that we are not incorporating

any information furnished under any of Item 2.02 or Item 7.01 (including exhibits furnished under Item 9.01 in connection with information

furnished under Item 2.02 or Item 7.01) of any current report on Form 8-K:

| ● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on February 29, 2024; |

| |

|

| ● |

Our

Current Reports on Form 8-K filed with the SEC on February 3, 2023, as amended on April 18, 2023; and

|

| |

|

| ● |

The

description of our Common Stock contained in Exhibit 4.2 to our Form 10-K for the fiscal year ended December 31, 2020, filed with

the SEC on March 15, 2021, including any amendments or reports filed for the purpose of updating this description. |

You

may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

MicroVision,

Inc.

18390

NE 68th Street

Redmond,

Washington 98052

Attention:

Investor Relations

(425)

936-6847

You

can also find these filings on our website at www.microvision.com. We are not incorporating the information on our website other than

these filings into this prospectus.

This

prospectus is part of a registration statement that we have filed with the SEC. You should rely only on the information or representations

provided in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these

securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as

of any date other than the date on the front of the document.

LEGAL

MATTERS

For

the purpose of this offering, Ropes & Gray LLP, is giving its opinion on the validity of the securities offered hereby.

EXPERTS

Our

consolidated financial statements and schedule and the effectiveness of our internal control over financial reporting as of December

31, 2023, have been audited by Moss Adams LLP, an independent registered public accounting firm, as set forth in their reports,

appearing in our Annual Report on Form 10-K for the year ended December 31, 2023, and incorporated herein by reference. Such consolidated

financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting

and auditing.

The

financial statements of Ibeo Automotive Systems GmbH appearing in our Current Report on Form 8-K/A Amendment No. 1, have been audited

by EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft, an independent auditor, as stated in their report, which is incorporated

herein by reference. Such financial statements have been so incorporated in reliance upon the report of such firm given upon their authority

as experts in accounting and auditing.

MicroVision,

Inc.

$150,000,000

Common

Stock

Prospectus

Supplement

| Deutsche

Bank Securities |

|

Mizuho

|

|

Craig-Hallum |

March

5, 2024

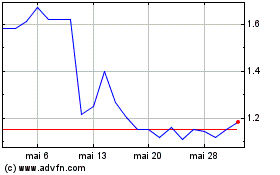

Microvision (NASDAQ:MVIS)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Microvision (NASDAQ:MVIS)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025