1/28/20250001396814false00013968142025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 28, 2025

PACIRA BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35060 | | 51-0619477 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

5401 West Kennedy Boulevard, Suite 890

Tampa, Florida 33609

(Address and Zip Code of Principal Executive Offices)

(813) 553-6680

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | PCRX | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Directors

On January 28, 2025, Paul J. Hastings, Chair of the Board of Directors (the “Board”), and Andreas Wicki, a member of the Board, each notified the Board of Pacira BioSciences, Inc. (the “Company”) of his respective decision to resign as a member of the Board, in each case, effective immediately (together, the “Resignations”). The Resignations were not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Appointment of Board Chair

On January 28, 2025, as a result of Mr. Hastings’s resignation, the Board, upon recommendation of the Nominating, Governance and Sustainability Committee of the Board, appointed Laura Brege as Chair of the Board, effective as of immediately following the effectiveness of the Resignations.

Decrease of the Size of the Board

As a result of the Resignations, pursuant to the Amended and Restated Certificate of Incorporation of the Company (as amended to date, the “Certificate of Incorporation”), and the Second Amended and Restated Bylaws of the Company (the “Bylaws”), the Board approved a decrease of the size of the Board from twelve directors to nine directors, effective as of immediately following the effectiveness of the Resignations.

Reclassification of Directors

As a result of the Resignations and in accordance with the Certificate of Incorporation and the Bylaws, on January 28, 2025, the Board reclassified the membership of the Board’s three director classes into three classes consisting of, as nearly as may be possible, one-third of the total number of directors constituting the entire Board, effective as of immediately following the effectiveness of the Resignations. In order to achieve an equal apportionment of membership among the Board’s three classes of directors, the Board determined that one of its members should be reclassified from Class III (with a term expiring at the Company’s 2026 annual meeting of stockholders) to Class II (with a term expiring at the Company’s 2025 annual meeting of stockholders) and one of its members should be reclassified from Class I (with a term expiring at the Company’s 2027 annual meeting of stockholders) to Class III (with a term expiring at the Company’s 2026 annual meeting of stockholders).

Accordingly, on January 28, 2025, Frank Lee resigned from his position as a Class III director, subject to and conditioned upon his simultaneous reappointment as a Class II director, and Mark Kronenfeld resigned from his position as a Class I director, subject to and conditioned upon his simultaneous reappointment as a Class III director. The Board accepted each of Mr. Lee’s and Dr. Kronenfeld’s resignations and simultaneously reappointed Mr. Lee as a Class II director and Dr. Kronenfeld as a Class III director. The resignation and reappointment of each of Mr. Lee and Dr. Kronenfeld was effected solely for the purpose of reclassifying the members of the Board into three classes consisting of, as nearly as may be possible, one-third of the total number of directors constituting the entire Board, and for all other purposes, each of Mr. Lee’s and Dr. Kronenfeld’s service on the Board is deemed to have continued uninterrupted.

A full list of the directors and their respective term expirations following the Resignations and the reclassifications of Mr. Lee and Dr. Kronenfeld is as follows:

| | | | | | | | |

Class I Terms Expiring at the 2027 Annual Meeting of Stockholders | Class II Terms Expiring at the 2025 Annual Meeting of Stockholders | Class III Terms Expiring at the 2026 Annual Meeting of Stockholders |

Laura Brege (Chair) | Marcelo Bigal | Abraham Ceesay |

Mark Froimson | Frank Lee | Christopher Christie |

Michael Yang | Alethia Young | Mark Kronenfeld |

Committee Reassignments

As a result of the Resignations and the appointment of a new Board Chair described above, on January 28, 2025, effective as of immediately following the effectiveness of the Resignations, the Board restructured the composition of certain committees of the Board, such that the composition of the committees of the Board is now as follows:

| | | | | | | | | | | |

Audit Committee | Compensation Committee | Nominating, Governance and Sustainability Committee | Science and Technology Committee |

Alethia Young (Chair) | Michael Yang (Chair) | Mark Kronenfeld (Chair) | Marcelo Bigal (Chair) |

Abraham Ceesay | Abraham Ceesay | Laura Brege | Mark Froimson |

Mark Froimson | Mark Kronenfeld | Christopher Christie | Mark Kronenfeld |

Item 7.01. Regulation FD Disclosure.

On January 30, 2025, the Company issued a press release announcing the Board changes. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01 and Exhibit 99.1 furnished hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (Formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | PACIRA BIOSCIENCES, INC.

(REGISTRANT) |

| | | |

| Dated: | January 30, 2025 | By: | /s/ KRISTEN WILLIAMS |

| | | Kristen Williams |

| | | Chief Administrative Officer and Secretary |

FOR IMMEDIATE RELEASE

NEWS RELEASE

Pacira Announces Updates to Board of Directors

-- Accomplished Business and Financial Leader, Laura Brege, Appointed Chair --

-- Paul J. Hastings and Andreas Wicki, PhD Retire from Board of Directors --

Parsippany, NJ, Jan. 30, 2025 (GLOBE NEWSWIRE) -- Pacira BioSciences, Inc. (Nasdaq: PCRX), the industry leader in its commitment to deliver innovative, non-opioid pain therapies to transform the lives of patients, today announced that Laura Brege has been appointed Chair of the Board. Former Chair Paul J. Hastings and Andreas Wicki, PhD. have retired from the Board. These changes align with Pacira’s ongoing commitment to Board refreshment. With these changes, the Board is composed of nine directors, eight of whom are independent and five of whom have joined since October 2023. Each director brings expertise in areas important to Pacira’s business to support Pacira’s 5x30 growth-oriented plan including executive leadership, M&A, research and development, operations, commercialization, manufacturing and supply chain.

Ms. Brege brings over a decade of experience with the Company, and has extensive knowledge of Pacira’s operations, strategy and unique position in the market. She also contributes to the Board 30 years of executive management experience as well as significant operational, development and strategic expertise in the pharmaceutical and biotechnology industries. Ms. Brege has held executive or strategic advisory positions at companies such as BridgeBio Pharma, Inc., Onyx Pharmaceuticals, Inc., and COR Therapeutics, Inc., and has led multiple functions including sales and marketing, business development, commercialization, strategic planning, corporate development, and medical, scientific and government affairs. Ms. Brege’s financial background and extensive experience helping companies develop, deliver and commercialize treatments that improve the lives of patients will be an asset to Pacira as it executes its new 5x30 growth strategy.

“I am honored to step into the role of Chair and look forward to continuing to work with my fellow directors, leadership team and the talented Pacira employees to drive our long-term success,” said Ms. Brege. “This is an exciting time for Pacira as we execute on our new 5x30 growth strategy to drive innovation and create value in the significant and growing markets of high unmet need. I look forward to working with the Board and the management team to help guide the Company toward even greater success while advancing Pacira’s mission of providing non-opioid pain management options to as many patients as possible.”

During his nearly 14-year tenure, Mr. Hastings had a pivotal role in Pacira becoming a leading provider of innovative non-opioid pain management solutions with a portfolio of three best-in-class commercial assets. The Board of Directors is grateful for his strategic insights and many contributions to the company. Dr. Wicki, who has served on the Board since 2006, has been instrumental in overseeing and supporting the execution of Pacira’s strategy and the Board thanks him for his service and leadership.

“I have had the privilege of working alongside an extraordinary team at Pacira for the past 14 years and I am incredibly proud of all that we have accomplished to improve patient care and quality of life,” said Mr. Hastings. “It has been an honor to work with my fellow Board members to oversee the evolution of Pacira’s strategy, including the recent hiring of Frank Lee who has the company on a very strong trajectory and the four new independent directors. Laura is an experienced leader with a deep understanding of the business and its opportunities for value creation, and as we approach the next phase of growth, the Board and I believe that it is good governance and is the right time to transition Board leadership.”

Today’s announcement marks an important milestone in Pacira’s ongoing Board transformation, which began 15 months ago with the appointment of four new independent directors. Pacira remains confident that the current composition of the Board combines the right mix of skills and expertise to oversee the Company’s strategic plan and drive value for Pacira shareholders. In connection with these changes, the Board has also refreshed committee assignments and appointed Alethia Young to succeed Ms. Brege as Chair of the Audit Committee.

About Pacira

Pacira delivers innovative, non-opioid pain therapies to transform the lives of patients. Pacira has three commercial-stage non-opioid treatments: EXPAREL® (bupivacaine liposome injectable suspension), a long-acting local analgesic currently approved for infiltration, fascial plane block, and as an interscalene brachial plexus nerve block, an adductor canal nerve block, and a sciatic nerve block in the popliteal fossa for postsurgical pain management; ZILRETTA® (triamcinolone acetonide extended-release injectable suspension), an extended-release, intra-articular injection indicated for the management of osteoarthritis knee pain; and ioveraº®, a novel, handheld device for delivering immediate, long-acting, drug-free pain control using precise, controlled doses of cold temperature to a targeted nerve. The company is also advancing the development of PCRX-201, a novel locally administered gene therapy with the potential to treat large prevalent diseases like osteoarthritis. To learn more about Pacira, visit www.pacira.com.

Forward-Looking Statements

Any statements in this press release about Pacira’s future expectations, plans, trends, outlook, projections and prospects, and other statements containing the words “believes,” “anticipates,” “plans,” “estimates,” “expects,” “intends,” “may,” “will,” “would,” “could,” “can” and similar expressions, constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995, including, without limitation, statements related to ‘5x30’, our growth and business strategy, our future outlook, contributions of directors, our intellectual property and patent terms, our future operating results and trends, our strategy, plans, objectives, expectations (financial or otherwise) and intentions, future financial results and growth potential, including our plans with respect to the repayment of our indebtedness, anticipated product portfolio, development programs, development of products, strategic alliances, plans with respect to the Non-Opioids Prevent Addiction in the Nation (“NOPAIN”) Act and other statements that are not historical facts. For this purpose, any statement that is not a statement of historical fact should be considered a forward-looking statement. We cannot assure you that our estimates, assumptions and expectations will prove to have been correct. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including risks relating to, among others: risks associated with acquisitions, such as

the risk that the acquired businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the transaction will not occur; our manufacturing and supply chain, global and U.S. economic conditions (including inflation and rising interest rates), and our business, including our revenues, financial condition, cash flow and results of operations; the success of our sales and manufacturing efforts in support of the commercialization of EXPAREL, ZILRETTA and iovera°; the rate and degree of market acceptance of EXPAREL, ZILRETTA and iovera°; the size and growth of the potential markets for EXPAREL, ZILRETTA and iovera° and our ability to serve those markets; our plans to expand the use of EXPAREL, ZILRETTA and iovera° to additional indications and opportunities, and the timing and success of any related clinical trials for EXPAREL, ZILRETTA and iovera°; the commercial success of EXPAREL, ZILRETTA and iovera°; the related timing and success of U.S. Food and Drug Administration supplemental New Drug Applications and premarket notification 510(k)s; the related timing and success of European Medicines Agency Marketing Authorization Applications; our plans to evaluate, develop and pursue additional product candidates utilizing our proprietary multivesicular liposome (“pMVL”) drug delivery technology; the approval of the commercialization of our products in other jurisdictions; clinical trials in support of an existing or potential pMVL-based product; our commercialization and marketing capabilities; our ability to successfully complete capital projects; the outcome of any litigation; the ability to successfully integrate any future acquisitions into our existing business; the recoverability of our deferred tax assets; assumptions associated with contingent consideration payments; assumptions used for estimated future cash flows associated with determining the fair value of the Company; the anticipated funding or benefits of our share repurchase program; and factors discussed in the “Risk Factors” of our most recent Annual Report on Form 10-K and in other filings that we periodically make with the Securities and Exchange Commission (the “SEC”).

In addition, the forward-looking statements included in this press release represent our views as of the date of this press release. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those indicated or implied by forward-looking statements, and as such we anticipate that subsequent events and developments will cause our views to change. Except as required by applicable law, we undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and readers should not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

###

| | | | | | | | |

Investor Contact: Susan Mesco, (973) 451-4030 susan.mesco@pacira.com | | Media Contact: Sara Marino, (973) 370-5430 sara.marino@pacira.com |

Cover Page

|

Jan. 28, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 28, 2025

|

| Entity Registrant Name |

PACIRA BIOSCIENCES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35060

|

| Entity Tax Identification Number |

51-0619477

|

| Entity Address, Address Line One |

5401 West Kennedy Boulevard, Suite 890

|

| Entity Address, City or Town |

Tampa

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33609

|

| City Area Code |

813

|

| Local Phone Number |

553-6680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PCRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001396814

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

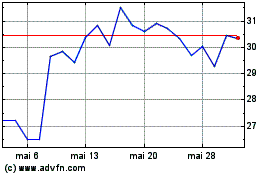

Pacira BioSciences (NASDAQ:PCRX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

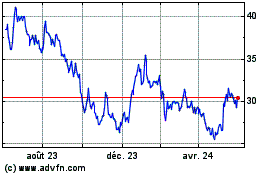

Pacira BioSciences (NASDAQ:PCRX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025