UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

ý Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

PILGRIM’S PRIDE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee paid previously with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Dear Fellow Pilgrim’s Shareholders:

You are cordially invited to attend a Special Meeting of Stockholders of Pilgrim’s Pride Corporation. Attached to this letter is the Notice of Special Meeting of Stockholders and Proxy Statement, which provides information about the Special Meeting and describes the business to be conducted. We urge you to read this information carefully.

Whether or not you attend the Special Meeting, and regardless of the number of shares that you own, it is important that your shares be represented and voted at the Special Meeting. Therefore, I urge you to vote your shares of common stock via the Internet or by promptly marking, dating, signing, and returning the proxy card via mail. Voting over the Internet, or by written proxy, will ensure that your shares are represented at the Special Meeting.

Thank you for your continued support.

/s/ Fabio Sandri

Fabio Sandri

President and Chief Executive Officer

Pilgrim’s Pride Corporation

1770 Promontory Circle

Greeley, Colorado 80634

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held December 4, 2024

To the Stockholders of Pilgrim’s Pride Corporation:

Notice is hereby given that Pilgrim’s Pride Corporation (“Pilgrim’s Pride,” the “Company”, or “we,” “us” or “our”) will hold a special meeting of its stockholders at the Company’s corporate headquarters, at 1770 Promontory Circle, Greeley, Colorado, on December 4, 2024, at 8:00 a.m., Mountain Time, to consider and vote to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate”). No other matters are expected to be voted on at the special meeting.

The Board of Directors of Pilgrim’s Pride has fixed the close of business on October 28, 2024, as the record date for determining stockholders entitled to notice of, and to vote at, the special meeting. If you owned shares of our common stock at the close of business on that date, you are cordially invited to attend the special meeting. Whether or not you plan to attend the special meeting, please vote at your earliest convenience. Most stockholders have three options for submitting their votes prior to the meeting:

(1) via the internet;

(2) by telephone; or

(3) by mail.

Please refer to the specific instructions set forth on the enclosed proxy card (if you are a stockholder of record) or voting instruction form (if you hold shares through a bank, broker or other nominee). Admission to the special meeting will be limited to our stockholders, proxy holders and invited guests. If you are a stockholder of record, please bring a form of government-issued photo identification to the special meeting. If you hold shares through a bank, broker or other nominee, please bring a form of government-issued photo identification and proof of beneficial ownership (such as a brokerage statement), and, if you wish to vote your shares in person, a signed legal proxy from the stockholder of record.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | |

FABIO SANDRI |

| Greeley, Colorado | | | President and |

| November 4, 2024 | | | Chief Executive Officer |

YOUR VOTE IS IMPORTANT

PLEASE SIGN AND RETURN THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM OR VOTE YOUR SHARES ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD OR VOTING INSTRUCTION FORM.

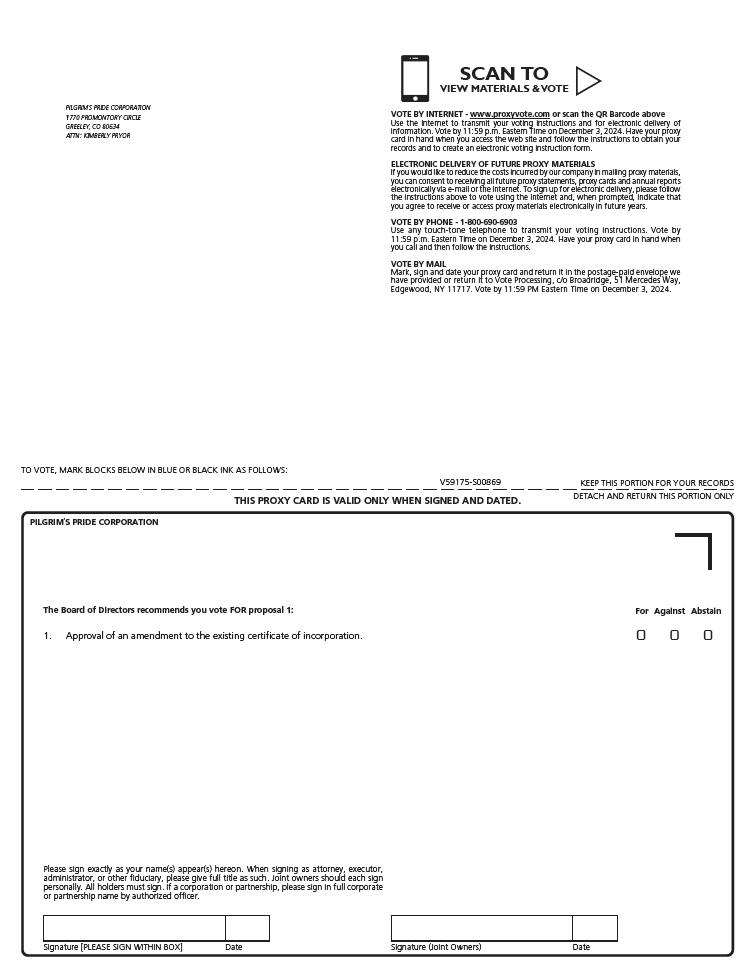

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 4, 2024: The Proxy Statement is available at www.proxyvote.com. Enter the 15-digit control number located on the proxy card and click “View Stockholder Material.”

Pilgrim’s Pride Corporation

1770 Promontory Circle

Greeley, Colorado 80634

GENERAL INFORMATION

Why did I receive this proxy statement?

The Board of Directors (the “Board of Directors” or the “Board”) of Pilgrim’s Pride Corporation is soliciting stockholder proxies for use at our special meeting of stockholders to be held at Pilgrim’s Pride corporate headquarters, at 1770 Promontory Circle, Greeley, Colorado, on December 4, 2024, at 8:00 a.m., Mountain Time, and any adjournments thereof (the “Special Meeting” or the “meeting”). This proxy statement and the accompanying proxy card are being mailed to stockholders on or about November [ ], 2024. Throughout this proxy statement, we will refer to Pilgrim’s Pride Corporation as “Pilgrim’s Pride,” “Pilgrim’s,” “PPC,” “we,” “us” or the “Company.”

What is the record date for the Special Meeting and why is it important?

The Board of Directors has fixed October 28, 2024 as the record date for determining stockholders who are entitled to vote at the Special Meeting (the “Record Date”). At the close of business on the Record Date, Pilgrim’s Pride had 237,123,076 shares of common stock, par value $0.01 per share, outstanding.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most stockholders of Pilgrim’s Pride hold their shares through a broker, bank or other nominee, rather than of record directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of Record: If your shares are registered directly in your name with our transfer agent, you are considered a stockholder of record with respect to those shares. As a stockholder of record, you have the right to vote in person at the meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered a beneficial owner of shares held in “street name.” As a beneficial owner, you have the right to direct your broker on how to vote your shares, and you are also invited to attend the meeting. Since you are not a stockholder of record, however, you may not vote your shares in person at the meeting unless you obtain a signed proxy from the holder of record giving you the right to vote the shares.

How do I attend and be admitted to the Special Meeting?

You are entitled to attend the Special Meeting only if you were a Pilgrim’s Pride stockholder as of the Record Date or if you hold a valid proxy for the Special Meeting. If you plan to attend the physical meeting, please be aware of what you will need for admission as described below. If you do not provide a government-issued photo identification and comply with the other procedures described here for attending the Special Meeting in person, you will not be admitted to the meeting location.

Stockholders of Record: If your shares are registered directly in your name with our transfer agent, your shares will be on a list maintained by the inspector of elections. You must present a government-issued photo identification, such as a driver’s license, state-issued ID card, or passport.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you must provide proof of beneficial ownership as of the record date, such as an account statement or similar evidence of ownership, along with a government-issued photo identification, such as a driver’s license, state-issued ID card, or passport.

For directions to the meeting, please contact our Corporate Counsel at Pilgrim’s Pride Corporation, 1770 Promontory Circle, Greeley, Colorado 80634.

What is a proxy?

A proxy is your legal designation of another person (the “proxy”) to vote on your behalf. By completing and returning the enclosed proxy card, you are giving the proxies appointed by the Board and identified on the proxy card the authority to vote your shares in the manner you indicate on your proxy card.

What if I receive more than one proxy card?

You will receive multiple proxy cards if you hold shares of our common stock in different ways (e.g., joint tenancy, trusts, custodial accounts) or in multiple accounts. If your shares are held in “street name” (i.e., by a broker, bank or other nominee), you will receive your proxy card or voting instruction form from your nominee, and you must return your voting instruction form to that nominee. You should complete, sign and return each proxy card or voting instruction form you receive.

What are the voting rights of the common stock?

Each holder of record of our common stock on the Record Date is entitled to cast one vote per share on each matter presented at the meeting.

How do I vote my shares?

If you are a “stockholder of record,” you have several choices. You can vote your proxy:

(1)via the internet;

(2) by telephone; or

(3) by mail, by completing, dating, signing and mailing the enclosed proxy card.

Please refer to the specific instructions set forth on the enclosed proxy card.

If you are a stockholder of record, you also have the right to vote in person at the meeting. If you are a beneficial owner, your broker, bank or nominee will provide you with materials and instructions for voting your shares. In most instances, you will be able to do this on the internet, by telephone or by mail as indicated above. As a beneficial owner, you have the right to direct your broker on how to vote your shares. However, you may not vote your shares in person at the meeting unless you obtain a signed legal proxy from the holder of record giving you the right to vote the shares.

If you are a current or former employee of Pilgrim’s Pride who holds shares in either the Pilgrim’s Pride Corporation Retirement Savings Plan or the To-Ricos Employee Savings and Retirement Plan, your vote serves as a voting instruction to the trustee for this plan. To be timely, if you vote your

shares in the Pilgrim’s Pride Corporation Retirement Savings Plan or the To-Ricos Employee Savings and Retirement Plan by telephone or internet, your vote must be received by 11:59 p.m., Mountain Time, on December 4, 2024. If you do not vote by telephone or internet, please return your proxy card as soon as possible. If you vote in a timely manner, the trustee will vote the shares as you have directed.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares FOR the approval of the amendment to the Amended and Restated Certificate of Incorporation (the “Certificate”).

What are my choices when voting?

With respect to the proposal, you may vote “FOR” or “AGAINST” the proposal, or you may elect to abstain from voting your shares. Abstaining will have the same effect as a vote against the proposal, as discussed below.

How will my shares be voted if I do not specify my voting instructions?

If you sign and return your proxy card without indicating how you want your shares to be voted, the proxies appointed by the Board will vote your shares FOR the approval of the amendment to the Certificate.

If you are a current or former employee of Pilgrim’s Pride who holds shares through the Pilgrim’s Pride Corporation Retirement Savings Plan or the To-Ricos Employee Savings and Retirement Plan, you will be given the opportunity to provide instruction to the trustee with respect to how to vote your shares. Any shares for which instructions are not received (1) will be voted by the trustee in accordance with instructions provided by Pilgrim’s Pride with respect to shares held under the Pilgrim’s Pride Corporation Retirement Savings Plan and (2) will not be voted with respect to shares held under the To-Ricos Employee Savings and Retirement Plan.

What is a quorum?

A “quorum” is necessary to hold the meeting. A quorum consists of a majority of the voting power of our common stock issued and outstanding and entitled to vote at the meeting, including the voting power that is present in person or by proxy. The shares of a stockholder whose ballot on any or all proposals is marked as “abstain” and shares represented by broker “non-votes” will be included in the number of shares present at the Special Meeting to determine whether a quorum is present.

What vote is required to approve the proposed amendment to our Certificate?

The Equity Directors (as defined in the Certificate), voting as a group, and our Board have each unanimously approved the amendment to our Certificate. The Equity Directors, voting as a group, and the Board have also each unanimously approved corresponding amendments to the Company’s Amended and Restated Corporate Bylaws (the “Restated Bylaws”) and the Stockholders Agreement between the Company and JBS USA Holding Lux, S.à.r.l. (formerly known as JBS USA Holdings, LLC, which was formerly known as JBS USA Holdings, Inc.) (the “Stockholders Agreement”).

At the Special Meeting, in accordance with Delaware General Corporation Law, the amendment to our Certificate also requires approval by a majority of the outstanding shares of our common stock entitled to vote thereon.

How are abstentions and non-broker votes treated?

Abstentions will be counted in the tally of votes. An abstention will have the same effect as a vote against the proposal in this proxy statement. A “broker non-vote” occurs when a nominee (a bank, broker or other nominee) holding shares for a beneficial owner returns a proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. Broker non-votes will have the same effect as a vote against the proposal in this proxy statement.

Can I change my vote after I have mailed in my proxy card?

Yes. You may revoke your proxy by doing one of the following:

• by sending to the Secretary of the Company a written notice of revocation that is received prior to the meeting;

• by submitting a new proxy card bearing a later date to the Secretary of the Company so that it is received prior to the meeting; or

• by attending the meeting and voting your shares in person.

If your shares are held in “street name,” you may submit new voting instructions by contacting your bank, broker or other nominee.

Who will pay the cost of this proxy solicitation?

We will pay the cost of preparing, printing and mailing this proxy statement and of soliciting proxies. We will request brokers, custodians, nominees and other like parties to forward copies of proxy materials to beneficial owners of our common stock and will reimburse these parties for their reasonable and customary charges or expenses.

Is this proxy statement the only way that proxies may be solicited?

No. In addition to mailing these proxy materials, certain of our directors, officers or employees may solicit proxies by telephone, facsimile, e-mail or personal contact. They will not be specifically compensated for doing so.

SECURITY OWNERSHIP

The following table sets forth certain information with respect to the beneficial ownership of our common stock by (1) each person known by us to own more than 5 percent of the outstanding shares of our common stock (the only class of voting securities outstanding); (2) each of our directors; (3) our named executive officers; and (4) all of our current directors and executive officers as a group. The information below is provided as of the Record Date, unless otherwise indicated below.

| | | | | | | | | | | |

Name and Beneficial Owner(a) | Amount and Nature of Beneficial Ownership of Common Stock | Percent of Outstanding Common Stock | Percent of Voting Power |

Wesley Mendonça Batista(b) | 195,447,632 | 82.42% | 82.42% |

Joesley Mendonça Batista(b) | 195,447,632 | 82.42% | 82.42% |

JBS Wisconsin Properties, LLC(b) | 195,445,936 | 82.42% | 82.42% |

| Fabio Sandri | 279,565 | * | * |

| Matthew Galvanoni | 51,750 | * | * |

| Wallim Cruz de Vasconcellos Junior | 16,908 | * | * |

| Farha Aslam | 14,122 | * | * |

| Arquimedes A. Celis | 14,122 | * | * |

| Ajay Menon | 9,162 | * | * |

| Raul Padilla | 6,731 | * | * |

| Gilberto Tomazoni | 1,696 | * | * |

| Andre Nogueira de Souza | 1,696 | * | * |

All current executive officers and Directors as a group (11 persons)(a) | 195,845,080 | 82.49% | 82.49% |

* Less than 1%.

(a) Unless otherwise noted, the address for each individual is c/o Pilgrim’s Pride Corporation, 1770 Promontory Circle, Greeley, CO 80634-9038. To our knowledge, except as otherwise indicated, each of the persons listed above has sole voting and investment power with respect to shares beneficially owned.The amounts for each individual include the following shares of common stock underlying restricted stock units (which, for our executive officers, vest within 60 days of the Record Date, and for our Directors, vest upon departure from the Board): for each of Messrs. Wesley and Joesley Batista, Tomazoni and Nogueira: 1,696; for Mr. Sandri, 190,366; for Mr. Galvanoni, 36,315; for Mr. Vasconcellos, 16,908; for each of Ms. Aslam and Mr. Celis, 14,122; for Mr. Menon, 9,162; and for Mr. Padilla, 6,731.

(b) JBS Wisconsin Properties, LLC is a wholly owned, indirect subsidiary of JBS S.A. and directly beneficially owns 195,445,936 shares of our common stock. JBS S.A. is ultimately controlled by Joesley Mendonça Batista and Wesley Mendonça Batista, who jointly control and equally and indirectly own: (1) 100% of the equity interests in J&F Investimentos S.A., a Brazilian corporation, which owns approximately 23.54% of the outstanding capital of JBS S.A.; and (2) 100% of the equity interests in J&F Participações S.A., a Brazilian corporation, which owns approximately 24.79% of the outstanding capital of JBS S.A. The address of JBS S.A. is Avenida Marginal Direita do Tietê, 500, Blocoo 1, 3rd Floor, City of São Paulo, State of São Paulo, Brazil, CEP 05118-100 and the address of JBS Wisconsin Properties, LLC is 1770 Promontory Circle, Greeley, CO 80634-9038. The ownership of each of Messrs. Batista also includes shares of common stock underlying restricted stock units that will vest upon their departure from the Board.

PROPOSAL 1. APPROVAL OF AMENDMENT TO THE CERTIFICATE

The Equity Directors, voting as a group, and the full Board have each unanimously approved, and have recommended for approval by the Company’s stockholders, an amendment to the Certificate as set forth in Annex A to this proxy statement. As a result of the amendment, at any time when the JBS Stockholder (as defined in the Certificate) beneficially owns equal to or greater than 80 percent but less than 90 percent of our outstanding common stock (an “80 Percent Holder”), JBS Directors (as defined in the Certificate) will constitute 80 percent of the total number of directors serving on our Board.

Background Information

JBS Directors are the directors on our Board who are designated as JBS Directors, and Equity Directors are the directors on our Board who are designated as Equity Directors, each pursuant to the terms of the Certificate. Only JBS Directors can serve as members of our JBS Nominating Committee, which has the exclusive authority to nominate JBS Directors, and only Equity Directors can serve as members of our Equity Nominating Committee, which has the exclusive authority to nominate Equity Directors.

Description of the Amendment

As shown in Annex A, the amendment will specifically provide that, at any time when JBS is an 80 Percent Holder, there shall be 10 directors on the Board consisting of eight JBS Directors and two Equity Directors. In addition, the amendment provides that at least two of the JBS Directors will be financially literate and be independent under Rule 5605(a)(2) of the listing rules of the Nasdaq Stock Market LLC and under Rule 10A-3 of the Exchange Act, such that they will not be affiliated with the Company or the JBS Stockholder and will be qualified to serve on the Company’s audit committee.

Under the current Certificate, only the Equity Nominating Committee (not the JBS Nominating Committee) nominates an additional director to the Board in place of the Founder Director following the Founder Triggering Event (as defined in the Certificate), such that, at any time when JBS is an 80 Percent Holder, the Board has nine directors consisting of only seven JBS Directors, or under 80 percent of the total number of directors serving on the Board, even though the JBS Stockholder holds 80 percent or more of the outstanding shares of the Company. As a result of the amendment, at any time when the JBS Stockholder becomes an 80 Percent Holder following the Founding Triggering Event, both the JBS Nominating Committee and the Equity Nominating Committee each nominate an additional director to the Board, increasing their respective representation on the Board to eight and two directors, respectively, and making the Board representation of the JBS Stockholder and the stockholders other than the JBS Stockholder (the “Minority Investors”) proportional and more closely aligned with their ownership in the Company.

Rationale for the Amendment

The Company is proposing this amendment to the Certificate in order to enable the consolidation for U.S. federal income tax purposes of the Company with JBS USA Food Company Holdings, a wholly-owned subsidiary of JBS (“JBS USA”), which will benefit all of the Company’s shareholders, as further described below.

In connection with this consolidation and the proposed amendment to the Certificate, the Company would enter into a tax sharing agreement with JBS USA, negotiated on an arm’s-length basis, governing the allocation, and certain payment and reimbursement obligations, of U.S. income tax liabilities and assets among the Company, on the one hand, and JBS USA (and its relevant U.S. corporate affiliates), on the other hand. This tax sharing agreement would generally require the Company to make payments to JBS USA (or its relevant U.S. corporate affiliates) in an amount equal to the Company’s U.S. income tax liability, if any, for each tax year following the planned consolidation, which tax liability generally would be determined as if the Company filed its own separate tax return for U.S. income tax purposes. This tax sharing agreement would also generally require JBS USA to make payments to the Company for the utilization of the Company’s tax assets (such as net operating losses, capital losses and tax credits) by JBS USA (or its relevant U.S. corporate affiliates) following the planned consolidation.

Under this tax sharing agreement, JBS USA would be required to make payments to the Company for the incremental tax cost savings to JBS USA arising from the planned consolidation with respect to any dividends paid by the Company prior to December 30, 2026, in the aggregate amount of up to $725,000,000. Based on certain assumptions, including the blended federal and state income tax rate in effect as of the date hereof, the Company and JBS USA estimate that the aggregate incremental tax cost savings to JBS USA that would be required to be paid to the Company would be approximately $50,000,000, to the extent that the aggregate amount of the up to $725,000,000 in dividends were paid by the Company.

In addition to the financial benefits described above, the Company also expects the consolidation to result in administrative and cost efficiencies, including from filing a single consolidated tax return for U.S. federal income tax purposes.

To achieve the consolidation for U.S. federal income tax purposes, JBS USA must own outstanding capital stock of the Company representing both (i) at least 80 percent of the total outstanding capital stock (by value) and (ii) at least 80 percent of the total stock voting power. The first requirement is already satisfied, because the JBS Stockholder currently and indirectly owns approximately 82.42 percent of our total issued and outstanding stock (as described in “Security Ownership”). The second requirement, which is generally determined by the ability to elect directors, is not currently satisfied, because the JBS Stockholder only has seven (7) Directors out of the nine (9) (or approximately 77.8 percent of the Board). For the JBS Stockholder to have the right to elect 80 percent of the Board, and for JBS USA thus to be deemed to have 80 percent of the total stock voting power for U.S. federal (and applicable state and local) income tax purposes, the Certificate must be amended as proposed herein.

Board Recommendation

The amendment to Article Five of the Certificate is set forth in Annex A. The Equity Directors, voting as a group, and the Board have each unanimously approved the amendment to the Certificate, as well as corresponding amendments to the Restated Bylaws and the Stockholders Agreement. At the Special Meeting, the JBS Stockholder may vote all shares of common stock held by them in their sole and absolute discretion. If approved by the stockholders, the amendment to the Certificate would become effective upon the filing of a Certificate with the Secretary of State of the State of Delaware, which we would expect to do as soon as practicable after the amendment is adopted by stockholders. Additionally, the amendments to the Restated Bylaws and the Stockholders Agreement would take effect concurrently therewith.

Our Board unanimously recommends that you vote “FOR” the approval of the amendment to the Certificate. Proxies will be so voted unless stockholders specify otherwise.

HOUSEHOLDING OF STOCKHOLDER MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements. This means that only one copy of this proxy statement may have been sent to multiple stockholders in the same household. We will promptly deliver a separate copy of either document to any stockholder who requests orally or by writing to our Investor Relations Department at the following address: 1770 Promontory Circle, Greeley, Colorado 80634 or by telephone (970) 506-7783. Any stockholder who currently is receiving multiple copies and would like to receive only one copy for his or her household should contact his or her bank, broker or other nominee record holder.

STOCKHOLDER PROPOSALS FOR 2025 ANNUAL MEETING OF STOCKHOLDERS

Pursuant to our Restated Bylaws, a stockholder must give our Secretary timely written notice in order to present a proposal (including nominations of Directors) at the 2025 annual meeting of stockholders. Such written notice must contain specified information prescribed in our Restated Bylaws and must be received at our principal executive offices by January 1, 2025 (but must not have been received before August 4, 2024), and, if the stockholder seeks the inclusion of its Director nominees on a universal proxy card, the notice must also contain the information required by Rules 14a-19(b) (2) and 14a-19(b)(3) of the Exchange Act (including a statement that the stockholder intends to solicit the holders of shares representing at least 67 percent of the voting power of shares entitled to vote on the election of

directors in support of director nominees other than ours). Additionally, for stockholder proposals submitted pursuant to Rule 14a-8 of the Exchange Act to be considered for inclusion in the proxy materials for the 2025 annual meeting of stockholders, they must be received by our Secretary at our principal executive offices no later than the close of business on December 2, 2024.

Our financial reports and recent filings with the SEC are available at www.sec.gov and on our website at ir.pilgrims.com. Information contained on our website is not part of this proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 4, 2024

This proxy statement is also available electronically on our hosted website. To access and review the materials:

1.Go to www.proxyvote.com.

2.Enter the 15-digit control number located on the proxy card.

3.Click “View Stockholder Material.”

We encourage you to review all of the important information contained in the proxy materials before voting.

OTHER BUSINESS

The Board of Directors is not aware of, and it is not anticipated that there will be presented at the Special Meeting, any business other than the proposal included in this proxy statement. If other matters properly come before the Special Meeting, the persons named on the accompanying proxy card will vote the returned proxies as the Board of Directors recommends.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | By order of the Board of Directors, |

| | | |

| | | |

| | FABIO SANDRI |

| Greeley, Colorado | | President and |

| November 4, 2024 | | Chief Executive Officer |

Forward-Looking Statements

Statements contained in this proxy statement that state the intentions, plans, hopes, beliefs, anticipations, expectations or predictions of the future of the Company and its management are considered forward-looking statements. Without limiting the foregoing, words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: matters affecting the poultry industry generally; the ability to execute the Company’s business plan to achieve desired cost savings and profitability; future pricing for feed ingredients and the Company’s products; outbreaks of avian influenza or other diseases, either in Pilgrim’s Pride’s flocks or elsewhere, affecting its ability to conduct its operations and/or demand for its poultry products; contamination of Pilgrim’s Pride’s products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; management of cash resources; restrictions imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes in laws or regulations affecting Pilgrim’s Pride’s operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause the costs of doing business to increase, cause Pilgrim’s Pride to change the way in which it does business, or otherwise disrupt its operations; competitive factors and pricing pressures or the loss of one or more of Pilgrim’s Pride’s largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels, including, but not limited to, the impacts of the Russia-Ukraine conflict; the risk of cyber-attacks, natural disasters, power losses, unauthorized access, telecommunication failures, and other problems on our information systems; and the impact of uncertainties of litigation and other legal matters described in our most recent Form 10-K and Form 10-Q, including the In re Broiler Chicken Antitrust Litigation, as well as other risks described under “Risk Factors” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings with the Securities and Exchange Commission. The forward-looking statements in this proxy statement speak only as of the date hereof, and the Company undertakes no obligation to update any such statement after the date of this proxy statement, whether as a result of new information, future developments or otherwise, except as may be required by applicable law.

Annex A

Proposed Amendment to Pilgrim’s Pride Corporation

Amended and Restated Certificate

Set forth below are proposed changes to Article V of the Company’s Amended and Restated Certificate.

ARTICLE V

DIRECTORS

Section 5.1. General Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board. In addition to the powers and authority expressly conferred upon them by statute or by this Certificate of Incorporation or the bylaws of the Corporation (the “Bylaws”), the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation.

Section 5.2. Number; Composition and Term of Office.

(a) Subject to Section 5.2(b), The number of directors shall be as set forth in this Section 5.2. nine (9).

(b) The Board shall consist of six (6)such number of JBS Directors, two (2) and Equity Directors, and one (1) Founder Director; provided that, if at any time, based on the beneficial ownership by the JBS Stockholder of the issued and outstanding Common Stock as a percentage of the total issued and outstanding Common Stock, changes to an amount, then there shall be the following changes in the composition of the Board as set forth below:

| | | | | | | | | | | |

% Owned by the | No. of JBS | No. of Equity | No. of Founder |

JBS Stockholder | Directors | Directors | Directors |

≥ 90% | 8 | 0 | 1 |

≥ 80% but < 90% | 7 | 1 | 1 |

≥ 50% but < 80% | 6 | 2 | 1 |

≥ 40% but < 50% | 5 | 3 | 1 |

≥ 35% but < 40% | 4 | 4 | 1 |

> 10% but < 35% | 3 | 5 | 1 |

≤ 10% | 0 | 8 | 1 |

provided that, upon the occurrence of the Founder Triggering Event, there shall no longer be a Founder Director on the Board, and the number of Equity Directors on the Board as set forth above shall be increased by one (1), except that, if the beneficial ownership by the JBS Stockholder of the issued and outstanding Common Stock as a percentage of the total issued and

outstanding Common Stock is equal to or greater than 80% but less than 90%, then the number of JBS Directors on the Board and the number of Equity Directors on the Board shall both be increased by one (1) director such that there shall be a total of ten (10) directors on the Board consisting of eight (8) JBS Directors and two (2) Equity Directors; provided further that during the Exchange Period (defined in Section 8.2(a)) there shall be at least two (2) Equity Directors; provided further that, if applicable law or, at any time while the Corporation’s equity securities are traded on an Exchange, the rules of such Exchange require a greater number or proportion of independent directors on the Board, then

(i) if the JBS Stockholder beneficially owns at least 50% of the issued and outstanding Common Stock, then, at the option of the JBS Nominating Committee, either (A) one or more of the then-existing JBS Directors who are not independent directors shall be replaced with one or more JBS Directors who are independent directors such that, after such replacement, the number or proportion of independent directors on the Board will comply with such requirement or (B) the number of directors on the Board shall be increased by two (2) and the vacancies created by such increase shall be filled with persons designated by the JBS Nominating Committee who are independent directors such that the number or proportion of independent directors on the Board will comply with such requirement; or

(ii) if the JBS Stockholder beneficially owns less than 50% of the issued and outstanding Common Stock, then one or more of the then-existing JBS Directors who are not independent directors shall be replaced with one or more JBS Directors who are independent directors such that, after such replacement, the number or proportion of independent directors on the Board will comply with such requirement.

In the event that the size of the Board is expanded pursuant to this Section 5.2, no person shall be nominated or appointed as a director if the Equity Nominating Committee reasonably determines that such person (A) is unethical or lacks integrity or (B) is a competitor or is affiliated with a competitor of the Corporation or any of its material subsidiaries. As used in this Certificate of Incorporation, a Person shall be deemed the “beneficial owner” of, shall be deemed to have “beneficial ownership” of and shall be deemed to “beneficially own” any Common Stock which such Person or any of such Person’s Affiliates is deemed to beneficially own, directly or indirectly, within the meaning of Rule 13d-3 of the Exchange Act; provided, however, that beneficial ownership by the JBS Stockholder will not include shares of Common Stock held by members of a “group” (as that term is used in Rule 13d-5 under the Exchange Act) other than JBS USA and its Affiliates. Notwithstanding anything in this Section 5.2(b) or Article XIII to the contrary, so long as the JBS Stockholder beneficially owns at least 80% of the issued and outstanding Common Stock, the JBS Nominating Committee may choose to maintain only six (6) JBS Directors on the Board, in which case there shall be two (2) Equity Directors and one (1) Founder Director on the Board.

****

Section 5.4. Special Nominating Committees.

(a) The Board shall establish two committees (collectively, the “Special Nominating Committees”), which shall be designated as the “JBS Nominating Committee” and the “Equity Nominating Committee,” each of which shall have the power and authority of the Board with respect to the matters described in Sections 5.3 and 5.4. The JBS Nominating Committee shall consist solely of JBS Directors, and the Equity Nominating Committee shall consist solely of all of the Equity Directors. The JBS Nominating Committee shall have the exclusive authority to nominate the JBS Directors, fill vacancies pursuant to Section 5.3 and select the members of the JBS Nominating Committee; and the Equity Nominating Committee shall have the exclusive authority to nominate the Equity Directors, fill vacancies pursuant to Section 5.3, select the members of the Equity Nominating Committee, and shall be entitled to call a special meeting of stockholders of the Corporation to comply with Section 3.01(d) of the Stockholders Agreement; provided that, prior to the occurrence of the Founder Triggering Event, the Equity Nominating Committee shall, to the fullest extent permitted by law and subject to any applicable fiduciary duties, nominate the Founder Director. Any member or alternate member of the Equity Nominating Committee shall be removed only by the approval of a majority of the members of the Equity Nominating Committee. For so long as the JBS Stockholder is the beneficial owner of 35% or more of the outstanding Common Stock, no person shall be nominated as an Equity Director pursuant to this Certificate of Incorporation if JBS USA reasonably determines that such person (i) is unethical or lacks integrity or (ii) is a competitor or is affiliated with a competitor of the Corporation. Two (2) Equity Directors (or one (1) if there is only one (1) Equity Director on the Board) shall satisfy the independence requirements of Rule 10A-3 under the Exchange Act and be financially literate for purposes of the applicable listing standards of the Exchange on which the Common Stock is then listed, or if the Common Stock is not then listed, then for purposes of Section 303A.07 of The New York Stock Exchange Listed Company Manual (or any successor rule) (“financially literate”), and, for so long as there are two (2) or more Equity Directors on the Board, at least one (1) Equity Director shall qualify as an “audit committee financial expert” as that term is used in Item 407 of Regulation S-K under the Exchange Act (or any successor rule). If the JBS Stockholder beneficially owns at least 50% of the issued and outstanding Common Stock, at least one two (1) JBS Directors shall (A) be an independent directors, (B) satisfy the independence requirements of Rule 10A-3 under the Exchange Act and (C) be financially literate.

Pilgrims Pride (NASDAQ:PPC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Pilgrims Pride (NASDAQ:PPC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024