false

0001616262

0001616262

2024-10-15

2024-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 15, 2024

Rocky Mountain Chocolate Factory, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36865

|

|

47-1535633

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

265 Turner Drive

Durango, Colorado 81303

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code: (970) 259-0554

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

RMCF

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 15, 2024, Rocky Mountain Chocolate Factory, Inc. (the “Company”) issued a press release reporting its results of operations for the three months ended August 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed incorporated by reference into any other filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language included in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No.

|

Description

|

| |

|

|

99.1*

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded with the Inline XBRL document)

|

*Furnished herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

|

| |

|

|

| |

|

|

|

Date: October 15, 2024

|

By:

|

/s/ Jeffrey R. Geygan

|

| |

Name:

|

Jeffrey R. Geygan

|

| |

Title:

|

Interim Chief Executive Officer

|

Exhibit 99.1

ROCKY MOUNTAIN CHOCOLATE FACTORY REPORTS FISCAL SECOND QUARTER 2025 FINANCIAL RESULTS

- Company to Host Conference Call Today at 5:00 p.m. ET -

DURANGO, Colo., Oct. 15, 2024 (GLOBE NEWSWIRE) -- Rocky Mountain Chocolate Factory Inc. (Nasdaq: RMCF) (the “Company”, “we”, or “RMCF”), an international franchisor and producer of premium chocolates and other confectionery products including gourmet caramel apples, is reporting financial and operating results for its fiscal second quarter ended August 31, 2024.

“We are pleased with our progress this quarter as we begin executing our multi-year strategic plan,” said Jeff Geygan, Interim CEO of RMCF. “We have been focused on several critical areas of the business: strengthening the company’s liquidity, rebuilding a strong executive team, expanding our franchise network, and laying a solid foundation for sustainable growth and profitability.

“In recent months, we welcomed several key team members, including a new CFO to lead our finance organization. We are also beginning to drive momentum with the expansion of our franchise network across eight strategic markets in the U.S., starting with a new store opening in Edmond Oklahoma next month. We are finalizing new franchise agreements for three additional store locations, which we expect to announce in the coming weeks. At the same time, our rebranding initiative is nearly complete, and we anticipate unveiling the new store design by year-end, which will enhance the RMCF experience for both franchisees and consumers.”

Geygan continued, “Subsequent to quarter end, we took an important step to improve our financial position with a new $6 million credit facility, which allowed us to retire our previous $4 million credit facility and raise additional capital for ongoing investments. With a strengthened balance sheet, improved liquidity and a committed franchise network, we believe we are well-positioned to execute our three-year strategic plan and drive RMCF toward sustainable growth and profitability.”

Fiscal Q2 2025 Financial Results vs. Year-Ago Quarter

| |

●

|

Total revenue for the second quarter of 2025 was $6.4 million compared to $6.6 million in the year-ago quarter.

|

| |

●

|

Total product and retail gross profit was $0.6 million compared to $0.4 million. Gross margin improved to 11.5% compared to 7.7%. The increase was primarily attributable to increased pricing and improved operating efficiencies.

|

| |

●

|

Total Costs and Expenses were reduced to $7.3 million compared to $7.6 million in the year-ago period.

|

| |

●

|

Net loss for the quarter was $0.7 million or ($0.11) per share, compared to net loss of $1.0 million or ($0.16) per share in fiscal Q2 2024.

|

Conference Call Information

The Company will conduct a conference call today at 5:00 p.m. Eastern time to discuss its financial results. A question-and-answer session will follow management’s opening remarks. The conference call details are as follows:

Date: Tuesday, October 15, 2024

Time: 5:00 p.m. Eastern time

Dial-in registration link: here

Live webcast registration link: here

Please dial into the conference call 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact the Company’s investor relations team at RMCF@elevate-ir.com.

The conference call will also be broadcast live and available for replay in the investor relations section of the Company’s website at https://ir.rmcf.com/.

About Rocky Mountain Chocolate Factory, Inc.

Rocky Mountain Chocolate Factory, Inc. is an international franchiser of premium chocolate and confection stores, and a producer of an extensive line of premium chocolates and other confectionery products, including gourmet caramel apples. Rocky Mountain Chocolate Factory was ranked in both the Franchise 500 by Entrepreneur Magazine and the Franchise 400 by Franchise Times for 2024. The Company is headquartered in Durango, Colorado. The Company and its franchisees and licensees operate over 260 Rocky Mountain Chocolate stores across the United States, with several international locations. The Company's common stock is listed on the Nasdaq Global Market under the symbol "RMCF."

Forward-Looking Statements

This press release includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The statements, other than statements of historical fact, included in this press release are forward-looking statements. Many of the forward-looking statements contained in this document may be identified by the use of forward-looking words such as "will," "intend," "believe," "expect," "anticipate," "should," "plan," "estimate," "potential," or similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future - including statements expressing general views about future operational performance, financial results and execution of the Company’s strategic plan - are forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date of this press release. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to: inflationary impacts, changes in the confectionery business environment, seasonality, consumer interest in our products, receptiveness of our products internationally, consumer and retail trends, costs and availability of raw materials, competition, the success of our co-branding strategy, the success of international expansion efforts and the effect of government regulations. For a detailed discussion of the risks and uncertainties that may cause our actual results to differ from the forward-looking statements contained herein, please see the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, each filed with the Securities and Exchange Commission.

Investor Contact

Sean Mansouri, CFA

Elevate IR

720-330-2829

RMCF@elevate-ir.com

Rocky Mountain Chocolate Factory, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except per share amounts)

| |

|

August 31, 2024

(unaudited)

|

|

|

February 29,

2024

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

973 |

|

|

$ |

2,082 |

|

|

Accounts receivable, less allowance for credit losses of $367 and $332, respectively

|

|

|

2,439 |

|

|

|

2,184 |

|

|

Notes receivable, current portion, less current portion of the allowance for credit losses of $18 and $30, respectively

|

|

|

36 |

|

|

|

489 |

|

|

Refundable income taxes

|

|

|

63 |

|

|

|

46 |

|

|

Inventories

|

|

|

6,115 |

|

|

|

4,358 |

|

|

Other

|

|

|

702 |

|

|

|

443 |

|

|

Current assets held for sale

|

|

|

666 |

|

|

|

- |

|

|

Total current assets

|

|

|

10,994 |

|

|

|

9,602 |

|

|

Property and Equipment, Net

|

|

|

7,724 |

|

|

|

7,758 |

|

|

Other Assets

|

|

|

|

|

|

|

|

|

|

Notes receivable, less current portion and allowance for credit losses of $12 and $0, respectively

|

|

|

77 |

|

|

|

695 |

|

|

Goodwill

|

|

|

576 |

|

|

|

576 |

|

|

Intangible assets, net

|

|

|

224 |

|

|

|

238 |

|

|

Lease right of use asset

|

|

|

1,460 |

|

|

|

1,694 |

|

|

Other

|

|

|

75 |

|

|

|

14 |

|

|

Total other assets

|

|

|

2,412 |

|

|

|

3,217 |

|

|

Total Assets

|

|

$ |

21,130 |

|

|

$ |

20,577 |

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

2,714 |

|

|

$ |

3,411 |

|

|

Line of credit

|

|

|

3,450 |

|

|

|

1,250 |

|

|

Accrued salaries and wages

|

|

|

962 |

|

|

|

1,833 |

|

|

Gift card liabilities

|

|

|

688 |

|

|

|

624 |

|

|

Other accrued expenses

|

|

|

154 |

|

|

|

301 |

|

|

Contract liabilities

|

|

|

147 |

|

|

|

150 |

|

|

Lease liability

|

|

|

380 |

|

|

|

503 |

|

|

Deposit Liability

|

|

|

358 |

|

|

|

- |

|

|

Total current liabilities

|

|

|

8,853 |

|

|

|

8,072 |

|

|

Lease Liability, Less Current Portion

|

|

|

1,081 |

|

|

|

1,191 |

|

|

Contract Liabilities, Less Current Portion

|

|

|

671 |

|

|

|

678 |

|

|

Total Liabilities

|

|

|

10,605 |

|

|

|

9,941 |

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.001 par value per share; 250,000 authorized; 0 shares issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock, $.001 par value, 46,000,000 shares authorized, 7,588,587 shares and 6,306,027 shares issued and outstanding, respectively

|

|

|

8 |

|

|

|

6 |

|

|

Additional paid-in capital

|

|

|

12,163 |

|

|

|

9,896 |

|

|

Retained earnings (accumulated deficit)

|

|

|

(1,646 |

) |

|

|

734 |

|

|

Total stockholders' equity

|

|

|

10,525 |

|

|

|

10,636 |

|

|

Total Liabilities and Stockholders' Equity

|

|

$ |

21,130 |

|

|

$ |

20,577 |

|

Rocky Mountain Chocolate Factory, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

August 31,

|

|

|

August 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$ |

4,918 |

|

|

$ |

5,016 |

|

|

$ |

10,197 |

|

|

$ |

10,032 |

|

|

Franchise and royalty fees

|

|

|

1,462 |

|

|

|

1,542 |

|

|

|

2,590 |

|

|

|

2,962 |

|

|

Total Revenue

|

|

|

6,380 |

|

|

|

6,558 |

|

|

|

12,787 |

|

|

|

12,994 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

4,350 |

|

|

|

4,632 |

|

|

|

9,936 |

|

|

|

9,391 |

|

|

Franchise costs

|

|

|

952 |

|

|

|

614 |

|

|

|

1,493 |

|

|

|

1,293 |

|

|

Sales and marketing

|

|

|

138 |

|

|

|

442 |

|

|

|

568 |

|

|

|

915 |

|

|

General and administrative

|

|

|

1,622 |

|

|

|

1,687 |

|

|

|

2,861 |

|

|

|

3,619 |

|

|

Retail operating

|

|

|

194 |

|

|

|

162 |

|

|

|

393 |

|

|

|

265 |

|

|

Depreciation and amortization, exclusive of depreciation and amortization expense of $190, $183, $386 and $354, respectively, included in cost of sales

|

|

|

38 |

|

|

|

32 |

|

|

|

80 |

|

|

|

63 |

|

|

Total costs and expenses

|

|

|

7,294 |

|

|

|

7,569 |

|

|

|

15,331 |

|

|

|

15,546 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from Operations

|

|

|

(914 |

) |

|

|

(1,011 |

) |

|

|

(2,544 |

) |

|

|

(2,552 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(63 |

) |

|

|

(6 |

) |

|

|

(98 |

) |

|

|

(13 |

) |

|

Interest income

|

|

|

7 |

|

|

|

18 |

|

|

|

14 |

|

|

|

38 |

|

|

Gain (loss) on disposal of assets

|

|

|

248 |

|

|

|

- |

|

|

|

248 |

|

|

|

- |

|

|

Other income, net

|

|

|

192 |

|

|

|

12 |

|

|

|

164 |

|

|

|

25 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss Before Income Taxes

|

|

|

(722 |

) |

|

|

(999 |

) |

|

|

(2,380 |

) |

|

|

(2,527 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision (Benefit)

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from Continuing Operations

|

|

|

(722 |

) |

|

|

(999 |

) |

|

|

(2,380 |

) |

|

|

(2,527 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from discontinued operations, net of tax

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

69 |

|

|

Gain on disposal of discontinued operations, net of tax

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

635 |

|

|

Earnings from discontinued operations, net of tax

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

704 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$ |

(722 |

) |

|

$ |

(999 |

) |

|

$ |

(2,380 |

) |

|

$ |

(1,823 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Loss per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$ |

(0.11 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.40 |

) |

|

Earnings from discontinued operations

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.11 |

|

|

Net loss

|

|

$ |

(0.11 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.29 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Loss per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$ |

(0.11 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.40 |

) |

|

Earnings from discontinued operations

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.11 |

|

|

Net loss

|

|

$ |

(0.11 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.29 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Basic

|

|

|

6,686,537 |

|

|

|

6,239,078 |

|

|

|

6,507,323 |

|

|

|

6,284,846 |

|

|

Dilutive Effect of Employee Stock Awards

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Weighted Average Common Shares Outstanding - Diluted

|

|

|

6,686,537 |

|

|

|

6,239,078 |

|

|

|

6,507,323 |

|

|

|

6,284,846 |

|

v3.24.3

Document And Entity Information

|

Oct. 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Rocky Mountain Chocolate Factory, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36865

|

| Entity, Tax Identification Number |

47-1535633

|

| Entity, Address, Address Line One |

265 Turner Drive

|

| Entity, Address, City or Town |

Durango

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

81303

|

| City Area Code |

970

|

| Local Phone Number |

259-0554

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

RMCF

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001616262

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

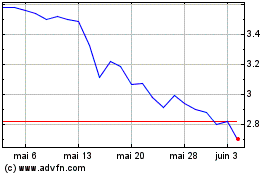

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025