What Will Impact the S&P 500 Index This Week?

06 Novembre 2023 - 11:35AM

Finscreener.org

After nearly three months of

negative returns, the S&P 500 index sprung back to life,

rising over 5% in the last week. Its recent rebound has meant the

popular index has now gained almost 14% year-to-date.

Let’s see if it can maintain this

momentum in the upcoming days.

Who will report Q3 earnings this week?

While the peak of the earnings

season may have passed, the upcoming week still has a diverse

roster of company earnings for investors to watch out for. Monday

will see financial disclosures from Ryanair

Holdings (NASDAQ:

RYAAY) and BioNTech

(NASDAQ: BNTX),

with Tuesday bringing updates from Gilead

Sciences (NASDAQ:

GILD),

Uber Technologies (NYSE: UBER),

and Rivian Automotive (NASDAQ:

RIVN).

The Walt Disney

Company (NYSE:

DIS) and

Warner Bros. Discovery (NASDAQ:

WBD) are set to release

their reports on Wednesday.

Consumer debt and more

The Federal Reserve Bank of New

York will release its quarterly snapshot of household debt and

credit on Tuesday, providing insights into the financial well-being

of U.S. households during the third quarter.

In the second quarter, U.S.

household debt climbed to an unprecedented $17.06 trillion, with an

increase in credit card debt, which hit a historic milestone by

crossing the $1 trillion mark for the first time.

Credit cards are being used more

frequently by consumers to cover their expenses as they grapple

with the ongoing pressures of high inflation.

Looking ahead to the end of the

week, the University of Michigan is set to publish the early

November figures for its Consumer Sentiment Index (MCSI) on Friday.

The indicator measures the confidence consumers have in their

personal financial situation and the national economy, as well as

their expectations for the future.

October saw the MCSI dip to a

five-month trough of 63.8, reflecting growing concerns among

consumers about their financial health.

Back in June of the previous

year, the MCSI plummeted to an all-time low of 50 during a period

marked by the most severe inflation seen in forty years. The figure

remains significantly lower than the pre-pandemic peak of 101

recorded in February 2020.

GM to invest $13 billion in new UAW deal

General Motors (NYSE:

GM) is set to channel

approximately $13 billion into its American facilities over the

next five years, as reported by the United Auto Workers union

following a provisional deal with the car manufacturer.

GM has already made public

certain investments within this plan, including $4 billion for the

Orion Assembly in the Detroit area and $2 billion for the

production of new electric vehicles in Spring Hill, Tennessee.

Newly disclosed is an investment of $1.25 billion designated for a

future electric vehicle facility at Lansing Grand River.

A significant portion of this

funding will be directed towards assembly plants to either bolster

their current operations or increase their production capacity,

along with investments in engine and component

factories.

Throughout the duration of the

4.5-year tentative agreement, GMU+02019s investment in U.S.

operations will be compared to the $8.1 billion Ford has committed,

as announced by the union, and the $18.9 billion investment plan by Stellantis,

which includes $6.2 billion for previously declared component

factories in Kokomo, Indiana.

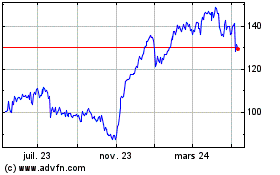

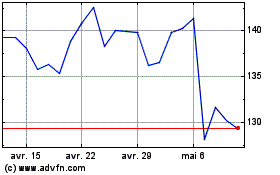

Ryanair (NASDAQ:RYAAY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ryanair (NASDAQ:RYAAY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024