EARNING CALLS DETAILS

July 19, 2024| 8:30 AM ET

Participant Dial in:

To join: +1-888-506-0062 (Toll Free in the U.S. or Canada) or

+1-973-528-0011 (International) | Access Code: 265815

On the call: Mr. Raju Vegesna, Chairman of the Board, Mr. M P

Vijay Kumar, Executive Director & Group CFO and Mr. Kamal Nath,

Chief Executive Officer

Live webcast:

https://www.webcaster4.com/Webcast/Page/2184/50888

Archives: +1-877-481-4010 (Toll Free in the U.S. or Canada) or

+1-919-882-2331 (International). On prompt, please enter passcode

50888. Replay is available until July 26, 2024.

---------------------------------------------------------------------------------------

HIGHLIGHTS

- Revenue

was INR 9,421 Million, an increase of 10% over the same quarter

last year.

- EBITDA

was INR 1,784 Million, an increase of 3% over the same quarter last

year.

- Loss

before tax was INR 46 Million. Loss after tax was

INR 105 Million.

- CAPEX during the quarter was

INR 2,656 Million.

MANAGEMENT COMMENTARY

Mr. Raju Vegesna, Chairman,

said, “India is currently in a remarkable phase of growth. The

combination of pro-industry regulations, a supportive investment

environment and a wealth of skilled talent positions our nation as

a key destination for international businesses. This confidence is

driving investments and building partnerships that benefit both

enterprises and the broader economy.

The advancement in regulatory and taxation norms

should help accelerate investment in the network and data center

landscape and enhance India’s status as a pivotal interconnect hub

between Asia and the Middle East. Our robust infrastructure and

comprehensive services portfolio uniquely position Sify to seize

these opportunities. As enterprises and government entities advance

their digital transformation and automation initiatives, Sify

stands ready to support them with our innovative digital tools and

services.”

Mr. Kamal Nath, CEO, said, “As

businesses embark on digital transformation, they are reconfiguring

their IT frameworks to incorporate multiple transformative

solutions. All of them with the common agenda of enhancing user

satisfaction, ensuring operational resilience and protecting

digital assets.

Our significant capital allocations and

extensive range of offerings are designed to effectively meet these

ambitions. Our capability to provide innovative outcomes through

our triad of infrastructure and managed services uniquely positions

us to support them throughout their digital transformation.”

Mr. M P Vijay Kumar, ED & Group CFO,

said, “The International Accounting Standard Board’s

(“IASB”) recently issued Accounting Standard IFRS 18 (Presentation

and Disclosure in Financial Statements) replacing IAS 1

(Presentation of Financial Statements). The new structure for the

profit and loss statement requires (i) the classification of income

and expenses into three new categories - operating, investing and

financing, and (ii) the presentation of subtotals for operating

profit or loss and profit or loss before financing and income

taxes.

Although the IASB set an effective date as

January 1, 2027, the Company will begin adhering to IFRS 18

beginning with its unaudited consolidated financial statements for

the quarter ended June 30, 2024. All prior periods presented herein

have been presented in accordance with the new structure. There is

no change in total income or net profit.

We will continue to invest in expanding our

network, both fiber in the metros and terrestrial long distance,

data center capacity and also strengthen our Digital services team

by adding people with the right skill sets and investing more in

our Learning and Development initiatives. Fiscal discipline will

continue to be remain central to our focus and strategy. The

cash balance at the end of the quarter was INR 6,471 Million.”

BUSINESS HIGHLIGHTS

- The Revenue

split between the businesses for the quarter was Data Center

colocation services 36%, Digital services 23% and Network services

41%.

- During the

quarter, Sify commissioned 6.5 MW capacity in Mumbai.

- As of June

30,2024, Sify provides services through 1055 fiber nodes across the

country, a 16% increase over same quarter last year.

- The network

connectivity service has now deployed 9415 SDWAN service points

across the country.

CUSTOMER ENGAGEMENTS

Among the most prominent new contracts during the quarter were

the following:

Network Services

- The cloud

platform of a global IT major contracted for interconnect at one of

their major locations.

- The largest

stock exchange, the regulatory body for the securities market, and

a national insurance major contracted Sify for a MPLS Network

build.

- The largest

stock exchange also signed up for WAN across their backbone

network.

- The largest

Private bank contracted for managed and secure SDWAN service.

Data Center Services

- A global OTT

player contracted for major Edge Data Center location in a

non-metro location

- The country’s

largest bank signed a multi-year deal for capacity at Sify’s Data

Center.

- A Private bank

chose to locate their Near Disaster Recovery (NDR) in one of Sify

Data Center.

- Two Private

banks contracted to expand their capacity at different Sify Data

Centers.

- An IT major

signed up to migrate from their on-premise Data Center to Sify’s

Data Center.

Digital services

- Sify was

contracted by the highest judicial body in the country for a

multi-year Data Center infrastructure build and related managed

services.

- A large private

bank contracted for Network Managed services for both their Data

Center and Branch networks.

- A digital

enablement major opted to move their online banking application to

Sify’s Cloud platform.

- An IT player, a

chemicals manufacturer, an NBFC and a training development

organisation contracted to migrate from their on-premise Data

Center to Sify’s Cloud platform.

- These players

also opted for managed services like DRaaS and SaaS.

- A Scheduled bank

and a housing finance major contracted for green field Cloud

implementation.

- A major steel

producer and a retail MNC contracted for multi-year managed

services.

- A logistics

player signed up for managed security services while a state power

distribution company and a state co-operative bank contracted Sify

to set up Security Operations Center (SOC) at their premises.

- The education

and training bodies of a State government and banking regulator

signed up for online assessments, while a retail and power major

signed up for Sify’s Cloud -based supply chain solution.

FINANCIAL HIGHLIGHTS

|

Unaudited Consolidated Income Statement as per

IFRS |

|

|

|

|

(In INR millions) |

|

|

|

|

|

|

Quarter ended |

Quarter ended |

Quarter ended |

Year ended |

|

Description |

June 2024 |

June 2023 |

March 2024 |

March 2024 |

|

|

|

|

|

(Audited) |

|

|

|

|

|

|

|

Revenue |

9,421 |

|

8,547 |

|

9,637 |

|

35,634 |

|

|

Cost of Sales |

(5,961 |

) |

(5,371 |

) |

(6,108 |

) |

(22,378 |

) |

|

Gross Profit |

3,460 |

|

3,176 |

|

3,529 |

|

13,256 |

|

|

Other Operating Income |

88 |

|

42 |

|

182 |

|

379 |

|

|

Selling, General and Administrative Expenses |

(1,676 |

) |

(1,421 |

) |

(1,700 |

) |

(6,462 |

) |

|

Depreciation and Amortisation expense |

(1,306 |

) |

(1,118 |

) |

(1,259 |

) |

(4,773 |

) |

|

Operating Profit |

566 |

|

679 |

|

752 |

|

2,400 |

|

|

Investment Income |

58 |

|

9 |

|

25 |

|

156 |

|

|

Profit before financing and income taxes |

624 |

|

688 |

|

777 |

|

2,556 |

|

|

Interest expenses on borrowings and lease liabilities |

(670 |

) |

(569 |

) |

(641 |

) |

(2,322 |

) |

|

Interest expenses on pension liabilities |

- |

|

- |

|

- |

|

(2 |

) |

|

Profit/(Loss) before income taxes |

(46 |

) |

119 |

|

136 |

|

232 |

|

|

|

|

|

|

|

|

Income Tax Expense |

(59 |

) |

(54 |

) |

(98 |

) |

(183 |

) |

|

|

|

|

|

|

|

Profit/(Loss) for the period |

(105 |

) |

65 |

|

38 |

|

49 |

|

|

|

|

|

|

|

|

Reconciliation with Management-defined Performance

Measures* |

|

|

|

|

|

|

|

|

|

|

Operating Profit |

566 |

|

679 |

|

752 |

|

2,400 |

|

|

Add: |

|

|

|

|

|

Depreciation and Amortisation expense |

1,306 |

|

1,118 |

|

1,259 |

|

4,773 |

|

|

Less: |

|

|

|

|

|

Interest expenses on pension liabilities |

- |

|

- |

|

- |

|

(2 |

) |

|

Other Income (including exchange gain/loss) |

(88 |

) |

(73 |

) |

(187 |

) |

(415 |

) |

|

|

|

|

|

|

|

EBITDA |

1,784 |

|

1,724 |

|

1,824 |

|

6,756 |

|

|

|

|

|

|

|

| |

|

|

|

|

*Management-defined Performance Measures

(MPMs)

Sify uses Earnings before Interest, Tax,

Depreciation and Amortisation (EBITDA) as the management-defined

performance measure in its public communications. This measure is

not specified by IFRS Accounting Standards and therefore might not

be comparable to apparently similar measures used by other

entities.

Segment Reporting:(In INR

millions)

| |

|

|

|

|

|

|

|

|

|

|

Q1 2024-25 |

Q1 2023-24 |

|

Particulars |

Network Services |

Data Center Colocation Services |

Digital Services |

Total |

Network Services |

Data Center Colocation Services |

Digital Services |

Total |

|

|

(A) |

(B) |

( C) |

(D)= (A)+(B)+(C) |

(A) |

(B) |

( C) |

(D)= (A)+(B)+(C) |

|

External customers Revenue |

3,865 |

|

3,360 |

|

2,196 |

|

9,421 |

|

3,427 |

|

2,704 |

|

2,416 |

|

8,547 |

|

|

Intersegment Revenue |

|

22 |

|

55 |

|

77 |

|

|

22 |

|

56 |

|

78 |

|

|

Operating Expense |

(3,261 |

) |

(1,966 |

) |

(2,397 |

) |

(7,624 |

) |

(2,872 |

) |

(1,546 |

) |

(2,404 |

) |

(6,822 |

) |

|

Intersegment Expense |

(63 |

) |

|

(14 |

) |

(77 |

) |

(63 |

) |

|

(14 |

) |

(77 |

) |

|

Segment Result |

541 |

|

1,416 |

|

(160 |

) |

1,797 |

|

492 |

|

1,180 |

|

54 |

|

1,726 |

|

|

Unallocated Expense: |

|

|

|

|

|

|

|

|

|

Support Service Unit Costs |

|

|

|

(44 |

) |

|

|

|

(47 |

) |

|

Depreciation & Amortisation |

|

|

|

(1,306 |

) |

|

|

|

(1,118 |

) |

|

Other income / (expense), net |

|

|

|

24 |

|

|

|

|

15 |

|

|

Finance Income |

|

|

|

122 |

|

|

|

|

25 |

|

|

Finance Expense |

|

|

|

(639 |

) |

|

|

|

(482 |

) |

|

Profit / (loss) before tax |

|

|

|

(46 |

) |

|

|

|

119 |

|

|

Income taxes (expense) / benefit |

|

|

|

(59 |

) |

|

|

|

(54 |

) |

|

Profit / (loss) for the period |

|

|

|

(105 |

) |

|

|

|

65 |

|

Highlights:

|

(In INR millions) |

30.06.2024 |

30.06.2023 |

31.03.2024 |

|

EQUITY |

17,369 |

15,210 |

15,230 |

|

BORROWINGS |

|

|

|

|

Long term |

16,717 |

14,897 |

17,608 |

|

Short term |

7,218 |

6,581 |

6,937 |

About Sify Technologies

A Fortune India 500 company, Sify Technologies

is India’s most comprehensive ICT service & solution provider.

With Cloud at the core of our solutions portfolio, Sify is focussed

on the changing ICT requirements of the emerging Digital economy

and the resultant demands from large, mid and small-sized

businesses.

Sify’s infrastructure comprising

state-of-the-art Data Centers, the largest MPLS network,

partnership with global technology majors and deep expertise in

business transformation solutions modelled on the cloud, make it

the first choice of start-ups, SMEs and even large Enterprises on

the verge of a revamp.

More than 10000 businesses across multiple

verticals have taken advantage of our unassailable trinity of Data

Centers, Networks and Digital services and conduct their business

seamlessly from more than 1700 cities in India. Internationally,

Sify has presence across North America, the United Kingdom and

Singapore.

Sify, www.sify.com, Sify Technologies and

www.sifytechnologies.com are registered trademarks of Sify

Technologies Limited.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. The forward-looking statements

contained herein are subject to risks and uncertainties that could

cause actual results to differ materially from those reflected in

the forward-looking statements. Sify undertakes no duty to update

any forward-looking statements.

For a discussion of the risks associated with

Sify’s business, please see the discussion under the caption “Risk

Factors” in the company’s Annual Report on Form 20-F for the year

ended March 31, 2024, which has been filed with the United States

Securities and Exchange Commission and is available by accessing

the database maintained by the SEC at www.sec.gov, and Sify’s other

reports filed with the SEC.

For further information, please contact:

|

Sify Technologies LimitedMr. Praveen

KrishnaInvestor Relations & Public Relations+91

9840926523praveen.krishna@sifycorp.com |

20:20 Media Nikhila Kesavan+91

9840124036nikhila.kesavan@2020msl.com |

Weber ShandwickLucia Domville+1-212

546-8260LDomville@webershandwick.com |

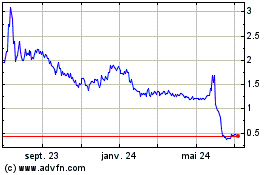

Sify Technologies (NASDAQ:SIFY)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

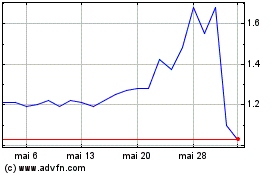

Sify Technologies (NASDAQ:SIFY)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025