false 0001618921 0001618921 2025-03-06 2025-03-06 0001618921 us-gaap:CommonStockMember 2025-03-06 2025-03-06 0001618921 wba:M3.600WalgreensBootsAllianceInc.NotesDue2025Member 2025-03-06 2025-03-06 0001618921 wba:M2.125WalgreensBootsAllianceInc.NotesDue2026Member 2025-03-06 2025-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2025

WALGREENS BOOTS ALLIANCE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36759 |

|

47-1758322 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

|

|

| 108 Wilmot Road, Deerfield, Illinois |

|

60015 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (847) 315-3700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.01 par value |

|

WBA |

|

The Nasdaq Stock Market LLC |

| 3.600% Walgreens Boots Alliance, Inc. notes due 2025 |

|

WBA25 |

|

The Nasdaq Stock Market LLC |

| 2.125% Walgreens Boots Alliance, Inc. notes due 2026 |

|

WBA26 |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On March 6, 2025, Walgreens Boots Alliance, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Blazing Star Parent, LLC, a Delaware limited liability company (“Parent”), Blazing Star Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), and certain affiliates of Parent identified therein, pursuant to which, subject to the satisfaction or waiver of certain conditions and on the terms set forth therein, Merger Sub will be merged with and into the Company with the Company surviving such merger as a wholly owned subsidiary of Parent. On March 6, 2025, the Company and Parent issued a joint press release announcing entry into the Merger Agreement. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

On March 6, 2025, the Company made available an investor presentation regarding the transactions contemplated by the Merger Agreement. The investor presentation is attached as Exhibit 99.2 hereto and incorporated by reference herein.

The information in this Item 7.01, including the exhibits attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such disclosure in this Form 8-K in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Additional Information and Where to Find It

In connection with the proposed transaction between Walgreens Boots Alliance, Inc. (the “Company”) and affiliates of Sycamore Partners Management, L.P. (“Sycamore Partners”), the Company will file with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A relating to its special meeting of stockholders, which will be mailed to the Company’s stockholders, and the Company and certain affiliates of the Company will jointly file a transaction statement on Schedule 13E-3. The Company may file or furnish other documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER RELEVANT DOCUMENTS FILED BY THE COMPANY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SYCAMORE PARTNERS AND THE PROPOSED TRANSACTION.

Stockholders may obtain free copies of the proxy statement and the Schedule 13E-3 (when available) and other documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Investors portion of the Company’s website at investor.walgreensbootsalliance.com under the link “Financials and Filings” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations team by e-mail at Investor.Relations@wba.com.

2

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed transaction. Information regarding the Company’s directors and executive officers is contained in the Company’s proxy statement for its 2025 annual meeting of stockholders filed with the SEC on December 13, 2024 (https://www.sec.gov/ix?doc=/Archives/edgar/data/1618921/000155837024016214/tmb-20250130xdef14a.htm) under the sections entitled “Corporate governance,” “Security ownership of certain beneficial owners and management” and “Executive compensation.” To the extent that holdings of the Company’s securities have changed since the amounts set forth in the Company’s proxy statement for its 2025 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement and other relevant materials to be filed with the SEC relating to the proposed transaction. These documents can be obtained (when available) free of charge from the sources indicated above.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, such as statements regarding our expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “accelerate,” “aim,” “ambition,” “anticipate,” “approximate,” “aspire,” “assume,” “believe,” “can,” “continue,” “could,” “create,” “enable,” “estimate,” “expect,” “extend,” “forecast,” “future,” “goal,” “guidance,” “intend,” “long-term,” “may,” “model,” “ongoing,” “opportunity,” “outlook,” “plan,” “position,” “possible,” “potential,” “predict,” “preliminary,” “project,” “seek,” “should,” “strive,” “target,” “transform,” “trend,” “vision,” “will,” “would,” and variations of these terms or other similar expressions, although not all forward-looking statements contain these words. Such statements include, but are not limited to, statements regarding the proposed transaction, our ability to consummate the proposed transaction on the expected timeline or at all, the anticipated benefits of the proposed transaction, and the terms, the impact of the proposed transaction on our future business, results of operations and financial condition and the scope of the expected financing in connection with the proposed transaction. Forward-looking statements are based on current estimates, assumptions and beliefs and are subject to known and unknown risks and uncertainties, many of which are beyond our control, that may cause actual results to vary materially from those indicated by such forward-looking statements. Such risks and uncertainties include, but are not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all; (ii) the ability of affiliates of Sycamore Partners to obtain the necessary financing arrangements set forth in the commitment letters received in connection with the proposed transaction; (iii) the failure to satisfy any of the conditions to the consummation of the proposed transaction, including the receipt of certain regulatory approvals and stockholder approval; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the transaction agreements, including in circumstances requiring the Company to pay a termination fee; (v) the effect of the announcement or pendency of the proposed transaction on the Company’s business relationships, operating results and business generally; (vi) the risk that the proposed transaction disrupts the Company’s current plans and operations; (vii) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (viii) risks related to diverting management’s attention from the Company’s ongoing business operations; (ix) significant or unexpected costs, charges or expenses resulting from the proposed transaction; (x) potential litigation relating to the proposed transaction that could be instituted against the parties to the transaction agreements or their respective directors, managers or officers, including the effects of any outcomes related thereto; (xi) uncertainties related to the continued availability of capital and financing and rating agency actions; (xii) certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; (xiii) uncertainty as to timing of completion of the proposed transaction; (xiv) the risk that the holders of Divested Asset Proceed Rights will receive less-than-anticipated payments or no payments with respect to the Divested Asset Proceed Rights after the closing of the proposed transaction and that such rights will expire valueless; (xv) the impact of adverse general and industry-specific economic and market conditions; and (xvi) other risks described in the Company’s filings with the SEC. Forward looking statements included herein are made only as of the date hereof and the Company does not undertake any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: March 6, 2025 |

|

WALGREENS BOOTS ALLIANCE, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Joseph B. Amsbary Jr. |

|

|

|

|

Name: |

|

Joseph B. Amsbary Jr.

|

|

|

|

|

Title: |

|

Senior Vice President, Corporate Secretary |

Exhibit 99.1

Walgreens Boots Alliance Enters into Definitive Agreement to Be Acquired by Sycamore Partners

Total Consideration Consists of $11.45 per Share in Cash and Additional Potential Value of Up To $3.00 in Cash per WBA Share

from Future Monetization of VillageMD Businesses

Sycamore and WBA Combine Retail and Healthcare Expertise to Better

Position WBA to Accelerate Turnaround Plan

DEERFIELD, Ill. & NEW YORK — March 6, 2025 — Walgreens Boots Alliance

(NASDAQ: WBA) (the “Company” or “WBA”) today announced that it has entered into a definitive agreement to be acquired by an entity affiliated with Sycamore Partners (“Sycamore”), a private equity firm specializing

in retail, consumer and distribution-related investments. The total value of the transaction represents up to $23.7 billion1.

WBA shareholders will receive total consideration consisting of $11.45 per share in cash at closing of the Sycamore transaction (the “Cash

Consideration”) and one non-transferable right (a “Divested Asset Proceed Right” or “DAP Right”) to receive up to $3.00 in cash per WBA share (together with the Cash Consideration, the

“Total Consideration”) from the future monetization of WBA’s debt and equity interests in VillageMD, which includes the Village Medical, Summit Health and CityMD businesses (such businesses, “Divested Assets”). The Cash

Consideration represents a premium of 29%, and the Total Consideration represents a premium of up to 63%, to the WBA closing share price of $8.85 on December 9, 2024, the day prior to the first media reports regarding a potential transaction.

Additional information about the future monetization of the Divested Assets and the DAP Rights is included below and a supplemental presentation can be found on the WBA investor relations website at investor.walgreensbootsalliance.com.

Leveraging WBA’s healthcare expertise and Sycamore’s established leadership in retail and consumer services, WBA will be better positioned to become

the first choice for pharmacy, retail and health services. The Company will continue to operate under Walgreens, Boots and its trusted portfolio of consumer brands. WBA will maintain its headquarters in the Chicago area and continue contributing to

the communities in which it operates, with the goal of positively impacting the health outcomes and overall well-being of its customers, patients, communities and team members.

Tim Wentworth, Chief Executive Officer, Walgreens Boots Alliance, said, “Throughout our history, Walgreens Boots Alliance has played a critical role in

the retail healthcare ecosystem. We are focused on making healthcare delivery more effective, convenient and affordable as we navigate the challenges of a rapidly evolving pharmacy industry and an increasingly complex and competitive retail

landscape. While we are making progress against our ambitious turnaround strategy, meaningful value creation will take time, focus and change that is better managed as a private company. Sycamore will provide us with the expertise and experience of

a partner with a strong track record of successful retail turnarounds. The WBA Board considered all these factors in evaluating this transaction, and we believe this agreement provides shareholders premium cash value, with the ability to benefit

from additional value creation going forward from monetization of the VillageMD businesses.”

| 1 |

Based on cash consideration of $11.45 per share and up to $3.00 per DAP Right, plus net debt, capital leases,

present value of opioid liability and Everly settlement, less fair value of all equity investments. |

Mr. Wentworth concluded, “Our trusted brands and deep commitment to our customers, patients,

communities and team members have and will continue to anchor our business as we realize our goal of being the first choice for pharmacy, retail and health services. I am grateful to the more than 311,000 team members globally who are fiercely

committed to WBA, our customers and patients.”

“For nearly 125 years, Walgreens, and for 175 years, Boots, along with their portfolio of

trusted brands, have been integral to the lives of patients and customers. Sycamore has deep respect for WBA’s talented and dedicated team members, and we are committed to stewarding the Company’s iconic brands,” said Stefan Kaluzny,

Managing Director of Sycamore Partners. “This transaction reflects our confidence in WBA’s pharmacy-led model and essential role in driving better outcomes for patients, customers and

communities.”

Financing, Approvals and Timing

The WBA Board of Directors, with Stefano Pessina and John Lederer recused from the deliberations and approval, has unanimously approved the proposed

transaction. The transaction is expected to close in the fourth quarter calendar year 2025, subject to customary closing conditions, including approval by WBA shareholders (including a majority of votes cast by WBA shareholders unaffiliated with

Mr. Pessina or Sycamore) and the receipt of required regulatory approvals. The transaction is not subject to a financing condition and Sycamore has received fully committed financing for the transaction.

Upon completion of the transaction, WBA’s common stock will no longer be listed on the Nasdaq Stock Market, and WBA will become a private company.

Go-Shop Period

The transaction agreement provides for a so-called “go-shop” period,

during which WBA, with the assistance of Centerview Partners, its financial advisor, will actively solicit, and depending on interest, potentially receive, evaluate and enter into negotiations with parties that offer alternative proposals. The

initial go-shop period is 35 days. There can be no assurance that this process will result in a superior proposal. WBA does not intend to disclose developments with respect to the solicitation process unless

and until the WBA Board of Directors has made a decision with respect to any potential superior proposal.

Voting and Reinvestment Agreements

Sycamore and WBA have entered into voting and reinvestment agreements with WBA’s Executive Chairman, Mr. Pessina, and his holding company, who in the

aggregate own approximately 17% of WBA’s shares of outstanding common stock. Under these agreements, Mr. Pessina and his holding company will vote all of their shares of WBA common stock in favor of the transaction (consistent with

obligations under his existing shareholder’s agreement), subject to certain terms and conditions contained therein, and will reinvest all of their Cash Consideration received in the transaction, in addition to an incremental cash investment,

into the acquiring company. Accordingly, Mr. Pessina and his holding company will maintain a significant equity investment in the businesses. Mr. Pessina and his holding company will receive one DAP Right per share of WBA common stock

owned by them and, accordingly, will hold approximately 17% of the DAP Rights following the closing of the Sycamore transaction.

In response to Sycamore’s request and in connection with facilitating Sycamore’s financing for the

transaction, WBA’s Board of Directors requested and authorized Mr. Pessina to begin discussions with Sycamore regarding the possibility of Mr. Pessina’s reinvestment of his Cash Consideration. These discussions followed

Mr. Pessina’s recusal from the WBA Board’s deliberation and evaluation of the transaction. Mr. Pessina agreed to participate as an investor in Sycamore’s acquisition following review of the proposal.

Value Maximization Process for VillageMD Businesses

As

previously announced, WBA is currently evaluating a variety of options with respect to its significant debt and equity interests in the Divested Assets. Following the closing of the Sycamore transaction, a committee consisting of a representative of

the pre-closing WBA Board of Directors, a representative of Mr. Pessina and a representative of Sycamore (the “Divested Assets Committee”) will determine the nature and timing of the process to

maximize value of WBA’s debt and equity interests in the Divested Assets. The Divested Assets Committee intends to consider all paths available to maximize the value of these businesses, including actions to significantly enhance operational

performance and strengthen the balance sheet of the businesses, ahead of any future monetization transaction or transactions.

WBA shareholders will

receive, at closing of the Sycamore transaction, one non-transferable DAP Right per WBA share.

As the sole lender

to the Divested Assets businesses, WBA expects to receive 100% of the initial net proceeds of any sale or sales of the Divested Assets up to the amount of debt owed to WBA by VillageMD, which as of February 28, 2025, is $3.4 billion,

accruing PIK interest at 19% per year.

Pursuant to the terms and conditions of the DAP Rights, 70% of any such net proceeds received by WBA from the sale

or sales of the Divested Assets would be payable to DAP Right holders. The maximum amount payable to DAP Right holders is $3.00 per DAP Right or approximately $2.7 billion in the aggregate.

Although the Divested Assets Committee will strive to maximize the value of the Divested Assets, and therefore, the DAP Rights, there can be no assurances

that a sale of the Divested Assets will occur, and no assurances as to the timing, terms or amount of proceeds from any potential sale of the Divested Assets.

Walgreens Boots Alliance Fiscal 2025 Second Quarter Earnings Announcement

WBA will release its fiscal year 2025 second quarter financial results and file its Quarterly Report on Form 10-Q

on April 8, 2025.

Advisors

Centerview Partners

is acting as financial advisor, Kirkland & Ellis LLP is acting as legal advisor and Ropes & Gray LLP is acting as healthcare regulatory counsel to WBA. Morgan Stanley & Co. LLC was also a financial advisor, and provided a

fairness opinion to the WBA Board of Directors.

UBS Investment Bank is acting as lead financial advisor, Goldman Sachs and J.P. Morgan are acting as co-lead financial advisors, Citi and Wells Fargo are acting as financial advisors, Davis, Polk & Wardwell LLP is acting as legal counsel and Bass Berry & Sims PLC is acting as healthcare regulatory

counsel to Sycamore Partners.

Debevoise & Plimpton LLP is acting as legal advisor to Stefano Pessina.

About Walgreens Boots Alliance

Walgreens Boots Alliance

(Nasdaq: WBA) is an integrated healthcare, pharmacy and retail leader serving millions of customers and patients every day, with a 175-year heritage of caring for communities.

A trusted, global innovator in retail pharmacy with approximately 12,500 locations across the U.S., Europe and Latin America, WBA plays a critical role in the

healthcare ecosystem. Through dispensing medicines, improving access to pharmacy and health services, providing high quality health and beauty products and offering anytime, anywhere convenience across its digital platforms, WBA is shaping the

future of healthcare in the thousands of communities it serves and beyond.

WBA employs approximately 311,000 people, with a presence in eight countries

and consumer brands including: Walgreens, Boots, Duane Reade, No7 Beauty Company and Benavides. The Company is proud of its contributions to healthy communities, a healthy planet, an inclusive workplace and a sustainable marketplace. In fiscal 2024,

WBA scored 100% on the Disability Equality Index for disability inclusion.

More Company information is available at www.walgreensbootsalliance.com.

(WBA-GEN)

(WBA-IR)

About Sycamore Partners

Sycamore Partners is a private equity firm based in New York. The firm specializes in consumer, distribution and retail-related investments and partners with

management teams to improve the operating profitability and strategic value of their business. With approximately $10 billion in aggregate committed capital raised since its inception in 2011, Sycamore Partners’ investors include leading

endowments, financial institutions, family offices, pension plans and sovereign wealth funds. For more information on Sycamore Partners, visit www.sycamorepartners.com.

Additional Information and Where to Find It

In

connection with the proposed transaction between Walgreens Boots Alliance, Inc. (the “Company”) and affiliates of Sycamore Partners Management, L.P. (“Sycamore Partners”), the Company will file with the Securities and Exchange

Commission (the “SEC”) a definitive proxy statement on Schedule 14A relating to its special meeting of stockholders, which will be mailed to the Company’s stockholders, and the Company and certain affiliates of the Company will

jointly file a transaction statement on Schedule 13E-3. The Company may file or furnish other documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE PROXY

STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER RELEVANT DOCUMENTS FILED BY THE COMPANY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SYCAMORE

PARTNERS AND THE PROPOSED TRANSACTION.

Stockholders may obtain free copies of the proxy statement and the Schedule

13E-3 (when available) and other documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Investors portion of the Company’s website at

investor.walgreensbootsalliance.com under the link “Financials and Filings” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations team by e-mail at

Investor.Relations@wba.com.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in

connection with the proposed transaction. Information regarding the Company’s directors and executive officers is contained in the Company’s proxy statement for its 2025 annual meeting of stockholders filed with the SEC on

December 13, 2024 (https://www.sec.gov/ix?doc=/Archives/edgar/data/

1618921/000155837024016214/tmb-20250130xdef14a.htm) under the sections entitled “Corporate governance,” “Security

ownership of certain beneficial owners and management” and “Executive compensation.” To the extent that holdings of the Company’s securities have changed since the amounts set forth in the Company’s proxy statement for its

2025 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their

interests will be contained in the proxy statement and other relevant materials to be filed with the SEC relating to the proposed transaction. These documents can be obtained (when available) free of charge from the sources indicated above.

Forward-Looking Statements

This communication contains

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that

do not relate solely to historical or current facts, such as statements regarding our expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of forward-looking terminology

such as “accelerate,” “aim,” “ambition,” “anticipate,” “approximate,” “aspire,” “assume,” “believe,” “can,” “continue,” “could,”

“create,” “enable,” “estimate,” “expect,” “extend,” “forecast,” “future,” “goal,” “guidance,” “intend,” “long-term,” “may,”

“model,” “ongoing,” “opportunity,” “outlook,” “plan,” “position,” “possible,” “potential,” “predict,” “preliminary,” “project,”

“seek,” “should,” “strive,” “target,” “transform,” “trend,” “vision,” “will,” “would,” and variations of these terms or other similar expressions, although not

all forward-looking statements contain these words. Such statements include, but are not limited to, statements regarding the proposed transaction, our ability to consummate the proposed transaction on the expected timeline or at all, the

anticipated benefits of the proposed transaction, and the terms, the impact of the proposed transaction on our future business, results of operations and financial condition and the scope of the expected financing in connection with the proposed

transaction. Forward-looking statements are based on current estimates, assumptions and beliefs and are subject to known and unknown risks and uncertainties, many of which are beyond our control, that may cause actual results to vary materially from

those indicated by such forward-looking statements. Such risks and uncertainties include, but are not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all; (ii) the ability of affiliates

of Sycamore Partners to obtain the necessary financing arrangements set forth in the commitment letters received in

connection with the proposed transaction; (iii) the failure to satisfy any of the conditions to the consummation of the proposed transaction, including the receipt of certain regulatory

approvals and stockholder approval; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the transaction agreements, including in circumstances requiring the Company to pay a

termination fee; (v) the effect of the announcement or pendency of the proposed transaction on the Company’s business relationships, operating results and business generally; (vi) the risk that the proposed transaction disrupts the

Company’s current plans and operations; (vii) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (viii) risks related

to diverting management’s attention from the Company’s ongoing business operations; (ix) significant or unexpected costs, charges or expenses resulting from the proposed transaction; (x) potential litigation relating to the

proposed transaction that could be instituted against the parties to the transaction agreements or their respective directors, managers or officers, including the effects of any outcomes related thereto; (xi) uncertainties related to the

continued availability of capital and financing and rating agency actions; (xii) certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or

strategic transactions; (xiii) uncertainty as to timing of completion of the proposed transaction; (xiv) the risk that the holders of Divested Asset Proceed Rights will receive less-than-anticipated payments or no payments with respect to

the Divested Asset Proceed Rights after the closing of the proposed transaction and that such rights will expire valueless; (xv) the impact of adverse general and industry-specific economic and market conditions; and (xvi) other risks

described in the Company’s filings with the SEC. Forward looking statements included herein are made only as of the date hereof and the Company does not undertake any obligation to update any forward-looking statements as a result of new

information, future developments or otherwise, except as required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

WBA Contacts

Investor Relations:

Brian Holzer

investor.relations@wba.com

Media:

Jonathon Hosea

media@wba.com

Sycamore Contacts

Michael Freitag or Arielle Rothstein

Joele Frank, Wilkinson

Brimmer Katcher

212-355-4449

media@sycamorepartners.com

Exhibit 99.2 Walgreens Boots Alliance to Be Acquired by Sycamore

Partners March 6, 2025 © 2025 Walgreens Boots Alliance, Inc. All rights reserved.

Safe Harbor and Non-GAAP Additional Information and Where to Find It In

connection with the proposed transaction between Walgreens Boots Alliance, Inc. (the “Company”) and affiliates of Sycamore Partners Management, L.P. (“Sycamore Partners”), the Company will file with the Securities and

Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A relating to its special meeting of stockholders, which will be mailed to the Company’s stockholders, and the Company and certain affiliates of the Company

will jointly file a transaction statement on Schedule 13E-3. The Company may file or furnish other documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER

RELEVANT DOCUMENTS FILED BY THE COMPANY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SYCAMORE PARTNERS AND THE PROPOSED TRANSACTION. Stockholders may obtain free copies of the proxy

statement and the Schedule 13E-3 (when available) and other documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Investors portion of the Company’s website at investor.walgreensbootsalliance.com

under the link “Financials and Filings” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations team by e-mail at Investor.Relations@wba.com. Participants in the Solicitation The Company

and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed transaction. Information regarding the Company’s directors and

executive officers is contained in the Company’s proxy statement for its 2025 annual meeting of stockholders filed with the SEC on December 13, 2024

(https://www.sec.gov/ix?doc=/Archives/edgar/data/1618921/000155837024016214/tmb-20250130xdef14a.htm) under the sections entitled “Corporate governance,” “Security ownership of certain beneficial owners and management” and

“Executive compensation.” To the extent that holdings of the Company’s securities have changed since the amounts set forth in the Company’s proxy statement for its 2025 annual meeting of stockholders, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement and other

relevant materials to be filed with the SEC relating to the proposed transaction. These documents can be obtained (when available) free of charge from the sources indicated above. Forward-Looking Statements This communication contains

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not

relate solely to historical or current facts, such as statements regarding our expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as

“accelerate,” “aim,” “ambition,” “anticipate,” “approximate,” “aspire,” “assume,” “believe,” “can,” “continue,”

“could,” “create,” “enable,” “estimate,” “expect,” “extend,” “forecast,” “future,” “goal,” “guidance,” “intend,”

“long-term,” “may,” “model,” “ongoing,” “opportunity,” “outlook,” “plan,” “position,” “possible,” “potential,”

“predict,” “preliminary,” “project,” “seek,” “should,” “strive,” “target,” “transform,” “trend,” “vision,” “will,”

“would,” and variations of these terms or other similar expressions, although not all forward-looking statements contain these words. Such statements include, but are not limited to, statements regarding the proposed transaction, our

ability to consummate the proposed transaction on the expected timeline or at all, the anticipated benefits of the proposed transaction, and the terms, the impact of the proposed transaction on our future business, results of operations and

financial condition and the scope of the expected financing in connection with the proposed transaction. Forward-looking statements are based on current estimates, assumptions and beliefs and are subject to known and unknown risks and uncertainties,

many of which are beyond our control, that may cause actual results to vary materially from those indicated by such forward-looking statements. Such risks and uncertainties include, but are not limited to: (i) the risk that the proposed transaction

may not be completed in a timely manner or at all; (ii) the ability of affiliates of Sycamore Partners to obtain the necessary financing arrangements set forth in the commitment letters received in connection with the proposed transaction; (iii) the

failure to satisfy any of the conditions to the consummation of the proposed transaction, including the receipt of certain regulatory approvals and stockholder approval; (iv) the occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the transaction agreements, including in circumstances requiring the Company to pay a termination fee; (v) the effect of the announcement or pendency of the proposed transaction on the Company’s

business relationships, operating results and business generally; (vi) the risk that the proposed transaction disrupts the Company’s current plans and operations; (vii) the Company’s ability to retain and hire key personnel and maintain

relationships with key business partners and customers, and others with whom it does business; (viii) risks related to diverting management’s attention from the Company’s ongoing business operations; (ix) significant or unexpected costs,

charges or expenses resulting from the proposed transaction; (x) potential litigation relating to the proposed transaction that could be instituted against the parties to the transaction agreements or their respective directors, managers or

officers, including the effects of any outcomes related thereto; (xi) uncertainties related to the continued availability of capital and financing and rating agency actions; (xii) certain restrictions during the pendency of the proposed transaction

that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; (xiii) uncertainty as to timing of completion of the proposed transaction; (xiv) the risk that the holders of Divested Asset Proceed

Rights will receive less-than-anticipated payments or no payments with respect to the Divested Asset Proceed Rights after the closing of the proposed transaction and that such rights will expire valueless; (xv) the impact of adverse general and

industry-specific economic and market conditions; and (xvi) other risks described in the Company’s filings with the SEC. Forward looking statements included herein are made only as of the date hereof and the Company does not undertake any

obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary

statement. Non-GAAP Financial Measures This communication includes certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA. Constant currency amounts are calculated by translating current period results at the foreign currency

exchange rates used in the comparable period in the prior year. The Company presents such constant currency financial information because it has significant operations outside of the U.S. reporting in currencies other than the U.S. dollar and such

presentation provides a framework to assess how its business performed excluding the impact of foreign currency exchange rate fluctuations. Please see the Appendix for reconciliations to the most directly comparable U.S. GAAP financial measures and

related information. The Company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not

available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred, are out of the Company’s control or cannot be reasonably predicted, and that would

impact the most directly comparable forward-looking GAAP financial measure. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Non-GAAP financial measures may vary materially from the

corresponding GAAP financial measures and may not be comparable to similarly titled measures reported by other companies. These supplemental non-GAAP financial measures should not be considered superior to, as a substitute for or as an alternative

to, our results determined in accordance with GAAP. 2 © 2025 Walgreens Boots Alliance, Inc. All rights reserved.

Transaction Overview • Walgreens Boots Alliance to be taken

private by • With WBA’s deep healthcare expertise and Sycamore’s Sycamore Partners, following a thorough process led by established leadership in retail and consumer the WBA Board of Directors to maximize shareholder investments,

WBA will be better positioned to improve value pharmacy, retail and health services and to enhance the customer, patient and team member experience with • Shareholders will receive total consideration of up to continued investments in the core

pharmacy operations $14.45 per share, comprised of $11.45 per share in cash and the right to receive up to an additional $3.00 • WBA’s trusted brands, alongside its deep commitment per share from the future monetization of WBA’s

debt to patients, communities and team members, will and equity interests in VillageMD, which includes the continue to anchor the Company’s global businesses Village Medical, Summit Health and CityMD businesses • The transaction is

expected to close in the fourth (“Divested Assets”) quarter of calendar year 2025 • The right to receive proceeds from the future monetization of the Divested Assets provides shareholders the potential to benefit from additional

value creation from the turnaround of those businesses © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 3

$11.45 per Up to $3.00 Maximizing WBA share per share Cash at closing of

Future Monetization WBA Transaction of Divested Assets Shareholder Value 2 DAP Rights Premium of 29% to undisturbed 1 • Total transaction value of up to $23.7B • WBA shareholders to participate in the future monetization of the Divested

Assets via Divested Asset Proceed Rights or “DAP Rights” Up to $14.45 per share • 35-day initial go-shop period Total Potential 1. Based on cash consideration of $11.45 per share and up to $3.00 per DAP Right, plus Consideration

net debt, capital leases, present value of opioid liability and Everly settlement less fair value of all equity investments. 2. Undisturbed WBA closing share price of $8.85 on December 9, 2024, the day prior to 2 Premium of up to 63% to undisturbed

first media reports of a potential transaction. © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 4

Divested Assets Financial Projections Includes Summit Health, CityMD and

Village Medical Projection commentary 1 • CY 2024 Adj. EBITDA represents year- CY CY CY CY CY CY over-year improvement of $292M 2024A 2025E 2026E 2027E 2028E 2029E • Projections assume the completion of sale processes for certain markets

in calendar Revenue $ 6.4 $ 5.6 $ 5.0 $ 5.3 $ 5.5 $ 5.8 ($ billions) 2025, with proceeds used to fund the ongoing operations of the Divested Assets 1 Adj. EBITDA (141) 31 101 202 253 292• Summit Health performance mainly ($ millions) improving

from fee-for-service revenue growth % Margin (2.2)% 0.6% 2.0% 3.8% 4.6% 5.1% 1 • Cost management improving Adj. EBITDA across the Divested Assets © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 1. Includes add-back for

stock-based compensation and non-GAAP cash expenses. See slide 10 for non-GAAP reconciliation tables 5

DAP Rights Enable Participation in Future Divested Assets Monetization

• At closing, WBA shareholders will receive one non-transferable DAP Right per WBA share owned • DAP Right Holders will be entitled to 70% of the net proceeds from the sale(s) of Divested Assets, up to $3.00 per share (approximately

$2.7B) • Divested Assets Committee comprising one representative each from pre-closing WBA Board, Stefano Pessina and Sycamore will determine nature and timing of process and intends to consider all paths to maximize value, including enhancing

operational performance and strengthening balance sheets 6 © 2025 Walgreens Boots Alliance, Inc. All rights reserved.

Flow of Proceeds from Future Sale of Divested Assets WBA receives 100%

Sale proceeds from of proceeds up to DAP Right Holders Divested Assets the amount of Capped at $3.00 per DAP Right 70% debt owed to it DAP Rights Holders share of WBA net proceeds VillageMD debt to WBA is $3.4 billion as of February 28, Up to 2025,

with PIK interest of 19% per year ~$2.7B 7 © 2025 Walgreens Boots Alliance, Inc. All rights reserved.

Roadmap to Closing Closing expected in the Includes

“go-shop” period No financing condition fourth quarter of calendar and subject to customary year 2025 closing conditions, including Sycamore has obtained fully approval by a majority of committed financing votes cast by WBA shareholders

unaffiliated with Mr. Pessina and Sycamore, and regulatory approvals © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 8

Appendix © 2025 Walgreens Boots Alliance, Inc. All rights reserved.

Reconciliation of Non-GAAP financial measures Supplemental Information

(unaudited) (in millions) OPERATING LOSS TO ADJUSTED EBITDA FOR VILLAGE PRACTICE MANAGEMENT COMPANY, LLC Twelve months ended December 31, 2023 2024 1 Operating loss (GAAP) $ (1,566) $ (13,896) 2 — 12,579 Impairment of goodwill, intangibles and

long-lived assets 3 378 514 Acquisition and disposition-related costs 4 542 448 Acquisition-related amortization 5 — 45 Certain legal and regulatory accruals and settlements (646) (310) Adjusted operating loss 155 124 Depreciation expense 6 58

44 Stock-based compensation expense $ (433) $ (141) Adjusted EBITDA (Non-GAAP measure) 1 The Company reconciles Adjusted EBITDA for Village Practice Management Company, LLC to Operating loss as the closest GAAP measure for the business

profitability. The Company does not measure Net earnings attributable to Walgreens Boots Alliance, Inc. for its individual businesses or its segments. 2 For twelve months ended December 31, 2024, the Company recorded $12.4 billion of non-cash

impairment charges related to VillageMD goodwill. The Company excludes these charges when evaluating operating performance because it does not incur such charges on a predictable basis and exclusion of such charges enables more consistent evaluation

of the Company’s operating performance. 3 Acquisition and disposition-related costs are transaction and integration costs associated with certain merger, acquisition and divestitures related activities recorded in Selling, general and

administrative expenses. Examples of such costs include deal costs, severance, stock-based compensation, employee transaction success bonuses, and other integration related exit and disposal charges. These costs are significantly impacted by the

timing and complexity of the underlying merger, acquisition and divestitures related activities and do not reflect the Company’s current operating performance. As part of the amendment to the VillageMD Secured Loan executed in November 30,

2024, Walgreen Co. and VillageMD agreed to terminate certain intercompany leases resulting in an early termination charge of $107 million incurred by VillageMD. 4 Acquisition-related amortization includes amortization of acquisition-related

intangible assets and stock-based compensation fair valuation adjustments. Amortization of acquisition-related intangible assets includes amortization of intangible assets such as provider networks, trade names, and developed technology. Intangible

asset amortization excluded from the related non-GAAP measure represents the entire amount recorded within the Company’s GAAP financial statements. The revenue generated by the associated intangible assets has not been excluded from the

related non-GAAP measures. Amortization expense, unlike the related revenue, is not affected by operations of any particular period unless an intangible asset becomes impaired, or the estimated useful life of an intangible asset is revised. These

charges are primarily recorded in Selling, general and administrative expenses. The stock-based compensation fair valuation adjustment reflects the difference between the fair value based remeasurement of awards under purchase accounting and the

grant date fair valuation. Post-acquisition compensation expense recognized in excess of the original grant date fair value of acquiree awards are excluded from the related non-GAAP measures as these arise from acquisition-related accounting

requirements or agreements, and are not reflective of normal operating activities. 5 Certain legal and regulatory accruals and settlements relate to significant charges associated with certain legal proceedings, including legal defense costs. The

Company excludes these charges when evaluating operating performance because it does not incur such charges on a predictable basis and exclusion of such charges enables more consistent evaluation of the Company’s operating performance. These

charges are recorded in Selling, general and administrative expenses. 6 Includes GAAP stock-based compensation expense excluding expenses related to acquisition-related amortization and acquisition-related costs. © 2025 Walgreens Boots

Alliance, Inc. All rights reserved. 10

v3.25.0.1

Document and Entity Information

|

Mar. 06, 2025 |

| Document And Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001618921

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 06, 2025

|

| Entity Registrant Name |

WALGREENS BOOTS ALLIANCE, INC.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-36759

|

| Entity Tax Identification Number |

47-1758322

|

| Entity Address, Address Line One |

108 Wilmot Road

|

| Entity Address, City or Town |

Deerfield

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60015

|

| City Area Code |

(847)

|

| Local Phone Number |

315-3700

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Common Stock, $0.01 par value

|

| Trading Symbol |

WBA

|

| Security Exchange Name |

NASDAQ

|

| M 3.600 Walgreens Boots Alliance Inc . Notes Due 2025 [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

3.600% Walgreens Boots Alliance, Inc. notes due 2025

|

| Trading Symbol |

WBA25

|

| Security Exchange Name |

NASDAQ

|

| M 2.125 Walgreens Boots Alliance Inc . Notes Due 2026 [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

2.125% Walgreens Boots Alliance, Inc. notes due 2026

|

| Trading Symbol |

WBA26

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wba_M3.600WalgreensBootsAllianceInc.NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wba_M2.125WalgreensBootsAllianceInc.NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

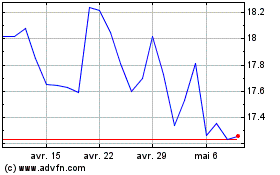

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025