Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

07 Mars 2025 - 10:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under § 240.14a-12 |

WALGREENS BOOTS ALLIANCE, INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

This Schedule 14A relates solely to preliminary communications made prior to furnishing security holders

of Walgreens Boots Alliance, Inc. (the “Company”) with a definitive proxy statement and a transaction statement on Schedule 13E-3 related to a proposed transaction with Blazing Star Parent, LLC, a

Delaware limited liability company (“Parent”), and Blazing Star Merger Sub, Inc., a Delaware corporation (“Merger Sub”), upon the terms and subject to the conditions set forth in the Agreement and Plan of Merger, dated as of

March 6, 2025, by and among the Company, Parent and Merger Sub.

1. U.S. Town Hall -Transcript

March 7, 2025

Tim Wentworth

Hi everyone, thanks for joining us. We’ve got a whole lot of you out there. We’re gonna try not to break the internet today. But we thought it was

terribly important as soon as possible to get all of us together and begin to share information about yesterday’s exciting announcement. We’ve had a little bit of time to digest it. I’m sure there’s questions. And one of the

things that I want you to know is we are going to have a continual process to give you information as it becomes available. This is the first step of that. You’ll see it on W Connect. We’re gonna have an intranet site. So we really want to

create an opportunity for you to be as excited about this as frankly I am. And we are. So what I wanna do is, is first of all, and I’m not gonna read this disclaimer ‘cause we’ve run out of time.

Tim Wentworth

We have 30 minutes today. You know, it’s a

relatively short day. We’ve got a lot of things that we’re working on. We will have a town hall as usual after our earnings in in April. And that will involve Q and A and so forth. So we will have an opportunity to have some dialogue at

that point in time. But I wanted to, I wanted to really get us together again. You know, a month ago, I think I talked a little bit about this, the rumor. And I told you that there was one goal to secure the successful future of WBA. That has been

the goal I’ve had since I got here. It’s what the board wanted me and our team to do. And that means we’ve reviewed a range of possibilities Now and I know I laid out a lot in my note yesterday, but I think it’s important to take

a step back, sort of think about how we got here.

Tim Wentworth

You know, we are in the middle of a turnaround. In fact, arguably we’re in the first third of a turnaround. We have a lot of work to do. None of that

changes, if anything. Quite frankly, the interesting thing is as we evolved our conversations with Sycamore, they clearly saw the early benefits of our turnaround. And it is one of the things that caused them to believe in our business is the work

you had already been doing to take our business and put it in a better place to increase its relevance. And ultimately, my goal, and I know I said this in the video that I did that’s posted on W Connect, my goal was very simple to honor our 125

year US history and to create the path for the next 125 years. I was never gonna be able to do that alone.

Tim Wentworth

I have been doing it with all of you, and we will now do it with a terrific partner. So in weighing this decision though, as you can imagine, it is a big

decision for a board to make a decision. Like we’ve announced yesterday, we looked at a wide range of options but with an eye toward always the value we provide to all of our stakeholders, you, our communities, our investors. And I believe we

have done the right thing by all of those parties. And we took, we took a look at the big picture. You know, macroeconomic changes things in the broader situation that we operate in, things that we don’t always control but impact us. And again,

while I believe that our future is strong and long in the face of Amazon, by the way Andy Jassy told me when I talked to him, and I’ve said this to some of you before, please don’t close the Walgreens near my house.

Tim Wentworth

That’s a great story. What that means is there’s room for both of us, which is exactly the conversation Andy and I then had, which is, you know,

there is room for both of us. And I said to Andy then, but I love that you exist ‘cause you forced us to be better every day. And I used to work for Pepsi and I loved Coke for the same reason. Because you woke up and you knew exactly what you

were fighting against and who you were serving. ‘cause If you didn’t, the other guy got ‘em. And so, you know, I believe that while our industry is rapidly evolving, the retail landscape that we’re evolving in is very complex,

very competitive. We see Walmart, we see Amazon, we can win, but we’ve got a lot of work to do. And what we have just done with this, this transaction is de-risked for you, our communities and our state

shareholders, the risks of that execution.

Tim Wentworth

And so we took a look at the early stages we were in and the board concluded that a transaction with Sycamore was the right thing for shareholders and for you

and for all of us. And I will tell you from my perspective I’ve gotten to know them very, very well over a long period of time. And I wanna say a couple quick things about ‘em because you’ll hear the words. Private equity, there are

many different flavors of private equity. The flavor that Sycamore represents is as follows. One, they fundamentally understand retail and they are unafraid to take risks to save brands. I’ll talk about that in just a moment. Two, they are

super interested in transforming their company into more than just a retailer. And they believe consumer healthcare is the future and is a chance for them to evolve to a higher plane in terms of the things that they can do terribly interesting.

Tim Wentworth

Three, and this is relevant. I think they employ

maybe 80 people, maybe not even that many people. They are not a private equity firm that sends in an army to fix things. They’re a private equity firm that looks to management to execute on its growth plans. And then they support management,

hold them accountable and resource it accordingly. We have got a very, very positive partner in Sycamore. And so from that standpoint, I believe you’ll come to understand. And what I would last point to is this. You can research, go online and

Google ‘cause everyone does that. Now, Stefan Kaluzny, the CEO of Sycamore, who I’ve come to know very, very well, you won’t find anything. He’s not one of these private equity peacock people that walk around and just struck

their feathers and talk about the things they’ve done. He does the opposite. He goes to work, he works side by side with management teams to improve the businesses that he invests in.

Tim Wentworth

And read his quote in our press release, read his

quote in our press release. First of all, he doesn’t do quotes. You’re not gonna find it. And he was initially not wanting to do a quote. He did not want it to be about him. He wanted it to be about us and our future. But ultimately, as we

talk to him about our business and we talk to him, and I know what his strategy largely is going to be and how important our retail pharmacies are to that strategy, as well as by the way, shield owns Village MD and other things as, as we talked

about things, but fundamentally our retail pharmacies. He gave us that quote. It was interesting. We wrote a quote for him and he basically threw it away and gave us that quote that is from his desk. And I think it shows you the mindset and should

be very reassuring in terms of his shared vision with all of us that we’ve been driving this turnaround to achieve that I believe is gonna make a difference.

1

Tim Wentworth

So I’ve already talked a little bit about our partners. I think we have not done, we found a partner. We have found the right and the best partner. And

again, if you’re not familiar with ‘em, I I would draw your attention to the brands, many of which would not exist, but for their unique combination of risk taking, thoughtful management and, and pure skill. And so they have a long history

of collaborating with management teams. They bring outside perspective and creativity. They see the things that we’ve been doing and they’re positive about them. That’s why they’re making this investment. This is not,

they’re coming in to buy a shipwreck and try to see if they can put sales back on it and fix the holes in the hole. This is, they see the opportunity that unfortunately too many of our public investors didn’t see, which is why our stock

price has been so struggled.

Tim Wentworth

And so I think,

you know, some of these companies, obviously you’re familiar with some of these companies. Yes, we do have a board member, John Lederer, who is the CEO of Staples. John was actually recused of this whole process, as you can imagine, as was our

chairman. Stefano was here today because it would not have been appropriate. So the board, X, those two folks did it. But I can tell you, you know, I’ve had a lot of opportunity to talk to John about his eight years with Sycamore. And I can

tell you that you’ll be very reassured if you were to hear the conversations I’ve had with John as it relates to how he, John and his team have been able to basically take Staples and save it. Not only save it, make it thrive, pay back

their investors, ultimately invest in it.

Tim Wentworth

And if you look at their competitor Office Depot, they’re worth less than a half a billion dollars. Now, Staples has done a great job of basically

commanding share. And now they’re out on Amazon’s web, on Amazon’s marketplace selling three times what they were selling on their own website because they’re creative, they’re smart, and they’re unafraid to do things

that feel risky, but are the right things to do. So I think we’ve got a great partner here and they, and they really do approach their investments where they focus on partnership. They’re completely supportive of our continued investment

in our teams. And I believe that’s very positive for us. An example, ‘cause I’m a proof point person, not just a blah person. We intend to have a top management meeting in September with probably a thousand plus people here in

Chicago. We shared that with Sycamore.

Tim Wentworth

A lot

of private equity firms will say, no, put that money on the balance sheet, save it. We just bought you guys and we need every penny. They said, no, can we come? We wanna actually let people know that we don’t have horns and that we believe in

what they stand for. That was their mindset. And we are having them 80 be ready for be ready for the save the dates For those of you that will be invited to that meeting, we’re excited. It’s been six years since we’ve had that kind of

meeting and it’s gonna be great. So this investment is an important vote of confidence in what we can achieve. Now, what does it mean to us? First of all today? It means we’ve got someone that believe strongly in us and we’ve just

gotta keep our heads down and keep executing against the things we are already doing, the things that are already making it better for our patients, for our customers, for our teammates, as it relates to everything from workforce scheduling to other

things from our assortment and the way we’ve been managing our, our holidays, which have the last two, two holidays been tremendously good for our business.

2

Tim Wentworth

We have, we have hit the objectives that we had set out for, for the first time, continued cost saving in the places, continued capital management. All those

things don’t change. They’re not, we’re not doing those because we were gonna sell Sycamore. We’re doing those because that’s how you turn a company around. And you have been leading the way with that and the results are

showing. And I think that’s really, really positive. And so we expect that this would probably close fourth quarter of 2025 because of the fact there are regulatory approvals. We have to get stores relicensed under a new name, et cetera, et

cetera. So until then though, we remain a publicly traded company. You know, in fact, what you heard Jim Cramer say on TV today was he would go out and buy our stock today to get actually the instrument that comes along with it with Village, City

and Summit.

Tim Wentworth

So the way this deal works is

$11.45 in cash. I’ll just say this really quick. And those of you, and many of you are shareholders, will receive a $11.45 in cash upon closing of the deal and a right to up to $3 of value at some point in the future. As we monetize City Summit

and Village MD, we fully intend to do that. Those businesses, they’re different. And we see real intrinsic value, particularly as I’ve said in prior earnings calls on Summit and on CityMD. And to the extent that our shareholders now will

get the first dollar, 70% of the first dollar through the three point eight billionth dollar of any sale or monetization of those first dollar goes to our investors, which would include any of you that are holding this the stock today. And

that’s, and we, we spent some time on the phone with analysts but Jim Cramer today said, I’m gonna buy the stock just so I have that.

Tim

Wentworth

So he, he definitely believes that it has real value. And I talked to Jim last night and he said to me, I was afraid Walgreens was going the way

of Sears and Kmart. He said, but now you’re not going to. And that’s a very, very strong statement. There is no way we’re going that direction. We are going to continue to thrive and we are not right aid, we are not Kmart, we are not

Sears. And Sycamore figured that out. Now, again, as it relates to you, therefore taking care of our each other, taking care of our patients and customers, supporting our stores, most important thing we can do and post the clothes we will still

operate as Walgreens boots and the other brand names that, you know, shields, CareCentrix, et cetera. We will maintain our global headquarters here in Chicagoland just as we do now with dedicated team members throughout the world as they are now.

Tim Wentworth

And we will continue to be an important

force in the communities that we operate in. And so from that standpoint I’m pleased that I’m gonna continue to lead as your CEO through the we till we close this transaction. People ask me, what are you gonna do after that? And my answer

is, I don’t know yet. I hope I get to stay, honestly, but we haven’t talked about that yet. But if you study my history at all, the last two companies that I’ve been part of that were, were ultimately bought. I Medco was bought by

Express Scripts, everyone but two of us left. I stayed, I became the CEO of Express Scripts. I then sold Express Scripts to Cigna. I was no longer the CEO. I stayed for three years to help make it successful because I so believed in that combination

and I was right.

Tim Wentworth

I truly believe in this

combination. And let me be very clear for all of you, Sycamore does not pretend to have healthcare knowledge. They’re looking to all of us to lead in that part of the business. And so from that standpoint, we are gonna bring in a partner that

can supplement the great work we’re doing at the

3

front of the store. And at the same time they’re counting on us to help them understand both how those all connect and how we go forward in new ways. Whether it’s using our, our multi

fulfillment sites so that we can free up even more clinical time in the back of our stores those investments or it’s digital check-in that modernize the experience for our patients and make our teammates

jobs better. Or the other things that we’ve talked about doing some of the store resets, et cetera.

Tim Wentworth

So these are things that will continue to, to go on. And so they recognize our business’ value, they recognize your value. So until we, until we close,

this is we’re a public company. Our day-to-day responsibilities are the same. You know, all the things that would’ve bound you before buying bind us all. Now,

as we think about that, if you happen to get an inquiry for folks, you know, please forward it on to the, your, your EC leader. You know, because we are, we obviously are very, very tightly communicating through this process until we close. It is

very risky to allow multiple points of communication. We are being very, very managed so that investors get a clear and consistent picture of this transaction and of our business. And, and you should just know, again, focused on the turnaround, we

will communicate on an ongoing basis with you as we hit key milestones.

Tim Wentworth

But, and, and again, we will have pages on W Connect, WBAWW that’ll be kept up to date as, as new information becomes available. But today, the message is

fairly straightforward. I’m sorry, a lot of words, we’re not gonna have time for q and a today, but let me just be very, very clear. You’re gonna have people say to you, oh gosh, you know, I saw there was an, in fact I saw today,

there’s an editorial in one of the Chicago newspapers. You know, there’s gonna be different views of should we have sold or not. I’m gonna tell you right now, we are absolutely turning this company around. You have proven it. And we

have just taken along with the board’s support and the board’s negotiation by the way, it was quite a negotiation. You know, we, we’ve got a very attractive outcome here for our shareholders, including all of you.

Tim Wentworth

We have

de-risked our shareholders’ position with the business while at the same time allowing them to participate as we actually improve the business, particularly at City, Summit and Village. And from that

standpoint, you know, you’re gonna be here from friends, family members, particularly those of you in Chicago land because of our footprint. And I just would hope that you have the confidence that I have. I recognize without all the answers yet

to say our future is amazing and this partnership only makes it more so. And that’s gonna be ‘cause of all you. And it’s gonna be because of a great partner. And it’s not gonna be easy because it was never gonna be easy. But

it’s gonna be super important and it will truly, this is what I told my daughters last night when they called me. Your kids will now be able to go into a Walgreens 20 years from now, and they’ll be proud of the fact that we had something

to do with that. And you will have that same pride. Thank you.

Additional Information and Where to Find It

In connection with the proposed transaction between Walgreens Boots Alliance, Inc. (the “Company”) and affiliates of Sycamore Partners Management,

L.P. (“Sycamore Partners”), the Company will file with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A relating to its special meeting of stockholders, which will be mailed to the

Company’s stockholders, and the Company and certain affiliates of the Company will jointly file a transaction statement on Schedule

4

13E-3. The Company may file or furnish other documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE PROXY

STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER RELEVANT DOCUMENTS FILED BY THE COMPANY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SYCAMORE

PARTNERS AND THE PROPOSED TRANSACTION.

Stockholders may obtain free copies of the proxy statement and the Schedule

13E-3 (when available) and other documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Investors portion of the Company’s website at

investor.walgreensbootsalliance.com under the link “Financials and Filings” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations team by e-mail at

Investor.Relations@wba.com.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in

connection with the proposed transaction. Information regarding the Company’s directors and executive officers is contained in the Company’s proxy statement for its 2025 annual meeting of stockholders filed with the SEC on

December 13, 2024 (https://www.sec.gov/ix?doc=/Archives/edgar/data/1618921/000155837024016214/tmb-20250130xdef14a.htm) under the sections entitled “Corporate governance,” “Security

ownership of certain beneficial owners and management” and “Executive compensation.” To the extent that holdings of the Company’s securities have changed since the amounts set forth in the Company’s proxy statement for its

2025 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their

interests will be contained in the proxy statement and other relevant materials to be filed with the SEC relating to the proposed transaction. These documents can be obtained (when available) free of charge from the sources indicated above.

Forward-Looking Statements

This communication contains

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that

do not relate solely to historical or current facts, such as statements regarding our expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of forward-looking terminology

such as “accelerate,” “aim,” “ambition,” “anticipate,” “approximate,” “aspire,” “assume,” “believe,” “can,” “continue,” “could,”

“create,” “enable,” “estimate,” “expect,” “extend,” “forecast,” “future,” “goal,” “guidance,” “intend,” “long-term,” “may,”

“model,” “ongoing,” “opportunity,” “outlook,” “plan,” “position,” “possible,” “potential,” “predict,” “preliminary,” “project,”

“seek,” “should,” “strive,” “target,” “transform,” “trend,” “vision,” “will,” “would,” and variations of these terms or other similar expressions, although not

all forward-looking statements contain these words. Such statements include, but are not limited to, statements regarding the proposed transaction, our ability to consummate the proposed transaction on the expected timeline or at all, the

anticipated benefits of the proposed transaction, and the terms, the impact of the proposed transaction on our future business, results of operations and financial condition and the scope of the expected financing in connection with the proposed

transaction. Forward-looking statements are based on current estimates, assumptions and beliefs and are subject to known and unknown risks and uncertainties, many of which are beyond our control, that may cause actual results to vary materially from

those indicated by such forward-looking

5

statements. Such risks and uncertainties include, but are not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all; (ii) the ability

of affiliates of Sycamore Partners to obtain the necessary financing arrangements set forth in the commitment letters received in connection with the proposed transaction; (iii) the failure to satisfy any of the conditions to the consummation

of the proposed transaction, including the receipt of certain regulatory approvals and stockholder approval; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the transaction

agreements, including in circumstances requiring the Company to pay a termination fee; (v) the effect of the announcement or pendency of the proposed transaction on the Company’s business relationships, operating results and business

generally; (vi) the risk that the proposed transaction disrupts the Company’s current plans and operations; (vii) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and

customers, and others with whom it does business; (viii) risks related to diverting management’s attention from the Company’s ongoing business operations; (ix) significant or unexpected costs, charges or expenses resulting from

the proposed transaction; (x) potential litigation relating to the proposed transaction that could be instituted against the parties to the transaction agreements or their respective directors, managers or officers, including the effects of any

outcomes related thereto; (xi) uncertainties related to the continued availability of capital and financing and rating agency actions; (xii) certain restrictions during the pendency of the proposed transaction that may impact the

Company’s ability to pursue certain business opportunities or strategic transactions; (xiii) uncertainty as to timing of completion of the proposed transaction; (xiv) the risk that the holders of Divested Asset Proceed Rights will

receive less-than-anticipated payments or no payments with respect to the Divested Asset Proceed Rights after the closing of the proposed transaction and that such rights will expire valueless; (xv) the impact of adverse general and

industry-specific economic and market conditions; and (xvi) other risks described in the Company’s filings with the SEC. Forward looking statements included herein are made only as of the date hereof and the Company does not undertake any

obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary

statement.

6

2. U.S. Town Hall - Presentation U.S. Town Hall March 7, 2025 © 2025

Walgreens Boots Alliance, Inc. All rights reserved.

Legal Disclaimers Additional Information and Where to Find It In connection

with the proposed transaction between Walgreens Boots Alliance, Inc. (the “Company”) and affiliates of Sycamore Partners Management, L.P. (“Sycamore Partners”), the Company will file with the Securities and Exchange

Commission (the “SEC”) a definitive proxy statement on Schedule 14A relating to its special meeting of stockholders, which will be mailed to the Company’s stockholders, and the Company and certain affiliates of the Company will

jointly file a transaction statement on Schedule 13E-3. The Company may file or furnish other documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER

RELEVANT DOCUMENTS FILED BY THE COMPANY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SYCAMORE PARTNERS AND THE PROPOSED TRANSACTION. Stockholders may obtain free copies of the proxy

statement and the Schedule 13E-3 (when available) and other documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Investors portion of the Company’s website at investor.walgreensbootsalliance.com

under the link “Financials and Filings” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations team by e-mail at Investor.Relations@wba.com. Participants in the Solicitation The Company

and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed transaction. Information regarding the Company’s directors and

executive officers is contained in the Company’s proxy statement for its 2025 annual meeting of stockholders filed with the SEC on December 13, 2024 (https://www.sec.gov/ix?doc=/Archives/edgar/data/1618921/000155837024016214/tmb-

20250130xdef14a.htm) under the sections entitled “Corporate governance,” “Security ownership of certain beneficial owners and management” and “Executive compensation.” To the extent that holdings of the

Company’s securities have changed since the amounts set forth in the Company’s proxy statement for its 2025 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed

with the SEC. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement and other relevant materials to be filed with the SEC relating to the proposed

transaction. These documents can be obtained (when available) free of charge from the sources indicated above. Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, such as statements regarding our

expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the use of forward- looking terminology such as “accelerate,” “aim,” “ambition,”

“anticipate,” “approximate,” “aspire,” “assume,” “believe,” “can,” “continue,” “could,” “create,” “enable,”

“estimate,” “expect,” “extend,” “forecast,” “future,” “goal,” “guidance,” “intend,” “long-term,” “may,” “model,”

“ongoing,” “opportunity,” “outlook,” “plan,” “position,” “possible,” “potential,” “predict,” “preliminary,” “project,”

“seek,” “should,” “strive,” “target,” “transform,” “trend,” “vision,” “will,” “would,” and variations of these terms or other similar

expressions, although not all forward-looking statements contain these words. Such statements include, but are not limited to, statements regarding the proposed transaction, our ability to consummate the proposed transaction on the expected timeline

or at all, the anticipated benefits of the proposed transaction, and the terms, the impact of the proposed transaction on our future business, results of operations and financial condition and the scope of the expected financing in connection with

the proposed transaction. Forward-looking statements are based on current estimates, assumptions and beliefs and are subject to known and unknown risks and uncertainties, many of which are beyond our control, that may cause actual results to vary

materially from those indicated by such forward-looking statements. Such risks and uncertainties include, but are not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all; (ii) the ability of

affiliates of Sycamore Partners to obtain the necessary financing arrangements set forth in the commitment letters received in connection with the proposed transaction; (iii) the failure to satisfy any of the conditions to the consummation of the

proposed transaction, including the receipt of certain regulatory approvals and stockholder approval; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the transaction agreements,

including in circumstances requiring the Company to pay a termination fee; (v) the effect of the announcement or pendency of the proposed transaction on the Company’s business relationships, operating results and business generally; (vi) the

risk that the proposed transaction disrupts the Company’s current plans and operations; (vii) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with

whom it does business; (viii) risks related to diverting management’s attention from the Company’s ongoing business operations; (ix) significant or unexpected costs, charges or expenses resulting from the proposed transaction; (x)

potential litigation relating to the proposed transaction that could be instituted against the parties to the transaction agreements or their respective directors, managers or officers, including the effects of any outcomes related thereto; (xi)

uncertainties related to the continued availability of capital and financing and rating agency actions; (xii) certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business

opportunities or strategic transactions; (xiii) uncertainty as to timing of completion of the proposed transaction; (xiv) the risk that the holders of Divested Asset Proceed Rights will receive less-than-anticipated payments or no payments with

respect to the Divested Asset Proceed Rights after the closing of the proposed transaction and that such rights will expire valueless; (xv) the impact of adverse general and industry-specific economic and market conditions; and (xvi) other risks

described in the Company’s filings with the SEC. Forward looking statements included herein are made only as of the date hereof and the Company does not undertake any obligation to update any forward-looking statements as a result of new

information, future developments or otherwise, except as required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. © 2025 Walgreens Boots Alliance, Inc. All rights

reserved. 2

Found Best Possible Partner to Help Achieve our Objectives Our turnaround

will take time and Trusted brands and commitment to relentless focus stakeholders will continue to anchor our business Better positioned to realize goal of being first choice for pharmacy, retail and Board concluded that a transaction with health

services Sycamore maximizes shareholder value Strengthens the value we deliver to team members, patients, communities and shareholders © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 3

An Introduction to Our New Partners Sycamore Partners: A leading private

equity firm specializing in retail and consumer investments • Sycamore has a long history of collaborating with management teams to grow the value of businesses • Sycamore’s established leadership in retail and consumer services +

WBA’s expertise in healthcare will be a strong combination • Sycamore brings objective outside perspectives and a track record of successful investments in retailers navigating change © 2020 Walgreens Boots Alliance, Inc. All rights

reserved. © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 4 Confidential and Proprietary information. For internal use only.

What This Means for our Team Members Sycamore recognizes and appreciates our

global team members • Transaction expected to close in the fourth quarter calendar year 2025 • Until then, we remain a public company and will continue to operate with excellence • Priorities and day-to-day responsibilities remain

the same; nothing is changing now • Please continue to do what you do best — serving our customers, patients and communities • Post-close, we will: • Operate under Walgreens, Boots and our trusted portfolio of consumer brands

• Maintain global headquarters in Chicagoland, with dedicated team members in our various locations around the world • Continue contributing to communities in which we operate © 2025 Walgreens Boots Alliance, Inc. All rights

reserved. 5

This Announcement is the First Step Until close, we remain a public We

remain focused on executing company and our priorities and turnaround plans day-to-day responsibilities remain the same As we reach key milestones, we will communicate with you directly If you receive an inquiry from an external stakeholder, please

contact Regular updates will be made on your EC leader and wait to receive WBAWW and WCONNECT with explicit permission before taking any resources action © 2025 Walgreens Boots Alliance, Inc. All rights reserved. 6

Thank you © 2025 Walgreens Boots Alliance, Inc. All rights reserved.

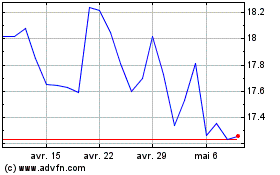

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025