Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

27 Septembre 2024 - 11:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Shimmick

Corporation

(Name of Issuer)

Common stock, par value $0.01 per share

(Title of Class of Securities)

82455M109

(CUSIP Number)

David Y. Gan

Executive Vice President, Chief

Legal Officer

AECOM

300 South Grand Avenue

Los Angeles, CA 90071

(213) 593-8000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communication)

September 25, 2024

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

*The remainder of this cover page shall

be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act")

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. 82455M109 |

|

SCHEDULE 13D |

| 1 |

NAMES OF REPORTING PERSONS |

|

| |

|

|

| |

AECOM |

|

| |

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

(b) x |

| |

|

|

| 3 |

SEC USE ONLY |

| |

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

| |

|

|

| |

OO |

|

| |

|

|

| |

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| |

|

|

| |

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| |

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER |

| |

|

| |

6,714,448 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

|

| |

0 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

|

| |

6,714,448 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

|

| |

0 |

| |

|

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

6,714,448 |

|

| |

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| |

|

|

| |

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

19.9%(1) |

|

| |

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

| |

|

|

| |

CO |

|

| |

|

|

| (1) | As reported in the Shimmick Corporation’s (the “Issuer”) Quarterly Report on Form 10-Q, filed with the Securities

and Exchange Commission (the “SEC”) on August 16, 2024, as of August 14, 2024, there were 33,589,035 shares of the Issuer’s

common stock, par value $0.01 per share (“Common Stock”), issued and outstanding. Percent ownership calculations in this Statement

are calculated by using a denominator of 33,589,035 shares of Common Stock outstanding as of August 14, 2024. The amounts in rows 7, 9

and 11 and the percentage in row 13 include (i) 6,708,051 shares of Common Stock directly held by the Reporting Person and (ii) 6,397

additional shares of Common Stock of which the Reporting Person may acquire voting and dispositive power within 60 days hereof pursuant

to the terms of the Escrow Services Agreement dated June 24, 2024, by and among the Issuer, the Reporting Person and Equiniti Trust Company,

LLC (the “Escrow Agreement”). The amounts in rows 7, 9 and 11 and the percentage in row 13 do not include 1,030,552 shares

of Common Stock of which the Reporting Person does not have voting and dispositive power within 60 days hereof pursuant to the terms of

the Escrow Agreement. |

| CUSIP No. 82455M109 |

|

SCHEDULE 13D |

Explanatory Note

This Amendment No. 2 (“Amendment

No. 2”) to Schedule 13D amends and supplements the initial statement on Schedule 13D originally filed with the SEC by the Reporting

Person on May 24, 2024 (as amended prior to the filing of this Amendment No. 2, the “Schedule 13D”). Capitalized terms used

but not defined in this Amendment No. 2 shall have the same meanings ascribed to them in the Schedule 13D.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby

amended and supplemented by amending and restating the disclosure under the subheading “Credit Agreement” to read as follows:

Credit Agreement

On May 20, 2024, the Issuer, as

guarantor, and its wholly-owned subsidiaries as borrowers (“Borrowers”), Alter Domus (US) LLC, as agent (the “Agent”),

and the Reporting Person and Berkshire Hathaway Specialty Insurance Company (“BHSI”) as lenders, entered into a revolving

credit facility (the “Credit Agreement”). The Credit Agreement provides borrowing capacity up to $60 million. The obligations

under the Credit Agreement bear interest at a per annum rate equal to one month Term SOFR (as defined in the Credit Agreement), subject

to a 1.00% floor, plus 3.50%. Interest on any outstanding amounts drawn under the Credit Agreement will be payable, in kind or in cash

at the election of the Issuer, on the last day of each month and upon prepayment.

The Issuer expects to use the proceeds

from the Credit Agreement for general corporate purposes. The Credit Agreement matures on May 20, 2029 (the “Maturity Date”),

and the Borrowers may borrow, repay and reborrow amounts under the Credit Agreement until the Maturity Date.

Obligations of the Borrowers under the

Credit Agreement are guaranteed by the Issuer, and secured by a lien on substantially all assets of the Issuer and the Borrowers.

The Credit Agreement contains customary

affirmative and negative covenants for a transaction of this type, including covenants that limit liens, asset sales and investments,

in each case subject to negotiated exceptions and baskets. In addition, the Credit Agreement contains a maximum leverage ratio covenant

that will be tested starting in the third quarter of fiscal year 2025. The Credit Agreement also contains representations and warranties

and event of default provisions customary for a transaction of this type.

On September 25, 2024, the Issuer entered

into Amendment No. 1 (the “Credit Agreement Amendment”) to the Credit Agreement. The Credit Agreement Amendment, among other

things, provides (i) that the Reporting Person and BHSI have consented to the execution of the Amendment No. 5 to the Issuer’s revolving

credit facility, dated March 27, 2023, with MidCap Financial Services, LLC (the “MidCap Amendment”), (ii) for certain additional

mandatory prepayments of the indebtedness if the loans under the MidCap Amendment are not utilized within 5 business days or for the uses

provided in the MidCap Amendment, (iii) certain conditions precedent to the effectiveness of the Credit Agremeent Amendment, including

delivery of the MidCap Amendment and (iv) for a conditional waiver, on a one-time basis, of certain specified events of default under

the Credit Agreement.

The foregoing descriptions of the Credit

Agreement and Credit Agreement Amendment set forth in this Item 4 do not purport to be complete and are qualified in their entirety by

reference to the full text of the Credit Agreement and Credit Agreement Amendment, which have been filed as Exhibit 99.2 and Exhibit

99.7 hereto, respectively, and are incorporated herein by reference.

Item 7. Material to Be Filed as Exhibits.

Item 7 of the Schedule 13D is hereby

amended and supplemented by adding the following exhibit:

| Exhibit 99.7 |

Amendment No. 1 to Credit, Security and Guaranty Agreement, dated September 25, 2024, by and among Shimmick Construction Company, Inc., Rust Constructors Inc., The Leasing Corporation, Shimmick Corporation, the other guarantors party thereto, the agent thereunder, and the lenders time to time party thereto (incorporated by reference to Exhibit 10.2 to the Issuer’s Current Report on Form 8-K filed with the SEC on September 26, 2024) |

SIGNATURE

After reasonable

inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

Date: September

27, 2024

| AECOM |

|

| |

|

| By: |

/s/ David Y. Gan |

|

| Name: David Y. Gan |

|

| Title: Executive Vice President, Chief Legal Officer |

|

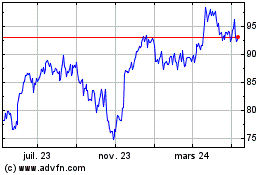

AECOM (NYSE:ACM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

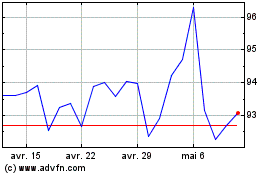

AECOM (NYSE:ACM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025