Full-Year Reported EPS2 of $3.65, Adjusted

EPS1,2 of $4.74

Announces Targeted Actions to Deliver $500 -

$750 Million in Cost Savings

Announces Increase in Quarterly Dividend

ADM (NYSE: ADM) today reported financial results for the fourth

quarter and full year ended December 31, 2024.

Full-Year 2024 Highlights

- Net earnings of $1.8 billion, adjusted net earnings1 of $2.3

billion

- Earnings per share2 of $3.65, with adjusted earnings per

share1,2 of $4.74, both down versus the prior year

- Trailing four-quarter average return on invested capital (ROIC)

of 6.7%, trailing four-quarter average adjusted return on invested

capital (ROIC)1 of 8.3%

2024 cash flows from operating activities were $2.8 billion,

with cash flows from operations before working capital1,3 of $3.3

billion, as compared to 2023 cash flows from operating activities

of $4.5 billion and cash flows from operations before working

capital1,3 of $4.7 billion.

Board Chair and CEO Juan Luciano commented, “With softer market

conditions and policy uncertainty around the world going into 2025,

we are focused on improving our operational performance,

accelerating costs savings, and simplifying our portfolio. As part

of that effort, we are announcing targeted actions to deliver $500

– 750 million in cost savings over the next several years. This

represents a continuation of ADM’s commitment to drive

simplification and better align our resources to deliver long-term

sustainable growth.

“We will also maintain our disciplined and balanced approach to

capital allocation, including prioritizing selective strategic

investments with strong return potential and returning cash to

shareholders. In line with this, we are announcing a 2% increase in

our quarterly dividend.”

Fourth Quarter and Full-Year 2024 Results

4Q 2024 Results Overview

($ in millions except per share

amounts)

Earnings Before Income

Taxes

EPS2 (as reported)

GAAP

$667

$1.17

vs. 4Q 2023

(9)%

10%

Total Segment Operating

Profit1

Adjusted EPS1,2

NON-GAAP

$1,051

$1.14

vs 4Q 2023

(16)%

(16)%

1 Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

2 All references in this document to

earnings per share (EPS) and adjusted earnings per share reflect

EPS on a diluted basis.

3 Cash flows from operations before

working capital is cash flows from operating activities of $2,780

million excluding the changes in working capital of $(519) million

in YTD 2024. Cash flows from operations before working capital is

cash flows from operating activities of $4,460 million excluding

the changes in working capital of $(267) million in YTD 2023

FY 2024 Results Review

($ in millions except per share

amounts)

Earnings Before Income

Taxes

EPS2 (as reported)

GAAP

$2,255

$3.65

vs. FY 2023

(47)%

(43)%

Total Segment Operating

Profit1

Adjusted EPS1,2

NON-GAAP

$4,209

$4.74

vs FY 2023

(28)%

(32)%

1 Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

2 All references in this document to

earnings per share (EPS) and adjusted earnings per share reflect

EPS on a diluted basis.

Summary of Fourth Quarter and Full Year

2024

For the fourth quarter ended December 31, 2024, earnings before

income taxes were $667 million, down (9)% versus the prior year

quarter. Earnings per share on a GAAP basis were $1.17, up 10% from

the prior year quarter, and adjusted earnings per share were $1.14,

down (16)% versus the prior year quarter. Total segment operating

profit was $1,051 million, down (16)% versus the prior year

quarter, and excluded specified items of $(36) million related to

gain on sale of assets and lowering of contingency liability

reserves.

For the full year, earnings before income taxes were $2.3

billion, down (47)% versus the prior year. Earnings per share on a

GAAP basis were $3.65 and adjusted earnings per share were $4.74,

both lower versus the prior year. Total segment operating profit

was $4.2 billion, down (28)% versus the prior year, and excluded

specified items of $480 million primarily related to the Wilmar

investment impairment, Nutrition trade name impairments, and gain

on asset sales.

4Q 2024 Segment Overview

($ in millions, except where noted)

4Q 2024

4Q 20232

% Change3

Total Segment Operating Profit1

$1,051

$1,253

(16)%

Segment Operating Profit:

Ag Services & Oilseeds

644

954

(32)%

Carbohydrate Solutions

319

309

3%

Nutrition

88

(10)

NM

3 NM: Not Meaningful. Percentage increases

above 200% or when one period includes income and other period

includes loss are considered not meaningful

FY 2024 Segment Overview

($ in millions, except where noted)

FY 2024

FY 20232

% Change

Total Segment Operating Profit1

$4,209

$5,869

(28)%

Segment Operating Profit:

Ag Services & Oilseeds

2,447

4,067

(40)%

Carbohydrate Solutions

1,376

1,375

—%

Nutrition

386

427

(10)%

1 Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

Ag Services and Oilseeds

Summary

AS&O segment operating profit was $644 million during the

fourth quarter of 2024, down (32)% compared to the prior year

quarter.

The Ag Services subsegment operating profit was 19% higher

versus the prior year quarter, due to higher origination volumes

and margins in North America, supported by improved river

conditions. The subsegment also had benefits from positive timing

impacts, as well as higher destination marketing volumes and

margins in Global Trade.

The Crushing subsegment operating profit was (46)% lower versus

the prior year quarter, as increased industry run rates, higher

manufacturing costs, and biofuel and trade policy uncertainty drove

lower executed crush margins in North America, partially offset by

higher margins and volumes in EMEA. There were immaterial net

mark-to-market timing effects during the quarter compared to

approximately $35 million of net positive impacts in the prior year

quarter. The current quarter also included $52 million of insurance

proceeds for the partial settlement of the Decatur East and West

claim.

The Refined Products and Other (RPO) subsegment operating profit

was (57)% lower versus the prior year quarter, as biofuel and trade

policy uncertainty, increased pre-treatment capacity, and higher

imports of used cooking oil negatively impacted margins in Europe

and North America. Softer demand from food customers in North

America negatively impacted refining margins compared to the prior

year. During the quarter, there were approximately $50 million of

net negative mark-to-market timing effects compared to

approximately $5 million of net positive impacts in the prior year

quarter.

Equity earnings from the Company’s investment in Wilmar were

approximately (20)% lower versus the prior year period.

For the full year, the AS&O segment operating profit was

$2.4 billion, (40)% lower compared to 2023.

In the Ag Services subsegment, operating profit was (39)% lower

versus the prior year, as slower farmer selling and higher

logistics costs related industry take-or-pay commitments negatively

impacted the South American origination environment.

In the Crushing subsegment, operating profit was $844 million,

(35)% lower versus the prior year, as ample supplies out of South

America drove more balanced supply and demand conditions, leading

to lower crush margins. For 2024, there were approximately $20

million of net positive mark-to-market timing effects, compared to

approximately $185 million of net positive impacts in the prior

year. The full year also included $76 million of insurance proceeds

for the partial settlement of the Decatur East and West claims

related to incidents in 2023.

The RPO subsegment operating profit was $552 million, (58)%

lower versus the prior year, as increased pre-treatment capacity at

renewable diesel facilities and higher imports of used cooking oil

drove significantly lower biodiesel and refining margins. For 2024,

there were approximately $195 million of net negative

mark-to-market timing effects, compared to approximately $235

million of net positive impacts in the prior year.

Equity earnings from the Company’s investment in Wilmar were

$336 million in 2024, approximately 11% higher than the prior

year.

4Q 2024 AS&O Overview

($ in millions, except where noted)

4Q 2024

4Q 2023

% Change

Segment Operating Profit

$644

$954

(32)%

Ag Services

254

214

19%

Crushing

212

389

(46)%

Refined Products and Other

121

280

(57)%

Wilmar

57

71

(20)%

FY 2024 AS&O Overview

($ in millions, except where noted)

FY 2024

FY 2023

% Change

Segment Operating Profit

$2,447

$4,067

(40)%

Ag Services

715

1,168

(39)%

Crushing

844

1,290

(35)%

Refined Products and Other

552

1,306

(58)%

Wilmar

336

303

11%

Carbohydrate Solutions

Summary

Carbohydrate Solutions segment operating profit was $319 million

during the fourth quarter of 2024, up 3% compared to the prior year

quarter.

The Starches & Sweeteners (S&S) subsegment decreased

(3)%, versus the prior year quarter, as higher volumes and margins

in North America were offset by lower co-product values and margins

in EMEA. The current quarter also included $37 million of insurance

proceeds related to both the partial settlement of the Decatur East

and West insurance claim.

In the Vantage Corn Processor (VCP) subsegment, operating profit

increased due to higher ethanol export volumes and improved ethanol

margins relative to the prior year quarter.

For the full year, Carbohydrate Solutions segment operating

profit was $1.4 billion, flat compared to the prior year. In

S&S, strong margins and volumes in North America were offset by

weaker domestic ethanol margins, co-product values, and margins in

EMEA. In 2024, there were $84 million of insurance proceeds related

to the partial settlement of the Decatur East and West claims. In

VCP, operating profit declined relative to the prior year, as

strong exports volumes were more than offset by lower margins due

to higher industry production and inventory levels.

4Q 2024 Carbohydrate Solutions

Overview

($ in millions, except where noted)

4Q 2024

4Q 2023

% Change1

Segment Operating Profit

$319

$309

3%

Starches and Sweeteners

304

312

(3)%

Vantage Corn Processors

15

(3)

NM

1 NM: Not Meaningful. Percentage increases

above 200% or when one period includes income and other period

includes loss are considered not meaningful

FY 2024 Carbohydrate Solutions

Overview

($ in millions, except where noted)

FY 2024

FY 2023

% Change

Segment Operating Profit

$1,376

$1,375

—%

Starches and Sweeteners

1,343

1,329

1%

Vantage Corn Processors

33

46

(28)%

Nutrition Summary

Nutrition segment operating profit was $88 million during the

fourth quarter of 2024, an increase from the segment operating loss

of $(10) million in the prior year quarter.

Human Nutrition subsegment operating profit was $62 million

compared to a loss of $(25) million in the prior year quarter.

Results were higher due to the lapping of previously disclosed

non-recurring negative impacts from the prior year, higher volumes

and improved mix, and strong performance by recent M&A,

partially offset by higher costs. During the quarter, there were

also negative impacts due to higher costs of goods sold associated

with the termination of an unfavorable supply agreement. The

current quarter also included $46 million of insurance proceeds

related to the partial settlement of the Decatur East claim.

In the Animal Nutrition subsegment, operating profit was $26

million, up relative to the prior year quarter, as cost

optimization actions and lower input costs supported higher

margins.

For the full year, Nutrition segment operating profit was $386

million, (10)% lower versus the prior year.

Human Nutrition subsegment operating profit of $327 million was

(22)% lower than the prior year, driven primarily by negative

impacts related to unplanned downtime at Decatur East and lower

texturants pricing. The full year also included $71 million of

insurance proceeds related to the partial settlement of the Decatur

East claim.

Animal Nutrition subsegment operating profit of $59 million was

higher compared to the prior year as cost optimization efforts and

lower input costs supported higher margins.

4Q 2024 Nutrition Overview

($ in millions, except where noted)

4Q 2024

4Q 2023

% Change1

Segment Operating Profit

$88

$(10)

NM

Human Nutrition

62

(25)

NM

Animal Nutrition

26

15

73%

1 NM: Not Meaningful. Percentage increases

above 200% or when one period includes income and other period

includes loss are considered not meaningful

FY 2024 Nutrition Overview

($ in millions, except where noted)

FY 2024

FY 2023

% Change1

Segment Operating Profit

$386

$427

(10)%

Human Nutrition

327

417

(22)%

Animal Nutrition

59

10

NM

1 NM: Not Meaningful. Percentage increases

above 200% or when one period includes income and other period

includes loss are considered not meaningful

Corporate and Other Business

Summary

For the fourth quarter, Other business contributed operating

profit of $47 million, down 68% compared to the prior year quarter

due to lower Captive insurance results from higher claim losses.

ADM Investor Services results decreased on lower interest

income.

For the full year, Other business contributed operating profit

of $247 million, down 34% compared to the prior year due to lower

Captive insurance results from higher claim settlements. Included

in claim settlements were partial settlements of $231 million for

the Decatur East and West insurance claims of which $133 million

was from reinsurers during the fourth quarter.

In Corporate for the fourth quarter, unallocated corporate costs

decreased versus the prior year due to $52 million in lower

incentive compensation, partially offset by $28 million of

increased legal fees.

In Corporate for the full year, unallocated corporate costs

increased versus the prior year on higher global technology

investments to support digital transformation efforts, $103 million

in increased legal fees and $38 million in increased financing

costs, partially offset by lower incentive compensation. Other

Corporate was favorable compared to last year’s investment

valuation losses.

Outlook3

The Company provided guidance for the full year 2025. ADM

expects adjusted earnings per share in the range of $4.00 to $4.75

per share1,2, reflecting weaker market fundamentals and on-going

biofuel and trade policy uncertainty.

_________________________

1 Non-GAAP financial measures; see pages

7-9 and 14-16 for explanations and reconciliations.

2 All references in this document to

earnings per share (EPS) and adjusted earnings per share reflect

EPS on a diluted basis.

3 Forecasted GAAP Earnings Reconciliation:

ADM is not presenting forecasted GAAP earnings per diluted share or

a quantitative reconciliation to forecasted adjusted earnings per

share in reliance on the unreasonable efforts exemption provided

under Item 10(e)(1)(i)(B) of Regulation S-K. ADM is unable to

predict with reasonable certainty and without unreasonable effort

the impact of any impairment and timing of restructuring-related

and other charges, along with acquisition-related expenses and the

outcome of certain regulatory, legal and tax matters. The financial

impact of these items is uncertain and is dependent on various

factors, including timing, and could be material to our

Consolidated Statements of Earnings.

Targeted Actions to Deliver Cost

Savings

The Company announced today targeted actions to deliver between

$500 - $750 million in cost savings over the next 3 - 5 years.

These proactive actions will further reduce the Company's costs in

response to ongoing market challenges, including global legislative

and regulatory policy uncertainty. Specifically, ADM expects to

achieve the majority of the cost savings on an annual run-rate

basis through improvement in manufacturing costs, reduction in

purchased materials and services, and targeted workforce reduction.

The Company currently expects a targeted workforce reduction of

approximately 600 - 700 roles globally in 2025.

Dividend

ADM’s Board of Directors has declared a cash dividend of $51.0

cents per share, up from $50.0 cents per share, on the company’s

common stock. The dividend is payable on March 11, 2025 to

shareholders of record on February 18, 2025. This is ADM’s 93rd

consecutive year of uninterrupted dividends.

Conference Call

Information

ADM will host a webcast today, February 4, 2025, at 9 a.m.

Central Time to discuss financial results and outlook. To listen to

the webcast, go to www.adm.com/webcast. A replay of the webcast

will also be available for an extended period of time at

www.adm.com/webcast.

About ADM

ADM unlocks the power of nature to enrich the quality of life.

We’re an essential global agricultural supply chain manager and

processor, providing food security by connecting local needs with

global capabilities. We’re a premier human and animal nutrition

provider, offering one of the industry’s broadest portfolios of

ingredients and solutions from nature. We’re a trailblazer in

health and well-being, with an industry-leading range of products

for consumers looking for new ways to live healthier lives. We’re a

cutting-edge innovator, guiding the way to a future of new consumer

and industrial solutions. And we're a leader in sustainability,

scaling across entire value chains to help decarbonize the multiple

industries we serve. Around the globe, our innovation and expertise

are meeting critical needs while nourishing quality of life and

supporting a healthier planet. Learn more at www.adm.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve substantial risks and uncertainties. All statements,

other than statements of historical fact included in this release,

are forward-looking statements. You can identify forward-looking

statements by the fact they do not relate strictly to historical or

current facts. These statements may include words such as

“anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,”

“believe,” “may,” “outlook,” “will,” “should,” “can have,”

“likely,” “forecasted”, and other words and terms of similar

meaning in connection with any discussion of the timing or nature

of future operating or financial performance or other events. All

forward-looking statements are subject to significant risks,

uncertainties and changes in circumstances that could cause actual

results and outcomes to differ materially from the forward-looking

statements. These forward-looking statements are not guarantees of

future performance and involve risks, assumptions and

uncertainties, including, without limitation, those described in

the Company’s most recent Annual Report on Form 10-K/A and in other

documents that the Company files or furnishes with the Securities

and Exchange Commission. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual outcomes may vary materially from those indicated

or anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made. Except

to the extent required by law, ADM does not undertake, and

expressly disclaims, any duty or obligation to update publicly any

forward-looking statement after the date of this announcement,

whether as a result of new information, future events, changes in

assumptions or otherwise.

Non-GAAP Financial

Measures

The Company uses certain “Non-GAAP” financial measures as

defined by the Securities and Exchange Commission. These are

measures of performance not defined by accounting principles

generally accepted in the United States, and should be considered

in addition to, not in lieu of, GAAP reported measures.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in this

press release.

Adjusted net earnings and Adjusted earnings per share (EPS).

Adjusted net earnings reflects ADM’s reported net earnings after

removal of the effect on net earnings of specified items as more

fully described in the reconciliation tables below. Adjusted EPS

reflects ADM’s fully diluted EPS after removal of the effect on EPS

as reported of specified items as more fully described in the

reconciliation tables below. Management believes that Adjusted net

earnings and Adjusted EPS are useful measures of ADM’s performance

because they provide investors additional information about ADM’s

operations allowing better evaluation of underlying business

performance and better period-to-period comparability. These

non-GAAP financial measures are not intended to replace or be

alternatives to net earnings and EPS as reported, the most directly

comparable GAAP financial measures, or any other measures of

operating results under GAAP. Earnings amounts described above have

been divided by the company’s diluted shares outstanding for each

respective period in order to arrive at an adjusted EPS amount for

each specified item.

Total segment operating profit. Total segment operating profit

is ADM’s consolidated earnings before income taxes adjusted for

Other business, Corporate, and specified items as more fully

described in the reconciliation tables below. Management believes

that total segment operating profit is a useful measure of ADM’s

performance because it provides investors information about ADM’s

reportable segment performance excluding other business, corporate

overhead costs as well as specified items. Total segment operating

profit is not a measure of consolidated operating results under

U.S. GAAP and should not be considered an alternative to earnings

before income taxes, the most directly comparable GAAP financial

measure, or any other measure of consolidated operating results

under U.S. GAAP.

Adjusted Return on Invested Capital (ROIC). Adjusted ROIC is

Adjusted ROIC earnings divided by adjusted invested capital.

Adjusted ROIC earnings is ADM’s net earnings adjusted for the

after-tax effects of interest expense on borrowings and specified

items. Adjusted invested capital is the sum of ADM’s equity

(excluding redeemable and non-redeemable noncontrolling interests)

and interest-bearing liabilities (which totals invested capital),

adjusted for specified items. Management believes Adjusted ROIC is

a useful financial measure because it provides investors

information about ADM’s returns excluding the impacts of specified

items and increases period-to-period comparability of underlying

business performance. Management uses Adjusted ROIC to measure

ADM’s performance by comparing Adjusted ROIC to its weighted

average cost of capital (WACC). Adjusted ROIC, Adjusted ROIC

earnings and Adjusted invested capital are non-GAAP financial

measures and are not intended to replace or be alternatives to GAAP

financial measures.

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. Adjusted EBITDA is defined as

earnings before interest on borrowings, taxes, depreciation, and

amortization, adjusted for specified items. The Company calculates

adjusted EBITDA by removing the impact of specified items and

adding back the amounts of income tax expense, interest expense on

borrowings, and depreciation and amortization to net earnings.

Management believes that EBITDA and adjusted EBITDA are useful

measures of the Company’s performance because they provide

investors additional information about the Company’s operations

allowing better evaluation of underlying business performance and

better period-to-period comparability. EBITDA and adjusted EBITDA

are non-GAAP financial measures and are not intended to replace or

be an alternative to net earnings, the most directly comparable

GAAP financial measure.

Cash flows from operations before working capital is defined as

cash flows from operating activities excluding the changes in

operating assets and liabilities as presented in the Company’s

consolidated statement of cash flows. Management believes that cash

flows from operations before working capital is a useful measure of

the Company’s cash generation. Cash flows from operations before

working capital is a non-GAAP financial measure and is not intended

to replace or be an alternative to cash from operating activities,

the most directly comparable GAAP financial measure.

Financial Tables Follow

Source: Corporate Release Source: ADM

Total Segment Operating Profit (a

non-GAAP financial measure) and Corporate Results

(unaudited)

Quarter ended

Year ended

December 31

December 31

(In millions)

2024

2023

Change

2024

2023

Change

Earnings before income taxes

$

667

$

734

$

(67

)

$

2,255

$

4,294

$

(2,039

)

Other Business (earnings) loss

(47

)

(146

)

99

(247

)

(375

)

128

Corporate

467

501

(34

)

1,721

1,606

115

Specified items:

(Gain) loss on sales of assets

(10

)

(7

)

(3

)

(10

)

(17

)

7

Impairment and restructuring charges and

settlement contingencies

(26

)

171

(197

)

490

361

129

Total Segment Operating Profit

$

1,051

$

1,253

$

(202

)

$

4,209

$

5,869

$

(1,660

)

Segment Operating Profit:

Ag Services and Oilseeds

$

644

$

954

$

(310

)

$

2,447

$

4,067

$

(1,620

)

Ag Services

254

214

40

715

1,168

(453

)

Crushing

212

389

(177

)

844

1,290

(446

)

Refined Products and Other

121

280

(159

)

552

1,306

(754

)

Wilmar

57

71

(14

)

336

303

33

Carbohydrate Solutions

$

319

$

309

$

10

$

1,376

$

1,375

$

1

Starches and Sweeteners

304

312

(8

)

1,343

1,329

14

Vantage Corn Processors

15

(3

)

18

33

46

(13

)

Nutrition

$

88

$

(10

)

$

98

$

386

$

427

$

(41

)

Human Nutrition

62

(25

)

87

327

417

(90

)

Animal Nutrition

26

15

11

59

10

49

Corporate Results

$

(467

)

$

(501

)

$

34

$

(1,721

)

$

(1,606

)

$

(115

)

Interest expense - net

(131

)

(105

)

(26

)

(482

)

(431

)

(51

)

Unallocated corporate costs

(302

)

(336

)

34

(1,205

)

(1,144

)

(61

)

Other

(20

)

(58

)

38

(4

)

(24

)

20

Specified items:

Expenses related to acquisitions

(3

)

(1

)

(2

)

(7

)

(7

)

—

Gain on debt conversion option

—

—

—

—

6

(6

)

Restructuring (charges) adjustment

(11

)

(1

)

(10

)

(23

)

(6

)

(17

)

Consolidated Statements of

Earnings

(unaudited)

Quarter ended

Year ended

December 31

December 31

2024

2023

2024

2023

(in millions, except per share

amounts)

Revenues

$

21,498

$

22,978

$

85,530

$

93,935

Cost of products sold (1)

20,140

21,238

79,752

86,422

Gross profit

1,358

1,740

5,778

7,513

Selling, general, and administrative

expenses (2)

943

919

3,706

3,456

Asset impairment, exit, and restructuring

costs

13

196

545

342

Equity in (earnings) losses of

unconsolidated affiliates

(123

)

(143

)

(621

)

(551

)

Interest and investment income

(162

)

(71

)

(562

)

(499

)

Interest expense (3)

179

165

706

647

Other (income) expense - net (4,5)

(159

)

(60

)

(251

)

(176

)

Earnings before income taxes

667

734

2,255

4,294

Income tax expense (benefit) (6)

106

192

476

828

Net earnings including non-controlling

interests

561

542

1,779

3,466

Less: Net earnings (losses) attributable

to non-controlling interests

(6

)

(23

)

(21

)

(17

)

Net earnings attributable to

ADM

$

567

$

565

$

1,800

$

3,483

Diluted earnings per common

share

$

1.17

$

1.06

$

3.65

$

6.43

Average diluted shares outstanding

484

531

493

542

(1) Includes $26 million in the current

quarter and YTD related to import duty contingent liability

reversal. Includes a contingency loss adjustment of $13 million

related to import duties in the prior-year quarter, and a net

reversal of charges related to inventory writedowns of $5 million

and a net contingency loss provision of $49 million related to

import duties in the prior YTD.

(2) Includes acquisition-related expenses

of $3 million and $7 million in the current quarter and YTD,

respectively. Includes acquisition-related expenses of $1 million

and $7 million in the prior-year quarter and YTD, respectively, and

a contingency loss of $8 million in the prior-year YTD.

(3) Includes (gains) losses related to the

mark-to-market adjustment of the conversion option of the

exchangeable bond issued in August 2020 ($6) million in the

prior-year YTD.

(4) Includes net (gains) losses related to

the sale of certain assets of $(10) million and $(11) million in

the current quarter and YTD, respectively, and ($7) million and

($17) million in the prior-year quarter and YTD, respectively.

(5) Includes a contingency loss adjustment

of $11 million in the prior-year quarter and YTD.

(6) Includes the tax expense (benefit)

impact of specified items and tax discrete items totaling $5

million and $28 million in the current quarter and YTD,

respectively, and ($11) million and ($49) million in the prior-year

quarter and YTD, respectively.

Summary of Financial Condition

(unaudited)

December 31, 2024

December 31, 2023

(in millions)

Net Investment In

Cash and cash equivalents

$

611

$

1,368

Short-term marketable securities

246

—

Operating working capital

9,501

9,843

Property, plant, and equipment

10,837

10,508

Investments in affiliates

5,276

5,500

Goodwill and other intangibles

6,769

6,341

Other non-current assets

2,670

2,515

$

35,910

$

36,075

Financed By

Short-term debt

$

1,903

$

105

Long-term debt, including current

maturities

8,254

8,260

Deferred liabilities

3,322

3,245

Temporary equity

253

320

Shareholders’ equity

22,178

24,145

$

35,910

$

36,075

Summary of Cash Flows

(unaudited)

Year ended

December 31

2024

2023

(in millions)

Cash flows from operating

activities

Net earnings

$

1,779

$

3,466

Depreciation and amortization

1,141

1,059

Asset impairment charges

519

309

(Gains) losses on sales/revaluation of

assets

(12

)

38

Other - net

(128

)

(145

)

Other changes in operating assets and

liabilities

(519

)

(267

)

Net cash provided by operating

activities

2,780

4,460

Cash flows from investing

activities

Purchases of property, plant and

equipment

(1,563

)

(1,494

)

Net assets of businesses acquired

(936

)

(23

)

Proceeds from sale of business/assets

46

60

Marketable securities - net

(223

)

—

Investments in affiliates

(47

)

(18

)

Other investing activities

3

(21

)

Net cash provided by investing

activities

(2,720

)

(1,496

)

Cash flows from financing

activities

Long-term debt borrowings

27

501

Long-term debt payments

(1

)

(963

)

Net borrowings (payments) under lines of

credit

1,800

(390

)

Share repurchases

(2,327

)

(2,673

)

Cash dividends

(985

)

(977

)

Acquisition of noncontrolling interest

(8

)

—

Other

(8

)

(102

)

Net cash used for financing activities

(1,502

)

(4,604

)

Effect of exchange rate on cash, cash

equivalents, restricted cash, and restricted cash equivalents

(24

)

(3

)

Net increase (decrease) in cash, cash

equivalents, restricted cash, and restricted cash

equivalents

(1,466

)

(1,643

)

Cash, cash equivalents, restricted

cash, and restricted cash equivalents - beginning of year

5,390

7,033

Cash, cash equivalents, restricted

cash, and restricted cash equivalents - end of year

$

3,924

$

5,390

Segment Operating Analysis

(unaudited)

Quarter ended

Year ended

December 31

December 31

2024

2023

2024

2023

(in ‘000s metric tons)

Processed volumes (by

commodity)

Oilseeds

9,050

8,841

35,719

34,899

Corn

4,708

4,718

18,541

18,067

Total processed volumes

13,758

13,559

54,260

52,966

Quarter ended

Year ended

December 31

December 31

2024

2023

2024

2023

(in millions)

Revenues

Ag Services and Oilseeds

$

16,874

$

18,524

$

66,516

$

73,426

Carbohydrate Solutions

2,750

2,631

11,234

12,874

Nutrition

1,774

1,721

7,349

7,211

Total Segment Revenues

21,398

22,876

85,099

93,511

Other Business

100

102

431

424

Total Revenues

$

21,498

$

22,978

$

85,530

$

93,935

Adjusted Net Earnings and Adjusted

Earnings Per Share

Non-GAAP financial measures

(unaudited)

Quarter ended December 31

Year ended December 31

2024

2023

2024

2023

In millions

Per share

In millions

Per share

In millions

Per share

In millions

Per share

Net earnings and fully diluted

EPS

$

567

$

1.17

$

565

$

1.06

$

1,800

$

3.65

$

3,483

$

6.43

Adjustments:

Loss (gain) on sales of assets and

businesses (a)

(8

)

(0.02

)

(5

)

—

(8

)

(0.02

)

(12

)

(0.03

)

Impairment and restructuring charges and

settlement contingencies (b)

(11

)

(0.02

)

158

0.30

512

1.04

310

0.57

Expenses related to acquisitions (c)

2

0.01

1

—

5

0.01

6

0.01

Gain on debt conversion option (d)

—

—

—

—

—

—

(6

)

(0.01

)

Tax adjustment (e)

—

—

1

—

30

0.06

4

0.01

Sub-total adjustments

(17

)

(0.03

)

155

0.30

539

1.09

302

0.55

Adjusted net earnings and adjusted

EPS

$

550

$

1.14

$

720

$

1.36

$

2,339

$

4.74

$

3,785

$

6.98

(a)

Current quarter and YTD gain of $10

million and $11 million pretax ($8 million and $8 million after

tax), respectively, was related to the sale of certain assets, tax

effected using the applicable tax rates. Prior-year quarter and YTD

gains of $7 million and $17 million pretax ($5 million and $12

million after tax), respectively was related to the sale of certain

assets, tax effected using the applicable tax rates.

(b)

Current quarter and YTD charges of $10

million and $539 million pretax ($9 million and $532 million after

tax), respectively, were related to the impairment of certain

long-lived assets, other intangibles, and restructuring. Also

included in the current quarter and YTD are contingency loss

adjustments of $(26) million and $(26) million pretax ($(20)

million and $(20) million after tax). Prior-year quarter and YTD

charges of $196 million and $337 million pretax ($158 million and

$310 million after tax), respectively, were related to the

impairment of certain assets, restructuring, and settlement

contingencies, tax effected using the applicable tax rates.

Prior-year YTD charges were also partially offset by an insurance

settlement, tax effected using the applicable tax rate.

(c)

Current quarter and YTD expenses of $3

million and $7 million pretax ($2 million and $5 million after

tax), respectively, were related to certain acquisitions, tax

effected using the Company’s U.S. income tax rate. Prior quarter

and YTD expenses of $1 million and $7 million pretax ($1 million

and $6 million after tax), respectively, were related to certain

acquisitions, tax effected using the Company’s U.S. income tax

rate.

(d)

Prior-year YTD gain on debt conversion of

$6 million pretax ($6 million after tax), respectively, was related

to the mark-to-market adjustment of the conversion option of the

exchangeable bonds issued in August 2020, tax effected using the

applicable tax rate.

(e)

Tax expense adjustment due to certain

discrete items totaling $0 million and $30 million in the current

quarter and YTD, respectively, and $1 million and $4 million in the

prior-year quarter and YTD, respectively.

Adjusted Return on Invested

Capital

A non-GAAP financial measure

(unaudited)

Adjusted ROIC Earnings (in

millions)

Four Quarters

Quarter Ended

Ended

Mar. 31, 2024

Jun. 30, 2024

Sep. 30, 2024

Dec. 31, 2024

Dec. 31, 2024

Net earnings attributable to ADM

$

729

$

486

$

18

$

567

$

1,800

Adjustments:

Interest expense

115

135

124

132

506

Other adjustments

21

22

512

(22

)

533

Total adjustments

136

157

636

110

1,039

Tax on adjustments

(27

)

(32

)

(30

)

(36

)

(125

)

Net adjustments

109

125

606

74

914

Total Adjusted ROIC Earnings

$

838

$

611

$

624

$

641

$

2,714

Adjusted Invested Capital (in

millions)

Quarter Ended

Trailing Four

Mar. 31, 2024

Jun. 30, 2024

Sep. 30, 2024

Dec. 31, 2024

Quarter Average

Equity (1)

$

23,219

$

22,148

$

21,974

$

22,168

$

22,377

+ Interest-bearing liabilities (2)

9,995

10,576

10,051

10,180

10,201

Other adjustments

21

22

512

(22

)

133

Total Adjusted Invested Capital

$

33,235

$

32,746

$

32,537

$

32,326

$

32,711

Adjusted Return on Invested

Capital

8.3

%

(1) Excludes non-controlling interests

(2) Includes short-term debt, current

maturities of long-term debt, finance lease obligations, and

long-term debt

Adjusted Earnings Before Interest,

Taxes, and Depreciation and Amortization (EBITDA)

A non-GAAP financial measure

(unaudited)

The tables below provide a reconciliation

of net earnings to adjusted EBITDA and adjusted EBITDA by segment

for the trailing four quarters ended December 31, 2024.

Four Quarters

Quarter Ended

Ended

Mar. 31, 2024

Jun. 30, 2024

Sep. 30, 2024

Dec. 31, 2024

Dec. 31, 2024

(in millions)

Net earnings

$

729

$

486

$

18

$

567

$

1,800

Net earnings (losses) attributable to

noncontrolling interests

(10

)

(5

)

—

(6

)

(21

)

Income tax expense

166

115

90

106

476

Earnings before income taxes

885

596

108

667

2,255

Interest expense

115

135

124

132

506

Depreciation and amortization

280

286

288

287

1,141

(Gain) loss on sales of assets and

businesses

—

—

(1

)

(10

)

(11

)

Impairment and restructuring charges and

settlement contingencies

18

7

504

(16

)

513

Railroad maintenance expense

—

4

28

32

64

Expenses related to acquisitions

—

4

—

3

7

Adjusted EBITDA

$

1,298

$

1,032

$

1,051

$

1,095

$

4,476

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204109464/en/

Media Contact Brett Lutz media@adm.com 312-634-8484

Investor Relations Megan Britt Megan.Britt@adm.com

872-257-8378

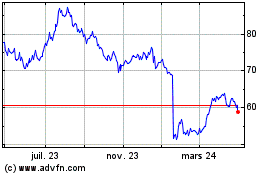

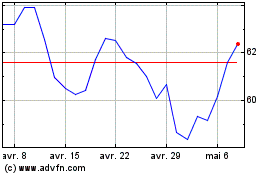

Archer Daniels Midland (NYSE:ADM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Archer Daniels Midland (NYSE:ADM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025