Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

15 Avril 2024 - 3:27PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of April 2024

Commission

File Number 001-35991

AENZA

S.A.A.

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant’s name into English)

Av.

Petit Thouars 4957

Miraflores

Lima

34, Peru

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

April

12, 2024

In

accordance with the provisions set forth in article 30 of the Unified Text of the Securities Market Law (Texto Único Ordenado

de la Ley del Mercado de Valores) approved by Supreme Decree No. 020-2023-EF, and the Regulation of Relevant Events and Reserved

Information (Reglamento de Hechos de Importancia e Información Reservada), approved by SMV Resolution No. 005-2014-SMV-01, we

hereby report as a Relevant Information Communication that our Board of Directors, regarding the decisions took on the shareholders meeting

conducted on November 2nd, 2020 as reopened on November 3rd, 2020 and March 27th, 2024 (the “Shareholders

Meeting”) approved in its Board of Directors meeting conducted on April 12, 2024 (the “Board of Directors Meeting”),

the following matters:

| (i) | The

issuance of corporate bonds to the international market under Rule 144A and Regulation S

of the U.S. Securities Act of 1993 with the following terms and conditions, as well as the

terms and conditions to be determined by the attorneys of the Company authorized by the Board

of Directors Meeting under the terms listed in (iv): |

| |

Instrument: |

Corporate Bond |

| |

|

|

|

| |

Amount: |

Up to USD 350,000,000.00 MM considering any reopening up

to maximum amount of US$420.000.000.00 approved by the Shareholders Meetings. |

| |

|

|

|

| |

Securities: |

Specific securities including the following

preliminary securities: |

| |

|

|

|

| |

|

|

● |

Corporate

Guarantee established by Unna Energía S.A.; |

| |

|

|

|

|

| |

|

|

● |

Stock

pledge (Garantías mobiliarias) and/or fiduciary securities (Fideicomiso en garantía) to be established

by the Company and/or its subsidiaries regarding the following assets: (a) On first tier, shares issued by Unna Energia S.A. and

owned by the Company; (b) On second tier, shares issued by Viva Negocio Inmobiliario S.A. and owned by the Company; (c) on first

tier, collection rights and cash flows of dividends to be distributed by Unna Energía S.A., Tren Urbano de Lima S.A., Red

Vial 5 S.A., Carretera Andina del Sur S.A.C., Carretera Sierra Piura S.A.C., and Concesionaria La Chira S.A; (d) on first tier, certain

cash flows owned by Unna Energía to be collected under services agreements; and (e) on first tier, credit rights and cash

flows from intercompany loans; and, |

| |

|

|

|

|

| |

|

|

● |

Security

to be established under New York Law or another foreign law regarding the amount of the debt service. |

| |

|

|

|

|

| |

|

Moreover,

corporate guarantees will be established by certain subsidiaries as well as other stock pledge (Garantía

mobiliaria) and/or fiduciary securities (Fideicomiso de garantía) (to be established or already

established) over the shares owned by the Company and issued by its subsidiaries or other assets which will be established

after the issuance of the Corporate Bonds. All the securities abovementioned, jointly, will be referred to

as the “Securities”.

Preliminary

and definitive Intercreditor Agreements, or similar, could be executed in order to rule the relationship among the Securities creditors.

|

| |

Term: |

Up to 7 years. |

| |

|

|

| |

Use of proceeds |

Repayment of certain financial covenants and financing organic and inorganic

of the Company, among other corporate matters. |

| |

|

|

| |

Stock Exchange: |

The Corporate Bonds could be filed under the Institutional Investors

Market rules of the Public Registry of the Peruvian Stock Exchange Market supervised by the Peruvian stock exchange authority (Superintendencia

del Mercado de Valores) and/or an international stock exchange (including but no restricted to the Stock Exchange of Bermuda

or Stock Exchange of Singapur). |

| (ii) | the

establishment of the Securities as well as the complementary documents and instruments including

but not limited to preliminary and or definitive intercreditor agreements or similar, irrevocable

power of attorney, amendments, and/or securities termination and cancelation. |

| (iii) | Negotiation,

subscription, amendment, and formalization of all the contracts and documents required for

the issuance and placement of the Corporate Bonds, including those related to the Securities

and the complementary documents and instruments abovementioned under the terms and conditions

as described before and others such as the opportunity, determined by the attorneys of the

Company as the most adequate, granted with powers of attorney by the Board of Directors Meeting. |

| (iv) | Grant

power of attorney to Dennis Fernando Fernández Armas, Oscar Orlando Pando Mendoza,

Cristian Restrepo Hernández, Jorge Luis Fernando Rodrigo Barrón, and Zoila

María Horna Zegarra (jointly, the Attornies), in order to represent the Company by

the jointly acting of any 2 of them, regarding the following: |

| a) | Take

any necessary and/or convenient decision to develop the issuance and placement of the Corporate

Bonds, including the determination of the most favourable alternatives regarding the Company

interests as the advice to be granted by the structuring banks, and to determine all the

terms, conditions, and opportunity of the issuance and placement of the Corporate Bonds,

including the selection and agreements with the structuring advisors, global coordinators,

joint-book runners, placement agents, advisors, underwriters, initial purchasers or trustees,

and to agree, improve, detail or amend, as correspond, all the additional terms and conditions

of the Corporate Bonds to be issued. |

| b) | Execute

before any public or private entity, foreign or local and define the terms and conditions

of all type of documents, contracts, acts, agreements, certificates, establishments, representations,

requirements and other public or private documentation to be related to and necessary or

convenient for the issuance and placement of the Corporate Bonds |

| c) | Submit

the Company to (i) federal legislation of the United States of America and/or any other legislation

of the United States of America; (ii) the competition of Peruvian and/or foreign administrative

authorities; (iii) competition and jurisdiction of the Peruvian and/or judicial authorities;

(iv) competition of local or foreign arbitrators or arbitration tribunal; and (v) competition

of any other public or private entity, local or foreign which, which results necessary or

convenient for the issuance of the Corporate Bonds, under the opinion of the Attorneys, as

required in the documents and contracts to be granted or executed by the Company in thar

regard. |

| d) | Execute

all the procedures, processes, filing of requirements and following up and execution of all

types of documentation in regard to the issuance of the Corporate Bonds, as corresponds,

before any record and/o local or foreign public or private entity as required, as well as

to execute, before local of foreign entities specialized in compensation and liquidation

of instruments, services contracts, annexes, and documents considered necessary and/o convenient

as well as to define the attorneys to be entitled to act before the abovementioned entities

regarding any procedure and execution of notice, documents, requirements. |

| e) | Define

the negotiation mechanism on which the Corporate Bonds will be listed and submit the Company

to the corresponding rules, as well as execute and amend all type of contracts, requirements,

statements, and documentation to achieve and keep the listing of the instruments. |

| f) | Approve

the costs of the issuance of the Corporate Bonds as well as the necessary or convenient payments

to be made in order to develop the task or enter into the agreements approved by the Board

of Directors Meeting regarding the issuance of the Corporate Bonds. |

| g) | Perform

and execute any necessary or convenient for the issuance of the Corporate Bonds, including

those considered as necessary or convenient by the Attorneys, act or document including complementary

or related acts to those approved or authorized by the Board of Directors Meeting. |

Moreover,

the Board of Directors agreed to state that, according to the faculties granted by the Shareholders Meetings, the Board of Directors

could approve the reopening of the Corporate Bonds in order to place the required additional amounts up to USD 420,000,000.00 approved

by the Shareholders Meetings.

SIGNATURES

Pursuant

to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| AENZA S.A.A. |

|

| |

|

|

| By: |

/s/ CRISTIAN

RESTREPO HERNANDEZ |

|

| Name: |

Cristian Restrepo Hernandez |

|

| Title: |

VP of Corporate Finance |

|

| |

|

|

| Date: April 12, 2024 |

|

4

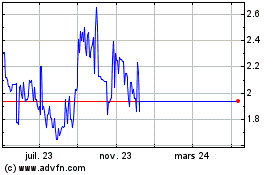

Aenza SAA (NYSE:AENZ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Aenza SAA (NYSE:AENZ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024