Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

01 Mai 2024 - 12:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number 001-35991

AENZA S.A.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. Petit Thouars 4957

Miraflores

Lima 34, Peru

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

April 30, 2024

In accordance with the provisions of Article 28

of the Securities Market Law, Sole Ordered Text approved by Supreme Decree No. 093-2002-EF and the Regulation of Relevant and Reserved

Information, approved by Resolution SMV No. 005-2014-SMV-01, we hereby informed that today we published the first quarter 2024 standalone

Financial Statements of AENZA S.A.A. and they were published in Spanish on the Investor Relations website of the Company: https://investorrelations.aenza.com.pe/.

We intend to publish the Company’s first quarter

2024 consolidated Financial Statements of AENZA S.A.A. around May 15, 2024.

AENZA S.A.A.

INTERIM SEPARATED STATEMENT OF FINANCIAL POSITION

(all amounts in thousands of S/ unless otherwise indicated)

| | |

| |

As of

December 31, | | |

As of

March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| Assets | |

| |

| | | |

| | |

| Current assets | |

| |

| | | |

| | |

| Cash and cash equivalents | |

7 | |

| 164,224 | | |

| 127,076 | |

| Trade accounts receivable, net | |

| |

| 942 | | |

| 1,791 | |

| Accounts receivable from related parties | |

8 | |

| 141,145 | | |

| 154,347 | |

| Other accounts receivable, net | |

9 | |

| 5,318 | | |

| 7,077 | |

| Prapaid expenses | |

| |

| 5,530 | | |

| 6,977 | |

| Total current assets | |

| |

| 317,159 | | |

| 297,268 | |

| Non-current assets | |

| |

| | | |

| | |

| Trade accounts receivable, net | |

| |

| 1,453 | | |

| 1,338 | |

| Accounts receivable from related parties | |

8 | |

| 239,471 | | |

| 240,060 | |

| Other accounts receivable, net | |

9 | |

| 69,389 | | |

| 69,537 | |

| Investments in associates | |

10 | |

| 1,666,813 | | |

| 1,671,737 | |

| Investment property, net | |

11 | |

| 38,630 | | |

| 38,139 | |

| Property, palnt and equipment, net | |

| |

| 1,049 | | |

| 982 | |

| Right-of-use assets, net | |

11 | |

| 26,060 | | |

| 24,605 | |

| Intangible assets, net | |

| |

| 1,474 | | |

| 1,363 | |

| Deferred tax asset | |

16 | |

| 56,807 | | |

| 57,186 | |

| Prapaid expenses | |

| |

| 580 | | |

| 567 | |

| Total non-current assets | |

| |

| 2,101,726 | | |

| 2,105,514 | |

| | |

| |

| | | |

| | |

| Total assets | |

| |

| 2,418,885 | | |

| 2,402,782 | |

| | |

| |

| | | |

| | |

| Liabilities | |

| |

| | | |

| | |

| Current liabilities | |

| |

| | | |

| | |

| Borrowings | |

12 | |

| 416,610 | | |

| 417,023 | |

| Trade accounts payable | |

| |

| 12,901 | | |

| 11,084 | |

| Accounts payable to related parties | |

8 | |

| 3,039 | | |

| 851 | |

| Other accounts payable | |

13 | |

| 26,819 | | |

| 29,974 | |

| Other provisions | |

14 | |

| 9,749 | | |

| 9,749 | |

| Total current liabilities | |

| |

| 469,118 | | |

| 468,681 | |

| Non-current liabilities | |

| |

| | | |

| | |

| Borrowings | |

12 | |

| 25,307 | | |

| 23,461 | |

| Accounts payable to related parties | |

8 | |

| 176,204 | | |

| 173,579 | |

| Other accounts payable | |

13 | |

| 457,965 | | |

| 458,200 | |

| Other provisions | |

14 | |

| 27,184 | | |

| 27,366 | |

| Total non-current liabilities | |

| |

| 686,660 | | |

| 682,606 | |

| Total liabilities | |

| |

| 1,155,778 | | |

| 1,151,287 | |

| | |

| |

| | | |

| | |

| Equity | |

| |

| | | |

| | |

| Capital | |

15 | |

| 1,371,965 | | |

| 1,371,965 | |

| Other reserves | |

| |

| (68,283 | ) | |

| (63,739 | ) |

| Retained earnings | |

| |

| (40,575 | ) | |

| (56,731 | ) |

| Total equity | |

| |

| 1,263,107 | | |

| 1,251,495 | |

| Total liabilities and equity | |

| |

| 2,418,885 | | |

| 2,402,782 | |

The accompanying notes ar part of the separated financial statements

| AENZA

S.A.A. |

| |

| INTERIM

SEPARATED STATEMENT OF PROFIT AND LOSS |

| (all

amounts in thousands of S/ unless otherwise indicated) |

| |

| | |

| |

For the three-month period | |

| | |

| |

ended March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| Revenue from services provided | |

| |

| 6,523 | | |

| 5,948 | |

| Cost of services provided | |

| |

| (5,538 | ) | |

| (4,836 | ) |

| Gross profit | |

| |

| 985 | | |

| 1,112 | |

| Administrative expenses | |

17 | |

| (6,082 | ) | |

| (4,503 | ) |

| Other income and expenses | |

19 | |

| 3,796 | | |

| 530 | |

| Operating loss | |

| |

| (1,301 | ) | |

| (2,861 | ) |

| Financial expenses | |

18 | |

| (23,450 | ) | |

| (27,823 | ) |

| Financial income | |

18 | |

| 16,063 | | |

| 6,963 | |

| Interests for present value of financial asset or liability | |

18 | |

| 244 | | |

| (1,855 | ) |

| Share of the profit or loss of associates and joint ventures under the equity method | |

10 A | |

| (7,173 | ) | |

| 9,285 | |

| Loss before income tax | |

| |

| (15,617 | ) | |

| (16,291 | ) |

| Income tax expense | |

| |

| (3,370 | ) | |

| 135 | |

| Loss for the period | |

| |

| (18,987 | ) | |

| (16,156 | ) |

| | |

| |

| | | |

| | |

| Loss per share attributable to controlling interest in the Company during the period | |

| |

| (0.016 | ) | |

| (0.012 | ) |

| Diluted loss per share attributable to controlling interest in the Company during the period | |

| |

| (0.016 | ) | |

| (0.012 | ) |

The

accompanying notes ar part of the separated financial statements

| AENZA S.A.A. |

| |

| INTERIM

SEPARATED STATEMENT OF OTHER COMPREHENSIVE INCOME |

| (all amounts in thousands

of S/ unless otherwise indicated) |

| |

| | |

| |

For the three-month period | |

| | |

| |

ended March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| Loss for the period | |

| |

| (18,987 | ) | |

| (16,156 | ) |

| Other comprehensive income: | |

| |

| | | |

| | |

| Items that may be subsequently reclassified to profit or loss | |

| |

| | | |

| | |

| Exchange difference from net investment in a foreign operation, net of tax | |

10.A | |

| (153 | ) | |

| 25 | |

| Share of the profit or loss of associates and joint ventures accounted for using the equity method | |

10.A | |

| 662 | | |

| 4,519 | |

| | |

| |

| 509 | | |

| 4,544 | |

| Total comprehensive income of the period | |

| |

| (18,478 | ) | |

| (11,612 | ) |

The

accompanying notes ar part of the separated financial statements

AENZA S.A.A.

INTERIM SEPARATED STATEMENT OF CHANGES IN EQUITY

(all amounts in thousands of S/ unless otherwise indicated)

| In thousands of soles | |

Note | |

Number of

shares in

thousands | | |

Capital | | |

Legal

reserve | | |

Voluntary

reserve | | |

Share

premium | | |

Other

reserves | | |

Retained

earnings | | |

Total | |

| Balances as of January 1, 2023 | |

| |

| 1,196,980 | | |

| 1,196,980 | | |

| 132,011 | | |

| 29,974 | | |

| 1,142,092 | | |

| (97,193 | ) | |

| (1,341,282 | ) | |

| 1,062,582 | |

| Loss for the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (18,987 | ) | |

| (18,987 | ) |

| Exchange difference from net investment in a foreign operation | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (153 | ) | |

| - | | |

| (153 | ) |

| Share of the profit or loss of

associates and joint ventures accounted for using the equity method | |

10 A | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 662 | | |

| - | | |

| 662 | |

| Comprehensive income of the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 509 | | |

| (18,987 | ) | |

| (18,478 | ) |

| Balances as of March 31, 2023 | |

| |

| 1,196,980 | | |

| 1,196,980 | | |

| 132,011 | | |

| 29,974 | | |

| 1,142,092 | | |

| (96,684 | ) | |

| (1,360,269 | ) | |

| 1,044,104 | |

| Balances as of January 1, 2024 | |

| |

| 1,371,965 | | |

| 1,371,965 | | |

| - | | |

| - | | |

| - | | |

| (68,283 | ) | |

| (40,575 | ) | |

| 1,263,107 | |

| Loss for the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (16,156 | ) | |

| (16,156 | ) |

| Exchange difference from net investment in a

foreign operation | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 25 | | |

| - | | |

| 25 | |

| Share of the profit or loss of associates and joint ventures accounted for using the equity method | |

10 A | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,519 | | |

| - | | |

| 4,519 | |

| Comprehensive income of the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,544 | | |

| (16,156 | ) | |

| (11,612 | ) |

| Balances as of March 31, 2024 | |

| |

| 1,371,965 | | |

| 1,371,965 | | |

| - | | |

| - | | |

| - | | |

| (63,739 | ) | |

| (56,731 | ) | |

| 1,251,495 | |

The accompanying notes ar part of the separated financial

statements

USO INTERNO

AENZA S.A.A.

INTERIM SEPARATED STATEMENT OF CASH FLOWS

(all amounts in thousands of S/ unless otherwise indicated)

| | |

| |

For the three-month period | |

| | |

| |

ended March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| Operating activities | |

| |

| | |

| |

| Loss before income tax | |

| |

| (15,617 | ) | |

| (16,291 | ) |

| Adjustments to profit not affecting cash flows from | |

| |

| | | |

| | |

| operating activities: | |

| |

| | | |

| | |

| Depreciation | |

11 C | |

| 2,535 | | |

| 2,509 | |

| Amortization of intangible assets | |

| |

| 142 | | |

| 111 | |

| Right-of-use adjustments | |

19 | |

| (535 | ) | |

| (459 | ) |

| Administrative penalties | |

19 | |

| - | | |

| 207 | |

| Financial expense,net | |

18 | |

| 7,387 | | |

| 20,860 | |

| Interests for present value of financial asset or liability | |

18 | |

| (244 | ) | |

| 1,855 | |

| Exchange difference from operating activities | |

| |

| (669 | ) | |

| (637 | ) |

| Share of the profit or loss of associates and joint ventures | |

10 A | |

| 7,173 | | |

| (9,285 | ) |

| Net variations in assets and liabilities: | |

| |

| | | |

| | |

| Trade accounts receivable | |

| |

| (1,262 | ) | |

| (734 | ) |

| Other accounts receivable | |

| |

| (34,115 | ) | |

| (1,761 | ) |

| Other accounts receivable from related parties | |

| |

| (3,136 | ) | |

| (1,731 | ) |

| Prepaid expenses and other assets | |

| |

| (116 | ) | |

| (1,434 | ) |

| Trade accounts payable | |

| |

| (3,244 | ) | |

| (1,817 | ) |

| Other accounts payable | |

| |

| 22,125 | | |

| (1,952 | ) |

| Other accounts payable to related parties | |

| |

| 4,016 | | |

| (1,632 | ) |

| Income tax paid | |

16 | |

| (1,367 | ) | |

| (173 | ) |

| Interest paid | |

| |

| (13,372 | ) | |

| (17,562 | ) |

| Net cash applied to operating activities | |

| |

| (30,299 | ) | |

| (29,926 | ) |

| Investing activities | |

| |

| | | |

| | |

| Dividends received | |

10.A.c | |

| 20,691 | | |

| 12,630 | |

| Acquisition of property, plant and equipment | |

| |

| (88 | ) | |

| - | |

| Loans provided to subsidiaries | |

8.C | |

| (55,568 | ) | |

| (19,851 | ) |

| Collection of loans and interest from subsidiaries | |

8.C | |

| 56,304 | | |

| 761 | |

| Collection of interests on time deposits | |

18 | |

| 2,821 | | |

| 2,061 | |

| Net cash provided (applied) to investing activities | |

| |

| 24,160 | | |

| (4,399 | ) |

| Financing activities | |

| |

| | | |

| | |

| Borrowings received | |

| |

| | | |

| | |

| Payment of borrowings | |

12 e | |

| (4,346 | ) | |

| (1,926 | ) |

| Payment of right-of-use liability | |

12 e | |

| (1,186 | ) | |

| (1,534 | ) |

| Interest received from related entities | |

| |

| (47 | ) | |

| - | |

| Net cash applied to financing activities | |

| |

| (5,579 | ) | |

| (3,460 | ) |

| Net decrease in cash and equivalents | |

| |

| (11,718 | ) | |

| (37,785 | ) |

| Exchange difference | |

| |

| 669 | | |

| 637 | |

| Cash and cash equivalents at the beginning of the period | |

| |

| 184,899 | | |

| 164,224 | |

| Cash and cash equivalents at the end of the period | |

7 | |

| 173,850 | | |

| 127,076 | |

| Non-cash transactions: | |

| |

| | | |

| | |

| Offsetting of dividends receivable | |

10.A.c | |

| 5,710 | | |

| 7,320 | |

| Offsetting of loans received from related parties | |

8.C | |

| (564 | ) | |

| - | |

The accompanying notes ar part of the separated financial statements

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has

duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| AENZA S.A.A. |

|

| |

|

|

| By: |

/s/ CRISTIAN RESTREPO HERNANDEZ |

|

| Name: |

Cristian Restrepo Hernandez |

|

| Title: |

VP of Corporate Finance |

|

| Date: |

April 30, 2024 |

|

7

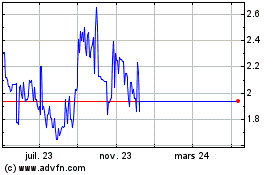

Aenza SAA (NYSE:AENZ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Aenza SAA (NYSE:AENZ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024