- GAAP Highlights:

- Net income attributable to Assured Guaranty Ltd. was $171

million, or $3.17 per share(1), for third quarter 2024.

- Shareholders’ equity attributable to Assured Guaranty Ltd. per

share was $111.09 as of September 30, 2024.

- Gross written premiums (GWP) were $61 million for third quarter

2024.

- Non-GAAP Highlights:

- Adjusted operating income(2) was $130 million, or $2.42 per

share, for third quarter 2024.

- Adjusted operating shareholders’ equity(2) per share and

adjusted book value (ABV)(2) per share were $113.96 and $166.47,

respectively, as of September 30, 2024.

- Present value of new business production (PVP)(2) was $63

million for third quarter 2024.

- Return of Capital to Shareholders:

- Third quarter 2024 capital returned to shareholders was $147

million including share repurchases of $131 million and dividends

of $16 million.

- Share repurchase authorization was increased by $250 million on

November 8, 2024.

Assured Guaranty Ltd. (NYSE: AGO) (AGL and, together with its

subsidiaries, Assured Guaranty or the Company) announced today its

financial results for the three-month period ended September 30,

2024 (third quarter 2024).

“Assured Guaranty has continued to build both shareholder and

policyholder value this year,” said Dominic Frederico, President

and CEO. “Shareholders’ equity per share on September 30, 2024 was

a record $111.09. Adjusted book value per share also set a record

at $166.47, as did adjusted operating shareholders’ equity per

share at $113.96. For the first three quarters, net income has

increased to $6.44 per share, up 8% year-over-year, and adjusted

operating income reached $5.80 per share, up 13%

year-over-year.

“New business production has been strong this year. GWP and PVP

for the first three quarters reached $254 million and $281 million,

respectively, which were $33 million and $32 million higher than

for last year’s comparable period. Municipal production benefited

from greater overall issuance and solid investor demand. We also

saw significant contributions from our non-U.S. public finance and

global structured finance businesses. After the merger of AGM into

AG (formerly AGC) in the third quarter, we believe the new AG is

positioned for significant growth, as we pursue further expansion

into new product and geographic markets.

“In our capital management program, as of November 8, 2024, the

Company had repurchased 10% of the shares that were outstanding on

December 31, 2023, and in November our board authorized an

additional $250 million of share repurchases.”

(1)

All per share information for net income

and adjusted operating income is based on diluted shares.

(2)

Please see “Explanation of Non-GAAP

Financial Measures.”

Summary Financial

Results

(in millions, except per share

amounts)

Quarter Ended

September 30,

2024

2023

GAAP (1)

Net income (loss) attributable to

AGL

$

171

$

157

Net income (loss) attributable to AGL

per diluted share

$

3.17

$

2.60

Weighted average diluted shares

53.4

59.6

Non-GAAP

Adjusted operating income (loss) (2)

$

130

$

206

Adjusted operating income per diluted

share (2)

$

2.42

$

3.42

Weighted average diluted shares

53.4

59.6

Gain (loss) related to FG VIE and CIV

consolidation (3) included in adjusted operating income

$

(7

)

$

(8

)

Gain (loss) related to FG VIE and CIV

consolidation included in adjusted operating income per share

$

(0.12

)

$

(0.13

)

Components of total adjusted operating

income (loss)

Insurance segment

$

162

$

59

Asset Management segment

4

—

Corporate division

(29

)

155

Other

(7

)

(8

)

Adjusted operating income (loss)

$

130

$

206

As of

September 30, 2024

December 31, 2023

Amount

Per Share

Amount

Per Share

Shareholders’ equity attributable to

AGL

$

5,728

$

111.09

$

5,713

$

101.63

Adjusted operating shareholders’ equity

(2)

5,875

113.96

5,990

106.54

ABV (2)

8,582

166.47

8,765

155.92

Common Shares Outstanding

51.6

56.2

________________________________________________

(1)

Generally accepted accounting principles

in the United States of America.

(2)

Please see “Explanation of Non-GAAP

Financial Measures” at the end of this press release.

(3)

The effect of consolidating financial

guaranty (FG) variable interest entities (VIEs) and consolidated

investment vehicles (CIVs).

On a per share basis, shareholders’ equity attributable to AGL

increased to $111.09 as of September 30, 2024 from $101.63 as of

December 31, 2023, primarily due to net income, unrealized gains in

the investment portfolio and share repurchases, partially offset by

dividends. On a per share basis, ABV increased to $166.47 primarily

due to adjusted operating income, new business production and share

repurchases, partially offset by dividends.

Insurance Segment

The Insurance segment primarily consists of (i) the Company’s

insurance subsidiaries that provide credit protection products to

the United States (U.S.) and non-U.S. public finance (including

infrastructure) and structured finance markets, excluding the

effect of VIE consolidations, and (ii) Assured Guaranty Inc.’s (AG,

formerly Assured Guaranty Corp.) investment subsidiary.

Insurance Segment New Business Production

Insurance Segment

New Business

Production

(in millions)

Quarter Ended September

30,

2024

2023

GWP

PVP (1)

Gross Par Written (2)

GWP

PVP (1)

Gross Par Written (2)

Public finance - U.S.

$

35

$

34

$

5,387

$

29

$

30

$

5,098

Public finance - non-U.S.

7

10

665

(5

)

2

61

Structured finance - U.S.

4

5

551

15

12

267

Structured finance - non-U.S.

15

14

834

1

2

522

Total

$

61

$

63

$

7,437

$

40

$

46

$

5,948

________________________________________________

(1)

PVP, a non-GAAP financial measure,

measures the value of the Insurance segment’s new business

production for all contracts regardless of form or GAAP accounting

model. See “Explanation of Non-GAAP Financial Measures” at the end

of this press release. PVP is based on “close date,” when the

transaction settles. PVP was discounted at 5.0% in third quarter

2024 and 4.0% in the three-month period ended September 30, 2023

(third quarter 2023).

(2)

Gross Par Written is based on “close

date,” when the transaction settles.

U.S. public finance GWP and PVP in third quarter 2024 were

higher than the comparable GWP and PVP in third quarter 2023,

primarily due to an increase in insured par and higher premium

rates on primary market transactions. The Company’s direct par

written represented 60% of the total U.S. municipal market insured

issuance in third quarter 2024, compared with 61% in third quarter

2023, and the Company’s penetration of all municipal issuance was

4.2% in third quarter 2024 compared with 4.6% in third quarter

2023.

In third quarter 2024, non-U.S. public finance GWP and PVP were

higher than GWP and PVP in third quarter 2023, primarily due to

guaranties of several United Kingdom (U.K.) regulated utility and

airport transactions in third quarter 2024.

Global structured finance GWP and PVP in third quarter 2024 were

higher than the comparable GWP and PVP in third quarter 2023. In

third quarter 2024, the Company insured a transaction in Australia

that provided protection on an approximately $600 million core

lending portfolio for an Australian bank.

Insurance Segment Adjusted Operating Income

Insurance segment adjusted operating income increased to $162

million in third quarter 2024 from $59 million in third quarter

2023, primarily due to a benefit in loss expense in third quarter

2024. This was offset in part by lower net investment income and a

$6 million write-off of insurance licenses in connection with the

merger of the U.S. insurance subsidiaries Assured Guaranty

Municipal Corp. and AG on August 1, 2024.

Insurance Segment

Results

(in millions)

Quarter Ended

September 30,

2024

2023

Segment revenues

Net earned premiums and credit derivative

revenues

$

101

$

99

Net investment income

82

101

Fair value gains (losses) on trading

securities

9

4

Foreign exchange gains (losses) on

remeasurement

1

(2

)

Other income (loss)

11

6

Total segment revenues

204

208

Segment expenses

Loss expense (benefit)

(53

)

101

Amortization of deferred acquisition costs

(DAC)

5

4

Employee compensation and benefit

expenses

40

37

Other operating expenses

36

23

Total segment expenses

28

165

Equity in earnings (losses) of

investees

28

25

Segment adjusted operating income

(loss) before income taxes

204

68

Less: Provision (benefit) for income

taxes

42

9

Segment adjusted operating income

(loss)

$

162

$

59

The components of the Insurance segment’s premiums, losses and

income from the investment portfolio are presented below.

Insurance Segment Net Earned Premiums and Credit Derivative

Revenues

Insurance Segment

Net Earned Premiums and Credit

Derivative Revenues

(in millions)

Quarter Ended

September 30,

2024

2023

Scheduled net earned premiums and credit

derivative revenues

$

87

$

84

Accelerations

14

15

Total

$

101

$

99

Insurance Segment Loss Expense (Benefit) and the Roll Forward of

Expected Losses

Loss expense is a function of net economic loss development

(benefit) and deferred premium revenue. The difference between loss

expense and economic development in a given period represents the

amount of deferred premium revenue absorbing expected losses to be

paid.

Insurance Segment

Loss Expense (Benefit)

(in millions)

Quarter Ended

September 30,

2024

2023

Public finance

$

(8

)

$

138

U.S. residential mortgage-backed

securities (RMBS)

(44

)

(38

)

Other structured finance

(1

)

1

Total

$

(53

)

$

101

The table below presents the roll forward of net expected losses

for third quarter 2024.

Roll Forward of Net Expected

Loss to be Paid (Recovered) (1)

(in millions)

Net Expected Loss to be Paid

(Recovered) as of June 30, 2024

Net Economic Loss

Development (Benefit)

Net (Paid) Recovered

Losses

Net Expected Loss to be Paid

(Recovered) as of September 30, 2024

Public finance

$

411

$

23

$

(115

)

$

319

U.S. RMBS

—

(56

)

10

(46

)

Other structured finance

36

(1

)

(2

)

33

Total

$

447

$

(34

)

$

(107

)

$

306

________________________________________________

(1)

Net economic loss development (benefit)

represents the change in net expected loss to be paid (recovered)

attributable to the effects of changes in the economic performance

of insured transactions, changes in assumptions based on observed

market trends, changes in discount rates, accretion of discount and

the economic effects of loss mitigation efforts, each net of

reinsurance. Net economic loss development (benefit) is the

principal measure that the Company uses to evaluate the loss

experience in its insured portfolio. Expected loss to be paid

(recovered) includes all transactions insured by the Company,

regardless of the accounting model prescribed under GAAP and

without consideration of deferred premium revenue.

The net economic benefit was $34 million in third quarter 2024,

and was primarily attributable to improved recovery assumptions in

U.S. RMBS and improvements in certain healthcare transactions,

offset in part by an increase in expected losses on certain U.K.

regulated utilities. The effect of changes in risk-free rates used

to discount expected losses was a loss of $3 million.

Insurance Segment Income from Investment Portfolio

Insurance Segment

Income from Investment

Portfolio

(in millions)

Quarter Ended

September 30,

2024

2023

Net investment income

$

82

$

101

Fair value gains (losses) on trading

securities (1)

9

4

Equity in earnings (losses) of investees

(2)

28

25

Total

$

119

$

130

________________________________________________

(1)

Primarily includes contingent value

instruments issued by Puerto Rico.

(2)

Equity in earnings (losses) of investees

primarily relates to funds managed by Sound Point Capital

Management, LP and certain of its investment management

subsidiaries (Sound Point) and Assured Healthcare Partners, LLC

(AHP). Investments in funds are reported on a one-quarter lag.

Net investment income, which represents interest income on

available-for-sale fixed-maturity debt and short-term investments,

decreased to $82 million in third quarter 2024 from $101 million in

third quarter 2023 primarily due to lower income on loss mitigation

securities.

As of September 30, 2024, the Insurance segment had $720 million

in alternative investments. In the Insurance segment, alternative

investments consist primarily of funds managed by Sound Point and

AHP, and are generally recorded at net asset value (NAV), with

changes in NAV reported in “equity in earnings (losses) of

investees.” Equity in earnings of investees is more volatile than

net investment income on available-for-sale fixed-maturity

securities and short-term investments. To the extent that the

amounts invested in alternative fund investments increase and

available-for-sale fixed-maturity securities decrease, net

investment income may decline and mark-to-market volatility related

to equity in earnings of investees may increase.

The inception-to-date annualized internal rate of return for all

alternative investments, which are primarily in the Insurance

segment and Corporate division, was approximately 13%.

Asset Management Segment

Since July 2023, the Company participates in the asset

management business through its ownership interest in Sound Point.

In third quarter 2024 asset management adjusted operating income of

$4 million was primarily due to the Company’s ownership interest in

Sound Point, including the amortization of intangible assets, as

well as certain ongoing performance fees. Sound Point’s results are

reported on a one quarter lag and are included in “equity in

earnings (losses) of investees.”

Corporate Division

Corporate Division

Results

(in millions)

Quarter Ended

September 30,

2024

2023

Revenues

Gain on sale of asset management

subsidiaries

$

—

$

255

Other

4

4

Total revenues

4

259

Expenses

Interest expense

24

26

Employee compensation and benefit

expenses

7

10

Other operating expenses

6

21

Total expenses

37

57

Adjusted operating income (loss) before

income taxes

(33

)

202

Less: Provision (benefit) for income

taxes

(4

)

47

Adjusted operating income

(loss)

$

(29

)

$

155

Corporate division adjusted operating income in third quarter

2023 included a pre-tax gain resulting from the Sound Point and AHP

transactions of $241 million, which was net of $14 million in

transaction costs (primarily advisory and legal expenses reported

in other operating expenses).

As part of the share redemption that occurred on August 5, 2024,

AG transferred certain alternative investments to Assured Guaranty

Municipal Holdings Inc., whose results are now reported in the

corporate division.

Reconciliation to GAAP

The following table presents a reconciliation of net income

(loss) attributable to AGL to adjusted operating income (loss).

Reconciliation of Net Income

(Loss) Attributable to AGL to

Adjusted Operating Income

(Loss)

(in millions, except per share

amounts)

Quarter Ended

September 30,

2024

2023

Total

Per Diluted Share

Total

Per Diluted Share

Net income (loss) attributable to

AGL

$

171

$

3.17

$

157

$

2.60

Less pre-tax adjustments:

Realized gains (losses) on investments

—

—

(9

)

(0.16

)

Non-credit impairment-related unrealized

fair value gains (losses) on credit derivatives

(2

)

(0.03

)

6

0.12

Fair value gains (losses) on committed

capital securities (CCS)

(3

)

(0.06

)

(20

)

(0.33

)

Foreign exchange gains (losses) on

remeasurement of premiums receivable and loss and loss adjustment

expense (LAE) reserves

54

1.00

(37

)

(0.61

)

Total pre-tax adjustments

49

0.91

(60

)

(0.98

)

Less tax effect on pre-tax adjustments

(8

)

(0.16

)

11

0.16

Adjusted operating income (loss)

$

130

$

2.42

$

206

$

3.42

Gain (loss) related to FG VIE and CIV

consolidation included in adjusted operating income

$

(7

)

$

(0.12

)

$

(8

)

$

(0.13

)

Non-credit impairment-related unrealized fair value gains on

credit derivatives in third quarter 2023 were primarily generated

by lower collateral asset spreads. Except for credit impairment,

the fair value adjustments on credit derivatives in the insured

portfolio are non-economic adjustments that reverse to zero over

the remaining term of that portfolio.

Fair value losses on CCS in both periods were primarily due to a

tightening in market spreads. Fair value of CCS is heavily affected

by, and in part fluctuates with, changes in market interest rates,

credit spreads and other market factors and is not expected to

result in an economic gain or loss.

Foreign exchange gains (losses) primarily relate to the

remeasurement of premiums receivable and are mainly due to changes

in the exchange rate relative to the U.S. dollar of the pound

sterling and, to a lesser extent, the euro.

Common Share Repurchases

On November 8, 2024, AGL’s Board of Directors (the Board)

authorized the repurchase of an additional $250 million of the

Company’s common shares. From the beginning of the repurchase

program in 2013 through November 8, 2024, the Company has

repurchased a total of 150 million common shares for $5.3 billion,

representing approximately 77% of the total shares outstanding as

of January 1, 2013. As of November 8, 2024, the Company was

authorized to purchase approximately $385 million of its common

shares. These repurchases can be made from time to time in the open

market or in privately negotiated transactions.

Summary of Share

Repurchases

(in millions, except per share

amounts)

Amount (1)

Number of Shares

Average Price Per

Share

2024 (January 1 - March 31)

$

129

1.54

$

84.07

2024 (April 1 - June 30)

152

1.93

78.50

2024 (July 1 - September 30)

131

1.66

78.87

2024 (October 1- November 8)

58

0.69

83.61

Total 2024

$

470

5.82

80.69

________________________________________________

(1)

Excludes commissions and excise taxes.

The timing, form and amount of the share repurchases under the

program are at the discretion of management and will depend on a

variety of factors, including funds available at the parent

company, other potential uses for such funds, market conditions,

the Company’s capital position, legal requirements and other

factors. The repurchase program may be modified, extended or

terminated by the Board at any time. It does not have an expiration

date.

Financial Statements

Condensed Consolidated

Statements of Operations (unaudited)

(in millions)

Quarter Ended

September 30,

2024

2023

Revenues

Net earned premiums

$

97

$

95

Net investment income

82

100

Net realized investment gains (losses)

—

(9

)

Fair value gains (losses) on credit

derivatives

3

9

Fair value gains (losses) on CCS

(3

)

(20

)

Fair value gains (losses) on FG VIEs

(7

)

6

Fair value gains (losses) on CIVs

21

(4

)

Foreign exchange gain (loss) on

remeasurement

55

(39

)

Fair value gains (losses) on trading

securities

9

4

Gain on sale of asset management

subsidiaries

—

255

Other income (loss)

12

6

Total revenues

269

403

Expenses

Loss and LAE (benefit)

(51

)

100

Interest expense

22

24

Amortization of DAC

5

4

Employee compensation and benefit

expenses

47

47

Other operating expenses

44

44

Total expenses

67

219

Income (loss) before income taxes and

equity in earnings (losses) of investees

202

184

Equity in earnings (losses) of

investees

18

18

Income (loss) before income

taxes

220

202

Less: Provision (benefit) for income

taxes

44

43

Net income (loss)

176

159

Less: Noncontrolling interests

5

2

Net income (loss) attributable to

AGL

$

171

$

157

Condensed Consolidated Balance

Sheets (unaudited)

(in millions)

As of

September 30, 2024

December 31, 2023

Assets

Investments:

Fixed-maturity securities

available-for-sale, at fair value

$

6,284

$

6,307

Fixed-maturity securities, trading, at

fair value

163

318

Short-term investments, at fair value

1,487

1,661

Other invested assets

912

829

Total investments

8,846

9,115

Cash

147

97

Premiums receivable, net of commissions

payable

1,513

1,468

DAC

172

161

Salvage and subrogation recoverable

412

298

FG VIEs’ assets

156

328

Assets of CIVs

359

366

Other assets

686

706

Total assets

$

12,291

$

12,539

Liabilities

Unearned premium reserve

$

3,631

$

3,658

Loss and LAE reserve

253

376

Long-term debt

1,698

1,694

Credit derivative liabilities, at fair

value

39

53

FG VIEs’ liabilities, at fair value

392

554

Other liabilities

496

439

Total liabilities

6,509

6,774

Shareholders’ equity

Common shares

1

1

Retained earnings

5,957

6,070

Accumulated other comprehensive income

(loss)

(231

)

(359

)

Deferred equity compensation

1

1

Total shareholders’ equity attributable

to AGL

5,728

5,713

Nonredeemable noncontrolling interests

54

52

Total shareholders’ equity

5,782

5,765

Total liabilities and shareholders’

equity

$

12,291

$

12,539

Explanation of Non-GAAP Financial Measures

The Company discloses both: (i) financial measures determined in

accordance with GAAP; and (ii) financial measures not determined in

accordance with GAAP (non-GAAP financial measures). Financial

measures identified as non-GAAP should not be considered

substitutes for GAAP financial measures. The primary limitation of

non-GAAP financial measures is the potential lack of comparability

to financial measures of other companies, whose definitions of

non-GAAP financial measures may differ from those of the

Company.

The Company believes its presentation of non-GAAP financial

measures provides information that is necessary for analysts to

calculate their estimates of Assured Guaranty’s financial results

in their research reports on Assured Guaranty and for investors,

analysts and the financial news media to evaluate Assured

Guaranty’s financial results.

GAAP requires the Company to consolidate entities where it is

deemed to be the primary beneficiary which include:

- FG VIEs, which the Company does not own and where its exposure

is limited to its obligation under the financial guaranty insurance

contract, and

- CIVs in which certain subsidiaries invest.

The Company discloses the effect of FG VIE and CIV consolidation

that is embedded in each non-GAAP financial measure, as applicable.

The Company believes this information may also be useful to

analysts and investors evaluating Assured Guaranty’s financial

results. In the case of both the consolidated FG VIEs and the CIVs,

the economic effect on the Company of each of the consolidated FG

VIEs and CIVs is reflected primarily in the results of the

Insurance segment.

Management of the Company and AGL’s Board of Directors use

non-GAAP financial measures further adjusted to remove the effect

of FG VIE and CIV consolidation (which the Company refers to as its

core financial measures), as well as GAAP financial measures and

other factors, to evaluate the Company’s results of operations,

financial condition and progress towards long-term goals. The

Company uses core financial measures in its decision-making process

for and in its calculation of certain components of management

compensation. The financial measures that the Company uses to help

determine compensation are: (1) adjusted operating income, further

adjusted to remove the effect of FG VIE and CIV consolidation; (2)

adjusted operating shareholders’ equity, further adjusted to remove

the effect of FG VIE and CIV consolidation; (3) adjusted book value

per share, further adjusted to remove the effect of FG VIE and CIV

consolidation; and (4) PVP.

Management believes that many investors, analysts and financial

news reporters use adjusted operating shareholders’ equity and/or

adjusted book value, each further adjusted to remove the effect of

FG VIE and CIV consolidation, as the principal financial measures

for valuing AGL’s current share price or projected share price and

also as the basis of their decision to recommend, buy or sell AGL’s

common shares. Management also believes that many of the Company’s

fixed income investors also use adjusted operating shareholders’

equity, further adjusted to remove the effect of FG VIE and CIV

consolidation, to evaluate the Company’s capital adequacy.

Adjusted operating income, further adjusted for the effect of FG

VIE and CIV consolidation, enables investors and analysts to

evaluate the Company’s financial results in comparison with the

consensus analyst estimates distributed publicly by financial

databases.

The following paragraphs define each non-GAAP financial measure

disclosed by the Company and describe why it is useful. To the

extent there is a directly comparable GAAP financial measure, a

reconciliation of the non-GAAP financial measure and the most

directly comparable GAAP financial measure is presented below.

Adjusted Operating Income

Management believes that adjusted operating income is a useful

measure because it clarifies the understanding of the operating

results of the Company. Adjusted operating income is defined as net

income (loss) attributable to AGL, as reported under GAAP, adjusted

for the following:

1) Elimination of realized gains (losses) on

the Company’s investments, except for gains and losses on

securities classified as trading. The timing of realized gains and

losses, which depends largely on market credit cycles, can vary

considerably across periods. The timing of sales is largely subject

to the Company’s discretion and influenced by market opportunities,

as well as the Company’s tax and capital profile.

2) Elimination of non-credit

impairment-related unrealized fair value gains (losses) on credit

derivatives that are recognized in net income, which is the amount

of unrealized fair value gains (losses) in excess of the present

value of the expected estimated economic credit losses, and

non-economic payments. Such fair value adjustments are heavily

affected by, and in part fluctuate with, changes in market interest

rates, the Company’s credit spreads, and other market factors and

are not expected to result in an economic gain or loss.

3) Elimination of fair value gains (losses)

on the Company’s CCS that are recognized in net income. Such

amounts are affected by changes in market interest rates, the

Company’s credit spreads, price indications on the Company’s

publicly traded debt and other market factors and are not expected

to result in an economic gain or loss.

4) Elimination of foreign exchange gains

(losses) on remeasurement of net premium receivables and loss and

LAE reserves that are recognized in net income. Long-dated

receivables and loss and LAE reserves represent the present value

of future contractual or expected cash flows. Therefore, the

current period’s foreign exchange remeasurement gains (losses) are

not necessarily indicative of the total foreign exchange gains

(losses) that the Company will ultimately recognize.

5) The tax effects related to the above

adjustments, which are determined by applying the statutory tax

rate in each of the jurisdictions that generate these

adjustments.

See “Reconciliation to GAAP” above for a reconciliation of net

income (loss) attributable to AGL to adjusted operating income

(loss).

Adjusted Operating Shareholders’ Equity and Adjusted Book

Value

Management believes that adjusted operating shareholders’ equity

is a useful measure because it excludes the fair value adjustments

on investments, credit derivatives and CCS that are not expected to

result in economic gain or loss.

Adjusted operating shareholders’ equity is defined as

shareholders’ equity attributable to AGL, as reported under GAAP,

adjusted for the following:

1) Elimination of non-credit

impairment-related unrealized fair value gains (losses) on credit

derivatives, which is the amount of unrealized fair value gains

(losses) in excess of the present value of the expected estimated

economic credit losses, and non-economic payments. Such fair value

adjustments are heavily affected by, and in part fluctuate with,

changes in market interest rates, credit spreads and other market

factors and are not expected to result in an economic gain or

loss.

2) Elimination of fair value gains (losses)

on the Company’s CCS. Such amounts are affected by changes in

market interest rates, the Company’s credit spreads, price

indications on the Company’s publicly traded debt and other market

factors and are not expected to result in an economic gain or

loss.

3) Elimination of unrealized gains (losses)

on the Company’s investments that are recorded as a component of

accumulated other comprehensive income (AOCI). The AOCI component

of the fair value adjustment on the investment portfolio is not

deemed economic because the Company generally holds these

investments to maturity and therefore would not recognize an

economic gain or loss.

4) The tax effects related to the above

adjustments, which are determined by applying the statutory tax

rate in each of the jurisdictions that generate these

adjustments.

Management uses adjusted book value, further adjusted to remove

the effect of FG VIE and CIV consolidation, to measure the

intrinsic value of the Company, excluding franchise value. Adjusted

book value per share, further adjusted for FG VIE and CIV

consolidation (core adjusted book value), is one of the key

financial measures used in determining the amount of certain

long-term compensation elements to management and employees and

used by rating agencies and investors. Management believes that

adjusted book value is a useful measure because it enables an

evaluation of the Company’s in-force premiums and revenues net of

expected losses. Adjusted book value is adjusted operating

shareholders’ equity, as defined above, further adjusted for the

following:

1) Elimination of deferred acquisition costs,

net. These amounts represent net deferred expenses that have

already been paid or accrued and will be expensed in future

accounting periods.

2) Addition of the net present value of

estimated net future revenue. See below.

3) Addition of the deferred premium revenue

on financial guaranty contracts in excess of expected loss to be

expensed, net of reinsurance. This amount represents the present

value of the expected future net earned premiums, net of the

present value of expected losses to be expensed, which are not

reflected in GAAP equity.

4) The tax effects related to the above

adjustments, which are determined by applying the statutory tax

rate in each of the jurisdictions that generate these

adjustments.

The unearned premiums and revenues included in adjusted book

value will be earned in future periods, but actual earnings may

differ materially from the estimated amounts used in determining

current adjusted book value due to changes in foreign exchange

rates, prepayment speeds, terminations, credit defaults and other

factors.

Reconciliation of

Shareholders’ Equity Attributable to AGL to

Adjusted Operating

Shareholders’ Equity and ABV

(in millions, except per share

amounts)

As of

September 30, 2024

December 31, 2023

Total

Per Share

Total

Per Share

Shareholders’ equity attributable to

AGL

$

5,728

$

111.09

$

5,713

$

101.63

Less pre-tax adjustments:

Non-credit impairment-related unrealized

fair value gains (losses) on credit derivatives

45

0.89

34

0.61

Fair value gains (losses) on CCS

1

0.02

13

0.22

Unrealized gain (loss) on investment

portfolio

(211

)

(4.10

)

(361

)

(6.40

)

Less taxes

18

0.32

37

0.66

Adjusted operating shareholders’

equity

5,875

113.96

5,990

106.54

Pre-tax adjustments:

Less: DAC

172

3.33

161

2.87

Plus: Net present value of estimated net

future revenue

189

3.67

199

3.54

Plus: Net deferred premium revenue on

financial guaranty contracts in excess of expected loss to be

expensed

3,370

65.35

3,436

61.12

Plus taxes

(680

)

(13.18

)

(699

)

(12.41

)

ABV

$

8,582

$

166.47

$

8,765

$

155.92

Gain (loss) related to FG VIE and CIV

consolidation included in:

Adjusted operating shareholders’

equity

$

(5

)

$

(0.08

)

$

5

$

0.07

ABV

(9

)

(0.17

)

—

—

Shares outstanding at the end of the

period

51.6

56.2

Net Present Value of Estimated Net Future Revenue

Management believes that this amount is a useful measure because

it enables an evaluation of the present value of estimated net

future revenue for non-financial guaranty insurance contracts. This

amount represents the net present value of estimated future revenue

from these contracts (other than credit derivatives with net

expected losses), net of reinsurance, ceding commissions and

premium taxes.

Future installment premiums are discounted at the approximate

average pre-tax book yield of fixed-maturity securities purchased

during the prior calendar year, other than Loss Mitigation

Securities. The discount rate is recalculated annually and updated

as necessary. Net present value of estimated future revenue for an

obligation may change from period to period due to a change in the

discount rate or due to a change in estimated net future revenue

for the obligation, which may change due to changes in foreign

exchange rates, prepayment speeds, terminations, credit defaults or

other factors that affect par outstanding or the ultimate maturity

of an obligation. There is no corresponding GAAP financial

measure.

PVP or Present Value of New Business Production

Management believes that PVP is a useful measure because it

enables the evaluation of the value of new business production in

the Insurance segment by taking into account the value of estimated

future installment premiums on all new contracts underwritten in a

reporting period as well as additional installment premiums and

fees on existing contracts (which may result from supplements or

fees or from the issuer not calling an insured obligation the

Company projected would be called), regardless of form, which

management believes GAAP gross written premiums and changes in fair

value of credit derivatives do not adequately measure. PVP in

respect of contracts written in a specified period is defined as

gross upfront and installment premiums received and the present

value of gross estimated future installment premiums.

Future installment premiums are discounted at the approximate

average pre-tax book yield of fixed-maturity securities purchased

during the prior calendar year, other than certain fixed-maturity

securities such as Loss Mitigation Securities. The discount rate is

recalculated annually and updated as necessary. Under GAAP,

financial guaranty installment premiums are discounted at a

risk-free rate. Additionally, under GAAP, management records future

installment premiums on financial guaranty insurance contracts

covering non-homogeneous pools of assets based on the contractual

term of the transaction, whereas for PVP purposes, management

records an estimate of the future installment premiums the Company

expects to receive, which may be based upon a shorter period of

time than the contractual term of the transaction.

Actual installment premiums may differ from those estimated in

the Company’s PVP calculation due to factors including, but not

limited to, changes in foreign exchange rates, prepayment speeds,

terminations, credit defaults or other factors that affect par

outstanding or the ultimate maturity of an obligation.

Reconciliation of GWP to

PVP

(in millions)

Quarter Ended

September 30, 2024

Public Finance

Structured Finance

U.S.

Non - U.S.

U.S.

Non - U.S.

Total

GWP

$

35

$

7

$

4

$

15

$

61

Less: Installment GWP and other GAAP

adjustments (1)

2

(1

)

2

15

18

Upfront GWP

33

8

2

—

43

Plus: Installment premiums and other

(2)

1

2

3

14

20

PVP

$

34

$

10

$

5

$

14

$

63

Quarter Ended

September 30, 2023

Public Finance

Structured Finance

U.S.

Non - U.S.

U.S.

Non - U.S.

Total

GWP

$

29

$

(5

)

$

15

$

1

$

40

Less: Installment GWP and other GAAP

adjustments (1)

6

(5

)

15

1

17

Upfront GWP

23

—

—

—

23

Plus: Installment premiums and other

(2)

7

2

12

2

23

PVP

$

30

$

2

$

12

$

2

$

46

________________________________________________

(1)

Includes the present value of new business

on installment policies discounted at the prescribed GAAP discount

rates, GWP adjustments on existing installment policies due to

changes in assumptions and other GAAP adjustments.

(2)

Includes the present value of future

premiums and fees on new business paid in installments, discounted

at the approximate average pre-tax book yield of fixed-maturity

securities purchased during the prior calendar year, other than

certain fixed-maturity securities such as Loss Mitigation

Securities. Nine months 2023 also includes the present value of

future premiums and fees associated with other guaranties written

by the Company that, under GAAP, are accounted for under ASC 460,

Guarantees.

Conference Call and Webcast Information

The Company will host a conference call for investors at 8:00

a.m. Eastern Time (9:00 a.m. Atlantic Time) on Tuesday, November

12, 2024. The conference call will be available via live webcast in

the Investor Information section of the Company’s website at

AssuredGuaranty.com or by dialing 1-833-470-1428 (in the U.S.) or

1-404-975-4839 (International); the access code is 921215.

A replay of the conference call will be available approximately

three hours after the call ends. The webcast replay will be

available for 90 days in the Investor Information section of the

Company’s website at AssuredGuaranty.com and the telephone replay

will be available for 30 days by dialing 1-866-813-9403 (in the

U.S.) or 1-929-458-6194 (International); the access code is

946421.

Please refer to Assured Guaranty’s September 30, 2024 Financial

Supplement, which is posted on the Company's website at

assuredguaranty.com/agldata, for more information on the Company’s

financial guaranty portfolio, investment portfolio and other items.

In addition, the Company is posting at

assuredguaranty.com/presentations its “September 30, 2024 Equity

Investor Presentation.”

The Company plans to post by early next week on its website at

assuredguaranty.com/agldata the following:

- “Public Finance Transactions in 3Q 2024,” which lists the U.S.

public finance new issues insured by the Company in third quarter

2024, and

- “Structured Finance Transactions at September 30, 2024,” which

lists the Company’s structured finance exposure as of that

date.

In addition, the Company will post on its website, when

available, the Company’s separate-company subsidiary financial

supplements and its “Fixed Income Presentation” for the current

quarter. Those documents will be furnished to the Securities and

Exchange Commission in a Current Report on Form 8-K.

Assured Guaranty Ltd. is a publicly traded (NYSE: AGO),

Bermuda-based holding company. Through its subsidiaries, Assured

Guaranty provides credit enhancement products to the U.S. and

non-U.S. public finance, infrastructure and structured finance

markets. Assured Guaranty also participates in the asset management

business through its ownership interest in Sound Point Capital

Management, LP and certain of its investment management affiliates.

More information on Assured Guaranty Ltd. and its subsidiaries can

be found at AssuredGuaranty.com.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this press release

reflect the Company’s current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Such statements involve risks and uncertainties that may cause

actual results to differ materially from those set forth in these

statements. Among factors that could cause actual results to differ

adversely are:

(i) significant changes in inflation, interest rates, the

world’s credit markets or segments thereof, credit spreads, foreign

exchange rates or general economic conditions, including the

possibility of a recession or stagflation; (ii) geopolitical risk,

terrorism and political violence risk, including those arising out

of Russia’s invasion of Ukraine and intentional or accidental

escalation between The North Atlantic Treaty Organization (NATO)

and Russia, conflict in the Middle East and confrontation over

Iran’s nuclear program, the polarized political environment in the

United States (U.S.), and U.S. – China strategic competition; (iii)

cybersecurity risk and the impacts of artificial intelligence,

machine learning and other technological advances, including

potentially increasing the risks of malicious cyber attacks,

dissemination of misinformation, and disruption of markets; (iv)

the possibility of a U.S. government shutdown, payment defaults on

the debt of the U.S. government or instruments issued, insured or

guaranteed by related institutions, agencies or instrumentalities,

and downgrades to their credit ratings; (v) developments in the

world’s financial and capital markets, including stresses in the

financial condition of banking institutions in the U.S. and the

possibility that increasing participation of unregulated financial

institutions in these markets results in losses or lower valuations

of assets, reduced liquidity and credit and/or contraction of these

markets, that adversely affect repayment rates of insured obligors,

Assured Guaranty’s insurance loss or recovery experience, or

investments of Assured Guaranty; (vi) reduction in the amount of

available insurance opportunities and/or in the demand for Assured

Guaranty’s insurance; (vii) the possibility that budget or pension

shortfalls, difficulties in obtaining additional financing or other

factors will result in credit losses or liquidity claims on

obligations of state, territorial and local governments, their

related authorities, public corporations and other obligors that

Assured Guaranty insures or reinsures; (viii) insured losses,

including losses with respect to related legal proceedings, in

excess of those expected by Assured Guaranty or the failure of

Assured Guaranty to realize loss recoveries that are assumed in its

expected loss estimates for insurance exposures, including as a

result of the final resolution of Assured Guaranty’s Puerto Rico

Electric Power Authority (PREPA) exposure or the amounts recovered

on securities received in connection with the resolution of Puerto

Rico exposures already resolved; (ix) the impact of Assured

Guaranty satisfying its obligations under insurance policies with

respect to legacy insured Puerto Rico bonds; (x) the possibility

that underwriting insurance in new jurisdictions and/or covering

new sectors or classes of business does not result in the benefits

anticipated or subjects Assured Guaranty to negative consequences;

(xi) increased competition, including from new entrants into the

financial guaranty industry, nonpayment insurance and other forms

of capital saving or risk syndication available to banks and

insurers; (xii) the possibility that investments made by Assured

Guaranty for its investment portfolio, including alternative

investments, do not result in the benefits anticipated or subject

Assured Guaranty to reduced liquidity at a time it requires

liquidity, or to other negative or unanticipated consequences;

(xiii) the impacts of Assured Guaranty’s transactions with Sound

Point Capital Management, LP (Sound Point, LP) and certain of its

investment management affiliates (together with Sound Point, LP,

Sound Point) and/or Assured Healthcare Partners LLC (AHP) on

Assured Guaranty and its relationships with its shareholders,

regulators, rating agencies, employees and the obligors it insures

and on the asset management business contributed to Sound Point, LP

and on the business of AHP and their relationships with their

respective clients and employees; (xiv) the possibility that

strategic transactions made by Assured Guaranty, including the

transactions with Sound Point and/or AHP and/or merger of Assured

Guaranty Municipal Corp. (AGM) with and into Assured Guaranty Inc.

(AG, formerly Assured Guaranty Corp.), do not result in the

benefits anticipated or subject Assured Guaranty to negative

consequences; (xv) the inability to control the business,

management or policies of entities in which Assured Guaranty holds

a minority interest; (xvi) the impact of market volatility on the

fair value of Assured Guaranty’s assets and liabilities subject to

mark-to-market, including certain of its investments, contracts

accounted for as derivatives, its committed capital securities, its

consolidated investment vehicles and certain consolidated variable

interest entities (VIEs); (xvii) rating agency action, including a

ratings downgrade, a change in outlook, the placement of ratings on

watch for downgrade, or a change in rating criteria, at any time,

of AGL or any of its insurance subsidiaries, and/or of any

securities AGL or any of its subsidiaries have issued, and/or of

transactions that AGL’s insurance subsidiaries have insured;

(xviii) the inability of Assured Guaranty to access external

sources of capital on acceptable terms; (xix) changes in applicable

accounting policies or practices; (xx) changes in applicable laws

or regulations, including insurance, bankruptcy and tax laws, or

other governmental actions; (xxi) the possibility that legal or

regulatory decisions or determinations subject obligations that

Assured Guaranty insures or reinsures to negative consequences;

(xxii) difficulties with the execution of Assured Guaranty’s

business strategy; (xxiii) loss of key personnel; (xxiv) the

effects of mergers, acquisitions and divestitures; (xxv) public

health crises, including pandemics and endemics, and the

governmental and private actions taken in response to such events;

(xxvi) natural or man-made catastrophes; (xxvii) the impact of

climate change on Assured Guaranty’s business and regulatory

actions taken related to such risk; (xxviii) other risk factors

identified in AGL’s filings with the U.S. Securities and Exchange

Commission (SEC); (xxix) other risks and uncertainties that have

not been identified at this time; and (xxx) management’s response

to these factors.

Readers are cautioned not to place undue reliance on these

forward-looking statements. These forward-looking statements are

made as of November 11, 2024, and Assured Guaranty undertakes no

obligation to update publicly or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107954631/en/

Robert Tucker Senior Managing Director, Investor Relations and

Corporate Communications 212-339-0861 rtucker@agltd.com

Ashweeta Durani Director, Media Relations 212-408-6042

adurani@agltd.com

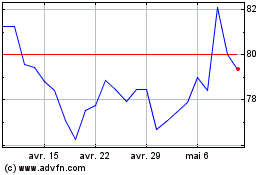

Assured Guaranty Municipal (NYSE:AGO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Assured Guaranty Municipal (NYSE:AGO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024