Schedule A

Executive Officers and Directors

The following sets forth the name, country of

citizenship, position and principal occupation of each executive officer and member of the board of directors of Tether Holdings, S.A. de C.V. and Tether Investments, S.A. de C.V.. Except as indicated below, none of the persons listed below has been convicted of a crime (other than

traffic violations or similar misdemeanors) or been subject to proceedings pertaining to violations of securities laws within the past

5 years.

Executive Officers and Directors of Tether Holdings, S.A. de C.V.:

| Name and Citizenship |

Position and Principal Occupation |

Beneficial Ownership |

Business Address |

| Giancarlo Devasini, citizen of Italy |

President |

20,398,699

(1)

| Final Av. La Revolucion,

Colonia San Benito, Edif.

Centro, Corporativo

Presidente Plaza, Nivel 12,

Oficina 2, Distrito de San

Salvador,

Municipio de San

Salvador Centro, Republica

de El Salvador |

| Ludovicus Jan Van der Velde, citizen of the Netherlands |

Alternate President |

0 |

Final Av. La Revolucion,

Colonia San Benito, Edif.

Centro, Corporativo

Presidente Plaza, Nivel 12,

Oficina 2, Distrito de San

Salvador,

Municipio de San

Salvador Centro, Republica

de El Salvador |

| Paolo Ardoino, citizen of Italy |

Secretary |

0 |

Final Av. La Revolucion,

Colonia San Benito, Edif.

Centro, Corporativo

Presidente Plaza, Nivel 12,

Oficina 2, Distrito de San

Salvador,

Municipio de San

Salvador Centro, Republica

de El Salvador |

| Josue Lopez, citizen of El Salvador |

Alternate Secretary |

0 |

Final Av. La Revolucion,

Colonia San Benito, Edif.

Centro, Corporativo

Presidente Plaza, Nivel 12,

Oficina 2, Distrito de San

Salvador, Municipio de San

Salvador Centro, Republica

de El Salvador |

Executive Officers and Directors of Tether Investments, S.A. de C.V.:

| Name and Citizenship |

Position and Principal Occupation |

Beneficial Ownership |

Business Address |

| Giancarlo Devasini, citizen of Italy |

Sole Administrator |

20,398,699

(1) |

Final Av. La Revolucion,

Colonia San Benito, Edif.

Centro, Corporativo

Presidente Plaza, Nivel 12,

Oficina 2, Distrito de San

Salvador, Municipio de San

Salvador Centro, Republica

de El Salvador |

| Paolo Ardoino, citizen of Italy |

Alternate Administrator |

0 |

Final Av. La Revolucion,

Colonia San Benito, Edif.

Centro, Corporativo

Presidente Plaza, Nivel 12,

Oficina 2, Distrito de San

Salvador, Municipio de San

Salvador Centro, Republica

de El Salvador |

| |

(1) |

Includes 20,398,699 common shares, par value $1.50 per share (“Common Shares”) of Adecoagro S.A. held by Tether Investments, S.A. de C.V., a wholly owned subsidiary of Tether Holdings, S.A. de C.V.. |

In October 2021, the U.S. Commodity Futures Trading

Commission (CFTC) instituted and settled regulatory proceedings against Tether Holdings Limited, Tether Limited, Tether Operations Limited,

and Tether International Limited (collectively, “Tether”) by way of an order accepting Tether’s payment of a civil monetary

penalty of $41 million without admitting or denying any of the CFTC’s findings or conclusions. The order settled CFTC allegations

that, from June 2016 to February 2019, Tether made untrue or misleading statements and omissions of material fact or omitted to state

material facts necessary to make statements made not true or misleading in connection with, among other things, whether USDT was fully

backed by U.S. Dollars held in bank accounts in Tether’s name.

In February 2021, the Office of the Attorney General

of the State of New York (NYAG) entered into an agreement with Tether and several Bitfinex (a group of companies with which Tether is

affiliated) companies to settle a 2019 proceeding brought by NYAG seeking an injunction related to, among other things, the transfer of

certain funds by and among Bitfinex and Tether. Without admitting or denying NYAG’s findings, Bitfinex and Tether agreed to settle

the NYAG proceeding by paying $18.5 million in penalties to the State of New York. The agreement further required Bitfinex and Tether

to discontinue any trading activity with New York persons or entities and to submit to mandatory reporting on certain business functions.

Schedule B

The following table lists all transactions completed

by the Reporting Persons in the Common Shares since December 20, 2024, which were all completed through open market purchases.

Tether Investments, S.A. de C.V.:

| Date |

Shares

Bought |

Price |

| January 3, 2025 |

31,297 |

9.5599 |

| January 6, 2025 |

52,734 |

9.6366 |

| January 7, 2025 |

43,852 |

9.7319 |

| January 8, 2025 |

16,106 |

9.6336 |

| January 10, 2025 |

52,605 |

9.8402 |

| January 13, 2025 |

18,500 |

9.8627 |

| January 14, 2025 |

35,911 |

9.9156 |

| January 15, 2025 |

10,450 |

10.0098 |

| January 16, 2025 |

38,995 |

9.8288 |

| January 17, 2025 |

50,000 |

9.71 |

Exhibit 99.1

Joint Filing Agreement

In accordance with Rule 13d-1(k) promulgated under

the Securities Exchange Act of 1934, as amended, each of the persons named below agrees to the joint filing of this Amendment to Schedule

13D, including further amendments thereto, with respect to the common shares, par value $1.50 per share, of Adecoagro S.A. and further

agrees that this Joint Filing Agreement be filed with the Securities and Exchange Commission as an exhibit to such filing; provided, however,

that no person shall be responsible for the completeness or accuracy of the information concerning the other persons making the filing

unless such person knows or has reason to believe such information is inaccurate (as provided in Rule 13d-1(k)(1)(ii)). This Joint Filing

Agreement may be executed in one or more counterparts, all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the persons named below have

executed this Joint Filing Agreement as of the date set forth below.

| |

February 18, 2025 |

| |

|

| |

Tether Holdings, S.A. de C.V. |

| |

|

| |

By: |

/s/ Giancarlo Devasini |

| |

Name: |

Giancarlo Devasini |

| |

Title: |

President |

| |

Tether Investments, S.A. de C.V. |

| |

|

| |

By: |

/s/ Giancarlo Devasini |

| |

Name: |

Giancarlo Devasini |

| |

Title: |

Sole Administrator |

| |

/s/ Giancarlo Devasini |

| |

Giancarlo Devasini, individually |

Exhibit 99.2

February 14, 2025

Board of Directors

Adecoagro S.A.

Attn: Plinio Musetti, Chairman

Attn: Mariano Bosch, Chief Executive Officer

By Email

Dear Members of the Board:

Tether Investments, S.A. de C.V., a member of the

Tether Group, which includes Tether International, S.A. de C.V. the issuer of USDT, the largest stablecoin with more than 400 million

users (“Tether”) is pleased to submit the following proposal (the “Acquisition Proposal”) for Tether

to acquire, by way of a takeover bid, tender offer or other mutually acceptable structure, such number of common shares, par value $1.50

per share (“Common Shares”), of Adecoagro S.A. (the “Company”), for cash consideration of $12.41

per Common Share (the “Purchase Price”), that would result in Tether collectively holding 51% of the outstanding Common

Shares of the Company (the “Acquisition”).

The Purchase Price represents a premium of: (i)

26.6% over the closing price of Common Shares on February 13, 2025; (ii) 22.8% over the average closing price of Common Shares since November

13, 2024; and (iii) 19% over the average closing price of Common Shares since February 13, 2024. This also represents the highest price

that Common Shares have traded since April 20, 2022.

Tether notes that: (i) the Company’s profitability

has significantly declined, with 3Q24 adjusted EBITDA down 29% YoY and materially negative free cash flow of $23 million after dividend

payments; (ii) the Company’s net debt has risen to $1 billion, with leverage increasing to 2.3x due to weaker earnings; and (iii)

the Sugar, Ethanol & Energy and Farming segments have continued to decline driven by lower production volumes and rising costs. In

light of the premiums described above and the aforementioned factors, Tether believes that the Acquisition Proposal is very attractive

to the Company’s shareholders and will allow them to recognize an immediate and significant cash return on their Common Shares that

are tendered and accepted for purchase pursuant to the Acquisition Proposal. If the Common Shares tendered will be greater than the maximum

number which Tether is proposing to purchase pursuant to the Acquisition Proposal, customary proration provisions would be applied.

With respect to the Common Shares that will continue

to be held by the public, Tcthcr also believes that the Acquisition Proposal will enhance their potential for long-term appreciation.

Tether firmly believes in establishing a partnership

with the Company, which will unlock significant value through targeted strategic investment, technological innovation, and enhanced operational

efficiency. The Company’s geographical footprint aligns well with Tether’s expanding presence in the region. South America

is one of USDT’s fastest growing markets, driven largely by demand from across Argentina and Brazil owing to economic instability,

volatile national currencies and perennial battles with inflation. Moreover, Tether’s commitment to clean energy, and blockchain

technology aligns well with the Company’s efforts to maximise the sustainability of its Agribusiness.

With Tether’s support and targeted investments,

the Company can easily overcome its current operational challenges, strengthening its market position, and driving long-term value creation,

benefiting not only shareholders but all stakeholders. Tether anticipates that upon consummation of the Acquisition, the Company's senior

management would be retained to help drive this new strategic plan for the Company.

Tether understands that an expeditious and efficient

Acquisition will be in the best interests of the Company and its shareholders, and that a drawn-out or failed Acquisition may disrupt

the Company’s business and its relationships with customers, suppliers, employees and others. Tether is prepared to work with the

Company, its Board of Directors, the Company’s management team and Company counsel to negotiate, finalize and execute a definitive

acquisition agreement, and complete its confirmatory due diligence investigation, as swiftly as possible.

Importantly, the Acquisition Proposal is not subject

to any financing condition. Tether will fund the entire purchase price from its existing cash resources.

As part of its preliminary due diligence efforts,

Tether has reviewed the Company’s reports and other documents filed with the U.S. Securities and Exchange Commission, and believes

the Acquisition Proposal can be made with confidence in deal certainty, limited execution risk, and speed to close. Tether and its advisors

will require the ability to conduct confirmatory due diligence in order for it to complete its evaluation of the Company and its business

and operations.

In addition, based on information in the public

filings, we understand that the Company’s significant landholdings in certain countries are subject to regulatory regimes that limit

or otherwise regulate the ownership of land (including rural land) in such countries by foreign persons and entities. Accordingly, our

obligation to consummate the Acquisition will be subject to local approvals and compliance with any such regulatory regimes, as well as

all other laws and regulations that may be applicable to the Acquisition.

Tether is prepared to enter into a confidentiality

agreement containing customary mutual confidentiality provisions, and is also requesting that the opportunity to negotiate the Acquisition

Proposal with the Company be on an exclusive basis for thirty (30) days. We are prepared to send to you immediately upon request proposed

forms of agreement providing for such confidentiality and exclusivity.

It is expressly understood that (i) this letter is

not intended to, and does not, create or constitute a decision or an agreement to enter the Acquisition or any other transaction, or to

enter into a set of definitive Acquisition agreements for such purpose, and (ii) neither Tether nor the Company will have any rights or

obligations of any kind whatsoever in respect of the Acquisition Proposal or the Acquisition by virtue of this letter or any other written

or oral expression by their respective representatives, other than as set out in the exclusivity and confidentiality agreements, unless

and until a set of definitive Acquisition agreements is executed and delivered in relation thereto. Nothing in this letter is intended

to limit the right of Tether to pursue unilaterally any course of action it deems appropriate to provide the Company’s shareholders

with the opportunity to realize the value inherent in the Acquisition Proposal.

Again, Tether strongly believes that the Acquisition

Proposal represents the best possible outcome for the Company’s current shareholders, both in the short-term or the long-term. Tether

also believes that for the Company to effectively execute upon its strategic plan, it will require a partner with both capital to fund

additional investment into its business and operations and significant operating human capital/expertise. Tether’s leadership team

is available to meet with the Company’s Board of Directors and executive management team at your earliest convenience to discuss

the Acquisition Proposal and a plan for moving forward with this transaction.

Please contact Giancarlo Devasini, Paolo Ardoino

or Richard Heathcote with any questions regarding the Acquisition Proposal and the proposed transaction. Tether looks forward to hearing

from the Company and is excited about the prospect of a transaction with the Company that will benefit the Company’s shareholders

and enhance the long-term prospects of the Company.

Sincerely,

Tether Investments, S.A. de C.V.

By: /s/ Giancarlo Devasini

Name: Giancarlo Devasini

Title: Sole Administrator

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

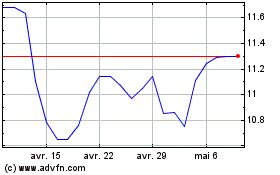

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025