Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

18 Février 2025 - 1:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-35052

Adecoagro S.A.

(Translation of registrant’s name into

English)

28, Boulevard F.W. Raiffeisen,

L-2411, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated February 18, 2025 titled “Adecoagro Announces Receipt of Unsolicited Proposal” |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Adecoagro S.A. |

| |

|

| |

|

| |

By: |

/s/ Emilio Federico Gnecco |

| |

|

Name: |

Emilio Federico Gnecco |

| |

|

Title: |

Chief Financial Officer |

Date: February 18, 2025

Item 1

Adecoagro Announces Receipt of

Unsolicited Proposal

LUXEMBOURG, February 18, 2025/PRNewswire/ -- Adecoagro

S.A. (NYSE: AGRO) (the “Company”), a leading sustainable production company in South America, announces its Board of Directors

received an unsolicited non-binding proposal from Tether Investments S.A. de C.V. (“Tether”) on February 14, 2025 to acquire

outstanding Common Shares of the Company at a price of $12.41 per Common Share through a tender offer that would result in Tether collectively

holding 51% of the outstanding Common Shares of the Company. Tether is already a shareholder of the Company, holding approximately 19.4%

of its outstanding Common Shares according to Tether’s last public filing on Schedule 13D dated November 14, 2024.

The Board of Directors held a meeting on February 16,

2025 to discuss the terms and conditions of the proposal and decided to engage legal and financial advisors to further assist the Board

in its evaluation of the proposal and whether it is in the best interests of all shareholders and the Company. The Board of

Directors will respond in due course. The Company’s shareholders are not required to take any action at this time.

About Adecoagro:

Adecoagro is a leading sustainable production company

in South America. Adecoagro owns 210.4 thousand hectares of farmland, and several industrial facilities spread across the most productive

regions of Argentina, Brazil and Uruguay, where it produces over 2.8 million tons of agricultural products and over 1 million MWh of renewable

electricity.

For questions please contact:

Victoria Cabello

IR Officer

Email: ir@adecoagro.com

No Offer or Solicitation; Additional Information

and Where to Find It

The tender offer referenced in this communication

has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation

of an offer to sell securities. The solicitation and offer to buy the Company’s securities will only be made pursuant

to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Tether will be required

to file a tender offer statement on Schedule TO and thereafter the Company will file a Solicitation/Recommendation Statement on Schedule

14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED

LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL

CONTAIN IMPORTANT INFORMATION. THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF THE COMPANY’S SECURITIES SHOULD CONSIDER BEFORE MAKING

ANY DECISION REGARDING TENDERING THEIR SECURITIES. These materials will be made available to the Company’s stockholders

at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for

free at the SEC's website at www.sec.gov. Copies

of the documents filed by the Company with the SEC by will be available free of charge on the Company’s internet website at www.adecoagro.com

or by contacting the Company’s investor relations department at ir@adecoagro.com.

Forward Looking Statements

This release contains information that may constitute

forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,”

“estimate,” “expect,” “believe,” “will likely result,” “outlook,” “project”

and other words and expressions of similar meaning. Investors are cautioned not to place undue reliance on forward-looking statements.

Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors,

including, but not limited to, those set forth in the “Risk Factors” section of the Company’s Form 20-F for the fiscal

year ended December 31, 2023 and subsequent filings with the SEC. The Company may not succeed in addressing these and other risks. Consequently,

all forward-looking statements in this release are qualified by the factors, risks and uncertainties contained therein. In addition, the

forward-looking statements included in this press release represent the Company’s views as of the date of this press release and

these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically

disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied

upon as representing the Company’s views as of any date subsequent to the date of this release.

Participants in the Solicitation

The Company, its directors, certain of its officers,

and other employees may be deemed to be “participants” (as defined in Section 14(a) of the Exchange Act of 1934, as amended)

in respect of the proposed transaction. Information about the names of the Company’s directors and officers, their respective interests

in the Company by security holdings or otherwise, and their respective compensation is set forth in the Company’s Form 20-F for

the fiscal year ended December 31, 2023 which was filed with the SEC on April 26, 2024, and any other relevant documents filed with the

SEC.

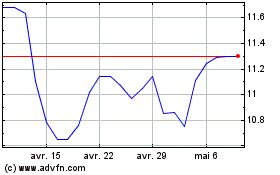

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025