false

0000001750

Common Stock, $1.00 par value

AIR

0000001750

2024-12-19

2024-12-19

0000001750

us-gaap:CommonStockMember

exch:XCHI

2024-12-19

2024-12-19

0000001750

us-gaap:CommonStockMember

exch:XNYS

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Common

Stock, $1.00 par value |

|

AIR |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

December 19,

2024

AAR

CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-6263 |

|

36-2334820 |

| (State of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

| One

AAR Place |

| 1100 N. Wood

Dale Road |

| Wood Dale,

Illinois

60191 |

| (Address and Zip Code of Principal Executive Offices) |

| Registrant’s telephone number, including

area code: (630) 227-2000 |

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common

Stock, $1.00 par value |

|

AIR |

|

New

York Stock Exchange |

| |

|

Chicago

Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On December 19,

2024, AAR CORP. (the “Company”) issued a press release announcing the resolution of the investigations described below.

A copy of the press release is being furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The information contained

in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act

of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

As previously disclosed, in

2019, the Company retained outside counsel to investigate possible violations of the U.S. Foreign Corrupt Practices Act (the “FCPA”)

relating to certain transactions in Nepal and South Africa that were signed in 2016 and 2017. Based on these investigations, in 2019,

the Company self-reported these matters to the U.S. Department of Justice (the “DOJ”), the Securities and Exchange Commission

(the “SEC”), and the U.K. Serious Fraud Office.

On December 19,

2024, after cooperating with the DOJ’s and SEC’s investigations, the Company reached resolutions with the DOJ and the SEC

regarding the aforementioned matters.

The Company agreed to the

terms contained in a Non-Prosecution Agreement with the DOJ, dated December 19, 2024 (the “NPA”), for an 18-month

term. Pursuant to the NPA, among other terms, the Company will pay a penalty of $26,363,029 and forfeiture of $18,568,713, the latter

of which will be credited in full against the disgorgement to be paid to the SEC as outlined below. The DOJ agreed that it will not prosecute

the Company for conduct described in the NPA provided that the Company complies with the terms of the NPA for the 18-month term.

The SEC approved the Company’s

Offer of Settlement and issued its Cease-and-Desist Order (the “SEC Order”) dated December 19, 2024 with respect to

certain violations of the anti-bribery, books and records, and internal accounting controls provisions of the FCPA. Pursuant to the terms

of the SEC Order, the Company will pay disgorgement of $23,451,100 and prejudgment interest of $5,785,524 to the SEC and cease and desist

any violations of the anti-bribery, books and records and internal accounting control provisions of the FCPA.

The total amount payable under

the NPA and SEC Order is $55,599,653, which will be reflected as a one-time charge in the Company’s consolidated financial statements

for fiscal year 2025 second quarter ended November 30, 2024. The Company expects to fund these payments using a combination of cash

on hand and borrowings under its revolving credit facility.

The above descriptions of

the NPA and the SEC Order are not complete and are qualified in their entirety by the terms thereof. The complete NPA and SEC Order, including

the Company’s obligations under each, can be accessed at the DOJ and SEC websites at www.justice.gov and www.sec.gov, respectively.

Forward-Looking Statements

This Current Report on Form 8-K

contains certain statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities

Litigation Reform Act of 1995, which reflect management’s expectations about future conditions, including, but not limited to, funding

the payments required pursuant to the resolution of the DOJ and SEC investigations.

Forward-looking statements

often address our expected future operating and financial performance and financial condition, or sustainability targets, goals, commitments,

and other business plans, and often may also be identified because they contain words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “likely,”

“may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,”

“should,” “target,” “will,” “would,” or similar expressions and the negatives of those

terms.

These forward-looking statements

are based on the beliefs of Company management, as well as assumptions and estimates based on information available to the Company as

of the dates such assumptions and estimates are made, and are subject to certain risks and uncertainties that could cause actual results

to differ materially from historical results or those anticipated, depending on a variety of factors, including: (i) factors that

adversely affect the commercial aviation industry; (ii) adverse events and negative publicity in the aviation industry; (iii) a

reduction in sales to the U.S. government and its contractors; (iv) cost overruns and losses on fixed-price contracts; (v) nonperformance

by subcontractors or suppliers; (vi) a reduction in outsourcing of maintenance activity by airlines; (vii) a shortage of skilled

personnel or work stoppages; (viii) competition from other companies; (ix) financial, operational and legal risks arising as

a result of operating internationally; (x) inability to integrate acquisitions effectively and execute operational and financial

plans related to the acquisitions; (xi) failure to realize the anticipated benefits of acquisitions; (xii) circumstances associated

with divestitures; (xiii) inability to recover costs due to fluctuations in market values for aviation products and equipment; (xiv) cyber

or other security threats or disruptions; (xv) a need to make significant capital expenditures to keep pace with technological developments

in our industry; (xvi) restrictions on use of intellectual property and tooling important to our business; (xvii) inability

to fully execute our stock repurchase program and return capital to stockholders; (xviii) limitations on our ability to access the

debt and equity capital markets or to draw down funds under loan agreements; (xix) non-compliance with restrictive and financial

covenants contained in our debt and loan agreements; (xx) changes in or non-compliance with laws and regulations related to federal

contractors, the aviation industry, international operations, safety, and environmental matters, and the costs of complying with such

laws and regulations; and (xxi) exposure to product liability and property claims that may be in excess of our liability insurance

coverage. Should one or more of those risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove

incorrect, actual results may vary materially from those described. Those events and uncertainties are difficult or impossible to predict

accurately and many are beyond our control.

For a discussion of these

and other risks and uncertainties, refer to our Annual Report on Form 10-K, Part I, “Item 1A, Risk Factors” and

our other filings from time to time with the SEC. These events and uncertainties are difficult or

impossible to predict accurately and many are beyond the Company’s control. The risks described in these reports are not the only

risks we face, as additional risks and uncertainties are not currently known or foreseeable or impossible to predict accurately or risks

that are beyond the Company’s control or deemed immaterial may materially adversely affect our business, financial condition or

results of operations in future periods. We assume no obligation to update any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

| Item 9.01 | Financial

Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 19, 2024 |

|

| |

AAR CORP. |

| |

|

| |

By: |

|

| |

|

/s/ Jessica A. Garascia |

| |

|

Jessica A. Garascia |

| |

|

Senior Vice President, General Counsel, Chief Administrative

Officer and Secretary | |

Exhibit 99.1

FOR IMMEDIATE RELEASE

December 19, 2024

Contact:

Media Team

+1-630-227-5100

Editor@aarcorp.com

AAR resolves Foreign Corrupt Practices Act investigations

with the DOJ and SEC

Wood Dale, Illinois — AAR

CORP. (NYSE: AIR) (“AAR” or the “Company”) announced today that it has reached resolutions with the Department

of Justice (“DOJ”) and the Securities and Exchange Commission (“SEC”) to resolve previously disclosed potential

violations of the U.S. Foreign Corrupt Practices Act (the “FCPA”) relating to certain transactions signed in 2016 and 2017

in Nepal and South Africa.

After self-reporting the potential violations

to the DOJ and SEC in 2019, and cooperating with both agencies in a multi-year investigation, AAR has entered a Non-Prosecution Agreement

(“NPA”) with the DOJ, and the SEC has accepted the Company’s Offer of Settlement and issued a cease-and-desist order

(the “SEC Order”). The resolutions with both the DOJ and SEC make clear that the relevant conduct was principally carried

out by a former employee of a Company subsidiary and former third-party agents.

The total amount payable by AAR under the

NPA and SEC Order is $55,599,653, inclusive of penalties, forfeiture, and prejudgment interest, which will be reflected as a one-time

charge in the Company’s consolidated financial statements for fiscal year 2025 second quarter ended November 30, 2024. The

Company expects to fund these payments using a combination of cash on hand and borrowings under its revolving credit facility.

“We are pleased to resolve these matters

with the DOJ and SEC,” said John M. Holmes, AAR’s Chairman, President and Chief Executive Officer. “We thank the DOJ

and SEC for their collaboration and their recognition of the Company’s substantial cooperation. AAR remains committed to transparency

and accountability and operating in an ethical and compliant manner as we deliver innovative, value-driven solutions to meet the ever-evolving

needs of our customers worldwide.”

Since self-reporting the potential violations

to the DOJ and SEC in 2019, the Company has taken extensive steps to enhance its global compliance program. AAR’s remedial actions,

along with the significant effort it made to cooperate with the investigations, were acknowledged by the DOJ and the SEC as part of the

resolutions.

About AAR

AAR is a global aerospace and defense aftermarket solutions company

with operations in over 20 countries. Headquartered in the Chicago area, AAR supports commercial and government customers through four

operating segments: Parts Supply, Repair & Engineering, Integrated Solutions, and Expeditionary Services. Additional information

can be found at aarcorp.com.

Forward-looking statements

This press

release contains certain statements relating to future results, which are forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995, which reflect management’s expectations about future conditions, including, but not limited

to, funding the payments required pursuant to the resolution of the DOJ and SEC investigations.

Forward-looking statements often address our expected future operating and financial performance and financial condition, or sustainability targets, goals, commitments, and other business plans, and often may also be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms.

These forward-looking statements are based on the beliefs of Company management, as well as assumptions and estimates based on information available to the Company as of the dates such assumptions and estimates are made, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated, depending on a variety of factors, including: (i) factors that adversely affect the commercial aviation industry; (ii) adverse events and negative publicity in the aviation industry; (iii) a reduction in sales to the U.S. government and its contractors; (iv) cost overruns and losses on fixed-price contracts; (v) nonperformance by subcontractors or suppliers; (vi) a reduction in outsourcing of maintenance activity by airlines; (vii) a shortage of skilled personnel or work stoppages; (viii) competition from other companies; (ix) financial, operational and legal risks arising as a result of operating internationally; (x) inability to integrate acquisitions effectively and execute operational and financial plans related to the acquisitions; (xi) failure to realize the anticipated benefits of acquisitions; (xii) circumstances associated with divestitures; (xiii) inability to recover costs due to fluctuations in market values for aviation products and equipment; (xiv) cyber or other security threats or disruptions; (xv) a need to make significant capital expenditures to keep pace with technological developments in our industry; (xvi) restrictions on use of intellectual property and tooling important to our business; (xvii) inability to fully execute our stock repurchase program and return capital to stockholders; (xviii) limitations on our ability to access the debt and equity capital markets or to draw down funds under loan agreements; (xix) non-compliance with restrictive and financial covenants contained in our debt and loan agreements; (xx) changes in or non-compliance with laws and regulations related to federal contractors, the aviation industry, international operations, safety, and environmental matters, and the costs of complying with such laws and regulations; and (xxi) exposure to product liability and property claims that may be in excess of our liability insurance coverage. Should one or more of those risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described. Those events and uncertainties are difficult or impossible to predict accurately and many are beyond our control.

For a discussion of these

and other risks and uncertainties, refer to our Annual Report on Form 10-K, Part I, “Item 1A, Risk Factors” and

our other filings from time to time with the U.S. Securities and Exchange Commission. These events and uncertainties are difficult or

impossible to predict accurately and many are beyond the Company’s control. The risks described in these reports are not the only

risks we face, as additional risks and uncertainties are not currently known or foreseeable or impossible to predict accurately or risks

that are beyond the Company’s control or deemed immaterial may materially adversely affect our business, financial condition or

results of operations in future periods. We assume no obligation to update any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

v3.24.4

Cover

|

Dec. 19, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2024

|

| Entity File Number |

1-6263

|

| Entity Registrant Name |

AAR

CORP.

|

| Entity Central Index Key |

0000001750

|

| Entity Tax Identification Number |

36-2334820

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

One

AAR Place

|

| Entity Address, Address Line Two |

1100 N. Wood

Dale Road

|

| Entity Address, City or Town |

Wood Dale

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60191

|

| City Area Code |

630

|

| Local Phone Number |

227-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] | NYSE CHICAGO, INC. [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

AIR

|

| Security Exchange Name |

CHX

|

| Common Stock [Member] | NEW YORK STOCK EXCHANGE, INC. [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $1.00 par value

|

| Trading Symbol |

AIR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

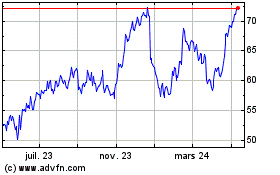

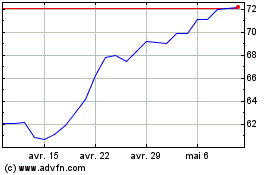

AAR (NYSE:AIR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

AAR (NYSE:AIR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024