0000922864false--12-31APARTMENT INVESTMENT & MANAGEMENT CO00009228642023-10-032023-10-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 03, 2023 |

Apartment Investment and Management Company

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

1-13232 |

84-1259577 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4582 South Ulster Street Suite 1450 |

|

Denver, Colorado |

|

80237 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 303 224-7900 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock (Apartment Investment and Management Company) |

|

AIV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On September 29, 2023, at the annual meeting of stockholders of Apartment Investment and Management Company (the “Company”), the Company’s stockholders approved certain amendments to the Company’s Articles of Amendment and Restatement (the “Charter”) to (i) lower the threshold for stockholders to remove directors to a simple majority of shares outstanding, eliminate the requirement that such removal be for “cause,” and enable stockholders to fill vacancies on the Board of Directors created by stockholder action, and (ii) reduce to a simple majority the stockholder vote required to amend the Company’s Charter and Amended and Restated Bylaws (as amended, the “Amended and Restated Charter”).

The Company’s Board of Directors previously approved the amendments to the Charter, which became effective when the Company filed the Amended and Restated Charter with the Maryland Department of Assessments & Taxation on October 3, 2023.

The foregoing description is only a summary of the amendments and is qualified in its entirety by reference to the full text of the Amended and Restated Charter, a copy of which is attached as Exhibit 3.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are filed with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY |

|

|

|

|

Date: |

October 3, 2023 |

By: |

/s/ H. Lynn C. Stanfield |

|

|

|

H. Lynn Stanfield

Executive Vice President and Chief Financial Officer |

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

ARTICLES OF AMENDMENT AND RESTATEMENT

APARTMENT INVESTMENT AND MANAGEMENT COMPANY, a Maryland corporation, having its principal office in Baltimore City, Maryland (hereinafter referred to as the “Corporation” or “AIMCO”), hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The Corporation desires to and does hereby amend and restate its Charter as currently in effect.

SECOND: The Charter of the Corporation as amended and restated in its entirety is as follows:

* * * * * *

ARTICLE I

NAME

The name of the corporation (the “Corporation”) is Apartment Investment and Management Company.

ARTICLE II

PURPOSE

The purpose for which the Corporation is formed is to engage in any lawful act or activity for which corporations may be organized under the general laws of the State of Maryland authorizing the formation of corporations as now or hereafter in force.

ARTICLE III

PRINCIPAL OFFICE IN STATE AND RESIDENT AGENT

The post office address of the principal office of the Corporation in the State of Maryland is c/o CSC-Lawyers Incorporating Service Company, 7 St. Paul Street, Suite 820, Baltimore, Maryland 21202. The name and address of the resident agent of the Corporation in the State of Maryland is CSC-Lawyers Incorporating Service Company, 7 St. Paul Street, Suite 820, Baltimore, Maryland 21202. The resident agent is a Maryland corporation located in the State of Maryland.

ARTICLE IV

STOCK

Section 1.Authorized Shares

1.1Class and Number of Shares. The total number of shares of stock that the Corporation from time to time shall have authority to issue is 510,587,500 shares of capital stock having a par value of $0.01 per share, amounting to an aggregate par value of $5,105,875, consisting of 510,587,500 shares currently classified as Class A Common Stock, par value $0.01 per share (the “Class A Common Stock”) (the Class A Common Stock and all other classes or series of common stock hereafter classified being referred to collectively herein as the “Common Stock”), and zero (0) shares currently classified as Preferred Stock, par

value $.01 per share (all other classes or series of preferred stock hereafter classified being referred to collectively herein as the “Preferred Stock”).

1.2Changes in Classification and Preferences. The Board of Directors by resolution or resolutions from time to time may classify and reclassify any unissued shares of capital stock by setting or changing in any one or more respects the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications or terms or conditions of redemption of such shares of capital stock, including, but not limited to, ownership restrictions consistent with the Ownership Restrictions with respect to each such class or subclass of capital stock, and the number of shares constituting each such class or subclass, and to increase or decrease the number of shares of any such class or subclass.

Section 2.No Preemptive Rights. No holder of shares of stock of the Corporation shall, as such holder, have any preemptive right to purchase or subscribe for any additional shares of the stock of the Corporation or any other security of the Corporation that it may issue or sell.

3.1Dividend Rights. The holders of shares of Common Stock shall be entitled to receive such dividends as may be declared by the Board of Directors of the Corporation out of funds legally available therefor.

3.2Rights Upon Liquidation. Subject to the preferential rights of Preferred Stock, if any, as may be determined by the Board of Directors pursuant to Section 1 of this Article IV, in the event of any voluntary or involuntary liquidation, dissolution or winding up of, or any distribution of the assets of the Corporation, each holder of shares of Common Stock shall be entitled to receive, ratably with each other holder of Common Stock, that portion of the assets of the Corporation available for distribution to its shareholders as the number of shares of the Common Stock held by such holder bears to the total number of shares of Common Stock then outstanding.

3.3Voting Rights. The holders of shares of Common Stock shall be entitled to vote on all matters (on which a holder of shares of Common Stock shall be entitled to vote) at the meetings of the shareholders of the Corporation, and shall be entitled to one vote for each share of Common Stock entitled to vote at such meeting.

3.4Restriction on Ownership and Transfers. The Beneficial Ownership and Transfer of Common Stock shall be subject to the restrictions set forth in this Section 3.4 of this Article IV.

(A)Limitation on Beneficial Ownership. Except as provided in Section 3.4.8 of this Article IV, from and after the date of the Initial Public Offering, no Person (other than the Initial Holder or a Look-Through Entity) shall Beneficially Own shares of Common Stock in excess of the Ownership Limit, the Initial Holder shall not Beneficially Own shares of Common Stock in excess of the Initial Holder Limit and no Look-Through Entity shall Beneficially Own shares of Common Stock in excess of the Look-Through Ownership Limit.

2

(B)Transfers in Excess of Ownership Limit. Except as provided in Section 3.4.8 of this Article IV, from and after the date of the Initial Public Offering (and subject to Section 3.4.12 of this Article IV), any Transfer (whether or not such Transfer is the result of transactions entered into through the facilities of the NYSE or other securities exchange or an automated inter-dealer quotation system) that, if effective, would result in any Person (other than the Initial Holder or a Look-Through Entity) Beneficially Owning shares of Common Stock in excess of the Ownership Limit shall be void ab initio as to the Transfer of such shares of Common Stock that would be otherwise Beneficially Owned by such Person in excess of the Ownership Limit, and the intended transferee shall acquire no rights in such shares of Common Stock.

(C)Transfers in Excess of Initial Holder Limit. Except as provided in Section 3.4.8 of this Article IV, from and after the date of the Initial Public Offering (and subject to Section 3.4.12 of this Article IV), any Transfer (whether or not such Transfer is the result of transactions entered into through the facilities of the NYSE or other securities exchange or an automated inter-dealer quotation system) that, if effective, would result in the Initial Holder Beneficially Owning shares of Common Stock in excess of the Initial Holder Limit shall be void ab initio as to the Transfer of such shares of Common Stock that would be otherwise Beneficially Owned by the Initial Holder in excess of the Initial Holder Limit, and the Initial Holder shall acquire no rights in such shares of Common Stock.

(D)Transfers in Excess of Look-Through Ownership Limit. Except as provided in Section 3.4.8 of this Article IV, from and after the date of the Initial Public Offering (and subject to Section 3.4.12 of this Article IV), any Transfer (whether or not such Transfer is the result of transactions entered into through the facilities of the NYSE or other securities exchange or an automated inter-dealer quotation system) that, if effective, would result in any Look-Through Entity Beneficially Owning shares of Common Stock in excess of the Look-Through Ownership Limit shall be void ab initio as to the Transfer of such shares of Common Stock that would be otherwise Beneficially Owned by such Look-Through Entity in excess of the Look-Through Ownership Limit, and such Look-Through Entity shall acquire no rights in such shares of Common Stock.

(E)Transfers Resulting in Ownership by Fewer than 100 Persons. Except as provided in Section 3.4.8 of this Article IV, from and after the date of the Initial Public Offering (and subject to Section 3.4.12 of this Article IV), any Transfer (whether or not such Transfer is the result of transactions entered into through the facilities of the NYSE or other securities exchange or an automated inter-dealer quotation system) that, if effective, would result in the Common Stock being Beneficially Owned by less than 100 Persons (determined without reference to any rules of attribution) shall be void ab initio as to the Transfer of such shares of Common Stock that would be otherwise Beneficially Owned by the transferee, and the intended transferee shall acquire no rights in such shares of Common Stock.

(F)Transfers Resulting in “Closely Held” Status. From and after the date of the Initial Public Offering, any Transfer that, if effective, would result in the Corporation being “closely held” within the meaning of Section 856(h) of the Code, or would otherwise result in the Corporation failing to qualify as a REIT (including,

3

without limitation, a Transfer or other event that would result in the Corporation owning (directly or constructively) an interest in a tenant that is described in Section 856(d)(2)(B) of the Code if the income derived by the Corporation from such tenant would cause the Corporation to fail to satisfy any of the gross income requirements of Section 856(c) of the Code) shall be void ab initio as to the Transfer of shares of Common Stock that would cause the Corporation (i) to be “closely held” within the meaning of Section 856(h) of the Code or (ii) otherwise fail to qualify as a REIT, as the case may be, and the intended transferee shall acquire no rights in such shares of Common Stock.

(G)Severability on Void Transactions. A Transfer of a share of Common Stock that is null and void under Sections 3.4.1(B), (C), (D), (E) or (F) of this Article IV because it would, if effective, result in (i) the ownership of Common Stock in excess of the Initial Holder Limit, the Ownership Limit, or the Look-Through Ownership Limit, (ii) the Common Stock being Beneficially Owned by less than 100 Persons (determined without reference to any rules of attribution), (iii) the Corporation being “closely held” within the meaning of Section 856(h) of the Code or (iv) the Corporation otherwise failing to qualify as a REIT, shall not adversely affect the validity of the Transfer of any other share of Common Stock in the same or any other related transaction.

3.4.2Remedies for Breach. If the Board of Directors or a committee thereof shall at any time determine in good faith that a Transfer or other event has taken place in violation of Section 3.4.1 of this Article IV or that a Person intends to acquire or has attempted to acquire Beneficial Ownership of any shares of Common Stock in violation of Section 3.4.1 of this Article IV (whether or not such violation is intended), the Board of Directors or a committee thereof shall be empowered to take any action as it deems advisable to refuse to give effect to or to prevent such Transfer or other event, including, but not limited to, refusing to give effect to such Transfer or other event on the books of the Corporation, causing the Corporation to redeem such shares at the then current Market Price and upon such terms and conditions as may be specified by the Board of Directors in its sole discretion (including, but not limited to, by means of the issuance of long-term indebtedness for the purpose of such redemption), demanding the repayment of any distributions received in respect of shares of Common Stock acquired in violation of Section 3.4.1 of this Article IV or instituting proceedings to enjoin such Transfer or to rescind such Transfer or attempted Transfer; provided, however, that any Transfers or attempted Transfers (or in the case of events other than a Transfer, Beneficial Ownership) in violation of Section 3.4.1 of this Article IV, regardless of any action (or non-action) by the Board of Directors or such committee, (a) shall be void ab initio or (b) shall automatically result in the transfer described in Section 3.4.3 of this Article IV; provided, further, that the provisions of this Section 3.4.2 shall be subject to the provisions of Section 3.4.12 of this Article IV; provided, further, that neither the Board of Directors nor any committee thereof may exercise such authority in a manner that interferes with any ownership or transfer of Common Stock that is expressly authorized pursuant to Section 3.4.8(D) of this Article IV.

4

(A)Establishment of Trust. If, notwithstanding the other provisions contained in this Article IV, at any time after the date of the Initial Public Offering there is a purported Transfer (an “Excess Transfer”) (whether or not such Transfer is the result of transactions entered into through the facilities of the NYSE or other securities exchange or an automated inter-dealer quotation system) or other change in the capital structure of the Corporation (including, but not limited to, any redemption of Preferred Stock) or other event such that (a) any Person (other than the Initial Holder or a Look-Through Entity) would Beneficially Own shares of Common Stock in excess of the Ownership Limit, or (b) the Initial Holder would Beneficially Own shares of Common Stock in excess of the Initial Holder Limit, or (c) any Person that is a Look-Through Entity would Beneficially Own shares of Common Stock in excess of the Look-Through Ownership Limit (in any such event, the Person, Initial Holder or Look-Through Entity that would Beneficially Own shares of Common Stock in excess of the Ownership Limit, the Initial Holder Limit or the Look-Through Entity Limit is referred to as a “Prohibited Transferee”), then, except as otherwise provided in Section 3.4.8 of this Article IV, such shares of Common Stock in excess of the Ownership Limit, the Initial Holder Limit or the Look-Through Ownership Limit, as the case may be, (rounded up to the nearest whole share) shall be automatically transferred to a Trustee in his capacity as trustee of a Trust for the exclusive benefit of one or more Charitable Beneficiaries. Such transfer to the Trustee shall be deemed to be effective as of the close of business on the business day prior to the date of the Excess Transfer, change in capital 2/10/structure or another event giving rise to a potential violation of the Ownership Limit, the Initial Holder Limit or the Look Through Entity Ownership Limit.

(B)Appointment of Trustee. The Trustee shall be appointed by the Corporation and shall be a Person unaffiliated with either the Corporation or any Prohibited Transferee. The Trustee may be an individual or a bank or trust company duly licensed to conduct a trust business.

(C)Status of Shares Held by the Trustee. Shares of Common Stock held by the Trustee shall be issued and outstanding shares of capital stock of the Corporation. Except to the event provided in Section 3.4.3(E), the Prohibited Transferee shall have no rights in the Common Stock held by the Trustee, and the Prohibited Transferee shall not benefit economically from ownership of any shares held in trust by the Trustee, shall have no rights to dividends and shall not possess any rights to vote or other rights attributable to the shares held in the Trust.

(D)Dividend and Voting Rights. The Trustee shall have all voting rights and rights to dividends with respect to shares of Common Stock held in the Trust, which rights shall be exercised for the benefit of the Charitable Beneficiary. Any dividend or distribution paid prior to the discovery by the Corporation that the shares of Common Stock have been transferred to the Trustee shall be repaid to the Corporation upon demand, and any dividend or distribution declared but unpaid shall be rescinded as void ab initio with respect to such shares of Common Stock. Any dividends or distributions so disgorged or rescinded shall be paid over to the Trustee and held in trust for the Charitable Beneficiary. Any vote cast by a Prohibited Transferee prior to the discovery by the Corporation that the shares of Common Stock have been transferred to the Trustee will be rescinded as void ab

5

initio and shall be recast in accordance with the desires of the Trustee acting for the benefit of the Charitable Beneficiary. The owner of the shares at the time of the Excess Transfer, change in capital structure or other event giving rise to a potential violation of the Ownership Limit, Initial Holder Limit or Look-Through Entity Ownership Limit shall be deemed to have given an irrevocable proxy to the Trustee to vote the shares of Common Stock for the benefit of the Charitable Beneficiary.

(E)Restrictions on Transfer. The Trustee of the Trust may transfer the shares held in the Trust to a person, designated by the Trustee, whose ownership of the shares will not violate the Ownership Restrictions. If such a transfer is made, the interest of the Charitable Beneficiary shall terminate and proceeds of the sale shall be payable to the Prohibited Transferee and to the Charitable Beneficiary as provided in this Section 3.4.3(E). The Prohibited Transferee shall receive the lesser of (1) the price paid by the Prohibited Transferee for the shares or, if the Prohibited Transferee did not give value for the shares (through a gift, devise or other transaction), the Market Price of the shares on the day of the event causing the shares to be held in the Trust and (2) the price per share received by the Trustee from the sale or other disposition of the shares held in the Trust. Any proceeds in excess of the amount payable to the Prohibited Transferee shall be payable to the Charitable Beneficiary. If any of the transfer restrictions set forth in this Section 3.4.3(E) or any application thereof is determined in a final judgment to be void, invalid or unenforceable by any court having jurisdiction over the issue, the Prohibited Transferee may be deemed, at the option of the Corporation, to have acted as the agent of the Corporation in acquiring the Common Stock as to which such restrictions would, by their terms, apply, and to hold such Common Stock on behalf of the Corporation.

(F)Purchase Right in Stock transferred to the Trustee. Shares of Common Stock transferred to the Trustee shall be deemed to have been offered for sale to the Corporation, or its designee, at a price per share equal to the lesser of (i) the price per share in the transaction that resulted in such transfer to the Trust (or, in the case of a devise or gift, the Market Price at the time of such devise or gift) and (ii) the Market Price on the date the Corporation, or its designee, accepts such offer. The Corporation shall have the right to accept such offer for a period of 90 days after the later of (i) the date of the Excess Transfer or other event resulting in a transfer to the Trust and (ii) the date that the Board of Directors determines in good faith that an Excess Transfer or other event occurred.

(G)Designation of Charitable Beneficiaries. By written notice to the Trustee, the Corporation shall designate one or more nonprofit organizations to be the Charitable Beneficiary of the interest in the Trust relating to such Prohibited Transferee if (i) the shares of Common Stock held in the Trust would not violate the Ownership Restrictions in the hands of such Charitable Beneficiary and (ii) each Charitable Beneficiary is an organization described in Sections 170(b)(1)(A), 170(c)(2) and 501(c)(3) of the Code.

3.4.4Notice of Restricted Transfer. Any Person that acquires or attempts to acquire shares of Common Stock in violation of Section 3.4.1 of this Article IV, or any Person that is a Prohibited Transferee such that stock is transferred to the Trustee under Section 3.4.3 of this Article IV, shall immediately give written notice to the

6

Corporation of such event and shall provide to the Corporation such other information as the Corporation may request in order to determine the effect, if any, of such Transfer or attempted Transfer or other event on the Corporation’s status as a REIT. Failure to give such notice shall not limit the rights and remedies of the Board of Directors provided herein in any way.

3.4.5Owners Required to Provide Information. From and after the date of the Initial Public Offering certain record and Beneficial Owners and transferees of shares of Common Stock will be required to provide certain information as set out below.

(A)Annual Disclosure. Every record and Beneficial Owner of more than 5% (or such other percentage between 0.5% and 5%, as provided in the applicable regulations adopted under the Code) of the number of Outstanding shares of Common Stock shall, within 30 days after January 1 of each year, give written notice to the Corporation stating the name and address of such record or Beneficial Owner, the number of shares of Common Stock Beneficially Owned, and a full description of how such shares are held. Each such record or Beneficial Owner of Common Stock shall, upon demand by the Corporation, disclose to the Corporation in writing such additional information with respect to the Beneficial Ownership of the Common Stock as the Board of Directors, in its sole discretion, deems appropriate or necessary to (i) comply with the provisions of the Code regarding the qualification of the Corporation as a REIT under the Code and (ii) ensure compliance with the Ownership Limit, the Initial Holder Limit or the Look-Through Ownership Limit, as applicable. Each shareholder of record, including without limitation any Person that holds shares of Common Stock on behalf of a Beneficial Owner, shall take all reasonable steps to obtain the written notice described in this Section 3.4.5 from the Beneficial Owner.

(B)Disclosure at the Request of the Corporation. Any Person that is a Beneficial Owner of shares of Common Stock and any Person (including the shareholder of record) that is holding shares of Common Stock for a Beneficial Owner, and any proposed transferee of shares, shall provide such information as the Corporation, in its sole discretion, may request in order to determine the Corporation’s status as a REIT, to comply with the requirements of any taxing authority or other governmental agency, to determine any such compliance or to ensure compliance with the Ownership Limit, the Initial Holder Limit and the Look-Through Ownership Limit, and shall provide a statement or affidavit to the Corporation setting forth the number of shares of Common Stock already Beneficially Owned by such shareholder or proposed transferee and any related persons specified, which statement or affidavit shall be in the form prescribed by the Corporation for that purpose.

3.4.6Remedies Not Limited. Nothing contained in this Article IV shall limit the authority of the Board of Directors to take such other action as it deems necessary or advisable (subject to the provisions of Section 3.4.12 of this Article IV) (i) to protect the Corporation and the interests of its shareholders in the preservation of the Corporation’s status as a REIT and (ii) to insure compliance with the Ownership Limit, the Initial Holder Limit and the Look-Through Ownership Limit.

7

3.4.7Ambiguity. In the case of an ambiguity in the application of any of the provisions of Section 3.4 of this Article IV, or in the case of an ambiguity in any definition contained in Section 4 of this Article IV, the Board of Directors shall have the power to determine the application of the provisions of this Article IV with respect to any situation based on its reasonable belief, understanding or knowledge of the circumstances.

3.4.8Exceptions. The following exceptions shall apply or may be established with respect to the limitations of Section 3.4.1 of this Article IV.

(A)Waiver of Ownership Limit. The Board of Directors, upon receipt of a ruling from the Internal Revenue Service or an opinion of tax counsel or other evidence or undertaking acceptable to it, may waive the application, in whole or in part, of the Ownership Limit or the Look-Through Ownership Limit to a Person subject to the Ownership Limit or the Look-Through Ownership Limit, as applicable, if such person is not an individual for purpose of Section 542(a) of the Code and is a corporation, partnership, estate or trust; provided, however, that in no event may any such exception cause such Person’s ownership, direct or indirect (without taking into account such Person’s ownership of interests in any partnership of which the Corporation is a partner), to exceed (i) 12.0% of the number of Outstanding shares of Common Stock, in the case of a Person subject to the Ownership Limit, or (ii) 20.0% of the number of Outstanding shares of Common Stock, in the case of a Look-Through Entity subject to the Look-Through Ownership Limit. In connection with any such exemption, the Board of Directors may require such representations and undertakings from such Person and may impose such other conditions as the Board deems necessary, in its sole discretion, to determine the effect, if any, of the proposed Transfer on the Corporation’s status as a REIT.

(B)Pledge by Initial Holder. Notwithstanding any other provision of this Article IV, the pledge by the Initial Holder of all or any portion of the Common Stock directly owned at any time or from time to time shall not constitute a violation of Section 3.4.1 of this Article IV and the pledgee shall not be subject to the Ownership Limit with respect to the Common Stock so pledged to it either as a result of the pledge or upon foreclosure.

(C)Underwriters. For a period of 270 days following the purchase of Common Stock by an underwriter that (i) is a corporation or a partnership and (ii) participates in an offering of the Common Stock, such underwriter shall not be subject to the Ownership Limit with respect to the Common Stock purchased by it as a part of or in connection with such offering and with respect to any Common Stock purchased in connection with market making activities.

(D)Ownership and Transfers by the CMO Trustee. The Ownership Limit shall not apply to the initial holding of Common Stock by the “CMO Trustee” (as that term is defined in the “Glossary” to the Prospectus) for the benefit of “HF Funding Trust” (as that term is defined in the “Glossary” to the Prospectus), to any subsequent acquisition of Common Stock by the CMO Trustee in connection with any conversion of Preferred Stock or to any transfer or assignment of all or any part of the legal or beneficial interest in the Common Stock to the CMO Trustee, “FSA”

8

(as that term is defined in the “Glossary” to the Prospectus), any entity controlled by FSA, or any direct or indirect creditor of HF Funding Trust (including without limitation any reinsurer of any obligation of HF Funding Trust) or any acquisition of Common Stock by any such person in connection with any conversion of Preferred Stock.

3.4.9Legend. Each certificate for Common Stock shall bear the following legend:

“The shares of Class A Common Stock represented by this certificate are subject to restrictions on transfer. No person may Beneficially Own shares of Class A Common Stock in excess of the Ownership Restrictions, as applicable, with certain further restrictions and exceptions set forth in the Charter. Any Person that attempts to Beneficially Own shares of Class A Common Stock in excess of the applicable limitation must immediately notify the Corporation. All capitalized terms in this legend have the meanings ascribed to such terms in the Charter, as the same may be amended from time to time, a copy of which, including the restrictions on transfer, will be sent without charge to each stockholder that so requests. If the restrictions on transfer are violated, (i) the transfer of shares of Class A Common Stock represented hereby will be void in accordance with the Charter or (ii) the shares of Class A Common Stock represented hereby automatically be will transferred to a Trustee of a Trust for the benefit of one or more Charitable Beneficiaries.”

3.4.10Severability. If any provision of this Article IV or any application of any such provision is determined in a final and unappealable judgment to be void, invalid or unenforceable by any Federal or state court having jurisdiction over the issues, the validity and enforceability of the remaining provisions shall not be affected and other applications of such provision shall be affected only to the extent necessary to comply with the determination of such court.

3.4.11Board of Directors Discretion. Anything in this Article IV to the contrary notwithstanding, the Board of Directors shall be entitled to take or omit to take such actions as it in its discretion shall determine to be advisable in order that the Corporation maintain its status as and continue to qualify as a REIT, including, but not limited to, reducing the Ownership Limit, the Initial Holder Limit and the Look-Through Ownership Limit in the event of a change in law.

3.4.12Settlement. Nothing in this Section 3.4 of this Article IV shall be interpreted to preclude the settlement of any transaction entered into through the facilities of the NYSE or other securities exchange or an automated inter-dealer quotation system.

Section 4.Definitions. The terms set forth below shall have the meanings specified below when used in this Article IV or in Article V of the Charter.

4.1Beneficial Ownership. The term “Beneficial Ownership” shall mean, with respect to any Person, ownership of shares of Common Stock equal to the sum of (i) the shares of Common Stock directly owned by such Person, (ii) the number of shares of Common Stock indirectly owned by such Person (if such Person is an “individual” as defined in Section 542(a)(2) of the Code) taking into account the constructive ownership rules of Section 544 of the Code, as modified by Section 856(h)(1)(B) of the Code, and (iii) the number of shares of Common Stock that such Person is deemed to beneficially own pursuant to Rule

9

13d-3 under the Exchange Act or that is attributed to such Person pursuant to Section 318 of the Code, as modified by Section 856(d)(5) of the Code, provided that when applying this definition of Beneficial Ownership to the Initial Holder, clause (iii) of this definition, and clause (b) of the definition of “Person” shall be disregarded. The terms “Beneficial Owner,” “Beneficially Owns” and “Beneficially Owned” shall have the correlative meanings.

4.2Charitable Beneficiary. The term “Charitable Beneficiary” shall mean one or more beneficiaries of the Trust as determined pursuant to Section 3.4.3 of this Article IV, each of which shall be an organization described in Section 170(b)(1)(A), 170(c)(2) and 501(c)(3) of the Code.

4.3Code. The term “Code” shall mean the Internal Revenue Code of 1986, as amended from time to time, or any successor statute thereto. Reference to any provision of the Code shall mean such provision as in effect from time to time, as the same may be amended, and any successor thereto, as interpreted by any applicable regulations or other administrative pronouncements as in effect from time to time.

4.4Common Stock. The term “Common Stock” shall mean all shares now or hereafter authorized of any class of Common Stock of the Corporation and any other capital stock of the Corporation, however designated, authorized after the Issue Date, that has the right (subject always to prior rights of any class of Preferred Stock) to participate in the distribution of the assets and earnings of the Corporation without limit as to per share amount.

4.5Excess Transfer. The term “Excess Transfer” has the meaning set forth in Section 3.4.3(A) of this Article IV.

4.6Exchange Act. The term “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

4.7Initial Holder. The term “Initial Holder” shall mean Terry Considine.

4.8Initial Holder Limit. The term “Initial Holder Limit” shall mean 15% of the number of Outstanding shares of Common Stock applied, in the aggregate, to the Initial Holder. From the date of the Initial Public Offering, the secretary of the Corporation, or such other person as shall be designated by the Board of Directors, shall upon request make available to the representative(s) of the Initial Holder and the Board of Directors, a schedule that sets forth the then-current Initial Holder Limit applicable to the Initial Holder.

4.9Initial Public Offering. The term “Initial Public Offering” shall mean the first underwritten public offering of Class A Common Stock registered under the Securities Act of 1933, as amended, on a registration statement on Form S-11 filed with the Securities and Exchange Commission.

4.10Look-Through Entity. The term “Look-Through Entity” shall mean a Person that is either (i) described in Section 401(a) of the Code as provided under Section 856(h)(3) of the Code or (ii) registered under the Investment Company Act of 1940.

4.11Look-Through Ownership Limit. The term “Look-Through Ownership Limit” shall mean 15% of the number of Outstanding shares of Common Stock.

10

4.12Market Price. The term “Market Price” on any date shall mean the Closing Price on the Trading Day immediately preceding such date. The term “Closing Price” on any date shall mean the last sale price, regular way, or, in case no such sale takes place on such day, the average of the closing bid and asked prices, regular way, in either case as reported in the principal consolidated transaction reporting system with respect to securities listed or admitted to trading on the NYSE or, if the Common Stock is not listed or admitted to trading on the NYSE, as reported in the principal consolidated transaction reporting system with respect to securities listed on the principal national securities exchange on which the Common Stock is listed or admitted to trading or, if the Common Stock is not listed or admitted to trading on any national securities exchange, the last quoted price, or if not so quoted, the average of the high bid and low asked prices in the over-the-counter market, as reported by the National Association of Securities Dealers, Inc. Automated Quotation System or, if such system is no longer in use, the principal other automated quotations system that may then be in use or, if the Common Stock is not quoted by any such organization, the average of the closing bid and asked prices as furnished by a professional market maker making a market in the Common Stock selected by the Board of Directors of the Company. The term “Trading Day” shall mean a day on which the principal national securities exchange on which the Common Stock is listed or admitted to trading is open for the transaction of business or, if the Common Stock is not listed or admitted to trading on any national securities exchange, shall mean any day other than a Saturday, a Sunday or a day on which banking institutions in the State of New York are authorized or obligated by law or executive order to close.

4.13NYSE. The term “NYSE” shall mean the New York Stock Exchange, Inc.

4.14Outstanding. The term “Outstanding” shall mean issued and outstanding shares of Common Stock of the Corporation, provided that for purposes of the application of the Ownership Limit, the Look-Through Ownership Limit or the Initial Holder Limit to any Person, the term “Outstanding” shall be deemed to include the number of shares of Common Stock that such Person alone, at that time, could acquire pursuant to any options or convertible securities.

4.15Ownership Limit. The term “Ownership Limit” shall mean, for any Person other than the Initial Holder or a Look-Through Entity, 8.7% of the number of the Outstanding shares of Common Stock of the Corporation.

4.16Ownership Restrictions. The term “Ownership Restrictions” shall mean collectively the Ownership Limit as applied to Persons other than the Initial Holder or Look-Through Entities, the Initial Holder Limit as applied to the Initial Holder and the Look-Through Ownership Limit as applied to Look-Through Entities.

4.17Person. The term “Person” shall mean (A) an individual, corporation, partnership, estate, trust (including a trust qualifying under Section 401(a) or 501(c) of the Code), association, private foundation within the meaning of Section 509(a) of the Code, joint stock company or other entity, and (B) also includes a group as that term is used for purposes of Section 13(d)(3) of the Exchange Act.

4.18Prohibited Transferee. The term “Prohibited Transferee” has the meaning set forth in Section 3.4.3(A) of this Article IV.

11

4.19REIT. The term “REIT” shall mean a “real estate investment trust” as defined in Section 856 of the Code.

4.20Transfer. The term “Transfer” shall mean any sale, transfer, gift, assignment, devise or other disposition of a share of Common Stock (including (i) the granting of an option or any series of such options or entering into any agreement for the sale, transfer or other disposition of Common Stock or (ii) the sale, transfer, assignment or other disposition of any securities or rights convertible into or exchangeable for Common Stock), whether voluntary or involuntary, whether of record or Beneficial Ownership, and whether by operation of law or otherwise (including, but not limited to, any transfer of an interest in other entities that results in a change in the Beneficial Ownership of shares of Common Stock). The term “Transfers” and “Transferred” shall have correlative meanings.

4.21Trust. The term “Trust” shall mean the trust created pursuant to Section 3.4.3 of this Article IV.

4.22Trustee. The term “Trustee” shall mean the Person unaffiliated with either the Corporation or the Prohibited Transferee that is appointed by the Corporation to serve as trustee of the Trust.

4.23Prospectus. The term “Prospectus” shall mean the prospectus that forms a part of the registration statement filed with the Securities and Exchange Commission in connection with the Initial Public Offering, in the form included in the registration statement at the time the registration statement becomes effective; provided, however, that, if such prospectus is subsequently supplemented or amended for use in connection with the Initial Public Offering, “Prospectus” shall refer to such prospectus as so supplemented or amended.

12

ARTICLE V

GENERAL REIT PROVISIONS

Section 5.Termination of REIT Status. The Board of Directors shall take no action to terminate the Corporation’s status as a REIT until such time as (i) the Board of Directors adopts a resolution recommending that the Corporation terminate its status as a REIT, (ii) the Board of Directors presents the resolution at an annual or special meeting of the shareholders and (iii) such resolution is approved by the vote of a majority of the shares entitled to be cast on the resolution.

Section 6.Exchange or Market Transactions. Nothing in Article IV or this Article V shall preclude the settlement of any transaction entered into through the facilities of the NYSE or other national securities exchange or an automated inter-dealer quotation system. The fact that the settlement of any transaction is permitted shall not negate the effect of any other provision of this Article V or any provision of Article IV, and the transferee, including but not limited to any Prohibited Transferee, in such a transaction shall remain subject to all the provisions and limitations of Article IV and this Article V.

Section 7.Severability. If any provision of Article IV or this Article V or any application of any such provision is determined to be invalid by any federal or state court having jurisdiction over the issues, the validity of the remaining provisions shall not be affected and other applications of such provision shall be affected only to the extent necessary to comply with the determination of such court.

Section 8.Waiver. The Corporation shall have authority at any time to waive the requirement that the Corporation redeem shares of Preferred Stock if, in the sole discretion of the Board of Directors, any such redemption would jeopardize the status of the Corporation as a REIT for federal income tax purposes.

ARTICLE VI

BOARD OF DIRECTORS

Section 9.Management. The business and the affairs of the Corporation shall be managed under the direction of its Board of Directors.

Section 10.Number. The number of directors that will constitute the entire Board of Directors shall be fixed by, or in the manner provided in, the Bylaws but shall in no event be less than three.

Section 11.Vacancies. Appointment of directors to fill vacancies on the Board of Directors shall be in a manner as provided under the Bylaws of the Corporation (as may be amended, the “Bylaws”), subject to applicable law.

Section 12.Removal. Except as otherwise required by law and subject to the rights of the holders of any class or series of stock separately entitled to elect one or more directors, removal of directors shall be in a manner as provided under the Bylaws, subject to applicable law.

13

Section 13.Bylaws. The Board of Directors shall have power to adopt, amend, alter, change and repeal any Bylaws of the Corporation by vote of the majority of the Board of Directors then in office. Any adoption, amendment, alteration, change or repeal of any Bylaws by the shareholders of the Corporation shall require the affirmative vote of at least a majority of all the shares of capital stock of the Corporation then entitled to vote generally in an election of directors, voting together as a single class, at an annual or special meeting of the shareholders of the Corporation called for such purpose.

Section 14.Powers. The enumeration and definition of particular powers of the Board of Directors included elsewhere in the Charter shall in no way be limited or restricted by reference to or inference from the terms of any other clause of this or any other Article of the Charter, or construed as excluding or limiting, or deemed by inference or otherwise in any manner to exclude or limit, the powers conferred upon the Board of Directors under the Maryland General Corporation Law (“MGCL”) as now or hereafter in force.

ARTICLE VII

LIMITATION OF LIABILITY

No director or officer of the Corporation shall be liable to the Corporation or its shareholders for money damages to the maximum extent that Maryland law in effect from time to time permits limitation of the liability of directors and officers. Neither the amendment nor repeal of this Article VII, nor the adoption or amendment of any other provision of the charter or Bylaws of the Corporation inconsistent with this Article VII, shall apply to or affect in any respect the applicability of the preceding sentence with respect to any act or failure to act that occurred prior to such amendment, repeal or adoption.

ARTICLE VIII

INDEMNIFICATION

The Corporation shall indemnify, to the fullest extent permitted by Maryland law, as applicable from time to time, all persons who at any time were or are directors or officers of the Corporation for any threatened, pending or completed action, suit or proceeding (whether civil, criminal, administrative or investigative) relating to any action alleged to have been taken or omitted in such capacity as a director or an officer. The Corporation shall pay or reimburse all reasonable expenses incurred by a present or former director or officer of the Corporation in connection with any threatened, pending or completed action, suit or proceeding (whether civil, criminal, administrative or investigative) in which the present or former director or officer is a party, in advance of the final disposition of the proceeding, to the fullest extent permitted by, and in accordance with the applicable requirements of, Maryland law, as applicable from time to time. The Corporation may indemnify any other persons permitted but not required to be indemnified by Maryland law, as applicable from time to time, if and to extent indemnification is authorized and determined to be appropriate, in each case in accordance with applicable law, by the Board of Directors, the majority of the shareholders of the Corporation entitled to vote thereon or special legal counsel appointed by the Board of Directors. No amendment of the Charter of the Corporation or repeal of any of its provisions shall limit or eliminate any of the benefits provided to directors and officers under this Article VIII in respect of any act or omission that occurred prior to such amendment or repeal.

14

ARTICLE IX

WRITTEN CONSENT OF SHAREHOLDERS

Any corporate action upon which a vote of shareholders is required or permitted may be taken without a meeting or vote of shareholders with the unanimous written consent of shareholders entitled to vote thereon.

ARTICLE X

AMENDMENT

The Corporation reserves the right to amend, alter or repeal any provision contained in this charter upon (i) adoption by the Board of Directors of a resolution recommending such amendment, alteration, or repeal, (ii) presentation by the Board of Directors to the shareholders of a resolution at an annual or special meeting of the shareholders and (iii) approval of such resolution by the affirmative vote of at least a majority of all the shares of capital stock of the Corporation then entitled to vote generally in an election of directors, voting together as a single class. All rights conferred upon shareholders herein are subject to this reservation.

ARTICLE XI

EXISTENCE

The Corporation is to have a perpetual existence.

* * * * * *

THIRD: The Board of Directors of the Corporation at a meeting or by a unanimous consent in writing in lieu of a meeting under § 2-408 of the Maryland General Corporation Law adopted a resolution that set forth and approved the foregoing restatement of the Charter.

FOURTH: The Charter of the Corporation is not amended by these Articles of Restatement; provided, however, that consistent with § 2-608(b)(7) of the Maryland General Corporation Law, the current number and names of directors are provided in the last sentence of Section 2 of Article VI of the restated Charter of the Corporation.

FIFTH: The current address of the principal office of the Corporation is 4582 South Ulster Street, Suite 1100, Denver, Colorado 80237. The current address of the principal office of the Corporation in the State of Maryland is c/o CSC-Lawyers Incorporating Service Company, 7 St. Paul Street, Suite 820, Baltimore, Maryland 21202.

SIXTH: The name and address of the Corporation’s resident agent in the State of Maryland is CSC-Lawyers Incorporating Service Company, 7 St. Paul Street, Suite 820, Baltimore, Maryland 21202.

SEVENTH: These Articles of Restatement shall become effective at 12:01 a.m., Eastern Time, on October 3, 2023.

15

IN WITNESS WHEREOF, APARTMENT INVESTMENT AND MANAGEMENT COMPANY has caused these presents to be signed in its name and on its behalf by its Executive Vice President and Chief Financial Officer and witnessed by its Executive Vice President, Chief Administrative Officer and General Counsel on September 29, 2023.

|

|

|

|

WITNESS: |

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY |

|

|

|

|

|

|

|

|

|

/s/ Jennifer Johnson |

|

/s/ Lynn Stanfield |

|

Jennifer Johnson

Executive Vice President, Chief Administrative Officer and General Counsel |

|

Lynn Stanfield Executive Vice President and Chief

Financial Officer |

|

|

|

|

THE UNDERSIGNED, Executive Vice President and Chief Financial Officer of APARTMENT INVESTMENT AND MANAGEMENT COMPANY, who executed on behalf of the Corporation the foregoing Articles of Restatement of which this certificate is made a part, hereby acknowledges in the name and on behalf of said Corporation the foregoing Articles of Restatement to be the corporate act of said Corporation and hereby certifies that to the best of her knowledge, information, and belief the matters and facts set forth therein with respect to the authorization and approval thereof are true in all material respects under the penalties of perjury.

|

|

|

/s/ Lynn Stanfield |

|

Lynn Stanfield Executive Vice President and Chief Financial Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

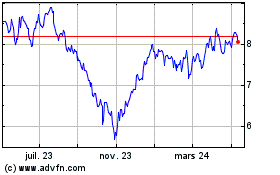

Apartment Investment and... (NYSE:AIV)

Graphique Historique de l'Action

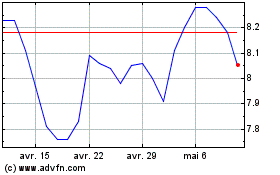

De Mar 2024 à Avr 2024

Apartment Investment and... (NYSE:AIV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024