Filed Pursuant to Rule 424(b)(5)

Registration No. 333-237387

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated July 20, 2023

Preliminary prospectus supplement

(To prospectus dated July 12, 2021)

Alta Equipment Group Inc.

2,000,000 Shares of Common Stock Offered by the Selling Stockholder

The selling stockholder identified in this prospectus supplement (the “selling stockholder”) is offering 2,000,000 shares of our common stock, par value $0.0001 per share (the “common stock”), pursuant to this prospectus supplement and the accompanying prospectus. We will not receive any proceeds from the sale of the common stock to be offered by the selling stockholder. Our common stock is listed on the New York Stock Exchange under the symbol “ALTG.” On July 19, 2023, the last reported sale price of our common stock on the New York Stock Exchange was $17.66 per share.

|

|

|

|

Per Share |

Total |

Public offering price |

$ |

$ |

Underwriting discounts and commissions(1) |

$ |

$ |

Proceeds to the selling stockholder before expenses |

$ |

$ |

(1) See the section titled “Underwriting (Conflict of interest)” for a description of the compensation payable to the underwriters.

The selling stockholder has granted the underwriters an option for a period of 30 days to purchase up to an additional 300,000 shares of our common stock at the public offering price, less the underwriting discounts and commissions. If the underwriters exercise the option in full, the total underwriting discounts payable by the selling stockholder will be $ million, and the total proceeds to the selling stockholder, before expenses, will be $ million. We will not receive any proceeds from the sale of our common stock by the selling stockholder pursuant to any exercise of the underwriters’ option to purchase additional shares.

Investing in our common stock involves a high degree of risk. Please read “Risk factors” beginning on page S-11 of this prospectus supplement, on page 6 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2023.

|

|

D.A. Davidson & Co. , 2023 |

B. Riley Securities |

Table of Contents

Prospectus Supplement

Prospectus

About this Prospectus Supplement

This document contains two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of shares of our common stock. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering of shares of our common stock. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. If the information about this offering of shares of our common stock varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”). The selling stockholder may use the registration statement to sell the shares of common stock registered thereby from time to time through any means described in the section entitled “Plan of Distribution.”

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read “Where You Can Find More Information; Incorporation by Reference” in this prospectus supplement.

Neither we, the selling stockholder, nor the underwriters have authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by us or on our behalf to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, the selling stockholder is not, and the underwriters are not, making an offer to sell or soliciting an offer to buy these securities under any circumstance in any jurisdiction where the offer or solicitation is not permitted. You should assume that the information contained in this prospectus supplement, the accompanying prospectus and any free writing prospectus prepared by us or on our behalf is accurate only as of the date of the respective document in which the information appears, and that any information in documents that we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

It is important for you to read and consider all of the information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision. We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can find additional related discussions. The table of contents in this prospectus supplement provides the pages on which these captions are located. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described in the section entitled “Where You Can Find More Information; Incorporation by Reference” of this prospectus supplement, before investing in our common stock.

The selling stockholder is offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

References in this prospectus supplement and the accompanying prospectus to “we,” “us,” “our,” “Alta,” “the Company” and similar designations refer, collectively, to Alta Equipment Group Inc. and its consolidated subsidiaries unless otherwise stated or the context otherwise requires.

S-1

All references in this prospectus supplement and the accompanying prospectus to our financial statements include the related notes thereto.

Alta Equipment Group Inc., the Alta Equipment Group Inc. logo and our other registered or common law trademarks, trade names or service marks appearing in this prospectus supplement are owned by us. This prospectus supplement, any applicable prospectus or any information incorporated herein or therein may contain references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus supplement and the accompanying prospectus, including logos, artwork and other visual displays, generally appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. All trademarks, service marks and trade names included or incorporated by reference in this prospectus supplement, the accompanying prospectus or any related free writing prospectus are the property of their respective owners.

The industry and market data and other statistical information contained in the documents we incorporate by reference are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources and, in each case, are believed by management to be reasonable estimates. Although we believe third-party sources of such information are reliable, we have not independently verified such information. Data regarding our industry and our market position and market share within our industry are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate market size, market position and market share within our industry. In addition, assumptions and estimates of our and our industry’s future performance involve risks and uncertainties and are subject to change based on various factors, including those described herein and in the documents incorporated herein under the heading “Risk Factors.”

S-2

Prospectus Supplement Summary

This summary highlights information more fully described elsewhere in this prospectus supplement and the accompanying prospectus and within the materials incorporated by reference herein. Because it is a summary, it does not contain all the information that you should consider before investing in our common stock. You should read this entire prospectus supplement carefully, including the accompanying prospectus, the “Risk Factors” section in this prospectus supplement, the risks outlined under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”), and our other reports incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. For more details on how you can obtain the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, see “Where You Can Find More Information; Incorporation by Reference.”

Our Business

Overview

We own and operate one of the largest integrated equipment dealership platforms in the United States (“U.S.”) and have a presence in Canada. Through our branch network, we sell, rent, and provide parts and service support for several categories of specialized equipment, including lift trucks, heavy and compact earthmoving equipment, environmental processing equipment, cranes, paving and asphalt equipment, and other material handling and construction equipment. We engage in five principal business activities in these equipment categories:

(i) new equipment sales;

(ii) used equipment sales;

(iii) parts sales;

(iv) repair and maintenance services; and

(v) equipment rentals.

We have operated as an equipment dealership for over 39 years and have developed a branch network that includes over 75 total locations in Michigan, Illinois, Indiana, Ohio, Massachusetts, Maine, Connecticut, New Hampshire, Vermont, Rhode Island, New York, Virginia, Nevada and Florida and the Canadian provinces of Ontario and Quebec. We offer our customers end-to-end solutions for their equipment needs by providing sales, parts, service and rental functions. Additionally, we provide warehouse design and build services, automated equipment installation and system integration solutions within our Material Handling segment.

Within our territories, we are the exclusive distributor of new equipment and replacement parts on behalf of our original equipment manufacturer (“OEM”) partners. We and our regional subsidiaries enjoy long-standing relationships with leading material handling and construction equipment OEMs, including Hyster-Yale, Volvo, JCB and Kubota, among many others. We also now, through the acquisition of Ecoverse Industries LTD (“Ecoverse”), as discussed further below, have exclusive master dealer rights throughout North America for environmental processing equipment with Doppstadt, Backus and Backers, among others. We are consistently recognized by OEMs as a top dealership partner and have been identified as a nationally recognized Hyster-Yale dealer and multi-year recipient of the Volvo Dealer of the Year award. More recently, we entered into a dealer agreement with Nikola Corporation to become the authorized dealer to sell and service Nikola medium and long-haul class 8 electric vehicle trucks in the New York, New Jersey, eastern Pennsylvania, New England, Florida and Illinois markets.

Products and Services

New Equipment Sales. We sell new heavy construction, material handling and environmental processing equipment and are a leading distributor for internationally recognized equipment manufacturers. Our new equipment sales operation is a primary source of new customers for the rental, parts and services business. The majority of our new equipment sales is predicated on exclusive distribution agreements we have with best-in-class OEMs. The sale of new equipment to customers, while profitable from a gross margin perspective, acts as a means of generating equipment field population and activity for our higher-margin aftermarket revenue streams, specifically service and parts. We also sell tangential products and services related to our material handling equipment offerings which include, but are not limited to, automated equipment and related installation, warehouse systems integration solutions and related controls software.

S-3

Used Equipment Sales. We sell used equipment which is typically equipment that has been taken in on trade from a customer that is purchasing new equipment, equipment coming off a third-party lease arrangement where we purchase the equipment from the finance company, or used equipment that is sourced for our customers in the open market by our used equipment specialists. Used equipment sales in our territories, like new equipment sales, generate parts and services business for the Company.

Parts Sales. We sell replacement parts to customers and supply parts to our own rental fleet. Our in-house parts inventory is extensive such that we are able to provide timely service support to our customers. The majority of our parts inventory is made up of OEM replacement parts for those OEMs with which we have exclusive agreements to sell new equipment.

Service Support. We provide maintenance and repair services for customer-owned equipment and we maintain our own rental fleet. In addition to repair and maintenance on an as needed or scheduled basis, we provide ongoing preventative maintenance services and warranty repairs for our customers. We have committed substantial resources to training our technical service employees and have a full-scale service infrastructure that we believe differentiates us from our competitors. Approximately 45% of our employees are skilled service technicians.

Equipment Rentals. We rent heavy construction, compact, aerial, material handling, and a variety of other types of equipment to our customers on a daily, weekly and monthly basis. In addition to being a core business, our rental business also creates cross-selling opportunities for us in our sales and product support activities.

Competitive Strengths

We believe that the following attributes are important to our ability to compete effectively and to achieve our financial objectives:

Integrated Dealership Platform Providing Full Scale Solutions to Customers. Our integrated equipment sales, service, and rental platform provide a one-stop-shop for a highly diverse group of customers, enabling us to profitably grow our revenue throughout the years and giving us a competitive advantage over our single channel competitors and traditional equipment rental houses, which may have difficulty expanding due to the infrastructure, training, and relationships necessary to support a growing population of equipment in a designated territory and that typically have limited parts and service offerings. With our over 75 dealership locations, we believe that our scale will help us be the leading provider of material handling, construction, and environmental processing equipment and aftermarket parts and service support in each of our territories.

Superior Parts and Services Operations Supporting Customer Relationships. We provide parts and service to our customers 24 hours a day, 365 days a year. Our parts and service capabilities support customers in maximizing equipment uptime, which we believe is a key consideration when an equipment customer is making a selection among competing product offerings. The aftermarket parts and service businesses provide us with a predictable, high-margin revenue source that is relatively insulated from the typical business cycle.

Ability to Attract and Retain Skilled Technical Employees. We believe that we provide best-in-class parts and service support to our customers, and the ability to attract and retain skilled technicians is critical to aftermarket performance. We have partnered with trade and technical schools in all of our territories and these relationships, along with our recruiting prowess, provide us with a pipeline of skilled employees. To retain employees, we offer attractive benefits, clean facilities with the most advanced diagnostic software, modern tools and OEM parts. Above all, we view our technicians as key contributors to future success, and we accord respect to our skilled technicians.

Leading Dealer for Equipment Manufacturers. We are a leading U.S. dealer for many nationally recognized material handling, construction, and environmental processing equipment OEMs, including Hyster-Yale, Volvo, JCB, Kubota and Doppstadt. Our primary dealer agreements grant us exclusivity for new equipment, replacement part sales, and diagnostic service software in our territories. The OEM relationships also promote our acquisition strategy, as the OEMs prefer to partner with fewer, larger financially stable dealerships and view us as a prominent consolidator.

High-Quality Rental Fleet for Rent-to-Sell and Rent-to-Rent Programs. Equipment rental is complementary to our new and used equipment sales and is an important component of our one-stop-shop model. Rental operations are fully aligned with our dealership strategy, as the rent-to-sell solution provides an additional sales channel by which we are able to populate our territories with equipment and generate high-margin parts and service revenue thereafter. In addition, our existing equipment customers rely on our rental fleet when facing short-term equipment needs and when customer equipment is being serviced.

S-4

Experienced Management Team. Our senior management team is led by Chief Executive Officer (“CEO”) Ryan Greenawalt, Chief Financial Officer (“CFO”) Anthony Colucci and Chief Operating Officer (“COO”) Craig Brubaker, each of whom has substantial experience in the equipment distribution industry. Our senior leadership is well known and highly respected in the industry. Industry relationships provide a meaningful portion of our acquisition pipeline, as dealership owners frequently approach our management team to discuss a sale. Additionally, our senior leadership team is experienced in managing our business throughout the business cycle.

Business Strategy

We employ the following business strategies:

Align with World-Class Original Equipment Manufacturers by Securing Dealership Agreements for Exclusive Territories. We contractually agree with best-in-class material handling and construction equipment OEMs to represent them exclusively in designated territories (i.e., a state or province). These exclusive agreements allow us to take a long-term view to a given market place, build a complementary product offering which drives market share with customers and ultimately allows us, and our OEMs, to focus on growing market share within the territory. Importantly, these agreements give us exclusive rights to purchase OEM parts and the access to OEM software which allows us to safely and effectively repair our customers’ equipment.

Grow the Field Population of Equipment in Our Territories and Leverage that Equipment to Grow Parts and Service Revenue. We actively populate our territories with new and used equipment, which generates predictable, high-margin parts and service revenue. We follow this strategy with each of our acquisitions into new territories and with new OEM partnerships, growing the field population of equipment through our new, used, and rent-to-sell sales channels upon market entry. As a result, we expect future benefits from increasing aftermarket parts and service revenue driven by the equipment maintenance cycle.

Recruit Skilled Technicians to Expand the Parts and Service Operations. We depend on our teams of technicians to provide customers with best-in-class parts and service support, and we have developed a multifaceted strategy to recruit skilled mechanics. We regularly hire mechanics away from independent rental or service businesses in our markets, where a lack of access to OEM parts and diagnostic tools make servicing increasingly sophisticated equipment difficult. Additionally, we have been successful in hiring skilled technicians from other industries, such as the automotive industry. Also, our partnerships with technical schools and community colleges provide consistent access to new technicians. We intend to replicate this strategy as we acquire additional dealership territories.

Pursue Strategic Acquisitions. Our management team has successfully completed over 25 acquisitions. We have two primary areas of focus when pursuing acquisitions:

•Territory In-Fill. Within our existing territories, we pursue acquisitions that may provide for new OEM relationships whose equipment will complement the existing product portfolio in a territory, new customer relationships and pools of skilled technicians. These acquisitions advance the parts and service strategy by simultaneously increasing the field population within the existing territory and expanding the number of skilled technicians to generate predictable, high-margin service and parts revenue.

•Territorial Expansion. Our geographic footprint has grown through acquisitions, from our original Michigan lift truck territory to a leading equipment dealer with operations in the Midwest, New York, New England, Florida, parts of Ontario and Quebec. In selecting additional territories for acquisition, we prioritize opportunities that can be improved by our systems and processes and/or markets with a high density of equipment users.

Pursue Synergistic Verticals. With our existing expertise with commercial equipment dealerships, we pursue strategic opportunities to leverage our knowledge in operating equipment dealerships to grow into other adjacent verticals of commercial equipment of over-the-road vehicles. As an example, to leverage our prowess in e-mobility and meet the growing demand for commercial electric vehicles within our existing territories, we have entered the over-the-road vehicle dealership industry by virtue of our new partnership with Nikola. Similarly, with our historic success and customer relationships in equipment distribution for OEMs in exclusive territories, we will pursue growth opportunities in the wholesale equipment distribution sector, where we look to contractually possess master dealer rights to distribute OEM equipment in a significant geographic territory (e.g., North America). Our recent acquisition of Ecoverse represents our entrance into the master equipment distribution sector.

S-5

Customers

Our customer end markets include diversified manufacturing, food and beverage, wholesale/retail, distribution, construction, automotive, municipal/government, and medical. Our customers vary from small, single machine owners to large construction contractors and leading multi-national commercial companies. In 2022, no single customer accounted for more than 1% of our total revenues. Our top ten customers combined accounted for approximately 5% of our total revenues in 2022.

Suppliers

We purchase a significant amount of equipment and parts from a large number of manufacturers with whom we have distribution agreements. We purchased approximately 43% of our new equipment, rental fleet, and replacement parts from four major OEMs (Hyster-Yale, Kubota, JCB and Volvo) during the year ended December 31, 2022. Notably, we are the exclusive OEM replacement part distributor in substantially all of our territories, allowing us to provide superior service support to our customers from an aftermarket perspective.

Competition

The material handling and construction equipment sales and distribution industries are competitive and remain fragmented, with large numbers of competitors operating on a regional or local scale. Within our territories, our competitors range from multi-location, regional operators to single-location dealers of competing equipment brands. We compete with other equipment dealers that sell other brands of equipment that we do not represent or that we do not represent in a particular market. We also compete with local and nationwide rental businesses in certain product categories.

Competition among equipment dealers, whether they offer material handling or construction equipment or both, is primarily based on customer service, including repair and maintenance service provided by the dealer, reputation of the OEM and dealer, quality and design of the products, and price. In our experience, reliability and uptime are the key considerations for customers in selecting a material handling and construction equipment dealer, and we believe that our focus on parts and service support has helped us win and maintain customer business. In contrast, price is not typically a customer’s key point of differentiation in selecting among competing equipment, as OEM partners often provide pricing flexibility and discounting in order to drive market share.

Within substantially all of our territories, we are the exclusive distributor of new equipment and replacement parts on behalf of our OEM partners. This exclusivity affords us effectively no competition from others when selling these brands in our territories.

Human Capital

Employees

As of December 31, 2022, we had approximately 2,800 employees. Of these employees, approximately 1,150 are skilled technicians paid on an hourly basis and the remainder are hourly and salaried corporate, sales, operating, and administrative personnel. We have approximately 550 employees covered by collective bargaining agreements. We believe our relations with our employees are good, and we have never experienced a long-term work stoppage. We are committed to fostering a diverse workforce and an inclusive environment and have instituted various initiatives to increase our diversity as it relates to recruiting and training opportunities.

Generally, the total number of employees does not significantly fluctuate throughout the year. However, acquisition activity may increase the number of our employees. Fluctuations in the level of our business activity could require some staffing level adjustments in response to actual or anticipated customer demand.

Health and Safety

The health and safety of our employees is an important focus at Alta. As part of our continuing goal to reduce our recordable injuries, we are committed to regularly reinforcing the importance of our safety programs and encouraging a culture of safe work practices in all of our locations. As part of our evaluation of our management employees, we evaluate the safety records of the employees for whom they have management responsibility.

Talent Development and Employee Training

S-6

Our goal is to attract, develop, and retain a talented and high-performing workforce. We are committed to our employees and their development, and we strive to create opportunities for the continual professional development of our employee base. These opportunities include continuing education and specialty training.

Recent Developments

Debt Refinance

In June 2023, we amended our Sixth Amended and Restated ABL First Lien Credit Agreement (the “A&R ABL Credit Agreement”) along with our Sixth Amended and Restated Floor Plan First Lien Credit Agreement (the “A&R Floor Plan Credit Agreement”), both dated April 1, 2021, by and between the Company, the other credit parties named therein, the lenders party thereto, and JP Morgan Chase Bank, N.A., as Administrative Agent. The A&R ABL Credit Agreement amendment, among other things, (i) exercised $55 million of our expansion option previously included in our asset-based revolving line of credit (the “ABL Facility”) increasing borrowing capacity from $430 million to $485 million; and (ii) provided for a $65 million expansion option, which allowed us to further increase borrowing capacity under the ABL Facility to $550 million. The A&R Floor Plan Credit Agreement amendment, among other things, (i) increased the maximum borrowing capacity of our revolving floor plan facility (the “Floor Plan Facility”) by $10 million from $60 million to $70 million; (ii) provided for a $20 million expansion option allowing us to further increase borrowing capacity under the Floor Plan Facility to $90 million; and (iii) increased permitted maximum borrowings under third-party floorplan facilities from $350 million to $390 million with additional annual 10% increases beyond 2023.

Preliminary, Unaudited Second Quarter Financial Results

Our financial statements for the quarter ended June 30, 2023 will not be available until after this offering is completed and consequently will not be available to you prior to investing in this offering. Based upon preliminary estimates and information available to us as of the date of this prospectus supplement, we expect to report that we had:

•revenue between $462.0 million to $472.0 million for the three months ended June 30, 2023;

•trailing twelve months “TTM” revenue between $1,716.3 million and $1,726.3 million as of June 30, 2023;

•net income (loss) between $(1.4) million and $4.3 million for the three months ended June 30, 2023;

•Adjusted EBITDA between $48.0 million to $50.5 million for the three months ended June 30, 2023; and

•TTM Adjusted EBITDA between $175.5 million and $178.0 million as of June 30, 2023.

The above includes financial measures not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

We disclose non-GAAP financial measures, including Adjusted EBITDA, because we believe they are useful performance measures that assist in an effective evaluation of our operating performance when compared to our peers, without regard to financing methods or capital structure. We believe such measures are useful for investors and others in understanding and evaluating our operating results in the same manner as our management. However, such measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for, or in isolation from, net income (loss), revenue, operating profit, debt, or any other operating performance measures calculated in accordance with GAAP.

We define Adjusted EBITDA as net income (loss) before interest expense (not including floorplan interest paid on new equipment), income taxes, depreciation and amortization, adjustments for certain one-time or non-recurring items and other adjustments. We exclude these items from net income (loss) in arriving at Adjusted EBITDA because these amounts are either non-recurring or can vary substantially within the industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance. For example, items such as a company’s cost of capital and tax structure, certain one-time or non-recurring items as well as the historic costs of depreciable assets, are not reflected in Adjusted EBITDA. Our presentation of Adjusted EBITDA should not be construed as an indication that results will be unaffected by the items excluded from this metric. Our computation of Adjusted EBITDA may not be identical to other similarly titled measures of other companies. For a reconciliation of non-GAAP measures to their most comparable measures under GAAP, please see the table below.

S-7

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2023 |

|

TTM, As of |

(amounts in millions) |

|

Estimated Range |

|

June 30, 2023 Estimated Range |

|

|

Low9 |

High9 |

|

Low9 |

High9 |

Net income (loss) available to common shareholders |

|

$(1.4) |

$4.3 |

|

$1.7 |

$7.4 |

Depreciation and amortization |

|

33.9 |

31.9 |

|

122.5 |

120.5 |

Interest expense |

|

14.3 |

13.3 |

|

45.2 |

44.2 |

Income tax expense |

|

0.6 |

– |

|

1.5 |

0.9 |

EBITDA8 |

|

$47.4 |

$49.5 |

|

$170.9 |

$173.0 |

Adjustments: |

|

|

|

|

|

|

Transaction costs1 |

|

0.5 |

0.5 |

|

1.6 |

1.6 |

Loan administration fees2 |

|

0.1 |

0.1 |

|

0.2 |

0.2 |

Share-based incentives3 |

|

1.1 |

1.1 |

|

3.5 |

3.5 |

Other expenses4 |

|

– |

0.4 |

|

1.5 |

1.9 |

Preferred stock dividend5 |

|

0.8 |

0.8 |

|

3.1 |

3.1 |

Showroom-ready equipment interest expense6 |

|

(1.9) |

(1.9) |

|

(5.3) |

(5.3) |

Adjusted EBITDA8 |

|

$48.0 |

$50.5 |

|

$175.5 |

$178.0 |

Pro forma EBITDA-acquisitions7 |

|

– |

– |

|

4.6 |

4.6 |

Adjusted pro forma EBITDA8 |

|

$48.0 |

$50.5 |

|

$180.1 |

$182.6 |

(1)Expenses related to acquisitions and capital raising activities.

(2)Debt administration expenses associated with debt refinancing activities.

(3)Reflects non-cash equity-based compensation expenses.

(4)Other non-recurring expenses inclusive of severance payments, greenfield startup, legal and consulting costs.

(5)Expenses related to preferred stock dividend payments.

(6)Represents interest expense associated with showroom-ready new equipment interest included in total interest expense above.

(7)Pro Forma EBITDA of acquisitions completed within the year, assuming acquisitions occurred as of January 1, prorated through the actual date of acquisition.

(9)Low and high estimates are management estimates and subject to change.

These estimates as of June 30, 2023 are preliminary, have not been audited, do not present all information necessary for an understanding of our financial condition as of June 30, 2023 and are subject to change upon completion of, among other things, quarter-end closing procedures and/or adjustments, the completion of our interim financial statements and other operational procedures. This preliminary financial information has been prepared in good faith on a consistent basis with prior periods. However, we have not completed our financial closing procedures for the three and six months ended June 30, 2023, and our actual results could be materially different from this preliminary financial information, which preliminary information should not be regarded as a representation by us, our management, or the underwriters as to our actual results as of and for the three and six months ended June 30, 2023. During the course of the preparation of our financial statements and related notes as

S-8

of and for the three and six months ended June 30, 2023, we may identify items that would require us to make material adjustments to this preliminary financial information. As a result, prospective investors should exercise caution in relying on this information and should not draw any inferences from this information. This preliminary financial information should not be viewed as a substitute for full financial statements prepared in accordance with GAAP. The preliminary estimated data should not be considered a substitute for the financial information to be filed with the SEC in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 once it becomes available. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus supplement, the accompanying prospectus and the information incorporated herein for additional information regarding factors that could result in differences between the preliminary estimated financial information for the quarter ended June 30, 2023 and the actual financial and other data we will report for the quarter ended June 30, 2023.

Corporate Information

Our principal executive offices are located at 13211 Merriman Road, Livonia, Michigan 48150, and our telephone number is (248) 449-6700. Our website address is www.altaequipment.com. We do not incorporate the information on, or accessible through, our website into this prospectus supplement, and you should not consider any information on, or that can be accessed through our website as part of this prospectus supplement. We have included our website address in this prospectus supplement solely for informational purposes.

S-9

The Offering

|

|

Common Stock Offered by the Selling Stockholder |

2,000,000 shares of common stock. |

Option to Purchase Additional Shares |

The selling stockholder has granted the underwriters an option to purchase up to an additional 300,000 shares of common stock. The underwriters may exercise this option at any time within 30 days from the date of this prospectus supplement. The number of shares subject to the underwriters’ option equals 15% of the total number of shares of common stock offered by the selling stockholder. See the section entitled “Underwriting (Conflict of interest).” |

Common Stock Outstanding |

32,368,112 shares. |

Use of Proceeds |

The selling stockholder will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholder in this offering, including any shares the selling stockholder may sell pursuant to the underwriters’ option to purchase additional shares of common stock. |

Listing |

Our common stock is listed on the New York Stock Exchange under the trading symbol “ALTG.” |

Conflict of interest |

Because an affiliate of B. Riley Securities, Inc., an underwriter in this offering, will receive 5% or more of the net proceeds of this offering as the selling stockholder, B. Riley Securities, Inc. is deemed to have a “conflict of interest” within the meaning of Rule 5121 (“Rule 5121”) of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering will be conducted in compliance with the requirements of Rule 5121. The appointment of a “qualified independent underwriter” is not required in connection with this offering because a “bona fide public market,” as defined in Rule 5121, exists for our shares of common stock. See “Underwriting (Conflict of interest)” for more information. |

Risk Factors |

Your investment involves a high degree of risk. You should read the section titled “Risk Factors” beginning on page S-11 of this prospectus supplement and page 6 of the accompanying prospectus, and the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of some of the risks and uncertainties that you should carefully consider before deciding to invest in our common stock. |

Except as otherwise stated in this prospectus supplement, the number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 32,368,112 shares of common stock outstanding as of July 20, 2023, and excludes as of that date: (a) 325,000 shares of common stock reserved for issuance under our employee stock purchase plan; and (b) 3,138,382 shares of common stock reserved and remaining available for future issuance under our 2020 Omnibus Incentive Plan, of which 868,380 shares of common stock are issuable upon vesting of restricted stock units (“RSUs”) and earned and unvested performance stock units (“PSUs”).

Except as otherwise indicated, all information in this prospectus supplement does not assume or give effect to the purchase of common stock under our employee stock purchase plan, the exercise of options or the vesting of RSUs and earned PSUs outstanding, in each case, after July 20, 2023.

S-10

Risk Factors

Investing in our securities involves risks. You should carefully consider the risks and uncertainties described below and in the “Risk Factors” section of the 2022 Form 10-K (incorporated by reference in this prospectus supplement and the accompanying prospectus), and any other reports that we may file from time to time with the SEC, and all other information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus, as updated by our subsequent filings under the Exchange Act, before investing in any of our securities. See “Where You Can Find More Information; Incorporation by Reference” in this prospectus supplement and “Incorporation of Certain Documents by Reference” in the accompanying prospectus.

Risks Related to the Ownership of our Common Stock

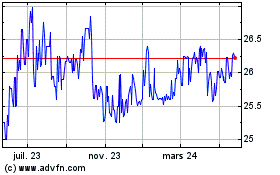

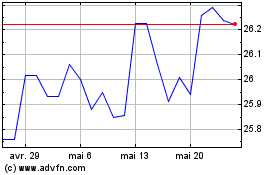

The price of our common stock may fluctuate substantially, and your investment may decline in value.

The market price of our common stock has been and in the future may be volatile and may fluctuate substantially due to many factors, including:

•actual or anticipated fluctuations in our results of operations;

•variance in our financial performance from the expectations of investors or market analysts;

•conditions and trends in the markets we serve, and changes in the estimation of the size and growth rate of these markets;

•our ability to make and integrate acquisitions;

•variance in our organic growth from the expectations of investors or market analysts;

•announcements of significant contracts by us or our competitors;

•changes in our pricing policies or the pricing policies of our competitors;

•restatements of historical financial results and changes in financial forecasts;

•loss of one or more of our significant OEM partners;

•changes in market valuation or earnings of comparable public companies;

•the trading volume of our common stock; and

•general economic conditions.

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of particular companies affected. These broad market and industry factors may materially harm the market price of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted against that company. Such litigation, if instituted against us, could result in substantial costs and a diversion of management’s attention and resources, which could materially harm our business, financial condition, future results and cash flow.

Sales of substantial amounts of our common stock in the public market, or the perception that these sales may occur, could cause the market price of our common stock to decline. We are unable to predict the effect that such sales may have on the prevailing market price of the common stock.

Sales of substantial amounts of our common stock in the public market, whether by us or our existing stockholders, or the perception that these sales may occur, could cause the market price of our common stock to decline. This could also impair our ability to raise additional capital through the sale of our equity securities. Under our amended and restated certificate of incorporation, we are authorized to issue up to 200,000,000 shares of common stock, of which 32,368,112 shares of common stock are currently issued and outstanding. We may issue additional shares of common stock, which may dilute existing shareholders, including purchasers of the common stock offered

S-11

hereby. In connection with the completion of this offering, we and each of our directors, executive officers, the selling stockholder and certain affiliates of the selling stockholder have agreed not to offer, sell or transfer any common stock or securities convertible into, or exchangeable or exercisable for, common stock, for a period of 60 days after the date of this prospectus supplement, subject to certain exceptions. D.A. Davidson & Co. and B. Riley Securities, Inc., however, may, in their sole discretion, permit us and our directors, executive officers, the selling stockholder and certain affiliates of the selling stockholder who will be subject to these lock-up agreements to sell shares prior to the expiration of the lock-up agreements. See the section entitled “Underwriting (Conflict of interest)” for additional information. Following the expiration of the lock-up period, these shares will be available for sale in the public markets subject to restrictions under applicable securities laws. We cannot predict the size of future issuances of our shares, or the effect, if any, that future sales and issuances of securities would have on the market price of our shares of common stock.

If securities or industry analysts publish inaccurate or unfavorable research about our business, the price of our common stock and our trading volume could decline.

The trading market for our common stock is influenced by the research and reports that securities or industry analysts publish about us or our business. In the event securities or industry analysts downgrade our common stock or publish inaccurate or unfavorable research about our business, the price of our common stock would likely decline. If one or more of these analysts cease coverage of the Company or fail to publish reports on us regularly, demand for our common stock could decrease, which might cause the price of our common stock and trading volume to decline.

Payment of dividends by us may vary.

Although we have paid cash dividends on shares of our common stock in the past, we may not pay cash dividends or increase our dividends on shares of our common stock in the future. The payment of future dividends and the amount thereof is uncertain and is at the sole discretion of our board of directors and is considered each quarter. The payment of dividends is dependent upon, among other things, operating cash flow generated by the Company, our financial requirements for operations, our credit agreements and related covenants, general economic and market conditions and the execution of our growth strategy.

Additional financing or future equity issuances may result in future dilution to our stockholders.

We may need to raise additional funds in the future to finance our growth, our acquisition plans, investment activities and for other reasons. We may issue additional common stock in future financing transactions or as incentive compensation for our executive management and other key personnel, consultants and advisors. Issuing any equity securities would be dilutive to the equity interests represented by our then-outstanding shares of common stock. The market price for our common stock could decrease as the market takes into account the dilutive effect of any of these issuances. Furthermore, we may enter into financing transactions at prices that represent a substantial discount to the market price of our common stock. A negative reaction by investors and securities analysts to any discounted sale of our equity securities could result in a decline in the trading price of our common stock.

S-12

Cautionary Note Regarding Forward-Looking Statements

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, concerning our plans, objectives and expectations for our business, operations and financial performance and condition. Any statements contained, or incorporated by reference, herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about our future financial performance and condition, future operations; our plans for expansion and acquisitions; our business strategy, projected costs, prospects, market position, and plans and objectives of management.

Because these forward-looking statements are based on current information available, and current expectations, forecasts and assumptions, and involve a number of judgments, they are subject to risks and uncertainties. As a result, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements:

•supply chain disruptions, inflationary pressures resulting from supply chain disruptions or a tightening labor market;

•negative impacts on customer payment policies and adverse banking and governmental regulations, resulting in a potential reduction to the fair value of our assets;

•the performance and financial viability of key suppliers, contractors, customers, and financing sources;

•economic, industry, business and political conditions including their effects on governmental policy and government actions that disrupt our supply chain or sales channels;

•our success in identifying acquisition targets and integrating acquisitions;

•our success in expanding into and doing business in additional markets;

•our ability to raise capital at favorable terms;

•the competitive environment for our products and services;

•our ability to continue to innovate and develop new business lines;

•our ability to attract and retain key personnel, including, but not limited to, skilled technicians;

•our ability to maintain our listing on the New York Stock Exchange;

•the impact of cyber or other security threats or other disruptions to our businesses;

•our ability to realize the anticipated benefits of acquisitions or divestitures, rental fleet investments or internal reorganizations;

•federal, state, and local government budget uncertainty, especially as it relates to infrastructure projects and taxation;

•currency risks and other risks associated with international operations; and,

•other risks and uncertainties identified in the section entitled “Risk Factors” in this prospectus supplement and in the 2022 Form 10-K, and in our other filings with the SEC.

S-13

Use of Proceeds

The selling stockholder is selling all of the common stock being sold in this offering, including any shares of common stock sold upon the exercise of the underwriters’ option to purchase additional shares. Accordingly, we will not receive any proceeds from the sale of shares of our common stock being sold in this offering. We will bear the costs associated with the sale of the shares in this offering by the selling stockholder, other than underwriting discounts and commissions. See “Underwriting (Conflict of interest)” and “Selling Stockholder.”

Dividend Policy

The preferred stock underlying our depositary shares accrues an annual dividend equivalent to $2,500 per share of preferred stock, or $2.50 per depositary share. During the six months ended June 30, 2023, we paid $1.5 million in cash dividends on our preferred stock. As of the date of this prospectus supplement, we have paid and declared $3.8 million in cash dividends on our common stock in 2023.

In the year ended December 31, 2022, we paid $3.0 million in cash dividends on our preferred stock. In addition, we paid and declared $3.7 million in cash dividends on our common stock in 2022.

The payment of cash dividends in the future, including payment of accrued dividends related to the depositary shares, will be dependent upon our revenues and earnings, capital requirements, and general financial condition. The payment of any cash dividends is within the discretion of our board of directors.

S-14

Selling Stockholder

The following table details the name of the selling stockholder, the number of shares of our common stock beneficially owned by the selling stockholder, and the number of shares of our common stock being offered by the selling stockholder for sale under this prospectus supplement. The percentage of shares of our common stock beneficially owned by the selling stockholder both prior to and following the offering of securities pursuant to this prospectus supplement, is based on 32,368,112 shares of common stock outstanding as of July 20, 2023.

The following table and footnote set forth information with respect to the beneficial ownership of our common stock by the selling stockholder. Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock Beneficially Owned Prior to this Offering |

|

Shares of Common Stock Beneficially Owned After this Offering |

Name of Selling Stockholder |

|

Shares of Common Stock |

|

Percentage of Common Stock Outstanding |

|

|

Shares of Common Stock Assuming the Underwriters’ Over-Allotment Option is Not Exercised |

|

Percentage of Shares of Common Stock Assuming the Underwriters’ Option is Not Exercised |

|

Shares of Common Stock Assuming the Underwriters’ Option is Exercised in Full |

|

Percentage of Shares of Common Stock Assuming the Underwriters’ Option is Exercised in Full |

BRF Investments, LLC (1) |

|

4,979,629 |

|

15.4% |

|

|

2,979,629 |

|

9.2% |

|

2,679,629 |

|

8.3% |

(1)Beneficial ownership based on information contained in a Schedule 13D/A filed by B. Riley Financial, Inc. (“B. Riley Financial”), B. Riley Securities, Inc. (“BRS”), the selling stockholder and Bryant R. Riley filed with the SEC on April 18, 2023. B. Riley Financial is the parent company of the selling stockholder. Daniel Shribman, a member of our board of directors, is the Chief Investment Officer of B. Riley Financial. All of the shares of common stock being sold by the selling stockholder in this offering were initially held by B. Riley Principal Sponsor Co. LLC (“B. Riley Sponsor”) and B. Riley Principal Investments, LLC (“BRPI”), and were included next to their names in the “Selling Securityholders” table in the accompanying prospectus. Subsequent to the date of the accompanying prospectus, B. Riley Sponsor and BRPI transferred such shares to BRS, which then transferred such shares to the selling stockholder.

S-15

Material U.S. Federal Tax Considerations for Holders of our Common Stock

The following discussion is a summary of the material U.S. federal income tax consequences of the purchase, ownership and disposition of our common stock sold in accordance with this prospectus but does not purport to be a complete analysis of all potential tax effects. The effects of other U.S. federal tax laws, such as estate and gift tax laws, and any applicable state, local, or non-U.S. tax laws are not discussed. This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”), its legislative history, Treasury Regulations promulgated under the Code, judicial decisions and published rulings and administrative pronouncements of the U.S. Internal Revenue Service (the “IRS”), in each case in effect as of the date hereof. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a holder of our common stock. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below. There can be no assurance the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the purchase, ownership and disposition of our common stock.

This discussion is limited to holders that acquire our common stock in this offering and hold our common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to a holder’s particular circumstances, including the impact of the Medicare contribution tax on net investment income. In addition, it does not address consequences relevant to holders subject to special rules, including, without limitation:

•U.S. expatriates and former citizens or long-term residents of the United States;

•persons subject to the alternative minimum tax;

•persons holding our common stock as part of a wash sale, constructive sale, straddle, or other risk reduction strategy or as part of a conversion transaction or other integrated investment;

•persons subject to special tax accounting rules as a result of any item of gross income with respect to our common stock being taken into account in an applicable financial statement;

•banks, insurance companies and other financial institutions;

•brokers, dealers, or traders in securities;

•“controlled foreign corporations,” “passive foreign investment companies,” and corporations that accumulate earnings to avoid U.S. federal income tax;

•partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors therein) or other entities or arrangements that are pass-through or disregarded entities for U.S. federal income tax purposes or persons that hold their common stock through such partnerships or other entities or arrangements;

•tax-exempt organizations or governmental organizations;

•persons deemed to sell our common stock under the constructive sale provisions of the Code;

•persons who hold or receive our common stock pursuant to the exercise of any employee stock option or otherwise as compensation;

•persons that own or have owned, or are deemed to own or have owned, more than 5% of our common stock (except to the extent specifically set forth below);

•regulated investment companies;

•real estate investment trusts;

•tax-qualified retirement plans; and

S-16

•“qualified foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests of which are held by qualified foreign pension funds.

If an entity (or arrangement) treated as a partnership or a pass-through entity for U.S. federal income tax purposes holds our common stock, the tax treatment of a partner or beneficial owner of the entity will depend on the status of the partner or beneficial owner, the status and activities of the entity and certain determinations made at the partner or beneficial owner level. Accordingly, entities treated as partnerships or pass-through entities for U.S. federal income tax purposes holding our common stock and the partners or beneficial owners in such entities should consult their tax advisors regarding the U.S. federal income tax consequences to them.

THIS DISCUSSION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT TAX ADVICE. INVESTORS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

U.S. Holders

This section applies to you if you are a “U.S. Holder.” As used herein, the term “U.S. Holder” means any beneficial owner of our common stock who or that, for U.S. federal income tax purposes, is or is treated as any of the following:

•an individual who is a citizen or resident of the United States;

•an entity created or organized under the laws of the United States, any state thereof, or the District of Columbia that is classified as a corporation for U.S. federal income tax purposes;

•an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

•a trust that (1) is subject to the primary supervision of a U.S. court and the control of one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code), or (2) has a valid election in effect to be treated as a United States person for U.S. federal income tax purposes.

Taxation of Distributions

If we pay distributions in cash or other property (other than certain distributions of our stock or rights to acquire our stock) to U.S. Holders, such distributions generally will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Distributions in excess of current and accumulated earnings and profits will constitute a return of capital that will be applied against and reduce (but not below zero) the U.S. Holder’s adjusted tax basis in our common stock. Any remaining excess will be treated as gain realized on the sale or other disposition of the common stock and will be treated as described under “U.S. Holders—Sale or Other Taxable Disposition” below.

Dividends we pay to a U.S. Holder that is treated as a taxable corporation generally will qualify for the dividends received deduction if the requisite holding period is satisfied. With certain exceptions (including, but not limited to, dividends treated as investment income for purposes of investment interest deduction limitations), and provided certain holding period requirements are met, dividends we pay to a non-corporate U.S. Holder may constitute “qualified dividend income” that will be subject to tax at the maximum tax rate accorded to long-term capital gains. If the holding period requirements are not satisfied, then a corporation may not be able to qualify for the dividends received deduction and would have taxable income equal to the entire dividend amount, and non-corporate U.S. Holders may be subject to tax on such dividend at regular ordinary income tax rates instead of the preferential rate that applies to qualified dividend income.

Sale or Other Taxable Disposition

Upon a sale or other taxable disposition of our common stock, a U.S. Holder generally will recognize capital gain or loss in an amount equal to the difference between the amount realized upon the sale or disposition of such common stock and the U.S. Holder’s adjusted tax basis in those common stock. Generally, the amount realized upon such

S-17

sale or disposition is the sum of the amount of cash and the fair market value of any property received in such sale or disposition, and a U.S. Holder’s adjusted tax basis in its common stock generally will equal the U.S. Holder’s acquisition cost reduced (but not below zero) by any prior distributions received on such common stock that are treated as a return of capital. Any such capital gain or loss generally will be long-term capital gain or loss if the U.S. Holder’s holding period for the common stock so disposed of exceeds one year. Long-term capital gains recognized by non-corporate U.S. Holders may be eligible to be taxed at reduced rates. The deductibility of capital losses is subject to limitations.

Information Reporting and Backup Withholding

In general, information reporting requirements may apply to dividends paid to a U.S. Holder and to the proceeds of the sale or other disposition of our common stock, unless the U.S. Holder is an exempt recipient. In addition, such payments may be subject to backup withholding, unless (1) the U.S. Holder is a corporation or other exempt recipient, and if required, demonstrates that fact or (2) the U.S. Holder provides a correct taxpayer identification number and certifies that it is not subject to backup withholding in the manner required.

Backup withholding is not an additional tax. The amount of any backup withholding from a payment to a U.S. Holder will generally be allowed as a credit against the U.S. Holder’s U.S. federal income tax liability or may entitle the U.S. Holder to a refund, provided that the required information is timely furnished to the IRS.

Non-U.S. Holders

This section applies to you if you are a “Non-U.S. Holder.” As used herein, the term “Non-U.S. Holder” means a beneficial owner of our common stock who or that, for U.S. federal income tax purposes, is or is treated as any of the following:

•a non-resident alien individual (other than certain former citizens and residents of the United States subject to U.S. tax as expatriates);

•a foreign corporation; or

•an estate or trust that is not a U.S. Holder.

You are not a Non-U.S. Holder if you are an individual present in the United States for 183 days or more in the taxable year of disposition of our common stock and who is not otherwise a resident of the United States for U.S. federal income tax purposes, in which case you should consult your own tax advisor regarding the U.S. federal income tax consequences of purchasing, owning and disposing of our common stock.

Distributions

If we make distributions of cash or other property on our common stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If a distribution exceeds our current and accumulated earnings and profits, the excess amounts will not be treated as dividends for U.S. federal income tax purposes. Rather, the excess will first constitute a return of capital and be applied against and reduce a Non-U.S. Holder’s adjusted tax basis in its common stock, but not below zero. Any remaining excess will be treated as capital gain and will be treated as described below under “Non-U.S. Holders—Sale or Other Taxable Disposition.” Any such distributions will also be subject to the discussions below under the sections titled “Information Reporting and Backup Withholding” and “Additional Withholding Tax on Payments Made to Foreign Accounts.”

Except as described below with respect to dividends effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States and subject to the discussions below of backup withholding and Sections 1471 to 1474 of the Code (such Sections and related Treasury Regulations commonly referred to as the Foreign Account Tax Compliance Act, or FATCA), dividends paid to a Non-U.S. Holder of our common stock will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of the dividends (or such lower rate specified by an applicable income tax treaty, provided the Non-U.S. Holder furnishes a valid IRS Form W-8BEN or W-8BEN-E (or other applicable documentation) certifying qualification for the lower treaty rate). If a Non-U.S. Holder holds the stock through a financial institution or other intermediary, the Non-U.S. Holder will be required to provide appropriate documentation to the intermediary, which then will be required to provide appropriate documentation to the

S-18

applicable withholding agent, either directly or through other intermediaries. A Non-U.S. Holder that does not timely furnish the required documentation, but that qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS. Non-U.S. Holders should consult their tax advisors regarding their entitlement to benefits under any applicable income tax treaty.

If dividends paid to a Non-U.S. Holder are effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States (and, if required by an applicable income tax treaty, the Non-U.S. Holder maintains a permanent establishment or a fixed base in the United States to which such dividends are attributable), the Non-U.S. Holder will be exempt from the U.S. federal withholding tax described above. To claim the exemption, the Non-U.S. Holder must furnish to the applicable withholding agent a valid IRS Form W-8ECI, certifying that the dividends are effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States.

Any such effectively connected dividends will be subject to U.S. federal income tax generally in the same manner as if the Non-U.S. Holder were a U.S. person and be subject to U.S. federal income tax on a net income basis at the regular U.S. federal income tax rates. A Non-U.S. Holder that is a corporation also may be subject to a branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on its effectively connected earnings and profits for the taxable year that are attributable to such dividends, as adjusted for certain items. Non-U.S. Holders should consult their tax advisors regarding any applicable tax treaties that may provide for different rules or rates.

Sale or Other Taxable Disposition

Subject to the discussions below regarding FATCA and backup withholding (see “Non-U.S. Holders—Information Reporting and Backup Withholding” and “Non-U.S. Holders—Additional Withholding Tax on Payments Made to Foreign Accounts”), a Non-U.S. Holder generally will not be subject to U.S. federal income tax or withholding tax on any gain realized upon the sale or other taxable disposition of our common stock unless:

•the gain is effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States (and, if required by an applicable income tax treaty, the Non-U.S. Holder maintains a permanent establishment or a fixed base in the United States to which such gain is attributable); or

•our common stock constitutes a United States real property interest as defined under Section 897(c)(1) of the Code (“USRPI”), by reason of our status as a United States real property holding corporation as defined under Section 897(c)(2) of the Code, (“USRPHC”), for U.S. federal income tax purposes, at any time within the shorter of the five-year period preceding such sale or other taxable disposition or the Non-U.S. Holder’s holding period for the applicable common stock, and certain other conditions are met.

Gain described in the first bullet point above generally will be subject to U.S. federal income tax generally in the same manner as if the Non-U.S. Holder were a U.S. person and be taxed on the net gain derived from the sale or other taxable disposition under regular U.S. federal income tax rates. A Non-U.S. Holder that is a corporation also may be subject to a branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on a portion of its effectively connected earnings and profits for the taxable year that are attributable to such gain, as adjusted for certain items.

With respect to the second bullet point above, we believe that we currently are not a USRPHC. Generally, a domestic corporation is a USRPHC if the fair market value of its USRPIs equals or exceeds 50% of the aggregate fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business. Because the determination of whether we are a USRPHC depends on the fair market value of our USRPIs relative to the fair market value of our non-U.S. real property interests and our other business assets, there can be no assurance that we currently are not a USRPHC or that we will not become a USRPHC in the future. Even if we are or were to become a USRPHC, our common stock will not be treated as a USRPI with respect to a Non-U.S. Holder if our common stock is “regularly traded,” as defined by applicable Treasury Regulations, on an established securities market (such as the New York Stock Exchange), and such Non-U.S. Holder actually or constructively owned, 5% or less of our common stock throughout the shorter of the five-year period ending on the date of the sale or other taxable disposition of, or the Non-U.S. Holder’s holding period for, our common stock. If the above exception does not apply, such Non-U.S. Holder generally will be taxed on its net gain derived from the disposition at the U.S. federal income tax rates applicable to United States persons (as defined in the Code). In addition, a buyer of our common stock from such Non-U.S. Holder may be required to withhold U.S. federal income tax at a rate of 15% of the amount realized upon such disposition.

S-19

Non-U.S. Holders should consult their tax advisors regarding the application of the above to their particular situation, including the potential application of any available income tax treaty that may provide for different rules.

Information Reporting and Backup Withholding

Payments of dividends on our common stock will not be subject to backup withholding, provided the applicable withholding agent does not have actual knowledge or reason to know the holder is a U.S. person and the Non-U.S. Holder either certifies its non-U.S. status, such as by furnishing a valid IRS Form W-8BEN, W-8BEN-E, W-8ECI, or W-8EXP or otherwise establishes an exemption. However, information returns are required to be filed with the IRS in connection with any dividends on our common stock paid to the Non-U.S. Holder, regardless of whether any tax was actually withheld. In addition, proceeds of the sale or other taxable disposition of our common stock within the United States or conducted through certain U.S.-related brokers generally will not be subject to backup withholding or information reporting, if the applicable withholding agent does not have actual knowledge or reason to know that such holder is a U.S. person and the Non-U.S. Holder either furnishes the certification described above or otherwise establishes an exemption. Proceeds of a disposition of our common stock conducted through a non-U.S. office of a non-U.S. broker generally will not be subject to backup withholding or information reporting.

Copies of information returns that are filed with the IRS may also be made available under the provisions of an applicable treaty or agreement to the tax authorities of the country in which the Non-U.S. Holder resides or is established or organized.

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a Non-U.S. Holder’s U.S. federal income tax liability, provided the required information is timely furnished to the IRS.