0000874501FALSE00008745012024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 22, 2024

| | |

| Ambac Financial Group, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-10777 | | 13-3621676 |

| (State of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

| | | | | | | | | | | |

| One World Trade Center | New York | NY | 10007 |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

| | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to |

| Section 13(a) of the Exchange Act. | ☐ | |

Item 1.01. Entry into a Material Definitive Agreement

Effective February 22, 2024, Ambac Financial Group, Inc. (“Ambac”) and Ambac Assurance Corporation (“AAC”) entered into a Stipulation and Order (the "Stipulation and Order”) with the Wisconsin Office of the Commissioner of Insurance (“OCI”), which supersedes the Stipulation and Order that became effective on February 12, 2018, as amended (the “2018 Stipulation and Order”).

The Stipulation and Order requires AAC to maintain a level of surplus and contingency reserves as regards policyholders which provide reasonable security against contingencies affecting AAC’s financial position that are not otherwise fully covered by reserves or reinsurance; discount loss reserves in a manner approved by OCI; maintain OCI’s runoff capital model according to parameters specified by OCI; pay the costs of consultants and other experts retained by OCI; refrain from certain affiliate transactions and the payment of any dividend or other distribution without the prior non-disapproval of OCI; notify OCI of events that would or would be reasonably likely to cause a material adverse effect to AAC or its affiliates; obtain OCI’s non-disapproval to exercise certain control rights with respect to certain policies that were previously allocated to the Segregated Account of AAC; obtain OCI’s approval for non-ordinary course transactions involving consideration to be paid by AAC of $100 million or more; and obtain OCI’s approval of any changes to AAC’s investment policy or derivative use plan. The Stipulation and Order also requires Ambac to use its best efforts to preserve the use of NOLs for the benefit of AAC and its subsidiaries. The Stipulation and Order differs from the 2018 Stipulation and Order in that the 2018 Stipulation and Order (i) did not refer to OCI’s Runoff Capital Framework; (ii) included certain affirmative covenants concerning books and records, and reporting of information or events, that were not included in the Stipulation and Order; and (iii) contained a more restrictive limitation on transactions with affiliates. The Stipulation and Order has no fixed term and may be terminated or modified only with the approval of OCI. OCI reserved the right to modify or terminate the Stipulation and Order in a manner consistent with the interests of policyholders, creditors and the public generally.

The preceding summary of the Stipulation and Order contained in this Item 1.01 is qualified in its entirety by reference to the full text of the Agreement attached as Exhibit 10.1, as though it were fully set forth herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibit is filed as part of this Current Report on Form 8-K:

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 10.1 | | |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| 104 | | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags or embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ambac Financial Group, Inc. |

| | | (Registrant) |

| | | | | |

| Dated: | February 27, 2024 | | By: | | /s/ William J. White |

| | | | | William J. White |

| | | | | First Vice President, Secretary and Assistant General Counsel |

Exhibit 10.1

OFFICE OF THE COMMISSIONER OF INSURANCE (OCI) STATE OF WISCONSIN

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

In the Matter of:

STIPULATION AND ORDER

Ambac Assurance Corporation,

Respondent. Case No. 23-C45288

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

WHEREAS, Ambac Assurance Corporation, One World Trade Center 41st Floor, New York, New York 10007 (“Respondent” or “AAC”), is subject to the jurisdiction of the Office of the Commissioner of Insurance (the “Commissioner”) in the State of Wisconsin; and

WHEREAS, Ambac Financial Group, Inc., One World Trade Center 41st Floor, New York, New York 10007 (“AFGI”), a corporation domiciled in Delaware that holds 100% of the issued and outstanding common stock of the Respondent, is subject to the jurisdiction of the Commissioner in the State of Wisconsin pursuant to Chapter 617 of the Wisconsin Statutes and through its consent to this Stipulation and Order; and

WHEREAS, pursuant to s. Ins 51.80(7), Wis. Adm. Code, the individual and special circumstances of the Respondent require the OCI to establish additional factors and adjustments to the Respondent’s compulsory surplus to assure an adequate margin of safety in the Respondent’s operations.

WHEREAS, the Respondent requires a structure of supervision suitable to address the complexity of operational and regulatory issues that reasonably may be anticipated to arise from time-to-time over the course of its operations; and

WHEREAS, the Commissioner may, pursuant to ss. 601.41(4) and 623.11, Wis. Stats., and s. Ins 51.80(7), Wis. Adm. Code, determine the amount of compulsory surplus an insurer is required to have and may issue an order under s. 601.41(4)(a) and ch. 617, Wis. Stat.; and

WHEREAS, the Commissioner intends to protect the interests of policyholders, creditors, and the general public, and the Respondent endeavors to cooperate with the Commissioner in that intention.

WHEREAS, the Respondent is required to provide information to the Commissioner pursuant to s. 601.42, Wis. Stat. and such information provided by the Respondent to the Commissioner has the potential for harm and competitive disadvantage to the Respondent if the documents and information are made public, pursuant to s. 601.465, Wis. Stat. The Commissioner has determined the OCI may refuse to disclose and may prevent any other person from disclosing any terms and conditions as set forth in paragraph (3) below.

NOW, THEREFORE, the Respondent and the Commissioner do agree and stipulate to the following terms and conditions:

Ambac Assurance Corporation

Case No. 23-C45288

Page 2

(1) While this Stipulation and Order is in effect, the Respondent shall maintain a level of surplus and contingency reserves as regards policyholders which provide reasonable security against contingencies affecting the Respondent’s financial position that are not otherwise fully covered by reserves or reinsurance, such that the Commissioner may continue to determine that the Respondent’s surplus and contingency reserves are reasonably in excess of a level that would constitute a financially hazardous condition. From time-to-time, in the Commissioner’s sole discretion, the Commissioner may undertake a review of the facts and circumstances of the Respondent’s business and interests for the purpose of reviewing the Respondent’s financial position and modifying or terminating this Stipulation and Order in a manner consistent with the interests of insureds, creditors, and the public generally and shall notify the Respondent as soon as reasonably practicable of his findings following such review.

(2) In determining compliance with paragraph (1), statutory surplus may not reflect the benefit of any reserve discounting, except to the extent approved in writing and notified to the Respondent by the Commissioner and as disclosed in the Notes to Financial Statement of each applicable annual and quarterly financial statement. As of the date of the execution of this Order, the Commissioner has approved that loss reserves are to be discounted at a rate of 5.1% per annum. The Commissioner, with the assistance of the consultants referenced in paragraph (4) below, will review, in consultation with Respondent, the loss reserve discounting practices of Respondent on at least an annual basis.

(3) The Respondent shall provide the Commissioner with a “Capital Model” that complies with the description delivered to the Respondent with this stipulation and order (together with the exhibits, appendices and instructions attached thereto, the “Capital Model Description”), which the Commissioner has determined is an appropriate measure of the Respondent’s capital. Specifically, the Capital Model is based upon certain data and assumptions used to calculate Risk Adjusted Assets (“RAA”) and Risk Adjusted Policy Liabilities (“RAPL”), with the difference between RAA less RAPL resulting in an estimate of Respondent’s capital position. The Commissioner requires the Capital Model pursuant to s. 601.42 Wis. Stat. and will therefore treat it as confidential pursuant to s. 601.465 Wis. Stat. Except with the prior approval of the Commissioner, Respondent and AFGI are hereby directed not to disclose the Capital Model, Capital Model Description, or any portion thereof.

(4) The Commissioner may retain consultants, including accountants, attorneys, investment bankers, and other experts to assist the Commissioner in the Commissioner’s assessment of the Respondent’s financial condition, “Capital Model”, its exposure to loss claims, credit risk, liquidity risk, and other risks and the evaluation of

Ambac Assurance Corporation

Case No. 23-C45288

Page 3

reporting information submitted by the Respondent and Respondent agrees to bear the cost of retaining such experts, including fees, costs, and expenses, and also indemnification under commercially reasonable indemnification agreements.

(5) All transactions between the Respondent and any affiliate shall be reasonable and fair to AAC as determined by the OCI and subject to periodic review to determine whether affiliate transactions continue to be reasonable and fair. The Respondent shall not enter into any transaction with any affiliate, including amendments to existing transactions, including, but not limited to, any of the following without the prior non-disapproval of the OCI:

a)Any sales, purchases, exchanges, loans, advances, extensions of credit, donations or investments; and

b)Payment of any dividend or other distribution.

Provided however, for subsection (a), matters, actions or transactions that require cash payments or asset transfers by Respondent or one of its subsidiaries of amounts less than the lower of (x) $25,000,000 or (y) the applicable threshold determined in accordance with s. Ins. 40.04(2)(a) Wis. Adm. Code (the lower of (x) or (y) being the “Transaction Threshold”) in any twelve-month period and involve the incurrence of obligations or commitments of less than the Transaction Threshold (in each case, measured per matter, action or transaction or, in the case of related matters, actions or transactions, in the aggregate), shall not be subject to this paragraph (5). The Respondent shall provide an annual report to the Commissioner by March 1 of each year which shall include all transactions not subject to this paragraph (5) that were completed in the prior calendar year.

(6) The Respondent shall provide notice to the Commissioner of the occurrence, or failure to occur, of any event which would or would be reasonably likely to cause a material adverse effect to the business, assets, properties, operations, or condition, financial or otherwise, or, insofar as can reasonably be foreseen, prospects, financial or otherwise, of the Respondent, an affiliate of the Respondent, or all affiliates of the Respondent taken as a whole; provided that the following shall be excluded in any determination of material adverse effect: (i) any circumstance, change, or effect, including international events such as acts of terrorism or war, affecting generally companies operating in the financial guaranty business in the same general manner and to the same general extent; or (ii) any circumstance, change, or effect affecting generally the United States or world economy. Without limiting the foregoing, a material adverse effect shall be conclusively presumed if the effect results, or reasonably could result, in a reduction of more than 10% in the Respondent’s surplus as regards

Ambac Assurance Corporation

Case No. 23-C45288

Page 4

policyholders. Notice pursuant to this paragraph (6) shall be provided as soon as practicable after the occurrence, or failure to occur, of the event, and shall include a brief description of the significance of the event, and copies of documents, if any, relating to or received in connection with the event.

(7) Except as otherwise approved by the Commissioner, AFGI shall use its best efforts to preserve use of the NOLs realized by the holding company system led by AFGI for the benefit of the Respondent and its subsidiaries. The term “NOLs” in this paragraph (7) shall have the meaning given in the Tax Sharing Agreement by and among AFGI, the Respondent, and the other parties thereto.

(8) With respect to certain insured transactions whose policies were previously allocated to the Segregated Account, the Respondent may have the ability currently or in the future to: (i) terminate and/or replace servicers, (ii) terminate and/or replace collateral managers, (iii) exercise other rights (to be identified) that have a significant impact on the economics of the insured transaction (collectively “Control Rights”). The Respondent shall file all Control Rights it proposes to exercise at least ten (10) business days before such exercise. If approval is granted by the Commissioner, the Control Right may be implemented prior to the expiration of the ten (10) business days. No Control Right may be executed or carried out if the Commissioner disapproves such Control Right.

(9) The Respondent shall report reasonable loss reserves in its annual and quarterly financial statements. Loss reserves shall be reflected in the Respondent’s annual financial statements at an amount for which a statement of opinion has been issued by an independent, qualified actuary acceptable to the Commissioner.

(10) The Respondent shall file with each annual financial statement, the actuarial report prepared by the actuary providing the statement of opinion under paragraph (9) that supports the statement of opinion. All such actuarial reports received by the Commissioner will be confidential pursuant to s. 601.465, Wis. Stat.

(11) The Respondent shall file each transaction that the Respondent proposes to enter into other than in ordinary course of business with non-affiliated counterparties where the aggregate consideration to be or expected to be paid by the Respondent is equal to or greater than $100,000,000 with the Commissioner for review at least ten (10) days (or such shorter time frame as the Commissioner may agree but in no event less than five (5) business days) prior to closing. If non-disapproval is granted by the Commissioner prior to the expiration of the ten (10) days or such agreed to shorter time frame, the transaction may be implemented immediately after such approval. If the

Ambac Assurance Corporation

Case No. 23-C45288

Page 5

Commissioner takes no action prior to the expiration of the ten (10) days or such agreed to shorter time frame, the transaction may be implemented upon the expiration of the ten (10) days or such shorter time frame. No transaction may be executed or carried out if the Commissioner disapproves the transaction. For the avoidance of doubt, transactions entered into pursuant to the Respondent’s Investment Policy and/or Derivative Use Plan shall not be subject to this paragraph (11).

(12) Any changes to the Respondent’s Investment Policy or Derivative Use Plan shall be submitted to the Commissioner for approval. The Commissioner or its designated representatives shall meet with the Respondent’s management, including its Chief Financial Officer, as requested by the Commissioner to discuss the Investment Policy and Derivative Use Plan and any changes appropriate thereto. The Commissioner may recommend changes to the Investment Policy and Derivative Use Plan and the Respondent shall consider such recommendations in good faith. No changes to the Respondent’s Investment Policy or Derivative Use Plan may be executed or carried out in the absence of OCI’s written approval.

(13) The Respondent hereby consents to the jurisdiction of the Commissioner and the courts of the State of Wisconsin and waives any objection based on lack of personal jurisdiction, improper venue or forum non conveniens with regard to any actions, claims, disputes or proceedings relating to this Stipulation and Order or any other document delivered hereunder or in connection herewith.

(14) For purposes of this Stipulation and Order, the application of the Wisconsin Statutes and the Wisconsin Administrative Code are not modified except as explicitly stated herein. This Order does not purport to supersede any decisions of any court of competent jurisdiction with respect to the Respondent.

(15) The Respondent, AFGI and the Commissioner agree that this Stipulation and Order is not being entered in consequence of any violation of law or for the purpose of imposing a penalty or a specific course of remedial action, but rather as an exercise of the Commissioner’s authority and obligation to determine, when necessary, the amount of compulsory surplus an insurer is required to have under s. 623.11, Wis. Stat., and to establish a structure of supervision suitable to address the complexity of operational and regulatory issues that reasonably may be anticipated to arise from time-to-time over the course of its operations.

(16) Respondent and AFGI acknowledge that the agreements contained herein are made without reservation and constitute a waiver of rights to a hearing, confrontation and cross-examination of witnesses, production of evidence, and judicial review associated with this Order. The Respondent and AFGI acknowledge that the

Ambac Assurance Corporation

Case No. 23-C45288

Page 6

Commissioner may make additional orders or subsequently modify or supersede this Order by making a subsequent order. However, this Stipulation applies only to this Order as originally issued and Respondent and AFGI reserve their rights to contest any other orders of the Commissioner or any modifications to this Order. This Stipulation and Order supersedes the Stipulation and Order (Case No. 17-C42069) entered on January 23, 2018, as amended, which shall have no further force and effect as of the date of the Order entered below.

Ambac Assurance Corporation

Case No. 23-C45288

Page 7

| | | | | | | | |

| 2/21/24 | | /s/ Claude LeBlanc |

Date | | Claude LeBlanc |

| | President and Chief Executive Officer |

| | Ambac Assurance Corporation and Ambac Financial |

| | Group, Inc. |

| | |

| 2/21/24 | | /s/ Amy Malm |

| Date | | Amy Malm, Administrator |

| | Division of Financial Regulation |

ORDER

NOW, THEREFORE, based upon consideration of the Stipulation in this matter, I hereby order under ss. 601.41(4)(a), 623.11, and ch. 617, Wis. Stat., and s. Ins 51.80 (7), Wis. Adm. Code:

1.The Respondent and AFGI shall comply with all agreements made in this Stipulation and Order.

2.Any report provided to the Commissioner or demanded by the Commissioner pursuant to this Stipulation and Order shall be required pursuant to s. 601.42, Wis. Stat., and under this Stipulation and Order.

3.This Order shall be effective on the date it is entered. The Respondent may request the Commissioner to review specific terms and conditions of this Order periodically as conditions warrant.

Dated at Madison, Wisconsin, this 22nd day of February 2024.

| | | | | | | | |

| | /s/ Nathan Houdek |

| | Nathan Houdek |

| | Commissioner of Insurance |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

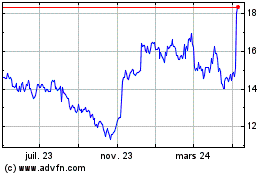

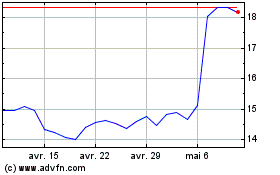

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024