Ambac Financial Group, Inc. (NYSE: AMBC) ("Ambac" or "AFG"), a

financial services holding company, today reported its results for

the quarter ended September 30, 2024.

Third Quarter 2024 Highlights

- Net loss of $(28) million or $(0.63) per diluted share and

Adjusted net loss of $(19) million or $(0.46) per diluted share

driven by approximately $20 million of transaction costs and

acquisition related short-term interest expense

- Total P&C Premium Production of $260 million, increased 86%

from the third quarter of 2023

- Insurance Distribution ("Cirrata") generated total revenue of

$24 million up 64.0% over last year

- Specialty P&C Insurance ("Everspan") combined ratio

improved by 600 bps to 100.5% and total revenue grew 158% from

third quarter of 2023 to $40 million due to growth in the business

and a $7.5 million gain on sale of CNIC

- Legacy Financial Guarantee segment net loss of $(13) million

driven by changes in discount rates

Claude LeBlanc, President and Chief Executive Officer, stated,

"During the quarter we closed the acquisition of Beat Capital

Partners, which sets the stage for our distribution business to

exceed $1 billion of premium placed in 2025. Further to the Beat

acquisition, we had an extraordinary period with the announcement

of three new MGAs, increasing our total to 19, up from 5 last

quarter, and up from 16 at the close of the Beat acquisition. Since

acquiring Beat, the pipeline for new opportunities has materially

expanded, highlighting the position of our combined platforms as a

premier destination for best in class underwriters and MGAs.

Furthermore, I am pleased with the underwriting trend at Everspan,

which improved its combined ratio by 600 basis points in the

quarter on its way towards achieving an attractive return

profile."

LeBlanc continued, “I am also extremely pleased by the

overwhelming shareholder support we received for the sale of our

Legacy Financial Guarantee business. In addition, with PRA

approving the sale, we have only one remaining necessary regulatory

approval, the Wisconsin OCI, which is expected to happen later this

year or early next year. The Board has also approved an

acceleration of our previously announced $50 million share buy-back

program, in advance of the close of the sale of the Legacy

Financial Guarantee Business, which we will commence immediately. I

am looking forward to 2025 when we emerge as a pure-play P&C

franchise and I am encouraged by the positive feedback we have

received from investors to date."

Ambac's Third Quarter 2024

Summary Results

B (W)

Percent

($ in millions, except per share

data)1

3Q2024

3Q2023

Gross written premium

$

113.6

$

79.6

43

%

Net premiums earned

33.1

18.3

81

%

Commission income

23.1

14.6

58

%

Program fees

3.6

2.4

50

%

Net investment income

38.0

30.4

25

%

Pretax income (loss)

(26.5

)

67.5

(139

)%

Net income (loss) attributable to common

stockholders

(27.5

)

65.9

(142

)%

Net income (loss) attributable to common

stockholders per diluted share2,3

$

(0.63

)

$

1.41

(145

)%

EBITDA2,4

6.3

90.8

(93

)%

Adjusted net income (loss) 2

(19.5

)

93.6

(121

)%

Adjusted net income (loss) per diluted

share 2, 3

$

(0.46

)

$

2.00

(123

)%

Weighted-average diluted shares

outstanding (in millions)

47.7

46.8

(2

)%

(1)

Some financial data in this press release

may not add up due to rounding

(2)

See Non-GAAP Financial Data section of

this press release for further information

(3)

Per diluted share includes the impact of

adjusting redeemable noncontrolling interests to current redemption

value

(4)

EBITDA is prior to the impact of

noncontrolling interests, relating to subsidiaries where Ambac does

not own 100%, of $(0.3) and $0.6 for the three months ended

September 30, 2024 and 2023, respectively.

Earnings Call and Webcast

On November 13, 2024, at 8:30am ET, Claude LeBlanc, President

and Chief Executive Officer, and David Trick, Executive Vice

President and Chief Financial Officer, will discuss Ambac's third

quarter 2024 results during a conference call. A live audio webcast

of the call will be available through the Investor Relations

section of Ambac’s website,

https://ambac.com/investor-relations/events-and-presentations/.

Participants may also listen via telephone by dialing (877)

407-9716 (Domestic) or (201) 493-6779 (International).

The webcast will be archived on Ambac's website. A replay of the

call will be available through November 27, 2024, and can be

accessed by dialing (Domestic) (844) 512-2921 or (International)

(412) 317-6671; and using ID#13749354

Additional information is included in an operating supplement

and presentations at Ambac's website at www.ambac.com.

Total Specialty P&C Insurance Production

Specialty P&C Insurance production, which includes gross

premiums written by Ambac's Specialty P&C Insurance segment and

premiums placed by the Insurance Distribution segment, totaled $260

million in the third quarter of 2024, an increase of 86.2% from the

third quarter of 2023.

Specialty P&C Insurance revenues are dependent on gross

premiums written as specialty program insurance companies earn

premiums based on the portion of gross premiums written retained

(i.e. net premiums written) and fees on gross premiums written that

are ceded to reinsurers. Insurance Distribution revenues are

dependent on premium volume as Managing General Agents/Underwriters

and brokers receive commissions based on the amount of premiums

placed (i.e. gross premiums written on behalf of insurance

carriers) with insurance carriers.

Three Months Ended September

30,

Nine Months Ended September

30,

($ in millions)

2024

2023

% Change

2024

2023

% Change

Specialty Property & Casualty

Insurance Gross Premiums Written

$

115.2

$

77.5

49

%

$

322.8

$

182.6

77

%

Insurance Distribution Premiums Placed

144.9

62.2

133

%

288.5

180.5

60

%

Specialty P&C Insurance Production

$

260.1

$

139.7

86

%

$

611.2

$

363.0

68

%

Results of Operations by Segment

Insurance Distribution Segment

Three Months Ended September

30,

Nine Months Ended September

30,

($ in millions)

2024

2023

% Change

2024

2023

% Change

Total revenues

$

24.0

$

14.6

64

%

$

55.2

$

39.2

41

%

Pretax income

$

(7.9

)

$

2.4

(424

)%

$

(2.8

)

$

6.7

(143

)%

EBITDA1

$

2.4

$

3.5

(31

)%

$

9.8

$

9.7

1

%

Pretax income margin2

(33.1

)%

16.7

%

-4980 bps

(5.2

)%

17.0

%

-2220 bps

EBITDA margin 3

10.2

%

24.1

%

-1390 bps

17.8

%

24.8

%

-700 bps

(1)

EBITDA is prior to the impact of

noncontrolling interests, relating to subsidiaries where Ambac does

not own 100%, of $(0.3) and $0.6 for the three months ended

September 30, 2024 and 2023, respectively.

(2)

Represents Pretax income divided by total

revenues

(3)

See Non-GAAP Financial Data section of

this press release for further information

- Premiums placed and revenue grew during the third quarter of

2024 compared to the third quarter of 2023 driven by the inclusion

of 2 months of Beat Capital's results, an additional month of

production from Riverton Insurance Agency (acquired August 1, 2023)

and organic growth.

- EBITDA of $2.4 million for the quarter was down from the $3.5

million in third quarter of 2023; EBITDA margin of 10.2% for the

quarter compared to 24.1% last year was largely due to $1.4 million

of foreign exchange losses, $1.3 million of de-novo/start up costs

and seasonal impacts.

Specialty Property & Casualty Insurance Segment

Three Months Ended September

30,

Nine Months Ended September

30,

($ in millions)

2024

2023

% Change

2024

2023

% Change

Net premiums written

$

32.8

$

24.8

32

%

$

91.3

$

43.1

112

%

Total revenue

$

40.1

$

15.5

158

%

$

101.5

$

35.5

186

%

Losses and loss expense

$

20.4

$

9.5

115

%

$

62.8

$

19.9

215

%

Pretax income (loss)

$

8.9

$

0.1

(6284

)%

$

9.7

$

(0.8

)

1373

%

Combined Ratio

100.5

%

106.5

%

-600 bps

102.8

%

112.3

%

-950 bps

- Gross premium written ("GPW") and Net premium written ("NPW")

grew substantially in the third quarter of 2024 relative to the

third quarter of 2023 as Everspan continues to add new programs and

existing programs scale.

- Combined ratio of 100.5% for the third quarter of 2024 improved

compared to 106.5% in the third quarter of 2023 and 109.4% in the

prior quarter.

- The loss and loss expense ratio for the third quarter of 2024

was 74.4% compared to 78.0% for the third quarter of 2023.

- The expense ratio(1) of 26.1% for the third quarter of 2024 was

down from 28.5% in the prior year period as expenses continue to

normalize on a relative basis. In addition, sliding scale

commissions, linked to loss ratios on certain programs, reduced the

expense ratio by 1.9% in the third quarter of 2024 compared to 8.1%

in the prior year period.

- Everspan realized a net gain of $7.5 million on the sale of

Consolidated National Insurance Company (“CNIC”), a subsidiary

admitted carrier.

(1)

Expense Ratio is defined as acquisition

costs and general and administrative expenses, reduced by program

fees divided by net premiums earned

Legacy Financial Guarantee Insurance Segment

Three Months Ended September

30,

Nine Months Ended September

30,

($ in millions)

2024

2023

% Change

2024

2023

% Change

Net premiums earned

$

5.7

$

6.1

(7

)%

$

18.7

$

20.5

(9

)%

Net investment income

$

34.5

$

26.7

29

%

$

104.9

$

90.1

17

%

Losses and loss adjustment expenses

(benefit)

$

17.2

$

(85.8

)

(120

)%

$

(8.8

)

$

(71.2

)

(88

)%

Pretax income (loss)

$

(9.4

)

$

69.2

114

%

$

28.4

$

29.4

3

%

EBITDA1

$

12.7

$

91.3

(86

)%

$

101.4

$

96.2

5

%

(1)

See Non-GAAP Financial Data section of

this press release for further information

- The Legacy Financial Guarantee Segment experienced a pre-tax

loss of $9.4 million in the third quarter of 2024, primarily as a

result incurred losses driven by a decline in discount rates. The

third quarter of 2023 results were driven by incurred loss benefits

from higher discount rates and a significant increase in RMBS

recoveries.

- Watch List and Adversely Classified Credits ("WLACC") decreased

1.7% (2.9%, excluding the impact of FX) to $5.2 billion in third

quarter of 2024, from June 30, 2024.

- NPO was $18.8 billion at third quarter of 2024 a increase of

0.5% (decrease of 2.0%, excluding the impact of FX) from June 30,

2024, due to the impact of FX rates.

AFG (holding company only) Assets

AFG on a standalone basis, excluding its ownership interests in

its Specialty P&C Insurance, Insurance Distribution, and Legacy

Financial Guarantee subsidiaries, had net assets of $147 million as

of September 30, 2024. Assets included cash and liquid securities

of $97 million and other investments of $32 million.

Consolidated Ambac Financial Group, Inc. Stockholders'

Equity

Stockholders’ equity at September 30, 2024, was $1.47 billion,

or $30.89 per share compared to $1.37 billion or $30.25 per share

as of June 30, 2024. The net loss attributable to common

shareholders of $28 million was offset by net unrealized investment

gains of $37 million, foreign exchange translation gains of $57

million ($11 million of which was attributable to Beat), and $29

million of stock issued in connection with the Beat

acquisition.

Non-GAAP Financial Data

In addition to reporting the Company’s quarterly financial

results in accordance with GAAP, the Company is reporting non-GAAP

financial measures: EBITDA, Adjusted Net Income, Adjusted Book

Value and EBITDA Margin. These amounts are derived from our

consolidated financial information, but are not presented in our

consolidated financial statements prepared in accordance with

GAAP.

We present non-GAAP supplemental financial information because

we believe such information is of interest to the investment

community, and that it provides greater transparency and enhanced

visibility into the underlying drivers and performance of our

businesses on a basis that may not be otherwise apparent on a GAAP

basis. We view these non-GAAP financial measures as important

indicators when assessing and evaluating our performance on a

segmented and consolidated basis and they are presented to improve

the comparability of our results between periods by eliminating the

impact of the items that may not be representative of our core

operating performance. These non-GAAP financial measures are not

substitutes for the Company’s GAAP reporting, should not be viewed

in isolation and may differ from similar reporting provided by

other companies, which may define non-GAAP measures

differently.

Given the changes of our business profile going forward we

expect to revise our non-GAAP financial measures in 2025.

Adjusted Net Income (Loss) —

We define Adjusted Net Income (Loss) as net income (loss)

attributable to common stockholders adjusted to reflect the

following items: (i) net investment (gains) losses, including

impairments; (ii) amortization of intangible assets; (iii)

litigation costs, including attorneys fees and other expenses to

defend litigation against the Company, excluding loss adjustment

expenses; (iv) foreign exchange (gains) losses; (v) workforce

change costs, which primarily include severance and other costs

related to employee terminations; and (vi) net (gain) loss on

extinguishment of debt. Adjusted Net Income is also adjusted for

the effect of the above items on both income taxes and

noncontrolling interests. The income tax effects are determined by

applying the statutory tax rate in each jurisdiction that generate

these adjustments. The noncontrolling interest adjustments relate

to subsidiaries where Ambac does not own 100%

Adjusted Net Income (Loss) was $(19.5) million, or $(0.46) per

diluted share, for the third quarter 2024 compared to Adjusted Net

Income (Loss) of $93.6 million, or $2.00 per diluted share, for the

third quarter of 2023.

The following table reconciles net income (loss) attributable to

common stockholders to the non-GAAP measure, Adjusted Net Income

(Loss), for the three-month periods ended September 30, 2024 and

2023, respectively:

Three Months Ended September

30,

2024

2023

($ in millions, other than per share

data)

$ Amount

Per Share

$ Amount

Per Share

Net income (loss) attributable to

common shareholders

$

(27.5

)

$

(0.63

)

$

65.9

$

1.41

Adjustments:

Net investment (gains) losses, including

impairments

1.5

0.03

(0.8

)

(0.02

)

Intangible amortization

12.6

0.27

7.2

0.15

Litigation costs

1.8

0.04

20.6

0.44

Foreign exchange (gains) losses

(4.1

)

(0.09

)

0.5

0.01

Workforce change costs

(0.1

)

—

0.2

—

Pretax adjusted net income

(loss)

(15.8

)

(0.38

)

93.6

1.99

Income tax effects

(1.9

)

(0.04

)

0.3

0.01

Net (gains) attributable to noncontrolling

interests

(1.8

)

(0.04

)

(0.2

)

—

Adjusted Net Income (Loss)

$

(19.5

)

$

(0.46

)

$

93.6

$

2.00

Weighted-average diluted shares

outstanding (in millions)

47.7

46.8

(1)

Per Diluted share includes the impact of

adjusting the Insurance Distribution segment related noncontrolling

interest to current redemption value

Nine Months Ended September

30,

2024

2023

($ in millions, other than per share

data)

$ Amount

Per Share

$ Amount

Per Share

Net income (loss) attributable to

common shareholders

$

(8.2

)

$

(0.23

)

$

19.3

$

0.41

Adjustments:

Net investment (gains) losses, including

impairments

(2.7

)

(0.06

)

7.0

0.15

Intangible amortization

33.2

0.71

20.6

0.44

Litigation costs

12.8

0.27

37.1

0.79

Foreign exchange (gains) losses

(3.4

)

(0.07

)

0.2

—

Workforce change costs

(0.1

)

—

0.9

0.02

Pretax adjusted net income

(loss)

31.7

0.62

85.0

1.81

Income tax effects

(2.3

)

(0.05

)

(1.2

)

(0.03

)

Net (gains) attributable to noncontrolling

interests

(2.2

)

(0.05

)

(0.6

)

(0.01

)

Adjusted Net Income (Loss)

$

27.3

$

0.52

$

83.2

$

1.77

Weighted average diluted shares

outstanding

46.6

46.8

EBITDA — We define EBITDA as

net income (loss) before interest expense, income taxes,

depreciation and amortization of intangible assets.

The following table reconciles net income (loss) attributable to

common shareholders to the non-GAAP measure, EBITDA on a

consolidation and segment basis.

Legacy Financial Guarantee

Insurance

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Three Months

Ended September 30, 2024

Net income (loss) (1)

$

(13.1

)

$

8.0

$

(7.1

)

$

(17.1

)

$

(29.3

)

Adjustments:

Interest expense

15.8

—

3.7

—

19.5

Income taxes

3.6

0.9

(0.9

)

(0.9

)

2.8

Depreciation

0.2

—

0.2

0.3

0.7

Amortization of intangible assets

6.2

—

6.4

—

12.6

EBITDA (2)

$

12.7

$

8.9

$

2.4

$

(17.8

)

$

6.3

Three Months

Ended September 30, 2023

Net income (loss) (1)

$

66.2

$

0.1

$

2.4

$

(2.5

)

$

66.3

Adjustments:

Interest expense

15.8

—

—

—

15.8

Income taxes

3.0

—

—

(1.8

)

1.2

Depreciation

0.3

—

—

—

0.3

Amortization of intangible assets

6.1

—

1.1

—

7.2

EBITDA (2)

$

91.3

$

0.1

$

3.5

$

(4.2

)

$

90.8

(1)

Net income (loss) is prior to the impact

of noncontrolling interests.

(2)

EBITDA is prior to the impact of

noncontrolling interests, relating to subsidiaries where Ambac does

not own 100%, of $(0.3) and $0.6 for the three months ended

September 30, 2024 and 2023, respectively. These noncontrolling

interests are primarily in the Insurance Distribution segment.

Legacy Financial Guarantee

Insurance

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Nine Months Ended

September 30, 2024

Net income (loss) (1)

$

17.7

$

8.6

$

(2.1

)

$

(33.3

)

$

(9.0

)

Adjustments:

Interest expense

47.7

—

3.7

—

51.5

Income taxes

10.8

1.0

(0.8

)

(1.0

)

10.0

Depreciation

0.7

—

0.2

0.9

1.8

Amortization of intangible assets

24.5

—

8.7

—

33.2

EBITDA (2)

$

101.4

$

9.7

$

9.8

$

(33.4

)

$

87.4

Nine Months Ended

September 30, 2023

Net income (loss) (1)

$

21.0

$

(0.8

)

$

6.6

$

(6.3

)

$

20.5

Adjustments:

Interest expense

48.2

—

—

—

48.2

Income taxes

8.4

—

0.1

(1.4

)

7.1

Depreciation

1.1

—

—

0.1

1.2

Amortization of intangible assets

17.6

—

3.0

—

20.6

EBITDA (2)

$

96.2

$

(0.8

)

$

9.7

$

(7.5

)

$

97.6

(1)

Net income (loss) is prior to the impact

of noncontrolling interests.

(2)

EBITDA is prior to the impact of

noncontrolling interests, relating to subsidiaries where Ambac does

not own 100%, of $1.1 and $1.8 for the nine months ended September

30, 2024 and 2023, respectively. These noncontrolling interests are

primarily in the Insurance Distribution segment.

(3)

EBITDA margin

— We define EBITDA margin as EBITDA divided by total revenues. We

report EBITDA margin for the Insurance Distribution segment

only.

Adjusted Book Value.

Adjusted book value is defined as Total Ambac Financial Group, Inc.

stockholders’ equity as reported under GAAP, adjusted for after-tax

impact of the following:

- Insurance intangible asset: Elimination of the financial

guarantee insurance intangible asset that arose as a result of

Ambac’s emergence from bankruptcy and the implementation of Fresh

Start reporting. This adjustment ensures that all financial

guarantee contracts are accounted for within adjusted book value

consistent with the provisions of the Financial Services—Insurance

Topic of the ASC.

- Net unearned premiums and fees in excess of expected losses:

Addition of the value of the unearned premium revenue ("UPR") on

financial guarantee contracts, in excess of expected losses, net of

reinsurance. This non-GAAP adjustment presents the economics of UPR

and expected losses for financial guarantee contracts on a

consistent basis. In accordance with GAAP, stockholders’ equity

reflects a reduction for expected losses only to the extent they

exceed UPR. However, when expected losses are less than UPR for a

financial guarantee contract, neither expected losses nor UPR have

an impact on stockholders’ equity. This non-GAAP adjustment adds

UPR in excess of expected losses, net of reinsurance, to

stockholders’ equity for financial guarantee contracts where

expected losses are less than UPR. This adjustment is only made for

financial guarantee contracts since such premiums are

non-refundable.

- Net unrealized investment (gains) losses in Accumulated Other

Comprehensive Income: Elimination of the unrealized gains and

losses on the Company’s investments that are recorded as a

component of accumulated other comprehensive income (“AOCI”), net

of income taxes.

Ambac has a significant U.S. tax net operating loss (“NOL”) that

is offset by a full valuation allowance in the GAAP consolidated

financial statements. As a result of this, tax planning strategies

and other considerations, we utilized a 0% effective tax rate for

non-GAAP operating adjustments to Adjusted Book.

Adjusted book value was $1.39 billion, or $29.28 per share, at

September 30, 2024, as compared to $1.32 billion, or $29.23 per

share, at June 30, 2024.

The following table reconciles Total Ambac Financial Group, Inc.

stockholders’ equity to the non-GAAP measure adjusted book value as

of each date presented:

September 30, 2024

June 30, 2024

($ in millions, other than per share

data)

$ Amount

Per Share

$ Amount

Per Share

Total AFG Stockholders' Equity

$

1,465.3

$

30.89

$

1,368.1

$

30.25

Adjustments:

Insurance intangible asset

(224.0

)

(4.73

)

(226.2

)

(5.00

)

Net unearned premiums and fees in excess

of expected losses

161.3

3.40

156.6

3.46

Net unrealized investment (gains) losses

in Accumulated Other Comprehensive Income

(13.4

)

(0.28

)

23.3

0.52

Adjusted book value

$

1,389.2

$

29.28

$

1,321.8

$

29.23

Shares outstanding (in millions)

47.4

45.2

Share Repurchase Authorization

On November 12, 2024, Ambac’s Board of Directors authorized a

share repurchase program, under which Ambac may opportunistically

repurchase up to $50 million of the Company’s common shares at

management’s discretion over the period ending on December 31,

2026. The Company previously announced that it would initiate a

share repurchase program in the first three months following the

closing of the sale of Ambac Assurance Corporation. The Board of

Directors has now authorized an earlier commencement of the program

based on market conditions and other factors. The Company intends

to repurchase no more than $15 million of the Company’s common

shares prior to the completion of the sale of Ambac Assurance

Corporation, due to contractual restrictions in the Company's

credit agreement entered into in connection with the financing of

the Beat acquisition. Under the share repurchase program, shares

may be repurchased from time to time in the open market or through

negotiated transactions at prevailing market rates, or by other

means in accordance with federal securities laws. There is no

guarantee as to the exact number or value of shares that will be

repurchased by the Company, and the Company may discontinue

repurchases at any time that management determines additional

repurchases are not warranted. The timing and amount of share

repurchases under the share repurchase program will depend on

several factors, including the Company's stock price performance,

ongoing capital planning considerations, general market conditions,

the likelihood of repurchases causing one or more stockholders to

hold 5% or more of the Company’s common stock, and applicable legal

requirements.

About Ambac

Ambac Financial Group, Inc. (“Ambac” or “AFG”) is an insurance

holding company headquartered in New York City. Ambac’s core

business is a growing specialty P&C distribution and

underwriting platform. Ambac also has a legacy financial guarantee

business in run-off which we have agreed to sell to funds managed

by Oaktree Capital Management pending regulatory and shareholder

approval. Ambac’s common stock trades on the New York Stock

Exchange under the symbol “AMBC”. Ambac is committed to providing

timely and accurate information to the investing public, consistent

with our legal and regulatory obligations. To that end, we use our

website to convey information about our businesses, including the

anticipated release of quarterly financial results, quarterly

financial, statistical and business-related information. For more

information, please go to www.ambac.com.

The Amended and Restated Certificate of Incorporation of Ambac

contains substantial restrictions on the ability to transfer

Ambac’s common stock. Subject to limited exceptions, any attempted

transfer of common stock shall be prohibited and void to the extent

that, as a result of such transfer (or any series of transfers of

which such transfer is a part), any person or group of persons

shall become a holder of 5% or more of Ambac’s common stock or a

holder of 5% or more of Ambac’s common stock increases its

ownership interest.

Forward-Looking Statements

In this press release, statements that may constitute

“forward-looking statements” within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Words such as “estimate,” “project,” “plan,” “believe,”

“anticipate,” “intend,” “planned,” “potential” and similar

expressions, or future or conditional verbs such as “will,”

“should,” “would,” “could,” and “may,” or the negative of those

expressions or verbs, identify forward-looking statements. We

caution readers that these statements are not guarantees of future

performance. Forward-looking statements are not historical facts

but instead represent only our beliefs regarding future events,

which may by their nature be inherently uncertain and some of which

may be outside our control. These statements may relate to plans

and objectives with respect to the future, among other things which

may change. We are alerting you to the possibility that our actual

results may differ, possibly materially, from the expected

objectives or anticipated results that may be suggested, expressed

or implied by these forward-looking statements. Important factors

that could cause our results to differ, possibly materially, from

those indicated in the forward-looking statements include, among

others, those discussed under “Risk Factors” in our most recent SEC

filed quarterly or annual report.

Any or all of management’s forward-looking statements here or in

other publications may turn out to be incorrect and are based on

management’s current belief or opinions. Ambac Financial Group’s

(“AFG”) and its subsidiaries’ (collectively, “Ambac” or the

“Company”) actual results may vary materially, and there are no

guarantees about the performance of Ambac’s securities. Among

events, risks, uncertainties or factors that could cause actual

results to differ materially are: (1) the high degree of volatility

in the price of AFG’s common stock; (2) uncertainty concerning the

Company’s ability to achieve value for holders of its securities,

whether from Ambac Assurance Corporation (“AAC”) and its

subsidiaries or from the specialty property and casualty insurance

business, the insurance distribution business, or related

businesses; (3) inadequacy of reserves established for losses and

loss expenses and the possibility that changes in loss reserves may

result in further volatility of earnings or financial results; (4)

potential for rehabilitation proceedings or other regulatory

intervention or restrictions against AAC; (5) credit risk

throughout Ambac’s business, including but not limited to credit

risk related to insured residential mortgage-backed securities,

student loan and other asset securitizations, public finance

obligations (including risks associated with Chapter 9 and other

restructuring proceedings), issuers of securities in our investment

portfolios, and exposures to reinsurers and insurance distribution

partners; (6) our inability to effectively reduce insured financial

guarantee exposures or achieve recoveries or investment objectives;

(7) the Company’s inability to generate the significant amount of

cash needed to service its debt and financial obligations, and its

inability to refinance its indebtedness; (8) the Company’s

substantial indebtedness could adversely affect the Company’s

financial condition and operating flexibility; (9) the Company may

not be able to obtain financing, refinance its outstanding

indebtedness, or raise capital on acceptable terms or at all due to

its substantial indebtedness and financial condition; (10) greater

than expected underwriting losses in the Company’s specialty

property and casualty insurance business; (11) failure of specialty

insurance program partners to properly market, underwrite or

administer policies; (12) inability to obtain reinsurance coverage

or charge rates for insurance on expected terms; (13) loss of key

relationships for production of business in specialty property and

casualty and insurance distribution businesses or the inability to

secure such additional relationships to produce expected results;

(14) the impact of catastrophic public health, environmental or

natural events, or global or regional conflicts; (15) credit risks

related to large single risks, risk concentrations and correlated

risks; (16) risks associated with adverse selection as Ambac’s

financial guarantee insurance portfolio runs off; (17) the risk

that the Company’s risk management policies and practices do not

anticipate certain risks and/or the magnitude of potential for

loss; (18) restrictive covenants in agreements and instruments that

impair Ambac’s ability to pursue or achieve its business

strategies; (19) adverse effects on operating results or the

Company’s financial position resulting from measures taken to

reduce financial guarantee risks in its insured portfolio; (20)

disagreements or disputes with the Company’s insurance regulators;

(21) loss of control rights in transactions for which we provide

financial guarantee insurance; (22) inability to realize expected

recoveries of financial guarantee losses; (23) risks attendant to

the change in composition of securities in Ambac’s investment

portfolios; (24) failure of a financial institution in which we

maintain cash and investment accounts; (25) adverse impacts from

changes in prevailing interest rates; (26) events or circumstances

that result in the impairment of our intangible assets and/or

goodwill that was recorded in connection with Ambac’s acquisitions;

(27) factors that may negatively influence the amount of

installment premiums paid to Ambac; (28) the risk of litigation,

regulatory inquiries, investigations, claims or proceedings, and

the risk of adverse outcomes in connection therewith; (29) the

Company’s ability to adapt to the rapid pace of regulatory change;

(30) actions of stakeholders whose interests are not aligned with

broader interests of Ambac's stockholders; (31) system security

risks, data protection breaches and cyber attacks; (32) regulatory

oversight of Ambac Assurance UK Limited (“Ambac UK”) and applicable

regulatory restrictions may adversely affect our ability to realize

value from Ambac UK or the amount of value we ultimately realize;

(33) failures in services or products provided by third parties;

(34) political developments that disrupt the economies where the

Company has insured exposures or the markets in which our insurance

programs operate; (35) our inability to attract and retain

qualified executives, senior managers and other employees, or the

loss of such personnel; (36) fluctuations in foreign currency

exchange rates; (37) failure to realize our business expansion

plans, including failure to effectively onboard new program

partners, or failure of such plans to create value; (38) greater

competition for our specialty property and casualty insurance

business and/or our insurance distribution business; (39) loss or

lowering of the AM Best rating for our property and casualty

insurance company subsidiaries; (40) disintermediation within the

insurance industry or greater competition from technology-based

insurance solutions or non-traditional insurance markets; (41)

adverse effects of market cycles in the property and casualty

insurance industry; (42) variations in commision income resulting

from timing of policy renewals and the net effect of new and lost

business production; (43) variations in contingent commissions

resulting from the effects insurance losses; (44) reliance on a

limited number of counterparties to produce revenue in our

specialty property and casualty insurance and insurance

distribution businesses; (45) changes in law or in the functioning

of the healthcare market that impair the business model of our

accident and health managing general underwriter; (46) failure to

consummate the proposed sale of all of the common stock of AAC and

the transactions contemplated by the related stock purchase

agreement (the “Sale Transactions”) in a timely manner or at all;

(47) potential litigation relating to the proposed Sale

Transactions; (48) disruptions from the proposed Sale Transactions

that may harm Ambac’s business, including current plans and

operations; (49) potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the

proposed Sale Transactions; (50) difficulties in identifying

appropriate acquisition or investment targets, properly evaluating

the business and prospects of acquired businesses, businesses in

which we invest, or targets, integrating acquired businesses into

our business or failures to realize expected synergies from

acquisitions or new business investments; (51) failure to realize

expected benefits from investments in technology; (52) harmful acts

and omissions of our business counterparts; and (53) other risks

and uncertainties that have not been identified at this time.

AMBAC FINANCIAL GROUP, INC. AND

SUBSIDIARIES

Consolidated Statements of Income (Loss)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in millions, except share

data)

2024

2023

2024

2023

Revenues:

Net premiums earned

$

33

$

18

$

99

$

47

Commission income

23

15

54

39

Program fees

4

2

10

6

Net investment income

38

30

116

100

Net investment gains (losses), including

impairments

(1

)

1

3

(7

)

Net gains (losses) on derivative

contracts

5

4

7

1

Income (loss) on variable interest

entities

3

1

5

—

Other income

10

2

28

7

Total revenues and other income

114

74

321

194

Expenses:

Losses and loss adjustment expenses

(benefit)

38

(76

)

54

(51

)

Amortization of deferred acquisition

costs, net

6

2

16

5

Commission expense

9

8

27

22

General and administrative expenses

55

49

139

122

Intangible amortization

13

7

33

21

Interest expense

20

16

51

48

Total expenses

141

6

320

166

Pretax income (loss)

(27

)

68

1

28

Provision for income taxes

3

1

10

7

Net income (loss)

(29

)

66

(9

)

21

Less: net (gain) loss attributable to

noncontrolling interest

2

—

1

(1

)

Net income (loss) attributable to

common stockholders

$

(28

)

$

66

$

(8

)

$

19

Net income (loss) per basic

share

$

(0.63

)

$

1.44

$

(0.23

)

$

0.42

Net income (loss) per diluted

share

$

(0.63

)

$

1.41

$

(0.23

)

$

0.41

Weighted-average number of common

shares outstanding:

Basic

47,688,986

45,635,373

46,580,518

45,652,555

Diluted

47,688,986

46,810,735

46,580,518

46,786,443

AMBAC FINANCIAL GROUP, INC. AND

SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

($ in millions, except share

data)

September 30,

2024

June 30, 2024

Assets:

Investments:

Fixed maturity securities, at fair value

(amortized cost: $1,737 and $1,737)

$

1,740

$

1,703

Fixed maturity securities pledged as

collateral, at fair value (amortized cost: $27 and $27)

27

25

Fixed maturity securities - trading

—

31

Short-term investments, at fair value

(amortized cost: $305 and $314)

305

314

Other investments (includes $535 and $533

at fair value)

561

558

Total investments (net of allowance for

credit losses of $1 and $3)

2,634

2,632

Cash and cash equivalents (including $16

and $12 of restricted cash)

70

35

Premium receivables (net of allowance for

credit losses of $3 and $4)

342

317

Reinsurance recoverable on paid and unpaid

losses (net of allowance for credit losses of $0 and $0)

311

277

Deferred ceded premium

242

232

Deferred acquisition costs

13

12

Subrogation recoverable

124

128

Intangible assets, less accumulated

amortization

598

285

Goodwill

434

70

Other assets

228

163

Variable interest entity assets:

Fixed maturity securities, at fair

value

2,238

2,101

Restricted cash

47

62

Loans, at fair value

1,651

1,567

Derivative and other assets

326

303

Total assets

$

9,256

$

8,184

Liabilities and Stockholders’

Equity:

Liabilities:

Unearned premiums

$

458

$

445

Loss and loss adjustment expense

reserves

938

890

Ceded premiums payable

165

140

Deferred program fees and reinsurance

commissions

8

7

Deferred taxes

100

20

Short-term debt

148

—

Long-term debt

518

515

Accrued interest payable

515

500

Other liabilities

262

183

Variable interest entity liabilities:

Long-term debt (includes $2,738 and $2,710

at fair value)

2,996

2,853

Derivative liabilities

1,223

1,136

Other liabilities

51

59

Total liabilities

7,383

6,748

Redeemable noncontrolling interest

204

17

Stockholders’ equity:

Preferred stock, par value $0.01 per

share; 20,000,000 shares authorized shares; issued and outstanding

shares—none

—

—

Common stock, par value $0.01 per share;

130,000,000 shares authorized; issued shares: 48,875,167 and

46,659,144

—

—

Additional paid-in capital

328

295

Accumulated other comprehensive income

(loss)

(81

)

(175

)

Retained earnings

1,235

1,265

Treasury stock, shares at cost: 1,432,634

and 1,463,774

(17

)

(17

)

Total Ambac Financial Group, Inc.

stockholders’ equity

1,465

1,368

Nonredeemable noncontrolling interest

205

51

Total stockholders’ equity

1,670

1,419

Total liabilities, redeemable

noncontrolling interest and stockholders’ equity

$

9,256

$

8,184

The following table presents segment financial results and

includes the non-GAAP measure, EBITDA on a segment and consolidated

basis.

($ in millions)

Legacy Financial Guarantee

Insurance

Specialty Property &

Casualty Insurance

Insurance Distribution

Corporate & Other

Consolidated

Three Months

Ended September 30, 2024

Gross premiums written

$

(1.6

)

$

115.2

$

113.6

Net premiums written

(1.9

)

32.8

30.8

Revenues:

Net premiums earned

5.7

27.4

33.1

Commission income

$

23.1

23.1

Program fees

3.6

3.6

Net investment income

34.5

1.7

0.3

$

1.5

38.0

Net investment gains (losses), including

impairments

(0.9

)

—

(0.6

)

(1.5

)

Net gains (losses) on derivative

contracts

(1.3

)

4.9

5.2

Other income

6.3

7.4

(1.0

)

—

12.7

Total revenues and other income

44.1

40.1

24.0

5.9

114.1

Expenses:

Losses and loss adjustment expenses

(benefit)

17.2

20.4

37.6

Commission expense

9.5

9.5

Amortization of deferred acquisition

costs, net

—

6.0

6.0

General and administrative expenses

14.2

4.8

12.1

23.7

54.7

Total expenses included for

EBITDA

31.4

31.2

21.6

23.7

107.8

EBITDA

12.7

8.9

2.4

(17.8

)

6.3

Less: Interest expense

15.8

19.5

Less: Depreciation expense

0.2

—

0.2

0.3

0.7

Less: Intangible amortization

6.2

6.4

12.6

Pretax income (loss)

(9.4

)

8.9

(7.9

)

(18.1

)

(26.5

)

Income tax expense (benefit)

3.6

0.9

(0.9

)

(0.9

)

2.8

Net income (loss)

$

(13.1

)

$

8.0

$

(7.1

)

$

(17.1

)

$

(29.3

)

Three Months

Ended September 30, 2023

Gross premiums written

$

2.1

$

77.5

$

79.6

Net premiums written

2.5

24.8

27.2

Revenues:

Net premiums earned

6.1

12.2

18.3

Commission income

$

14.6

14.6

Program fees

2.4

2.4

Net investment income

26.7

1.0

$

2.6

30.4

Net investment gains (losses), including

impairments

0.8

—

—

0.8

Net gains (losses) on derivative

contracts

4.4

—

4.4

Other income

3.0

(0.1

)

0.1

—

3.0

Total revenues and other income

40.9

15.5

14.6

2.6

73.8

Expenses:

Losses and loss adjustment expenses

(benefit)

(85.8

)

9.5

(76.3

)

Amortization of deferred acquisition

costs, net

—

2.0

1.9

Commission expense

8.5

8.5

General and administrative expenses

35.5

3.9

2.6

6.8

48.9

Total expenses included for

EBITDA

(50.4

)

15.4

11.1

6.8

(17.1

)

EBITDA

91.3

0.1

3.5

(4.2

)

90.8

Less: Interest expense

15.8

15.8

Less: Depreciation expense

0.3

—

—

—

0.3

Less: Intangible amortization

6.1

1.1

7.2

Pretax income (loss)

69.2

0.1

2.4

(4.2

)

67.5

Income tax expense (benefit)

3.0

—

—

(1.8

)

1.2

Net income (loss)

$

66.2

$

0.1

$

2.4

$

(2.5

)

$

66.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112924492/en/

Charles J. Sebaski Managing Director, Investor Relations (212)

208-3222 csebaski@ambac.com

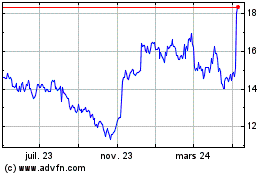

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

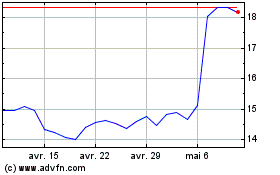

Ambac Financial (NYSE:AMBC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025