Amphenol Corporation Announces Pricing of Senior Notes Offering

02 Avril 2024 - 11:29PM

Business Wire

Amphenol Corporation (NYSE: APH) announced today the pricing of

its offering of $450 million aggregate principal amount of senior

notes due 2027 (the “2027 Notes”), $450 million aggregate principal

amount of senior notes due 2029 (the “2029 Notes”) and $600 million

aggregate principal amount of senior notes due 2034 (the “2034

Notes”, and together with the 2027 Notes and 2029 Notes, the

“Notes”). The 2027 Notes will have an interest rate of 5.050% per

annum, the 2029 Notes will have an interest rate of 5.050% per

annum, and the 2034 Notes will have an interest rate of 5.250% per

annum. The closing of the offering is expected to occur on April 5,

2024, subject to the satisfaction of customary closing

conditions.

The Company intends to use the net proceeds from the offering,

together with a combination of cash on hand and other debt

financing, to pay the cash consideration for the Company’s pending

acquisition of the Carlisle Interconnect Technologies business of

Carlisle Companies Incorporated (the “CIT Acquisition”), the

payment of fees and expenses related thereto and, to the extent

that the net proceeds from this offering are not used for such

purposes, for general corporate purposes.

Each series of the Notes are expected to be subject to a special

mandatory redemption (at a price equal to 101% of the principal

amount of such series of the Notes, plus accrued and unpaid

interest from the date of initial issuance, or the most recent date

to which interest has been paid or provided for, whichever is

later, to, but not including, the special mandatory redemption

date) under certain circumstances if the CIT Acquisition is not

consummated or is not consummated by an agreed upon date.

BofA Securities, Inc., Citigroup Global Markets Inc., J.P.

Morgan Securities LLC and TD Securities (USA) LLC are serving as

the joint book-running managers for the offering of each series of

the Notes.

Each series of the Notes are being offered pursuant to the

Company’s effective shelf registration statement on file with the

Securities and Exchange Commission (the “SEC”). A prospectus

supplement describing the terms of this offering will be filed with

the SEC. Copies of the prospectus supplement and accompanying

prospectus for the offering may be obtained from BofA Securities,

Inc. toll-free at 1-800-294-1322, Citigroup Global Markets Inc.

toll-free at 1-800-831-9146, J.P. Morgan Securities LLC at

1-212-834-4533 and TD Securities (USA) LLC toll-free at

1-855-495-9846.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any series of the Notes, nor will

there be any sale of any series of the Notes, in any jurisdiction

in which such offer, solicitation or sale would be unlawful. Any

offer, solicitation or sale of any series of the Notes will be made

only by means of the prospectus supplement and the accompanying

prospectus.

About Amphenol Amphenol Corporation is one of the world’s

largest designers, manufacturers and marketers of electrical,

electronic and fiber optic connectors and interconnect systems,

antennas, sensors and sensor-based products and coaxial and

high-speed specialty cable. Amphenol designs, manufactures and

assembles its products at facilities in approximately 40 countries

around the world and sells its products through its own global

sales force, independent representatives and a global network of

electronics distributors. Amphenol has a diversified presence as a

leader in high-growth areas of the interconnect market including:

Automotive, Broadband Communications, Commercial Aerospace,

Defense, Industrial, Information Technology and Data

Communications, Mobile Devices and Mobile Networks. For more

information, visit www.amphenol.com.

Forward-Looking Statements Statements in this press

release which are other than historical facts are intended to be

“forward-looking statements” within the meaning of the Securities

Exchange Act of 1934, as amended, the Private Securities Litigation

Reform Act of 1995 and other related laws. While the Company

believes such statements are reasonable, the actual results and

effects could differ materially from those currently anticipated.

Details regarding various significant risks and uncertainties that

may affect our operating and financial performance can be found in

the Company’s latest Annual Report on Form 10-K and the Company’s

subsequent filings with the Securities and Exchange Commission,

including Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. In providing forward-looking statements, the Company is

not undertaking any duty or obligation to update these statements

publicly as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240402757851/en/

Sherri Scribner Vice President, Strategy and Investor Relations

203-265-8820 IR@amphenol.com

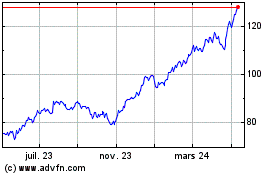

Amphenol (NYSE:APH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

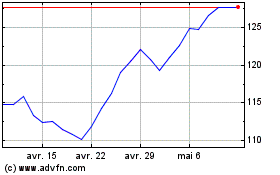

Amphenol (NYSE:APH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024