false

0000820313

0000820313

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 21, 2024

AMPHENOL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

1-10879 |

|

22-2785165 |

(State

or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 358

Hall Avenue, Wallingford,

Connecticut |

|

06492 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (203)

265-8900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Class A

Common Stock, $0.001 par value |

|

APH |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

On

May 21, 2024, Amphenol Corporation, a Delaware corporation (the “Company”), issued a press release announcing the

closing of the transactions contemplated by that certain Stock Purchase Agreement, dated as of January 30, 2024, by and between the Company

and Carlisle Companies Incorporated, a Delaware corporation. A copy of the press release is furnished as Exhibit 99.1 to this Current

Report on Form 8-K.

The

information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be

deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AMPHENOL CORPORATION |

| |

|

|

| |

By: |

|

| Date: May 21, 2024 |

|

/s/ Lance E. D’Amico |

| |

Name: |

Lance E. D’Amico |

| |

Title: |

Senior Vice President, Secretary and General Counsel |

Exhibit 99.1

World

Headquarters

358

Hall Avenue

Wallingford, CT 06492

Telephone

(203) 265-8900

AMPHENOL CORPORATION

COMPLETES

ACQUISITION

OF CIT BUSINESS FROM CARLISLE

Wallingford, Connecticut, May 21,

2024. Amphenol Corporation (NYSE: APH) today announced it had completed the acquisition of the Carlisle Interconnect Technologies (CIT)

business from Carlisle Companies Incorporated (NYSE: CSL).

“The acquisition of CIT enhances

Amphenol’s product offerings for highly engineered harsh environment interconnect solutions and will enable us to deliver a more

comprehensive technology offering for our customers in the commercial air, defense and industrial markets,”

said Amphenol President and Chief Executive

Officer, R. Adam Norwitt. “We are excited to welcome CIT’s talented employees to the Amphenol family and look forward to

working together with them to drive outstanding operating performance.”

As previously announced, the CIT business

is expected to have full-year 2024 sales and adjusted EBITDA margin of approximately $900 million and 20%, respectively. Amphenol expects

the CIT business to be approximately $0.02 accretive to 2024 earnings per share, which excludes acquisition-related expenses. Once the

Company’s recently announced 2-for-1 stock split is effective, this would translate to accretion of approximately $0.01 per share

in 2024.

About Amphenol

Amphenol

Corporation is one of the world’s largest designers, manufacturers and marketers of electrical, electronic and fiber optic connectors

and interconnect systems, antennas, sensors and sensor-based products and coaxial and high-speed specialty cable. Amphenol designs, manufactures

and assembles its products at facilities in approximately 40 countries around the world and sells its products through its own global

sales force, independent representatives and a global network of electronics distributors. Amphenol has a diversified presence as a leader

in high-growth areas of the interconnect market including: Automotive, Broadband Communications, Commercial Aerospace, Defense, Industrial,

Information Technology and Data Communications, Mobile Devices and Mobile Networks. For more information, visit www.amphenol.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements may contain words and terms such

as: “anticipate,” “could,” “believe,” “continue,” “expect,” “estimate,”

“forecast,” “ongoing,” “project,” “seek,” “predict,” “target,”

“will,” “intend,” “plan,” “look ahead,” “optimistic,” “potential,”

“guidance,” “may,” “should,” or “would” and other words and terms of similar meaning.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain,

such as statements about expected 2024 CIT sales and adjusted EBITDA margin as well as expected 2024 accretion related to the CIT acquisition.

These statements are only predictions, and such forward-looking statements are based on current expectations and involve inherent risks

and uncertainties, including factors that could delay, divert or change any of them, and could cause actual outcomes and results to differ

materially from current expectations. No forward-looking statement can be guaranteed. Risks and uncertainties include, but are not limited

to, unanticipated difficulties relating to the CIT acquisition, the response of business partners and competitors to the announcement

of the closing of the transaction, potential disruptions to current plans and operations and/or potential difficulties in employee retention

as a result of the closing of the CIT transaction. The foregoing list of risk factors is not exhaustive. Forward-looking statements in

this press release should be evaluated together with the many uncertainties that affect Amphenol’s business, particularly those

identified in the risk factor discussion in Amphenol’s Annual Report on Form 10-K for the year ended December 31, 2023, as well

as other documents that may be filed by Amphenol with the SEC. Amphenol does not undertake any obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or otherwise. The forward-looking statements made in this communication

relate only to events as of the date on which the statements are made.

Contact:

Sherri Scribner

Vice President,

Strategy and Investor Relations

203-265-8820

IR@amphenol.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

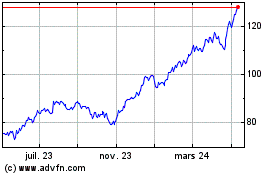

Amphenol (NYSE:APH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

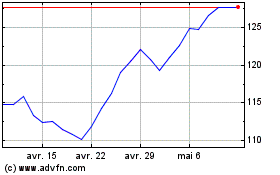

Amphenol (NYSE:APH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024