- Total revenues of $1.1 billion in the first quarter, up 9.1%

versus the prior year.

- Systemwide comparable sales¹ grew 38.6% in the first quarter,

supported by the twelfth consecutive quarter of guest volume

growth.

- Digital channels (Mobile App, Delivery and Self-order Kiosks)

generated 55% of systemwide sales in the period, including 22%

identified sales.

- Loyalty Program reached 8 million registered members, more than

double the year-end 2023 total.

- Consolidated Adjusted EBITDA¹ was $108.9 million, rising 8.4%

year-over-year.

- Net Income was $28.5 million in the first quarter, or $0.14 per

share.

Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the

“Company”), Latin America and the Caribbean’s largest restaurant

chain and the world’s largest independent McDonald’s franchisee,

today reported unaudited results for the three months ended March

31, 2024.

First Quarter 2024 Highlights

- Consolidated revenues totaled $1.1 billion, up 9.1% in US

dollars versus the prior year period.

- Systemwide comparable sales¹ increased 38.6% versus the first

quarter of 2023, supported by positive guest traffic at the

consolidated level, which grew for the twelfth consecutive

quarter.

- Consolidated Adjusted EBITDA¹ of $108.9 million, grew 8.4% in

US dollars versus the prior year period, with strong performances

in both Brazil and the North Latin American Division (NOLAD).

- Adjusted EBITDA margin expanded 90 basis points in Brazil and

30 basis points in NOLAD.

- Net income was $ 28.5 million in the quarter, or $0.14 per

share.

- Net Debt to Adjusted EBITDA leverage ratio ended the first

quarter at 1.2x.

- The Company opened 22 restaurants in the quarter, including 19

free-standing locations.

1 For definitions, please refer to pages

15 and 16 of this document.

Message from Marcelo Rabach, Chief Executive Officer

The strength of these results demonstrate how far we have come

as a company over the last decade. The Arcos Dorados business model

delivered solid US dollar growth to start 2024, despite a

challenging economic environment in one of our main markets.

Importantly, by operating responsibly and managing the business

with a long-term mindset, we built our strongest ever Brand

reputation among Latin America’s quick service restaurant (QSR)

customers.

Over the last ten years we diversified our business to reduce

our exposure to any single country. While Brazil remains our

biggest market, both NOLAD and SLAD now contribute significantly to

sales and EBITDA. NOLAD generates results in hard or very stable

currencies while high growth potential markets in SLAD, such as

Chile, Colombia and Uruguay, have also increased their

contributions to consolidated results.

The business model and the Three-D’s strategy (Digital, Delivery

and Drive-thru) are working well together. We are focused on

generating sustainable profitability growth over the long term. Our

balanced approach to managing pricing, product mix and guest

volumes is driving above-inflation comparable sales growth

throughout our operations. Guest volumes are key to driving

sustainable sales growth, and the McDonald’s Brand captures the

highest volume per restaurant in our region.

We see significant growth potential in Latin America and the

Caribbean, and we are accelerating restaurant openings. We expect

investments in the McDonald’s Brand to foster a virtuous cycle of

growth in our communities and local economies. A more robust local

economy should, in turn, support our long-term expansion plans

while insulating the business from short-term volatility.

Before closing, I want to express how saddened we are by the

severe flooding in Brazil's southernmost state: Rio Grande do Sul.

Since this is an ongoing situation, it is too early to estimate the

long-term human and environmental impacts of this natural disaster.

In the meantime, we are actively supporting our people, suppliers,

sub-franchisees and the communities we serve.

Our efforts are focused on our employees and their families,

including by providing basic necessities and by guaranteeing their

job security during this difficult period. We have also begun

distributing food within the communities we serve as well as to

first responders. Our restaurant spaces have been made available to

people seeking shelter, food or even just a place to charge their

cell phones. Moving forward we will be working on several

initiatives, in coordination with local governments and NGO’s to

continue supporting our people and to aid in reconstruction.

Finally, as we think about the future of Arcos Dorados, we

believe all the levers we pulled to generate the strong results of

the first quarter and, indeed, the last several years, will

continue to drive results into the future. This is why we are

confident we will be able to generate significant shareholder value

for many more years to come.

Thank you for your continued support of Arcos Dorados.

Consolidated Results

Figure 1. AD Holdings Inc Consolidated:

Key Financial Results

(In millions of U.S. dollars, except as

noted)

1Q23(a) CurrencyTranslation(b)

ConstantCurrencyGrowth(c) 1Q24(a+b+c) %

AsReported % ConstantCurrency Total Restaurants

(Units)

2,312

2,381

Sales by Company-operated Restaurants

946.4

(365.5)

450.5

1,031.4

9.0%

47.6%

Revenues from franchised restaurants

44.4

(8.1)

13.6

49.9

12.4%

30.6%

Total Revenues

990.8

(373.6)

464.1

1,081.4

9.1%

46.8%

Systemwide Comparable Sales

38.6%

Adjusted EBITDA

100.5

6.9

1.6

108.9

8.4%

1.6%

Adjusted EBITDA Margin

10.1%

10.1%

-

Net income (loss) attributable to AD

37.4

1.8

(10.7)

28.5

-23.8%

-28.7%

No. of shares outstanding (thousands)

210,595

210,656

EPS (US$/Share)

0.18

0.14

Arcos Dorados’ total revenues reached $1.1 billion, up 9.1% in

US dollars versus the prior year quarter. Systemwide comparable

sales in the first quarter rose 38.6%, with nearly all the

Company’s markets growing sales above local inflation. Importantly,

consolidated guest volume grew for the twelfth consecutive quarter.

The Company’s systemwide comparable sales grew 2.2x blended

inflation for the period, excluding Argentina.

Off-premise sales (Delivery and Drive-thru) increased 14% in US

dollars versus the prior year, and generated 44% of systemwide

sales in the first quarter of 2024. On-premise sales (front

counter, dessert centers and McCafé) grew 7% in US dollars versus

the prior year, accounting for 56% of systemwide sales in the

quarter.

Digital channel sales rose 30% versus the prior year and

represented 55% of systemwide sales. The Company’s Digital platform

continued to drive topline performance in the first quarter,

boosted by the strong penetration of sales through Self-order

kiosks and the Own Delivery and Mobile Order and Pay

functionalities on the Mobile App.

The Company’s Digital platform drove visit frequency by offering

an increasingly personalized experience to guests. As of the end of

March 2024, Arcos Dorados’ Customer Relationship Management

platform had about 85 million unique registered users and the

Company’s Mobile App surpassed 123 million cumulative downloads,

reaching more than 19 million monthly active users in the quarter.

During the quarter, identified sales represented 22% of total

sales.

Notably, in the first quarter of 2024 the Company signed an

agreement to become a regional sponsor of Formula One in Latin

America. The sport has become very popular with families throughout

the region, bridging all demographic, gender and socioeconomic

groups. This agreement is expected to provide significant brand

presence and the sponsorship will focus on further leveraging the

Company's successful Three-D’s strategy, especially the Drive-thru

segment with its precision, teamwork and speed of service.

Adjusted EBITDA

1Q24 Adjusted EBITDA Bridge

($ million)

First quarter consolidated Adjusted EBITDA reached $108.9

million, up 8.4% in US dollars over the prior year quarter, with

strong performances in Brazil and NOLAD more than offsetting the

decline in the South Latin American Division (SLAD). The

significant devaluation of the Argentine peso in December 2023 and

a weaker consumption environment in Argentina impacted SLAD’s

results in the quarter. Consolidated Adjusted EBITDA margin

remained flat at 10.1% versus the prior year, with margin expansion

in Brazil (90 basis points) and NOLAD (30 basis points) offsetting

a margin contraction in SLAD.

Consolidated margin performance included lower Food and Paper

(F&P) costs as a percentage of revenue, driven by a better

gross margin in Brazil, coupled with operating leverage in General

and Administrative expenses (G&A) when compared with the prior

year. Payroll expenses were flat as a percentage of revenue

compared with the prior year quarter. These effects were offset by

moderately higher Occupancy & Other Operating expenses in the

first quarter as a percentage of revenue, primarily explained by a

decline in operating leverage due to below inflation sales growth

in Argentina.

Notable items in the Adjusted EBITDA reconciliation

Included in Adjusted EBITDA: There

were no notable items included in Adjusted EBITDA in either the

first quarter of 2024 or the first quarter of 2023.

Excluded from Adjusted EBITDA:

There were no notable items excluded from Adjusted EBITDA in either

the first quarter of 2024 or the first quarter of 2023.

Non-operating Results

Arcos Dorados’ non-operating results for the first quarter

included net interest expenses of $16.4 million and a non-cash

foreign exchange loss of $1.0 million. The Company recorded an

income tax expense of $19.0 million in the quarter.

Net income attributable to the Company totaled $28.5 million, or

$0.14 per share, in the first quarter of 2024. Total weighted

average shares for the first quarter of 2024 amounted to

210,655,747 compared to 210,594,545 in the prior year’s

quarter.

Divisional Results

Brazil Division

Figure 2. Brazil Division: Key Financial Results(In millions

of U.S. dollars, except as noted)

1Q23(a)

CurrencyTranslation(b) ConstantCurrencyGrowth(c)

1Q24(a+b+c) % AsReported % ConstantCurrency

Total Restaurants (Units)

1,091

1,141

Total Revenues

374.2

20.8

54.0

448.9

20.0%

14.4%

Systemwide Comparable Sales

9.4%

Adjusted EBITDA

59.5

3.5

12.5

75.4

26.9%

21.0%

Adjusted EBITDA Margin

15.9%

16.8%

0.9 p.p.

Brazil’s revenues increased 20.0% in US dollars versus the first

quarter 2023, reaching $448.9 million. Systemwide comparable sales

rose 9.4% year-over-year, or 2.2x the country’s inflation in the

period.

Guest traffic and sales growth were driven by a strong

performance of Digital channels. Digital sales rose 38% versus the

prior year and contributed more than 65% of the division’s

systemwide sales in the period, including 26% identified sales.

Delivery sales grew 44% in US dollars versus the prior year and

reached a new quarterly sales record for this channel in the

country. Off-premise channel sales represented 42% of Brazil’s

systemwide sales in the quarter.

The Loyalty program “Meu Méqui” continues to grow and had more

than 8 million registered members at the end of April 2024, up from

3.2 million at the end of 2023. The program continued driving

improvements in guest frequency, average check and redemption

rates.

Brazil’s marketing plans and campaigns included the continuation

of the successful “Méqui Me Pega” campaign and the launch of the

“Big Tasty Turbo Cheese” sandwich. The market engaged with

Generation Z customers by continuing its sponsorship of the

region’s most popular music festival, Lollapalooza, in São Paulo as

well as the country’s most popular primetime television program,

Big Brother Brazil. The division also drove brand excitement and

customer engagement across all sales channels by bringing back the

McFish sandwich as a limited time offer, selling out in a short

time. In the dessert category, Brazil introduced the McFlurry

“Chocrocante” with a popular local chocolate known as “Diamante

Negro”.

The Brazil division continued to strengthen its brand leadership

position, achieving an all-time-high visit share score over the

trailing 12 months. The market share gain in Brazil was accompanied

by record high scores in brand equity, including Top of Mind and

Favorite Brand, which were 4.0x and 2.0x the main competitor’s

scores, respectively, according to the Company’s proprietary

research. In fact, all brand attributes tracked by the Company

presented favorable gaps compared with the nearest competitor in

the market.

As reported Adjusted EBITDA in the division reached $75.4

million in the quarter, rising 26.9% versus the prior year in US

dollars. Adjusted EBITDA margin was 16.8%, up 90 basis points

versus the prior year period, including lower F&P costs as a

percentage of revenue and operating leverage in both Payroll and

G&A due to strong sales growth in the division.

North Latin American Division (NOLAD)

Figure 3. NOLAD Division: Key Financial Results(In millions

of U.S. dollars, except as noted)

1Q23(a)

CurrencyTranslation(b) ConstantCurrencyGrowth(c)

1Q24(a+b+c) % AsReported % ConstantCurrency

Total Restaurants (Units)

639

647

Total Revenues

259.3

14.9

28.6

302.7

16.8%

11.0%

Systemwide Comparable Sales

8.0%

Adjusted EBITDA

23.7

1.5

3.4

28.6

20.7%

14.3%

Adjusted EBITDA Margin

9.1%

9.4%

0.3 p.p.

As reported revenues in NOLAD reached $302.7 million, up 16.8%

in US dollars versus the prior year quarter. Systemwide comparable

sales rose 8.0% year-over-year, or 3.1x the division’s blended

inflation in the period, with sales increasing above inflation in

all markets. The result also included particularly strong traffic

growth in Mexico, Costa Rica, Panama and the French West Indies.

Additionally, the quarter benefitted from the extra trading day on

February 29 and a positive impact from Holy Week, particularly in

Mexico.

Digital channels drove topline growth in the first quarter as

the Company continued to invest in the modernization of its

restaurants and the digitalization of the division. Digital sales

reached 38% of systemwide sales in the quarter, compared with just

25% in the prior year quarter, boosted by a significant expansion

of sales through self-order kiosks and Delivery versus the previous

year.

NOLAD’s key marketing activities included the launch of a new

value platform “Elige tu Fav” in Mexico, which allows guests to

choose between delicious beef or chicken combos at an attractive

price. Also in Mexico, Digital channel sales doubled versus last

year and the McDonald’s App is now the most downloaded, and used,

App across the country’s QSR industry. Panama implemented a strong

value platform, coupled with one of the highest brand equity scores

in the region, to accelerate the business in that country. In

Puerto Rico, the Company gained significant visit share as the new

brand campaign “Saca tu Encanto” resonated well with guests. Each

of these three important markets also achieved significant visit

and sales share growth during the quarter.

As reported Adjusted EBITDA in the division reached $28.6

million in the quarter, rising 20.7% versus the prior year in US

dollars. Adjusted EBITDA margin increased by 30 basis points in the

quarter benefiting from operating leverage in Occupancy & Other

Operating expenses as well as G&A due to the strong sales

growth. These more than offset a modest increase in Payroll

expenses as a percentage of revenue.

South Latin American Division (SLAD)

Figure 4. SLAD Division: Key Financial Results(In millions

of U.S. dollars, except as noted)

1Q23(a)

CurrencyTranslation(b) ConstantCurrencyGrowth(c)

1Q24(a+b+c) % AsReported % ConstantCurrency

Total Restaurants (Units)

582

593

Total Revenues

357.3

(409.2)

381.6

329.7

-7.7%

106.8%

Systemwide Comparable Sales

103.0%

Adjusted EBITDA

40.7

(28.4)

12.5

24.7

-39.2%

30.6%

Adjusted EBITDA Margin

11.4%

7.5%

-3.9 p.p.

As reported revenues in SLAD totaled $329.7 million in the first

quarter, down 7.7% year-over-year. Systemwide comparable sales,

which includes the impact of Argentina and Venezuela’s high

inflation rates, rose 103.0% versus the prior year. SLAD’s

systemwide comparable sales grew 1.8x blended inflation, excluding

Argentina.

The division’s results were primarily impacted by the ongoing

hyperinflationary environment in Argentina, which caused a material

reduction of consumption in this market, as well as the significant

devaluation of the country’s currency at the end of 2023. The

devaluation of the Chilean peso and the social unrest in Ecuador

also contributed to offset strong sales performances in other

markets such as Colombia, Peru and Uruguay.

Digital sales, which accounted for 53% of systemwide sales in

SLAD, benefited from the improving performance of the Mobile Order

and Pay and Own Delivery functionalities in the Mobile App, which

led to an increase in identified sales across the division.

The SLAD division strengthened brand affinity among younger

consumers, by sponsoring the most relevant music festivals in the

region, including Lollapalooza in Argentina and Chile, as well as

Estereo Picnic in Colombia. The Company brought menu innovation to

SLAD’s markets with the launch of the “Quarter Pounder Western BBQ”

in Chile and Uruguay, “Quarter Pounder Cheesy Jalapeño” in Ecuador

and the “Grand Tasty Spicy” in Argentina, among others. These new

product launches helped drive restaurant traffic and average check

growth. SLAD continued making inroads in the chicken category, with

the launch of the “McCrispy Chicken” platform in Uruguay and the

“McCrispy Chicken Legend” in Colombia, with the latter quickly

becoming a guest favorite.

Despite some challenging economic conditions, many of SLAD’s

main markets continued gaining market share against their main

competitors, a clear reflection of consumer preference for the

McDonald’s Brand across the division. This includes Argentina,

where the Company’s brand attributes strengthened, and market share

increased strongly.

As reported Adjusted EBITDA totaled $24.7 million in the quarter

and Adjusted EBITDA margin contracted 390 basis points versus the

prior year quarter. The division’s Adjusted EBITDA reflects reduced

operating leverage in all cost and expense line items due to the

below-inflation sales growth in the first quarter, mostly in

Argentina and Ecuador.

New Unit Development

Figure 5. Total Restaurants (end of period)* March2024

December2023 September2023 June2023 March2023 Brazil

1,141

1,130

1,113

1,098

1,091

NOLAD

647

647

638

639

639

SLAD

593

584

588

580

582

TOTAL

2,381

2,361

2,339

2,317

2,312

* Considers Company-operated and franchised restaurants at

period-end

Figure 6. Footprint as of March 31, 2024 Store

Type* TotalRestaurants Ownership McCafes DessertCenters FS IS MS

& FC CompanyOperated Franchised Brazil

589

91

461

1,141

699

442

108

2,011

NOLAD

406

48

193

647

494

153

19

518

SLAD

247

125

221

593

503

90

199

726

TOTAL

1,242

264

875

2,381

1,696

685

326

3,255

* FS: Free-Standing; IS: In-Store; MS: Mall Store; FC: Food Court.

During the first quarter of 2024, the Company opened 22

Experience of the Future (EOTF) restaurants, including 19

free-standing units. The Brazil division opened 11 EOTF restaurants

in the quarter, with 10 new free-standing units.

At the end of the quarter, 52% of Arcos Dorados’ restaurant

footprint was made up of free-standing units and the Company plans

to continue focusing its investments on this format to offer guests

the most complete McDonald’s restaurant experience while leveraging

the incrementality of Drive-thru and Delivery sales.

Arcos Dorados also continued the modernization of its existing

restaurants in the quarter and, as of the end of March 2024, there

were 1,430 EOTF restaurants making up 60% of the total

footprint.

Balance Sheet & Cash Flow Highlights

Figure 7. Consolidated Debt and Financial Ratios(In

thousands of U.S. dollars, except ratios)

March 31,

December 31,

2024

2023

Total Cash & cash equivalents (i)

162,473

246,767

Total Financial Debt (ii)

740,015

728,093

Net Financial Debt (iii)

577,542

481,326

LTM Adjusted EBITDA

480,735

472,304

Total Financial Debt / LTM Adjusted EBITDA ratio

1.5

1.5

Net Financial Debt / LTM Adjusted EBITDA ratio

1.2

1.0

(i) Total cash & cash equivalents includes short-term

investment (ii)Total financial debt includes short-term debt,

long-term debt, accrued interest payable and derivative instruments

(including the asset portion of derivatives amounting to $49.0

million and $46.5 million as a reduction of financial debt as of

March 31, 2024 and December 31, 2023, respectively). (iii) Net

financial debt equals total financial debt less total cash &

cash equivalents.

As of March 31, 2024, total cash and cash equivalents were

$162.5 million and total financial debt (including the net

derivative instrument position) was $740.0 million. Net debt (total

financial debt minus total cash and cash equivalents) was $577.5

million, up from $481.3 million at the end of 2023, due to the

lower cash balance.

The net debt to Adjusted EBITDA leverage ratio ended the quarter

at a healthy 1.2x.

Net cash used in operating activities for the three months ended

March 31, 2024, totaled $9.4 million. Cash used in net investing

activities totaled $49.2 million, including capital expenditures of

$61.2 million. Net cash used in financing activities was $8.0

million in the first quarter 2024.

Recent Developments

2024 Annual General Shareholders Meeting (AGM)

The Company held its AGM on April 26, 2024. All proposals were

approved at the meeting.

Moody’s Rating Action

In May 2024, Moody’s re-affirmed Arcos Dorados’ corporate and

senior debt rating at Ba2 and upgraded the outlook from Stable to

Positive based on the Company's liquidity condition and latest

operating performance, following Brazil’s sovereign rating

action.

First Quarter 2024 Earnings Webcast

A webcast to discuss the information contained in this press

release will be held today, May 15, 2024, at 10:00 a.m. ET. In

order to access the webcast, members of the investment community

should follow this link: Arcos Dorados First Quarter 2024 Earnings

Webcast.

A replay of the webcast will be available later today in the

investor section of the Company’s website:

www.arcosdorados.com/ir.

Definitions

In analyzing business trends, management considers a variety of

performance and financial measures which are considered to be

non-GAAP including: Adjusted EBITDA, Constant Currency basis,

Systemwide sales, and Systemwide comparable sales growth.

Adjusted EBITDA: In addition to financial measures

prepared in accordance with the general accepted accounting

principles (GAAP), this press release and the accompanying tables

use a non-GAAP financial measure titled ‘Adjusted EBITDA’.

Management uses Adjusted EBITDA to facilitate operating performance

comparisons from period to period.

Adjusted EBITDA is defined as the Company’s operating income

plus depreciation and amortization plus/minus the following

losses/gains included within other operating income (expenses),

net, and within general and administrative expenses on the

statement of income: gains from sale or insurance recovery of

property and equipment, write-offs of long-lived assets, and

impairment of long-lived assets.

Management believes Adjusted EBITDA facilitates

company-to-company operating performance comparisons by backing out

potential differences caused by variations such as capital

structures (affecting net interest expense and other financing

results), taxation (affecting income tax expense) and the age and

book depreciation of facilities and equipment (affecting relative

depreciation expense), which may vary for different companies for

reasons unrelated to operating performance. Figure 8 of this

earnings release includes a reconciliation for Adjusted EBITDA. For

more information, please see Adjusted EBITDA reconciliation in Note

9 – Segment and geographic information – of our financial

statements (6-K Form) filed today with the S.E.C.

Constant Currency basis: refers to amounts calculated

using the same exchange rate over the periods under comparison to

remove the effects of currency fluctuations from this trend

analysis. To better discern underlying business trends, this

release uses non-GAAP financial measures that segregate

year-over-year growth into two categories: (i) currency translation

and (ii) constant currency growth. (i) Currency translation

reflects the impact on growth of the appreciation or depreciation

of the local currencies in which the Company conducts its business

against the US dollar (the currency in which the Company’s

financial statements are prepared). (ii) Constant currency growth

reflects the underlying growth of the business excluding the effect

from currency translation. The Company also calculates variations

as a percentage in constant currency, which are also considered to

be non-GAAP measures, to provide a more meaningful analysis of its

business by identifying the underlying business trends, without

distortion from the effect of foreign currency fluctuations.

Systemwide sales: Systemwide sales represent measures for

both Company-operated and sub-franchised restaurants. While sales

by sub-franchisees are not recorded as revenues by the Company,

management believes the information is important in understanding

its financial performance because these sales are the basis on

which it calculates and records sub-franchised restaurant revenues

and are indicative of the financial health of its sub-franchisee

base.

Systemwide comparable sales growth: this non-GAAP

measure, refers to the change, on a constant currency basis, in

Company-operated and sub-franchised restaurant sales in one period

from a comparable period for restaurants that have been open for

thirteen months or longer (year-over-year basis) including those

temporarily closed. Management believes it is a key performance

indicator used within the retail industry and is indicative of the

success of the Company’s initiatives as well as local economic,

competitive and consumer trends. Sales by sub-franchisees are not

recorded as revenues by the Company.

About Arcos Dorados

Arcos Dorados is the world’s largest independent McDonald’s

franchisee, operating the largest quick service restaurant chain in

Latin America and the Caribbean. It has the exclusive right to own,

operate and grant franchises of McDonald’s restaurants in 20 Latin

American and Caribbean countries and territories with more than

2,350 restaurants, operated by the Company or by its

sub-franchisees, that together employ over 100 thousand people (as

of 03/31/2024). The Company is also committed to the development of

the communities in which it operates, to providing young people

their first formal job opportunities and to utilize its Recipe for

the Future to achieve a positive environmental impact. Arcos

Dorados is listed for trading on the New York Stock Exchange (NYSE:

ARCO). To learn more about the Company, please visit the Investors

section of our website: www.arcosdorados.com/ir.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its expectation for revenue generation and its outlook

and guidance for 2024. These statements are subject to the general

risks inherent in Arcos Dorados' business. These expectations may

or may not be realized. Some of these expectations may be based

upon assumptions or judgments that prove to be incorrect. In

addition, Arcos Dorados' business and operations involve numerous

risks and uncertainties, many of which are beyond the control of

Arcos Dorados, which could result in Arcos Dorados' expectations

not being realized or otherwise materially affect the financial

condition, results of operations and cash flows of Arcos Dorados.

Additional information relating to the uncertainties affecting

Arcos Dorados' business is contained in its filings with the

Securities and Exchange Commission. The forward-looking statements

are made only as of the date hereof, and Arcos Dorados does not

undertake any obligation to (and expressly disclaims any obligation

to) update any forward-looking statements to reflect events or

circumstances after the date such statements were made, or to

reflect the occurrence of unanticipated events.

First Quarter 2024 Consolidated Results

Figure 8. First Quarter 2024 Consolidated Results(In

thousands of U.S. dollars, except per share data)

For Three-Months ended

March 31,

2024

2023

REVENUES Sales by Company-operated restaurants

1,031,422

946,354

Revenues from franchised restaurants

49,934

44,438

Total Revenues

1,081,356

990,792

OPERATING COSTS AND EXPENSES Company-operated restaurant expenses:

Food and paper

(360,987

)

(333,866

)

Payroll and employee benefits

(201,960

)

(185,317

)

Occupancy and other operating expenses

(299,053

)

(263,723

)

Royalty fees

(65,003

)

(56,739

)

Franchised restaurants - occupancy expenses

(21,990

)

(18,209

)

General and administrative expenses

(68,658

)

(65,592

)

Other operating income (expense), net

3,846

(1,061

)

Total operating costs and expenses

(1,013,805

)

(924,507

)

Operating income

67,551

66,285

Net interest expense and other financing results

(16,438

)

(9,859

)

Loss from derivative instruments

(1,933

)

(4,929

)

Foreign currency exchange results

(998

)

7,283

Other non-operating expenses, net

(429

)

(110

)

Income before income taxes

47,753

58,670

Income tax expense, net

(18,961

)

(21,026

)

Net income

28,792

37,644

Less: Net income attributable to non-controlling interests

(283

)

(237

)

Net income attributable to Arcos Dorados Holdings Inc.

28,509

37,407

Earnings per share information ($ per share): Basic net

income per common share

$

0.14

$

0.18

Weighted-average number of common shares outstanding-Basic

210,655,747

210,594,545

Adjusted EBITDA Reconciliation Operating income

67,551

66,285

Depreciation and amortization

43,091

33,520

Operating charges excluded from EBITDA computation

(1,707

)

699

Adjusted EBITDA

108,935

100,504

Adjusted EBITDA Margin as % of total revenues

10.1

%

10.1

%

First Quarter 2024 Results by Division

Figure 9. First Quarter 2024 Consolidated Results by

Division(In thousands of U.S. dollars)

For Three-Months ended

as reported

Constant Currency

March 31,

2024

2023

Incr/(Decr)%

Incr/(Decr)%

Revenues Brazil

448,937

374,198

20.0 %

14.4%

NOLAD

302,721

259,266

16.8 %

11.0%

SLAD

329,698

357,328

-7.7%

106.8%

TOTAL

1,081,356

990,792

9.1 %

46.8%

Operating Income (loss)

Brazil

57,042

44,090

29.4 %

23.4%

NOLAD

17,983

13,947

28.9%

21.5%

SLAD

14,442

33,462

-56.8%

-6.6%

Corporate and Other

(21,916)

(25,214)

13.1%

-109.9%

TOTAL

67,551

66,285

1.9 %

-25.0%

Adjusted EBITDA Brazil

75,446

59,473

26.9 %

21.0%

NOLAD

28,602

23,700

20.7 %

14.3%

SLAD

24,741

40,716

-39.2%

30.6%

Corporate and Other

(19,854)

(23,385)

15.1%

-114.5%

TOTAL

108,935

100,504

8.4 %

1.6 %

Figure 10. Average Exchange Rate per Quarter* Brazil

Mexico Argentina

1Q24

4.95

16.97

834.32

1Q23

5.19

18.66

192.33

* Local $ per 1 US$

Summarized Consolidated Balance Sheet

Figure 11. Summarized Consolidated Balance Sheets(In

thousands of U.S. dollars)

March 31, December 31,

2024

2023

ASSETS

Current assets Cash and cash equivalents

127,496

196,661

Short-term investments

34,977

50,106

Accounts and notes receivable, net

148,745

147,980

Other current assets (1)

237,329

210,531

Derivative instruments

45

—

Total current assets

548,592

605,278

Non-current assets Property and equipment, net

1,124,925

1,119,885

Net intangible assets and goodwill

71,073

70,026

Deferred income taxes

101,184

98,163

Derivative instruments

48,993

46,486

Equity method investments

19,031

18,111

Leases right of use asset

953,139

954,564

Other non-current assets (2)

106,490

106,725

Total non-current assets

2,424,835

2,413,960

Total assets

2,973,427

3,019,238

LIABILITIES AND EQUITY

Current liabilities Accounts payable

322,753

374,986

Taxes payable (3)

161,929

163,143

Accrued payroll and other liabilities

167,246

142,487

Royalties payable to McDonald’s Corporation

22,007

21,292

Provision for contingencies

1,480

1,447

Interest payable

18,342

7,447

Financial debt (4)

40,145

37,361

Operating lease liabilities

93,146

93,507

Total current liabilities

827,048

841,670

Non-current liabilities Accrued payroll and other

liabilities

27,891

27,513

Provision for contingencies

51,015

49,172

Financial debt (5)

730,566

729,771

Deferred income taxes

1,598

1,166

Operating lease liabilities

848,784

853,107

Total non-current liabilities

1,659,854

1,660,729

Total liabilities

2,486,902

2,502,399

Equity Class A shares of common stock

389,923

389,907

Class B shares of common stock

132,915

132,915

Additional paid-in capital

8,703

8,719

Retained earnings

544,140

566,188

Accumulated other comprehensive loss

(571,554)

(563,081)

Common stock in treasury

(19,367)

(19,367)

Total Arcos Dorados Holdings Inc shareholders’ equity

484,760

515,281

Non-controlling interest in subsidiaries

1,765

1,558

Total equity

486,525

516,839

Total liabilities and equity

2,973,427

3,019,238

(1) Includes "Other receivables", "Inventories" and "Prepaid

expenses and other current assets". (2) Includes "Miscellaneous"

and "Collateral deposits". (3) Includes "Income taxes payable" and

"Other taxes payable". (4) Includes "Short-term debt”, “Current

portion of long-term debt" and "Derivative instruments”. (5)

Includes "Long-term debt, excluding current portion" and

"Derivative instruments".

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515698616/en/

Investor Relations Contact Dan Schleiniger VP of Investor

Relations Arcos Dorados daniel.schleiniger@mcd.com.uy

Media Contact David Grinberg VP of Corporate Communications

Arcos Dorados david.grinberg@mcd.com.uy

Follow us on: LinkedIn Instagram X YouTube

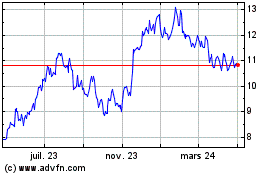

Arcos Dorados (NYSE:ARCO)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

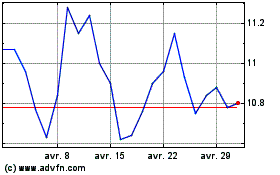

Arcos Dorados (NYSE:ARCO)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025