UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

ARLO TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 001-38618 |

(State or other jurisdiction

of incorporation) | | | | (Commission file number) |

| | | | |

| 2200 Faraday Ave. Suite #150, Carlsbad, California | | 92008 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | |

| | Brian Busse | | |

| | (408) 890-3900 | | |

| (Name and telephone number, including area code, of the person to contact in connection with this report) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

☐ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended _________.

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Arlo Technologies, Inc. (the “Company”) evaluated its current product families and determined that certain products it manufactures or contracts to manufacture contain tin, tungsten, tantalum and/or gold. As a result, the Company has prepared, and is filing with this Form, a Conflict Minerals Report. A copy of the Company’s Conflict Minerals Report for the calendar year ended December 31, 2023 is provided as Exhibit 1.01 hereto and also is publicly available at: https://investor.arlo.com.

Item 1.02 Exhibit

The Conflict Minerals Report for the calendar year ended December 31, 2023 is provided as Exhibit 1.01 to this Form SD.

Section 3 - Exhibits

Item 3.01 Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | |

| | ARLO TECHNOLOGIES, INC. |

| | (Registrant) |

| | |

| | |

| By: | /s/ Brian Busse |

| | Brian Busse |

| | General Counsel and Corporate Secretary |

| | |

Dated: May 28, 2024 | | |

CONFLICT MINERALS REPORT

ARLO TECHNOLOGIES, INC.

In accordance with Rule 13p-1 under the Securities Exchange Act of 1934

for the Calendar Year Ended December 31, 2023

Introduction

Rule 13p-1 was adopted by the United States Securities and Exchange Commission (“SEC”) to implement reporting and disclosure requirements related to Conflict Minerals as directed by Section 1502 of the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010. Rule 13p-1 imposes certain reporting obligations on SEC registrants whose products contain Conflict Minerals necessary to the functionality or production of their products. Conflict Minerals are defined by Rule 13p-1 as (A) cassiterite, columbite-tantalite (coltan), gold, wolframite, and their derivatives, which are limited to tin, tungsten, tantalum, and gold (collectively, “3TG” or “Conflict Minerals”); or (B) any other mineral or its derivatives determined by the Secretary of State to be financing conflict in the Covered Countries (as defined below).

If, after conducting a reasonable country-of-origin inquiry, a registrant has reason to believe that any 3TG in its supply chain may have originated in the Democratic Republic of the Congo (“DRC”) or adjoining countries (collectively, the “Covered Countries”), or if it is unable to determine the country of origin of the 3TG in its products, or that the 3TG in its products are entirely from recycled and scrap sources, then the issuer must conduct due diligence on the source and chain of custody of the 3TG. The registrant must annually submit a Form SD and Conflict Minerals Report (“CMR”) to the SEC that includes a description of those due diligence measures. Arlo Technologies, Inc. (“we” or “Arlo”) has determined that Conflict Minerals that may have originated from the Covered Countries are necessary to the functionality or production of some or all of its products the manufacturing of which was completed during the 2023 calendar year and, therefore, is required to perform due diligence and file this report. This report is Arlo's CMR for the reporting calendar year ended December 31, 2023.

This CMR is not audited, as Rule 13p-1 and current SEC guidance provide that if the registrant is not declaring products as “DRC Conflict Free,” the CMR is not subject to an independent private sector audit.

This CMR contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Although forward-looking statements in this report reflect our good faith judgment, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Forward-looking statements include statements regarding Arlo’s intentions and expectations regarding further supplier engagement and escalation, steps to mitigate risk and improve due diligence, and future reporting. Any statements contained herein that are not statements of historical fact may also be deemed to be forward-looking statements. For example, the words “believes,” “anticipates,” “plans,” “expects,” “intends,” “could,” “may,” “will,” and similar expressions are intended to identify forward-looking statements. Factors that could cause or contribute to material differences in results and outcomes include without limitation: the risk that information reported to us by our suppliers from which we directly procure finished goods, components, materials and/or services for our products (direct suppliers), or industry information used by us, may be inaccurate or incomplete; the risk that smelters or refiners (processing facilities) may not participate in the Responsible Minerals Assurance Process (“RMAP”), which is a voluntary initiative in which independent third parties audit processing facilities’ procurement and processing activities and determine if the processing facilities maintain sufficient documentation to reasonably demonstrate conflict-free sourcing; as well as risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the period ended March 31, 2024, including those related to our customer concentration, our dependence on a limited number of third-party suppliers and our being subject to government regulations and policies. Readers are urged not to place undue reliance on forward-looking statements, which speak only as of the date of this report. We

undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report. Throughout this report, whenever a reference is made to our website, such reference does not incorporate information from the website by reference into this report unless specifically identified as such.

Section 1 - Company Overview

Arlo is transforming the ways in which people can protect everything that matters to them with advanced home, business, and personal security services that combine a globally scaled cloud platform, advanced monitoring and analytics capabilities, and award-winning app-controlled devices to create a personalized security ecosystem. Arlo’s deep expertise in cloud services, cutting-edge AI and computer vision analytics, wireless connectivity and intuitive user experience design delivers seamless, smart home security for Arlo users that is easy to set up and engage with every day. Our highly secure, cloud-based platform provides users with visibility, insight and a powerful means to help protect and connect in real-time with the people and things that matter most, from any location with a Wi-Fi or a cellular connection – all rooted in a commitment to safeguard privacy for our users and their personal data.

To date, we have launched subscription services such as Arlo Secure, Arlo Total Security, and Arlo Safe, and several categories of award-winning smart security devices, including smart Wi-Fi and LTE-enabled cameras, video doorbells, floodlight cameras and home security systems. In addition, Arlo’s broad compatibility allows the platform to seamlessly integrate with third-party internet-of-things (“IoT”) products and protocols, such as Amazon Alexa, Apple HomeKit, Apple TV, Google Assistant, IFTTT, Stringify and Samsung SmartThings. We plan to continue to introduce new smart security devices to the Arlo platform both in cameras and other categories, increase the number of registered accounts on our platform, keep them highly engaged through our mobile app and generate incremental recurring revenue by offering them paid subscription services.

Arlo’s internet address is www.arlo.com. This CMR will be posted on Arlo’s website with other SEC filings under https://investor.arlo.com/financials-and-filings/sec-filings/default.aspx as soon as reasonably practicable after it is electronically filed with the SEC.

1.1 Arlo Products

All of our hardware products fall within the scope of Rule 13p-1 as they contain one or more Conflict Minerals. The following product line descriptions provide additional details:

• Smart security devices – wired and wire-free smart Wi-Fi and LTE-enabled cameras, video doorbells, floodlight cameras, and home security system

• Arlo accessories – charging accessories and Arlo mounts

We conducted an analysis of Arlo products and found that small quantities of 3TG, necessary to the hardware products’ functionality or production, are found in all Arlo hardware products.

1.2 Conflict Minerals Report

This CMR relates to all of our hardware products in the product categories listed under section 1.1 the manufacture of which was completed during 2023. We have been unable to conclusively determine countries of origin of the 3TG those products contain, or to conclusively determine the extent to which the 3TG came from recycled or scrap sources; the facilities used to process them; or their mine or location of origin. All of our Tier 1 suppliers declared that the scope of their Conflict Minerals Reporting Template (“CMRT”) was at the level of products shipped to us.

This report describes our Reasonable Country of Origin Inquiry (“RCOI”) efforts, the due diligence measures we took on the 3TG source and chain of custody, the results of our due diligence efforts, expected risk assessment and mitigation steps.

1.3 Conflict Minerals Policy

Arlo has published its conflict minerals policy on its webpage located at:

https://www.arlo.com/images/pdf/Arlo-Conflict-Minerals-Sourcing-Policy.pdf

Section 2 - Reasonable Country of Origin Inquiry (“RCOI”)

To determine whether the necessary 3TG in our products originated in any of the Covered Countries, we first needed to determine the scope of our Conflict Minerals program. As explained above, Arlo has determined that its hardware products contain one or more Conflict Minerals and, therefore, we determined to solicit information on the sourcing of 3TG. This year, to improve efficiency and eliminate redundancies, we have streamlined our process by surveying only the four direct suppliers with which we contract to supply products or components for our hardware products. We refer to these direct suppliers as “Tier 1” suppliers. We relied on these Tier 1 suppliers, all original design manufacturers, for their survey information regarding indirect suppliers in our supply chain.

We excluded suppliers of plastics, software, packaging, as well as other suppliers that were not used for production orders completed in reporting year 2023.

Arlo utilized the CMRT version 6.31 to conduct a survey of all four in-scope Tier 1 suppliers. The CMRT is a free, standardized reporting template developed by the RMI that is widely considered the industry standard in conflict minerals data collection. During the supplier survey process, we contacted all Tier 1 suppliers and required that they complete a valid CMRT and provide it to Arlo for assessment. Tier 1 suppliers were contacted through emails and/or conference calls for follow-up on their CMRT submissions or for clarifying any questions that the Arlo Conflict Minerals Program team or Arlo’s third-party service provider may have had. Arlo’s Conflict Minerals Program team was also in charge of all the communication with Tier 1 suppliers.

We received completed CMRTs from all in-scope Tier 1 suppliers. Once all CMRTs were collected, they were evaluated using automated data validation. The goal of data validation is to increase the accuracy of submissions and identify any contradictory answers in the CMRT. This data validation is based on the suppliers’ answers to questions 1 through 6 of the CMRT.

All submitted forms were accepted and classified as valid or invalid so that data is still retained. As of March 9, 2024, there were no supplier submissions that the automated data validation system had determined to be invalid that had not been corrected.

Based on the RCOI, we had reason to believe that some of the 3TG used in the products may have originated from the Covered Countries. Therefore, in accordance with the Rule, we performed due diligence on the source and chain of custody of the 3TG used in the manufacture of Arlo products.

Section 3 - Conflict Minerals Due Diligence Program Design

Arlo’s conflict minerals due diligence program is designed to conform in all material aspects with the framework recommended by the Organization for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, including supplements, also known as the OECD Guidance, as it relates to Arlo’s supply chain position as a “downstream” or finished product manufacturer and purchaser.

Summarized below are the components of Arlo’s program, some of which are performed by Arlo’s third-party service provider, as they relate to the five-step framework set forth in the OECD Guidance:

3.1 Establish strong company management systems

•Adopted and publicly communicated a Conflict Minerals company policy which is posted on the Arlo website at https://www.arlo.com/images/pdf/Arlo-Conflict-Minerals-Sourcing-Policy.pdf

•Required that our suppliers and contract manufacturers implement the Responsible Business Alliance’s (“RBA”) Code of Conduct, which includes an obligation to conduct due diligence regarding Conflict Minerals.

•Assembled our internal Conflict Minerals Program team, led by our Quality & Compliance team and supported by a cross-functional team consisting of representatives from Operations, Supply Chain, Legal, Finance and Internal Audit functions.

•Established a system of control through the use of our Supplier Code of Conduct and transparency over Arlo’s Conflict Minerals supply chain by engaging Tier 1 suppliers and requesting relevant information through the use of a third-party service provider, which utilized due diligence tools created by the RMI, including the CMRT.

•Provided updates on our Conflict Minerals due diligence progress and status to Arlo’s Chief Financial Officer.

•Educated and trained those personnel responsible to work on Arlo’s Conflict Minerals Program.

•Established a grievance mechanism to allow employees, suppliers, and others to report suspected non-compliance with the applicable legal requirement and/or suspected non-compliance with Arlo’s Code of Ethics and Supplier Code of Conduct. These policies are publicly available at https://www.arlo.com/en-us/about/corporate-social-responsibility/ethics/

•Internal audit reviewed our internal Conflict Minerals risk assessment and due diligence processes against Arlo’s documented procedure.

•Identified business records relating to Conflict Minerals due diligence, including records of due diligence processes, findings and resulting decisions, that will be retained in accordance with our records retention policies.

3.2 Identify and manage risk in the supply chain

•Identified relevant Tier 1 suppliers that supplied products containing 3TG.

•Requested such Tier 1 suppliers to provide information regarding smelters or refiners in our supply chain by using the CMRT.

•Reviewed Tier 1 supplier responses for completeness and accuracy.

•Risks were identified by analyzing Tier 1 supplier data regarding mineral processing facilities (smelters or refiners) identified on their CMRT declarations.

•Compared information in Tier 1 supplier responses with the list of 3TG processing facilities that received a “conflict-free” designation, produced by the RMAP.

•Each facility that meets the RMI definition of a smelter or refiner of a Conflict Mineral is assessed according to red flag indicators defined in the OECD Guidance. To determine the level of risk that each smelter posed to the supply chain, we assessed the following criteria: geographic proximity to the Covered Countries, known mineral source country of origin, RMAP audit status, credible evidence of unethical or conflict sourcing, and peer assessments conducted by credible third-party sources.

•Provided Tier 1 suppliers with feedback on responses containing errors, inconsistencies or incomplete information and encouraged them to resubmit a valid response.

•Requested Tier 1 suppliers to remove specific smelters or refiners from their supply chain that we deemed to be high-risk.

•Evaluated Tier 1 suppliers on the strength of their internal Conflict Minerals programs as reflected in their CMRTs. When Tier 1 suppliers met or exceeded the below criteria (that is, responded “yes” to all four questions listed below), they were deemed to have a strong program. When they responded “No” to any one or more of the questions, they were deemed to have a weak program. The criteria used to evaluate the strength of their programs are based on these four questions in the CMRT:

◦Have you established a conflict minerals sourcing policy?

◦Have you implemented due diligence measures for conflict-free sourcing?

◦Do you review due diligence information received from your suppliers against your company’s expectations?

◦Does your review process include corrective action management?

3.3 Design and implement a strategy to respond to risk

•Conducted regular Conflict Minerals Program team meetings to review, among other things, Arlo’s Conflict Minerals program, any potential or actual risks identified during due diligence, and the status of supplier responses.

•Identified high-risk smelters and refiners in Arlo’s supply chain by using the smelter and refiner database from the RMI that includes information on each smelter’s and refiner’s chain of custody of minerals.

•Based the smelter and refiner risk calculation on the following criteria:

◦Geographic proximity to the Covered Countries;

◦RMAP audit status; and

◦Credible evidence of unethical or conflict sourcing.

•Maintained an escalation plan in the event that we have to address non-responsive suppliers and/or to contact suppliers that provided incomplete or inaccurate supply chain information.

•Conducted Conflict Minerals Program due diligence process survey of Arlo’s Tier 1 suppliers that accounted for about 99% of Arlo’s hardware products purchase in reporting year.

3.4 Audit of smelter/refiner’s due diligence practices

•Relied on the RMAP to coordinate third-party audits of smelters and refiners to validate the sourcing practices of such facilities in our supply chain.

3.5 Report annually on supply chain due diligence

•Publicly communicated Conflict Minerals Policy on Arlo’s website at:

https://www.arlo.com/images/pdf/Arlo-Conflict-Minerals-Sourcing-Policy.pdf

•Will file our Form SD for the reporting period from January 1, 2023 to December 31, 2023, including this Conflict Minerals Report, with the SEC and make it available on the Investor Relations pages of our website at https://investor.arlo.com/financials-and-filings/sec-filings/default.aspx

•Reported supply chain smelter information in this Conflict Minerals Report.

The content of any website referred to in this report is included for general information only and is not incorporated by reference in this report.

Section 4 - Due Diligence Results

Arlo does not have direct contractual relationships with smelters and refiners; therefore, we relied on our Tier 1 suppliers and the entire supply chain to gather and provide specific information on 3TG used in Arlo products.

4.1 Survey Results

In 2023, Arlo conducted supply chain surveys, using the CMRT, of Tier 1 suppliers that we identified that contribute necessary 3TG in our products. The results of our supply chain survey of all Tier 1 suppliers and conclusion of our RCOI are as follows:

•100% of Arlo-surveyed suppliers provided responses using an accepted version of the CMRT.

•None of the four CMRTs collected have been deemed invalid against criteria defined by Arlo.

•The surveyed Tier 1 suppliers identified 220 legitimate smelters and refiner facilities that may process the necessary 3TG contained in the products manufactured.

•Of these 220 legitimate smelters and refiners, 218 were validated as conflict-free by RMAP, based on information provided by the RMI through RMAP.

•Two of these 220 legitimate smelters and refiners may have used 3TG that originated in the Covered Countries and are not validated as conflict-free by RMAP and are not solely from recycled or scrap sources. We have been advised that the two identified smelters and refiners will be phased out of the supply chain by our Tier1 supplier.

Attached as Table A is a list of all smelters and refiners identified by our Tier 1 suppliers in their CMRTs that appear on the list of legitimate smelters and refiners maintained by the RMI.

A list of potential countries of origin, identified by our Tier 1 suppliers, from which the reported smelters and refiners collectively sourced 3TG is provided in Table B.

Section 5 - Risk Mitigation and Due Diligence Improvement Plan

5.1 Inherent limitation on due diligence measures

Because of our business model, our due diligence measures can provide only reasonable, not absolute, assurance regarding the source and chain of custody of the necessary Conflict Minerals in the products we contract to have manufactured. Given our place in the supply chain, we have no direct relationships with smelters or refiners and therefore possess no independent means of determining the source and origin of Conflict Mineral ores processed by smelters or refiners. Our due diligence processes are based on the necessity of seeking data from our suppliers and component manufacturers, and we depend on those suppliers seeking similar information within their supply chains to identify the original sources of the necessary Conflict Minerals. The information provided by suppliers may be inaccurate or incomplete or subject to other irregularities. Because of our relative location within the supply chain in relation to the actual extraction, transport, smelting, and refinement of 3TG, our ability to verify the accuracy of information reported by suppliers is limited. We also rely, to a large extent, on information collected and provided by independent third-party audit programs.

5.2 Steps to be taken to mitigate risk and improve due diligence process

We intend to take the following steps to improve the due diligence conducted and to further mitigate any risk that the necessary Conflict Minerals in our products could benefit armed groups in the Covered Countries:

•Increase the emphasis on clean and validated smelter and refiner information from our supply chain as the list of conflict-free smelters and refiners grows and more smelters and refiners declare their intent to enroll in the program.

•Encourage our Tier 1 suppliers to have due diligence procedures in place for their supply chains to improve the content of the responses from such Tier 1 suppliers and follow up with Tier 1 suppliers that appear to have gaps in their internal processes for conflict minerals.

•Engage with our Tier 1 suppliers more closely and provide Tier 1 suppliers with more information and training resources regarding responsible sourcing of 3TG.

•Request Tier 1 suppliers to remove specific smelters or refiners from their supply chain that we deem to be high-risk.

•Engage any Tier 1 suppliers that we have reason to believe are supplying Arlo with 3TG from sources that may be considered red flag sources and encourage them to establish alternative sources of 3TG.

•Encourage our Tier 1 suppliers to take these same steps with regard to their suppliers in our supply chain.

•Engage Tier 1 suppliers to encourage smelters or refiners in our supply chain, not yet certified/identified by the RMAP or an equivalent independent third-party audit, to undergo smelter audits and verify compliance.

Table A

Smelter & Refiners Reported to be in Supply Chain of Arlo

Below is a list of smelters and refiners identified by our Tier 1 suppliers as smelters and refiners used in processing of necessary 3TG contained in Arlo products, the manufacture of which was completed during calendar year 2023:

| | | | | | | | |

| Metal | Smelter or Refiner Facility Name | Location of Facility |

| Gold | Abington Reldan Metals, LLC | United States Of America |

| Gold | Advanced Chemical Company | United States Of America |

| Gold | Agosi AG | Germany |

| Gold | Aida Chemical Industries Co., Ltd. | Japan |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | Uzbekistan |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | Brazil |

| Gold | Argor-Heraeus S.A. | Switzerland |

| Gold | Asahi Pretec Corp. | Japan |

| Gold | Asahi Refining Canada Ltd. | Canada |

| Gold | Asahi Refining USA Inc. | United States Of America |

| Gold | Asaka Riken Co., Ltd. | Japan |

| Gold | Aurubis AG | Germany |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Philippines |

| Gold | Boliden AB | Sweden |

| Gold | C. Hafner GmbH + Co. KG | Germany |

| Gold | CCR Refinery - Glencore Canada Corporation | Canada |

| Gold | Chimet S.p.A. | Italy |

| Gold | Chugai Mining | Japan |

| Gold | Dowa | Japan |

| Gold | DSC (Do Sung Corporation) | Korea, Republic Of |

| Gold | Eco-System Recycling Co., Ltd. East Plant | Japan |

| Gold | Eco-System Recycling Co., Ltd. North Plant | Japan |

| Gold | Eco-System Recycling Co., Ltd. West Plant | Japan |

| Gold | Emirates Gold DMCC | United Arab Emirates |

| Gold | Gold by Gold Colombia | Colombia |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | China |

| Gold | Heimerle + Meule GmbH | Germany |

| Gold | Heraeus Germany GmbH Co. KG | Germany |

| Gold | Heraeus Metals Hong Kong Ltd. | China |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | China |

| Gold | Ishifuku Metal Industry Co., Ltd. | Japan |

| Gold | Istanbul Gold Refinery | Turkey |

| Gold | Italpreziosi | Italy |

| Gold | Japan Mint | Japan |

| Gold | Jiangxi Copper Co., Ltd. | China |

| Gold | JX Nippon Mining & Metals Co., Ltd. | Japan |

| Gold | Kazzinc | Kazakhstan |

| Gold | Kennecott Utah Copper LLC | United States Of America |

| Gold | KGHM Polska Miedz Spolka Akcyjna | Poland |

| Gold | Kojima Chemicals Co., Ltd. | Japan |

| | | | | | | | |

| Gold | Korea Zinc Co., Ltd. | Korea, Republic Of |

| Gold | L'Orfebre S.A. | Andorra |

| Gold | LS-NIKKO Copper Inc. | Korea, Republic Of |

| Gold | LT Metal Ltd. | Korea, Republic Of |

| Gold | Materion | United States Of America |

| Gold | Matsuda Sangyo Co., Ltd. | Japan |

| Gold | Metal Concentrators SA (Pty) Ltd. | South Africa |

| Gold | Metalor Technologies (Hong Kong) Ltd. | China |

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | Singapore |

| Gold | Metalor Technologies (Suzhou) Ltd. | China |

| Gold | Metalor Technologies S.A. | Switzerland |

| Gold | Metalor USA Refining Corporation | United States Of America |

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V. | Mexico |

| Gold | Mitsubishi Materials Corporation | Japan |

| Gold | Mitsui Mining and Smelting Co., Ltd. | Japan |

| Gold | MKS PAMP SA | Switzerland |

| Gold | MMTC-PAMP India Pvt., Ltd. | India |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | Turkey |

| Gold | Navoi Mining and Metallurgical Combinat | Uzbekistan |

| Gold | NH Recytech Company | Korea, Republic Of |

| Gold | Nihon Material Co., Ltd. | Japan |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | Austria |

| Gold | Ohura Precious Metal Industry Co., Ltd. | Japan |

| Gold | Planta Recuperadora de Metales SpA | Chile |

| Gold | PT Aneka Tambang (Persero) Tbk | Indonesia |

| Gold | PX Precinox S.A. | Switzerland |

| Gold | Rand Refinery (Pty) Ltd. | South Africa |

| Gold | REMONDIS PMR B.V. | Netherlands |

| Gold | Royal Canadian Mint | Canada |

| Gold | SAFINA A.S. | Czechia |

| Gold | SEMPSA Joyeria Plateria S.A. | Spain |

| Gold | Shandong Gold Smelting Co., Ltd. | China |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | China |

| Gold | Sichuan Tianze Precious Metals Co., Ltd. | China |

| Gold | Solar Applied Materials Technology Corp. | Taiwan, Province Of China |

| Gold | Sumitomo Metal Mining Co., Ltd. | Japan |

| Gold | SungEel HiMetal Co., Ltd. | Korea, Republic Of |

| Gold | T.C.A S.p.A | Italy |

| Gold | Tanaka Kikinzoku Kogyo K.K. | Japan |

| Gold | Tokuriki Honten Co., Ltd. | Japan |

| Gold | TOO Tau-Ken-Altyn | Kazakhstan |

| Gold | Torecom | Korea, Republic Of |

| Gold | Umicore S.A. Business Unit Precious Metals Refining | Belgium |

| Gold | United Precious Metal Refining, Inc. | United States Of America |

| Gold | Valcambi S.A. | Switzerland |

| Gold | WEEEREFINING | France |

| | | | | | | | |

| Gold | Western Australian Mint (T/a The Perth Mint) | Australia |

| Gold | WIELAND Edelmetalle GmbH | Germany |

| Gold | Yamakin Co., Ltd. | Japan |

| Gold | Yokohama Metal Co., Ltd. | Japan |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | China |

| Tantalum | AMG Brasil | Brazil |

| Tantalum | D Block Metals, LLC | United States Of America |

| Tantalum | F&X Electro-Materials Ltd. | China |

| Tantalum | FIR Metals & Resource Ltd. | China |

| Tantalum | Global Advanced Metals Aizu | Japan |

| Tantalum | Global Advanced Metals Boyertown | United States Of America |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | China |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | China |

| Tantalum | Jiangxi Tuohong New Raw Material | China |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | China |

| Tantalum | Jiujiang Tanbre Co., Ltd. | China |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | China |

| Tantalum | KEMET de Mexico | Mexico |

| Tantalum | Materion Newton Inc. | United States Of America |

| Tantalum | Metallurgical Products India Pvt., Ltd. | India |

| Tantalum | Mineracao Taboca S.A. | Brazil |

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | Japan |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | China |

| Tantalum | NPM Silmet AS | Estonia |

| Tantalum | QuantumClean | United States Of America |

| Tantalum | Resind Industria e Comercio Ltda. | Brazil |

| Tantalum | RFH Yancheng Jinye New Material Technology Co., Ltd. | China |

| Tantalum | Taki Chemical Co., Ltd. | Japan |

| Tantalum | TANIOBIS Co., Ltd. | Thailand |

| Tantalum | TANIOBIS GmbH | Germany |

| Tantalum | TANIOBIS Japan Co., Ltd. | Japan |

| Tantalum | TANIOBIS Smelting GmbH & Co. KG | Germany |

| Tantalum | Telex Metals | United States Of America |

| Tantalum | Ulba Metallurgical Plant JSC | Kazakhstan |

| Tantalum | XIMEI RESOURCES (GUANGDONG) LIMITED | China |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | China |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | China |

| Tin | Alpha | United States Of America |

| Tin | Aurubis Beerse | Belgium |

| Tin | Aurubis Berango | Spain |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | China |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | China |

| Tin | China Tin Group Co., Ltd. | China |

| Tin | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda | Brazil |

| Tin | CRM Synergies | Spain |

| Tin | CV Ayi Jaya | Indonesia |

| | | | | | | | |

| Tin | CV Venus Inti Perkasa | Indonesia |

| Tin | Dowa | Japan |

| Tin | DS Myanmar | Myanmar |

| Tin | EM Vinto | Bolivia (Plurinational State Of) |

| Tin | Estanho de Rondonia S.A. | Brazil |

| Tin | Fabrica Auricchio Industria e Comercio Ltda. | Brazil |

| Tin | Fenix Metals | Poland |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | China |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | China |

| Tin | HuiChang Hill Tin Industry Co., Ltd. | China |

| Tin | Jiangxi New Nanshan Technology Ltd. | China |

| Tin | Luna Smelter, Ltd. | Rwanda |

| Tin | Magnu's Minerais Metais e Ligas Ltda. | Brazil |

| Tin | Malaysia Smelting Corporation (MSC) | Malaysia |

| Tin | Metallic Resources, Inc. | United States Of America |

| Tin | Mineracao Taboca S.A. | Brazil |

| Tin | Minsur | Peru |

| Tin | Mitsubishi Materials Corporation | Japan |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | Thailand |

| Tin | O.M. Manufacturing Philippines, Inc. | Philippines |

| Tin | Operaciones Metalurgicas S.A. | Bolivia (Plurinational State Of) |

| Tin | PT Aries Kencana Sejahtera | Indonesia |

| Tin | PT Artha Cipta Langgeng | Indonesia |

| Tin | PT ATD Makmur Mandiri Jaya | Indonesia |

| Tin | PT Babel Inti Perkasa | Indonesia |

| Tin | PT Babel Surya Alam Lestari | Indonesia |

| Tin | PT Bangka Prima Tin | Indonesia |

| Tin | PT Bangka Serumpun | Indonesia |

| Tin | PT Bukit Timah | Indonesia |

| Tin | PT Cipta Persada Mulia | Indonesia |

| Tin | PT Menara Cipta Mulia | Indonesia |

| Tin | PT Mitra Stania Prima | Indonesia |

| Tin | PT Mitra Sukses Globalindo | Indonesia |

| Tin | PT Premium Tin Indonesia | Indonesia |

| Tin | PT Prima Timah Utama | Indonesia |

| Tin | PT Putera Sarana Shakti (PT PSS) | Indonesia |

| Tin | PT Rajawali Rimba Perkasa | Indonesia |

| Tin | PT Rajehan Ariq | Indonesia |

| Tin | PT Refined Bangka Tin | Indonesia |

| Tin | PT Sariwiguna Binasentosa | Indonesia |

| Tin | PT Stanindo Inti Perkasa | Indonesia |

| Tin | PT Sukses Inti Makmur | Indonesia |

| Tin | PT Timah Nusantara | Indonesia |

| Tin | PT Timah Tbk Kundur | Indonesia |

| Tin | PT Timah Tbk Mentok | Indonesia |

| Tin | PT Tinindo Inter Nusa | Indonesia |

| | | | | | | | |

| Tin | PT Tommy Utama | Indonesia |

| Tin | Resind Industria e Comercio Ltda. | Brazil |

| Tin | Rui Da Hung | Taiwan, Province Of China |

| Tin | Super Ligas | Brazil |

| Tin | Thaisarco | Thailand |

| Tin | Tin Smelting Branch of Yunnan Tin Co., Ltd. | China |

| Tin | Tin Technology & Refining | United States Of America |

| Tin | White Solder Metalurgia e Mineracao Ltda. | Brazil |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | China |

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd. | China |

| Tungsten | A.L.M.T. Corp. | Japan |

| Tungsten | Asia Tungsten Products Vietnam Ltd. | Vietnam |

| Tungsten | China Molybdenum Tungsten Co., Ltd. | China |

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | China |

| Tungsten | Cronimet Brasil Ltda | Brazil |

| Tungsten | Fujian Xinlu Tungsten Co., Ltd. | China |

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | China |

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | China |

| Tungsten | Global Tungsten & Powders LLC | United States Of America |

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | China |

| Tungsten | H.C. Starck Tungsten GmbH | Germany |

| Tungsten | Hubei Green Tungsten Co., Ltd. | China |

| Tungsten | Hunan Chenzhou Mining Co., Ltd. | China |

| Tungsten | Hunan Jintai New Material Co., Ltd. | China |

| Tungsten | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch | China |

| Tungsten | Japan New Metals Co., Ltd. | Japan |

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | China |

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | China |

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | China |

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | China |

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | China |

| Tungsten | Kennametal Fallon | United States Of America |

| Tungsten | Kennametal Huntsville | United States Of America |

| Tungsten | Lianyou Metals Co., Ltd. | Taiwan, Province Of China |

| Tungsten | Malipo Haiyu Tungsten Co., Ltd. | China |

| Tungsten | Masan High-Tech Materials | Vietnam |

| Tungsten | Niagara Refining LLC | United States Of America |

| Tungsten | Philippine Chuangxin Industrial Co., Inc. | Philippines |

| Tungsten | TANIOBIS Smelting GmbH & Co. KG | Germany |

| Tungsten | Wolfram Bergbau und Hutten AG | Austria |

| Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | China |

| Tungsten | Xiamen Tungsten Co., Ltd. | China |

Table B

Countries of Origin

Our Tier 1 suppliers have identified the following countries of origin for the Conflict Minerals used in our products:

•Level 1 countries (not identified as conflict regions or plausible areas of smuggling or export from the Covered Countries): Albania, Andorra, Argentina, Armenia, Australia, Austria, Azerbaijan, Belarus, Belgium, Benin, Bolivia (Plurinational State of), Botswana, Brazil, Bulgaria, Burkina Faso, Cambodia, Canada, Chile, China, Colombia, Cyprus, Djibouti, Dominican Republic, Ecuador, Egypt, El Salvador, Estonia, Ethiopia, Fiji, Finland, France, Georgia, Germany, Ghana, Guatemala, Guinea, Guyana, Honduras, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Ivory Coast, Japan, Jersey, Kazakhstan, Kenya, Korea, Kyrgyzstan, Liberia, Liechtenstein, Lithuania, Luxembourg, Madagascar, Malaysia, Mali, Mauritania, Mexico, Mongolia, Morocco, Mozambique, Namibia, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, Oman, Panama, Papua New Guinea, Peru, Philippines, Poland, Portugal, Russian Federation(1), Saudi Arabia, Senegal, Serbia, Sierra Leone, Singapore, Slovakia, South Africa, Spain, Sudan, Suriname, Sweden, Switzerland, Taiwan, Tajikistan, Thailand, Togo, Turkey, United Arab Emirates, United Kingdom, United States of America, Uruguay, Uzbekistan, Vietnam

•Level 2 countries (known or plausible countries for smuggling, export out of region or transit of materials containing tantalum, tin, tungsten or gold): Eritrea, Myanmar

•Level 3 countries (the Covered Countries): Angola, Burundi, Central African Republic, Republic of the Congo, Democratic Republic of Congo, Rwanda, Tanzania, Uganda, Zambia

_________________________

(1) We are not in privity of contract with any verifiable smelter or refiner, nor do we have control over the origin or the sourcing of any Conflict Minerals processed by any smelter or refiner. We do not source any conflict minerals directly from smelters or refiners in Russia.

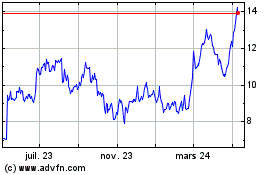

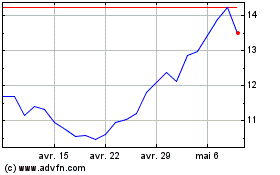

Arlo Technologies (NYSE:ARLO)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Arlo Technologies (NYSE:ARLO)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024