Amended Statement of Beneficial Ownership (sc 13d/a)

31 Mars 2023 - 3:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. 1)*

Atento S.A.

(Name of Issuer)

Ordinary Shares, par value $0.01 per

share

(Title of Class of Securities)

L0427L204

(CUSIP Number)

Mark Anthony Marlowe (Anthony Marlowe)

Iowa City Capital Partners, LC

Anthony Marlowe, LC

1460 S Treasure Dr.

North Bay Village

Florida 33141

(310) 680-0101

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications)

March 23, 2023

(Date of Event Which Requires Filing

of This Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box: o

NOTE: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7 for other parties to whom

copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

| CUSIP No. L0427L204 |

13D |

Page 2 of 6 |

| 1. |

NAME OF REPORTING PERSON

Anthony Marlowe, LC |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) o (b) o

|

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE OF FUNDS

WC, OO

|

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

o

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Iowa

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER

0

|

| 8. |

SHARED VOTING POWER

839,390

|

| 9. |

SOLE DISPOSITIVE POWER

0

|

| 10. |

SHARED DISPOSITIVE POWER

839,390

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

839,390

|

| 12. |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES

o

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.32% (1)

|

| 14. |

TYPE OF REPORTING PERSON

OO

|

| |

|

|

|

| (1) |

The calculation of the percentage of outstanding shares beneficially

owned is based on 15,451,667 shares outstanding as of November 30, 2022, as reported by the Issuer in its Solicitation/Recommendation

Statement on Schedule 14D-9, as filed with the Securities and Exchange Commission on December 6, 2022, and 320,000 shares

potentially issuable upon exercise of certain warrants held by Anthony Marlowe, LC, which have been added to the shares outstanding

for such purpose in accordance with Rule 13d-3(d)(1)(i) under the Securities Exchange Act of 1934, as amended. |

| CUSIP No. L0427L204 |

13D |

Page 3 of 6 |

| 1. |

NAME OF REPORTING PERSON

Iowa City Capital Partners, LC

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) o (b) o

|

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE OF FUNDS

WC, OO

|

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

o

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Iowa

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER

0

|

| 8. |

SHARED VOTING POWER

839,390

|

| 9. |

SOLE DISPOSITIVE POWER

0

|

| 10. |

SHARED DISPOSITIVE POWER

839,390

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

839,390

|

| 12. |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES

o

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.32% (1)

|

| 14. |

TYPE OF REPORTING PERSON

OO

|

| |

|

|

|

| (1) |

The calculation of the percentage of outstanding shares beneficially

owned is based on 15,451,667 shares outstanding as of November 30, 2022, as reported by the Issuer in its Solicitation/Recommendation

Statement on Schedule 14D-9, as filed with the Securities and Exchange Commission on December 6, 2022, and 320,000 shares

potentially issuable upon exercise of certain warrants held by Anthony Marlowe, LC, which have been added to the shares outstanding

for such purpose in accordance with Rule 13d-3(d)(1)(i) under the Securities Exchange Act of 1934, as amended. |

| CUSIP No. L0427L204 |

13D |

Page 4 of 6 |

| 1. |

NAME OF REPORTING PERSON

Mark Anthony Marlowe

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) o (b) o

|

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE OF FUNDS

OO

|

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

o

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER

0

|

| 8. |

SHARED VOTING POWER

839,390

|

| 9. |

SOLE DISPOSITIVE POWER

0

|

| 10. |

SHARED DISPOSITIVE POWER

839,390

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

839,390

|

| 12. |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES

o

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.32% (1)

|

| 14. |

TYPE OF REPORTING PERSON

IN

|

| |

|

|

|

| (1) |

The calculation of the percentage of outstanding shares beneficially

owned is based on 15,451,667 shares of outstanding as of November 30, 2022, as reported by the Issuer in its Solicitation/Recommendation

Statement on Schedule 14D-9, as filed with the Securities and Exchange Commission on December 6, 2022, and 320,000 shares

potentially issuable upon exercise of certain warrants held by Anthony Marlowe, LC, which have been added to the shares outstanding

for such purpose in accordance with Rule 13d-3(d)(1)(i) under the Securities Act of 1934, as amended. |

| CUSIP No. L0427L204 |

13D |

Page 5 of 6 |

SCHEDULE 13D

This amendment (“Amendment No. 1”) amends

and supplements the Schedule 13D filed with the Securities and Exchange Commission on March 20, 2023 (the “Schedule 13D”)

with respect to the ordinary shares, no par value per share (the “Ordinary Shares”), of Atento S.A., a public

limited company (societe anonyme) incorporated under the laws of Luxembourg (the “Issuer”), as specifically

set forth herein. Information contained in the Schedule 13D remains effective except to

the extent that it is amended, restated, supplemented, or superseded by the information contained in this Amendment No. 1.

Item 4. Purpose of Transaction.

Item 4 of the Schedule

13D is hereby amended and supplemented as follows:

On March 23, 2023, an

affiliate of Iowa City Capital Partners, LC wrote to the Issuer to say that they would appreciate an opportunity to discuss with

the Issuer, on a preliminary basis, the possibility of acquiring most to all of the non-Argentinian, non-Brazilian, non-Spanish

assets of the Issuer and its subsidiaries. During the following week, the Issuer communicated with Iowa City Capital Partners

and affiliates regarding potential non-disclosure agreement terms and availability for discussion.

| CUSIP No. L0427L204 |

13D |

Page 6 of 6 |

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 31, 2023

| |

ANTHONY MARLOWE,

LC |

| |

|

|

| |

By: |

/s/ Mark Anthony Marlowe |

| |

|

Name: Mark Anthony Marlowe |

| |

|

Title: President and Chief

Executive Officer |

| |

|

|

| |

IOWA CITY CAPITAL PARTNERS, LC |

| |

|

|

| |

By: |

/s/ Mark Anthony

Marlowe |

| |

|

Name: Mark Anthony Marlowe |

| |

|

Title: President and Chief

Executive Officer |

| |

|

|

| |

|

/s/ Mark Anthony

Marlowe |

| |

|

Name: Mark Anthony Marlowe |

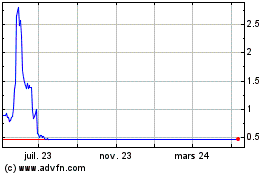

Atento (NYSE:ATTO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Atento (NYSE:ATTO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025