false

0001214816

0001214816

2025-02-03

2025-02-03

0001214816

us-gaap:CommonStockMember

2025-02-03

2025-02-03

0001214816

us-gaap:SeriesEPreferredStockMember

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): February 3, 2025

AXIS CAPITAL HOLDINGS LIMITED

(Exact Name Of Registrant As Specified In Charter)

| Bermuda |

|

001-31721 |

|

98-0395986 |

| (State of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

92 Pitts Bay Road

Pembroke, Bermuda HM 08

(Address of principal executive offices, including zip code)

(441) 496-2600

(Registrant's telephone number, including area code)

Not applicable

(Former name or address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2 below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e(4)(c)) |

Securities registered pursuant

to Section 12(b) of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common shares, par value $0.0125 per share |

AXS |

New York Stock Exchange |

| Depositary

shares, each representing a 1/100th interest in a 5.50% Series E preferred share |

AXS PRE |

New York Stock Exchange |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On

February 3, 2025, AXIS Capital Holdings Limited (the “Company”) entered into a stock repurchase agreement (the “Repurchase

Agreement”) with T-VIII PubOpps LP (“T8”), pursuant to which T8 agreed to sell 2,234,636 shares to the Company for an

aggregate price of approximately $200 million (the “Repurchase”). T8 is an investment vehicle managed by Stone Point Capital

LLC (“Stone Point”). Stone Point manages the Trident Funds including investment funds that hold approximately 8% of the Company’s

outstanding common shares (which will be approximately 5% following the Repurchase). Charles Davis, one of the Company’s directors,

is the sole member of an entity that is one of five general partners of the entity serving as general partner for the relevant investment

funds. Mr. Davis is the Chairman, Co-Chief Executive Officer and a member of Stone Point, and he serves as the Chairman of the

Investment Committees of the Trident Funds.

The Repurchase was made under the Company’s

Board-authorized share repurchase program. The Repurchase Agreement is attached as Exhibit 10.1 to this Report on Form 8-K and incorporated

herein by reference.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 3, 2025 | |

| | |

| | AXIS CAPITAL HOLDINGS LIMITED |

| | | |

| | | |

| | By: | /s/ G. Christina Gray-Trefry |

| | | G. Christina Gray-Trefry |

| | | General Counsel and Secretary |

Exhibit 10.1

Stock

REPurchase Agreement

This Stock Repurchase Agreement, dated as of February 3,

2025 (this “Agreement”), is made and entered into by and among AXIS Capital Holdings Limited, a company incorporated

in Bermuda (the “Company”) and T-VIII PubOpps LP, a Delaware limited partnership (the “Seller”).

W I T N E S S E T H:

WHEREAS, the Seller beneficially owns outstanding

ordinary shares, par value $0.0125 per share (the “Shares”), of the Company; and

WHEREAS, upon the terms and subject to the conditions

set forth herein, the Company desires to purchase from the Seller, and the Seller desires to sell to the Company, the Shares.

NOW, THEREFORE, for good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Purchase

and Sale of the Shares. The Seller shall sell, transfer, assign, convey and deliver or cause to be sold, transferred, assigned, conveyed

and delivered to the Company, and the Company shall purchase from the Seller, free and clear of any liens (other than any restrictions

on transfer imposed by applicable foreign, federal and state securities and insurance laws), 2,234,636 Shares owned by the Seller to

be sold to the Company for a purchase price per share equal to $89.50, for an aggregate purchase price of $199,999,922.00, payable as

set forth below in Section 2.

2. Closing.

The closing (the “Closing”) of the purchase and sale of the Shares contemplated hereby will take place on the date

three business days after the date hereof or on such other date as may be agreed upon by the parties hereto (the date on which the Closing

occurs, the “Closing Date”) unless another date is agreed to in writing by the Parties hereto. At the Closing, (a) the

Company shall deliver to the Seller by wire transfer in immediately available funds the amount noted above in Section 1 to be paid

by the Company and (b) the Seller shall transfer the Shares through Deposit/Withdrawal At Custodian (DWAC) to the Company’s

account at the Company’s transfer agent.

3. Agreement.

The Seller and the Company agree that each party hereto shall be responsible for all fees and expenses incident to its performance of,

or compliance with, its obligations under this Agreement (including, in the case of the Seller, all applicable transfer taxes, if any,

involved in the transfer to the Company of its Shares to be purchased by the Company).

4. Notices.

Any notice, request, instruction or other document to be given hereunder by any person under this Agreement shall be in writing and delivered

personally or sent by registered or certified mail, postage prepaid, by nationally recognized overnight courier, or by facsimile:

(a) if

to the Seller:

c/o Stone Point Capital LLC, manager

20 Horseneck Lane

Greenwich, CT 06830

Attention: David J. Wermuth, Esq.

Principal and General Counsel

Telephone: (203) 862-2924

(b) if

to the Company:

AXIS Capital Holding Limited

92 Pitts Bay Road

Pembroke HM 08

Bermuda

Attention: Christina Gray-Trefry

General Counsel

Telephone: (441) 496-2600

5. Counterparts.

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which shall constitute

one and the same instrument.

6. Governing

Law; Jurisdiction. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York without

giving effect to the principles of conflicts of law thereof.

[signatures follow]

IN WITNESS HEREOF, the parties hereto have caused

this Agreement to be duly executed and delivered as of the date first written above.

| |

AXIS Capital Holdings

Limited |

| |

|

| |

By: |

/s/

Peter Vogt |

| |

|

Name: |

Peter Vogt |

| |

|

Title: |

Chief Financial Officer |

| |

T-VIII PubOpps LP |

| |

|

| |

By: |

T-VIII PubOpps GP LLC, its general

partner |

| |

|

|

| |

By |

/s/ Sally DeVino |

| |

Name: |

Sally DeVino |

| |

Title: |

Vice President and Assistant Treasurer |

| |

|

|

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

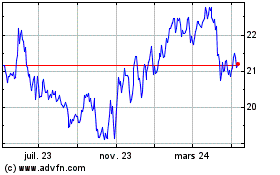

Axis Capital (NYSE:AXS-E)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

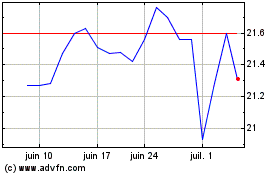

Axis Capital (NYSE:AXS-E)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025