UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 Under

the Securities Exchange Act of 1934

November 29, 2024

Commission File Number: 001-36614

Alibaba Group Holding Limited

(Registrant’s name)

26/F Tower One, Times Square

1 Matheson Street

Causeway Bay

Hong Kong S.A.R.

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F

x Form 40-F ¨

EXHIBITS

Exhibit 99.1 – Press Release – Alibaba Group Announces Completion of US$2.65 Billion Offering of U.S. Dollar-denominated Senior Unsecured Notes and RMB17 Billion Offering of RMB-denominated Senior Unsecured Notes

Exhibit 99.2 – Announcement – Notice of Listing on the Stock Exchange of Hong Kong Limited

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ALIBABA GROUP HOLDING LIMITED |

| |

|

|

| Date: November 29, 2024 |

By: |

/s/ Kevin Jinwei ZHANG |

| |

Name: |

Kevin Jinwei ZHANG |

| |

Title: |

Company Secretary |

Exhibit 99.1

Alibaba Group Announces Completion of US$2.65

Billion Offering of U.S. Dollar-denominated Senior Unsecured Notes and RMB17 Billion Offering of RMB-denominated Senior Unsecured Notes

Hangzhou,

China, November 28, 2024 — Alibaba Group Holding Limited (NYSE: BABA and HKEX: 9988 (HKD Counter) and 89988

(RMB Counter), “Alibaba,” “Alibaba Group” or the “Company”) today announced (i) the completion

of an offering, on November 26, 2024, of US$2.65 billion aggregate principal amount of U.S. dollar-denominated senior unsecured notes,

consisting of:

US$1,000,000,000 4.875% notes due 2030 at an issue price

per note of 99.838%;

US$1,150,000,000 5.250% notes due 2035 at an issue price

per note of 99.649%; and

US$500,000,000 5.625% notes due 2054 at an issue price per

note of 99.712% (collectively, the “USD Notes”);

and (ii) the completion of an offering, on November 28, 2024,

of RMB17 billion aggregate principal amount of RMB-denominated senior unsecured notes, consisting of:

RMB8,400,000,000 2.65% notes due 2028 at an issue price

per note of 100%;

RMB5,000,000,000 2.80% notes due 2029 at an issue price

per note of 100%;

RMB2,500,000,000 3.10% notes due 2034 at an issue price

per note of 100%; and

RMB1,100,000,000 3.50% notes due 2044 at an issue price per

note of 100% (collectively, the “RMB Notes,” and together with the USD Notes, the “Notes”).

The Notes have not been registered under the U.S. Securities Act of

1933, as amended (the “U.S. Securities Act”) or any state securities laws. The USD Notes have been offered and sold in the

United States only to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the U.S. Securities

Act and to certain non-U.S. persons in offshore transaction in reliance on Regulation S under the U.S. Securities Act. Alibaba entered

into a registration rights agreement in connection with the offering of the USD Notes, under which it agreed to use commercially reasonable

efforts to file an exchange offer registration statement to exchange the USD Notes for a new issue of substantially identical debt securities

registered under the Securities Act or, under specified circumstances, a shelf registration statement to cover resales of the USD Notes.

The RMB Notes have been offered and sold only to certain non-U.S. persons in offshore transaction in reliance on Regulation S under the

U.S. Securities Act.

This press release shall not constitute an offer to sell or a solicitation

of an offer to purchase any securities, in the United States or elsewhere, and shall not constitute an offer, solicitation or sale of

the securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

Investor Relations Contact

Lydia Liu

Head of Investor Relations

Alibaba Group Holding Limited

investor@alibaba-inc.com

Media Contacts

Cathy Yan

cathy.yan@alibaba-inc.com

Ivy Ke

ivy.ke@alibaba-inc.com

Exhibit 99.2

|

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of

Hong Kong Limited (the “Hong Kong Stock Exchange”) take no responsibility for the contents of this announcement, make

no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from

or in reliance upon the whole or any part of the contents of this announcement.

This announcement is for information purposes only and does not constitute

an invitation or offer to acquire, purchase or subscribe for securities. This announcement is not an invitation or offer to sell or acquire

or the solicitation of an offer to buy securities in the United States or in any other jurisdiction in which such invitation, offer, acquisition,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Neither this announcement nor anything herein forms the basis for any

contract or commitment whatsoever. Neither this announcement nor any copy hereof may be taken into or distributed in the United States.

The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended,

or with any securities regulatory authority of any state of the United States or other jurisdiction and may not be offered or sold in

the United States, except pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements

of the United States Securities Act of 1933, as amended, and applicable state or local securities laws. Any public offering of securities

to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the company

making the offer and its management and financial statements. We do not intend to make any public offering of securities in the United

States.

We have one class of shares, and each holder of our shares is entitled

to one vote per share. As the Alibaba Partnership’s director nomination rights are categorized as a weighted voting rights structure

(the “WVR structure”) under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited

(the “Hong Kong Listing Rules”), we are deemed as a company with a WVR structure. Shareholders and prospective investors

should be aware of the potential risks of investing in a company with a WVR structure. Our American depositary shares, each representing

eight of our shares, are listed on the New York Stock Exchange in the United States under the symbol BABA. |

NOTICE OF LISTING ON

THE STOCK EXCHANGE OF HONG KONG LIMITED

Alibaba Group Holding Limited

阿里巴巴集團控股有限公司

(Incorporated in the Cayman Islands with limited

liability)

(Stock

Code: 9988 (HKD Counter) and 89988 (RMB Counter))

CNY8,400,000,000 2.65% Senior Notes due 2028

(Debt Stock Code: 84590)

CNY5,000,000,000 2.80% Senior Notes due 2029

(Debt Stock Code: 84591)

CNY2,500,000,000 3.10% Senior Notes due 2034

(Debt Stock Code: 84592)

CNY1,100,000,000 3.50% Senior Notes due 2044

(Debt Stock Code: 84593)

Application

has been made to the Hong Kong Stock Exchange for the listing of, and permission to deal in, CNY8,400,000,000 2.65% Senior Notes

due 2028, CNY5,000,000,000 2.80% Senior Notes due 2029, CNY2,500,000,000 3.10% Senior Notes due 2034 and CNY1,100,000,000 3.50% Senior

Notes due 2044 (together, the “Notes”) issued by us by way of debt issues to professional investors (as defined in

Chapter 37 of the Hong Kong Listing Rules) only, as described in the offering memorandum relating thereto dated November 19, 2024.

The listing of and permission to deal in the Notes are expected to become effective on November 29, 2024.

| |

By order of the Board

Alibaba Group Holding Limited

Kevin Jinwei ZHANG

Secretary |

Hong Kong, November 28, 2024

As at the date of this announcement, our board of directors comprises

Mr. Joseph C. TSAI as the chairman, Mr. Eddie Yongming WU, Mr. J. Michael EVANS and Ms. Maggie Wei WU as directors,

and Mr. Jerry YANG, Ms. Wan Ling MARTELLO, Mr. Weijian SHAN, Ms. Irene Yun-Lien LEE, Mr. Albert Kong Ping NG

and Mr. Kabir MISRA as independent directors.

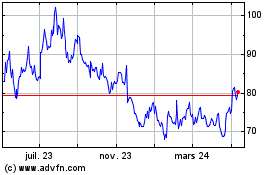

Alibaba (NYSE:BABA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

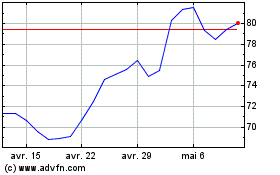

Alibaba (NYSE:BABA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024