Bank of America Recognizes $1.6 Billion Charge on Discontinuation of Loan Index

08 Janvier 2024 - 5:06PM

Dow Jones News

By Ben Glickman

Bank of America will recognize a $1.6 billion charge in the

fourth quarter related to the transition away from the London

Interbank Offered Rate benchmark.

The company said the charge was related to the discontinuation

of an alternative reference rate, the Bloomberg Short-Term Bank

Yield Index.

The bank said in a regulatory filing Monday that it had to

"de-designate" some interest-rate swaps used in cash flow hedges of

certain BSBY indexed loans.

The non-cash, pretax charge will be presented in revenue through

market making and similar activities, Bank of America said.

The company expects the net impact of the charge will be

recognized back in interest income, in various periods until

2026.

The charge lowered Bank of America's common equity tier 1 ratio

by eight basis points, as of Dec. 31.

Bank of America said the accounting change was due to "the

expectation that interest payments on the BSBY-indexed loans will

change to SOFR," or Secured Overnight Financing Rate, another

alternative reference rate to LIBOR. This will have a "nominal

impact" on the economics of the loans.

Write to Ben Glickman at ben.glickman@wsj.com

(END) Dow Jones Newswires

January 08, 2024 10:51 ET (15:51 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

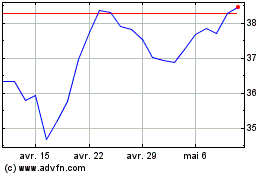

Bank of America (NYSE:BAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bank of America (NYSE:BAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024