0001328581false00013285812024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 4, 2024

BOISE CASCADE COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 1-35805 | | 20-1496201 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1111 West Jefferson Street, Suite 300

Boise, Idaho 83702-5389

(Address of principal executive offices) (Zip Code)

(208) 384-6161

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | BCC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2024, Boise Cascade Company ("Boise Cascade" or the "Company") issued a press release announcing its third quarter 2024 financial results, a copy of which is furnished as Exhibit 99.1 to this Report on Form 8-K. Additionally, Exhibit 99.2, a copy of which is attached hereto, includes certain statistical information related to the Company's quarterly performance.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this Report on Form 8-K:

| | | | | |

| Exhibit | Description |

| |

| |

| |

| |

| |

| 101 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| BOISE CASCADE COMPANY |

| | |

| By | /s/ Jill Twedt |

| | Jill Twedt Senior Vice President, General Counsel and Secretary |

| Date: November 4, 2024 | | |

| | | | | |

| Boise Cascade Company | Exhibit 99.1 |

| 1111 West Jefferson Street, Suite 300 | |

| Boise, ID 83702 | |

| | | | | | | | |

Investor Relations Contact - Chris Forrey investor@bc.com | | Media Contact - Amy Evans mediarelations@bc.com |

For Immediate Release: November 4, 2024

Boise Cascade Company Reports Third Quarter 2024 Results

BOISE, Idaho - Boise Cascade Company ("Boise Cascade," the "Company," "we," or "our") (NYSE: BCC) today reported net income of $91.0 million, or $2.33 per share, on sales of $1.7 billion for the third quarter ended September 30, 2024, compared with net income of $143.1 million, or $3.58 per share, on sales of $1.8 billion for the third quarter ended September 30, 2023.

"In what has proven to be a moderate demand environment, once again, we were able to deliver good financial results in the third quarter. We could not have done this without the tremendous efforts of our associates and our unique combination of best-in-class engineered wood products and an unmatched nationwide wholesale distribution network,” stated Nate Jorgensen, CEO. “In addition, we continue to progress on our key strategic investment initiatives and thoughtfully deploy capital to shareholders. Looking forward, we expect normal seasonality through the winter months, and are well positioned to serve and support our customer and vendor partners as changes in demand dictate."

Third Quarter 2024 Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3Q 2024 | | 3Q 2023 | | % change | | | | | | |

| | (in thousands, except per-share data and percentages) |

| Consolidated Results | | | | | | | | | | | | |

| Sales | | $ | 1,713,724 | | | $ | 1,834,441 | | | (7) | % | | | | | | |

| Net income | | 91,038 | | | 143,068 | | | (36) | % | | | | | | |

| Net income per common share - diluted | | 2.33 | | | 3.58 | | | (35) | % | | | | | | |

Adjusted EBITDA 1 | | 154,480 | | | 216,465 | | | (29) | % | | | | | | |

| | | | | | | | | | | | |

| Segment Results | | | | | | | | | | | | |

| Wood Products sales | | $ | 453,896 | | | $ | 515,225 | | | (12) | % | | | | | | |

| Wood Products income | | 53,853 | | | 99,574 | | | (46) | % | | | | | | |

Wood Products EBITDA 1 | | 77,404 | | | 122,924 | | | (37) | % | | | | | | |

| | | | | | | | | | | | |

| Building Materials Distribution sales | | 1,567,466 | | | 1,670,296 | | | (6) | % | | | | | | |

| Building Materials Distribution income | | 74,821 | | | 97,076 | | | (23) | % | | | | | | |

Building Materials Distribution EBITDA 1 | | 87,749 | | | 104,857 | | | (16) | % | | | | | | |

1 For reconciliations of non-GAAP measures, see summary notes at the end of this press release.

In third quarter 2024, total U.S. housing starts and single-family housing starts decreased 3% and 1%, respectively, compared to the same period in 2023. On a year-to-date basis through September 2024, total housing starts decreased 3%, while single-family housing starts increased 10%, compared to the same period in 2023. Single-family housing starts are the key demand driver for our sales.

Wood Products

Wood Products' sales, including sales to Building Materials Distribution (BMD), decreased $61.3 million, or 12%, to $453.9 million for the three months ended September 30, 2024, from $515.2 million for the three months ended September 30, 2023. The decrease in sales was driven by lower plywood sales prices, as well as lower sales prices for LVL and I-joists (collectively referred to as EWP). In addition, lower sales volumes for I-joists decreased sales, while sales volumes for LVL and plywood were flat. Other sales related to lumber and residual byproducts also decreased.

Comparative average net selling prices and sales volume changes for EWP and plywood are as follows:

| | | | | | | | | | | | | | | |

| | 3Q 2024 vs. 3Q 2023 | | 3Q 2024 vs. 2Q 2024 | |

| | | | | |

| Average Net Selling Prices | | | | | |

| LVL | | (5)% | | (2)% | |

| I-joists | | (6)% | | (2)% | |

| Plywood | | (13)% | | (8)% | |

| | | | | |

| Sales Volumes | | | | | |

| LVL | | —% | | (2)% | |

| I-joists | | (8)% | | (10)% | |

| Plywood | | —% | | 2% | |

| | | | | |

Wood Products' segment income decreased $45.7 million to $53.9 million for the three months ended September 30, 2024, from $99.6 million for the three months ended September 30, 2023. The decrease in segment income was due primarily to lower EWP and plywood sales prices, as well as higher conversion costs. In addition, lower I-joist sales volumes contributed to the decrease in segment income.

Building Materials Distribution

BMD's sales decreased $102.8 million, or 6%, to $1,567.5 million for the three months ended September 30, 2024, from $1,670.3 million for the three months ended September 30, 2023. Compared with the same quarter in the prior year, the overall decrease in sales was driven by a sales price decrease of 6%, as sales volumes were flat. Excluding the impact of the BROSCO acquisition on October 2, 2023, sales would have decreased by 9%. By product line, commodity sales decreased 12%, general line product sales increased 4%, and EWP sales (substantially all of which are sourced through our Wood Products segment) decreased 14%.

BMD segment income decreased $22.3 million to $74.8 million for the three months ended September 30, 2024, from $97.1 million for the three months ended September 30, 2023. The decrease in segment income was driven by increased selling and distribution expenses and depreciation and amortization expense of $10.0 million and $5.1 million, respectively. In addition, gross margin decreased $7.7 million, driven by lower margins on commodity products and EWP, offset partially by improved margins on general line products.

Balance Sheet and Liquidity

Boise Cascade ended third quarter 2024 with $761.6 million of cash and cash equivalents and $395.7 million of undrawn committed bank line availability, for total available liquidity of $1,157.3 million. The Company had $450.0 million of outstanding debt at September 30, 2024.

Capital Allocation

We expect capital expenditures in 2024, excluding potential acquisition spending, to total approximately $220 million to $240 million. In addition, we expect capital expenditures in 2025 to total approximately $200 million to $220 million. These levels of capital expenditures could increase or decrease as a result of several factors, including acquisitions, efforts to further accelerate organic growth, exercise of lease purchase options, our financial results, future economic conditions, availability of engineering and construction resources, and timing and availability of equipment purchases.

For the nine months ended September 30, 2024, the Company paid $220.5 million in common stock dividends. On October 30, 2024, our board of directors declared a quarterly dividend of $0.21 per share on our common stock, payable on December 18, 2024, to stockholders of record on December 2, 2024.

For the three and nine months ended September 30, 2024, the Company paid $69.7 million and $158.5 million, respectively, for the repurchase of 554,500 and 1,232,345 shares of our common stock, respectively. Furthermore, in October 2024, the Company repurchased an additional 50,000 shares of our common stock at a cost of $6.9 million. On October 30, 2024, our board of directors authorized the repurchase of an additional 1.4 million shares of our common stock. This increase is in addition to the remaining authorized shares under our prior common stock repurchase program. As of October 31, 2024, approximately 2 million shares were available for repurchase under our existing share repurchase program.

Outlook

Demand for the products we manufacture, as well as the products we purchase and distribute, is correlated with new residential construction, residential repair-and-remodeling activity, and light commercial construction. Residential construction, particularly new single-family construction, is the key demand driver for the products we manufacture and distribute. As reported by the U.S. Census Bureau, housing starts were 1.42 million in 2023. Current industry forecasts for U.S. housing starts are approximately 1.35 million in 2024 followed by 2025 starts at or modestly above 1.40 million. For the nine months ended September 2024, single-family starts are outpacing 2023 levels by 10% whereas multi-family starts have declined sharply from historic levels due to increased capital costs for developers, combined with historic levels of multi-family unit completions in 2024. Home affordability remains a challenge for many consumers due to home prices and the cost of financing, with the level of mortgage rates also limiting the supply of existing housing stock available for sale. Large homebuilders are addressing affordability challenges by reducing home sizes and plan complexity, as well as offering mortgage rate buydowns. New residential construction will continue to be an important source of supply for the demand created by undersupplied housing, favorable demographic trends, and low unemployment. We expect 2025 to reflect modest growth in home improvement spending, as the age of U.S. housing stock and elevated levels of homeowner equity will continue to provide a favorable backdrop for repair-and-remodel spending. Ultimately, macroeconomic factors, the level and expectations for mortgage rates, home affordability, home equity levels, home size, and other factors will influence the near-term demand environment for the products we manufacture and distribute.

As a manufacturer of certain commodity products, we have sales and profitability exposure to declines in commodity product prices and rising input costs. Our distribution business purchases and resells a broad mix of products with periods of increasing prices providing the opportunity for higher sales and increased margins, while declining price environments expose us to declines in sales and profitability. Future product pricing, particularly commodity products pricing and input costs, may be volatile in response to economic uncertainties, industry operating rates, supply-related disruptions, transportation constraints or disruptions, net import and export activity, inventory levels in various distribution channels, and seasonal demand patterns.

About Boise Cascade

Boise Cascade Company is one of the largest producers of engineered wood products and plywood in North America and a leading U.S. wholesale distributor of building products. For more information, please visit the Company's website at www.bc.com.

Webcast and Conference Call

Boise Cascade will host a webcast and conference call to discuss third quarter earnings on Tuesday, November 5, 2024, at 10 a.m. Eastern.

To join the webcast, go to the Investors section of our website at www.bc.com/investors and select the Event Calendar link. Analysts and investors who wish to ask questions during the Q&A session can register for the call here.

The archived webcast will be available in the Investors section of Boise Cascade's website.

Use of Non-GAAP Financial Measures

We refer to the terms EBITDA and Adjusted EBITDA in this earnings release and the accompanying Quarterly Statistical Information as supplemental measures of our performance and liquidity that are not required by or presented in accordance with generally accepted accounting principles in the United States (GAAP). We define EBITDA as income before interest (interest expense and interest income), income taxes, and depreciation and amortization. Additionally, we disclose Adjusted EBITDA, which further adjusts EBITDA to exclude the change in fair value of interest rate swaps.

We believe EBITDA and Adjusted EBITDA are meaningful measures because they present a transparent view of our recurring operating performance and allow management to readily view operating trends, perform analytical comparisons, and identify strategies to improve operating performance. We also believe EBITDA and Adjusted EBITDA are useful to investors because they provide a means to evaluate the operating performance of our segments and our Company on an ongoing basis using criteria that are used by our management and because they are frequently used by investors and other interested parties when comparing companies in our industry that have different financing and capital structures and/or tax rates. EBITDA and Adjusted EBITDA, however, are not measures of our liquidity or financial performance under GAAP and should not be considered as alternatives to net income, income from operations, or any other performance measure derived in accordance with GAAP or as alternatives to cash flow from operating activities as a measure of our liquidity. The use of EBITDA and Adjusted EBITDA instead of net income or segment income have limitations as analytical tools, including: the inability to determine profitability; the exclusion of interest expense, interest income, and associated significant cash requirements; and the exclusion of depreciation and amortization, which represent unavoidable operating costs. Management compensates for these limitations by relying on our GAAP results. Our measures of EBITDA and Adjusted EBITDA are not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation.

Forward-Looking Statements

This press release includes statements about our expectations of future operational and financial performance that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, but not limited to, statements regarding our outlook. Statements preceded or followed by, or that otherwise include, the words "believes," "expects," "anticipates," "intends," "project," "estimates," "plans," "forecast," "is likely to," and similar expressions or future or conditional verbs such as "will," "may," "would," "should," and "could" are generally forward-looking in nature and not historical facts. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties. The accuracy of such statements is subject to a number of risks, uncertainties, and assumptions that could cause our actual results to differ materially from those projected, including, but not limited to, prices for building products, changes in the competitive position of our products, commodity input costs, the effect of general economic conditions, our ability to efficiently and effectively integrate the BROSCO acquisition, mortgage rates and availability, housing demand, housing vacancy rates, governmental regulations, unforeseen production disruptions, as well as natural disasters. These and other factors that could cause actual results to differ materially from such forward-looking statements are discussed in greater detail in our filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of this press release. We undertake no obligation to revise them in light of new information. Finally, we undertake no obligation to review or confirm analyst expectations or estimates that might be derived from this release.

Boise Cascade Company

Consolidated Statements of Operations

(in thousands, except per-share data) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30 | | June 30, 2024 | | September 30 |

| 2024 | | 2023 | | | 2024 | | 2023 |

| | | | | | | | | |

| Sales | $ | 1,713,724 | | | $ | 1,834,441 | | | $ | 1,797,670 | | | $ | 5,156,814 | | | $ | 5,193,989 | |

| | | | | | | | | |

| Costs and expenses | | | | | | | | | |

| Materials, labor, and other operating expenses (excluding depreciation) | 1,375,719 | | | 1,442,178 | | | 1,440,680 | | | 4,123,838 | | | 4,099,249 | |

| Depreciation and amortization | 36,861 | | | 31,474 | | | 34,367 | | | 107,078 | | | 93,382 | |

| Selling and distribution expenses | 157,522 | | | 147,714 | | | 149,783 | | | 451,415 | | | 415,707 | |

| General and administrative expenses | 26,172 | | | 27,583 | | | 25,943 | | | 77,232 | | | 84,193 | |

| | | | | | | | | |

| Other (income) expense, net | 94 | | | (141) | | | (84) | | | (68) | | | (1,752) | |

| 1,596,368 | | | 1,648,808 | | | 1,650,689 | | | 4,759,495 | | | 4,690,779 | |

| | | | | | | | | |

| Income from operations | 117,356 | | | 185,633 | | | 146,981 | | | 397,319 | | | 503,210 | |

| | | | | | | | | |

| Foreign currency exchange gain (loss) | 300 | | | (602) | | | (104) | | | (103) | | | (355) | |

| Pension expense (excluding service costs) | (37) | | | (40) | | | (37) | | | (111) | | | (122) | |

| Interest expense | (6,082) | | | (6,351) | | | (6,105) | | | (18,257) | | | (19,051) | |

| Interest income | 10,168 | | | 13,760 | | | 10,543 | | | 31,308 | | | 34,964 | |

| Change in fair value of interest rate swaps | (866) | | | (327) | | | (487) | | | (1,573) | | | (798) | |

| | | | | | | | | |

| 3,483 | | | 6,440 | | | 3,810 | | | 11,264 | | | 14,638 | |

| | | | | | | | | |

| Income before income taxes | 120,839 | | | 192,073 | | | 150,791 | | | 408,583 | | | 517,848 | |

| Income tax provision | (29,801) | | | (49,005) | | | (38,499) | | | (101,129) | | | (131,727) | |

| Net income | $ | 91,038 | | | $ | 143,068 | | | $ | 112,292 | | | $ | 307,454 | | | $ | 386,121 | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 38,848 | | | 39,675 | | | 39,412 | | | 39,286 | | | 39,648 | |

| Diluted | 39,063 | | | 39,983 | | | 39,608 | | | 39,521 | | | 39,849 | |

| | | | | | | | | |

| Net income per common share: | | | | | | | | | |

| Basic | $ | 2.34 | | | $ | 3.61 | | | $ | 2.85 | | | $ | 7.83 | | | $ | 9.74 | |

| Diluted | $ | 2.33 | | | $ | 3.58 | | | $ | 2.84 | | | $ | 7.78 | | | $ | 9.69 | |

| | | | | | | | | |

| Dividends declared per common share | $ | 5.21 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 5.61 | | | $ | 3.50 | |

Wood Products Segment

Statements of Operations

(in thousands, except percentages) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30 | | June 30, 2024 | | September 30 |

| 2024 | | 2023 | | | 2024 | | 2023 |

| | | | | | | | | |

| Segment sales | $ | 453,896 | | | $ | 515,225 | | | $ | 489,823 | | | $ | 1,412,647 | | | $ | 1,482,926 | |

| | | | | | | | | |

| Costs and expenses | | | | | | | | | |

| Materials, labor, and other operating expenses (excluding depreciation) | 361,313 | | | 376,754 | | | 378,920 | | | 1,097,954 | | | 1,091,900 | |

| Depreciation and amortization | 23,551 | | | 23,350 | | | 22,270 | | | 70,205 | | | 70,145 | |

| Selling and distribution expenses | 10,587 | | | 10,786 | | | 11,114 | | | 32,252 | | | 33,901 | |

| General and administrative expenses | 4,640 | | | 5,018 | | | 4,606 | | | 14,266 | | | 15,560 | |

| | | | | | | | | |

| Other (income) expense, net | (48) | | | (257) | | | 133 | | | 99 | | | (1,584) | |

| 400,043 | | | 415,651 | | | 417,043 | | | 1,214,776 | | | 1,209,922 | |

| | | | | | | | | |

| Segment income | $ | 53,853 | | | $ | 99,574 | | | $ | 72,780 | | | $ | 197,871 | | | $ | 273,004 | |

| | | | | | | | | |

| (percentage of sales) |

| | | | | | | | | |

| Segment sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

| Costs and expenses | | | | | | | | | |

| Materials, labor, and other operating expenses (excluding depreciation) | 79.6 | % | | 73.1 | % | | 77.4 | % | | 77.7 | % | | 73.6 | % |

| Depreciation and amortization | 5.2 | % | | 4.5 | % | | 4.5 | % | | 5.0 | % | | 4.7 | % |

| Selling and distribution expenses | 2.3 | % | | 2.1 | % | | 2.3 | % | | 2.3 | % | | 2.3 | % |

| General and administrative expenses | 1.0 | % | | 1.0 | % | | 0.9 | % | | 1.0 | % | | 1.0 | % |

| | | | | | | | | |

| Other (income) expense, net | — | % | | — | % | | — | % | | — | % | | (0.1 | %) |

| 88.1 | % | | 80.7 | % | | 85.1 | % | | 86.0 | % | | 81.6 | % |

| | | | | | | | | |

| Segment income | 11.9 | % | | 19.3 | % | | 14.9 | % | | 14.0 | % | | 18.4 | % |

Building Materials Distribution Segment

Statements of Operations

(in thousands, except percentages) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30 | | June 30, 2024 | | September 30 |

| 2024 | | 2023 | | | 2024 | | 2023 |

| | | | | | | | | |

| Segment sales | $ | 1,567,466 | | | $ | 1,670,296 | | | $ | 1,655,221 | | | $ | 4,727,708 | | | $ | 4,686,076 | |

| | | | | | | | | |

| Costs and expenses | | | | | | | | | |

| Materials, labor, and other operating expenses (excluding depreciation) | 1,322,001 | | | 1,417,153 | | | 1,409,510 | | | 4,009,932 | | | 3,983,718 | |

| Depreciation and amortization | 12,928 | | | 7,781 | | | 11,741 | | | 35,776 | | | 22,237 | |

| Selling and distribution expenses | 146,994 | | | 136,982 | | | 138,716 | | | 419,324 | | | 381,878 | |

| General and administrative expenses | 10,580 | | | 11,195 | | | 10,070 | | | 30,184 | | | 33,314 | |

| Other (income) expense, net | 142 | | | 109 | | | (216) | | | (192) | | | (382) | |

| 1,492,645 | | | 1,573,220 | | | 1,569,821 | | | 4,495,024 | | | 4,420,765 | |

| | | | | | | | | |

| Segment income | $ | 74,821 | | | $ | 97,076 | | | $ | 85,400 | | | $ | 232,684 | | | $ | 265,311 | |

| | | | | | | | | |

| (percentage of sales) |

| | | | | | | | | |

| Segment sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

| Costs and expenses | | | | | | | | | |

| Materials, labor, and other operating expenses (excluding depreciation) | 84.3 | % | | 84.8 | % | | 85.2 | % | | 84.8 | % | | 85.0 | % |

| Depreciation and amortization | 0.8 | % | | 0.5 | % | | 0.7 | % | | 0.8 | % | | 0.5 | % |

| Selling and distribution expenses | 9.4 | % | | 8.2 | % | | 8.4 | % | | 8.9 | % | | 8.1 | % |

| General and administrative expenses | 0.7 | % | | 0.7 | % | | 0.6 | % | | 0.6 | % | | 0.7 | % |

| Other (income) expense, net | — | % | | — | % | | — | % | | — | % | | — | % |

| 95.2 | % | | 94.2 | % | | 94.8 | % | | 95.1 | % | | 94.3 | % |

| | | | | | | | | |

| Segment income | 4.8 | % | | 5.8 | % | | 5.2 | % | | 4.9 | % | | 5.7 | % |

Segment Information

(in thousands) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30 | | June 30, 2024 | | September 30 |

| 2024 | | 2023 | | | 2024 | | 2023 |

| Segment sales | | | | | | | | | |

| Wood Products | $ | 453,896 | | | $ | 515,225 | | | $ | 489,823 | | | $ | 1,412,647 | | | $ | 1,482,926 | |

| Building Materials Distribution | 1,567,466 | | | 1,670,296 | | | 1,655,221 | | | 4,727,708 | | | 4,686,076 | |

| | | | | | | | | |

| Intersegment eliminations | (307,638) | | | (351,080) | | | (347,374) | | | (983,541) | | | (975,013) | |

| Total net sales | $ | 1,713,724 | | | $ | 1,834,441 | | | $ | 1,797,670 | | | $ | 5,156,814 | | | $ | 5,193,989 | |

| | | | | | | | | |

| Segment income | | | | | | | | | |

| Wood Products | $ | 53,853 | | | $ | 99,574 | | | $ | 72,780 | | | $ | 197,871 | | | $ | 273,004 | |

| Building Materials Distribution | 74,821 | | | 97,076 | | | 85,400 | | | 232,684 | | | 265,311 | |

| Total segment income | 128,674 | | | 196,650 | | | 158,180 | | | 430,555 | | | 538,315 | |

| Unallocated corporate costs | (11,318) | | | (11,017) | | | (11,199) | | | (33,236) | | | (35,105) | |

| Income from operations | $ | 117,356 | | | $ | 185,633 | | | $ | 146,981 | | | $ | 397,319 | | | $ | 503,210 | |

| | | | | | | | | |

| Segment EBITDA | | | | | | | | | |

| Wood Products | $ | 77,404 | | | $ | 122,924 | | | $ | 95,050 | | | $ | 268,076 | | | $ | 343,149 | |

| Building Materials Distribution | 87,749 | | | 104,857 | | | 97,141 | | | 268,460 | | | 287,548 | |

See accompanying summary notes to consolidated financial statements and segment information.

Boise Cascade Company

Consolidated Balance Sheets

(in thousands) (unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| |

| ASSETS | | | |

| | | |

| Current | | | |

| Cash and cash equivalents | $ | 761,599 | | | $ | 949,574 | |

| Receivables | | | |

Trade, less allowances of $4,979 and $3,278 | 408,487 | | | 352,780 | |

| Related parties | 289 | | | 181 | |

| Other | 17,411 | | | 20,740 | |

| Inventories | 792,356 | | | 712,369 | |

| Prepaid expenses and other | 32,024 | | | 21,170 | |

| Total current assets | 2,012,166 | | | 2,056,814 | |

| | | |

| Property and equipment, net | 985,808 | | | 932,633 | |

| Operating lease right-of-use assets | 50,039 | | | 62,868 | |

| Finance lease right-of-use assets | 22,925 | | | 24,003 | |

| Timber deposits | 9,078 | | | 7,208 | |

| Goodwill | 171,945 | | | 170,254 | |

| Intangible assets, net | 177,028 | | | 190,743 | |

| Deferred income taxes | 4,605 | | | 4,854 | |

| Other assets | 8,033 | | | 9,269 | |

| Total assets | $ | 3,441,627 | | | $ | 3,458,646 | |

Boise Cascade Company

Consolidated Balance Sheets (continued)

(in thousands, except per-share data) (unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| | | |

| Current | | | |

| Accounts payable | | | |

| Trade | $ | 372,199 | | | $ | 310,175 | |

| Related parties | 2,216 | | | 1,501 | |

| Accrued liabilities | | | |

| Compensation and benefits | 122,000 | | | 149,561 | |

| | | |

| Interest payable | 5,086 | | | 9,958 | |

| | | |

| Other | 141,741 | | | 122,921 | |

| Total current liabilities | 643,242 | | | 594,116 | |

| | | |

| Debt | | | |

| Long-term debt | 445,945 | | | 445,280 | |

| | | |

| Other | | | |

| Compensation and benefits | 42,864 | | | 40,189 | |

| Operating lease liabilities, net of current portion | 43,550 | | | 56,425 | |

| Finance lease liabilities, net of current portion | 27,492 | | | 28,084 | |

| Deferred income taxes | 96,967 | | | 82,014 | |

| Other long-term liabilities | 18,134 | | | 16,874 | |

| 229,007 | | | 223,586 | |

| | | |

| Commitments and contingent liabilities | | | |

| | | |

| Stockholders' equity | | | |

Preferred stock, $0.01 par value per share; 50,000 shares authorized, no shares issued and outstanding | — | | | — | |

Common stock, $0.01 par value per share; 300,000 shares authorized, 45,130 and 44,983 shares issued, respectively | 451 | | | 450 | |

Treasury stock, 6,675 and 5,443 shares at cost, respectively | (305,227) | | | (145,335) | |

Additional paid-in capital | 561,223 | | | 560,697 | |

Accumulated other comprehensive loss | (495) | | | (517) | |

| Retained earnings | 1,867,481 | | | 1,780,369 | |

| Total stockholders' equity | 2,123,433 | | | 2,195,664 | |

| Total liabilities and stockholders' equity | $ | 3,441,627 | | | $ | 3,458,646 | |

Boise Cascade Company

Consolidated Statements of Cash Flows

(in thousands) (unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30 |

| 2024 | | 2023 |

| Cash provided by (used for) operations | | | |

| Net income | $ | 307,454 | | | $ | 386,121 | |

| Items in net income not using (providing) cash | | | |

Depreciation and amortization, including deferred financing costs and other | 109,531 | | | 95,516 | |

| Stock-based compensation | 11,668 | | | 11,518 | |

| Pension expense | 111 | | | 122 | |

| Deferred income taxes | 15,096 | | | 4,351 | |

| Change in fair value of interest rate swaps | 1,573 | | | 798 | |

| | | |

| Other | 322 | | | (1,877) | |

| | | |

| Decrease (increase) in working capital, net of acquisitions | | | |

| Receivables | (51,192) | | | (158,756) | |

| Inventories | (80,739) | | | 14,145 | |

| Prepaid expenses and other | (6,697) | | | (6,604) | |

| Accounts payable and accrued liabilities | 44,547 | | | 152,303 | |

| | | |

| Income taxes payable | (3,970) | | | 23,664 | |

| Other | (3,952) | | | (172) | |

| Net cash provided by operations | 343,752 | | | 521,129 | |

| | | |

| Cash provided by (used for) investment | | | |

| Expenditures for property and equipment | (135,760) | | | (99,251) | |

| Acquisitions of businesses and facilities | (5,581) | | | — | |

| | | |

| Proceeds from sales of assets and other | 1,197 | | | 2,450 | |

| Net cash used for investment | (140,144) | | | (96,801) | |

| | | |

| Cash provided by (used for) financing | | | |

| | | |

| | | |

| | | |

| Treasury stock purchased | (158,509) | | | (1,539) | |

| Dividends paid on common stock | (220,485) | | | (140,885) | |

| Tax withholding payments on stock-based awards | (11,141) | | | (5,926) | |

| | | |

| | | |

| Other | (1,448) | | | (1,359) | |

| Net cash used for financing | (391,583) | | | (149,709) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | (187,975) | | | 274,619 | |

| | | |

| Balance at beginning of the period | 949,574 | | | 998,344 | |

| | | |

| Balance at end of the period | $ | 761,599 | | | $ | 1,272,963 | |

Summary Notes to Consolidated Financial Statements and Segment Information

The Consolidated Statements of Operations, Segment Statements of Operations, Consolidated Balance Sheets, Consolidated Statements of Cash Flows, and Segment Information presented herein do not include the notes accompanying the Company's Consolidated Financial Statements and should be read in conjunction with the Company’s 2023 Form 10-K and the Company's other filings with the Securities and Exchange Commission. Net income for all periods presented involved estimates and accruals.

EBITDA represents income before interest (interest expense and interest income), income taxes, and depreciation and amortization. Additionally, we disclose Adjusted EBITDA, which further adjusts EBITDA to exclude the change in fair value of interest rate swaps. The following table reconciles net income to EBITDA and Adjusted EBITDA for the (i) three months ended September 30, 2024 and 2023, (ii) three months ended June 30, 2024, and (iii) nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30 | | June 30, 2024 | | September 30 |

| 2024 | | 2023 | | | 2024 | | 2023 |

| (in thousands) |

| Net income | $ | 91,038 | | | $ | 143,068 | | | $ | 112,292 | | | $ | 307,454 | | | $ | 386,121 | |

| Interest expense | 6,082 | | | 6,351 | | | 6,105 | | | 18,257 | | | 19,051 | |

| Interest income | (10,168) | | | (13,760) | | | (10,543) | | | (31,308) | | | (34,964) | |

| Income tax provision | 29,801 | | | 49,005 | | | 38,499 | | | 101,129 | | | 131,727 | |

| Depreciation and amortization | 36,861 | | | 31,474 | | | 34,367 | | | 107,078 | | | 93,382 | |

| EBITDA | 153,614 | | | 216,138 | | | 180,720 | | | 502,610 | | | 595,317 | |

| Change in fair value of interest rate swaps | 866 | | | 327 | | | 487 | | | 1,573 | | | 798 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 154,480 | | | $ | 216,465 | | | $ | 181,207 | | | $ | 504,183 | | | $ | 596,115 | |

The following table reconciles segment income and unallocated corporate costs to EBITDA and adjusted EBITDA for the (i) three months ended September 30, 2024 and 2023, (ii) three months ended June 30, 2024, and (iii) nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30 | | June 30, 2024 | | September 30 |

| 2024 | | 2023 | | | 2024 | | 2023 |

| (in thousands) |

| Wood Products | | | | | | | | | |

| Segment income | $ | 53,853 | | | $ | 99,574 | | | $ | 72,780 | | | $ | 197,871 | | | $ | 273,004 | |

| Depreciation and amortization | 23,551 | | | 23,350 | | | 22,270 | | | 70,205 | | | 70,145 | |

| EBITDA | $ | 77,404 | | | $ | 122,924 | | | $ | 95,050 | | | $ | 268,076 | | | $ | 343,149 | |

| | | | | | | | | |

| Building Materials Distribution | | | | | | | | | |

| Segment income | $ | 74,821 | | | $ | 97,076 | | | $ | 85,400 | | | $ | 232,684 | | | $ | 265,311 | |

| Depreciation and amortization | 12,928 | | | 7,781 | | | 11,741 | | | 35,776 | | | 22,237 | |

| EBITDA | $ | 87,749 | | | $ | 104,857 | | | $ | 97,141 | | | $ | 268,460 | | | $ | 287,548 | |

| | | | | | | | | |

| Corporate | | | | | | | | | |

| Unallocated corporate costs | $ | (11,318) | | | $ | (11,017) | | | $ | (11,199) | | | $ | (33,236) | | | $ | (35,105) | |

| Foreign currency exchange gain (loss) | 300 | | | (602) | | | (104) | | | (103) | | | (355) | |

| Pension expense (excluding service costs) | (37) | | | (40) | | | (37) | | | (111) | | | (122) | |

| Change in fair value of interest rate swaps | (866) | | | (327) | | | (487) | | | (1,573) | | | (798) | |

| | | | | | | | | |

| Depreciation and amortization | 382 | | | 343 | | | 356 | | | 1,097 | | | 1,000 | |

| EBITDA | (11,539) | | | (11,643) | | | (11,471) | | | (33,926) | | | (35,380) | |

| Change in fair value of interest rate swaps | 866 | | | 327 | | | 487 | | | 1,573 | | | 798 | |

| | | | | | | | | |

| Corporate adjusted EBITDA | $ | (10,673) | | | $ | (11,316) | | | $ | (10,984) | | | $ | (32,353) | | | $ | (34,582) | |

| | | | | | | | | |

| Total Company adjusted EBITDA | $ | 154,480 | | | $ | 216,465 | | | $ | 181,207 | | | $ | 504,183 | | | $ | 596,115 | |

Exhibit 99.2

Boise Cascade Company

Quarterly Statistical Information

| | | | | | | | | | | | | | | | | |

| Wood Products Segment | | | | | |

| 2024 |

| Q1 | Q2 | Q3 | Q4 | YTD |

| LVL sales volume (MCF) | 4,777 | | 5,074 | | 4,952 | | | 14,803 | |

| I-joist sales volume (MELF) | 56,587 | | 65,788 | | 58,884 | | | 181,259 | |

| Plywood sales volume (MSF 3/8") | 371,699 | | 383,092 | | 390,978 | | | 1,145,769 | |

| Lumber sales volume (MBF) | 22,772 | | 17,619 | | 19,390 | | | 59,781 | |

| LVL mill net sales price ($/CF) | $ | 28.75 | | $ | 28.12 | | $ | 27.62 | | | $ | 28.15 | |

| I-joist mill net sales price ($/MELF) | $ | 2,018 | | $ | 1,961 | | $ | 1,921 | | | $ | 1,966 | |

| Plywood net sales price ($/MSF 3/8") | $ | 378 | | $ | 362 | | $ | 333 | | | $ | 357 | |

| Lumber net sales price ($/MBF) | $ | 650 | | $ | 751 | | $ | 705 | | | $ | 698 | |

| Segment sales (000) | $ | 468,928 | | $ | 489,823 | | $ | 453,896 | | | $ | 1,412,647 | |

| Segment income (000) | $ | 71,238 | | $ | 72,780 | | $ | 53,853 | | | $ | 197,871 | |

Segment depreciation and amortization (000)2 | $ | 24,384 | | $ | 22,270 | | $ | 23,551 | | | $ | 70,205 | |

Segment EBITDA (000)1 | $ | 95,622 | | $ | 95,050 | | $ | 77,404 | | | $ | 268,076 | |

| EBITDA as a percentage of sales | 20.4 | % | 19.4 | % | 17.1 | % | | 19.0 | % |

| Capital spending (000) | $ | 19,643 | | $ | 17,793 | | $ | 24,771 | | | $ | 62,207 | |

| Receivables (000) | $ | 84,892 | | $ | 83,445 | | $ | 77,244 | | | |

| Inventories (000) | $ | 213,050 | | $ | 206,198 | | $ | 226,300 | | | |

| Accounts payable (000) | $ | 61,834 | | $ | 66,374 | | $ | 73,922 | | | |

| | | | | |

| 2023 |

| Q1 | Q2 | Q3 | Q4 | YTD |

| LVL sales volume (MCF) | 3,639 | | 4,682 | | 4,945 | | 4,109 | | 17,375 | |

| I-joist sales volume (MELF) | 38,711 | | 62,950 | | 64,125 | | 54,015 | | 219,801 | |

| Plywood sales volume (MSF 3/8") | 405,960 | | 439,963 | | 389,827 | | 363,008 | | 1,598,758 | |

| Lumber sales volume (MBF) | 31,560 | | 32,528 | | 31,729 | | 29,221 | | 125,038 | |

| LVL mill net sales price ($/CF) | $ | 31.17 | | $ | 30.14 | | $ | 29.08 | | $ | 29.93 | | $ | 30.01 | |

| I-joist mill net sales price ($/MELF) | $ | 2,168 | | $ | 2,088 | | $ | 2,035 | | $ | 2,093 | | $ | 2,088 | |

| Plywood net sales price ($/MSF 3/8") | $ | 367 | | $ | 365 | | $ | 382 | | $ | 375 | | $ | 372 | |

| Lumber net sales price ($/MBF) | $ | 724 | | $ | 707 | | $ | 641 | | $ | 588 | | $ | 667 | |

| Segment sales (000) | $ | 437,428 | | $ | 530,273 | | $ | 515,225 | | $ | 449,676 | | $ | 1,932,602 | |

| Segment income (000) | $ | 69,395 | | $ | 104,035 | | $ | 99,574 | | $ | 64,128 | | $ | 337,132 | |

Segment depreciation and amortization (000)2 | $ | 23,790 | | $ | 23,005 | | $ | 23,350 | | $ | 28,565 | | $ | 98,710 | |

Segment EBITDA (000)1 | $ | 93,185 | | $ | 127,040 | | $ | 122,924 | | $ | 92,693 | | $ | 435,842 | |

| EBITDA as a percentage of sales | 21.3 | % | 24.0 | % | 23.9 | % | 20.6 | % | 22.6 | % |

| Capital spending (000) | $ | 7,262 | | $ | 12,106 | | $ | 11,807 | | $ | 28,185 | | $ | 59,360 | |

| Receivables (000) | $ | 77,318 | | $ | 97,229 | | $ | 88,688 | | $ | 56,882 | | |

| Inventories (000) | $ | 232,136 | | $ | 200,948 | | $ | 205,111 | | $ | 218,861 | | |

| Accounts payable (000) | $ | 63,275 | | $ | 60,656 | | $ | 69,023 | | $ | 60,196 | | |

Boise Cascade Company

Quarterly Statistical Information (continued)

| | | | | | | | | | | | | | | | | |

| Wood Products Segment (continued) | | | | | |

| 2022 |

| Q1 | Q2 | Q3 | Q4 | YTD |

| LVL sales volume (MCF) | 4,641 | | 4,586 | | 5,190 | | 3,176 | | 17,593 | |

| I-joist sales volume (MELF) | 65,362 | | 69,467 | | 64,421 | | 30,130 | | 229,380 | |

| Plywood sales volume (MSF 3/8") | 316,941 | | 280,594 | | 328,586 | | 392,975 | | 1,319,096 | |

| Lumber sales volume (MBF) | 17,139 | | 16,935 | | 24,045 | | 24,985 | | 83,104 | |

| LVL mill net sales price ($/CF) | $ | 26.40 | | $ | 28.47 | | $ | 33.82 | | $ | 34.36 | | $ | 30.56 | |

| I-joist mill net sales price ($/MELF) | $ | 1,877 | | $ | 2,066 | | $ | 2,429 | | $ | 2,553 | | $ | 2,178 | |

| Plywood net sales price ($/MSF 3/8") | $ | 689 | | $ | 569 | | $ | 477 | | $ | 396 | | $ | 523 | |

| Lumber net sales price ($/MBF) | $ | 1,011 | | $ | 1,214 | | $ | 880 | | $ | 720 | | $ | 927 | |

| Segment sales (000) | $ | 558,944 | | $ | 536,030 | | $ | 595,320 | | $ | 425,602 | | $ | 2,115,896 | |

| Segment income (000) | $ | 190,116 | | $ | 154,101 | | $ | 155,972 | | $ | 74,978 | | $ | 575,167 | |

| Segment depreciation and amortization (000) | $ | 13,640 | | $ | 13,653 | | $ | 21,285 | | $ | 24,730 | | $ | 73,308 | |

Segment EBITDA (000)1 | $ | 203,756 | | $ | 167,754 | | $ | 177,257 | | $ | 99,708 | | $ | 648,475 | |

| EBITDA as a percentage of sales | 36.5 | % | 31.3 | % | 29.8 | % | 23.4 | % | 30.6 | % |

Capital spending (000)3 | $ | 8,986 | | $ | 12,861 | | $ | 12,949 | | $ | 17,138 | | $ | 51,934 | |

| Receivables (000) | $ | 120,960 | | $ | 113,395 | | $ | 94,017 | | $ | 43,406 | | |

| Inventories (000) | $ | 181,810 | | $ | 191,411 | | $ | 214,576 | | $ | 229,361 | | |

| Accounts payable (000) | $ | 53,797 | | $ | 65,272 | | $ | 72,877 | | $ | 44,202 | | |

| | | | | |

1Segment EBITDA is calculated as segment income before depreciation and amortization. |

2Segment depreciation and amortization in first quarter 2024 and fourth quarter 2023 include accelerated depreciation of $2.2 million and $6.2 million, respectively, for the indefinite curtailment of lumber production assets at our Chapman, Alabama, facility. |

3Capital spending in 2022 excludes $515.2 million of cash paid for the acquisition of businesses and facilities. |

Boise Cascade Company

Quarterly Statistical Information (continued)

| | | | | | | | | | | | | | | | | |

| Building Materials Distribution Segment | | | | |

| 2024 |

| Q1 | Q2 | Q3 | Q4 | YTD |

Commodity sales1 | 36.7 | % | 35.0 | % | 34.9 | % | | 35.5 | % |

General line sales1 | 41.0 | % | 42.4 | % | 43.8 | % | | 42.4 | % |

EWP sales1 | 22.3 | % | 22.6 | % | 21.3 | % | | 22.1 | % |

| Total sales (000) | $ | 1,505,021 | | $ | 1,655,221 | | $ | 1,567,466 | | | $ | 4,727,708 | |

Gross margin2 | 15.1 | % | 14.8 | % | 15.7 | % | | 15.2 | % |

| Segment income (000) | $ | 72,463 | | $ | 85,400 | | $ | 74,821 | | | $ | 232,684 | |

| Segment depreciation and amortization (000) | $ | 11,107 | | $ | 11,741 | | $ | 12,928 | | | $ | 35,776 | |

Segment EBITDA (000)3 | $ | 83,570 | | $ | 97,141 | | $ | 87,749 | | | $ | 268,460 | |

| EBITDA as a percentage of sales | 5.6 | % | 5.9 | % | 5.6 | % | | 5.7 | % |

Capital spending (000)4 | $ | 14,672 | | $ | 21,904 | | $ | 36,902 | | | $ | 73,478 | |

| Receivables (000) | $ | 453,083 | | $ | 436,992 | | $ | 386,303 | | | |

| Inventories (000) | $ | 601,546 | | $ | 626,044 | | $ | 566,056 | | | |

| Accounts payable (000) | $ | 412,919 | | $ | 392,798 | | $ | 300,978 | | | |

| | | | | |

| 2023 |

| Q1 | Q2 | Q3 | Q4 | YTD |

Commodity sales1 | 39.7 | % | 37.5 | % | 37.4 | % | 36.9 | % | 37.8 | % |

General line sales1 | 38.7 | % | 39.6 | % | 39.4 | % | 40.4 | % | 39.5 | % |

EWP sales1 | 21.6 | % | 22.9 | % | 23.2 | % | 22.7 | % | 22.7 | % |

| Total sales (000) | $ | 1,379,242 | | $ | 1,636,538 | | $ | 1,670,296 | | $ | 1,492,614 | | $ | 6,178,690 | |

Gross margin2 | 14.8 | % | 15.0 | % | 15.2 | % | 15.2 | % | 15.0 | % |

| Segment income (000) | $ | 69,685 | | $ | 98,550 | | $ | 97,076 | | $ | 70,497 | | $ | 335,808 | |

| Segment depreciation and amortization (000) | $ | 7,070 | | $ | 7,386 | | $ | 7,781 | | $ | 10,116 | | $ | 32,353 | |

Segment EBITDA (000)3 | $ | 76,755 | | $ | 105,936 | | $ | 104,857 | | $ | 80,613 | | $ | 368,161 | |

| EBITDA as a percentage of sales | 5.6 | % | 6.5 | % | 6.3 | % | 5.4 | % | 6.0 | % |

Capital spending (000)5 | $ | 22,659 | | $ | 25,929 | | $ | 19,135 | | $ | 88,001 | | $ | 155,724 | |

| Receivables (000) | $ | 393,338 | | $ | 445,991 | | $ | 434,755 | | $ | 344,978 | | |

| Inventories (000) | $ | 506,663 | | $ | 502,085 | | $ | 478,295 | | $ | 493,509 | | |

| Accounts payable (000) | $ | 363,163 | | $ | 390,840 | | $ | 362,196 | | $ | 252,144 | | |

Boise Cascade Company

Quarterly Statistical Information (continued)

| | | | | | | | | | | | | | | | | |

| Building Materials Distribution Segment (continued) | | | |

| 2022 |

| Q1 | Q2 | Q3 | Q4 | YTD |

Commodity sales1 | 52.2 | % | 44.9 | % | 39.6 | % | 41.5 | % | 44.9 | % |

General line sales1 | 29.1 | % | 32.9 | % | 35.3 | % | 37.1 | % | 33.3 | % |

EWP sales1 | 18.7 | % | 22.2 | % | 25.1 | % | 21.4 | % | 21.8 | % |

| Total sales (000) | $ | 2,111,833 | | $ | 2,131,200 | | $ | 1,956,802 | | $ | 1,443,780 | | $ | 7,643,615 | |

Gross margin2 | 18.0 | % | 13.9 | % | 15.4 | % | 15.8 | % | 15.8 | % |

| Segment income (000) | $ | 225,892 | | $ | 154,308 | | $ | 154,436 | | $ | 92,455 | | $ | 627,091 | |

| Segment depreciation and amortization (000) | $ | 6,576 | | $ | 6,728 | | $ | 6,760 | | $ | 6,941 | | $ | 27,005 | |

Segment EBITDA (000)3 | $ | 232,468 | | $ | 161,036 | | $ | 161,196 | | $ | 99,396 | | $ | 654,096 | |

| EBITDA as a percentage of sales | 11.0 | % | 7.6 | % | 8.2 | % | 6.9 | % | 8.6 | % |

Capital spending (000)6 | $ | 7,892 | | $ | 10,009 | | $ | 7,938 | | $ | 34,624 | | $ | 60,463 | |

| Receivables (000) | $ | 616,040 | | $ | 540,167 | | $ | 479,876 | | $ | 286,789 | | |

| Inventories (000) | $ | 622,858 | | $ | 612,196 | | $ | 552,610 | | $ | 468,189 | | |

| Accounts payable (000) | $ | 479,584 | | $ | 413,235 | | $ | 355,170 | | $ | 215,308 | | |

| | | | | |

1Product line sales are shown as a percentage of total Building Materials Distribution (BMD) sales. |

2We define gross margin as "Sales" less "Materials, labor, and other operating expenses (excluding depreciation)." Substantially all costs included in "Materials, labor, and other operating expenses (excluding depreciation)" for our BMD segment are for inventory purchased for resale. Gross margin percentage is gross margin as a percentage of segment sales. |

3Segment EBITDA is calculated as segment income before depreciation and amortization. |

4During 2024, capital spending in third quarter includes approximately $20 million to purchase a previously leased BMD property in Westfield, Massachusetts. |

5During 2023, capital spending in first quarter includes approximately $11 million to purchase a property in Kansas City, Missouri, to house a new door and millwork location and capital spending in fourth quarter includes approximately $63 million to purchase properties in West Palm Beach, Florida, and Modesto, California. Capital spending in fourth quarter 2023 excludes approximately $163 million for the acquisition of businesses and facilities, net of cash acquired. |

6During 2022, capital spending in fourth quarter includes approximately $13 million to purchase a previously leased BMD property in Milton, Florida. |

Boise Cascade Company

Quarterly Statistical Information (continued)

Reconciliation of Non-GAAP Financial Measures

(in thousands)

| | | | | | | | | | | | | | | | | |

| Total Boise Cascade Company |

| | | | | |

| EBITDA represents income before interest (interest expense and interest income), income taxes, and depreciation and amortization. Additionally, we disclose Adjusted EBITDA, which further adjusts EBITDA to exclude the change in fair value of interest rate swaps. The following tables reconcile net income to EBITDA and Adjusted EBITDA for the periods noted below: |

| 2024 |

| Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | |

| Net income | $ | 104,124 | | $ | 112,292 | | $ | 91,038 | | | $ | 307,454 | |

| Interest expense | 6,070 | | 6,105 | | 6,082 | | | 18,257 | |

| Interest income | (10,597) | | (10,543) | | (10,168) | | | (31,308) | |

| Income tax provision | 32,829 | | 38,499 | | 29,801 | | | 101,129 | |

| Depreciation and amortization | 35,850 | | 34,367 | | 36,861 | | | 107,078 | |

| EBITDA | 168,276 | | 180,720 | | 153,614 | | | 502,610 | |

| Change in fair value of interest rate swaps | 220 | | 487 | | 866 | | | 1,573 | |

| | | | | |

| Adjusted EBITDA | $ | 168,496 | | $ | 181,207 | | $ | 154,480 | | | $ | 504,183 | |

| | | | | |

| 2023 |

| Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | |

| Net income | $ | 96,733 | | $ | 146,320 | | $ | 143,068 | | $ | 97,535 | | $ | 483,656 | |

| Interest expense | 6,361 | | 6,339 | | 6,351 | | 6,445 | | 25,496 | |

| Interest income | (9,685) | | (11,519) | | (13,760) | | (13,142) | | (48,106) | |

| Income tax provision | 33,275 | | 49,447 | | 49,005 | | 29,666 | | 161,393 | |

| Depreciation and amortization | 31,186 | | 30,722 | | 31,474 | | 39,085 | | 132,467 | |

| EBITDA | 157,870 | | 221,309 | | 216,138 | | 159,589 | | 754,906 | |

| Change in fair value of interest rate swaps | 804 | | (333) | | 327 | | 993 | | 1,791 | |

| | | | | |

| Adjusted EBITDA | $ | 158,674 | | $ | 220,976 | | $ | 216,465 | | $ | 160,582 | | $ | 756,697 | |

| | | | | |

| 2022 |

| Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | |

| Net income | $ | 302,600 | | $ | 218,111 | | $ | 219,587 | | $ | 117,360 | | $ | 857,658 | |

| Interest expense | 6,254 | | 6,317 | | 6,398 | | 6,443 | | 25,412 | |

| Interest income | (65) | | (1,385) | | (3,238) | | (7,575) | | (12,263) | |

| Income tax provision | 98,866 | | 73,886 | | 76,042 | | 39,929 | | 288,723 | |

| Depreciation and amortization | 20,543 | | 20,694 | | 28,374 | | 31,982 | | 101,593 | |

| EBITDA | 428,198 | | 317,623 | | 327,163 | | 188,139 | | 1,261,123 | |

| Change in fair value of interest rate swaps | (2,066) | | (394) | | (1,134) | | 35 | | (3,559) | |

| | | | | |

| Adjusted EBITDA | $ | 426,132 | | $ | 317,229 | | $ | 326,029 | | $ | 188,174 | | $ | 1,257,564 | |

For additional information regarding the non-GAAP measures presented in this document, please refer to our press release announcing our third quarter 2024 financial results, a copy of which is attached as Exhibit 99.1 to our Current Report on Form 8-K furnished to the Securities and Exchange Commission on November 4, 2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

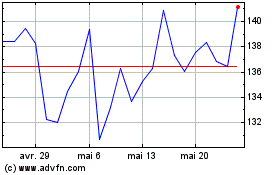

Boise Cascade (NYSE:BCC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Boise Cascade (NYSE:BCC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024