Brookfield Renewable Announces Reorganization of Brookfield Renewable Corporation

09 Octobre 2024 - 11:40PM

Brookfield Renewable Partners L.P. (NYSE: BEP; TSX: BEP.UN) (the

“Partnership”) and Brookfield Renewable Corporation (“BEPC”) (TSX,

NYSE: BEPC) today announced their intention to complete a

reorganization (the “Arrangement”) that maintains the benefits of

Brookfield Renewable’s business structure, while addressing

proposed amendments to the Income Tax Act (Canada) that are

expected to result in additional costs to BEPC if no action is

taken.

BEPC was created by the Partnership in 2020 to

provide investors with an opportunity to gain access to the

Partnership’s globally diversified portfolio of high-quality

renewable power and sustainable solutions assets through a

corporate structure. BEPC provides shareholders with the benefits

of broader index inclusion, a differentiated investor base,

improved trading liquidity, a simplified tax reporting framework

and higher after-tax yield for certain shareholders.

Since the initial listing of BEPC, the market

capitalization of Brookfield Renewable has grown to over $20

billion, our average daily trading volumes have more than

doubled and our investor base has grown and diversified with U.S.

and non-Canadian shareholders owning almost 60% of our float.

Following the Arrangement, BEPC shareholders

will own an economically equivalent security that provides the same

economic benefits and governance of investing in our company today.

The Arrangement is also expected to be tax-deferred for the vast

majority of investors, including Canadian and U.S.

shareholders.

The Arrangement will be implemented pursuant to

a court-approved plan of arrangement and will require shareholder

approval. A management information circular outlining the

transaction in detail is expected to be mailed to BEPC shareholders

at the end of October, in advance of a special meeting of

shareholders (the “Meeting”) to be held virtually on December 3,

2024 at 10:00 a.m. (Eastern time). Shareholders of record as of the

close of business on October 21, 2024 will be entitled to vote at

the Meeting. Subject to the receipt of court and shareholder

approval, and the satisfaction of certain other customary

conditions, it is anticipated that the Arrangement will be

completed in the fourth quarter of 2024. The newly issued class A

exchangeable subordinate voting shares are expected to be listed on

the Toronto Stock Exchange and New York Stock Exchange and will

trade under the same “BEPC” symbol.

The BEPC Nominating and Governance Committee

unanimously determined that the Arrangement is in the best

interests of the corporation and recommended that the BEPC board of

directors (the “Board”) approve the Arrangement and recommend that

holders of exchangeable shares vote in favour of the

Arrangement.

The Board1, on the recommendation of the

Nominating and Governance Committee, determined that the

Arrangement is in the best interest of BEPC and unanimously

resolved to approve the Arrangement and recommend that holders of

exchangeable shares vote in favour of the Arrangement. In making

its determination, the Board considered, among other factors, the

fairness opinion of RBC Dominion Securities Inc. (“RBC”) to the

effect that, as of October 9, 2024 and subject to the assumptions,

limitations and qualifications described therein, the consideration

to be received by Public Holders (as defined in RBC’s fairness

opinion) of exchangeable shares pursuant to the Arrangement is

fair, from a financial point of view to such shareholders. A copy

of the fairness opinion will be included in the management

information circular.

Investors in the Partnership will not be

impacted by the Arrangement and are not required to approve the

Arrangement or take any other action.

Copies of the management information circular,

the arrangement agreement, the plan of arrangement and certain

related documents will be filed with the applicable Canadian

securities regulators and with the United States Securities and

Exchange Commission and will be available on SEDAR+ at

https://sedarplus.ca and on EDGAR at https://sec.gov.

– ends –

About Brookfield Renewable

Brookfield Renewable operates one of the world’s

largest publicly traded platforms for renewable power and

sustainable solutions. Our renewable power portfolio consists of

hydroelectric, wind, utility-scale solar and storage facilities in

North America, South America, Europe and Asia. Our operating

capacity totals over 34,000 megawatts and our development pipeline

stands at approximately 200,000 megawatts. Our portfolio of

sustainable solutions assets includes our investments in

Westinghouse (a leading global nuclear services business) and a

utility and independent power producer with operations in the

Caribbean and Latin America, as well as both operating assets and a

development pipeline of carbon capture and storage capacity,

agricultural renewable natural gas and materials recycling. Further

information is available

at https://bep.brookfield.com.

Brookfield Renewable is the flagship listed

renewable power and transition company of Brookfield Asset

Management, a leading global alternative asset manager with

approximately $1 trillion of assets under management. For more

information, go to https://brookfield.com.

Contact Information

|

Media: |

Investors: |

| Simon Maine |

Alex Jackson |

| Managing Director |

Vice President |

| Corporate Communications |

Investor Relations |

| Tel: +44 739 890 9278 |

Tel: +1 416 649 8196 |

| Email:

simon.maine@brookfield.com |

Email:

alexander.jackson@brookfield.com |

| |

|

Cautionary Statement Regarding

Forward-looking Statements

This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words, “will”, “intend” and “expect” or

derivations thereof and other expressions which are predictions of

or indicate future events, trends or prospects, and which do not

relate to historical matters, identify forward-looking statements.

Forward-looking statements in this news release include statements

regarding the Partnership and BEPC’s beliefs on certain benefits of

the Arrangement and the anticipated tax treatment of the proposed

transaction for BEPC and its shareholders resident in Canada and

the U.S. Factors that could cause actual results, performance,

achievements or events to differ from current expectations include,

among others, risks and uncertainties related to: obtaining

approvals, rulings, court orders, or satisfying other requirements,

necessary or desirable to permit or facilitate completion of the

Arrangement (including regulatory and shareholder approvals);

future factors that may arise making it inadvisable to proceed

with, or advisable to delay, all or part of the Arrangement; the

potential benefits of the Arrangement; and business cycles,

including general economic conditions. Although Brookfield

Renewable believes that these forward-looking statements and

information are based upon reasonable assumptions and expectations,

the reader should not place undue reliance on them, or any other

forward-looking statements or information in this news release. The

future performance and prospects of Brookfield Renewable are

subject to a number of known and unknown risks and

uncertainties.

Factors that could cause actual results of

Brookfield Renewable to differ materially from those contemplated

or implied by the statements in this news release are described in

the documents filed by Brookfield Renewable with the securities

regulators in Canada and the United States including under “Risk

Factors” in each of the Partnership’s and BEPC’s most recent Annual

Report on Form 20-F and other risks and factors that are described

therein. Certain risks and uncertainties specific to the proposed

Arrangement will be further described in the management information

circular to be mailed to shareholders in advance of the Meeting.

Except as required by law, Brookfield Renewable undertakes no

obligation to publicly update or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise. All references to “$” or “dollars” are

to U.S. dollars.

____________________________

1 Excluding Jeffrey Blidner who, as Vice Chair of Brookfield

Corporation, recused himself from voting.

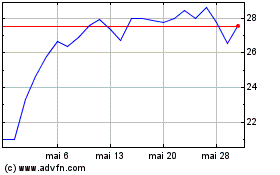

Brookfield Renewable Par... (NYSE:BEP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

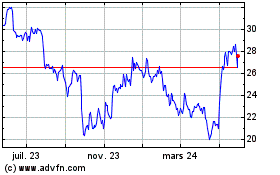

Brookfield Renewable Par... (NYSE:BEP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024