0001830210false00018302102023-10-312023-10-310001830210us-gaap:CommonClassAMember2023-10-312023-10-310001830210bhil:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockMember2023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2023

BENSON HILL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39835 | | 85-3374823 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1001 North Warson Rd.

St. Louis, Missouri 63132

(Address of principal executive offices)

(314) 222-8218

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

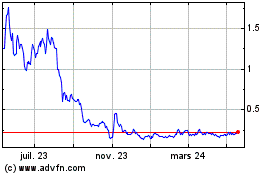

| Common stock, $0.0001 par value | | BHIL | | The New York Stock Exchange |

| Warrants exercisable for one share of common stock at an exercise price of $11.50 | | BHIL WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Asset Purchase Agreement

On October 31, 2023, Benson Hill Ingredients, LLC (“Ingredients”), a wholly-owned subsidiary of Benson Hill, Inc. (“Benson Hill” and, with Ingredients, “we,” “us,” “our,” or the “Company”) entered into an asset purchase agreement (the “Asset Purchase Agreement”) with White River Soy Processing, LLC (“White River”), pursuant to which, among other things, on October 31, 2023 (the “Closing”) Ingredients sold to White River the Company’s soybean processing facility located in Seymour, Indiana (the “Facility”), together with certain related assets, for approximately $36 million of total gross proceeds, subject to certain adjustments, including an adjustment for inventory and other working capital (the “Purchase Price”).

Upon Closing, $1.7 million of the Purchase Price (the “Holdback”) was held back by White River. The Holdback may be used by White River to satisfy certain Adverse Consequences (as such term is defined in the Asset Purchase Agreement, the “Adverse Consequences”) subject to the indemnification provisions of the Asset Purchase Agreement. The Holdback, less any amounts due to White River under the terms of the Asset Purchase Agreement, shall be paid to us following the 12-month anniversary of the Closing.

The Asset Purchase Agreement contains customary indemnification provisions, pursuant to which White River indemnifies and holds Ingredients harmless against certain Adverse Consequences and Ingredients indemnifies and holds White River harmless against certain Adverse Consequences. The Asset Purchase Agreement also contains customary representations and warranties.

The Asset Purchase Agreement contains certain restrictive covenants applicable to Ingredients, including among other things that, (i) during the 2-year period immediately following the Closing, Ingredients shall not solicit, employ or retain as consultant certain employees employed by White River, and (ii) during the 5-year period following the Closing, Ingredients shall not operate any soybean processing facility within the Restricted Territory (as such term is defined in the Asset Purchase Agreement). The Asset Purchase Agreement also contains a covenant requiring the parties to the Asset Purchase Agreement to act in good faith to continue to negotiate and finalize a Grain Supply and License Agreement following the Closing.

On October 31, 2023, in connection with the Asset Purchase Agreement, Benson Hill entered into a Transitional Administrative Services Agreement with White River, pursuant to which, among other things, White River has agreed to retain Benson Hill to provide certain administrative support services to White River for a 6-month period.

The foregoing description of the Asset Purchase Agreement does not purport to be complete and is subject to and qualified in its entirety by the full text of the Asset Purchase Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Factual Information

The Asset Purchase Agreement has been included to provide investors with information regarding their respective terms. It is not intended to provide any other factual information about Benson Hill or any of its subsidiaries or affiliates, or to modify or supplement any factual disclosures about Benson Hill included in its public reports filed with the SEC. The Asset Purchase Agreement contains representations, warranties and covenants of Benson Hill that were made only for purposes of the Asset Purchase Agreement, as of specific dates, were solely for the benefit of the parties to the Asset Purchase Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Asset Purchase Agreement, instead of establishing these matters as facts, and may be subject to standards of materiality that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of Benson Hill or its subsidiaries or affiliates. Investors should read the Asset Purchase Agreement together with the other information

concerning Benson Hill that Benson Hill files in reports and statements with the Securities and Exchange Commission (the “SEC”) which are available on the SEC’s website at www.sec.gov.

Fourth Amendment to Loan Documents

The information contained in Item 2.03 of this Current Report on Form 8-K is hereby incorporated by reference herein.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On October 31, 2023 (the “Amendment Date”), the Company and certain of its directly or indirectly wholly-owned subsidiaries (the Company and such subsidiaries are each individually referred to as a “Borrower” and are all collectively referred to as the “Borrowers”), entered into a Fourth Amendment to Loan Documents (the “Fourth Amendment”) with Avenue Capital Management II, L.P., as administrative agent and collateral agent (the “Agent”); and certain affiliates of the Agent (each such affiliate individually referred to as a “Lender” and all collectively as the “Lenders”). The Fourth Amendment amends the Loan and Security Agreement among the Borrowers, the Lenders, and the Agent entered into December 29, 2021 (as amended, restated, or supplemented from time to time, the “Loan Agreement”), which was previously filed as Exhibit 10.1 to the Current Report on Form 8-K filed on January 4, 2022 (the “January 2022 8-K”), as previously amended pursuant to (i) the Joinder and First Amendment to Loan Documents previously filed as Exhibit 10.1 to the Current Report on Form 8-K filed on July 7, 2022 (the “July 2022 8-K”), (ii) the Second Amendment to Loan Documents previously filed as Exhibit 10.1 to the Current Report on Form 8-K filed on November 10, 2022 (the “November 2022 8-K”), and (iii) the Third Amendment to Loan Documents previously filed as Exhibit 10.32 to the Annual Report on Form 10-K filed on March 16, 2022 (the “Fiscal Year 2022 10-K” and, collectively with the January 2022 8-K, July 2022 8-K, and the November 2022 8-K, the “Filings”).

Pursuant to the Fourth Amendment, among other things:

•The “Maturity Date” under the Loan was brought forward to March 1, 2024.

•The “Prepayment Fee” under the Loan was changed to be equal to 1% of any prepayment of Loans (as defined in the Loan Agreement) for any prepayments made prior to January 14, 2024.

•The “Final Payment” under the Loan was increased by 500 basis points.

•Within one business day after the closing of certain sales of the Company’s equity securities, Borrowers must pay as a prepayment the lesser of (i) 100% of the net closing proceeds or (ii) the outstanding principal of the Obligations (as defined in the Loan Agreement).

•Within one business day of the closing under certain asset sales, Borrowers must pay as a prepayment the net closing proceeds from such asset sales.

•Within one business day of either November 15, 2023 or the closing under certain asset sales, Borrowers must pay as a prepayment the lesser of (i) all cash in the Blocked Account (as defined in the Loan Agreement) or (ii) the outstanding principal and pro rata portion of fees due under the Loan Agreement.

•The covenant of the Borrowers to maintain at all times an RML equal to or greater than four or six months, depending on the terms and conditions of the Loan Agreement, will be removed effective upon Lender’s receipt of the net closing proceeds from certain asset sales and all cash in the Blocked Account, and following such removal the Borrowers are instead required to maintain $20,000,000 of unrestricted cash at all times.

•The Warrants (as such term is defined in the Loan Agreement) must be repriced based on the trailing 5-day VWAP immediately prior to the date of the Fourth Amendment.

The other material terms of the Loan Agreement remain effective as described in the Filings. The foregoing description of the Fourth Amendment does not purport to be complete and is qualified in its entirety by reference to the text of the Fourth Amendment, which is filed as Exhibit 10.2 to this Current Report on Form 8-K, the text of the Loan Agreement, which was previously filed as Exhibit 10.1 to the January 2022 8-K; the Joinder and First Amendment to Loan Documents, which was previously filed as Exhibit 10.1 to the July 2022 8-K; the Second Amendment to Loan Documents, which was previously filed as Exhibit 10.1 to the November 2022 8-K; and the Third Amendment, which was previously filed as Exhibit 10.32 to the Fiscal Year 2022 Form 10-K, all of which are incorporated herein by reference.

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As previously disclosed, on June 15, 2023, the Company’s Board of Directors (the “Board”) appointed Adrienne Elsner as the Company’s Interim Chief Executive Officer.

Effective October 31, 2023, the Board appointed Ms. Elsner as the Company’s Chief Executive Officer. A summary of Ms. Elsner's biographical and business experience can be found under Item 5.02(c) in the Company's Current Report on Form 8-K filed with Securities and Exchange Commission on June 16, 2023, which summary is incorporated by reference in this Item 5.02.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

Asset Purchase Agreement Press Release

On October 31, 2023, the Company issued a press release related to the Asset Purchase Agreement disclosed in Item 1.01 of this Current Report on Form 8-K (the “Asset Purchase Press Release”). A copy of the Asset Purchase Press Release is attached hereto as Exhibit 99.1 and is incorporated herein in its entirety by reference.

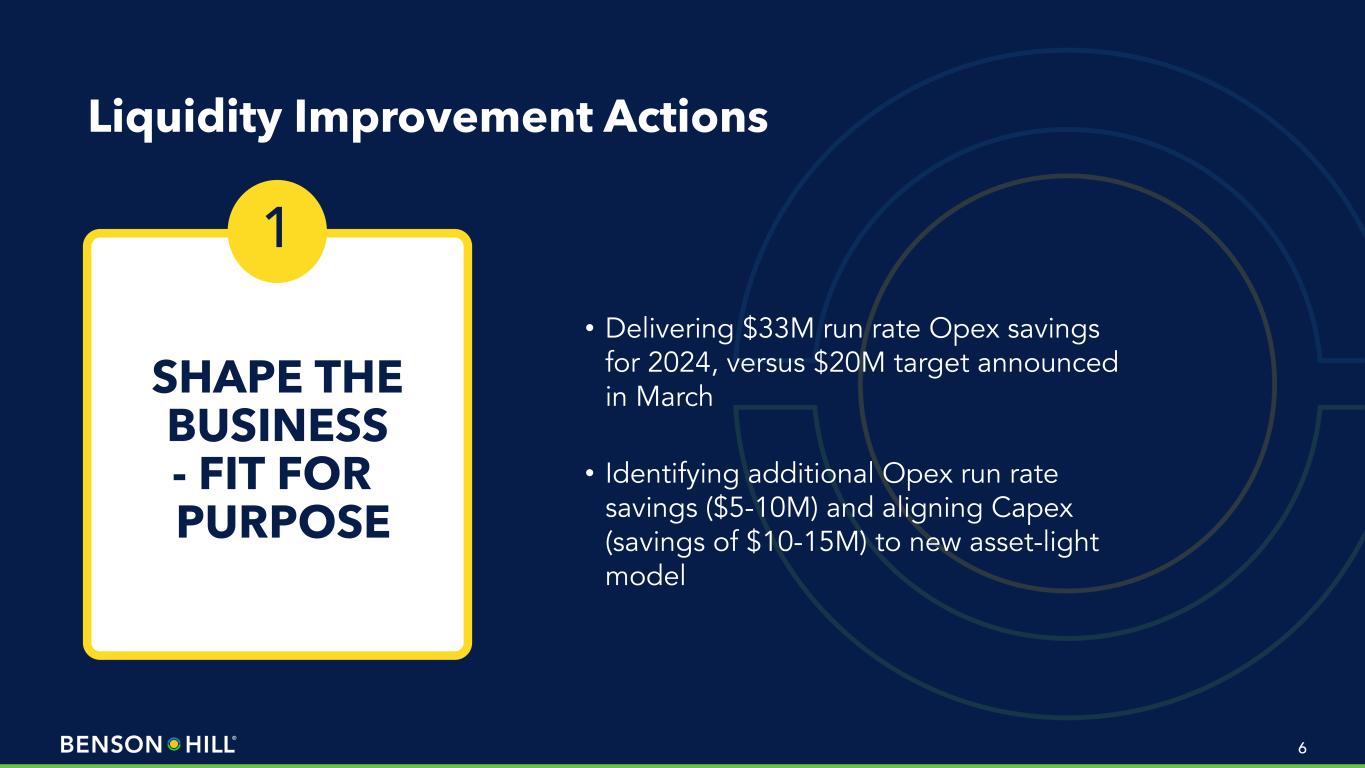

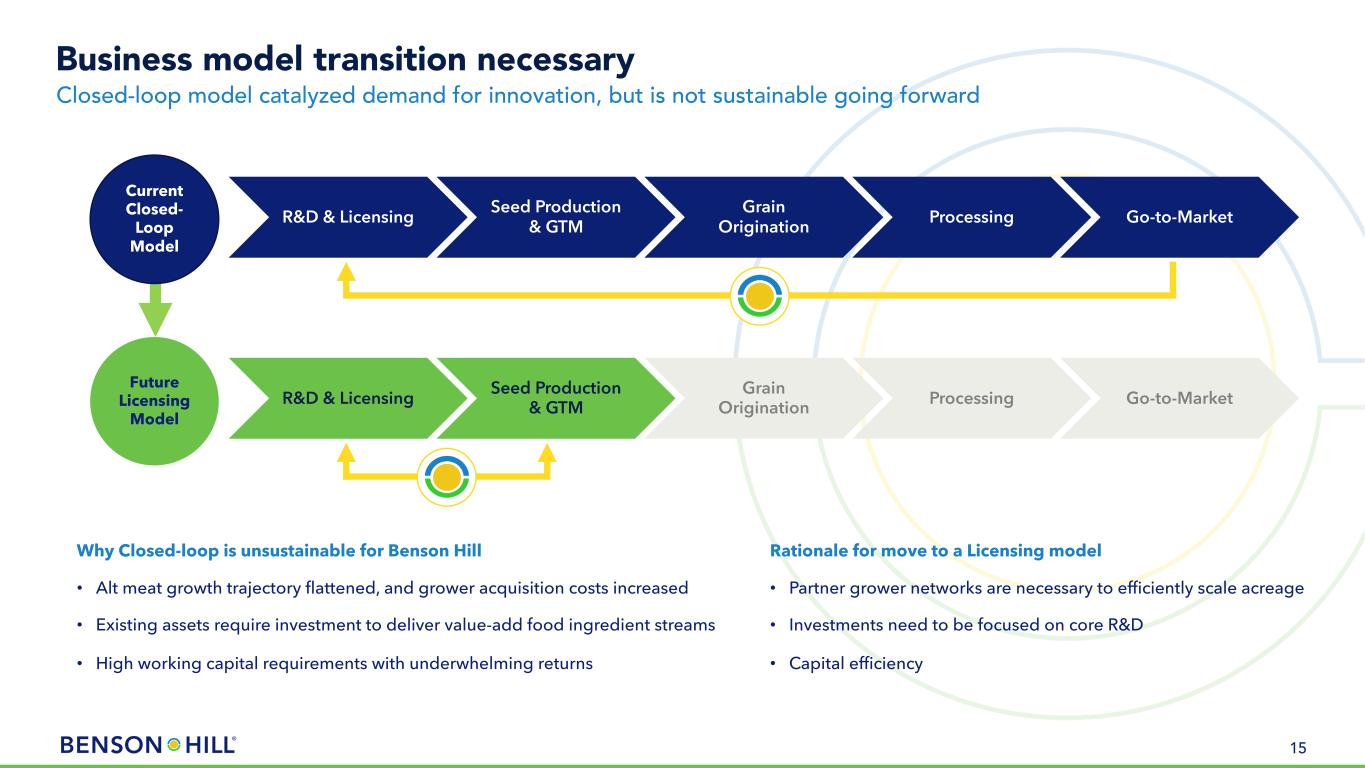

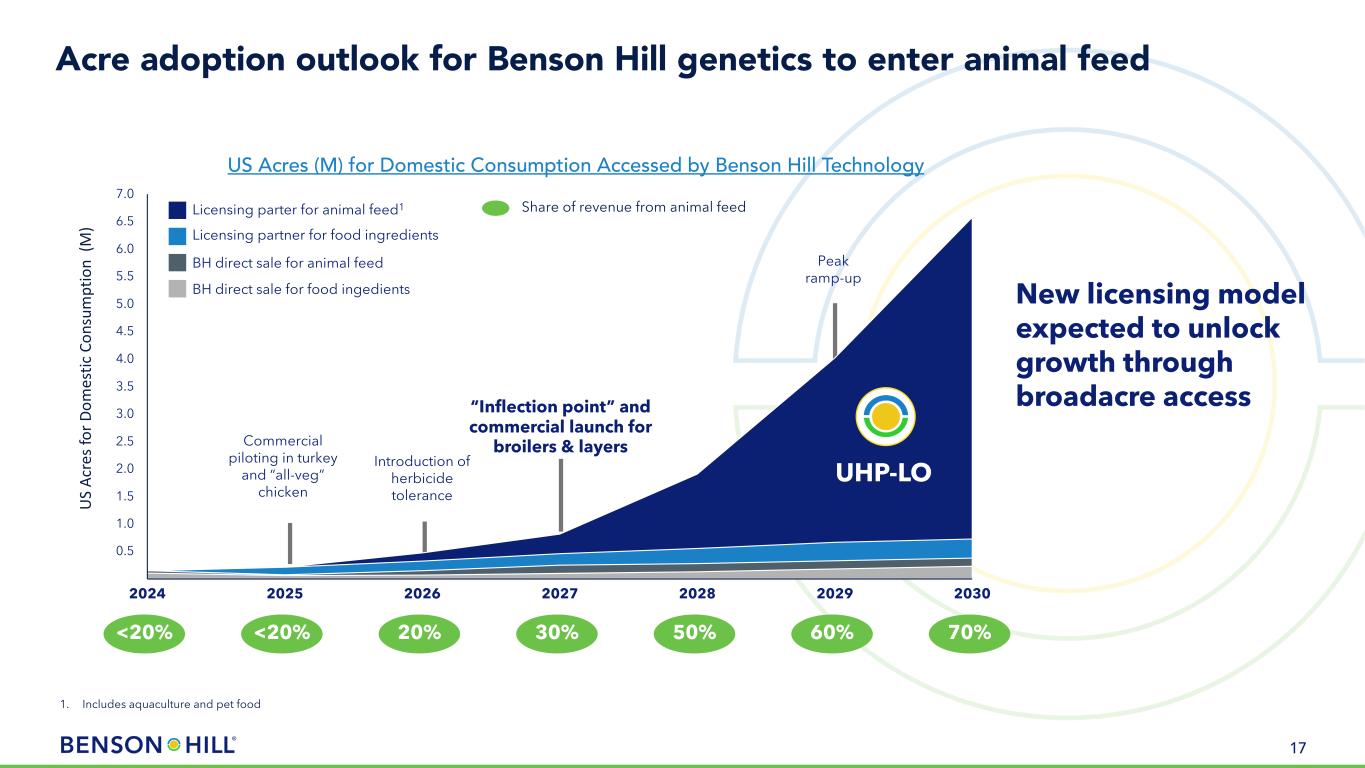

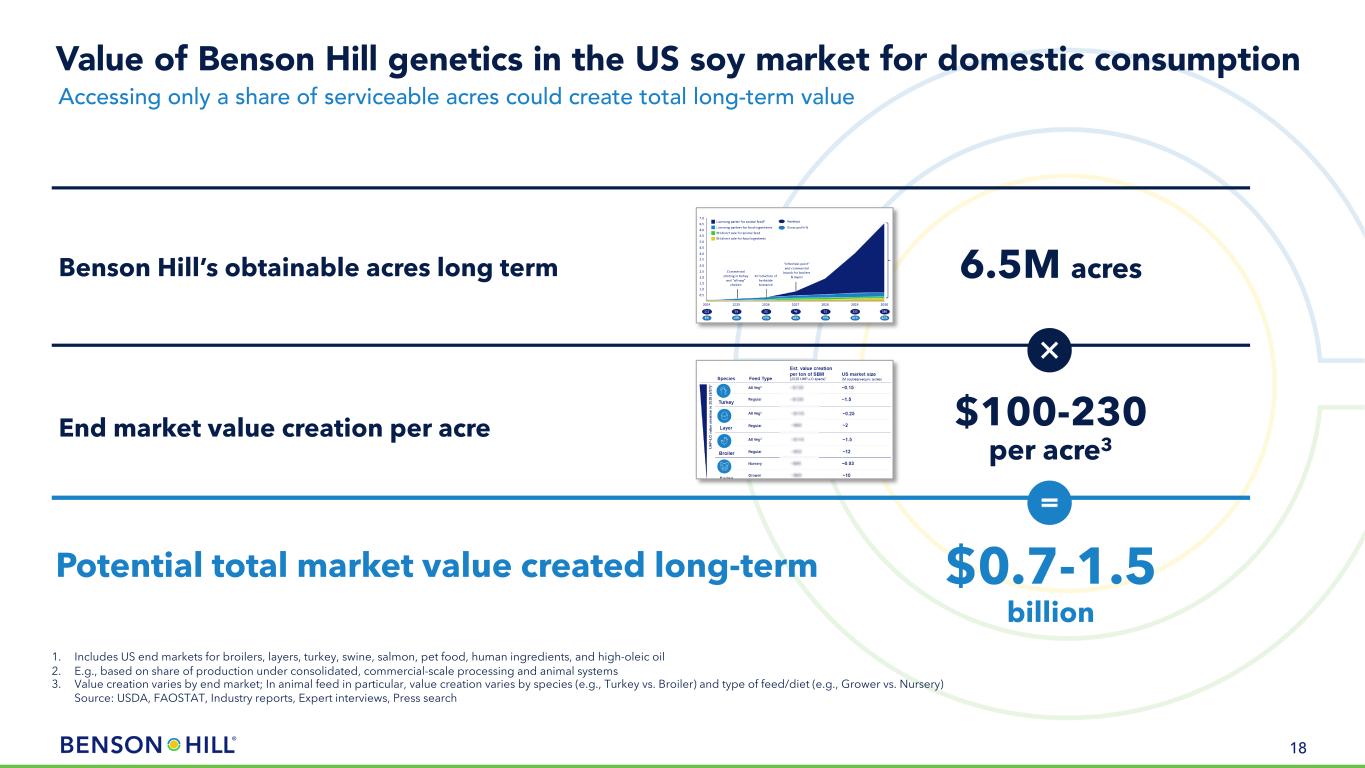

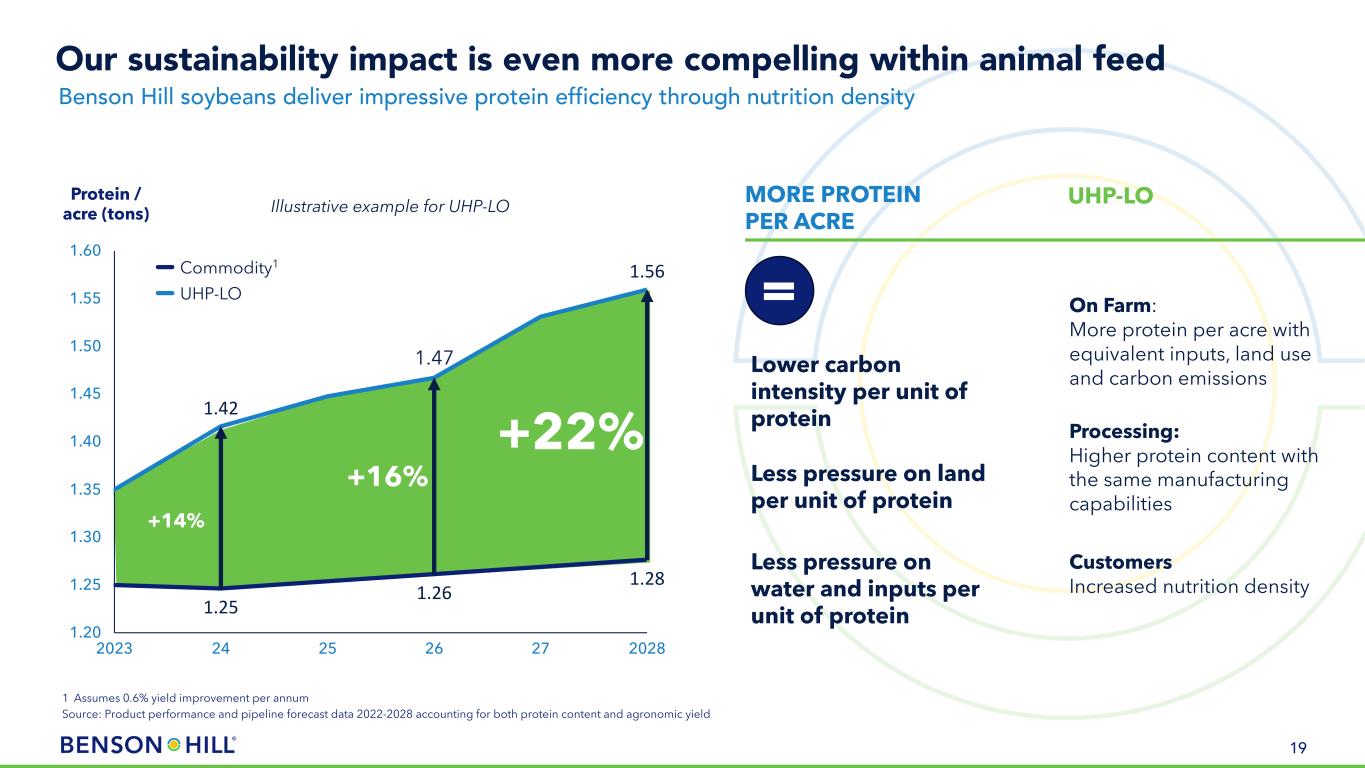

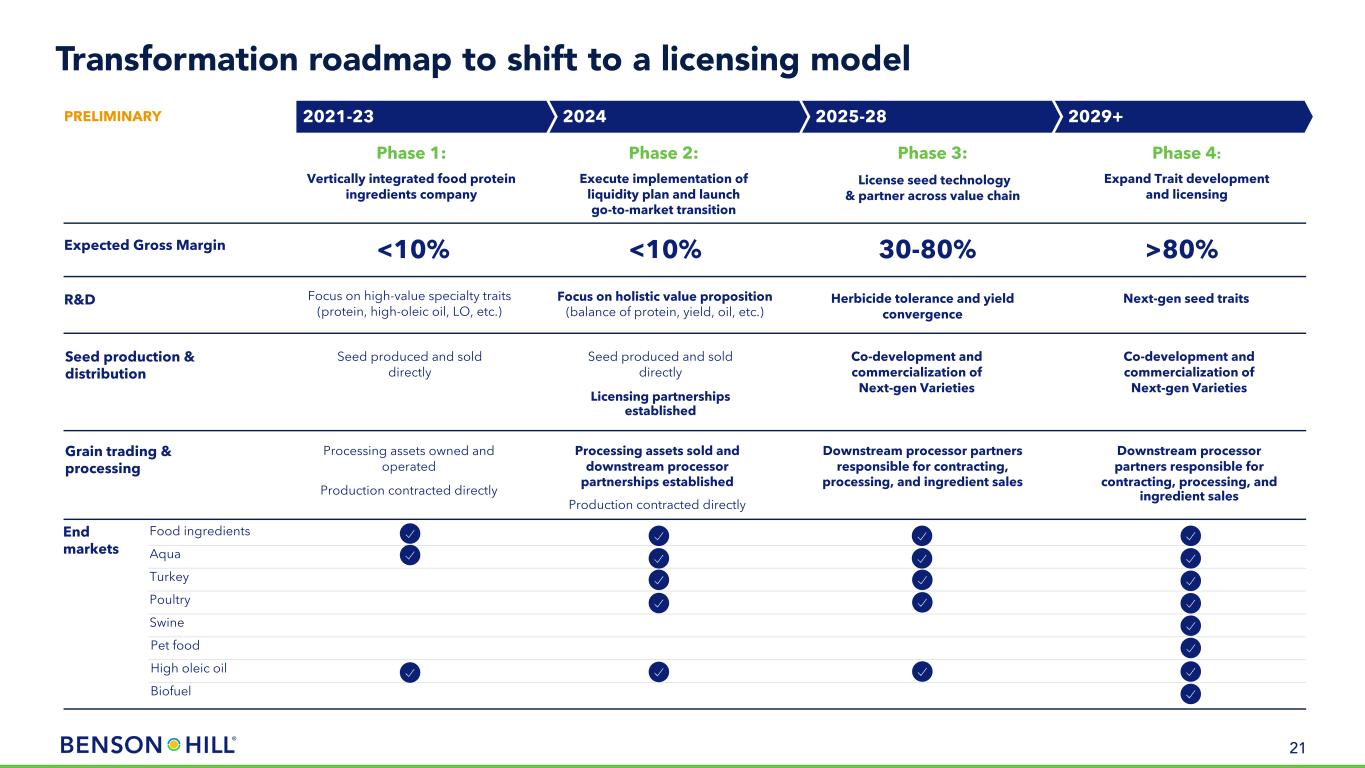

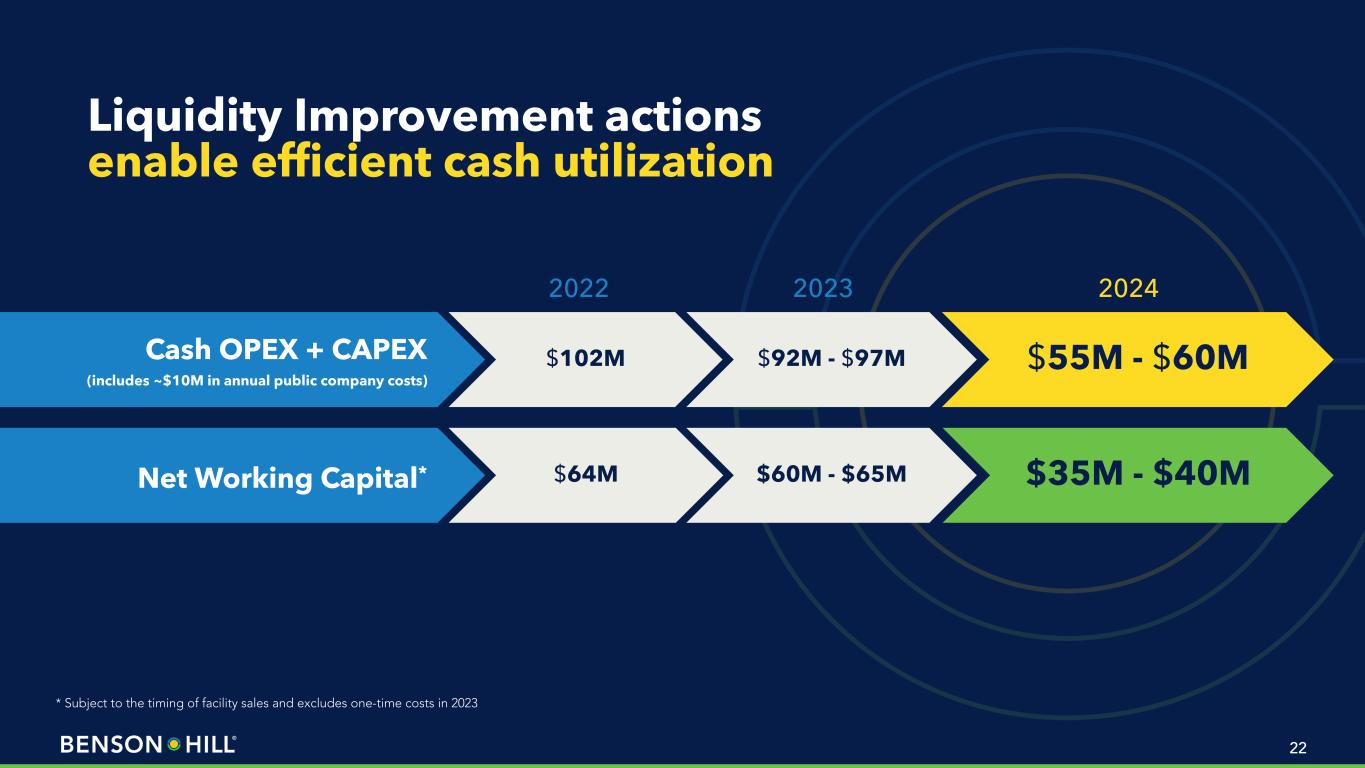

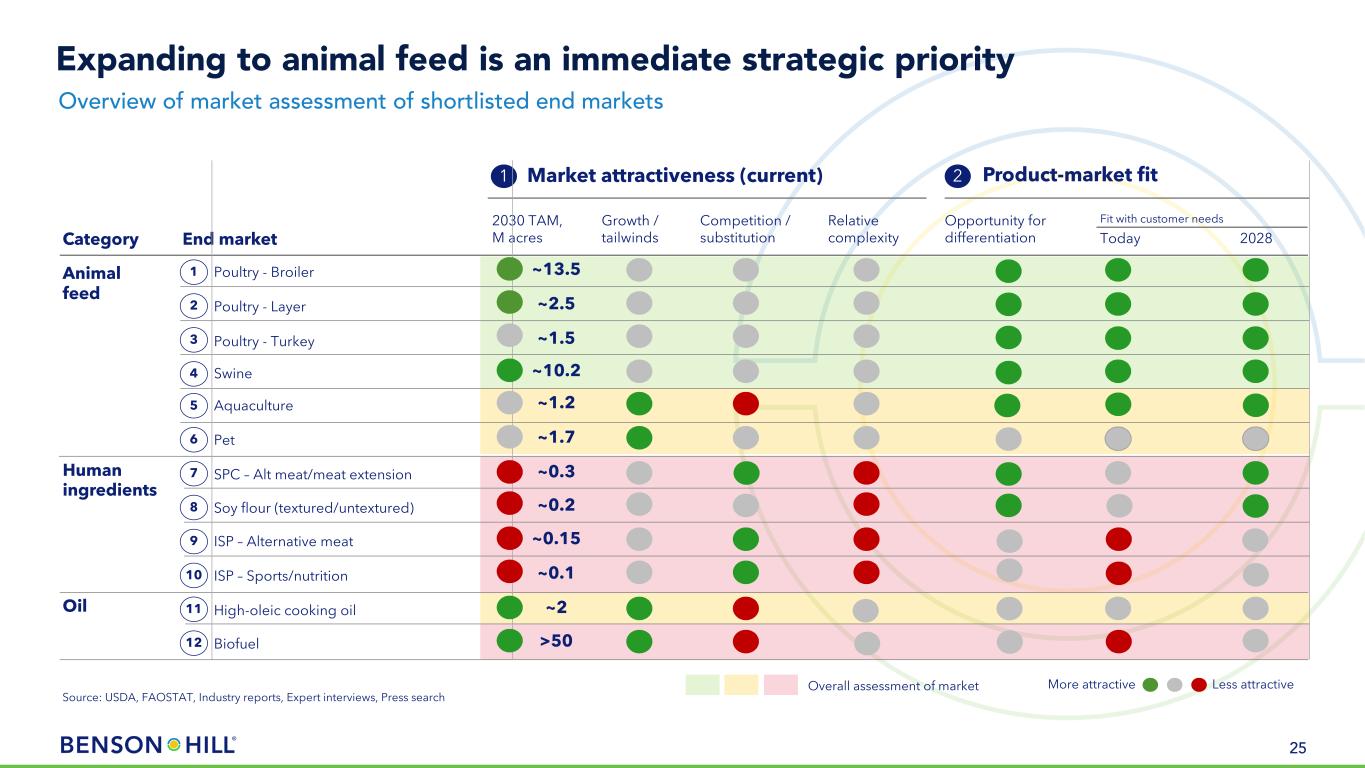

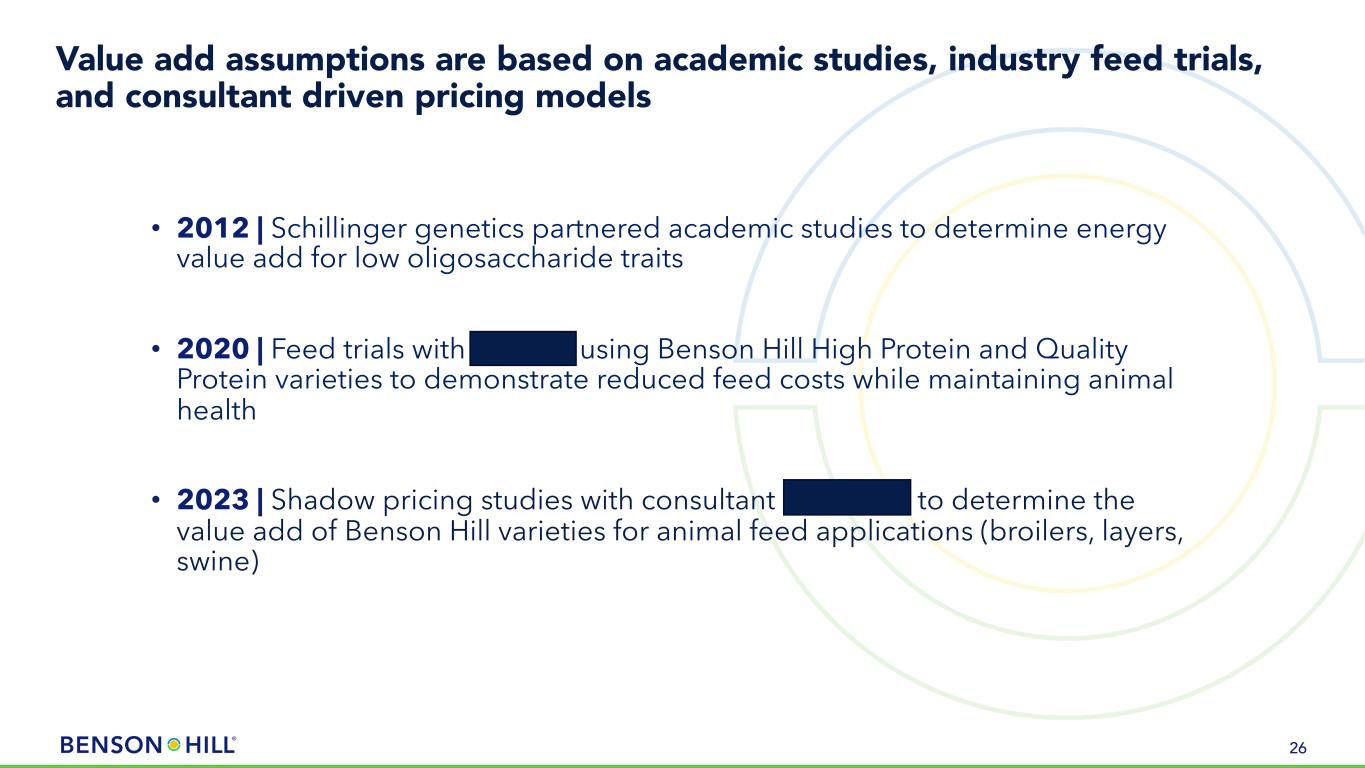

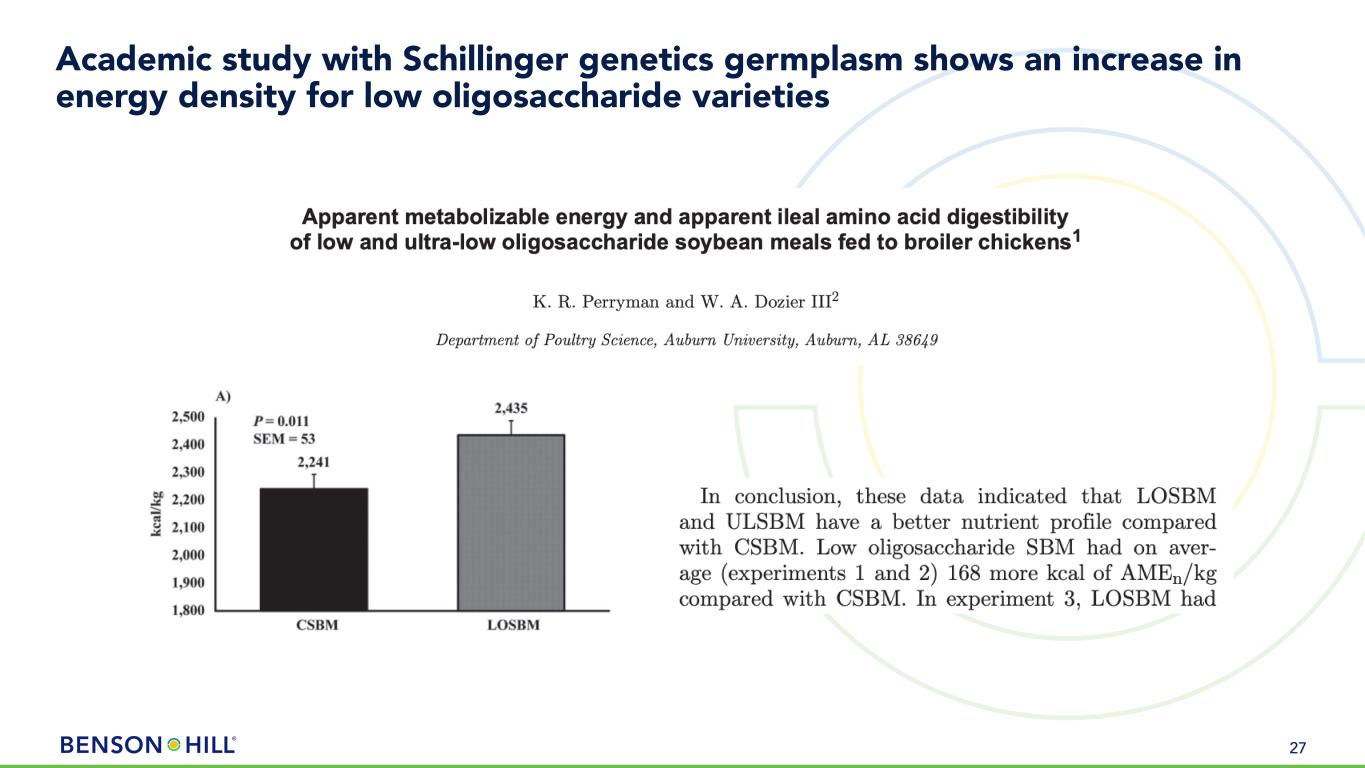

Investor Press Release and Presentation

On October 31, 2023, the Company issued a press release relating to strengthening its financial position and shifting to an asset-light business model (the “Investor Press Release”). A copy of the Investor Press Release is attached hereto as Exhibit 99.2 and is incorporated herein in its entirety by reference.

On October 31, 2023, the Company posted an investor presentation to its website at https://bensonhill.com/investors/ (the “Investor Presentation”). A copy of the Investor Presentation is attached hereto as Exhibit 99.3 and is incorporated herein in its entirety by reference.

Limitation on Incorporation by Reference. The information furnished in this Item 7.01, including each of the Asset Purchase Press Release and the Investor Press Release attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and the Investor Presentation attached hereto as Exhibit 99.3, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements. Except for historical information contained in each of the Asset Purchase Press Release and the Investor Press Release attached hereto as Exhibit 99.1 and

Exhibit 99.2, respectively, and the Investor Presentation attached as Exhibit 99.3, the Asset Purchase Press Release, the Investor Press Release, and the Investor Presentation contain forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary notes in the Asset Purchase Press Release, the Investor Press Release and the Investor Presentation, respectively, regarding these forward-looking statements.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made in this Current Report on Form 8-K may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements include, among other things, statements regarding the covenants and other terms of the Asset Purchase Agreement and the Fourth Amendment. Factors that may cause actual results to differ materially from current expectations and guidance include, but are not limited to, risks associated with realizing the benefits of the transactions contemplated by the Asset Purchase Agreement, the successful implementation of the Company’s liquidity improvement plan, the risk of default under the Loan Agreement, the risks that the covenants contained in the Asset Purchase Agreement and the Fourth Amendment will not be complied with by the parties thereto, and the risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. Nothing in this Current Report on Form 8-K should be regarded as a representation that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1† | | |

| 10.2 | | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

† Portions of this exhibit have been omitted in compliance with Regulation S-K Items 601(a)(5) and 601(b)(1)(iv). The registrant undertakes to furnish supplemental copies of any of the omitted schedules upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| BENSON HILL, INC. |

| | |

| By: | /s/ Dean Freeman |

| Name: Dean Freeman |

| Title: Chief Financial Officer |

Date: October 31, 2023

Exhibit 10.1

1

Certain identified information has been excluded because it is both not material and is the type that the registrant treats as private or confidential. These redacted terms have been marked in this exhibit at the appropriate places with the three asterisks [***].

ASSET PURCHASE AGREEMENT

BY AND BETWEEN

WHITE RIVER SOY PROCESSING, LLC

AND

BENSON HILL INGREDIENTS, LLC

DATED AS OF

October 31, 2023

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) is made and entered into as of October 31, 2023, by and between White River Soy Processing, LLC, a Nebraska limited liability company (“Purchaser”), and Benson Hill Ingredients, LLC, a Delaware limited liability company (“Seller”).

WITNESSETH:

WHEREAS, Seller is engaged in the business of operating a certain soybean processing facility (the “Facility”) located at 6874 North Base Road, Seymour, Indiana 47274 (the “Business”); provided, however, for the avoidance of doubt, the term “Business” as used in this Agreement shall not include any of Seller’s or its Affiliates’ other facilities or lines of businesses and shall not include the business of processing Benson Hill proprietary soy beans and selling of ingredients made from such proprietary soy beans; and

WHEREAS, Seller desires to sell, and Purchaser desires to purchase, specified assets of Seller used in the Business, subject to certain Liabilities to be assumed by Purchaser on the terms and subject to the conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the foregoing initial paragraph and recitals, and the representations, warranties, covenants, agreements, conditions and indemnities contained in this Agreement, and intending to be legally bound, the Parties agree as follows:

ARTICLE 1

THE TRANSACTION

1.1 Sale and Purchase of Assets. At the Closing, Seller shall sell, transfer and deliver to Purchaser, or cause to be sold, transferred and delivered to Purchaser, and Purchaser shall purchase from Seller, free and clear of all Liens (other than Permitted Liens), the following assets used in the Business (the “Purchased Assets”):

(a) All machinery, equipment, computers, hardware, fixtures, leasehold improvements, furniture, supplies, vehicles, tools, signage and other tangible personal property that (1) constitute the Facility and (2) are used in or necessary for, the operation of the Business as presently conducted or designed and configured, excluding only the tangible personal property set forth on Schedule 2.4 (collectively, the “Tangible Personal Property”);

(b) All rights of Seller to and under all contracts and agreements set forth on Schedule 1.1(b) (the “Assigned Contracts”);

(c) Intentionally Deleted;

(d) The Permits set forth on Schedule 1.1(d) (the “Assigned Permits”);

(e) All rights of Seller under (i) that certain Ground Lease Agreement, dated September 17, 2021, between Seller and Rose Acre Farms, Inc., as amended by that certain Amendment to Ground Lease, dated August 24, 2023, between Seller and Rose Acre Farms, Inc. (the “Facility Lease”) and (ii) the other Leased Real Property;

(f) All books, records and other documents used or useful in the conduct of the Business or related to the ownership or operation of the Facility, including fixed asset records, books of account and records, information data bases, surveys, capital expense reports, ledgers, files, correspondence, architectural plans, appraisals, drawings and specifications, but in each case only to the extent such books, records and other documents relate primarily to the Business and/or the Tangible Personal Property, Assigned Contracts, Assigned Permits, Leased Real Property and/or Soybean Inventory (the “Books and Records”);

(g) The soybeans, hulls, soybean meal and soybean oil located at the Facility and set forth on Exhibit A attached hereto, which will be based on the jointly conducted physical count performed prior to Closing (the “Soybean Inventory”);

(h) All prepaid expenses and deposits for the Facility included in the Final Working Capital as determined pursuant to Section 1.7;

(i) The telephone and facsimile numbers for the Facility;

(j) All third party warranties, claims, deposits, refunds, causes of action, choses in action, rights of recovery, rights of set off, counterclaims and rights of recoupment (including for past, present or future damages) for the infringement or misappropriation of, or related to, the Tangible Personal Property, Assigned Contracts, Assigned Permits, Leased Real Property and/or Soybean Inventory; and

(k) Interests in the leasehold related to the Facility and all improvements, fixtures, and fittings thereon, and easements, rights-of-way, and other appurtenants thereto (such as appurtenant rights in and to public streets).

1.2 Excluded Assets. Other than the Purchased Assets, Purchaser expressly understands and agrees that it is not purchasing or acquiring, and Seller is not selling or assigning, any other assets or properties of Seller or its Affiliates, and all such other assets and properties shall be excluded from the Purchased Assets (collectively, the “Excluded Assets”). Solely by way of illustration, the Excluded Assets include the following:

(a) The franchise to be a limited liability company, minute books, equity of Seller held in treasury, unit books and any other limited liability company records relating to the organization or capitalization of Seller;

(b) All books and records that Seller is required to retain pursuant to any applicable Law;

(c) All defenses, rights of set off and counterclaims arising out of or relating to any of the Retained Liabilities;

(d) All cash, cash deposits, bank accounts, certificates of deposit, savings and other similar cash or cash equivalents of every kind, character, nature and description;

(e) All accounts or notes receivable related to the conduct or operation of the Business or otherwise;

(f) All insurance policies and rights, claims or causes of action thereunder and prepaid insurance amounts and refunds;

(g) Any assets relating to any Employee Benefit Plan;

(h) All Tax Returns, Tax-related work papers, books and records, and Tax refund claims;

(i) Any assets that are not located at the Business, including assets related to Seller’s administration, IT, and similar infrastructure, or assets of Seller used in, and located at, other parts of its business;

(j) With respect to customers who are, after the Closing, customers of both Purchaser and the Business, on the one hand, and Seller or its Affiliates, on the other hand, all assets relating to the portion of such customer relationship that is not exclusively related to the Business;

(k) All contracts and agreements other than the Assigned Contracts and Facility Lease; and

(l) The assets set forth on Schedule 1.2(l), if any.

1.3 Restricted Interests. Set forth on Schedule 1.3 is a listing of Assigned Contracts that are not assignable without the consent of any other Person (collectively, the “Restricted Interests”). If a written consent (“Restricted Interest Consent”) to the assignment of any Restricted Interest is not obtained prior to Closing, then this Agreement and related instruments of transfer will not constitute an assignment or transfer thereof; provided, however, the Closing shall occur notwithstanding the foregoing without any adjustment to the Purchase Price on account thereof and Seller, at its expense, shall use its commercially reasonable efforts to obtain any such Restricted Interest Consent promptly. If any such Restricted Interest Consent shall not be obtained or if any attempted assignment would be ineffective or would impair Purchaser’s rights under the Restricted Interests in question so that Purchaser would not in effect acquire the benefit of all such rights, Purchaser shall not have any obligation or liability with respect to the Restricted Interests and such Restricted Interest shall constitute a Retained Liability.

1.4 Assumption of Liabilities. At Closing, Purchaser shall assume only the Assumed Liabilities.

1.5 Retained Liabilities. Except for the Assumed Liabilities, Purchaser shall not assume any Liabilities of Seller (collectively, the “Retained Liabilities”). Neither the Purchaser nor any Affiliates of the Purchaser assumes or agrees to be or becomes liable for or successor to any Retained Liabilities, whether of Seller, any predecessor thereof, or any other Person or entity, and without limiting the generality of the foregoing, each of the following shall constitute a Retained Liability hereunder: (1) any Liability for Taxes (including, but not limited to, any arising as a result of the transactions contemplated by this Agreement), (2) any Liability for compensation, (3) any Liability for Indebtedness or any Employee Benefit Plan, (4) any Liability for products sold by Seller or warranty claims for such products or (5) any other Liability arising out of circumstances or occurrences related to the Seller’s Business or the ownership or operation of the Facility prior to Closing.

1.6 Purchase Price.

(a) The aggregate purchase price for the Purchased Assets shall consist of the sum of the following: (i) $25,867,500 and (ii) plus the amount of the Estimated Working Capital (such consideration the “Preliminary Purchase Price”, subject to the adjustments described in Section 1.7).

(b) Purchaser shall pay the Preliminary Purchase Price as follows:

(i) At Closing, Purchaser shall pay to Seller the Preliminary Purchase Price minus the Holdback Amount; and

(ii) Purchaser shall hold and retain the Holdback Amount in accordance with Section 5.2(k).

(c) All monetary payments payable pursuant to this Agreement shall be paid by wire transfer or delivery of other immediately available United States funds, as directed by Seller.

1.7 Purchase Price Adjustment.

(a) Prior to the Closing Date, Seller has prepared and delivered to Purchaser a good faith estimate of its calculation of Working Capital (the “Estimated Working Capital”) as of the close of business on the day immediately prior to the Closing Date and which has been prepared in accordance with the Accounting Principles.

(b) As soon as practicable, but no later than sixty (60) days after the Closing Date, Purchaser shall prepare and deliver to Seller its calculation of Working Capital (the “Closing Working Capital”), as of the close of business on the day immediately prior to the Closing Date. The Closing Working Capital shall be prepared in accordance with the books and records of the Business, in

accordance with the Accounting Principles and using the same methodology used to determine the Estimated Working Capital. The Parties agree that the Accounting Principles set forth herein are not intended to permit the introduction of different standards, policies, practices, classifications, estimation methodologies, assumptions, or procedures for purposes of determining the Closing Working Capital or Final Working Capital.

(c) Seller shall notify Purchaser within thirty (30) days after the date on which Seller receives the Closing Working Capital if Seller has any objections to the Closing Working Capital. If Seller does not notify Purchaser of any objections within such thirty (30) day period, the calculation of Closing Working Capital shall be deemed to be the “Final Working Capital”. If Seller does notify Purchaser of any objections within such thirty (30) day period, Seller and Purchaser shall use commercially reasonable efforts thereafter to promptly and mutually resolve all such objections. If Seller and Purchaser do not reach a final resolution of all such objections within thirty (30) days after delivery of Seller’s objections to the Closing Working Capital, either Seller or Purchaser may submit all unresolved objections to the Independent Accounting Firm. Any documents submitted by a Party to the Independent Accounting Firm, either unilaterally or at the Independent Accounting Firm’s request, shall be simultaneously submitted to the other Party. In resolving any submitted objection, the Independent Accounting Firm may not assign a value to any item greater than the highest value claimed for such item or less than the lowest value claimed for such item by either Purchaser or Seller. The Independent Accounting Firm’s decision as to the Parties’ unresolved objections shall be rendered within forty-five (45) days after submittal. The determination of the Independent Accounting Firm shall be set forth in writing and shall be conclusive and binding upon Purchaser and Seller. The Closing Working Capital shall be revised by Purchaser, as appropriate, to reflect the resolution of any such objections among the Parties or by the Independent Accounting Firm, and such revised Closing Working Capital shall be deemed to be the “Final Working Capital”.

(d) In the event Purchaser or Seller submits any unresolved objections to the Closing Working Capital to the Independent Accounting Firm for resolution as provided herein, Seller, on the one hand, and Purchaser, on the other hand, shall share responsibility for the fees and expenses of the Independent Accounting Firm as follows: (i) if the Independent Accounting Firm resolves all of the unresolved objections in favor of Seller, Purchaser shall be responsible for all of the fees and expenses of the Independent Accounting Firm; (ii) if the Independent Accounting Firm resolves all of the unresolved objections in favor of Purchaser, Seller shall be responsible for all of the fees and expenses of the Independent Accounting Firm; and (iii) if the Independent Accounting Firm resolves some of the unresolved objections in favor of Seller and the rest of the unresolved objections in favor of Purchaser, (A) Seller shall be responsible for a proportionate amount of the fees and expenses of the Independent Accounting Firm based on the dollar amount of the unresolved objections resolved against Seller compared to the total amount of all unresolved objections submitted to the Independent Accounting Firm and (B) Purchaser shall be responsible for a proportionate amount of the fees and expenses of the Independent Accounting Firm based on the dollar amount of the unresolved objections resolved against Purchaser compared to the total dollar amount of all unresolved objections submitted to the Independent Accounting Firm.

(e) The Preliminary Purchase Price shall then be adjusted, upwards or downwards, as follows:

(i) For the purposes of this Agreement, the “Net Adjustment Amount” means the amount, which may be positive or negative, equal to the Final Working Capital minus the Estimated Working Capital.

(ii) If the Net Adjustment Amount is positive, the Preliminary Purchase Price shall be adjusted upwards in an amount equal to the Net Adjustment Amount. In such event, Purchaser shall pay the Net Adjustment Amount to Seller by wire transfer or delivery of other immediately available United States funds, as directed by Seller, within three (3) business days after the date on which the Final Working Capital is determined pursuant to Section 1.7(c).

(iii) If the Net Adjustment Amount is negative (in which case the “Net Adjustment Amount” for purposes of this Section 1.7(e)(iii) shall be deemed to be equal to the

absolute value of such amount), the Preliminary Purchase Price shall be adjusted downwards in an amount equal to the Net Adjustment Amount. In such event, Seller shall pay the Net Adjustment Amount to Purchaser by wire transfer or delivery of other immediately available United States funds, as directed by Purchaser, within three (3) business days after the date on which the Final Working Capital is determined pursuant to Section 1.7(c).

The Preliminary Purchase Price, as finally adjusted pursuant to this Section 1.7, shall be referred to herein as the “Purchase Price”.

1.8 Closing. The closing of the Transaction (the “Closing”) shall take place (i) on the date hereof, or at such other time or on such other date as mutually agreed upon by the Parties (the “Closing Date”) and (ii) remotely via electronic exchange of documents. All transactions which are to take place at Closing shall be considered to have taken place simultaneously, and no delivery or payment shall be considered to have been made until all the transactions have been completed. Title to, ownership of, control over and risk of loss of the Purchased Assets shall pass to Purchaser effective as of 12:01 a.m. Central Time on the Closing Date unless provided otherwise herein.

1.9 Deliveries by Seller at Closing. At Closing, Seller shall deliver the following to Purchaser, duly executed by Seller or other indicated parties, if applicable, and otherwise in form reasonably satisfactory to Purchaser:

(a) A transition services agreement by and between Purchaser and Seller (the “Transition Services Agreement”).

(b) One or more bills of sale and assignment for the Purchased Assets.

(c) The Restricted Interest Consents.

(d) An Assignment and Assumption Agreement for the Assigned Contracts and Assigned Permits.

(e) An executed copy of the Secretary’s Certificate of Seller with respect to the Transaction.

(f) Customary affidavits, indemnity agreements and certifications of Seller as may be reasonably necessary to permit Purchaser to obtain the Title Policy (at a cost split equally between Seller and Purchaser) with the “standard exceptions” deleted excluding only the standard survey exception.

(g) An Entity Transfer Certification confirming that Seller is a “United States Person” within the meaning of Section 1445 of the Code.

(h) An estoppel certificate from the owner of the Facility Lease in form acceptable to Purchaser.

(i) Such other instruments and certificates as may be reasonably requested by Purchaser.

1.10 Deliveries by Purchaser at Closing. At Closing, Purchaser shall deliver the following to Seller, duly executed by Purchaser or other indicated parties, if applicable, and otherwise in form reasonably satisfactory to Seller:

(a) The Preliminary Purchase Price minus the Holdback Amount, pursuant to Section 1.6(b)(i).

(b) The Transition Services Agreement.

(c) An instrument of assumption for the Assumed Liabilities (the “Instrument of Assumption”).

(d) An executed copy of the Secretary’s Certificate of Purchaser with respect to the Transaction.

(e) Such other instruments and certificates as may be reasonably requested by Seller.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES

OF SELLER

Seller hereby represents and warrants to Purchaser as follows:

2.1Organization and Power. Seller is duly organized, validly existing and in good standing under the Laws of the State of Delaware and duly qualified to do business in Indiana. Seller has the requisite power and authority to carry on the Business, to own and use the Purchased Assets, and to perform all of its obligations under this Agreement. Seller is not in default under or in violation of any provision of its Organizational Documents, as amended, or any resolution adopted by the member or managers of Seller.

2.2Authority and Enforceability. Seller has the requisite power and authority to execute, deliver and perform this Agreement and each Ancillary Document delivered or to be delivered pursuant to the Transaction, and the execution, delivery and performance of this Agreement by Seller has been duly authorized by all necessary corporate action on the part of Seller. This Agreement has been, and each Ancillary Agreement will be duly executed and delivered by Seller and, subject to the Bankruptcy and Equity Exception, constitute the valid and legally binding obligation of Seller, enforceable in accordance with the terms of this Agreement or the Ancillary Agreement, as applicable.

2.3Non-contravention. The Transaction will not: (a) violate any Law or other restriction of any Authority to which Seller, the Purchased Assets or the Business are subject; (b) violate any provision of the Organizational Documents of Seller, as amended, or any resolution adopted by the members or managers of Seller; (c) except as set forth on Schedule 1.3 or Schedule 2.3, result in a breach or violation of any term or provision of, or constitute a default under any Assigned Contract, Assigned Permit, or Facility Lease; or (d) result in the creation or imposition of any Lien upon any Purchased Assets. Except as set forth in Schedule 1.3 or Schedule 2.3, the Seller does not need to give any notice to, make any filing with, or obtain any authorization, consent, or approval from any Person or Authority in order for the Parties to consummate the Transactions (including the assignments and assumptions referred to in Section 1.9).

2.4Title to and Sufficiency of Assets. Seller has good, marketable, and valid title to, or a valid leasehold interest or license interest in, as applicable, the Purchased Assets, free and clear of all Liens, other than Permitted Liens. Except as set forth on Schedule 2.10, none of the Tangible Personal Property is leased or licensed. Seller is the sole owner of the Soybean Inventory. Except as shown on Schedule 2.4, (a) the Purchased Assets, together with the services made available pursuant to the Transition Services Agreement, include all assets and rights that have been used during the periods covered by the Financial Statements in the conduct of the Business and the operation of the Facility as operated during such period; (b) all of the assets and rights owned or used by the Seller in the conduct of the Business or operation of the Facility during the period covered by the Financial Statements will be owned or available for use by the Purchaser on identical terms and conditions immediately subsequent to the Closing; (c) no Person owns any equipment or other tangible assets or properties that were used by the Seller in the Business or the operation of the Facility during the period subject to the Financial Statements; and (d) the Purchased Assets include all such material property owned or used by Seller at the Business during the prior twenty-four (24) months (excluding only Soybean Inventory sold in the Ordinary Course of Business and such other property that was replaced with similar value). Except as shown on Schedule 2.4, each of the Purchased Assets constituting tangible assets (including, but not limited to, buildings, plants, structures, furniture, fixtures, machinery, equipment, and vehicles) are free from defects and structurally sound, are suitable for the purposes for which they are presently used,

designed and configured, have been maintained in accordance with normal industry practice, are in good operating condition and repair (subject to normal wear and tear), and are adequate for the uses to which they are being put.

2.5Financial Statements.

(a) Schedule 2.5 contains internally prepared balance sheets and statements of income for the Business for the years ended December 31, 2021, and December 31, 2022, and for the eight (8) month period ended September 30, 2023 (individually, a “Financial Statement” and collectively, the “Financial Statements”). Each Financial Statement (i) has been prepared based on, and in accordance with, the books of account and related records of the Business; (ii) has been prepared in accordance with the Accounting Principles and on a consistent basis; (iii) are correct, accurate and complete; and (iv) fairly presents the cash flows and the results of operations of the Business for the periods covered and the financial condition of the Business as of such dates; provided, however, that the Financial Statements for the period ended September 30, 2023 are subject to normal year-end adjustments (which will not be material individually or in the aggregate) and lack footnotes and other presentation items. The Seller does not have any Liabilities of a nature and type required to be set forth on a balance sheet prepared in accordance with GAAP, except for (i) Liabilities set forth on the face of the balance sheet dated as of September 30, 2023 (rather than in any notes thereto) and (ii) Liabilities which have arisen after September 30, 2023, in the Ordinary Course of Business (none of which results from, arises out of, relates to, is in the nature of, or was caused by any breach of contract, breach of warranty, tort, infringement, or violation of Law). The Soybean Inventory of the Seller is reflected properly on its books and records in accordance with the Accounting Principles and is merchantable and fit for the purpose for which it was procured, processed or manufactured, and none of which is obsolete, damaged, or defective, subject only to the reserve for inventory write-down set forth on the face of the balance sheet dated as of September 30, 2023 (rather than in any notes thereto).

(b) All accounts payable and notes payable of the Seller (and the Business) arose in bona fide arm's-length transactions in the Ordinary Course of Business and no such account payable or note payable is delinquent in its payment. Since the date of the latest balance sheet, the Seller (and the Business) have paid their accounts payable in the Ordinary Course of Business. The Seller (nor the Business) does not have any accounts payable or loans payable to any Person which is affiliated with it or any of its officers, directors, members, managers, employees or equity holders.

2.6Absence of Change. Since January 1, 2023, Seller has conducted the Business in the Ordinary Course of Business and there has been no development, event or occurrence which had or would reasonably be expected to have individually or in the aggregate, a materially adverse effect on the Business or the Facility. Without limiting the generality of the foregoing, since January 1, 2023, except as contemplated by this Agreement or disclosed in Schedule 2.6 (in each case only with respect to the Business or the Purchased Assets):

(a) the Seller has not sold, leased, transferred, or assigned any of its assets, tangible or intangible, other than Soybean Inventory sold in the Ordinary Course of Business and other assets which were replaced; and

(b) the Seller has not entered into any agreement, contract, lease, or license (or series of related agreements, contracts, leases, and licenses) either involving more than $50,000 or outside the Ordinary Course of Business; and

(c) no Person (including the Seller) has accelerated, terminated, modified, or cancelled any agreement, contract, lease, or license (or series of related agreements, contracts, leases, and licenses) involving more than $50,000 to which the Seller is a party or by which it is bound; and

(d) the Seller has not adopted a change in its accounting methods: and

(e) No Lien has been imposed upon any of Seller’s assets, tangible or intangible; and

(f) the Seller has not made any loan to, or entered into any other transaction with, any of its managers, officers, or employees; and

(g) the Seller has not entered into any employment contract or collective bargaining agreement, written or oral, or modified the terms of any existing such contract or agreement; and

(h) the Seller has not granted any material increase in the base compensation of any of its managers, officers, or employees outside the Ordinary Course of Business; and

(i) the Seller has not adopted, amended, modified, or terminated any bonus, profit-sharing, incentive, severance, or other plan, contract, or commitment for the benefit of any of its managers, officers, or employees (or taken any such action with respect to any other Employee Benefit Plan); and

(j) the Seller has not made any other change in employment terms for any of its managers, officers, or employees outside the Ordinary Course of Business; and

(k) Seller has not been made aware of any indication that any employee of Seller intends to terminate such employee’s employment with Seller or will refuse to accept employment with the Purchaser on the same basis following the consummation of the Transaction; and

(l) the Seller has not cancelled, compromised, waived, or released any right or claim (or series of related rights and claims) either involving more than $50,000 or outside the Ordinary Course of Business; and

(m) the Seller has not granted any license or sublicense of any rights under or with respect to any Intellectual Property; and

(n) there has been no change made or authorized in the Organizational Documents of the Seller; and

(o) the Seller has not experienced any damage, destruction, or loss (whether or not covered by insurance) to its property; and

(p) all accepted and unfilled orders for the sale of goods by the Seller have been entered into in the Ordinary Course of Business, are not extraordinary, and (if outstanding) can be filled in accordance with their terms; and

(q) the Seller has not adopted a material change in the fees or prices that it charges for its products and services; and

(r) Seller has not received any written notification that any Key Customer or any other material customer will or intends to significantly reduce its purchase of products from the Seller or will refuse to deal with the Purchaser on the same basis following the consummation of the transactions contemplated hereby; and

(s) Seller has not received any written notification that any Key Vendor or any other material vendor will or intends to significantly reduce its supply of products to the Seller or will refuse to deal with the Purchaser on the same basis following the consummation of the transactions contemplated hereby; and

(t) Seller has not deferred or failed to incur any capital expenditures, maintenance obligations or other expenditures in the Ordinary Course of Business; and

(u) the Seller has not committed to any of the foregoing.

2.7Claims. Except as shown on Schedule 2.7, (a) There are no material actions, suits, proceedings, hearings, investigations, audits, charges, complaints, claims or demands of any kind (collectively, “Proceedings”) pending or, to the Knowledge of Seller, threatened against Seller related to the Business, any of the Purchased Assets or against Seller that would reasonably be expected to result in the creation or imposition of any Lien or Liability upon any Purchased Assets or Purchaser; (b) during the past three (3) years there have been no injunctions, judgments, orders, decrees or rulings of any kind entered or issued against Seller involving to the Business or any of the Purchased Assets and no injunction, judgment, order, decree or ruling of any kind whenever entered or issued against Seller is unsatisfied; and (c) Seller is not charged or, to the Knowledge of Seller, threatened with, or under investigation with respect to, any alleged material violation of any provision of any Law related to the Business or any of the Purchased Assets.

2.8Legal Compliance. Except as set forth on Schedule 2.8, to the extent related to the Business or any of the Purchased Assets, Seller is and, during the past two (2) years, has been in compliance in all material respects with each applicable Law. Seller has obtained all Permits required by Law to own and operate the Business and the Facility or maintain the Purchased Assets and all such Permits are listed on Schedule 2.8. All of the Assigned Permits are in full force and effect and there are no violations of any Assigned Permit; and no Proceeding is pending or, to the Knowledge of the Seller, threatened to revoke, terminate, suspend, cancel or limit any Assigned Permit.

2.9Customers; Vendors. Set forth on Schedule 2.9 is a list of the customers that, by dollar volume, accounted for not less than eighty percent (80%) of the Business’s revenue for the years ended December 31, 2021, and December 31, 2022 (collectively, the “Key Customers”). Set forth on Schedule 2.9 is a list of the vendors or suppliers that, by dollar volume, accounted for not less than eighty percent (80%) of the Business’s expenses or costs for the years ended December 31, 2021, and December 31, 2022 (collectively, the “Key Vendors”).

2.10Contracts. Schedule 2.10 lists the following Contracts related in any way to the Business, the Facility or the Purchased Assets: (a) any agreement (or group of related agreements) for the lease of personal property to or from any Person; (b) any agreement (or group of related agreements) for the purchase or sale of raw materials, commodities, supplies, products, or other personal property, for capital expenditures or acquisition of fixed assets, or for the furnishing or receipt of services, the performance of which will extend over a period of more than 6 months or involve consideration in excess of $100,000; (c) any agreement involving any joint venture, partnership, or limited liability company agreement involving a sharing of profits, losses, costs, Taxes, or other liabilities by Seller with any other Person; (d) any agreement containing covenants that in any way purport to restrict the right or freedom of the Seller or any other Person for the benefit of the Seller to (I) engage in any business activity, (II) engage in any line of business or compete with any Person, or (III) solicit any Person to enter into a business or employment relationship, or enter into such a relationship with any Person; (e) any agreement involving an Affiliate of the Seller; (f) any collective bargaining agreement; (g) any agreement for the employment of any individual on a full-time, part-time, consulting, or other basis providing annual compensation in excess of $150,000 or providing severance benefits; (h) any agreement under which Seller has advanced or loaned any amount to any of its managers, officers, or employees outside the Ordinary Course of Business; (i) any Contract related to the Leased Real Property or Intellectual Property; (j) any agreement granting any Person a Lien on all or any part of the Purchased Assets (other than Permitted Liens and Liens that will be released at or prior to Closing); (k) any agreement that has any (i) minimum purchase or sale requirement obligation or (ii) a “most favored nation” or other similar obligation; (l) any other Contract material to the operation of the Business; and/or (m) constituting an amendment, supplement, or modification (whether oral or written) in respect of any of the foregoing. The Seller has delivered to the Purchaser a correct and complete copy of each Contract (as amended to date) listed in Schedule 2.10 and a written summary setting forth the terms and conditions of each oral agreement referred to in Schedule 2.10.

With respect to each Contract that is listed on Schedule 2.10: (a) the Contract is legal, valid, binding and enforceable and in full force and effect; (b) if the Contract is an Assigned Contract, then the Contract will continue to be legal, valid, binding, enforceable, and in full force and effect on identical terms in favor of Purchaser following the consummation of the Transactions (including the assignments and assumptions referred to in Section 1.9); (c) Seller is not in breach or default, and to the Knowledge of

Seller, no other party is in breach or default and no event has occurred which with notice or lapse of time would constitute a breach or default, or permit termination, modification or acceleration, under the Contract; and (d) no Person has repudiated any provision of the Contract.

2.11Taxes. Seller has: (a) timely filed and will timely file all Tax returns, forms, reports, statements or similar documents (collectively, “Tax Returns”) that Seller is required to file; (b) withheld or paid and will withhold or pay all Taxes that are due in connection with or with respect to the periods or transactions covered by such Tax Returns, and withheld or paid all other Taxes as are due, except such Taxes, if any, that are being contested in good faith by appropriate proceedings (to the extent that any such proceedings are required); and (c) collected and will collect all Taxes that Seller was required to collect, and to the extent required, paid and will pay such Taxes to the proper Authority. No extensions or waivers of statutes of limitations have been requested or provided in connection with taxes payable by the Seller. Seller is not a party to any action by any taxing authority and there are no pending or threatened actions against Seller. There are no Tax-related Liens upon any of the Purchased Assets nor, to the Seller’s Knowledge, is any taxing authority in the process of imposing such Liens. Seller has not entered into any “listed transactions” as defined in Treasury Regulation Section 1.6011-4(b)(2) (or any similar provision of state, local or non-U.S. Law). All Tax Returns have been and shall be prepared in all material respects in accordance with applicable Law and accurately reflect, in all material respects, the taxable income or other measure of Tax.

2.12Real Property. Seller does not own any real property. Set forth on Schedule 2.12 is a list and brief description, including street address or location, of all real property leased by Seller relating to the Facility or the Purchased Assets including, but not limited to, the Facility Lease (collectively, the “Leased Real Property”). Correct, accurate, and complete copies of such leases have been provided to Purchaser. With respect to each lease or sublease for the Leased Real Property, except as set forth on Schedule 2.12: (a) each such lease or sublease for the Leased Real Property has been duly authorized and executed by the Seller and is in full force and effect, and there exists no breach or default by Seller or, to the Knowledge of Seller, by any other party under the Leases; (b) all buildings, improvements or facilities leased or subleased thereunder or located on the Leased Real Property have received all approvals of all applicable Authorities (including all Permits) required in connection with the operation thereof and have been operated and maintained in accordance with each applicable Law and applicable insurance requirements; (c) all buildings, improvements or facilities leased or subleased thereunder or located on the Leased Real Property are supplied with utilities and other services (including gas, electricity, water, telephone, sanitary sewer, and storm sewer) necessary for the operation of said facilities and all of which utilities and services are adequate in accordance with all applicable Laws and are provided access via public roads or via permanent, irrevocable, appurtenant easements benefiting the parcel of Leased Real Property; (d) all buildings, improvements or facilities leased or subleased thereunder or located on the Leased Real Property (including, but not limited to, heating, ventilation, air conditioning systems, mechanical, electrical, plumbing, environmental control, remediation and abatement systems, sewer, storm, waste water systems, irrigation, parking facilities, fire protection, security and surveillance systems, telecommunications, computer wiring, cable installations, roof, foundation load-bearing walls and floors) are in good operating condition and repair (subject to ordinary wear and tear), have been maintained in accordance with industry practices and standards and are suitable for the uses for which they are presently being used in the Facility; (e) to the Knowledge of Seller, the owner of the buildings, improvements or facilities leased or subleased has marketable title to the parcel of real property, free and clear of all Liens, except for installments of special assessments not yet delinquent and recorded Liens, restrictions or conditions which do not impair the current use, occupancy, value or marketability of or title to, the property subject thereto; (f) the buildings, improvements and facilities constituting the Business are located within the boundary lines of the real property subject to the Facility Lease, are not in violation of applicable setback requirements or zoning Laws, and do not encroach on any other property; and (g) to the Knowledge of Seller, none of the Leased Real Property contains any patent defects or latent defects. Seller does not owe, and will not in the future owe, any brokerage commissions or finder’s fees with respect to any Leased Real Property.

2.13Environmental. Except as set forth on Schedule 2.13, within the past three (3) years, (a) no written notification, demand, request for information, citation, summons or order has been received, no complaint has been filed, no penalty has been assessed and no investigation, action, claim, suit, proceeding or review is pending, or, to the Knowledge of Seller, threatened by any authority or ot

her Person with respect to any matters relating to the Facility and relating to or arising out of any Environmental Law, and (b) neither Seller nor the Purchased Assets are the subject to any Liabilities or expenditures relating to, or arising under, any failure to comply with any Environmental Law or Permit.

2.14Employment Matters. Set forth on Schedule 2.14 is a list of the following information for each Employee: name, job title, location of employment, full or part time status, tenure with the Seller, and annual base salary or hourly wage. All salaries, wages, commissions and other compensation and benefits payable to each Employee have been accrued and paid by Seller when due for all periods ending on or before the Closing Date, except for stub period payroll obligations resulting from the Closing Date occurring between normal paydays, which stub payroll obligations will be promptly and timely paid by Seller following Closing. Seller is not (and never has been) a party to or bound by any collective bargaining agreement and Seller has not experienced any strikes, labor grievances, or claims of unfair labor practices, in each case with respect to the Business. The Seller has not committed any unfair labor practice. To the Seller’s Knowledge, there is no organizational effort made or threatened, either currently or within the past two years, by or on behalf of any labor union with respect to employees of the Seller. Seller is in compliance with all applicable employment related Laws in all material respects.

(a) List of Employees. A list of Seller’s salaried and non-salaried employees involved in the operation of the Business, or the Facility (each, an “Employee”) is included in Schedule 2.14. Except for those Employees that are subject to contracts described in Schedule 2.10, all of the Employees are terminable at will. To the Knowledge of the Seller, no executive, key employee, or group of employees has any plans to terminate employment with the Seller prior to the Closing Date.

(b) Independent Contractors. Schedule 2.14 contains a list of all independent contractors currently engaged by Seller in the operation of the Business, along with the position, date of retention, and rate of renumeration for each such independent contractor. Except as sect for in Schedule 2.14, none of such independent contractors is a party to a written agreement or contract with the Seller.

(c) FMLA. Schedule 2.14 lists those Employees who are absent from work on short or long-term disability leave or leave under the Family and Medical Leave Act of 1993, on a leave of absence relating to pregnancy or childbirth, or have notified the Seller of their intent to take any such leave.

(d) Worker’s Compensation. Schedule 2.14 sets forth (a) the worker’s compensation losses for Seller since January 1, 2021; and (b) a description of all reports and filings made by Seller pursuant to the Occupational Safety and Health Act and similar state and local Laws since January 1, 2021 (copies of which will be made available to Purchaser upon request).

(e) Immigration Matters. Seller has not made any representations to any person concerning any sponsorship for temporary or permanent immigration status. Seller has no employees for whom it currently has petitions or applications for immigration benefits pending with the U.S. Citizenship and Immigration Services or DOL. The Seller and its Affiliates are in compliance in all material respects with, and have not materially violated the terms and provisions of, the Immigration Reform and Control Act of 1986, as amended, and all related regulations promulgated thereunder (“Immigration Laws”). All employees and service providers of the Seller and its Affiliates are legally authorized to work in the United States and with respect to each Employee, the Seller or its applicable Affiliates have obtained Form I-9 (Employment Eligibility Verification Form) and all other records, documents, or other papers that are required pursuant to the Immigration Laws, including such onboarding materials that are generally collected in connection with the completion of the Form I-9. Neither the Seller nor any of its Affiliates has been penalized by reason of its failure to comply with the Immigration Laws.

2.15Employee Benefits.

(a) Details Of Plans. Schedule 2.15 lists each Employee Benefit Plan that the Seller maintains or to which the Seller contributes or has any obligation to contribute with respect to the Business.

(b) Other Arrangements. Except as shown on Schedule 2.15, there is no employment, management, consulting, deferred compensation, reimbursement, indemnity, retirement, early retirement, severance, or similar plans or agreements, under discussion or negotiation by Seller with any employee or group of employees, any member of management, or any other individual.

2.16Intellectual Property.

(a) With respect to the operation of the Facility and the conduct of the Business, Seller has not interfered with, infringed upon, misappropriated, or otherwise conflicted with any Intellectual Property rights of any other Person, and none of Seller, the directors, managers, employees or officers of Seller have ever received any charge, complaint, claim, demand or notice alleging any such interference, infringement, misappropriation or violation (including any claim that Seller must license or refrain from using any Intellectual Property rights of any other Person). To the Knowledge of Seller, no third party has interfered with, infringed upon, misappropriated, or otherwise come into conflict with any Intellectual Property rights of the Seller related to the operation of the Business or the Facility.

(b) The computer systems, including the software, databases, firmware, hardware, networks, interfaces, platforms and related systems used in the conduct of the Business in connection with the occupancy or operation of the Facility (collectively, “Systems”) are sufficient for the continued occupancy or operation of the Facility as presently conducted and as presently contemplated to be conducted by Seller, are included within the Purchased Assets and may be assigned to Purchaser without the consent of any Person. The Systems are in good working condition to effectively perform all information technology operations necessary for the continued occupancy or operation of the Facility as presently conducted and as presently contemplated to be conducted by Seller. With respect to the Systems, the Seller has implemented and maintain commercially reasonable security, data backup, data storage, system redundancy and disaster avoidance and recovery procedures and business continuity plans, procedures and facilities. There has been no failure with respect to any Systems that has had (or reasonably could have) a material effect on the operations of the Seller or the Business, and to the Knowledge of the Seller, the Systems do not have any material security vulnerabilities, and there has been no unauthorized access to or use of any Systems. Seller has implemented any and all security patches or upgrades that are generally available for the Systems, as applicable. Seller is current with all of its obligations under its software license agreements.

2.17Assigned Contracts. With respect to each Assigned Contract: (i) the Assigned Contract is legal, valid, binding and enforceable, except as such enforceability may be limited by the effect of the Bankruptcy and Equity Exception; (ii) Seller is not in material breach or default under the Assigned Contract and, to the Knowledge of Seller, no other Person that is party to the Assigned Contract is in material breach or default under the Assigned Contract; and (iii) subject to obtaining any applicable Restricted Interest Consents, the Assigned Contract will continue to be in full force and effect according to its terms immediately following the Transaction and will not (with or without the passage of time or the giving of notice) require the consent or approval of any Person.

2.18Brokers. There are no brokers or finders known to Seller to be involved with the Transaction and neither of Seller nor its representatives have made any agreement or taken any other action which might cause any Person to become entitled to a broker’s or finder’s fee or commission or other similar payment as a result of the Transaction.

2.19Product Warranty. Each product manufactured, processed, sold, leased, or delivered by the Seller as a part of the Business has been in conformity with all applicable contractual commitments and all express and implied warranties, and the Seller has no Liability for replacement thereof or other damages in connection therewith, subject only to the reserve for product warranty claims set forth on the balance sheet dated as of September 30, 2023 (rather than in any notes thereto). No product manufactured, processed, sold, leased, or delivered by the Seller is subject to any guaranty, warranty, or other indemnity beyond the applicable terms and conditions of sale set forth in Schedule 2.19.

2.20Product Liability. The Seller has no Liability arising out of any injury to individuals or property as a result of the ownership, possession, or use of any product manufactured, processed, sold, or delivered by the Seller.

2.21Certain Payments. Neither the Seller nor, to the Knowledge of the Seller, any other Person associated with or acting on behalf of the Seller, including any member, manager, officer, agent, employee, or Affiliate of the Seller has: (a) used any Seller funds for any unlawful contribution, gift, entertainment, or other unlawful expense relating to political activity or to influence official action; (b) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from Seller funds; (c) made any bribe, rebate, payoff, influence payment, kickback, or other unlawful payment; or (d) violated or is in violation of any provision of the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder; and the Seller has instituted and maintains policies and procedures designed to ensure compliance therewith.

2.22Guaranties. With respect to the operation of the Business (a) the Seller is neither a guarantor nor otherwise responsible or liable for any Liability of any other Person; or (b) no other Person acts to guarantee any obligations or performance of the Seller.

2.23Certain Business Relationships With The Seller. Except as set forth in Schedule 2.23, no Affiliate, Employee, director, manager, officer or agent of the Seller has been involved in any business arrangement or relationship with the Seller (including acting as a guarantor of any Liabilities of Seller) during the period subject to the Financial Statements, and no Affiliate, Employee, director, manager, officer or agent of the Seller owns any asset, tangible or intangible, which is used in the business of the Seller.

2.24Insurance Policies.

(a) Seller has been covered during the past two (2) years by insurance in scope and amount customary and reasonable for the Business. Seller has delivered to the Purchaser complete and correct copies of all policies and binders of insurance (each of which is listed on Schedule 2.24) maintained as of the date hereof by Seller for the Business (collectively, the “Insurance Policies”), together with descriptions of all “self-insurance” programs. All Insurance Policies are in full force and effect for such amounts as are sufficient for requirements of Law and all Contracts to which the Seller is a party or by which the Seller is bound. Except as set forth on Schedule 2.24, there have been no claims made under any such Insurance Policies at any time during the three (3) year period prior to the date hereof. Seller has not received written notice under any Insurance Policy denying or disputing any claim (or coverage with respect thereto) made by Seller or regarding the termination, cancellation or material amendment of, or material premium increase with respect to, any Insurance Policy, in each case, at any time during the one (1) year period prior to the date hereof. During the past three (3) years, Seller has not been refused any insurance, nor has the coverage of the Seller been limited or suspended.

(b) All Insurance Policies are legal, valid, binding, enforceable, and in full force and effect as of the Closing Date. Neither Seller nor any other party to any Insurance Policy is in breach or default (including with respect to the payment of premiums or the giving of notices), and no event has occurred that, with notice or the lapse of time, would constitute such a breach or default, or permit termination, modification, or acceleration, under any Insurance Policy. No party to any Insurance Policy has repudiated any provision thereof.

2.25No Additional Representations or Warranties. SELLER IS NOT MAKING AND HEREBY DISCLAIMS, AND PURCHASER ACKNOWLEDGES THAT SELLER HAS NOT MADE AND IS NOT MAKING, ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, OF ANY NATURE WHATSOEVER WITH RESPECT TO SELLER OR THE BUSINESS, INCLUDING ANY OF THE PURCHASED ASSETS OR OTHERWISE, EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES EXPRESSLY SET FORTH IN THIS ARTICLE 2 (INCLUDING THE RELATED PORTIONS OF THE DISCLOSURE SCHEDULES). Any and all prior representations and warranties made by Seller, whether verbally or in writing, are merged into this Agreement, it being understood that no such prior representations or warranties shall survive the execution and delivery of this Agreement or the consummation of the Transaction. For the avoidance of doubt, none of Seller, its Affiliates or their respective representatives makes any representations or warranties to Purchaser or to any other Person regarding (i) any information furnished or made available to the Purchaser or its representatives, including any information, documents or material made available to Purchaser in any data room or in any

other form in expectation of the Transaction, unless referenced, incorporated or set forth herein or (ii) the probable success, projections or future profitability of the Business or the Purchased Assets.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

OF PURCHASER

Purchaser represents and warrants to Seller as follows:

3.1Organization and Good Standing. Purchaser is duly organized, validly existing and in good standing under the Laws of the State of Nebraska.

3.2Authority and Enforceability. Purchaser has the requisite power and authority to execute, deliver and perform this Agreement and each Ancillary Document delivered or to be delivered pursuant to the Transaction, and the execution, delivery and performance of this Agreement by Purchaser has been duly authorized by all necessary corporate action on the part of Purchaser. This Agreement has been duly executed and delivered by Purchaser and, subject to the Bankruptcy and Equity Exception, constitutes the valid and legally binding obligation of Purchaser, enforceable in accordance with its terms.

3.3Non-contravention. The Transaction will not: (a) violate any Law or other restriction of any Authority to which Purchaser is subject; (b) violate any provision of Purchaser’s Organizational Documents or any resolution adopted by the managers or members of Purchaser; or (c) result in a breach or violation of any material term or provision of, or (with or without notice or passage of time, or both) constitute a default under any agreement, permit, instrument or other arrangement to which Purchaser is a party or by which it is bound or to which any of its assets or properties are subject.

3.4Litigation. There are no actions, suits or proceedings pending or, to Purchaser’s knowledge, threatened against or affecting Purchaser at law or in equity, or before or by any Authority, which would, or are reasonably likely to, adversely affect Purchaser’s performance under this Agreement or the consummation of the Transaction.

3.5Independent Investigation; Acknowledgement. Purchaser has had an opportunity to discuss the management, operations and finances of the Business with Seller’s officers, employees, agents, representatives and Affiliates. Purchaser has conducted its own independent investigation of the Business. In making its decision to execute and deliver this Agreement and to consummate the Transaction, Purchaser acknowledges that the representations and warranties set forth in Article 2 (including the related portions of the Disclosure Schedules) are the only representations and warranties made by Seller, and that Purchaser has not relied upon any other information provided by, for or on behalf of Seller, or its agents or representatives, to Purchaser or any of its agents or representatives in connection with the Transaction. Purchaser has entered into the Transaction with the understanding, acknowledgement and agreement that no representations or warranties, express or implied, are made with respect to any projection or forecast regarding future results or activities or the probable success or profitability of the Business except for the representations and warranties set forth in Article 2 (including the related portions of the Disclosure Schedules). Purchaser acknowledges that no current or former stockholder, director, officer, employee, Affiliate or advisor of Seller has made or is making any representations, warranties or commitments whatsoever regarding the subject matter of this Agreement, express or implied.

3.6Brokers. There are no brokers or finders known to Purchaser to be involved with the Transaction and Purchaser has not made any agreement or taken any other action which might cause any Person to become entitled to a broker’s or finder’s fee or commission or other similar payment as a result of the Transaction.

ARTICLE 4

COVENANTS

The Parties covenant and agree as follows with respect to the period following Closing:

4.1General. In case at any time after Closing any further action is necessary or desirable to carry out the purposes of this Agreement or any Ancillary Document delivered or to be delivered pursuant to the Transaction, each of the Parties shall take such further action (including the execution and delivery of such further instruments and documents) as any other Party reasonably may request, all at the sole cost and expense of the requesting Party with respect to reasonable out of pocket costs (unless the requesting Party is entitled to indemnification therefor under Article 5). The Parties shall act in good faith to continue to negotiate and finalize a Grain Supply and License Agreement following the Closing.

4.2Post-Closing Cooperation, Access to Information and Retention of Records.