UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Benson Hill, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value per share

(Title of Class of Securities)

082490103

(CUSIP Number)

J. Stephan Dolezalek

Grosvenor Food & AgTech Limited

3000 El Camino Real, Building 4, Suite 200

Palo Alto, CA 94306

650-382-0981

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 25, 2022

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing

on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 082490103

| 1. |

Names of Reporting Persons

Grosvenor Food & AgTech Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨ (b) ¨ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

¨ |

| 6. |

Citizenship or Place of Organization

United Kingdom |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

11,679,899 (1)(2) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

11,679,899 (1)(2) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

11,679,899 (1)(2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions)

¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

5.6% (3) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) | Consists

of (i) 10,806,710 shares of common stock, par value $0.0001 per share (“Common Stock”), of Benson Hill, Inc. a Delaware

corporation (the “Issuer”), held directly by Grosvenor Food & AgTech US Inc. (f/k/a Wheatsheaf Group U.S., Inc.),

(ii) 106,523 shares of Common Stock held by J. Stephan Dolezalek for the benefit of Grosvenor Food & AgTech Limited pursuant

to an accommodation agreement by and among the Issuer, Grosvenor Food & AgTech US Inc. and Mr. Dolezalek, and (iii) 766,666

shares of Common Stock issuable to Grosvenor Food & AgTech US Inc. pursuant to warrants exercisable within 60 days of the date

of this Schedule 13D. Of the aforementioned shares of Common Stock, 1,078,798 are subject to an earn-out contingency until the achievement

of certain stock price targets (“Earn-Out Shares”). Holders of Earn-Out Shares are entitled to exercise voting rights carried

by those securities, but the Earn-Out Shares are held in escrow until the satisfaction of the relevant contingencies, and if such contingencies

are not satisfied on or prior to the third anniversary of the completion of the Issuer’s business combination on September 29,

2021, then the Earn-Out Shares shall not vest and shall be canceled. |

| | |

| (2) | Grosvenor Food & AgTech US Inc. is wholly owned by Grosvenor Food & AgTech Limited.

Voting and investment power with respect to the shares held by Grosvenor Food & AgTech US Inc. and by J. Stephan Dolezalek for

the benefit of Grosvenor Food & AgTech Limited may be exercised in whole or in part by J. Stephan Dolezalek, Anthony James, Montell

Bayer, Katrin Burt, Fiona Emmett, William Kendall, Stefano Rettore, Jonathon Bond, Robert Davis, Mark Preston, and Alexander Scott, who

are the directors of Grosvenor Food & AgTech Limited. The majority of the shares in Grosvenor Food & AgTech Limited

are held by trusts and trustees for the benefit of the current and future generations of the Grosvenor family, headed by the Duke of Westminster.

These trusts are based in the United Kingdom. Pursuant to an accommodation agreement by and among the Issuer, Grosvenor Food &

AgTech US Inc. and Mr. Dolezalek, who serves as a Managing Partner of Grosvenor Food & AgTech (f/k/a Wheatsheaf Group, LLC),

a wholly-owned subsidiary of Grosvenor Food & AgTech Limited, Grosvenor Food & AgTech Limited maintains the pecuniary

interest in any compensation Mr. Dolezalek receives for his service as a member of the board of directors of the Issuer. Mr. Dolezalek

disclaims beneficial ownership in the shares of Common Stock that he holds except to the extent of his pecuniary interest therein, if

any. |

| | |

| (3) | The calculation is based on dividing (i) the aggregate number of shares of Common Stock beneficially

owned by the Reporting Person as set forth in Row 11 by (ii) the sum of (a) 208,379,035 shares of Common Stock outstanding as

of November 7, 2023 as reported by the Issuer in the Quarterly Report on Form 10-Q for the quarterly period ended September 30,

2023 filed by the Issuer with the Securities and Exchange Commission (“SEC”) on November 9, 2023 and (ii) 766,666

shares of Common Stock issuable to Grosvenor Food & AgTech US Inc. pursuant to warrants exercisable within 60 days of the date

of this Schedule 13D. |

Explanatory Note

This initial statement on

Schedule 13D (the “Schedule 13D”) constitutes a late filing due to an inadvertent administrative error. On March 25,

2022, Grosvenor Food & AgTech Limited (the “Reporting Person”) beneficially acquired 2,300,000 issued and outstanding

shares of common stock, $0.0001 par value (the “Common Stock”), of Benson Hill, Inc. and immediately exercisable warrants

to purchase up to 766,666 shares of Common Stock in connection with the 2022 PIPE Transaction (as defined below), representing approximately

1.5% of the total number of shares of Common Stock then issued and outstanding. Pursuant to Rule 13d-1(a) of the Securities

Exchange Act of 1934, as amended, the Reporting Person was required to file an initial statement Schedule 13D in connection with such

acquisition on or prior to April 4, 2022, and any amendments thereto upon subsequent material changes to its beneficial ownership

of shares of Common Stock.

CUSIP No. 082490103

| Item 1. | Security and Issuer |

This Schedule 13D (this “Schedule

13D”) relates to the Common Stock, par value $0.0001 per share (the “Common Stock”), of Benson Hill, Inc., a Delaware

corporation (the “Issuer”). The address of the principal executive offices of the Issuer is 1001 North Warson Rd., St. Louis,

Missouri 63132.

| Item 2. | Identity and Background |

| (a) | This Schedule 13D is being filed by Grosvenor Food & AgTech Limited (the “Reporting Person”). |

| | |

| (b) –

(c) | The principal business office of Reporting Person is located at 70 Grosvenor Street, London W1K 3JP, United Kingdom. Certain information

concerning the identity and background of each of the executive officers and directors of the Reporting Person is set forth in Annex A

attached hereto, which is incorporated herein by reference in response to this Item 2. |

| | |

| | Voting and investment power with respect

to the shares held by the Grosvenor Food & AgTech US Inc. and by J. Stephan Dolezalek for the benefit of the Reporting Person

may be exercised in whole or in part by J. Stephan Dolezalek, Anthony James, Montell Bayer, Katrin Burt, Fiona Emmett, William Kendall,

Stefano Rettore, Jonathon Bond, Robert Davis, Mark Preston, and Alexander Scott, who are the directors of the Reporting Person, which

wholly owns Grosvenor Food & AgTech US Inc. The majority of the shares in the Reporting Person are held by trusts and trustees

for the benefit of the current and future generations of the Grosvenor family, headed by the Duke of Westminster. These trusts are based

in the United Kingdom. |

| | |

| | The principal business of the Reporting

Person is investing in entrepreneurial business in the food and agricultural technology sectors. |

| | |

| (d) | During the last five years, the Reporting Person has not, nor, to the best knowledge of the Reporting

Person, have any of the persons listed on Annex A attached hereto, been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors). |

| | |

| (e) | During the last five years, the Reporting Person has not, nor, to the best knowledge of the Reporting

Person, have any of the persons listed on Annex A attached hereto, been a party to a civil proceeding of a judicial of administrative

body of competent jurisdiction and as a result of such proceeding been subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws. |

| | |

| (f) | The Reporting Person was organized under the laws of the United Kingdom. |

| Item 3. | Source and Amount of Funds or Other

Consideration |

Business Combination

On September 29, 2021

(the “Closing Date”), the date of the closing of the transactions (the “Merger”) contemplated by that certain

Agreement and Plan of Merger (the “Merger Agreement”), dated May 8, 2021, by and among the Issuer (formerly known as

Star Peak Corp II), STPC Merger Sub Corp. and Benson Hill, Inc. (“Legacy Benson Hill”), at the effective time of the

Merger (the “Effective Time”), the shares of common stock of Legacy Benson Hill that were outstanding immediately prior to

the Effective Time and held by the Reporting Person were canceled and converted into the right to receive 8,006,710 shares of Common Stock,

pursuant to the Merger Agreement. Of the aforementioned shares of Common Stock, 1,078,798 are subject to an earn-out contingency until

the achievement of certain stock price targets, as further described below (the “Earn-Out Shares”).

In connection with the consummation

of the Merger, the Company entered into that certain Earnout Escrow Agreement, dated as of the Closing Date, with Shareholder Representative

Services LLC and Continental Stock Transfer & Trust Company (the “Escrow Agent,” and such agreement, the “Escrow

Agreement”), which provides that the Earn-Out Shares be held in escrow until, and vest upon, the achievement of certain earn-out

thresholds prior to the third anniversary of the Closing Date. Pursuant to the terms of the Escrow Agreement, (i) one-half of the Earn-Out

Shares will vest if the dollar volume-weighted average closing price of the Common Stock is greater than or equal to $14.00 over any

20 trading days within any 30 consecutive trading day period, and (ii) one-half of the Earn-Out Shares will vest if the dollar volume-weighted

average closing price of the Common Stock is greater than or equal to $16.00 over any 20 trading days within any 30 consecutive trading

day period, in each case, on or prior to the third anniversary of the Closing Date (the “Earn-Out Period”). If the Earn-Out

Shares have not vested by the end of the Earn-Out Period, such shares shall be released by the Escrow Agent to the Issuer for cancellation.

The material terms of the Escrow Agreement are incorporated by reference to the Issuer’s Current

Report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on October 5, 2021.”

2021 PIPE Transaction

Additionally, on the Closing

Date, Grosvenor Food & AgTech US Inc. purchased 500,000 shares (the “2021 PIPE Shares”) of Common Stock from the

Issuer at a purchase price of $10.00 per share pursuant to a subscription agreement entered into and effective as of May 8, 2021

(the “2021 PIPE Transaction”). The funds used by Grosvenor Food & AgTech US Inc. to acquire the 2021 PIPE Shares

were from capital contributions made by the Reporting Person.

2022 PIPE Transaction

On March 25, 2022, Grosvenor

Food & AgTech US Inc. purchased 2,300,000 units (collectively the “Units”) from the Issuer at a purchase price $3.25

per Unit pursuant to a subscription agreement entered into and effective as of March 24, 2022 (the “2022 PIPE Transaction”).

The Units consisted of (i) 2,300,000 shares of Common Stock and (ii) warrants to purchase 766,666 shares of Common Stock. The

funds used by Grosvenor Food & AgTech US Inc. to acquire the 2022 PIPE Shares were from capital contributions made by the Reporting

Person.

J. Stephan Dolezalek Accommodation Agreement

Mr. Dolezalek serves

as a member of the board of directors of the Issuer (the “Board”). As compensation for his service as a member of the Board,

106,523 shares of Common Stock have been issued to, and are currently held by, Mr. Dolezalek. Pursuant to an accommodation agreement

(the “Accommodation Agreement”) by and among the Issuer, Grosvenor Food & AgTech US Inc. and Mr. Dolezalek,

who serves as a Managing Partner of Grosvenor Food & AgTech (f/k/a Wheatsheaf Group, LLC), a wholly-owned subsidiary of the Reporting

Person, the Reporting Person maintains the pecuniary interest in any compensation and beneficial ownership over any stock-based compensation

Mr. Dolezalek receives for his service as a member of the Board.

| Item 4. | Purpose of Transaction |

The information set forth

in Item 6 of this Schedule 13D is incorporated by reference in its entirety into this Item 4.

The Reporting Person acquired

beneficial ownership of the shares of Common Stock reported herein for investment purposes with the aim of increasing the value of its

investment and the Issuer. The Reporting Person intends to review its investment on a regular basis and, as a result thereof, may, directly

or through one or more affiliates, at any time or from time to time determine, either alone or as part of a group, (i) to acquire

additional securities of the Issuer, through open market purchases, privately negotiated transactions, or otherwise, (ii) to dispose

of all or a portion of the securities of the Issuer owned by them in the open market, in privately negotiated transactions, or otherwise,

or (iii) to take any other available course of action, which could involve one or more of the types of transactions or have one or

more of the results specified in clauses (a) through (j) of Item 4 of Schedule 13D of the Securities and Exchange Act of 1934,

as amended. Any such acquisition or disposition or other transaction would be made in compliance with all applicable laws and regulations,

and subject to the terms and conditions of any agreements between the Reporting Person and the Issuer.

The Reporting Person has

explored, and expect to continue to explore, various potential alternatives with respect to its investment in the Issuer, including, among

other things, extraordinary corporate transactions involving the Issuer, such as a merger, reorganization, consolidation or other take-private

transaction that could result in the delisting and/or deregistration of the publicly traded securities of the Issuer, joint ventures,

or other material changes to the Issuer’s business or capital or governance structure. There can be no guarantee that the Reporting

Person will make any such proposal, and if any such proposal is made, the Reporting Person can provide no assurances such proposal will

be accepted or that it will successfully consummate any proposed transaction. Continued exploration of any such proposal, and whether

the Reporting Person will make any such proposal and the completion of any such proposed transaction, is subject to many factors, many

of which are outside the control of the Reporting Person, including, but not limited to, the following: terms believed by the Reporting

Person to be favorable to it; the Reporting Person’s ongoing assessment of the Issuer’s business, prospects, and other developments

concerning the Issuer and its businesses generally; changes in law and government regulations; general economic conditions; tax considerations;

other investment opportunities available to the Reporting Person; and prevailing market conditions, including the market price of the

securities of Issuer. The potential alternative opportunities currently being explored by the Reporting Person do not include a sale of

securities of the Issuer by the Reporting Person to a third party.

The Reporting Person, and

Mr. Dolezalek in his position as a director of the Issuer, a director of the Reporting Person and a Managing Partner of Grosvenor

Food & AgTech, have begun to engage, and intend to continue to engage, in communications, discussions and negotiations with members

of management and of the Board, and its legal, financial, accounting and other advisors; potential partners and counterparties in any

transaction; current or prospective stockholders of the Issuer; and other relevant parties, regarding the various alternatives that may

from time to time be under consideration by the Reporting Person and/or its affiliates. To facilitate its consideration of such matters,

the Reporting Person has retained, or intends to retain, consultants and advisors and enter into discussions with potential sources of

capital and other third parties. The Reporting Person may exchange information with any such persons pursuant to appropriate confidentiality

or similar obligations or agreements.

Notwithstanding anything

contained herein, the Reporting Person intends to review its investment in the Issuer and the Issuer’s performance and market conditions

periodically and to take such actions with respect to its investment as it deems appropriate in light of the circumstances existing from

time to time. Accordingly, the Reporting Person specifically reserves the right to change its intention with respect to any or all such

matters described above. In reaching any decision as to its course of action (as well as to the specific elements thereof), the Reporting

Person currently expects that it would take into consideration a variety of factors, including, but not limited to, the following: the

Issuer’s business and prospects; other developments concerning the Issuer and its businesses generally; other business opportunities

available to the Issuer; changes in law and government regulations; general economic conditions; tax considerations; other investment

opportunities available to the Reporting Person; and prevailing market conditions, including the market price of the securities of Issuer.

Except as set forth in this

Item 4, the Reporting Person has no present plan or proposal that relates to or would result in any of the actions specified in clauses

(a) through (j) of Item 4 of Schedule 13D of the Exchange Act.

| Item 5. | Interest in Securities of the Issuer |

The information contained

in rows 7, 8, 9, 10, 11 and 13 on the cover page of this Schedule 13D and the information set forth or incorporated in Items 2 and

3 of this Schedule 13D is incorporated by reference in its entirety into this Item 5.

| (a) –

(b) | The Reporting Person may be deemed to beneficially own an aggregate of 11,679,899 shares of Common Stock, which consists (i) 10,806,710

shares of Common Stock held directly by Grosvenor Food & AgTech US Inc., (ii) 106,523 shares of Common Stock held by J.

Stephan Dolezalek for the benefit of the Reporting Person pursuant to the Accommodation Agreement, and (iii) 766,666 shares of Common

Stock issuable to Grosvenor Food & AgTech US Inc. pursuant to warrants exercisable within 60 days of the date of this Schedule

13D, representing in the aggregate approximately 5.6% of the issued and outstanding shares of Common Stock, as calculated pursuant to

Rule 13d-3 under the Exchange Act. Of the aforementioned shares of Common Stock, 1,078,798 are Earn-Out Shares. Holders of Earn-Out

Shares are entitled to exercise voting rights carried by those securities, but the Earn-Out Shares are held in escrow until the satisfaction

of the relevant contingencies, and if such contingencies are not satisfied on or prior to the third anniversary of the Closing Date, then

the Earn-Out Shares shall not vest and shall be canceled. |

| | |

| (c) | The Reporting Person has not effected any transactions in the Common Stock during the last 60 days. |

| | |

| (d) | No other person is known to have the right to receive or the power to direct the receipt of dividends

from, or any proceeds from the sale of, the shares of the Common Stock beneficially owned by the Reporting Person. |

| | |

| (e) | Not applicable. |

| Item 6. | Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer |

The information set forth

in Items 3 and 4 of this Schedule 13D are incorporated by reference in their entirety to this Item 6.

| Item 7. | Material to be Filed as Exhibits |

| A. | Agreement

and Plan of Merger, dated May 8, 2021, by and among the Issuer, STPC Merger Sub Corp and Legacy Benson Hill (incorporated by reference

to Exhibit 2.1 of the Issuer’s Current Report on Form 8-K, filed with the SEC on October 5, 2021). |

| | |

| B. | Form

of Subscription Agreement, dated as of May 8, 2021, by and between the Issuer and Grosvenor Food & AgTech US Inc. (incorporated by

reference to Exhibit 10.1 of the Issuer’s Current Report on Form 8-K, filed with the SEC on October 5, 2021). |

| | |

| C. | Earnout

Escrow Agreement, dated as of September 29, 2021, by and among the Company, Shareholder Representative Services LLC and Continental Stock

Transfer & Trust Company (incorporated by reference to Exhibit 10.2 of the Issuer’s Current Report on Form 8-K, filed with the

SEC on October 5, 2021). |

| | |

| D. | Form

of Subscription Agreement, dated as of March 24, 2022, by and between the Issuer and Grosvenor Food & AgTech US Inc. (incorporated

by reference to Exhibit 10.1 to the Issuer’s Current Report on Form 8-K, filed with the SEC on March 28, 2022). |

| | |

| E. | Form

of Warrant, dated as of March 25, 2022, issued to Grosvenor Food & AgTech US Inc. by the Issuer (incorporated by reference to Exhibit

10.2 to the Issuer’s Current Report on Form 8-K, filed with the SEC on March 28, 2022). |

| | |

| F. | Accommodation Agreement, dated as of December 31, 2022, by and among the Issuer, Grosvenor Food & AgTech US Inc. and J. Stephan Dolezalek. |

Signature

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 29, 2024

| Grosvenor Food & AgTech Limited |

|

| |

|

|

| By: |

/s/ J. Stephan Dolezalek |

|

| |

Name: J. Stephan Dolezalek |

|

| |

Title: Managing Director |

|

ANNEX

A

The following sets forth

the name and principal occupation of each of the executive officers and directors of Grosvenor Food & AgTech Limited (the “Reporting

Person”).

| Name |

Business Address |

Principal Occupation |

Citizenship |

| J. Stephan Dolezalek(1) |

c/o Grosvenor Food & AgTech

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto, CA 94306 |

Managing Partner of Grosvenor Food & AgTech |

United States |

| |

|

|

|

| Anthony James |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Managing Partner of Grosvenor Food & AgTech |

United Kingdom |

| Montell Bayer |

c/o Grosvenor Food & AgTech

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto, CA 94306

|

Managing Partner of Grosvenor Food & AgTech |

Canada |

| Katrin Burt |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Managing Partner of Grosvenor Food & AgTech |

United Kingdom |

| Fiona Emmett |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Group Finance Director of Grosvenor Food & AgTech |

United Kingdom |

| William Kendall |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Trustee of Grosvenor Group Limited |

United Kingdom |

| Stefano Rettore |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Non-Executive Director of Grosvenor Food & AgTech |

Italy |

| Jonathon Bond |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Chief Investment Officer of Grosvenor |

United Kingdom |

| Robert Davis |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Chief Financial Officer of Grosvenor |

United Kingdom |

| Mark Preston |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Chief Executive Office of Grosvenor |

United Kingdom |

| Alexander Scott |

c/o Grosvenor Food & AgTech Limited

70 Grosvenor Street

London W1K 3JP

United Kingdom

|

Trustee of Grosvenor Group Limited |

United Kingdom |

Except as described in footnote

(1) to this Annex A with respect to Mr. Dolezalek, none of the persons listed above beneficially owns any shares of common stock,

par value $0.0001 per share (“Common Stock”), of Benson Hill, Inc. a Delaware corporation (the “Issuer”).

| (1) | Mr. Dolezalek holds 106,523 shares of Common Stock, which are held for the benefit of Grosvenor Food &

AgTech pursuant to an accommodation agreement (the “Accommodation Agreement”) by and among the Issuer, Grosvenor Food &

AgTech US Inc. and Mr. Dolezalek, who serves as a Managing Partner of Grosvenor Food & AgTech (f/k/a Wheatsheaf Group, LLC),

a wholly-owned subsidiary of the Reporting Person. Pursuant to the Accommodation Agreement, the Reporting Person maintains the pecuniary

interest in any compensation and beneficial ownership over any stock-based compensation Mr. Dolezalek receives for his service as

a member of the board of directors of the Issuer. Voting and investment power with respect to the shares held by Mr. Dolezalek for

the benefit of the Reporting Person may be exercised in whole or in part by the directors of the Reporting Person set forth on this Annex

A. Mr. Dolezalek disclaims beneficial ownership in the shares of Common Stock that he holds except to the extent of his pecuniary

interest therein, if any. |

Exhibit F

Accommodation Agreement

This Accommodation Agreement, dated as of December

31, 2022 (this “Agreement”), is entered into by and

between Grosvenor Food & AgTech U.S. Inc. (together with its affiliates, “Grosvenor”),

and J. Stephan Dolezalek (“Mr. Dolezalek”, the “Parties”, and

each, a “Party”).

Background

WHEREAS, Mr.

Dolezalek is a non-employee director of Benson Hill and, in exchange for his services as a director, is entitled to cash compensation

(“Cash Compensation”) and stock-based equity compensation based on or relating to Benson Hill’s common stock

(“Equity Compensation” and, together with Cash Compensation, “Director Compensation”);

WHEREAS, Mr. Dolezalek

is a full-time Managing Partner at Grosvenor, and Grosvenor requires as a condition of Mr. Dolezalek’s employment (“Grosvenor

Employment Condition”) that Mr. Dolezalek

remit to Grosvenor all compensation for providing services to third parties, including all Director Compensation;

THEREFORE, in consideration of the mutual covenants

and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the Parties hereto agree as follows:

1. Recitals.

The Parties acknowledge and agree that the above recitals are true and correct and are hereby incorporated into this Agreement in their

entirety by this reference.

2. Cash

Compensation Accommodation.

(a) In

order to satisfy his Grosvenor Employment Condition, for so long as he remains a full-time employee of Grosvenor, Mr. Dolezalek

hereby:

(i) confirms

his desire to, and does, transfer his Cash Compensation to Grosvenor immediately upon receipt from time to time of Cash Compensation

from Benson Hill; and

(ii) shall

request that Benson Hill take reasonable steps to assist Mr. Dolezalek in effecting such transfers of his Cash Compensation from

Mr. Dolezalek to an account for the benefit of Grosvenor.

(b) For

the avoidance of doubt, “Cash Compensation” shall not include, for the purposes of Section 2(a) above, any reimbursement

of reasonable out-of-pocket expenses incurred by Mr. Dolezalek

(including without limitation in connection with attending meetings of

Benson Hill’s board of directors and committees), or similar expenses, in accordance with Benson Hill’s reimbursement policies

as in effect from time to time.

3.

Equity Compensation Accommodation.

(a)

In order to further satisfy his Grosvenor Employment Condition, Mr. Dolezalek hereby:

(i) confirms

his desire to, and does, transfer his Equity Compensation to Grosvenor at the earliest practicable times at which any portion of such

Equity Compensation may from time to time be so transferred, it being understood that (A) under Benson Hill’s current equity

compensation programs for non-employee directors, until Mr. Dolezalek’s rights in

such Equity Compensation have vested and such Equity Compensation has been issued to Mr. Dolezalek,

it may not be transferred, and (B) any such transfers may be limited by Benson Hill’s Insider Trading Policy, as it may be

amended from time to time (“Benson Hill Insider Trading Policy”);

and

(ii) shall

request that Benson Hill take reasonable steps to assist Mr. Dolezalek in effecting such transfers of his vested and issued Equity

Compensation from Mr. Dolezalek to an account for the benefit of Grosvenor, which reasonable assistance may include, without limitation,

coordinating with Benson Hill’s transfer agent to help effect such transfers, subject to applicable law.

(b) Mr. Dolezalek

hereby agrees and certifies that:

(i) Following

his execution of this Agreement, Mr. Dolezalek may not and will not exercise any discretion, authority, influence, or control with

regard to any Equity Compensation to be transferred to Grosvenor pursuant to the terms of this Agreement.

(ii) Mr. Dolezalek

is entering into this Agreement in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1, as

in effect on the date hereof (regarding trading of the Company’s securities on the basis of material non-public information),

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It

is Mr. Dolezalek’s intent that this Agreement comply with the requirements of Rule 10b5-1(c)(l)(i) under

the Exchange Act, as in effect on the date hereof, and be interpreted to comply with the requirements of Rule 10b5-1 (c) under

the Exchange Act, as in effect on the date hereof.

(iii) Mr. Dolezalek’s

agreements hereunder regarding the transfer of the Equity Compensation are irrevocable.

4. Further

Agreements and Restrictions Applicable to Equity Compensation. The Parties acknowledge and agree as follows:

(a) In

light of Mr. Dolezalek’s relationships with both Benson Hill and Grosvenor, Grosvenor shall be bound by, and shall comply

with, the Benson Hill Insider Trading Policy as if Grosvenor were a non-employee director of Benson Hill thereunder.

(b) Any

Equity Compensation that Grosvenor receives from time to time hereunder may constitute “restricted securities,” as such term

is defined in Rule 144 promulgated under the Securities Act of 1933, as amended. Grosvenor agrees that it shall not sell, transfer

or otherwise dispose of any such Equity Compensation other than in compliance with applicable U.S.

securities laws. Grosvenor further understands and agrees that it shall be solely responsible for its tax and securities law reporting obligations,

if any, with respect to the assignment of Cash Compensation and Equity Compensation hereunder, and that Benson Hill has made no representation

nor warranty with respect thereto.

5. Taxes.

Mr. Dolezalek acknowledges that his request that Benson Hill take reasonable steps to assist his transfer of Director Compensation

to Grosvenor will be made pursuant to, and in order to satisfy the terms of, his Employment Condition, and that such transfer constitutes

an assignment of income otherwise payable to Mr. Dolezalek in connection with the performance

of his services to Benson Hill. The Parties expressly acknowledge and agree that Mr. Dolezalek is responsible for the payment of

all taxes arising from the payment of Director Compensation and shall treat the reporting of such taxes, the filing

of any income tax returns with respect to such Director Compensation and associated taxes, and any other matters pertaining to such Director

Compensation and the delivery thereof to Grosvenor as described in this paragraph in a manner consistent in all respects with such assignment

of income principle and the terms of this Agreement.

6. Termination

of Employment; Termination of Agreement. This Agreement shall terminate and be of no further force or effect if Mr. Dolezalek’s

full-time employment with Grosvenor is terminated for any reason, or if the Grosvenor Employment

Condition no longer applies for any reason.

7. Governing

Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to conflicts

of laws principles.

8. Assignment.

The rights and obligations of each Party hereunder may not be assigned, delegated or transferred without the prior, express, written

consent of the other Parties.

9. Entire

Agreement. This Agreement, and all agreements referenced to herein, constitute the entire agreement between the Parties with respect

to the subject matter of this Agreement, and this Agreement supersedes all prior negotiations and understandings between the Parties

with respect to the matters described in this Agreement. No changes, alterations, modifications, or qualifications to the terms of this

Agreement shall be made or be binding unless made in writing and signed by all Parties.

10.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be a duplicate original,

but all of which, taken together, shall constitute a single instrument. This Agreement shall not be subject to any conditions precedent

or subsequent, and shall be effective and binding upon its execution in counterpart, without regard to the delivery or exchange of signed

originals.

11. Attorneys’

Fees. If any Party brings an action to enforce the terms of this Agreement or to declare or clarify any rights hereunder, the prevailing

party in any such action will be entitled to recover from the non-prevailing

party or parties all costs and expenses incurred by the prevailing party in such action, including, but not limited to, reasonable attorneys’

fees, paralegal fees, law clerk fees and other legal costs or expenses, whether incurred at or before trial and whether incurred at the

trial level or in any appellate, bankruptcy, administrative or other legal proceeding.

[SIGNATURE PAGE FOLLOWS]

IN WlTNESS WHEREOF, the parties hereto

have caused this Accommodation Agreement to be executed as of the date first written above by their respective officers thereunto duly

authorized.

| J. Stephan Dolezalek | |

| | | |

| By: | /s/ J. Stephan Dolezalek | |

| Name: | J. Stephan Dolezalek | |

| Title: | Managing Partner | |

| | | |

| Grosvenor Food & AgTech US Inc. | |

| | | |

| By: | /s/ Anthony James | |

| Name: | Anthony James | |

| Title: | Managing Partner | |

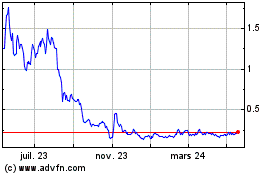

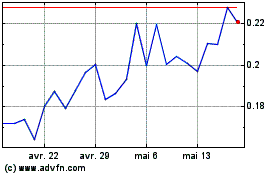

Benson Hill (NYSE:BHIL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Benson Hill (NYSE:BHIL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024