FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated January

23, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: January 23, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ/MF 01.838.723/0001-27

NIRE 42.300.034.240

CVM 1629-2

EXTRACT FROM THE MINUTES OF THE EXTRAORDINARY

MEETING OF THE BOARD OF DIRECTORS

HELD ON DECEMBER 20, 2023

1.

Date, Time, and Place: Meeting

held on December 20, 2023, at 11 a.m., at BRF S.A.’s (“Company”) office located at Avenida das Nações

Unidas, n° 14.401, 25º floor, Chácara Santo Antônio, Zip Code 04794-000, São Paulo, São Paulo.

2.

Call and Attendance: Call duly carried out under the

terms of article 21 of the Company's Bylaws, with the presence of the totality of the members of the Board of Directors, namely: Marcos

Antonio Molina dos Santos, Sergio Agapito Lires Rial, Marcia Aparecida Pascoal Marçal dos Santos, Flávia Maria Bittencourt,

Augusto Marques da Cruz Filho, Deborah Stern Vieitas, Aldo Luiz Mendes, Pedro de Camargo Neto, Altamir Batista Mateus da Silva and Eduardo

Augusto Rocha Pocetti.

3.

Presiding Board: Charmain: Mr. Marcos Antonio

Molina dos Santos. Secretary: Mr. Bruno Machado Ferla.

4.

Agenda: Analysis and Approval of the: (i) the

provision and constitution, by the Company, of a guarantee (“Guarantee”), to be provided by the Company together with

AES BRASIL ENERGIA S.A., a joint-stock company registered as a publicly-held company with the CVM in the category "A",

with headquarters in the city of São Paulo, State of São Paulo, at Avenida Luiz Carlos Berrini, nº 1,376, 12th

floor, Torre A, Room Digitalização, Cidade Monções, Zip Code 05425-011, registered with the CNPJ/MF under

nº 37.663.076/0001-07 (“AES” and, when together with the Company, the “Guarantors”), in proportion

to their respective shareholdings in POTENGI HOLDINGS S.A., a joint-stock company without registration as a publicly-held company

with the Securities and Exchange Commission, with headquarters at Avenida Engenheiro Luiz Carlos Berrini, nº 1376, ESC 121, Torre

-A – Torre Nações Unidas, Cidade Monções, in the City of São Paulo, State of São Paulo,

CEP 04571-936, registered with CNPJ/MF under nº 42.165.941/0001-24, with it is constituent acts registered under NIRE nº 35300569903

(“Issuer” or “Potengi”), with the aim of ensuring faithful, punctual and full compliance with the

main and ancillary obligations assumed by the Issuer, within the scope of its 1st

| Page 1 de 5 Extract from the Minutes of the Extraordinary Meeting of the Board of Directors held on December 20, 2023. |

BRF S.A. Publicly Held Company CNPJ/MF 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON DECEMBER 20, 2023 |

(first) issue of 300,000 (three hundred thousand)

simple debentures not convertible into shares, of the type unsecured, with additional guarantee (“Debentures”), with

a maturity period of 18 (eighteen) years from de date of issue of the Debentures to be defined in the Issuance Deed (as defined bellow)

(“Issuance Date”) and nominal value unit of R$ 1,000.00 (one thousand reais) (“Nominal Unit Value”),

totaling, on the Issuance Date, the total amount of R$ 300,000,000.00 (three hundred million reais) (“Issuance”), which

will be subject to public distribution, intended exclusively for professional investors, as defined in accordance with article 11 of the

Resolution of the Securities and Exchange Commission (“CVM”) No. 30, of May 11, 2021, as amended from time to time,

being, therefore, subject to the automatic procedure for registering a public offering for the distribution of securities, in accordance

with article 26, item IX, and article 27 of CVM Resolution No. 160, of July 13, 2022, as amended, of Law No. 12, 431, of June 24, 2011,

as amended, and other applicable legal and regulatory provisions (“Offer”), under the firm placement guarantee regime

for the total value of the Issue, subject to the terms and conditions of the Issue and Debentures to be established through the execution

of the “Private Indenture Instrument for the 1st (First) Issuance of Simple Debentures, Non-Convertible into Shares,

of the Unsecured Type, with Additional Guarantee, in a Single Series, for Public Distribution, under the Automatic Registration Rite,

of Potengi Holdings S.A.”, to be celebrated between the Issuer, Oliveira Trust Distribuidora de Títulos e Valores Mobiliários

S.A., a financial institution, domiciled in the City of São Paulo, State of São Paulo, at Rua Joaquim Floriano, nº

1.052, 13th floor, Itaim Bibi, CEP 04534-004, registered with the CNPJ/MF under no. 36.113,876/004-34, as fiduciary agent (“Fiduciary

Agent”), the Company and AES, as guarantors (“Deed of Issuance”); (ii) express authorization for the

Company’s representatives and well-established attorneys, in accordance with the Company’s Bylaws, to perform all acts, take

all measures and adopt all necessary measures relating to the achievement and formation of the Issuance, the Offer and the provision of

the Guarantee, including, but without limitation, the execution of the Deed of Issuance, the Offer distribution agreement (“Distribution

Agreement”) and any amendments thereto; e (iii) the ratification of acts already carried out by the Company’s Board

of Directors and well-established attorneys, exclusively related to the above deliberations.

| Page 2 de 5 Extract from the Minutes of the Extraordinary Meeting of the Board of Directors held on December 20, 2023. |

BRF S.A. Publicly Held Company CNPJ/MF 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON DECEMBER 20, 2023 |

5.

Resolutions: The members of the Board of Directors approved,

by unanimous vote and without any reservations or restrictions, the drawing up of these minutes in the form of a summary. Once the agenda

has been examined, the following matter was discussed, and the following decision was taken:

5.1.

Approve the Company’s provision of the Guarantee, as a guarantee of faithful, punctual

and full payment of the Guarantee Obligations (as defined in the Deed of Issuance), including, but not limited to, pecuniary obligations,

main and accessory, present and future, assumed by the Issuer in the Issuance, including but not limited to, obligations relating to the

full and punctual payment of the Updated Nominal Unit Value, the respective Remuneration, Late Payment Charges, as well as other charges

related to the Issuance Deed, whether on the respective Payment Dates of the Remuneration or Amortization Date, on the Maturity Date,

or due to the early maturity of obligations arising from the Debentures under the terms of the Issuance Deed.

5.2.

Expressly authorize the Company’s representatives and well-established attorneys-in-fact,

in accordance with the Company’s Bylaws, to perform all acts, take all measures and adopt all necessary measures relating to the

Issuance, the Offer and the Guarantee, including, but without limitation: (i) the formalization, implementation and negotiation

of the terms and conditions related to the resolutions now approved for the Issuance, the Offer and the Guarantee, with the Company authorized

to execute any and all minutes, books, powers of attorney, notifications, communications, documents, applications, forms, instruments,

contracts and annexes related to the Issuance, the Offer and the provision of the Guarantee, including signing the Deed of Issuance and

the Distribution Agreement and any amendments; and (ii) the establishment of additional conditions, carrying out all necessary

acts and signing all documents required to carry out the deliberations provided for herein; it is

| Page 3 de 5 Extract from the Minutes of the Extraordinary Meeting of the Board of Directors held on December 20, 2023. |

BRF S.A. Publicly Held Company CNPJ/MF 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 EXTRACT FROM THE MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON DECEMBER 20, 2023 |

5.3.

Ratify the acts already carried out by the Company’s Board of Directors and well-established

attorneys, exclusively related to the above deliberations.

6.

Documents Filed at the Company: The documents analyzed

by the members of the Board of Directors or information presented during the meeting were filed at the Company’s head office.

7.

Closure: There being no other matters to be discussed,

the meeting was closed, being the present minutes drawn up by electronic processing, which after having been read and found correct by

all those present, were signed.

I certify that the above text is a faithful

copy of the minutes which are filed in Book of the Minutes of the Ordinary and Extraordinary Meetings of the Company´s Board of

Directors.

São Paulo, December

20, 2023.

Bruno Machado Ferla

Secretary

| Page 4 de 5 Extract from the Minutes of the Extraordinary Meeting of the Board of Directors held on December 20, 2023. |

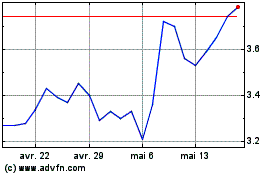

BRF (NYSE:BRFS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

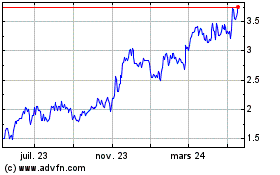

BRF (NYSE:BRFS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024